TIDMEPIC

RNS Number : 6717M

Ediston Property Inv Comp PLC

25 May 2022

THIS ANNOUNCEMENT HAS BEEN DETERMINED TO CONTAIN INSIDE

INFORMATION FOR THE PURPOSES OF THE MARKET ABUSE REGULATION (EU)

NO. 596/2014.

Ediston Property Investment Company plc

(the 'Company')

(LEI: 213800JRL87EGX9TUI28)

HALF YEAR RESULTS

MOVING FORWARD WITH A REFRESHED STRATEGY

Ediston Property Investment Company plc (LSE: EPIC) announces

its half-year results for the six months ended 31 March 2022.

Key points for the six months to 31 March 2022:

-- Property portfolio increased in value, on a like-for like basis by 11.2%;

-- Net asset value increased 7.1% to 96.1 pence (30 September 2021: 89.7 pence);

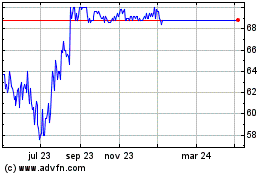

-- Share price increased by 6.7% to 78.8 pence, narrowing the

discount to 13.1% at the period end;

---------------------------------------------------------------------------------------------------------------------------------

-- Completed the first phase of the Company's revised investment

strategy by selling the office portfolio, realising net proceeds of

GBP60.0 million;

-- Completed 12 lease transactions across office, leisure and retail warehouse properties;

-- 98.2% of the rent due was collected for the period; and

-- Various pipeline projects, including investment opportunities

and asset management initiatives being considered.

Key Performance Indicators

Six months Six months Year ended

ended 31 ended 31 30 September

March March 2021

2022 2021 (audited)

EPRA NAV per share 96.1p 84.3p 89.7p

----------- ----------- --------------

NAV total return 10.1% 0.3% 9.6%

----------- ----------- --------------

Share price total return 10.2% 39.8% 54.6%

----------- ----------- --------------

Average discount of share price

to NAV (17.3)% (24.3)% (22.1)%

----------- ----------- --------------

EPRA vacancy rate 7.3% 5.6% 8.6%

----------- ----------- --------------

William Hill, Chairman, commented:

"The Company has made significant progress over the last 12

months. It is close to completing the restructuring of its

portfolio in line with its revised investment strategy and is now

focused on the retail warehouse sector. This is a part of the

market that is now performing strongly. "

---------------------------------------------------------------------------------------------------------------------------------

Chairman's Statement

introduction

In the first half of the year the Company focused on the

execution of its refreshed investment strategy announced last July.

It has made significant progress. This strategy committed the

Company to be invested in retail warehouse assets for the

foreseeable future. Encouragingly, the assets already owned have

increased in value with positive NAV increases recorded for the

last four quarters.

However, whilst the retail warehouse market has flourished over

the last six months, the macro picture has become more challenging

as the optimism from the lifting of COVID-19 restrictions has been

dissipated by world events and an inflationary cost of living

crisis.

The highlights of the last six months and post period end

are:

-- The completion of the sale of all four office properties, a

process that has realised GBP60.0 million in total. The Company is

now focussed on the retail warehouse sector;

-- The NAV has increased by 7.1% over the last six months to

96.1p per share, despite the impact of selling the office portfolio

at below the valuations at the start of the period;

-- The 'like-for-like' increase in the value of the property

assets held throughout the six month period was 11.2%;

-- Share price total return over the last twelve months was

21.9% and 10.2% over the last six months. The discount to NAV at

the period end was 13.1% (17.6% September 2021) with an average

discount of 17.3% during the period;

-- 12 asset management initiatives were undertaken during the

period securing GBP1.4 million of income per annum;

-- Tenant interest in vacant units has picked up and the EPRA

vacancy rate of 8.6% reported at the year-end had fallen to 7.3% at

the end of the period and stands at 6.3% at the date of this

report; and

-- Post the period end the Company has made good progress in

identifying retail warehouse investments to acquire.

NAV AND SHARE PRICE PERFORMANCE

The Company's investment portfolio was valued at GBP238.8

million at 31 March 2022 (30 September 2021: GBP214.8 million on a

like-for-like basis). The value of property assets held throughout

the period has risen by 11.2%.

The NAV over the period has increased by 7.1% from 89.7p per

share to 96.1p per share. 6.0% of the increase was recorded over

the last three months and can be attributed to the ongoing recovery

in the retail warehouse market where the Company is now principally

invested, other than cash available for future investment. The NAV

total return over the period was 10.1% and the share price return

was 10.2%.

The office portfolio was a drag on performance over the period

as the aggregate sale proceeds of GBP60.0 million, net of costs,

were below the 30 September valuations. Performance was

additionally impacted by the costs of the disposals.

INVESTMENT STRATEGY

The refreshed investment strategy announced in July last year is

close to being executed with the disposal of the offices completed

and the reinvestment of the proceeds into retail warehouses well

advanced.

The composition of the portfolio at 31 March 2022 was 97.7% in

retail warehouses and 2.3% in leisure assets. The Company has

disposed of one of its two leisure assets since period end.

The Board remains fully supportive of the Investment Manager's

decision to focus on the retail warehouse sector. Much of the

Company's portfolio is centred on the essential/ value end of the

retail market. It is this sector of the UK commercial property

market that stood up well during the Covid crisis and remained

largely open during lockdown periods. It is also likely to be more

insulated from any consumer spending headwinds from the cost of

living crisis than other parts of the retail and leisure economy.

Evidence continues to point to retail warehousing working well with

the digital economy and its ability to provide efficient and

cost-effective accommodation for retailers. Vacancy is lower than

the office and industrial sectors. There is virtually no new

supply, and poor schemes are being taken out of the market as they

are repurposed for other uses. Rents are starting to recover as

retailers now face competition for the best available space.

The Investment Manager has maintained for some time that the

sector was oversold by investors and this view is now held more

widely. The February 2022 Investment Property Forum Consensus

forecast, drawn on its survey work with investors, has the retail

warehouse sector as the best performing property sub sector for the

period from 2022 to 2026.

PORTFOLIO and transaction ACTIVITY

During the period the Investment Manager has completed twelve

new asset management initiatives with a further one post period

end. These are discussed in more detail in the Investment Manager's

report. The transaction at Prestatyn Shopping Park, completed post

period end, is a good example of how the market balance between

landlord and tenant is shifting. The Investment Manager has

successfully replaced New Look, a tenant trading on preferential

terms secured under a CVA, with JD Sports, at a market rent 44.0%

ahead of the turnover rent being paid by New Look.

The improving letting market is helping to reduce vacancy levels

in the portfolio with the EPRA vacancy rate of 7.3% at the end of

the period falling to 6.3% post period end.

All four office assets in the portfolio (Bath, Edinburgh,

Newcastle and Birmingham) were sold during the period realising net

sale proceeds of GBP60.0 million. These were sold into a difficult

office market struggling with understanding the implications for

the sector of working from home, the changing needs of occupiers

and concerns over the costs for older buildings to comply with

future sustainability regulations. The assets were sold at 3.3%

below the property valuations at the time of the sales, and were

therefore a drag on performance during the period. However, the

Board agreed with the Investment Manager that the downside was not

fully in the pricing and the capital could be used more effectively

if deployed into retail warehousing.

