TIDMEQT

RNS Number : 0762B

EQTEC PLC

29 September 2022

29 September 2022

EQTEC plc

("EQTEC", the "Company" or the "Group")

Interim results for the six months ended 30 June 2022

EQTEC plc (AIM: EQT), a global technology innovator powering

distributed, decarbonised, new energy infrastructure through its

waste-to-value solutions for hydrogen, biofuels, and energy

generation, announces its unaudited interim results for the six

months ended 30 June 2022 ("H1 2022"), with post-period progress

and financial outlook.

Financial highlights

-- Revenue and other operating income EUR2.98 million (H1 2021: EUR0.48 million)

-- Gross profit EUR0.24 million (H1 2021 EUR0.07 million)

-- EBITDA loss EUR1.97 million (H1 2021 EUR3.49 million)

-- Capital raise of GBP3.75 million through the placing of shares

-- Loan facility for up to GBP10 million with initial drawdown of GBP5 million

Commercial and operational highlights

-- Two of three Market Development Centres progress toward key milestones

-- UK RDF projects move ahead with top-tier partners

-- Contaminated plastics and liquid fuels added to solution portfolio

-- Project finance accelerates project development in Greece, UK and USA

Current trading and outlook

Advanced technology innovation and integration significantly,

with:

-- Acquisition of a failed gasification plant in France, for

upgrade to EQTEC technology, recommissioning and operation for

three, different waste feedstocks;

-- Launch into the contaminated plastic waste treatment business

in France, with a French partner following completion of successful

contaminated plastic waste trials;

-- Progress with project development for two UK,

multi-technology plants to transform MSW into biogas, power and/or

hydrogen; and

-- New or strengthened partnerships with Anaergia for anaerobic

digestion solutions, Wood for integrated Waste-to-hydrogen and

Waste-to-SNG solutions and CompactGTL for Waste-to-biofuels

solutions.

Project execution through EQTEC go-to-markets and development

partners, including:

-- Upgrade, restoration and cold commissioning of Italia Market

Development Centre ("MDC") toward full commercial operation by

year's end;

-- Successful acquisition of a MDC for France, with numerous

contracts already in place and with feedstock and offtake

arranged;

-- Transition of approach to project funding, with corporate

centre team actively engaging infrastructure investors through

top-tier advisors;

-- Heads of terms for sale of the Deeside, UK project to a

corporate investor, with funds to develop the project to financial

close, acquire EQTEC's equity, and pay all EQTEC development

services fees due, with financial impact expected before the year

end;

-- Successful renegotiation of agreement at the Southport, UK

project, releasing the Company from liabilities for acquisition of

project scope deploying non-EQTEC technology whilst preserving its

right to develop project scope and deploy integrated

syngas-to-hydrogen technology, with the combined capabilities of

EQTEC and Wood;

-- Improved financial modelling and development strategy for the

Billingham project, for a multi-technology, multi-use facility

built around the existing, consented syngas-to-power facility, with

Petrofac appointed as the FEED partner;

-- Successful arrangement of a debt facility with Greek lenders,

backed by the European RRF, amounting to 80 per cent of the funding

required for the Livadia project in Boeotia, Greece; and

-- Accelerated progress with funding and planning for the BMEC project in California, USA.

David Palumbo, CEO of EQTEC, commented:

"As we witness the cost-of-living crisis alongside the worsening

situation with Russia, attention inevitably leads back to our

energy needs, their costs and their consequences. It is now clearer

than ever that new responses to these are needed. EQTEC has some of

those responses, and as the world's needs become more urgent, not

only does our resolve strengthen, but our capability to respond

increases.

"Our MDCs will demonstrate those responses for the world to see,

in live, commercial environments. The first will be operational

this year, in one of the greenest, most beautiful parts of Italy.

We are commissioning Italia MDC now and will shortly thereafter

move on to MDCs in Croatia and France. Not only will these showcase

numerous feedstocks for a range of offtake solutions, but they will

demonstrate new business models to power a decarbonised world.

"Our RDF projects in the UK are gaining momentum, benefitting

from innovative, multi-technology solutions, sharper financial

models and world-class partnerships. We are excited about these

integrated solutions we will introduce to the UK, right in line

with its move away from traditional solutions and its need for

energy independence and security. We now have Deeside on a path to

be fully funded through to financial close and Southport re-focused

for accelerated development.

"Our 2022 will be less backloaded than last year, but we still

have an ambitious Q4 ahead of us. Behind our progress is an

increasingly focused, collaborative and professional team that will

drive the Company forward through Q4 and into 2023 with increasing

success and global impact."

Chief Executive's statement and outlook

EQTEC's purpose is to decarbonise local communities and

transform waste into value, deploying our innovative, carbon

engineering capabilities to baseload energy and biofuel solutions

across a wide range of decentralised business models. This purpose

is enabled by our world-leading proficiency with synthesis gas

("syngas").

EQTEC's syngas technology is proprietary, patented and proven.

It accommodates the widest range of feedstocks including forestry

and agricultural wastes, municipal wastes and industrial wastes.

EQTEC's growing library of nearly 60 waste feedstocks, together

with its highly accurate, proprietary computational modelling

capability enable EQTEC to design tailored and highly efficient

syngas production facilities to support the widest range of

applications including thermal energy, electrical power, hydrogen,

SNG, chemicals and liquid fuels. Because EQTEC designs all aspects

of the syngas production process and programs its proprietary

control systems in-house, it is able to achieve the highest levels

of efficiency and operational availability.

The Company's target business model positions EQTEC as a leading

technology innovator for production of clean, renewable, baseload

energy and biofuels. The Company envisions three, priority customer

types for its solutions:

-- Industrial: manufacturing companies with captive waste,

hazardous or not, with the business case to safely and cleanly

transform that waste into electrical power, thermal energy,

hydrogen, synthetic natural gas ("SNG") and/or liquid fuels. The

Company's longest-standing deployment of EQTEC technology is in a

large-scale, agro-industrial facility in southern Spain and has

delivered strong performance there for over a decade. The Company

is engaged with several, multi-national companies in the consumer

products, industrial products and agro-industrial sectors who are

considering EQTEC solutions.

-- Utility: generators and distributors of heat, power and/or

fuel for sale to consumers or industrial customers. These owners

and commercial operators of generation facilities, many of whom are

looking to transition away from traditional, fossil fuel-led and/or

incineration technologies, are looking at EQTEC technologies as a

sustainable alternative for future business.

-- Municipalities: local or super-local (e.g., state, regional)

authorities with waste management requirements who want to dispose

of waste cleanly and efficiently and also generate value from it

for the local community. Nearly every project in EQTEC's portfolio

focuses on value creation for local communities but public sector

entities are becoming increasingly active in driving energy

transition toward technologies such as EQTEC's.

