TIDMEOG

RNS Number : 2774J

Europa Oil & Gas (Holdings) PLC

26 April 2022

Europa Oil & Gas (Holdings) plc / Index: AIM / Epic: EOG /

Sector: Oil & Gas

26(th) April 2022

Europa Oil & Gas (Holdings) plc

("Europa" or "the Company")

Wressle Update

Europa Oil & Gas (Holdings) plc, the AIM traded UK, Ireland

and Morocco focused oil and gas exploration, development, and

production company, notes the update by Operator Egdon Resources

U.K. Limited ("Egdon") on activities issued today in their Half

Yearly Statement.

Europa is pleased to highlight this update.

Wressle production has significantly exceeded the original 500

barrels of oil per day ("bopd") expectation and is currently

producing at permit constrained rates of 760-800 bopd following

upgrades to the production facilities.

Wressle, in which Europa holds a 30% interest, quickly exceeded

pre-production expectations of 500 bopd on resumption of production

following the successful proppant-squeeze and coiled-tubing

operation on the 19 August 2021. Instantaneous rates of over 1,000

bopd have been achieved. Early restrictions to production have been

successfully addressed through upgrades and modifications to the

site facilities, including installation of a secondary separator

and progressive upgrades to the gas incineration system, which have

culminated in the installation of a larger capacity enclosed

incineration unit. Production is currently limited by the 10 tonnes

per day gas incineration limit imposed by the Environmental Permit

to between 760-800 bopd (228-240 bopd net). Once the gas

monetisation development is complete, this production limitation

will be removed and the production rate is expected to be increased

significantly. Pressure test analysis has indicated potential flow

rates for Wressle-1 of between approximately 1,200 and 1,500

bopd.

Since production commenced at Wressle-1 in January 2021, the

cumulative production has exceeded 150,000 barrels of oil with no

formation water produced to date.

A revised Field Development Plan was submitted to the North Sea

Transition Authority ("NSTA") during April 2022.

The likely preferred gas monetisation approach will be to export

the gas via a short pipeline (approximately 600m) into the local

gas distribution network. This will require regulatory consents

(Planning and EA) and it is hoped to be completed in time for gas

sales during the coming winter. This export route will also be

available in the longer term for the development of the Penistone

Flags reservoir where detailed work is underway.

Environmental monitoring throughout the operations has shown no

measurable impact on surface or groundwater quality, no related

seismicity and that noise levels have been within the permitted

levels.

In the coming period the Operator will:

-- Complete the installation of the remaining permanent production facilities;

-- Progress planning and permitting and implement the gas

monetisation plan, reduce gas flaring and remove the limitations on

oil production; and,

-- Advance the development plan and consenting process to enable

production from the Penistone Flags reservoir.

Outlook:

-- Continuing to optimise oil and gas production from the

Ashover Grit reservoir at Wressle, building on the strong

performance to date;

-- Progressing gas monetisation at Wressle; and,

-- Finalising plans for development of the material Contingent

Resources in the Penistone Flags at Wressle.

Simon Oddie, CEO said :

"The well performance at Wressle continues to exceed our initial

expectations and once the planned connection to the local gas

distribution network is completed by winter 2022 the well will be

able to produce at unrestricted rates which will materially impact

the cash flows associated with the field. This will also allow the

field to be further developed by targeting the contingent resources

located in the Penistone Flags reservoir and I look forward to

updating the market in due course with details of this work

programme."

Qualified Person Review

This release has been reviewed by Alastair Stuart, engineering

advisor to Europa, who is a petroleum engineer with over 35 years'

experience and a member of the Society of Petroleum Engineers and

has consented to the inclusion of the technical information in this

release in the form and context in which it appears.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the company's obligations under Article 17 of MAR.

* * ENDS * *

For further information please visit www.europaoil.com or

contact:

Simon Oddie Europa mail@europaoil.com

Murray Johnson Europa mail@europaoil.com

+ 44 (0) 20 7220

Christopher Raggett finnCap Ltd 0500

+ 44 (0) 20 7220

Simon Hicks finnCap Ltd 0500

+44 (0) 20 7186

Peter Krens Tennyson Securities 9033

+ 44 (0) 20 7236

Oonagh Reidy St Brides Partners Ltd 1177

+ 44 (0) 20 7236

Ana Ribeiro St Brides Partners Ltd 1177

Notes to Editors

Europa Oil & Gas (Holdings) plc has a diversified portfolio

of multi-stage hydrocarbon assets which includes production,

development and exploration interests, in countries that are

politically stable, have transparent licensing processes, and offer

attractive terms. Production in the half-year to 31st January 2022

was 208 boepd. The Company holds two exploration licences offshore

Ireland, which have the potential to host gross mean un-risked

prospective resources of 1.5 trillion cubic feet ('tcf') gas.

Inishkea is a near field gas prospect in the Slyne Basin which the

Company classifies as lower risk due to its close proximity to the

producing Corrib gas field and associated gas processing

infrastructure. In September 2019, Europa was awarded a 75%

interest in the Inezgane permit offshore Morocco. Initial results

of technical work have identified 30 prospects and leads that have

the potential to hold in excess of one billion barrels of unrisked

oil resources. In December 2021, Europa announced a collaboration

between Baker Hughes and CausewayGT to conduct a geothermal clean

heat project at the Company's West Firsby field. If this project is

successful, it will prove the operational ability to extract and

use geothermal heat from the site.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDIAMPTMTMTBMT

(END) Dow Jones Newswires

April 26, 2022 02:01 ET (06:01 GMT)

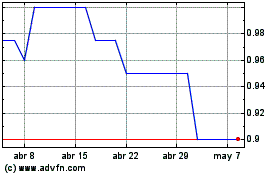

Europa Oil & Gas (holdin... (LSE:EOG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Europa Oil & Gas (holdin... (LSE:EOG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024