The Investment Manager is well advanced with the reinvestment of

the office sale proceeds and announcements on acquisitions will be

made in the normal way as and when contracted.

The Board has continued to work closely with the Investment

Manager on achieving the Company's sustainability goals. This

progress will be reported on in detail in the next annual

report.

INCOME AND DIVID

Rent collection continues to be strong. 98.2% of the rent due

for the six-month period was collected by the period end.

Disposing of the offices and reinvesting the proceeds into

retail warehousing has created a hiatus in the Company's income

profile during the execution of this strategy. The Board believes

that it is not prudent to consider increasing the dividend until

the portfolio has been re-positioned. The Board will update

shareholders further on both investing for the portfolio and the

resultant net income position when it is able to do so.

CAPITAL STRUCTURE

The Company's total debt is unchanged at GBP111.1 million at a

blended 'all-in' fixed rate of 2.9%. Gearing at 31 March 2022 was

35.0% of total assets. As at 31 March 2022, the Company had

approximately GBP41.2 million of cash for investment and

operational purposes. The Company had a further GBP36.3 million of

cash held in its debt facility, including the Hartlepool sale

proceeds. This cash is subject to the lender's LTV requirements

being met for it to be released for investment purposes.

At the date of the March valuation, the average loan-to-value

across the Company's two debt facilities was 32.4%. The Company is

fully compliant with all debt covenants and has significant

headroom against income and asset value covenants.

board

We have managed the Company's affairs with a small and highly

engaged board from the inception of the Company. We intend to

continue to do so whilst mindful of corporate governance issues on

Board composition, diversity and collective competence to undertake

the tasks. One immediate issue is succession planning which was

referred to in last year's report and accounts. The aim is to have

an orderly Board transition, enabling the two longest serving board

members (Chair and Audit Chair) to stand down from the Board, in

the absence of unforeseen circumstances, no later than the AGM in

2024.

At the Company's AGM, all the resolutions put to the meeting

were passed by substantial margins. However, voting agencies raised

concerns over Mr Archibald's independence in acting as SID and

Audit Chair, given the roles he was fulfilling on the Board and how

he was remunerated. This resulted in recommendations to vote

against his reappointment at the 2022 AGM. The Board and its

advisers do not agree with the voting agencies' views on

independence and continue to benefit from Mr Archibald fulfilling

the roles that he does for the Board. However, the Board does not

want governance issues to be a distraction in the lead up to the

next AGM of the Company.

Accordingly, Ms Moss has been appointed as Senior Independent

Director from 1 June 2022 and Mr Archibald will be replaced as

Audit Chair before year end. Recruitment consultants have been

appointed for a new Audit Chair and the Board will increase in size

to five when this appointment is made. Mr Archibald will remain as

a non-executive director, at least for the next year, whilst Board

transition is taking place, to assist in the growth strategy of the

Company and to continue to act as director overseeing corporate

issues that arise for the Company.

OUTLOOK

The Company has made significant progress over the last 12

months. It is close to completing the restructuring of its

portfolio in line with its revised investment strategy and is now

focused on the retail warehouse sector. This is a part of the

market that is now performing strongly and one which consensus

forecasts suggest will continue to do so over the next few

years.

The Board hopes that the positive progress on implementing the

refreshed investment strategy, along with other initiatives being

considered, will help close the share price discount to NAV. The

Investment Manager will continue to review opportunities to grow

the Company, which might include use of the tap issuance

authorities for individual asset opportunities. In parallel with

the longer term ambition for growth, the Investment Manager will

continue to generate value adding asset management opportunities

and to drive income growth which will support the potential for

increases in the dividend.

William Hill

Chairman

24 May 2022

Investment Manager's Review

Introduction

The first half of the Company's financial year has seen positive

momentum build across various parts of the property portfolio,

driven by the continued recovery in the retail warehouse market.

The NAV has improved, the EPRA vacancy rate has fallen, rent

collection has remained strong and asset management initiatives

have been identified and completed which have also improved the

Company's income stream. Good progress has been made with the

revised strategy, announced in quarter three 2021, to sell offices

and reinvest in retail warehouses. During the period all four of

the office assets were sold.

Portfolio Composition

The Company can invest in all the principal commercial property

sectors and does not diversity for diversification's sake. There is

no constraint limiting the maximum weighting to any of the main

property sectors.

The Company's property portfolio is valued by Knight Frank on a

quarterly basis throughout the year. As at 31 March 2022 it was

valued at GBP238.8 million, a like-for-like increase of 11.2%

compared to the 30 September 2021 valuation. The allocation is

detailed in the table below.

Retail Warehouse Leisure

Number of properties 11 2

----------------- ---------------

Value GBP233.2 million GBP5.6 million

----------------- ---------------

Sector weighted average 4.9 years 0.5 years

unexpired lease term

(WAULT)

----------------- ---------------

Total contracted GBP15.9 million GBP0.6 million

rent per annum

----------------- ---------------

The WAULT of the property portfolio as at 31 March 2022 was 4.9

years.

Following a strategy update in quarter three 2021, the Company

will focus the next phase of reinvestment on the retail warehouse

sector. In line with this strategy, the Company exited its office

portfolio during the period and at the period end was invested in

the retail warehouse and leisure sectors as follows:

Sector Exposure

(%)

Retail warehouse 97.7

---------

Other commercial/

Leisure 2.3

---------

Geographical diversification as at 31 March 2022

The portfolio is diversified across the regional markets.

Region Exposure

(%)

Scotland 26.1

---------

Wales 25.9

---------

North West 16.3

---------

Yorkshire 15.0

---------

North East 9.2

---------

East Midlands 6.2

---------

West Midlands 1.3

---------

Top five tenants as at 31 March 2022

The top five tenants comprise 37.1% of the Company's rent roll.

The remaining 62.9% is made up of tenants who individually do not

comprise more than 3.8% of the rent roll.

Tenant Exposure

(%)

B&Q Limited 14.7

---------

B&M Retail Limited 7.7

---------

Marks & Spencer

plc 6.3

---------

Boots UK Limited 4.6

---------

Pets at Home

Limited 3.8

---------

rent collection

The Company maintained strong rent collection levels during the

period. For the six months to 31 March 2022, 98.2% of the rent due

has been collected. The rent collection since quarter two 2021 is

summarised in the following table:

Quarter Q2 2021 (%) Q3 2021 (%) Q4 2021 (%) Q1 2022 (%)

Rent received 96.0 99.1 97.7 98.2

------------ ------------ ------------ ------------

Payment expected 0.5 0.9 2.3 1.8

------------ ------------ ------------ ------------

Deferred 3.1 0.0 0.0 0.0

------------ ------------ ------------ ------------

Under discussion 0.0 0.0 0.0 0.0

------------ ------------ ------------ ------------

Outstanding 0.4 0.0 0.0 0.0

------------ ------------ ------------ ------------

Total 100 100 100 100

------------ ------------ ------------ ------------

The Company's income stream has been resilient and has not been

negatively affected by any tenant insolvency events in the period.

However, because of the property sales in the period, the Company's

contracted income has temporarily reduced. Over the period, on a

like-for-like basis, accounting for the office sales, the

contracted rent increased by 1.5% and the ERV increased by 1.7%.

The objective is to replace the sold office income with rent from

suitable retail warehouse properties.