The three pillars of the Company's business strategy aim to

position EQTEC as a renewable technology leader, able to scale

globally:

-- Global leadership with syngas technology innovation and integration

-- Project execution through a Group operating model and partner ecosystem

-- Global scale through licensing, modular deployment and digital tooling

As the Company deploys its technology into an increasing number

of fully operational, high-performance plants, its revenues will

shift from one-off project revenues to recurring revenues, derived

from annual licensing and value-added services. Its near-term focus

is establishing a critical mass of operational plants and

well-funded projects with the world's leading finance, development,

delivery and technology partners.

In H1 2022, our strategy sharpened amidst challenging market

conditions. We responded with speed and resilience, focusing

execution on our highest-priority projects. We redoubled our

efforts driving Italia MDC and Croatia MDC toward live operations,

and France MDC toward full funding and financial close. We

significantly improved the viability of our large, UK RDF projects

at Deeside, Southport and Billingham through collaboration with

top-tier partners including Anaergia, Black & Veatch, Wood and

Petrofac. With our development partners, we accelerated funding at

Livadia in Greece and Blue Mountain Electric Company ("BMEC") in

USA.

Concurrently, we de-risked EQTEC's financial position on

projects by offloading development liabilities, reaffirming our

role as technology provider and core engineering partner. Despite

supply-side challenges, demand for EQTEC syngas technology

continues to grow. In response, we formalised our France entry,

affirmed our capabilities with contaminated plastics and partnered

with CompactGTL for liquid fuel production.

Even as demand grows, project developers face challenging

financing conditions and this has slowed our pace, so that some

projects will achieve revenues later than previously anticipated,

resulting in an adjustment to our 2022 revenue forecast.

Alongside completion of a modest capital raise, we grew our

innovation and engineering team, rationalised our corporate centre

and focused it on targeting and securing project funding. Our

outlook remains conservative, given difficult financial markets,

but our business strategy and project execution focus remain

firm.

In Q4 2022, we will launch the Italia MDC into full operation

and complete establishment of a steam-oxygen gasification

capability to produce syngas for hydrogen and SNG applications, at

our R&D centre at the Université de Lorraine in France.

Through the end of 2022 and on into 2023, we will continue our

pursuit of growth and strategic development in the face of

difficult trading conditions and in a market that is likely to

become more volatile. We will continue monitoring and supporting

project development efforts and drive strong engagement with global

infrastructure investors and top-tier partners.

Investor presentation

In line with EQTEC's commitment to ensuring appropriate

communication structures are in place for all shareholders,

management will deliver an online presentation on the interim

results for the six months ended 30 June 2022. The presentation is

available to all existing and potential shareholders, via the

Investor Meet Company platform, today at 10:30am UK time.

Questions may be submitted prior to the event through the

platform, or at any time during the live presentation. Management

may not be in a position to answer every question it receives but

will address those it can while remaining within the confines of

information already disclosed to the market.

Q&A responses will be published at the earliest opportunity

on the Investor Meet Company platform.

Investors can sign up for free via:

https://www.investormeetcompany.com/eqtec-plc/register-investor .

Those who have already registered and requested to meet the Company

will be invited automatically.

This announcement contains inside information as defined in

Article 7 of the EU Market Abuse Regulation No 596/2014, as it

forms part of United Kingdom domestic law by virtue of the European

Union (Withdrawal) Act 2018, as amended, and has been announced in

accordance with the Company's obligations under Article 17 of that

Regulation.

ENQUIRIES

EQTEC plc +44 20 3883 7009

David Palumbo / Nauman Babar

---------------------

Strand Hanson - Nomad & Financial Adviser +44 20 7409 3494

---------------------

James Harris / Richard Johnson

---------------------

Panmure Gordon - Joint Broker +44 20 7886 2500

---------------------

John Prior / Harriette Johnson

---------------------

Canaccord Genuity - Joint Broker +44 20 7523 8000

---------------------

Henry Fitzgerald-O'Connor / James Asensio

/ Patrick Dolaghan

---------------------

Alma PR - Financial Media & Investor

Relations +44 20 3405 0205

---------------------

Josh Royston / Sam Modlin EQTEC@almapr.co.uk

---------------------

+44 20 7457 2381

Instinctif - General Media Enquiries +44 788 788 4794

---------------------

Chris Speight / Tim Field EQTEC@instinctif.com

---------------------

Technology innovation and integration

The versatility of EQTEC technology makes it suitable for a wide

range of emerging business models for distributed, decarbonised new

energy infrastructure. At present, the Company is focused on

specific projects best able to showcase its capabilities here and

now, building partnerships and driving R&D efforts to make it

able to rapidly pursue innovation opportunities in future, as the

market evolves.

-- On 14 March 2022, the Company announced its intention to

acquire a failed gasification plant and recommission it with EQTEC

technology, to process a mixture of diverse feedstocks, including

wood, contaminated wood and RDF ("France MDC").

-- On 14 March 2022, the Company also announced a partnership

with SEPS SAS ("SEPS"), a French company specialising in waste

management and recycling of industrial waste, indicating the

partners' joint intent to develop contaminated waste treatment

plants that apply their combined capabilities. The Company also

announced the partners' first project opportunity at an on-premise,

industrial facility in Haute-Garonne, France.

-- On 30 May 2022, the Company acknowledged a report published

by t he Université de Lorraine ("UdL") in France verifying that

EQTEC's Advanced Gasification Technology successfully converts

contaminated plastic waste into syngas cleanly, stably and

efficiently. The report followed a series of tests on contaminated

plastics carried out in December 2021 at EQTEC's technology

innovation facility in France and opened the market for this

difficult feedstock to the Company and its partners.

-- On 30 June 2022, in line with its strategic collaboration

agreement with global engineering leader Wood, the Company

announced its selection of Wood and its VESTA technology as its

partner for co-development of an integrated

RDF-to-syngas-to-hydrogen solution for its Southport project.

-- On 07 July 2022, the Company announced it had entered into a

collaboration agreement with CompactGTL Limited ("CompactGTL"), a

gas-to-liquids company specialising in the production and use of

synthetic fuels from gases, including syngas. The partners

committed to collaborate on waste-to-fuel projects and other

synthetic fuel and energy infrastructure projects, starting with a

pilot demonstration project at a location already identified.

-- Throughout H1 2022, the Company announced progress with its

three waste-to-value projects in the UK, including a

multi-technology plant for MSW-to-biogas and power at Deeside,

Flintshire, a multi-technology plant for MSW-to-biogas and hydrogen

at Southport, Merseyside and RDF-to-combined heat and power and

hydrogen at Billingham, Teesside.

