TIDMEPIC

RNS Number : 3210O

Ediston Property Inv Comp PLC

31 January 2023

Ediston Property Investment Company plc

(LEI: 213800JRL87EGX9TUI28)

Net Asset Value ('NAV') as at 31 December 2022

And Trading Update

Ediston Property Investment Company plc (LSE: EPIC) (the

'Company') announces its unaudited NAV at 31 December 2022.

Quarter Headlines

-- NAV per share at 31 December 2022 of 80.93 pence (30

September 2022: 94.86 pence), a decrease of 14.7% in the

quarter.

-- Fair value independent valuation of the property portfolio at

31 December 2022 of GBP203.1 million, a like-for-like decrease of

12.3% on the audited financial year end valuation at 30 September

2022.

-- NAV total return (including dividends) for the quarter of

-13.4% (30 September 2022 quarter: -2.5%).

-- NAV total return of -5.8% for the year ended 31 December 2022.

-- NAV decline of 10.7% for the year ended 31 December 2022.

-- Portfolio weighted average unexpired lease term (WAULT) of

5.1 years and EPRA Vacancy Rate of 6.7%.

-- Dividends totalling 1.25 pence per share (5.00 pence per

share annualised) paid in the quarter.

--------------------------------------------------------------------------------------

-- Four asset management deals completed, in line with or ahead

of the independent valuer's ERVs, securing GBP829,500 of rental

income per annum.

--------------------------------------------------------------------------------------

Net Asset Value

The unaudited NAV of the Company at 31 December 2022 was

GBP171.02 million, or 80.93 pence per share, a decrease of 14.7% on

the Company's NAV per share as at 30 September 2022.

Pence Per GBP million

Share

NAV at 30 September 2022 94.86 200.48

---------- ------------

Valuation of retained property

portfolio (13.41) (28.36)

---------- ------------

Capital expenditure (0.14) (0.30)

---------- ------------

Income earned 1.90 4.01

---------- ------------

Expenses & finance costs (1.03) (2.17)

---------- ------------

Dividends paid (1.25) (2.64)

---------- ------------

NAV at 31 December 2022 80.93 171.02

---------- ------------

The NAV attributable to the ordinary shares has been calculated

under International Financial Reporting Standards ('IFRS'); the

EPRA NAV is not reported separately in this update as it is the

same as the IFRS NAV.

The NAV incorporates the independent portfolio valuation as at

31 December 2022 and undistributed income for the quarter, but does

not include a provision for any accrued monthly dividend.

Overview

During the period, commercial property values fell across all

sub sectors. The market continued to adjust to the repriced gilt

market, rising interest rates and general negative economic

conditions and outlook.

According to the MSCI UK Monthly Index, 'All Property' capital

values declined by 16.5% over Q4 2022. This was driven by 'All

Industrial' falling by 21.8% and 'All Offices' by 13.3%. According

to this index, retail warehousing fell in value by 13.0% in the

period.

The Company was unable to buck this negative trend and saw its

property portfolio decline in value by 12.3%, to GBP203.1 million

as at 31 December 2022. The decline was driven by outward yield

movement, partially offset by the completion of asset management

activity and the fact that there were no new voids or rental value

falls within the portfolio.

After adjusting for gearing, capital expenditure and Company

costs, the Company's NAV declined by 14.7% in the period.

Asset management activity

Four asset management deals were completed during the period,

securing GBP829,500 of income per annum.

At Widnes Shopping Park, the Company signed an Agreement for

Lease (AFL) with Poundland, an existing tenant that is increasing

its trading footprint from 4,998 sq. ft. to 11,295 sq. ft. To

facilitate the deal, the Company has served notice to break on New

Look, a tenant that was paying below the market rent following its

most recent Company Voluntary Arrangement (CVA).

The new rent is 43% ahead of the rent being paid by New Look and

12% ahead of the independent valuer's estimated rental value (ERV)

of the unit. On completion of the five-year lease, which is subject

to vacant possession and the completion of landlord works, the

Company will have one unit of 4,998 sq. ft. available to let. Given

its location on the terrace and the strong tenant line-up, the

Investment Manager is confident it will secure a new tenant to

lease it.

At Kingston Retail Park, Hull, Mamas and Papas signed a

five-year lease extension on its 4,693 sq. ft. unit. The rent,

which is in line with the valuer's ERV, remains unchanged.

At Wombwell Lane Retail Park, Barnsley, B&M extended its

lease by 10-years. It now expires in September 2037. The passing

rent increased by 6.0% and is in line with the valuer's ERV.

At Springkerse Retail Park, Stirling, Bensons For Beds (Bensons)

'rightsized' from a unit of 11,916 sq. ft. to one of 9,977 sq. ft.

and signed a 10-year lease (without break). The annual rent being

paid by Bensons on the new unit is 48% higher than under its old

lease and is 11.5% higher than the valuer's ERV.