NAV

The NAV increased in the period by 7.1% to 96.1p, with four

consecutive quarters of NAV growth for the Company. Over the 12

months ended 31 March 2022, the NAV increased by 14.0%. This

positive momentum is primarily because of valuation increases in

the retail warehouse portfolio. General market movement, and the

completion of asset management initiatives have both contributed to

the upwards direction of travel. The disposal of the office

portfolio had a negative impact on NAV growth.

Asset Management Activity

During the period, 12 asset management initiatives were

completed in the property portfolio, across the office, leisure and

retail warehouse assets, securing GBP1.4 million of rental income

per annum, which is in line with ERV. They are summarised

below:

Retail Warehouse

-- At Kingston Retail Park in Hull, The Range signed a 15-year

lease on a 14,500 sq. ft. unit which was vacated by Outfit

(Arcadia) in Q2 2021;

-- Also at Hull, Greggs signed a 10-year lease with a five-year

tenant break option on a 2,000 sq. ft. unit;

-- At Prestatyn Shopping Park, The Tech Edge leased a vacant

unit of 1,300 sq. ft. on a five-year lease;

-- At Clwyd Retail Park, Rhyl, Now to Bed leased 8,017 sq. ft. on a three-year lease;

-- At Barnsley, Bensons downsized from a unit of 10,000 sq. ft.

into one of 5,036 sq. ft. and signed a five-year lease;

-- Jysk signed a 10-year lease with a five-year break option on the unit vacated by Bensons;

-- Also at Barnsley, One Below, occupying a 4,996 sq. ft. unit

on a short-term lease, committed to the park for five years;

-- At Widnes Shopping Park, Card Factory signed a five-year

lease, without break, on a 1,590 sq. ft. unit; and

-- At Stirling, Harry Corry signed a five-year lease extension

on its 9,968 sq. ft. unit, meaning its lease will now expire in

February 2027.

At Prestatyn Shopping Park, JD Sports exchanged an Agreement for

Lease (AFL) on a 7,623 sq. ft. unit, which was previously occupied

by New Look. New Look was occupying the unit on a turnover rent

basis following the approval of its Company Voluntary Arrangement

(CVA). Under the terms of the CVA landlords were entitled to break

the leases.

We considered that the terms of the CVA were below market, so we

took the opportunity to exercise the break clause and identified JD

Sports as a more suitable tenant for the space. Post-period-end,

the lease has completed. The rent received from JD Sports is 44.0%

higher than the rent being paid by New Look.

Office

-- At Citygate II in Newcastle, UNW LLP signed an extension to

its leases, to expire in March 2032, with a tenant break option in

March 2027. Subsequent to this deal completing, the asset was

sold.

Leisure

-- At Hartlepool, Mecca Bingo signed a 10-year reversionary

lease with a seven-year tenant break option on its 31,284 sq. ft

unit. The lease expiry date was extended to September 2032, with a

break option in September 2029. Post-period-end the property was

sold.

We are seeing improving occupational demand from retail

warehouse tenants for both the vacant units and on lease extensions

and we are currently in discussions with several tenants across

multiple assets.

ASSET SALES & REINVESTMENT

The Company's four remaining office assets were sold, for a

headline price of GBP61.9 million. This is 3.3% below the property

valuations at the time of the sales. Once deductions for topped up

rents and rent-free periods were factored in, the net receipt to

the Company was GBP60.0 million.

The sales were in line with the Company's investment approach of

seeking to identify and capitalise on attractive investment themes

and opportunities as they arise and evolve across the UK commercial

property sector. We have recently been repositioning the portfolio

to focus on the retail warehouse sector, with good progress being

made with the reinvestment phase.

Post period end, the Company completed the sale of one of its

two leisure assets. The Lanyard, Hartlepool was sold for GBP2.62

million. The asset is let to Mecca Bingo Limited. We had completed

a lease extension with the tenant in quarter four last year which

extended the unexpired lease term by seven years.

The intention is to reinvest the sale proceeds into the retail

warehouse sector, a sector in which we have extensive experience as

a developer, investor and asset manager. We believe the prospects

are attractive for retail warehouses, both in absolute terms and

relative to other sectors of the real estate market.

ESG UPDATE

During the period, the Company continued to make good progress

in implementing its ESG objectives. The Company has delivered

improvements across the four focus areas of its Sustainability

Strategy. Some of the achievements are highlighted below:

-- Announced a Net Zero Commitment within the Annual Report and

Accounts 2021 and developed a pathway towards net zero;

-- Delivered employee ESG training, focused on Sustainable

Design and Environmental Management;

-- Developed a Supplier Code of Conduct;

-- Assessed the Environmental Management System against the ISO14001 standard;

-- Undertook an occupier satisfaction survey with a focus on ESG;

-- Continued progress against 100% Renewable Electricity by 2023;

-- Implemented emissions reduction activities through Asset

Sustainability Plans, which are due to be completed in Q3 2022;

-- Maintained alignment to EPRA Best Practices Recommendations

for Sustainability Reporting (sBPR);

-- Improved alignment to the Task Force on Climate-related

Financial Disclosures (TCFD) recommendations;

-- Developed a GRESB improvement plan and commenced submission for 2022; and

-- Began assessment of the climate change physical and transition risks.

A full update on the Company's ESG progress will be provided in

the annual report and accounts later this year.

Outlook

This has been a positive period for the Company, with progress

made across several key metrics. However, there are some headwinds

building which could affect the Company. Global supply chain

issues, rising inflation and the squeeze on household incomes all

pose a risk to the economy and the forecast recovery since the

health crisis. Inflation may prove to be less transitory than

previously forecast, interest rates could increase further by the

end of 2022 and consumers might have less money in their pockets to

spend - all of which could impact on retail, particularly

discretionary purchasing. However, our tenant line-up is

underpinned by convenience led retailers, a strength during the

pandemic when retail was under pressure.

Whilst these issues must be borne in mind, there are still

plenty of reasons to be optimistic. There is no doubt that the

Company is in a much stronger position than it was 12 months ago.

There are no signs that investment demand for retail warehousing

will wane in the near term, which should lead to further NAV

improvement. There is good occupational demand from tenants looking

to extend leases and acquire new space. In a sector with low supply

levels, this could lead to rental growth. Rent collection remains

strong, the EPRA vacancy rate has fallen, and we continue to

identify and complete asset management projects across multiple

properties.

Our key objective currently is to reinvest the proceeds from the

sale of the office portfolio and once we are fully invested to take

the next steps towards growth and delivering a progressive

dividend.

All this asset management and investment activity means the

Company has a reshaped portfolio and a strategy focused on a sector

which is forecast to perform well. This gives the Company a solid

platform on which to build and deliver growth in asset value and

income, which remain the key long-term objectives of the

Company.

Calum Bruce

Investment Manager

24 May 2022

Statement of Principal and emerging Risks and Uncertainties

The risks, and the way in which they are managed, are described

in more detail under the heading 'Principal and emerging risks'

within the Strategic Report in the Group's Annual Report and

Accounts for the year ended 30 September 2021. The Group's

principal and emerging risks have not changed materially since the

date of that report, other than the events in Ukraine, and its

geopolitical and economic impacts, and the heightened inflationary

risks to UK and other developed economies.