-- Throughout H1 2022, the Company strengthened its partnership

with Anaergia, Inc. ("Anaergia"), a technology provider with

capabilities focused on materials recovery facilities ("MRF") and

anaerobic digestion ("AD"), announcing further collaboration at its

Deeside and Southport projects.

In addition to working on concept designs and detailed designs

across a range of projects, with construction advisory,

commissioning leadership and Operations and Maintenance ("O&M")

preparations at others, EQTEC's technical team has also been hard

at work with Research and Development ("R&D"): testing new

feedstocks for prospective projects and preparing the full-scope,

end-to-end R&D facility at UdL for trials of new solutions

including for hydrogen, SNG and advanced biofuels. The Company

intends to install steam-oxygen capabilities at the UdL site this

autumn, which is critical for syngas production that supports these

offtakes.

Market Development Centres

MDCs are live, profitable plants operated by the Company and

employed as showcases of EQTEC technology in full-scale, commercial

environments. Strategically, MDCs are catalysts for accelerated

engagement of project finance, owner-operators and other key

stakeholders.

In 2022, the Company has progressed work on two MDCs, with a

focus on funding the third:

-- At the Italia MDC in Gallina, Tuscany, Italy, the Company in

H1 delivered new equipment and completed critical upgrades. It also

arranged for additional funding from existing investors, to cover

price increases for remaining equipment and unforeseen work. In Q3,

the Company recruited the plant operations team and commenced

commissioning.

At the France MDC in Villers-sous-Montrond, Doubs, France, the

Company on 14 March announced its intention to acquire, upgrade and

recommission the 6.5 MWe plant, replacing the failed gasification

technology with EQTEC technology. On 07 September, the acquisition

was approved and finalised by France's Ministère de l'Économie, des

Finances et de l'Industrie (MINEFI). The France MDC would process

diverse feedstock, with a combination of wood, contaminated wood

and RDF and is expected to be France's largest ever gasification

project for combined heat and power.

To support the French market and projects, the Company in March

announced the launch of EQTEC France SAS and appointment of David

Le Saint as market lead.

For the Croatia MDC in Belišće, Croatia, key components were

manufactured in H1 to support the plant's capacity upgrade to

1.5MWe from the original 1.2MWe. Discussions with investors and

operators for the sale of the project started in July and continue.

Once the final business model and ownership of the project have

been formalised with the ultimate buyer/s, construction and

commissioning will be completed with a view toward full commercial

operations as early as Q1 2023.

The Italia MDC is expected to complete commissioning and become

fully operational before the end of 2022, with the Croatia MDC

requiring final funding to complete its commissioning and the

France MDC finalising funding arrangements toward construction work

in 2023.

UK RDF projects

The Company's UK projects are expected to produce some of the

first, commercially viable gasification plants for RDF in the

world, qualifying EQTEC and its partners as leaders in the

high-growth sector for municipal waste-to-value. The UK plants will

also demonstrate business solutions for industrial customers and

municipalities.

In 2022, the Company progressed development of three UK projects

and collaborated with top-tier ecosystem partners to bring quality

execution and risk mitigation to them:

-- At Deeside Industrial Estate, at Deeside, Flintshire, the

Company on 01 April announced its appointment of global

engineering, procurement, consulting and construction company Black

& Veatch ("B&V") to review the project, with a particular

focus on integration risks in light of the multiple technologies

for the plant, provided by EQTEC and technology partner Anaergia.

On 11 July, the Company announced its appointment of B&V as

Front-end Engineering and Design ("FEED") partner with the added

remit of preparing an Engineering, Procurement and Construction

("EPC") cost estimate for power generation equipment and systems.

The Company confirmed on 01 April that based on successful

completion of feasibility work for hydrogen production from syngas

in future phases of work, EQTEC had received proposals from

prospective partners for provision of syngas-to-hydrogen

technology. On 26 September, the Company confirmed that it and

development partner Logik Developments Limited had signed

non-binding heads of terms for full acquisition of the project by a

corporate investor. A completed contract with the party would allow

the project to proceed to financial close and compensate the

Company for development services fees.

-- At Southport Hybrid Energy Park, Southport, Merseyside, the

Company on 24 June announced that technology partner Anaergia had

reached agreement with the project for construction and operation

of its Phase 1 scope of work. On 30 June, the Company announced its

selection of Wood as its technology partner for co-development of

an integrated RDF-to-syngas-to-hydrogen solution for its Phase 2

scope of work. The Company then announced on 21 September that it

had agreed with development partner Rotunda Group Limited

("Rotunda") a new agreement under which Rotunda would retain Phase

1 of the project and deploy Anaergia technology, allowing the

Company to focus on development of Phase 2, deploying EQTEC

technology for the UK's first waste-to-hydrogen plant, whilst still

recovering all development services fees due to the Company for

Phase 1.

-- At the Haverton Hill project in Billingham, Teesside, the

Company on 15 February confirmed that it had a fully consented

scheme for advanced thermal conversion and that it was exploring a

range of additional solutions for syngas-to-power, syngas-to-heat

and syngas-to-chemical applications on the 17-acre site. At its AGM

in May, the Company went on to confirm that it was developing

financial models for a variety of scenarios, including

syngas-to-hydrogen production on the site, indicating that there

were other technologies also seeking to use the land on the site.

On 18 July, the Company announced its selection of Petrofac Limited

("Petrofac") as FEED contractor and potential EPC partner. Out of

period, the Company has secured heads of terms for over 250 per

cent of its feedstock requirement at attractive gate fees, with a

grid connection and highly favourable power purchase agreement

("PPA"). The Company is further discussing private wire

opportunities with local companies. Once funded, the project is

expected to move quickly into FEED work with Petrofac. Petrofac has

confirmed it will support the Company's efforts with engagement of

funding candidates toward that end.

The UK RDF projects remain some of the most complex in the

Company's portfolio, but with the quality of partners now in place

and with strong progress on commercial, engineering and planning

work, funding remains the key that will unlock further progress to

financial close and construction. The Company is prioritising

funding at project level therefore as its key focus in H2 2022.

Other projects

Funding has proven to be the critical key to progressing

projects at pace. Beyond the projects outlined above, the Company

and its partners have put other projects in good positions to move

forward at pace once full funding is secured.

-- For the Livadia project in Boeotia, Greece, the Company

announced on 21 June 2022 that its partners ewerGy GmbH and ECO

Hellas M IKE had confirmed a new debt facility with Optima Bank S.A

("Optima") to support construction of the plant, making it 80 per

cent funded. The Optima facility is backed in part by the Recovery

and Resilience Facility for Greece.

