TIDMEPIC

RNS Number : 3660B

Ediston Property Inv Comp PLC

11 February 2022

Ediston Property Investment Company plc

(LEI: 213800JRL87EGX9TUI28)

Net Asset Value ('NAV') as at 31 December 2021

And Trading Update

Ediston Property Investment Company plc (LSE: EPIC) (the

'Company') announces its unaudited NAV at 31 December 2021 and a

trading update for a quarter of considerable asset management

activity.

Quarter Summary

-- Fair value independent valuation of the property portfolio at

31 December 2021 of GBP249.85 million, a like-for-like increase of

2.03% compared to the valuation at 30 September 2021.

-- The uplift was reduced by the sale of the office assets below

the 30 September valuation and by a fall in the value of the

remaining office asset.

-- Retail warehouse values continued to improve with a 4.4%

like-for-like increase in the quarter.

-- NAV per share at 31 December 2021 of 90.64 pence (30

September 2021: 89.69 pence), an increase of 1.06% in the

quarter.

-- NAV total return (including dividends) for the quarter of 2.5% (30 September 2021, 4.2%).

--------------------------------------------------------------------------------------

-- In line with the revised strategy, during the period, sold

three of the four offices realising GBP36.4 million.

-- Completed ten lease transactions, securing GBP1.2 million of rent per annum.

-- EPRA vacancy rate has reduced from 8.6% to 8.2%.

--------------------------------------------------------------------------------------

Net Asset Value

The unaudited NAV of the Company at 31 December 2021 was

GBP191.5 million, or 90.64 pence per share, an increase of 1.06% on

the Company's NAV per share as at 30 September 2021.

Pence Per Share GBP million

NAV at 30 September 2021 89.69 189.55

---------------- ------------

Valuation of property portfolio (15.39) (32.53)

---------------- ------------

Capital proceeds net of capital

expenditure 14.53 30.70

---------------- ------------

Profit on sale of investment

properties 1.94 4.10

---------------- ------------

Income earned 2.10 4.44

---------------- ------------

Expenses & finance costs (0.98) (2.08)

---------------- ------------

Dividends paid (1.25) (2.64)

---------------- ------------

NAV at 31 December 2021 90.64 191.54

---------------- ------------

The NAV attributable to the ordinary shares has been calculated

under International Financial Reporting Standards ('IFRS'); the

EPRA NAV is not reported separately in this update as it is the

same as the IFRS NAV.

The NAV incorporates the independent portfolio valuation as at

31 December 2021 and undistributed income for the quarter, but does

not include a provision for any accrued monthly dividend.

Sale of the office portfolio and reinvestment strategy

During the period, in line with the revised strategy announced

in quarter three last year, the Company disposed of three of its

four office assets. It sold Midland Bridge House, Bath; 145

Morrison Street Edinburgh; and Citygate II Newcastle. The sales

realised GBP36.4 million before costs. This was below the 30

September 2021 valuation and reflected the general weakness in

office markets outside London. However, the sale price was above

the book cost of GBP29.9 million. The net income received from

these properties was GBP2.4 million per annum.

The Company found that there was not a significant depth of

investor demand for office assets. This affected the prices

achieved and consequently had a negative impact on the NAV.

The Investment Manager believes that selling the office assets

was the correct decision as the effects of the COVID-19 pandemic

and increasing ESG requirements have not yet had full impact on the

office occupational market or are reflected in the current

valuation of office properties.

With the sale of the three offices, the Company has made good

progress with the implementation of the revised investment

strategy. The remaining office will be sold in due course. The

Investment Manager remains focused on the redeployment of capital

into retail warehouses and is pursuing several opportunities. It is

targeting the completion of the reinvestment programme over the

next four months.

For the foreseeable future the Company will concentrate its

investment in the retail warehouse sector. The Investment Manager

believes the prospects are attractive for retail warehouses, both

in absolute terms, and relative to other sectors of the real estate

market.

Asset management update

During the period ten lease transactions were completed, which

secured GBP1.2 million of income per annum. The EPRA vacancy rate

reduced from 8.6% to 8.2%.

Eight of the ten deals were in the retail warehouse portfolio

and there was one in each of the office and leisure portfolios.

At Kingston Retail Park in Hull, the letting to The Range

completed. The Range signed a 15-year lease on a 14,500 sq. ft.

unit which was vacated by Outfit (Arcadia) in Q2 2021. Also at

Hull, Greggs exchanged an Agreement for Lease (AFL) on a 2,000 sq.

ft. unit which is leased to, but not occupied by, Carphone

Warehouse. A lease surrender has been agreed with Carphone

Warehouse.

At Prestatyn Shopping Park, The Tech Edge leased a vacant unit

of 1,300 sq. ft. on a five-year lease. At Clwyd Retail Park, Rhyl,

Now to Bed leased 8,017 sq. ft. on a three-year lease.