The Board regularly reviews the principal and emerging risks and

uncertainties faced by the Company together with the mitigating

actions it has established to manage the risks. These are set out

within the Strategic Report contained within the Annual Report for

the year ended 30 September 2021 and comprise the following risk

headings:

-- Investment strategy and performance;

-- Premium and discount level;

-- Financial;

-- Regulatory;

-- Operational; and

-- Economic, governmental and exogenous

In addition to these categories of risks, the Board is conscious

of the continuing impact on the global economy and financial

markets caused by the Covid-19 pandemic which emerged in early

2020. Added to this has been the more recent geopolitical risk and

impact of events in Ukraine and the heightened inflationary impact

affecting many developed economies, including the impact on living

costs and discretionary income. The Board considers that these

risks could have further implications for financial markets and the

operating environment of the Company.

DIRECTORS' RESPONSIBLIITIES

Directors' Responsibility Statement

The Directors are responsible for preparing the Half Yearly

Financial Report in accordance with applicable law and regulations.

The Directors confirm that to the best of their knowledge:

-- the condensed set of interim financial statements within the

Half Yearly Financial Report has been prepared in accordance with

IAS 34 'Interim Financial Reporting' of the UK-adopted IFRS;

and

-- the Interim Board Report (constituting the Interim Management

Report) includes a fair review of the information required by rules

4.2.7R of the Disclosure Guidance and Transparency Rules (being an

indication of important events that have occurred during the first

six months of the financial year and their impact on the condensed

set of financial statements and a description of the principal

risks and uncertainties for the remaining six months of the

financial year) and 4.2.8R (being related party transactions that

have taken place during the first six months of the financial year

and that have materially affected the financial position of the

Company during that period; and any changes in the related party

transactions described in the last Annual Report that could so

do).

These interim financial statements are unaudited and have not

been subject to review by the audit firm.

On behalf of the Board

William Hill

Chairman

24 May 2022

Financial Statements

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 31 March 2022

Notes Six months ended 31 March 2022 (unaudited)

===== ============================================== ================= ===============

Six months ended Year ended

31 March 30 September

2021 (unaudited) 2021 (audited)

Revenue Capital Total Total Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

========================= ===== ============== ============== ============== ================= ===============

Revenue

Rental income 8,016 - 8,016 9,107 17,371

Other income 463 - 463 - -

========================= ===== ============== ============== ============== ================= ===============

Total revenue 8,479 - 8,479 9,107 17,371

Unrealised loss on

revaluation of

investment properties 5 - 11,516 11,516 (5,324) 4,655

Gain on sale of

investment properties

realised 5 - 2,944 2,944 192 1,179

========================= ===== ============== ============== ============== ================= ===============

Total income 8,479 14,460 22,939 3,975 23,205

========================= ===== ============== ============== ============== ================= ===============

Expenditure

Investment management fee 2 (834) - (834) (824) (1,687)

Other expenses (1,845) - (1,845) (1,132) (1,914)

========================= ===== ============== ============== ============== ================= ===============

Total expenditure (2,679) - (2,679) (1,956) (3,601)

========================= ===== ============== ============== ============== ================= ===============

Movement in expected

credit losses 50 - 50 89 615

Profit/(loss) before

finance costs and

taxation 5,850 14,460 20,310 2,108 20,219

Net finance costs

Interest receivable 1 - 1 - -

Interest payable (1,540) - (1,540) (1,588) (3,109)

========================= ===== ============== ============== ============== ================= ===============

Profit/(loss) before

taxation 4,311 14,460 18,771 520 17,110

Taxation - - - - -

========================= ===== ============== ============== ============== ================= ===============

Profit/(loss) and total

comprehensive income for

the period 4,311 14,460 18,771 520 17,110

========================= ===== ============== ============== ============== ================= ===============

Basic and diluted

earnings per share 3 2.0p 6.9p 8.9p 0.3p 8.1p

========================= ===== ============== ============== ============== ================= ===============

The total column of this statement represents the Group's

Condensed Consolidated Statement of Comprehensive Income, prepared

in accordance with IFRS.

The supplementary revenue return and capital return columns are

prepared under guidance published by the Association of Investment

Companies.

All revenue and capital items in the above statement are derived

from continuing operations.

No operations were acquired or discontinued in the period.

The accompanying notes are an integral part of these condensed

consolidated financial statements.

Condensed Consolidated Statement of Financial Position

As at 31 March 2022

Notes As at As at As at

31 March 2022 31 March 2021 30 September 2021

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

=================================== ===== =============== =============== ===================

Non-current assets

Investment properties 5 235,078 242,008 277,984

=================================== ===== =============== =============== ===================

235,078 242,008 277,984

=================================== ===== =============== =============== ===================

Current assets

Trade and other receivables 38,572 33,194 13,390

Cash and cash equivalents 43,417 16,186 11,642

=================================== ===== =============== =============== ===================

81,989 49,380 25,032

=================================== ===== =============== =============== ===================

Total assets 317,067 291,388 303,016

=================================== ===== =============== =============== ===================

Non-current liabilities

Loans 6 (110,360) (110,195) (110,277)

=================================== ===== =============== =============== ===================

(110,360) (110,195) (110,277)

Current liabilities

Trade and other payables (3,671) (3,126) (3,190)

=================================== ===== =============== =============== ===================

Total liabilities (114,031) (113,321) (113,467)

=================================== ===== =============== =============== ===================

Net assets 203,036 178,067 189,549

=================================== ===== =============== =============== ===================

Equity and reserves

Called-up equity share capital 7 2,113 2,113 2,113

Share premium 125,559 125,559 125,559

Capital reserve - investments held (31,194) (52,689) (42,710)

Capital reserve - investments sold 6,505 2,574 3,561

Special distributable reserve 82,454 82,893 82,711

Revenue reserve 17,599 17,617 18,315

=================================== ===== =============== =============== ===================

Equity shareholders' funds 203,036 178,067 189,549

=================================== ===== =============== =============== ===================

Net asset value per Ordinary Share 8 96.1p 84.3p 89.7p

=================================== ===== =============== =============== ===================

The accompanying notes are an integral part of these condensed

consolidated financial statements.

The unaudited condensed financial statements on pages 8 to 14

were approved by the Board of Directors and authorised for issue on

24 May 2022 and were signed on its behalf by:

William Hill

Chairman

Registered number: 09090446

Condensed Consolidated Statement of Changes in Equity

For the six months ended 31 March 2022 (unaudited)

Capital Capital

reserve - reserve - Special

Share capital investments investments distributable Revenue

account Share premium held sold reserve reserve Total equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

============== ============= ============= ============= ============= ============= ============= ============

As at 30

September

2021 2,113 125,559 (42,710) 3,561 82,711 18,315 189,549

Profit and

total

comprehensive

income for

the period - - 11,516 2,944 - 4,311 18,771

Transactions

with owners

recognised in

equity:

Dividends paid - - - - - (5,284) (5,284)

Transfer from

special

reserve - - - - (257) 257 -

As at 31 March

2022 2,113 125,559 (31,194) 6,505 82,454 17,599 203,036

============== ============= ============= ============= ============= ============= ============= ============

For the six months ended 31 March 2021 (unaudited)

Capital Capital

reserve - reserve - Special

Share capital investments investments distributable Revenue

account Share premium held sold reserve reserve Total equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

============== ============= ============= ============= ============= ============= ============= ============