Additionally, the Company and its partners have been pursuing

equity funding with institutional funds for the remaining

requirement and intend to secure heads of terms as soon as

possible.

The project has already secured all licenses, building permits

and a grid connection and PPA.

-- For the Blue Mountain Electric Company ("BMEC") project in

Wilseyville, California, USA, development funding has been secured

to support concept design work toward application for a large,

federal loan to support construction of the plant. Additional term

sheets have been received from both equity investors and lenders. A

strong project manager appointed to BMEC with funding from the

Company has engaged a range of top-tier EPCs to bid for work on the

project and the Company anticipates applying for the loan in Q4

with confirmation of funding expected in early 2023.

-- At the North Fork Community Power ("NFCP") project in North

Fork, California, USA, the power purchase agreement ("PPA") for the

project has been extended to Q3 2023 to provide additional time for

project commissioning and EPC works are progressing under an

updated construction schedule. The project has been impacted by

several local fires, causing delays that exacerbated the effect of

cost inflation due to global supply issues. The drawdown on the

convertible loan facility committed by the Company in 2021 has

therefore been suspended until the additional gap funding has been

secured by NFCP. In the meantime, NFCP Managing Members, including

the Company, are engaged in advanced discussions with the project

lender and the State of California, toward a solution to the

funding challenge.

The Company's pipeline of interest and demand expands weekly,

and the team is closely managing and prioritising new

opportunities, communicating with high-priority prospects. However,

the near-term priorities are focused less on generation or pursuit

of new demand and more on execution of existing projects and

commissioning of plants.

Group operations and financial management

In H1 2022, the Company grew its technical and engineering team

and rationalised its corporate centre team to fit its near-term

objectives of project funding, at the project level, executing

projects and commissioning plants. Especially given tighter capital

availability, the Company reviewed and reduced its working capital

requirements and cut non-essential expenditure for focus on

strategic execution.

Financial performance

For H1 2022, the Company recorded a five-fold increase in

revenues over the same period last year, with EUR2.98 million in

revenues (H1 2021: EUR0.48 million). Gross profit increased to

EUR0.24 million (H1 2021: EUR0.07 million) and EBITDA loss

decreased by 44% over the same period last year, to EUR1.97 million

(H1 2021: EUR3.49 million).

The net assets were recorded at EUR40.9 million at the end of H1

2022 compared to EUR43.4 million as at 31 December 2021.

On 29 March 2022, the Company announced a new loan facility for

up to GBP10 million with an initial disbursement of GBP5 million

received by the Company the same day.

On 14 July, the Company announced completion of a fundraising

that raised GBP3.75 million (before expenses) through the placing

of 233,385,650 placing shares, subscription for 73,614,350 Primary

Bid shares and subscription for 443,000,000 subscription shares, in

each case at an issue price of 0.5 pence per share.

Financial outlook

With revenue dependent on funding sufficient to meet project

milestones, based on a re-focused portfolio, the Company

anticipates its total revenues for 2022 to be in the range of EUR10

- 12 million. In line with the project re-focus, the Company

currently forecasts an EBITDA loss in the range of EUR2 - 3 million

(2021: (EUR3.8) million). The revenue and EBITDA guidance is

predicated on the progression of projects' meeting anticipated

timelines, in particular Deeside.

EQTEC plc

Unaudited condensed consolidated statement of profit or loss

for the six months ended 30 June 2022

Notes 6 months ended 6 months ended

30 June 2022 30 June 2021

EUR EUR

Revenue 6 2,981,006 481,720

Cost of sales (2,742,168) (414,549)

Gross profit 238,838 67,171

Operating income/(expenses)

Administrative expenses (2,464,310) (2,277,559)

Impairment of project costs (1,872) -

Other gains/(losses) 7 - (1,404,755)

Foreign currency gains/(losses) 253,214 123,044

Operating loss (1,974,130) (3,492,099)

Share of loss from equity

accounted investments (7,322) (2,914)

Gains from sales to equity (83,504) -

accounted investments deferred

Loss on revaluation of equity (488) -

accounted investment

Change in fair value of investments (249,120) (52,846)

Finance income 233,953 21,711

Finance costs (199,751) (512,414)

Loss before taxation 6 (2,280,362) (4,038,562)

Income tax 8 - -

LOSS FOR THE FINANCIAL PERIOD (2,280,362) (4,038,562)

Loss/(Profit) attributable

to:

Owners of the company (2,280,379) (4,037,800)

Non-controlling interest 17 (762)

(2,280,362) (4,038,562)

6 months ended 6 months ended

30 June 2022 30 June 2021

EUR per share EUR per share

Basic loss per share:

From continuing operations 9 (0.0003) (0.0005)

From continuing and discontinued

operations 9 (0.0003) (0.0005)

Diluted loss per share:

From continuing operations 9 (0.0003) (0.0005)

From continuing and discontinued

operations 9 (0.0003) (0.0005)

EQTEC plc

Unaudited condensed consolidated statement of other

comprehensive income

for the six months ended 30 June 2022

6 months 6 months

ended ended

30 June 2022 30 June

2021

EUR EUR

Loss for the financial period (2,280,362) (4,038,562)

Other comprehensive income/(loss)

Items that may be reclassified

subsequently to profit or loss

Exchange differences arising on

retranslation

of foreign operations (235,360) 88,473

(235,360) 88,473

Total comprehensive loss for the

financial period (2,515,722) (3,950,089)

Attributable to:

Owners of the company (2,574,813) (3,843,401)

Non-controlling interests 59,091 (106,688)

(2,515,722) (3,950,089)

EQTEC plc

Unaudited condensed consolidated statement of financial

position

At 30 June 2022

Notes 30 June 2022 31 December

2021

ASSETS EUR EUR

Non-current assets

Property, plant and equipment 10 353,868 446,861

Intangible assets 11 17,640,532 17,702,833

Investments accounted for

using the equity method 12 11,087,383 8,074,184

Financial assets 3,835,738 4,050,030

Other financial investments 252,018 506,976

Total non-current assets 33,169,539 30,780,884

Current assets

Development costs 13 5,015,864 3,455,496

Loans receivable from project

development 13 3,748,458 3,000,469

Trade and other receivables 14 8,754,929 6,876,747

Cash and cash equivalents 2,221,662 6,446,217

Total current assets 19,740,913 19,778,929

Total assets 52,910,452 50,559,813

EQUITY AND LIABILITIES EUR EUR

Equity

Share capital 15 25,977,130 25,977,130

Share premium 83,610,562 83,610,562

Other reserves 2,353,868 2,353,868

Accumulated deficit (68,751,885) (66,177,072)