It is encouraging that the rental levels which have been secured

are in line with or ahead of the valuer's ERVs. It is also

significant that all four tenants currently trade from the

Company's parks and are validating them as trading locations by

taking new leases. The Investment Manager continues to progress

lettings and lease restructures across the portfolio, with the aim

of improving the Company's income stream and reducing the vacancy

rate.

Cash and dividend

At the date of this announcement the Company has approximately

GBP50.5 million of cash available for investment and operational

purposes. The Company also has GBP31.2 million of cash held in its

debt facility, which is subject to the lender's LTV requirements

being met for it to be released for investment purposes.

The Company has held its cash position for approaching a year.

It pulled back from purchasing assets in the middle of last year as

the market started to correct. It has evaluated several

opportunities since then, but none were deemed sufficiently

attractive at the prevailing pricing levels to merit

acquisition.

The Board is aware of the impact of holding cash on the coverage

of the dividend whilst cash remains uninvested. However, it

believes that continuing to pay the current level of dividend from

cash resources is sustainable, given that it is unlikely that

uninvested cash will be retained for the longer term.

The Board believes holding cash to invest is a positive for the

Company as it allows it to review repriced properties for

acquisition. However, this is in the context of ensuring that any

acquisition terms reflect market conditions, and that the financial

resilience of the Company remains secure.

Debt

As at 31 December 2022, the average loan-to-value across the

Company's two debt facilities was 39.4%. The Company is compliant

with its debt covenants and there are no imminent refinancing

events, with GBP56.9 million maturing in 2025 and GBP54.2 million

in 2027.

Summary

Despite the valuation readjustment and consequent NAV decline,

the Board and Investment Manager take considerable comfort from the

operational performance of the portfolio.

During the quarter the effect of the asset management

initiatives has been to improve the rental value of the portfolio

and increase the WAULT. In addition, rent collection remains strong

(99.9% of rent expected to be collected for the period) and there

are no new voids in the portfolio.

There is good tenant demand for the Company's assets, as

evidenced by ongoing discussions with multiple retailers across its

portfolio who want to lease vacant space or extend leases on

existing units. Completing these transactions should increase the

WAULT of the property portfolio and reduce the EPRA Vacancy

Rate.

Clearly there are concerns about the effect of a recession on

the Company's occupier base. However, the retail warehousing format

would appear to be working well and is a good platform for

delivering retailers' omnichannel strategies. The sector appears

less vulnerable, off its rebased rents, compared to other sectors

of the real estate market.

The Board and Investment Manager remain comfortable with the

Company's investment strategy in focusing on the retail warehouse

sector. The attraction of the sector is a view shared by others.

According to the IPF Consensus Forecast published on 30 November

2022, the retail warehouse sector is again forecast to be the top

performing property sub-sector, on a total return basis, over the

period 2022 to 2026.

Portfolio sector weightings and tenant and locational exposure

as at 31 December 2022

Sector

Sector Exposure

(%)

Retail warehouse 100.0

---------

Geography

The portfolio is diversified across the regional markets.

Region Exposure

(%)

Scotland 28.9

---------

Wales 23.5

---------

Yorkshire 16.4

---------

North West 16.4

---------

North East 8.6

---------

East Midlands 6.2

---------

Top five tenants (contracted income) as at 31 December 2022

Tenant Exposure

(%)

B&Q Limited 11.6

---------

B&M Retail Limited 7.9

---------

Marks & Spencer

plc 7.5

---------

Boots UK Limited 4.6

---------

Pets at Home

Limited 3.8

---------

Valuation yield profile as at 31 December 2022

Net Initial Yield 6.3%

Equivalent yield 7.2%

-----

Forthcoming events

The next interim dividend announcement is expected to be made by

2 March 2023. The next scheduled independent quarterly valuation of

the property portfolio will be conducted by Knight Frank LLP for 31

March 2023. The unaudited NAV per share at that date is expected to

be announced in April 2023.

The Company intends to publish its next factsheet shortly, which

will be made available on the Company's website at

www.ediston-reit.com.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014. Upon the

publication of this announcement via Regulatory Information

Service, this inside information is now considered to be in the

public domain.

Enquiries

Will Barnett - Investec Bank plc 0207 597 5873

- Ediston Investment Services

Calum Bruce Limited 0131 225 5599

Ruth Wright - JTC 0203 893 1011

Ben Robinson - Kaso Legg Communications 0203 995 6672

Stephanie

Ross - Kaso Legg Communications 0203 995 6676

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVFLFFTLVIIVIV

(END) Dow Jones Newswires

January 31, 2023 02:00 ET (07:00 GMT)

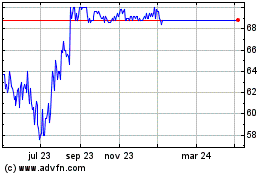

Ediston Property Investm... (LSE:EPIC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Ediston Property Investm... (LSE:EPIC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024