At Barnsley, three deals completed across 20,000 sq. ft. of

space. Bensons downsized from a unit of 10,000 sq. ft. into one of

5,036 sq. ft. and signed a five-year lease. Jysk signed an AFL on

the unit vacated by Bensons. On completion of some landlord works,

Jysk will enter into a new ten-year lease with a five-year tenant

break option. Lastly at Barnsley, One Below, who was occupying a

4,996 sq. ft. unit on a short-term lease, has committed to the park

for five years.

In the office portfolio, at Citygate II in Newcastle, UNW LLP

signed an extension to its leases to expire in March 2032, with a

tenant break option in March 2027. Subsequent to this deal

completing, the asset was sold.

Finally, in the leisure portfolio, at Hartlepool, Mecca Bingo

signed a 10-year reversionary lease with a seven-year tenant break

option on its unit which extends to 31,284 sq. ft. The lease will

expire in September 2032, with a break option in September

2029.

The Investment Manager is progressing other new lettings and

lease restructures across the portfolio, which will further improve

the Company's income stream. These will be reported on when

completed.

Rent collection and dividend

Rent collection continues to be strong, with 99.9% of the rent

due for quarter four 2021 expected to be collected. The income

received by the Company will fluctuate over the coming months as

the rent lost through office sales will be replaced by rent from

new acquisitions. Against this backdrop, it remains the Board's

expectation that the dividend will be increased further in the

coming months, with the timing influenced by when the available

capital is reinvested and becomes income producing.

Cash and debt

At the date of this announcement, the Company has approximately

GBP30.4 million of cash available for investment and operational

purposes. The Company also has GBP23.25 million of cash held in its

debt facility.

At the date of the December valuation, the average loan-to-value

across the Company's two debt facilities was 35.2%. The Company is

fully compliant with all debt covenants and has significant

headroom against income and asset value covenants.

Summary

Three of the Company's offices have now been sold, but the

weakness in the office market negatively affected the sale price

and consequently the Company's NAV. However, the positive momentum

in the retail warehouse sector has continued to build and looks set

to improve further given increased tenant demand and attractive

pricing, relative to other sectors of the market. Retail warehouse

valuations increased again in the period and contributed to the

third consecutive quarter of NAV growth for the Company.

The immediate focus is now on reinvesting the sales proceeds

into suitable retail warehouse stock and on continuing to identify

and execute asset management initiatives to improve both income and

capital values across the portfolio.

William Hill, Chairman, commented:

"This is the third consecutive quarter of NAV growth for the

Company which has been delivered despite the frictional costs of

disposing of its offices. For the foreseeable future the Company

will specialise in the retail warehouse market, a sector that has

strong positive momentum and looks attractively priced relative to

other property types."

Portfolio sector weightings and tenant and locational

exposure

Sector

Sector Exposure

(%)

Retail warehouse 87.7

---------

Office 10.2

---------

Other commercial/

Leisure 2.1

---------

Geography

The portfolio is diversified across the regional markets.

Region Exposure

(%)

Wales 23.9

---------

Scotland 22.9

---------

North West 14.2

---------

Yorkshire 13.4

---------

West Midlands 11.4

---------

North East 8.7

---------

East Midlands 5.5

---------

Top five tenants

Tenant Exposure (%)

B&Q Limited 13.3

-------------

B&M Retail Limited 7.0

-------------

Marks & Spencer

plc 5.7

-------------

Boots UK Limited 4.1

-------------

AXA Insurance UK

plc 3.8

-------------

Forthcoming events

The next interim dividend announcement is expected to be made by

3 March 2022. The next scheduled independent quarterly valuation of

the property portfolio will be conducted by Knight Frank LLP for 31

March 2022, which will form part of the Company's interim report.

The unaudited NAV per share at that date is expected to be

announced in April 2022.

The Company intends to publish its next factsheet shortly which

will be made available on the Company's website at

www.ediston-reit.com.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014. Upon the

publication of this announcement via Regulatory Information

Service, this inside information is now considered to be in the

public domain.

Enquiries

Will Barnett Investec Bank plc 0207 597 5873

Ediston Investment Services

Calum Bruce Limited 0131 225 5599

Ruth Wright JTC 0203 893 1011

Ben Robinson Kaso Legg Communications 0203 995 6672

Stephanie Ross Kaso Legg Communications 0203 995 6676

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVEADAEFDXAEAA

(END) Dow Jones Newswires

February 11, 2022 02:00 ET (07:00 GMT)

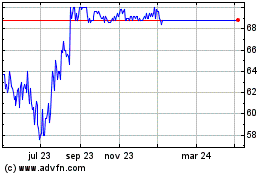

Ediston Property Investm... (LSE:EPIC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Ediston Property Investm... (LSE:EPIC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024