Equity attributable to the

owners of the company 43,189,675 45,764,488

Non-controlling interests (2,325,098) (2,384,189)

Total equity 40,864,577 43,380,299

Non-current liabilities

Lease liabilities 17 - 56,855

Total non-current liabilities - 56,855

Current liabilities

Trade and other payables 18 6,314,360 6,921,806

Borrowings 16 5,575,757 -

Lease liabilities 17 155,758 200,853

Total current liabilities 12,045,875 7,122,659

Total equity and liabilities 52,910,452 50,559,813

EQTEC plc

Unaudited condensed consolidated statement of changes in

equity

for the six months ended 30 June 2022 and the six months ended

30 June 2021

Equity

attributable

Share Accumulated to owners of Non-controlling

Capital Share premium Other reserves deficit the company interests Total

EUR EUR EUR EUR EUR EUR EUR

Balance at

01 January

2021 24,355,545 62,896,521 2,148,220 (61,875,561) 27,524,725 (2,223,986) 25,300,739

Issue of

ordinary

shares 1,403,448 21,344,046 - - 22,747,494 - 22,747,494

Issue of share

capital on

exercise

of employee

share warrants 46,884 89,351 - - 136,235 - 136,235

Share issue

costs - (1,470,869) - - (1,470,869) - (1,470,869)

Transactions

with owners 1,450,332 19,962,528 - - 21,412,860 - 21,412,860

Loss for the

financial

period - - - (4,037,800) (4,037,800) (762) (4,038,562)

Unrealised

foreign

exchange

gains/(losses) - - - 194,399 194,399 (105,926) 88,473

Total

comprehensive

loss for the

financial

period - - - (3,843,401) (3,843,401) (106,688) (3,950,089)

Balance at

30 June 2021 25,805,877 82,859,049 2,148,220 (65,718,962) 45,094,184 (2,330,674) 42,763,510

Balance at

01 January

2022 25,977,130 83,610,562 2,353,868 (66,177,072) 45,764,488 (2,384,189) 43,380,299

Transactions

with owners - - - - - - -

Loss/(profit)

for the

financial

period - - - (2,280,379) (2,280,379) 17 (2,280,362)

Unrealised

foreign

exchange

losses - - - (294,434) (294,434) 59,074 (235,360)

Total

comprehensive

loss for the

financial

period - - - (2,574,813) (2,574,813) 59,091 (2,515,722)

Balance at

30 June 2022 25,977,130 83,610,562 2,353,868 (68,751,885) 43,189,675 (2,325,098) 40,864,577

EQTEC plc

Unaudited condensed consolidated statement of cash flows

for the six months ended 30 June 2022

Notes 6 months ended 6 months ended

30 June 2022 30 June 2021

EUR EUR

Cash flows from operating

activities

Loss for the financial period (2,280.362) (4,038,562)

Adjustments for:

Depreciation of property,

plant and equipment 117,055 59,596

Amortisation of intangible 62,301 -

assets

Share of loss from equity

accounted investments 7,322 2,914

Gains from sales to equity 83,504 -

accounted investments deferred

Loss on revaluation of equity 488 -

accounted investment

Change in fair value of investments 249,120 52,846

Loss/(gain) on debt for equity

swap - 1,404,755

Unrealised foreign exchange

movements (468,471) 328,535

Operating cash flows before

working capital changes (2,229,043) (2,189,916)

Increase in:

Development costs (1,444,134) (1,929,353)

Trade and other receivables (1,296,294) (840,758)

(Decrease)/(increase) in Trade

and other payables (186,641) 87,226

Cash used in operating activities

- continuing operations (5,156,112) (4,872,801)

Finance income (233,953) (21,711)

Finance costs 199,751 512,414

Cash used in operating activities (5,190,314) (4,382,098)

Cash flows from investing

activities

Additions to property, plant (26,465) -

and equipment

Additions to intangible assets (1,000,000)

Deposit paid on land purchase (593,799) -

Investment in related undertakings (356,279) -

Loans advanced to equity accounted

investments (2,715,253) (492,000)

Loans advanced to project

development undertakings (781,483) (1,283,801)

Cash used in investing activities (4,473,279) (2,775,801)

Cash flows from financing activities

Proceeds from borrowings and

lease liabilities 5,981,262 1,391,174

Repayment of borrowings and

lease liabilities (212,847) (2,929,858)

Proceeds from issue of ordinary

shares - 19,034,484

Share issue costs - (1,266,913)

Loan issue costs (328,769) -

Interest paid (608) -

Net cash generated from financing

activities 5,439,038 16,228,887

Net (decrease)/ increase in

cash and cash equivalents (4,224,555) 9,070,988

Cash and cash equivalents at

the beginning of the financial

period 6,446,217 6,270,581

Cash and cash equivalents at

the end of the financial period 2,221,662 15,341,569

EQTEC plc

Notes to the unaudited condensed consolidated financial

statements

1. GENERAL INFORMATION

The unaudited interim condensed consolidated financial

statements of EQTEC plc ("the Company") and its subsidiaries ("the

Group") for the six months ended 30 June 2022 were authorised for

issue in accordance with a resolution of the directors on 28

September 2022.

EQTEC plc ("the Company") is a company domiciled in Ireland. The

Company's registered office is at Building 1000, City Gate, Mahon,

Cork T12 W7CV, Ireland. The Company's shares are quoted on the AIM

market of the London Stock Exchange plc.

The Group is a waste-to-value group, which uses its proven

proprietary Advanced Gasification Technology to generate safe,

green energy from nearly 60 different kinds of feedstock such as

municipal, agricultural and industrial waste, biomass, and

plastics. The Group collaborates with waste operators, developers,

technologists, EPC contractors and capital providers to build

sustainable waste elimination and green energy infrastructure.

Our income currently comes from the following streams:

gasification technology sales including software, engineering &

design and other related services; maintenance income from

operating plants; and we receive development fees from projects

where we invest development capital. In the future we expect to

receive potential revenue from licensing opportunities and revenue

from live operations where EQTEC has an equity stake in a

plant.

2. BASIS OF PREPERATION

The unaudited interim condensed consolidated financial

statements are for the six months ended 30 June 2022 and are

presented in Euro, which is the functional currency of the parent

company. They have been prepared on a going concern basis in

accordance with International Accounting Standard (IAS) 34 Interim

Financial Reporting.

