TIDMEPIC

RNS Number : 9943E

Ediston Property Inv Comp PLC

02 November 2022

Ediston Property Investment Company plc

(LEI: 213800JRL87EGX9TUI28)

Net Asset Value ('NAV') as at 30 September 2022

And Trading Update

Ediston Property Investment Company plc (LSE: EPIC) (the

'Company') announces its unaudited NAV at 30 September 2022, which

will form the basis for the year end accounts.

Quarter Headlines

-- NAV per share at 30 September 2022 of 94.86 pence (30 June

2022: 98.35 pence), a decrease of 3.5% in the quarter.

-- Fair value independent valuation of the property portfolio at

30 September 2022 of GBP231.4 million, a like-for-like decrease of

2.5% on the valuation at 30 June 2022.

-- NAV total return (including dividends) for the quarter of

-2.5% (30 June 2022 quarter: 3.7%).

-- NAV total return of 11.5% for the year ended 30 September 2022.

-- Portfolio weighted average unexpired lease length of 4.5

years and EPRA vacancy rate of 6.5%.

-- Dividends totalling 1.25 pence per share (5.00 pence per

share annualised) paid in the quarter.

--------------------------------------------------------------------------------------

-- Last remaining non-retail warehouse asset sold for GBP5.0

million. The Company now only holds retail warehouse assets and has

cash available for further investment in the retail warehouse

sector.

-- Two asset management deals completed, securing GBP1.25 million of rental income per annum.

--------------------------------------------------------------------------------------

Net Asset Value

The unaudited NAV of the Company at 30 September 2022 was

GBP200.48 million, or 94.86 pence per share, a decrease of 3.5% on

the Company's NAV per share as at 30 June 2022.

Pence Per GBP million

Share

NAV at 30 June 2022 98.35 207.82

---------- ------------

Valuation of retained property

portfolio (3.66) (7.74)

---------- ------------

Reduction in value of the property

portfolio as a result of Telford

sale (1.58) (3.35)

---------- ------------

Sale proceeds 2.37 5.00

---------- ------------

Capital expenditure (0.45) (0.92)

---------- ------------

Income earned 1.89 4.00

---------- ------------

Expenses & finance costs (0.81) (1.69)

---------- ------------

Dividends paid (1.25) (2.64)

---------- ------------

NAV at 30 September 2022 94.86 200.48

---------- ------------

The NAV attributable to the ordinary shares has been calculated

under International Financial Reporting Standards ('IFRS'); the

EPRA NAV is not reported separately in this update as it is the

same as the IFRS NAV.

The NAV incorporates the independent portfolio valuation as at

30 September 2022 and undistributed income for the quarter, but

does not include a provision for any accrued monthly dividend.

Investment and asset management activity

During the period, the Company sold its leisure unit at

Southwater Square, Telford, its final non-retail warehouse

property, for GBP5.0 million. The Company is now only invested in

retail warehouse assets, in line with its revised strategy.

In the quarter, the Investment Manager completed two asset

management deals securing GBP1.25 million of rental income per

annum.

At Coatbridge, Glasgow, an Agreement for Lease (AFL) was

completed with the existing tenant, B&Q, keeping it on the park

for a further 10 years. B&Q had a lease expiry in December this

year. As part of the transaction, B&Q will downsize from

102,000 sq. ft. to 79,960 sq. ft. Aldi, has signed an AFL for a

20,000 sq. ft. unit which will be created in the space vacated by

B&Q. Planning permission has been obtained for the change to

food use. On completion of the landlord works, Aldi will enter into

a 20-year lease without break, subject to five-yearly rent reviews

linked to RPI. This transaction will be reflected in the NAV when

the condition relating to the landlord works has been discharged

and the leases have completed.

At Springkerse Retail Park, Stirling, Pets at Home agreed to the

removal of its lease break option, which was due in June 2024. The

lease will now expire in June 2029. The passing rent is unchanged

but will benefit from an upwards only rent review in June 2024.