As at 30

September

2020 2,113 125,559 (47,365) 2,382 83,162 15,922 181,773

(Loss)/Profit

and total

comprehensive

income for

the period - - (5,324) 192 - 5,652 520

Transactions

with owners

recognised in

equity:

Dividends paid - - - - - (4,226) (4,226)

Transfer from

special

reserve - - - - (269) 269 -

============== ============= ============= ============= ============= ============= ============= ============

As at 31 March

2021 2,113 125,559 (52,689) 2,574 82,893 17,617 178,067

============== ============= ============= ============= ============= ============= ============= ============

For the year ended 30 September 2021 (audited)

Capital Capital

reserve - reserve - Special

Share capital investments investments distributable Revenue

account Share premium held sold reserve reserve Total equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

============== ============= ============= ============= ============= ============= ============= ============

As at 30

September

2020 2,113 125,559 (47,365) 2,382 83,162 15,922 181,773

Loss and total

comprehensive

income for

the year - - 4,655 1,179 - 11,276 17,110

Transactions

with owners

recognised in

equity:

Dividends paid - - - - - (9,334) (9,334)

Transfer from

special

reserve - - - - (451) 451 -

============== ============= ============= ============= ============= ============= ============= ============

As at 30

September

2021 2,113 125,559 (42,710) 3,561 82,711 18,315 189,549

============== ============= ============= ============= ============= ============= ============= ============

The accompanying notes are an integral part of these condensed

consolidated financial statements.

Condensed Consolidated Cash Flow Statement

For the six months ended 31 March 2022

Six months ended Six months ended Year ended

31 March 2022 31 March 2021 30 September 2021

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

======================================================== ================= ================ ===================

Cash flows from operating activities

Profit/(loss) before tax 18,771 520 (17,110)

Adjustments for:

Interest receivable (1) - -

Interest payable 1,540 1,588 3,109

Unrealised revaluation (gain)/loss on property portfolio (11,516) 5,324 (4,655)

Gain on sale of investment property realised (2,944) (192) (1,179)

============================================================ ================= ================ ===================

Operating cash flows before working capital changes 5,850 7,240 14,385

(Increase)/decrease in trade and other receivables (26,296) (18,078) 1,823

Increase/(decrease) in trade and other payables 653 (538) (492)

============================================================ ================= ================ ===================

Net cash (outflow)/inflow from operating activities (19,793) (11,376) 15,716

============================================================ ================= ================ ===================

Cash flows from investing activities

Capital expenditure (1,630) (5,512) (10,345)

Acquisition of investment properties - - (21,640)

Sale of investment properties 60,084 26,466 27,953

============================================================ ================= ================ ===================

Net cash inflow/(outflow) from investing activities 58,454 20,954 (4,032)

============================================================ ================= ================ ===================

Cash flows from financing activities

Dividends paid (5,284) (4,090) (9,334)

Interest received 1 - -

Interest paid (1,603) (1,610) (3,016)

============================================================ ================= ================ ===================

Net cash outflow from financing activities (6,886) (5,700) (12,350)

============================================================ ================= ================ ===================

Net increase/(decrease) in cash 31,775 3,878 (666)

Opening cash and cash equivalents 11,642 12,308 12,308

============================================================ ================= ================ ===================

Closing cash and cash equivalents 43,417 16,186 11,642

============================================================ ================= ================ ===================

The accompanying notes are an integral part of these condensed

financial statements.

Notes to the Condensed Consolidated Financial Statements

1. General information

Basis of preparation

These unaudited condensed consolidated financial statements for

the six month period ended 31 March 2022 have been prepared in

accordance with UK-adopted International Financial Reporting

Standards (IFRS) and the accounting policies set out in the

statutory accounts of the Group for the year ended 30 September

2021. The unaudited condensed consolidated financial statements for

the six month period ended 31 March 2022 do not include all the

information required for a complete set of IFRS financial

statements and should be read in conjunction with the financial

statements of the Group for the year ended 30 September 2021, which

were prepared under UK-adopted IFRS. The accounting policies

adopted in this report are consistent with those applied in the

Group's audited financial statements for the year ended 30

September 2021. The accounting policies applied in the preparation

of this financial information are expected to be consistently

applied in the financial statements for the year to 30 September

2022. Based on the current operations of the Group, no other new or

revised accounting standards have been issued that are expected to

have a material effect on the Group's financial statements in the

future. There have been no significant changes to management

judgements and estimates since 30 September 2021.

The Company is a public listed company incorporated and

domiciled in England and Wales. The Company's ordinary shares are

listed on the Premium Segment of the Official List and traded on

the London Stock Exchange's Main Market. The Group follows the Real

Estate Investment Trust (REIT) regime for the purposes of UK

taxation.

The registered address of the Company is disclosed in the

Corporate information.

going concern

The condensed consolidated financial statements have been

prepared on the going concern basis. In assessing the going concern

basis of accounting the Directors have had regard to the guidance

issued by the Financial Reporting Council.

The Company's assets consist mainly of UK commercial property

assets. The condensed consolidated financial statements have been

prepared on the going concern basis. In assessing the going concern

basis of accounting the Directors have had regard to the guidance

issued by the Financial Reporting Council. After making enquiries,

and bearing in mind the nature of the Group's business and assets,

the Directors consider that the Group has adequate resources to

continue in operational existence over the medium term. For these

reasons, the Board continues to adopt the going concern basis in

preparing these financial statements.

The Board has set limits for borrowing and regularly reviews

actual exposures, cash flow projections and compliance with banking

covenants, including the headroom available. The Board also reviews

sensitivity analysis of the Group's operations and the ability to

fulfil its operational commitments under different stress

scenarios.

Having taken these factors into account, the Directors believe

that the Company has adequate resources to continue in operational

existence for the foreseeable future and is able to meet its

financial obligations as they fall due for the period to 23 May

2023, which is at least twelve months from the date of approval of

this Report. For these reasons, they continue to adopt the going

concern basis of accounting in preparing the financial

statements.

2. Investment Management Fee

Six months ended Six months ended Year ended

31 March 2022 31 March 2021 30 September 2021

GBP'000 GBP'000 GBP'000

========================== ================ ================ ==================

Investment management fee 834 824 1,687

========================== ================ ================ ==================

Total 834 824 1,687

========================== ================ ================ ==================

Ediston Investment Services Limited has been appointed as the

Company's Alternative Investment Fund Manager (AIFM) and investment

manager, with the property management services for the Group being

delegated to Ediston Properties Limited. Ediston Investment

Services Limited is entitled to a fee calculated as 0.95% per annum

of the net assets of the Group up to GBP250m, 0.75% per annum of

the net assets of the Group over GBP250m and up to GBP500m and

0.65% per annum of the net assets of the Group over GBP500m. The

management fee on any cash available for investment (being all cash

held by the Group except cash required for working capital and

capital expenditure) is reduced to 0.475% per annum while such cash

remains uninvested. The Management fee is reduced by a quarterly

contribution of GBP10,000 (GBP40,000 per annum) towards the overall

management costs of the Company.

Ediston Investment Services Limited has committed to investing

20.0% of the quarterly management fee in the Company's shares each

quarter for a period of three years commencing 1 October 2020.

Refer to note 10 for further information.