The annual financial statements of the group are prepared in

accordance with International Financial Reporting Standards (IFRSs)

as adopted by the EU. The condensed set of financial statements has

been prepared applying the accounting policies and presentation

that were applied in the preparation of the Company's published

consolidated financial statements for the financial year ended 31

December 2021, except for the adoption of new standards effective

as of 01 January 2022. The Group has not early adopted any other

standard, interpretation or amendment that has been issued but is

not yet effective.

The financial information contained in this interim statement,

which is unaudited, does not constitute statutory accounts as

defined by the Companies Act, 2014. The interim condensed

consolidated financial statements do not include all the

information and disclosures required in the annual financial

statements and should be read in conjunction with the Group's

financial statements for the financial year ended 31 December 2021.

The financial statements of the Group were prepared in accordance

with IFRSs as adopted by the European Union and can be found on the

Group's website at www.eqtec.com .

The financial information for the six months ended 30 June 2022

and the comparative financial information for the six months ended

30 June 2021 have not been audited or reviewed by the Company's

auditors pursuant to guidance issued by the Auditing Practices

Board. The comparative figures for the financial year ended 31

December 2021 are not the Group's statutory accounts for that

financial year. Those accounts have been reported on by the

Company's auditor and will be delivered to the Company's

Registration Office in due course. The audit report on those

statutory accounts

was unqualified.

The Group incurred a loss on continuing operations of

EUR2,280,362 (1H 2021: EUR4,038,562) during the six-month period

ended 30 June 2022 and had net current assets of EUR7,578,894 (31

December 2021: EUR12,656,270) and net assets of EUR40,864,577 (31

December 2021: EUR43,380,299) at 30 June 2022.

Going concern

The unaudited interim financial statements have been prepared on

the going concern basis, which assumes that the Company will have

sufficient funds available to enable them to continue to trade for

the foreseeable future.

During July 2022 the Company raised GBP3.75 million (before

expenses) by way of a Placing and Retail Offer. The directors

consider that this is sufficient funding for the Company to

continue as a going concern beyond the twelve months of the date of

this report.

The directors are confident that the funding received by the

Company in June 2022 will ensure that it will continue as a going

concern and that there will be sufficient funding in the Company to

continue to support its activities for the foreseeable future being

not less than twelve months from the date of approval of these

financial statements. The directors have therefore prepared the

financial statements on a going concern basis.

The financial statements do not include any adjustments that

would arise if the Company were unable to continue as a going

concern.

3. BASIS OF CONSOLIDATION

The unaudited interim condensed consolidated financial

statements include the financial statements of the Group and all

subsidiaries. The financial period ends of all entities in the

Group are coterminous.

EQTEC plc

Notes to the unaudited condensed consolidated financial

statements

4. SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies used in preparing the

unaudited interim condensed consolidated financial information are

consistent with those disclosed in the Annual Report and Accounts

of EQTEC plc for the financial year ended 31 December 2021, except

for the amendment to the development assets policy and the adoption

of new standards and interpretations and revisions of existing

standards as of 1 January 2022 noted below:

New/revised standards and interpretations adopted in 2022

The following amendments to existing standards and

interpretations were effective in the period to 30 June 2022, but

were either not applicable or did not have any material effect on

the Group:

-- Amendments to IFRS 3 Reference to the Conceptual Framework;

-- Amendments to IFRS 16: COVID-19 Rent Related Concessions beyond 30 June 2021;

-- Amendments to IAS 16 Property, Plant and Equipment: Proceeds before Intended Use;

-- Amendments to IAS 37 Onerous Contracts - Costs of fulfilling a contract;

-- Annual improvements to IFRS Standards 2018-2020 cycle

Amendments to IFRS 1 First time adoption of International Financial

Reporting Standards, IFRS 9 Financial Instruments, IFRS 16 Leases

and IAS 41 Agriculture ;

The directors do not expect the adoption of the above amendments

and interpretations to have a material effect on the interim

condensed financial statements in the period of initial

application.

5. ESTIMATES

The preparation of the interim condensed consolidated financial

statements requires management to make judgements, estimates and

assumptions that affect the application of policies and reported

amounts of certain assets, liabilities, revenues and expenses

together with disclosure of contingent assets and liabilities.

Estimates and underlying assumptions are reviewed on an on-going

basis. Revisions of accounting estimates are recognised in the

period in which the estimate is revised.

The judgements, estimations and assumptions applied in the

interim financial statements, including the key sources of

estimation uncertainty, were the same as those applied in the

Group's last annual financial statements for the financial year

ended 31 December 2021.

6. SEGMENT INFORMATION

Information reported to the chief operating decision maker for

the purposes of resource allocation and assessment of segment

performance focuses on the products and services sold to customers.

The Group's reportable segments under IFRS 8 Operating Segments are

as follows:

Technology Sales: Being the sale of Gasification Technology and

associated Engineering and Design Services;

Power Generation: Being the development and operation of

renewable energy electricity and heat generating plants.

The chief operating decision maker is the Chief Executive

Officer. Information regarding the Group's current reportable

segment is presented below. The following is an analysis of the

Group's revenue and results from continuing operations by

reportable segment:

Segment Revenue Segment Profit/(Loss)

6 months ended 6 months ended

30 June 2022 30 June 2021 30 June 30 June

2022 2021

EUR EUR EUR EUR

Technology Sales 2,981,006 481,720 (536,346) (427,114)

Power Generation - - (63) (185)

Total from continuing

operations 2,981,006 481,720 (536,409) (427,299)

Central administration costs and directors'

salaries (1,689,063) (1,783,089)

Impairment of project costs (1,872) -

Other gains and losses - (1,404,755)

Foreign currency gains/(losses) 253,214 123,044

Share of loss of equity accounted

investments (7,322) (2,914)

Gains from sales to equity (83,504) -

accounted investments deferred

Loss on revaluation of equity (488) -

accounted investment

Change in fair value of investments (249,120) (52,846)

Finance income 233,953 21,711

Finance costs (199,751) (512,414)

Loss before taxation (continuing operations) (2,280,362) (4,038,562)

EQTEC plc

Notes to the unaudited condensed consolidated financial

statements

6. SEGMENT INFORMATION - continued

Revenue reported above represents revenue generated from

associated undertakings and external customers. Inter-segment sales

for the financial period amounted to EURNil (2021: EURNil).

Included in revenues in the Technology Sales Segment are revenues

of EUR2,550,000 (2021: EURNil) which arose from sales to associate

undertakings and joint ventures of EQTEC plc.

Segment profit or loss represents the profit or loss earned by

each segment without allocation of central administration costs and

directors' salaries, other operating income, share of losses of

jointly controlled entities, investment revenue and finance costs.

This is the measure reported to the chief operating decision maker

for the purposes of resource allocation and assessment of segment

performance.

