TIDMEQT

RNS Number : 5389A

EQTEC PLC

26 September 2022

26 September 2022

EQTEC plc

("EQTEC", the "Company" or the "Group")

Heads of Terms toward Sale of Deeside Project

EQTEC plc (AIM: EQT), a world-leading technology innovation

company enabling the Net Zero Future through advanced solutions for

hydrogen, biofuels, SNG and other energy production is pleased to

announce that, further to its announcements on 30 June 2022 and 1

September 2022, the Company, Deeside WTV Limited ("Deeside WTV")

and Logik Developments Limited (" Logik ") have signed non-binding

Heads of Terms ("HoTs") for the acquisition by a publicly quoted

corporate investor ("Investor") of the project at Deeside,

Flintshire, UK that comprises a waste reception plant, anaerobic

digestion facility and EQTEC Advanced Gasification Technology

facility (the "Project").

To facilitate this transaction, Deeside WTV and Logik have

agreed to further extend the longstop date specified in the share

purchase agreement they signed on 7 December 2020 (as amended on 6

December 2021, 1 April 2022 and 30 June 2022) (the "SPA"), to 28

February 2023 (the "Long Stop Date").

The agreement of the HoTs is in line with the Company's stated

strategy to focus its efforts on high-margin technology and

innovation services, engaging partners and customers to develop and

fund the capital projects that will deploy EQTEC's technologies.

This announcement follows a similar announcement on 21 September

2022 about the Company's Southport, UK project, whereby the Company

signed new agreements that would release it from the requirement to

purchase the project company, whilst ensuring it receives

outstanding development fees and future technology sales and

engineering services fees.

Summary of the Heads of Terms

-- The Investor will acquire 100% equity in project development

company Deeside WTV, a wholly owned subsidiary of the Company; and

be granted an option (the "Option") to acquire 100% equity in land

company Logik WTE Limited ("Logik WTE" and together with Deeside

WTV, the "SPVs") , a wholly owned subsidiary of Logik; for a total

consideration of GBP15 million.

-- The Company will charge Deeside WTV for up to GBP5.5 million

in development services fees (such fees to be largely settled from

the consideration being applied to Deeside WTV as further described

below), payable to the Company in instalments between completion of

the SPA ("Completion") and the Project reaching financial close

("Financial Close"), expected to occur in H1 2023.

-- Consideration will be paid by the Investor in two tranches:

the first of GBP6 million upon the parties entering into Definitive

Documents (as defined below); and the second tranche of GBP9

million upon Completion (assuming the Investor exercises the

Option).

-- The initial GBP6 million payment by the Investor will be applied as follows:

o GBP500,000 to the Company for 100% of its equity in Deeside

WTV;

o GBP1.5 million paid to Deeside WTV to cover all outstanding

budgeted development costs to Financial Close (less any costs which

the Investor shall settle on behalf of the SPVs, as referred to

below); and

o GBP4 million paid to Deeside WTV to fund its payment of the

Option fee to Logik under the amended and restated SPA.

-- The further GBP9 million payment by the Investor will be applied as follows:

o GBP6 million to Logik to acquire Logik WTE (and accordingly

the Project land); and

o GBP3 million paid to Deeside WTV to fund its partial payment

of EQTEC's development service fee (with the balance of GBP2.5

million payable at Financial Close). The total consideration to be

received by EQTEC for the development of the project is GBP6.0

million.

-- The non-binding elements of the HoTs, which include summary

terms set out above, will be incorporated into definitive and

binding documentation (the "Definitive Documents"). It is intended

that the Definitive Documents will be entered into as soon as

reasonably practicable, and in any event by 30 November 2022, with

Completion to occur by the Long Stop Date, although there can be no

guarantee that the transaction will proceed to completion

-- The Investor will pay for all agreed development costs until

execution of the Definitive Documents and in turn will be granted

exclusivity until 30 November 2022 to complete the transaction.

-- In the event the Investor does not exercise the Option by the

Long Stop Date, Logik will retain the land company and the

Investor, through Deeside WTV, will have the option to enter into a

lease with Logik WTE; the full GBP5.5 million development service

fee due to the Company by Deeside WTV will remain outstanding until

Financial Close and payment will be guaranteed by the Investor for

GBP4.5 million.

Project progress

The Company is in the final stages of discussion with Toyota

Motor Manufacturing (UK) Limited ("Toyota") toward agreement of

heads of terms for the supply of gas and electricity from the

Project to Toyota's neighbouring Deeside Engine Plant.

The Project has received updated heads of terms (subject to

contract) for gas and power offtake with new tariffs that

significantly improve project economics, from TotalEnergies, a

company producing and marketing a variety of energies on a global

scale.

David Palumbo, CEO of EQTEC, commented:

"The Deeside Project has gathered significant momentum and once

funded should progress steadily toward financial close. We have

top-tier partners working with us, strong support from local

stakeholders and our feedstock and offtake arrangements ready to

contract. In addition to being an exciting, multi-technology plant,

Deeside will also be one of our first RDF plants and we believe the

most efficient RDF-to-energy plants we know. We are also happy to

formally focus EQTEC's role on our core capabilities of technology

development and engineering, with a degree of broader project

development as required to support the Project. Not only does this

release us from capital investment commitments that come with

sustained SPV ownership, but it accelerates progress with our

business strategy, toward becoming exclusively a technology

innovator and licensor."