3. Earnings per Share

Six months ended Six months ended Year ended

31 March 2022 31 March 2021 30 September 2021

================================== ======================== ======================== ========================

GBP'000 Pence per share GBP'000 Pence per share GBP'000 Pence per share

================================== ======= =============== ======= =============== ======= ===============

Revenue earnings 4,311 2.0 5,652 2.7 11,276 5.3

Capital earnings 14,460 6.9 (5,132) (2.4) 5,834 2.8

Total earnings 18,771 8.9 520 0.3 17,110 8.1

================================== ======= =============== ======= =============== ======= ===============

Average number of shares in issue 211,333,737 211,333,737 211,333,737

================================== ======================== ======================== ========================

Earnings for the period to 31 March 2022 should not be taken as

a guide to the results for the year to 30 September 2022.

4. Dividends

Six monthly dividends of 0.4167 pence per share, at a cost of

GBP5,284,000 (six monthly dividends at a rate of 0.3333 pence per

share for the six months ended 31 March 2021, at a cost of

GBP4,224,000) were paid during the period. The rate was increased

from 0.3333 pence per share to 0.4167 pence per share in May

2021.

A seventh interim dividend for the year ending 30 September

2022, of 0.4167 pence per share, will be paid on 31 May 2022 to

shareholders on the register on 13 May 2022. This monthly dividend

of 0.4167 pence per share equates to an annualised dividend level

of 5.00 pence per share.

All of the distributions made by the Company have been Property

Income Distributions (PIDs).

5. Investment Properties

As at As at As at

31 March 31 March 30 September

2022 2021 2021

Freehold and leasehold properties GBP'000 GBP'000 GBP'000

=========================================== ========= ========= ==========================

Opening book cost 320,694 315,611 315,611

Opening unrealised appreciation (42,710) (47,365) (47,365)

=========================================== ========= ========= ==========================

Opening fair value 277,984 268,246 268,246

=========================================== ========= ========= ==========================

Movement for the period

Acquisitions - - 21,850

Sales

- net proceeds (60,084) (26,466) (27,953)

- gain on sales 2,944 192 1,179

Capital expenditure 2,719 5,360 10,007

=========================================== ========= ========= ==========================

Movement in book cost (54,421) (20,914) 5,083

=========================================== ========= ========= ==========================

Unrealised gain realised during the year - - -

Unrealised gains on investment properties 23,086 598 10,798

Unrealised losses on investment properties (11,571) (5,922) (6,143)

=========================================== ========= ========= ==========================

Movement in fair value (42,906) (26,238) 4,655

=========================================== ========= ========= ==========================

Closing book cost 266,273 294,697 320,694

=========================================== ========= ========= ==========================

Closing unrealised (depreciation) (31,195) (52,689) (42,710)

=========================================== ========= ========= ==========================

Closing fair value 235,078 242,008 277,984

=========================================== ========= ========= ==========================

During the period ended 31 March 2022 the Group sold office

properties at Bath, Newcastle, Edinburgh and Birmingham. The Group

received a net amount of GBP60,084,000 from investments sold in the

period. The book cost of the investments when it was purchased was

GBP58,016,000. This investment has been revalued over time and,

until it was sold, any unrealised gains/losses were included in the

fair value of the investments.

The fair value of the investment properties reconciled to the appraised value as follows:

Six months ended Six months ended Year ended

31 March 2022 31 March 2021 30 September 2021

GBP'000 GBP'000 GBP'000

========================================================== ================ ================ ==================

Closing fair value 235,078 242,008 277,984

Lease incentives held as debtors 3,742 4,842 5,361

========================================================== ================ ================ ==================

Appraised market value per Knight Frank 238,820 246,850 283,345

========================================================== ================ ================ ==================

Changes in the valuation of investment properties

Six months ended Six months ended Year ended

31 March 2022 31 March 2021 30 September 2021

GBP'000 GBP'000 GBP'000

========================================================== ================ ================ ==================

Gain on sale of investment properties 2,944 192 1,179

Gain on sale of investment properties realised* 2,944 192 1,179

Unrealised gains on investment properties 23,086 598 -

Unrealised (losses)/gains on investment properties (11,571) (5,922) 4,655

========================================================== ================ ================ ==================

Total gain/(loss) on revaluation of investment properties 14,459 (5,132) (5,834)

========================================================== ================ ================ ==================

*Represents the difference between the sales proceeds, net of

costs, and the property valuation at the end of the prior year.

5. Investment Properties continued

The loss on revaluation of investment properties reconciles to the movement in appraised market

value as follows:

Six months ended Six months ended Year ended

31 March 2022 31 March 2021 30 September 2021

GBP'000 GBP'000 GBP'000

=================================================== ================ ================ ==================

Total loss on revaluation of investment properties 14,459 (5,132) 4,655

Purchases - - 21,850

Capital expenditure 2,719 5,360 10,007

Sales - net proceeds (60,084) (26,466) (26,774)

--------------------------------------------------- ---------------- ---------------- ------------------

Movement in fair value (42,906) (26,238) 9,738

--------------------------------------------------- ---------------- ---------------- ------------------

Movement in lease incentives held as debtors (1,619) 113 632

--------------------------------------------------- ---------------- ---------------- ------------------

Movement in appraised market value (44,525) (26,125) 10,370

--------------------------------------------------- ---------------- ---------------- ------------------

At 31 March 2022, the properties were valued at GBP238,820,000

(31 March 2021: GBP246,850,000 and 30 September 2021:

GBP283,345,000) by Knight Frank LLP (Knight Frank), in their

capacity as external valuers. The valuation was undertaken in

accordance with the current editions of RICS Valuation - Global

Standards, which incorporate the International Valuation Standards,

and the RICS UK National Supplement.

Fair value is based on an open market valuation (the price that

would be received to sell an asset, or paid to transfer a

liability, in an orderly transaction between market participants at

the measurement date), provided by Knight Frank on a quarterly

basis, using recognised valuation techniques as set out in the

accounting policies and Note 9 of the consolidated financial

statements of the Group for the year ended 30 September 2021. The

valuations are the ultimate responsibility of the Directors.

Accordingly, the critical assumptions used in establishing the

independent valuation are reviewed by the Board.

There were no other significant changes to the valuation

process, assumptions or techniques used during the period.

6. Loans

As at As at As at

31 March 31 March 30 September

2022 2021 2021

GBP'000 GBP'000 GBP'000

================================== ========= ========= =============

Principal amount outstanding 111,076 111,076 111,076

Set-up costs (1,612) (1,612) (1,612)

Amortisation of loan set-up costs 896 731 813

================================== ========= ========= =============

Total 110,360 110,195 110,277

================================== ========= ========= =============

The Group's loan arrangements are with Aviva Commercial Finance

Limited.

The Group has loans totalling GBP56,920,000 which carry a fixed

blended interest rate of 2.9% and mature in May 2025. This rate is

fixed for the period of the loan as long as the loan-to-value is

maintained below 40.0%, increasing by ten basis points if the

loan-to-value is 40.0% or higher. These loans are secured over EPIC

(No.1) Limited's property portfolio. The Group also has loans

totalling GBP54,156,000 which carry a fixed interest rate of 2.7%

and mature in December 2027. This rate is fixed for the period of

the loan as long as the loan-to-value is maintained below 40.0%,

increasing by ten basis points if the loan-to-value is 40.0% or

higher. These loans are secured over EPIC (No.2) Limited's property

portfolio.