Other segment information: Depreciation and Additions to non-current

amortisation assets

6 months ended 6 months ended

30 June 30 June 30 June 30 June

2022 2021 2022 2021

EUR EUR EUR EUR

Technology sales 61,794 41,732 26,465 -

Power Generation - - - -

Head Office 117,563 17,864 - 2,658,570

179,357 59,596 26,465 2,658,570

The Group operates in four principal geographical areas:

Republic of Ireland (country of domicile), the European Union,

United States and the United Kingdom. The Group's revenue from

continuing operations from external customers and information about

its non-current assets* by geographical location are detailed

below:

Revenue from Associates Non-current assets*

and External Customers

6 months 6 months

ended ended As at As at

30 June 30 June 30 June 31 December

2022 2021 2022 2021

EUR EUR EUR EUR

Republic of - - - -

Ireland

European Union 2,981,006 481,720 2,620,797 2,720,427

United States - - - -

United Kingdom - - 90,144 147,808

2,981,006 481,720 2,710,941 2,868,235

*Non-current assets excluding goodwill, financial instruments,

deferred tax and investment in jointly controlled entities and

associates.

The management information provided to the chief operating

decision maker does not include an analysis by reportable segment

of assets and liabilities and accordingly no analysis by reportable

segment of total assets or total liabilities is disclosed.

OTHER GAINS AND LOSSES 6 months ended 6 months ended

7.

30 June 2022 30 June 2021

EUR EUR

Gain/(Loss) on debt for equity swap - (1,404,755)

During the financial period the Group extinguished some of its

borrowings by issuing equity instruments. In accordance with IFRIC

19 Extinguishing Financial Liabilities with Equity Instruments, the

gain recognised on these transactions was EURNil (H1 2021: loss of

EUR1,404,755).

INCOME TAX 6 months ended 6 months ended

8.

30 June 2022 30 June 2021

EUR EUR

Income tax expense comprises:

Current tax expense - -

Deferred tax credit - -

Adjustment for prior financial periods - -

Tax expense - -

An income tax charge does not arise for the six months ended 30

June 2022 or 30 June 2021 as the effective tax rate applicable to

expected total annual earnings is Nil as the Group has sufficient

tax losses carried forward to offset against any taxable profits. A

deferred tax asset as not been recognised for the losses coming

forward.

EQTEC plc

Notes to the unaudited condensed consolidated financial

statements

LOSS PER SHARE 6 months 6 months ended

9. ended 30 June 2021

30 June 2022

EUR per share EUR per share

Basic loss per share

From continuing operations (0.0003) (0.0005)

From discontinued operations - -

Total basic loss per share (0.0003) (0.0005)

Diluted loss per share

From continuing operations (0.0003) (0.0005)

From discontinued operations - -

Total diluted loss per share (0.0003) (0.0005)

The loss and weighted average number of ordinary shares used in

the calculation of the basic and diluted loss per share are as

follows:

6 months 6 months ended

ended 30 June 2021

30 June 2022

EUR EUR

Loss for period attributable to equity

holders of the parent (2,280,379) (4,037,800)

Profit for the period from discontinued

operations used in the calculation - -

of basic earnings per share from discontinued

operations

Losses used in the calculation of basic

loss per share from continuing operations (2,280,379) (4,037,800)

No. No.

Weighted average number of ordinary

shares for

the purposes of basic loss per share 8,599,024,945 7,358,418,295

Weighted average number of ordinary

shares for

the purposes of diluted loss per share 8,599,024,945 7,358,418,295

Dilutive and anti-dilutive potential ordinary shares

The following potential ordinary shares were excluded in the

diluted earnings per share calculation as they were

anti-dilutive.

30 June 2022 30 June 2021

Share warrants in issue 462,472,488 596,005,793

Share options in issue 67,304,542 67,304,542

Convertible loans 93,457,944 -

LTIP Shares in issue 23,045,003 -

Total anti-dilutive shares 646,279,977 663,310,355

Events after the balance sheet date

802,757,286 ordinary shares were issued after the period end. If

these shares were in issue prior to 30 June 2022, they would have

affected the calculation of the weighted average number of shares

in issue for the purposes of calculating both the basic loss per

share and diluted loss per share by 133,792,881.

PROPERTY, PLANT AND EQUIPMENT

10.

During the six-month period ended 30 June 2022, the Group acquired

property, plant and equipment to the value of EUR26,465.

GOODWILL

11.

Included are the following amounts relating to goodwill:

30 June 31 December 2021

2022

Cost EUR EUR

At start and at end

of the financial period 16,710,497 16,710,497

Accumulated impairment

losses

At start of the financial

period 1,427,038 1,427,038

Impairment losses - -

At end of the

financial period 1,427,038 1,427,038

Carrying value

At start and at end

of the financial period 15,283,459 15,283,459

EQTEC plc

Notes to the unaudited condensed consolidated financial

statements

12. INVESTMENTS ACCOUNTED FOR USING THE EQUITY METHOD

Investments accounted for using the equity method are made

up as follows:

30 June 2022 31 December

2021

EUR EUR

Investment in associate undertakings 7,714,902 6,951,064

Investment in joint ventures 3,372,481 1,123,120

11,087,383 8,074,184

The carrying amount of equity-accounted investments has changed

as follows in the six months to June 2022:

Associate Joint

Undertakings Ventures

6 months 6 months ended

ended 30 June 2022

30 June 2022

EUR EUR

Beginning of the period 6,951,064 1,123,120

Loans advanced in period 444,478 2,270,775

Interest accrued on loans in period 122,728 63,522

Share of profit/loss on equity-accounted

investments in period 4,080 (11,402)

Adjustment in respect of unrealised

gains on sales from the Group (8,709) (74,795)

Loss on revaluation of equity accounted

investment - (488)

Exchange differences 201,261 1,749

7,714,902 3,372,481

13. DEVELOPMENT ASSETS

30 June 2022 31 December

2021

EUR EUR

Costs associated with project development

5,015,864 3,455,496

Loan receivable from project development

undertakings 3,748,458 3,000,469

The Group uses its expertise in engineering, project management,

permitting, planning and financing to develop waste to value

projects. Once the projects reach a certain level of maturity,

third party investors are allowed invest in the project SPV. The

Group charges a premium to the project SPV for the development

services over and above the costs incurred in developing the

project.

Costs associated with project development, including loans

advanced to project undertakings (together "Total Project Costs")

comprise expenses associated with engineering, project management,

permitting, planning, financing and other services, incurred in

furthering the development of a project towards financial close.

Total Project Costs set out above represent the cost of delivery of

project development services and are transferred to cost of sales

when the project SPV is invoiced by the Group for project

development work.