Further information about the Project

The Project comprises 6.27 hectares of land o ff Weighbridge

Road on Deeside Industrial Estate and adjacent to the Toyota

Deeside Engine Plant , in Flintshire, north Wales, UK, on a site

that was formerly a Gaz de France power station.

The prospective, multi-technology plant would include a material

recovery facility ("MRF") and anaerobic digestion ("AD") facility

that would deploy technologies from Anaergia, Inc. ("Anaergia"),

with an advanced thermal conversion ("ATC") facility that would

deploy EQTEC's syngas technology.

The MRF would process 182,000 tonnes per year of municipal solid

waste ("MSW"), separating recyclables and sending them off site for

processing, separating biogenic materials for processing at the AD

facility and producing refused-derived fuel ("RDF") from the

remaining materials, including plastics, for processing by the

EQTEC ATC facility. The 2.0 MW AD facility would produce 5.5

million NM(3) per year of biomethane, with 17,000 MWh of the gas

(c. 29%) exported to Toyota and the remainder exported to the

national grid. The 9.9 MW ATC facility would receive 77,000 tonnes

per year of RDF from the MRF and produce 77 - 87,000 MWh of

electricity per year, of which 27,000 MWh (c. 35%) would be

exported to Toyota, with the remainder exported to the national

grid. There is additional potential to apply the ATC facility to

production of hydrogen, for which initial feasibility work has been

undertaken.

At present, the Company is lead developer for the Project, in

partnership with Logik, which owns the land on which the Project is

being developed. As announced on 28 October 2021, Flintshire County

Council's Planning Committee resolved to grant planning permission

for the proposed plant. The planning authority's decision follows

its prior approval of the site for the original plan of a recycling

and AD facility.

The Project is one of three waste-to-energy/fuel projects the

Group is developing in the UK, including others at Billingham,

Teesside and Southport, Merseyside.

This announcement contains inside information as defined in

Article 7 of the EU Market Abuse Regulation No 596/2014, as it

forms part of United Kingdom domestic law by virtue of the European

Union (Withdrawal) Act 2018, as amended, and has been announced in

accordance with the Company's obligations under Article 17 of that

Regulation.

ENQUIRIES

EQTEC plc +44 203 883 7009

David Palumbo / Nauman Babar

---------------------------

Strand Hanson - Nomad & Financial Adviser +44 20 7409 3494

---------------------------

James Harris / Richard Johnson

---------------------------

Panmure Gordon - Joint Broker +44 207 886 2500

---------------------------

John Prior / Harriette Johnson

---------------------------

Canaccord Genuity - Joint Broker +44 207 523 8000

---------------------------

Henry Fitzgerald-O'Connor / James Asensio

/ Patrick Dolaghan

---------------------------

Alma PR - Financial Media & Investor Relations +44 203 405 0205

---------------------------

Josh Royston / Sam Modlin EQTEC@almapr.co.uk

---------------------------

+44 207 457 2381 / +44 788

Instinctif - General Media Enquiries 788 4794

---------------------------

Chris Speight / Tim Field EQTEC@instinctif.com

---------------------------

About EQTEC plc

As one of the world's most experienced gasification technology

and engineering companies, with a growing track record of

delivering operational and commercial success for transforming

waste-to-energy through best-in-class technology innovation,

engineering and project development , EQTEC brings together design

innovation, project delivery discipline and solid commercial

experience to add momentum to the global energy transition. EQTEC's

proven, proprietary and patented technology is at the centre of

clean energy projects, sourcing local waste, championing local

businesses, creating local jobs and supporting the transition to

localised, decentralised and resilient energy systems.

EQTEC designs, supplies and builds advanced gasification

facilities in the UK, EU and US, with highly efficient equipment

that is modular and scalable from 1MW to 30MW. EQTEC's versatile

solutions process over 50 varieties of feedstock, including

forestry wood waste, vegetation and other agricultural waste from

farmers, industrial waste and sludge from factories and municipal

waste, all with no hazardous or toxic emissions . EQTEC's solutions

produce a pure, high-quality synthesis gas ("syngas") that can be

used for the widest range of applications, including the generation

of electricity and heat, production of synthetic natural gas

(through methanation) or biofuels (through Fischer-Tropsch,

gas-to-liquid processing) and reforming of hydrogen.

EQTEC's technology integration capabilities enable the Group to

lead collaborative ecosystems of qualified partners and to build

sustainable waste reduction and green energy infrastructure around

the world.

The Company is quoted on AIM (ticker: EQT) and the London Stock

Exchange has awarded EQTEC the Green Economy Mark, which recognises

listed companies with 50% or more of revenues from

environmental/green solutions.

Further information on the Company can be found at www.eqtec.com

.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFLAAIIEFIF

(END) Dow Jones Newswires

September 26, 2022 02:01 ET (06:01 GMT)

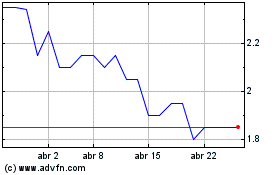

Eqtec (LSE:EQT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Eqtec (LSE:EQT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024