Under the terms of early repayment relating to the loans, the

cost of repaying the loans on 31 March 2022, based on the yield on

the Treasury 5% 2025 and Treasury 4.25% 2027 plus a margin of 0.5%,

would have been approximately GBP114,084,000 (31 March 2021:

GBP122,222,000 and 30 September 2021: GBP120,268,000), Including

repayment of the principal GBP111,076,000 (31 March 2021:

GBP111,076,000 and 30 September 2021: GBP111,076,000).

The fair value of the loans based on a marked-to-market basis,

being the yield on the relevant Treasury plus the appropriate

margin, was GBP109,969,000 at 31 March 2022 (31 March 2021:

GBP116,274,000 and 30 September 2021: GBP114,918,000). This

includes the principal borrowed.

7. Called-up Equity Share Capital

The Company had 211,333,737 Ordinary Shares of 1 pence par value

in issue at 31 March 2022 (31 March 2021: 211,333,737 and 30

September 2021: 211,333,737).

During the period to 31 March 2022, the Company did not issue

any Ordinary Shares (six months ended 31 March 2021: issued none;

year ended 30 September 2021: issued none). The Company did not

buyback or resell from treasury any Ordinary Shares during the

period or during either comparative period.

The Company did not hold any shares in treasury at 31 March 2022

(31 March 2021: nil and 30 September 2021: nil).

8. Net Asset Value

The Group's net asset value per Ordinary Share of 96.1 pence (31

March 2021: 84.3 pence and 30 September 2021: 89.7 pence) is based

on equity shareholders' funds of GBP203,036,000 (31 March 2021:

GBP178,087,000 and 30 September 2021: GBP189,549,000) and on

211,333,737 (31 March 2021: 211,333,737 and 30 September 2021:

211,333,737) Ordinary Shares, being the number of shares in issue

at the period end.

The net asset value calculated under IFRS is the same as the

EPRA net asset value as at 31 March 2022 and for both comparative

periods.

9. Investment in subsidiaries

The Group's results consolidate those of EPIC (No.1) Limited, a

wholly owned subsidiary of Ediston Property Investment Company plc,

incorporated in England & Wales on 27 June 2014 (Company

Number: 09106328) and EPIC (No.2) Limited, a wholly owned

subsidiary of Ediston Property Investment Company plc, incorporated

in England & Wales on 23 September 2017 (Company Number:

10978359). The subsidiaries hold all the investment properties

owned by the Group and are also the parties which hold the Group's

borrowings (see Note 6).

10. Related Parties

There have been no material transactions between the Company and

its Directors during the period other than amounts paid to them in

respect of expenses and remuneration for which there were no

outstanding amounts payable at the period end.

Ediston Investment Services Limited has received investment

management fees of GBP834,000 in relation to the six months ended

31 March 2022 (six months ended 31 March 2021: GBP824,000 and year

ended 30 September 2021: GBP1,687,000) of which GBP424,068 (31

March 2021: GBP411,213 and 30 September 2021: GBP437,000) remained

payable at the period end. Ediston Investment Services Limited

received no development management fees in relation to the six

months ended 31 March 2022 (six months ended 31 March 2021:

GBP177,000 and year ended 30 September 2021: GBP257,000) with

GBPnil (31 March 2021: GBPnil and 30 September 2021: GBPnil)

payable at the period end.

The aggregate shareholding of the manager and its senior

personnel as at 31 March 2022 is 2,378,244 shares, 1.1% of the

issued share capital as at that date.

11. Commitments

As at 31 March 2022 the Group had contractual commitments

totalling GBP1,687,000 (31 March 2021: GBP1,738,000 and 30

September 2021: GBP405,000). This is in relation to retentions for

the capital works on Barnsley, Prestatyn, Hull, Stirling and

Haddington.

The Group did not have any other contractual commitments to

refurbish, construct or develop any investment property, or for

repair, maintenance or enhancements, as at 31 March 2022.

12. Fair Value Measurements

The fair value measurements for assets and liabilities are

categorised into different levels in the fair value hierarchy based

on the inputs to valuation techniques used. These different levels

have been defined as follows:

-- Level 1 - quoted prices (unadjusted) in active markets for

identical assets or liabilities that the Group can access at the

measurement date.

-- Level 2 - inputs, other than quoted prices included within

Level 1 that are observable for the asset or liability, either

directly or indirectly.

-- Level 3 - unobservable inputs for the asset or liability.

Value is the Directors' best estimate, based on advice from

relevant knowledgeable experts, use of recognised valuation

techniques and on assumptions as to what inputs other market

participants would apply in pricing the same or similar instrument.

All investment properties are included in Level 3.

There were no transfers between levels of the fair value

hierarchy during the six months ended 31 March 2022.

13. Interim Report Statement

The Company's auditor, Grant Thornton UK LLP, has not audited or

reviewed the Interim Report to 31 March 2022 pursuant to the

Auditing Practices Board guidance on 'Review of Interim Financial

Information'. These are not full statutory accounts in terms of

Section 434 of the Companies Act 2006 and are unaudited. Statutory

accounts for the year ended 30 September 2021, which received an

unqualified audit report and which did not contain a statement

under Section 498 of the Companies Act 2006, have been lodged with

the Registrar of Companies. No full statutory accounts in respect

of any period after 30 September 2021 have been reported on by the

Company's auditor or delivered to the Registrar of Companies.

Shareholder Information

Corporate Summary

Ediston Property Investment Company plc (the Company) is a

closed- ended property investment company which began trading in

October 2014. The Company has a single class of Ordinary Shares in

issue, which are listed on the premium segment of the Official List

and traded on the London Stock Exchange's Main Market. The Company

has two wholly owned subsidiary undertakings, EPIC (No.1) Limited

and EPIC (No.2) Limited (the Subsidiaries). The Company and the

Subsidiaries are referred to collectively throughout this document

as 'the Group', although references to the Company may also

encompass matters relevant to the Subsidiaries.

The Group has entered the Real Estate Investment Trust (REIT)

regime for the purposes of UK taxation. Further information for

shareholders on the tax structure and UK taxation of the Group's

distributions is provided in the Annual Report for the year ended

30 September 2021.

Investment Objective

The Company's investment objective is to provide shareholders

with an attractive level of income together with the prospect of

income and capital growth.

Investment policy

The Company's full investment policy is contained in the

Directors' Report in the Annual Report and Accounts for the year

ended 30 September 2021.

INVESTMENT MANAGER AND AIFM

Ediston Investment Services Limited has been appointed as the

Company's alternative investment fund manager (AIFM) and investment

manager and therefore provides portfolio and risk management

services, including ensuring compliance with the Group's investment

policy and the requirements of the AIFMD, through the Management

Agreement. Management services, including advising on the

acquisition, development, leasing, management and sale of the

Group's properties, are delegated to Ediston Properties Limited

under the Investment Manager's Delegation Agreement. Both

agreements are subject to 12 months' notice, other than in a breach

scenario.

Investor relations

Information on Ediston Property Investment Company plc,

including the latest share price can be found on the Company's

website at www.ediston-reit.com .

Registrar

Computershare Investor Services PLC

The Pavilions

Bridgwater Road

Bristol BS99 6ZZ

T: 0370 707 1079

E: www.investorcentre.co.uk/contactus

Enquiries about the following administrative matters should be

addressed to the Company's registrar:

- Change of address notification.