The Investment Manager continues to progress lettings and lease

restructures across the portfolio, with the aim of further

improving the Company's income stream.

Potential new acquisitions continue to be reviewed. However,

this is in the context of ensuring that terms reflect market

conditions, and that the financial resilience of the Company is

secure.

Cash and debt

At the date of this announcement, the Company has approximately

GBP51.2 million of cash available for investment and operational

purposes. The Company also has GBP31.2 million of cash held in its

debt facility, which is subject to the lender's LTV requirements

being met for it to be released for investment purposes.

At the date of the September valuation, the average

loan-to-value across the Company's two debt facilities was 34.7%.

The Company is fully compliant with all debt covenants.

Summary

The Company's NAV decreased by 3.5%, following five consecutive

quarters of NAV growth. Values reduced across the UK commercial

property market, with some sub sectors more affected than

others.

The cost-of-living crisis, rising energy costs, high inflation,

rising interest rates, political instability and wider

geo-political events eroded the confidence of consumers and

investors alike and have created headwinds, not just for property,

but also for the wider economy. However, it was the material

increase in gilt yields which caused the biggest recent shift in

property values, particularly for the lower yielding sub-sectors

such as industrial and logistics. How the gilt market responds to

the switch in government economic policy will be important for real

estate markets going forward.

However, the fundamentals of retail warehousing remain

attractive, and it is likely to continue to be the most resilient

and flexible of the retail sub-sectors, able to adapt to the

changing needs of consumers and tenants as well as accommodating

many convenience-led retailers.

There will be challenges to contend with, but with a reshaped

portfolio (with no office or leisure exposure), a good tenant line

up, a low vacancy rate (6.5%) an attractive WAULT (4.5 years) and

ongoing asset management opportunities, the Company has a robust

platform on which to build. Further, the Company has cash available

for investment into a re-priced market, at the appropriate

time.

Portfolio sector weightings and tenant and locational exposure

as at 30 September 2022

Sector

Sector Exposure

(%)

Retail warehouse 100.0

---------

Geography

The portfolio is diversified across the regional markets.

Region Exposure

(%)

Scotland 27.2

---------

Wales 26.1

---------

North West 16.9

---------

Yorkshire 15.2

---------

North East 8.4

---------

East Midlands 6.2

---------

Top five tenants (contracted income) 30 September 2022

Tenant Exposure

(%)

B&Q Limited 15.0

---------

B&M Retail Limited 7.9

---------

Marks & Spencer

plc 7.6

---------

Boots UK Limited 4.7

---------

Pets at Home

Limited 3.9

---------

Forthcoming events

The next interim dividend announcement is expected to be made by

3 November 2022. The next scheduled independent quarterly valuation

of the property portfolio will be conducted by Knight Frank LLP for

31 December 2022. The unaudited NAV per share at that date is

expected to be announced in January 2023.

The Company intends to publish its next factsheet shortly which

will be made available on the Company's website at

www.ediston-reit.com.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014. Upon the

publication of this announcement via Regulatory Information

Service, this inside information is now considered to be in the

public domain.

Enquiries

Will Barnett - Investec Bank plc 0207 597 5873

Calum Bruce - Ediston Investment Services Limited 0131 225 5599

Ruth Wright - JTC 0203 893 1011

Ben Robinson - Kaso Legg Communications 0203 995 6672

Stephanie Ross - Kaso Legg Communications 0203 995 6676

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVFFFFILILLIIF

(END) Dow Jones Newswires

November 02, 2022 03:01 ET (07:01 GMT)

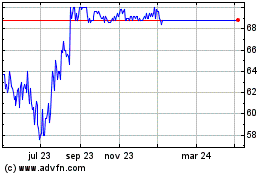

Ediston Property Investm... (LSE:EPIC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Ediston Property Investm... (LSE:EPIC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024