- Lost share certificates.

- Dividend payment enquiries.

- Dividend mandate instructions. Shareholders may have their

dividends paid directly into their bank or building society

accounts by completing a dividend mandate form. Tax vouchers, where

applicable, are sent directly to shareholders' registered

addresses.

- Amalgamation of shareholdings. Shareholders who receive more

than one copy of the Annual/Interim Report are invited to

amalgamate their accounts on the share register.

Shareholders can view and manage their shareholdings online at

www.investorcentre.co.uk, including updating address records,

making dividend payment enquiries, updating dividend mandates and

viewing the latest share price. Shareholders will need their

Shareholder Reference Number (SRN), which can be found on their

share certificate or a recent dividend tax voucher, to access this

site. Once signed up to Investor Centre, an activation code will be

sent to the shareholder's registered address to enable the

shareholder to manage their holding.

anticipated Financial Calendar 2021/22

July 2022 Announcement of Net Asset Value as at 30 June 2022

============= ==============================================================

October 2022 Announcement of Net Asset Value as at 30 September 2022

============= ==============================================================

December 2022 Publication of Annual Report for the year to 30 September 2022

============= ==============================================================

January 2023 Announcement of Net Asset Value as at 31 December 2022

============= ==============================================================

February 2023 Annual General Meeting

============= ==============================================================

The Board will consider the calendar at each meeting and amend

as appropriate. The Company continues to pay monthly dividends.

Glossary of terms, definitions and alternative performance

measures

The Company uses Alternative Performance Measures (APMs). APMs

do not have a standard meaning prescribed by accounting standards

and therefore may not be comparable to similar measures presented

by other entities. The APMs used by the Company are included below.

A full glossary was included in the Annual Report 2021 to assist

investors in their understanding of the other technical terms that

the Company may use in reporting its results.

Contracted Rent The annualised rent adjusting for the inclusion of rent

subject to rent-free periods and rental

guarantees.

======================================================= =============================================================

Discount (or Premium) of Share Price to Net Asset Value If the share price is less than the Net Asset Value per

share, the shares are trading at a

discount. If the share price is greater than the Net Asset

Value per share, the shares are

trading at a premium. The discount (or premium) is calculated

by reporting the difference

between the Net Asset Value per share and the Share Price as

a percentage of the Net Asset

Value per share.

======================================================= =============================================================

Dividend Cover Revenue profit for the period, excluding exceptional items,

divided by dividends paid during

the period.

======================================================= =============================================================

Dividend Yield Calculated using the annual dividend as a percentage of the

share price at the period end.

======================================================= =============================================================

Earnings per share (EPS) Profit for the period attributable to ordinary equity holders

of the Company divided by the

time weighted average number of ordinary shares outstanding

during the period. As there are

no dilutive instruments outstanding, basic and diluted

earnings per share are identical.

======================================================= =============================================================

EPRA NAV NAV adjusted to include properties and other investment

interests at fair value and to exclude

certain items not expected to crystallise in a long-term

investment property business model.

Makes adjustments to the IFRS NAV to provide stakeholders

with the most relevant information

on the fair value of the assets and liabilities within a true

real estate investment company

with a long-term investment strategy. At 31 March 2022, 30

September 2021 and 31 March 2021,

the EPRA NAV was the same as the IFRS NAV.

======================================================= =============================================================

EPRA Net Asset Value (NAV) per Share EPRA NAV at the period end divided by the number of Ordinary

Shares in issue at that date.

======================================================= =============================================================

EPRA Vacancy Rate Estimated Market Rental Value (ERV) of vacant space expressed

as a percentage of the ERV of

the whole portfolio. The vacancy rate excludes those

properties which are under development

or major refurbishment.

======================================================= =============================================================

Gearing Unlike open-ended investment companies, closed-ended

investment companies have the ability

to borrow to invest.

This term is used to describe the level of borrowings that an

Investment Company has undertaken.

The higher the level of borrowings, the higher the gearing

ratio. This is expressed as a percentage

of the principal value of borrowings against total assets.

======================================================= =============================================================

Like-for-like Movement The like-for-like increase (or decrease) in the property

portfolio is calculated as the movement

in the fair value of the property portfolio excluding any

properties bought or sold in the

period.

======================================================= =============================================================

Loan-to-Value (LTV) Debt outstanding and drawn at the period end, net of any cash

held in the Lender deposit account,

expressed as a percentage of the market value of all property

assets.

======================================================= =============================================================

NAV per Ordinary Share (or IFRS NAV) This is calculated as the net assets of the Group calculated

under its accounting policies

(as set out on pages 80 to 84 of the Annual Report 2021)

divided by the number of shares in

issue, excluding those shares held in treasury. This is the

number disclosed at the foot of

the Consolidated Statement of Financial Position on page 8.

At 31 March 2022 and 30 September

2021, the IFRS NAV was the same as the EPRA NAV.

======================================================= =============================================================

NAV Total Return The growth in NAV plus dividends reinvested, and this can be

expressed as a percentage of

NAV per share at the start of the period.

======================================================= =============================================================

Share Price Total Return The percentage change in the Share Price assuming dividends

are reinvested to purchase additional

Ordinary Shares at the prevailing share price.

======================================================= =============================================================

WAULT (Weighted Average Unexpired Lease Term) The average lease term remaining to the earlier of break or

expiry, across the portfolio weighted

by contracted rental income (including rent-frees). The

calculation excludes properties allocated

as developments.

======================================================= =============================================================

Capitalised terms above are as defined in the glossary included

in the Annual Report 2021.

HOW TO INVEST

Shares in Ediston Property Investment Company plc are listed on

the main market of the London Stock Exchange (LSE: EPIC).

As with any publicly quoted company, the Company's shares can be

bought and sold on the stock market. This can be done directly

through a wealth manager, financial adviser or stockbroker.

Another option is to use one of the platform providers who offer

an 'execution only' service. Links to such providers are available

on the Company's website at www.ediston-reit.com. Potential

investors should note that by clicking on any of the links

contained thereon, you will leave the Company's website and go to

an external website. The Company is not responsible for the content

or accuracy of these external websites.

KEY INFORMATION DOCUMENT

Investors should be aware that the Packaged Retail and

Insurance-based Investment Products Regulation (PRIIPs) Regulation

requires the AIFM, as the PRIIP manufacturer, to prepare a key

information document (KID) in respect of the Company. This KID must

be made available by the Investment Manager to retail investors

prior to them making any investment decision and is available on

the Company's website. The Company is not responsible for the

information contained in the KID and investors should note that the

procedures for calculating the risks, costs and potential returns

are prescribed by the law. The figures in the KID may not reflect

the expected returns for the Company and anticipated performance

returns cannot be guaranteed.

Important Information

Past performance is not necessarily a guide to future

performance. The value of investments and income from them may go

down as well as up and are not guaranteed. NAV performance is not

linked to share price performance and shareholders may realise

returns that are lower or higher in performance.

Certain statements in this report are forward-looking

statements. By their nature, forward-looking statements involve a

number of risks, uncertainties or assumptions that could cause

actual results or events to differ materially from those expressed

or implied by those statements. Forward-looking statements

regarding past trends or activities should not be taken as

representation that such trends or activities will continue in the

future. Accordingly, undue reliance should not be placed on