As described in Note 20, the Company has cancelled its share

purchase agreement to purchase shares in Shankley Biogas Limited.

The exclusivity payment paid of GBP100,000 with respect to this

(classified as financial assets on 31 December 2021 (EUR119,119))

has been reclassified to project development assets at 30 June 2022

(EUR116,234).

Included in loans receivable from project development

undertakings is an amount of EUR550,000 which is receivable, along

with accrued interest, 18 months from the date of drawdown.

Interest is charged at 15% per annum. At 30 June 2022, the loan is

valued at EUR654,589 (31 December 2021: EUR613,678).

The remaining loans receivables were issued with no interest and

no fixed repayment date.

EQTEC plc

Notes to the unaudited condensed consolidated financial

statements

14. TRADE AND OTHER RECEIVABLES

Included in trade and other receivables is an amount of

EUR883,382 (31 December 2021: EUR309,708) being a deposit towards

the purchase of land on which the proposed up to 25 MWe Billingham

waste gasification and power plant at Haverton Hill, Billingham,

UK, will be constructed. On 15 February 2022, a further payment of

GBP250,000, along with a further fee towards the Variation was made

with respect to an agreement ("the Variation") to extend the

existing, conditional Land Purchase Agreement.

15. EQUITY

During the 6-month period ended 30 June 2022, Nil shares (6

months ended 30 June 2021:1,450,322,620 shares) were issued as

follows:

Amounts of shares 6 months 6 months

ended ended

30 June 2022 30 June 2021

Ordinary Shares of EUR0.001 each issued

and fully paid

* Beginning of the period 8,599,024,945 6,977,439,598

* Issued on exercise of warrants for cash - 156,773,543

* Issued on exercise of employee share warrants for

cash - 46,884,149

* Issued in settlement of suppliers and other creditors - 152,075,311

* Issued in exchange for shares in other entity - 27,932,961

* Share issue for cash - public and private placement - 1,066,666,656

Total Ordinary shares of EUR0.001

each authorised, issued and fully paid

at the end of the period 8,599,024,945 8,427,772,218

16. BORROWINGS

During the six months ended 30 June 2022, the following occurred

in relation to debt securities:

On 29 March 2022, the Company announced that it had agreed an

unsecured loan facility ("Loan Facility") of up to GBP10 million

with Riverfort Global Opportunities PCC Limited and YA II PN, Ltd

(together, the "Lenders"). The Loan Facility may be drawn down in

multiple instalments with the Initial Advance of GBP5million (net

of a commitment fee of 2.5% of the aggregate amount of the Loan

Facility) that was received on 29 March 2022. Each instalment of

the Loan Facility will have a maturity date of 12 months from the

date of advance with repayments of principal made on a monthly

basis, as set out in a closing statement to be agreed at the time

of each advance. The Loan Facility will accrue a fixed interest

coupon equivalent to 7.5% of the Initial Advance and of any further

advance, payable on a quarterly basis.

The Company and the Lenders may mutually agree that the Company

satisfies any payment of the amounts due under the Loan Agreement

by the issue of ordinary shares of EUR0.001 each in the capital of

the Company ("Ordinary Shares") at a reference price as set out in

the Loan Facility documents.

The Company and the Lenders have also entered into a performance

agreement pursuant to which the Company may pay a performance fee

to the Lenders if the share price of the Company significantly

increases whilst the facility is in place. The requirement to make

any payments under the performance agreement will only come into

effect 90 days following the entering into of the Loan Facility,

should the loan not be repaid within 90 days.

The Company will use the proceeds of the Loan Facility to fund

further growth and development activities in its key markets, and

for general working capital purposes.

EQTEC plc

Notes to the unaudited condensed consolidated financial

statements

17. LEASES

Lease liabilities are presented in the statement of financial

position as follows:

30 June 2022 31 December

2021

EUR EUR

Current 155,758 200,853

Non-current - 56,855

155,758 257,708

The Group has a lease for its offices in Iberia, Spain and

London, United Kingdom. The lease liabilities are secured by the

related underlying asset. Further minimum lease payments at 30 June

2022 were as follows:

Minimum lease payments due

Within 1-2 2-3 3-4 4-5 After Total

1 year years years years years 5 years

EUR EUR EUR EUR EUR EUR EUR

30 June 2022

Lease payments 157,789 - - - - - 157,789

Finance charges (2,031) - - - - - (2,031)

Net Present

Values 155,758 - - - - - 155,758

31 December

2021

Lease payments 205,838 57,177 - - - - 263,015

Finance charges (4,985) (322) - - - - (5,307)

Net Present

Values 200,853 56,855 - - - - 257,708

18. TRADE AND OTHER PAYABLES

Included in trade and other payables at 30 June 2022 is an

amount of EUR2,557,158 (GBP2,200,000) (31 December 2021:

EUR2,977,963 (GBP2,500,000)) relating to consideration payable

under the share purchase contract to acquire Logik WTE Limited. On

01 April 2022 GBP300,000 was paid with respect to this share

purchase contract.

19. RELATED PARTY TRANSACTIONS

Transactions with associate undertakings and joint ventures

The following aggregated transactions were made with associate

undertakings and joint ventures in the six months ended 30 June

2022:

6 months 6 months

ended ended

30 June 2022 30 June

2021

Loans to associated undertakings EUR EUR

and joint ventures

Beginning of the financial period 3,621,307 -

Loans advanced in period 2,715,253 482,000

Interest accrued on loans in period 186,251 687

Exchange differences 203,103 -

At end of the financial period 6,725,914 482,687

6 months 6 months

ended ended

30 June 2022 30 June

2021

Sales of goods and services EUR EUR

Technology sales 2,550,000 -

Re-charge of costs - 93,148

EQTEC plc

Notes to the unaudited condensed consolidated financial

statements

19. RELATED PARTY TRANSACTIONS - Continued

Transactions with associate undertakings and joint ventures

- continued

30 June 2022 31 December

2021

Period-end balances EUR EUR

Included in trade receivables 4,951,310 4,243,628

Re-charge of costs 27,488 27,508

Transactions with key management

Key management of the Group are the members of EQTEC plc's board

of directors. There have been no non-remuneration transactions with

key management in the six months ended 30 June 2022.

Transactions with other parties

The Group is in the process of acquiring a 32% stake in Logik

WTE Limited. During the six-month period ended 30 June 2022, the

Group advanced EUR593,897 (or GBP500,083) (H1 2021: EUR741,702 (or

GBP643,962)) to Logik WTE Limited to advance the development of the

Deeside project. Included in the loans receivable from project

development undertakings is EUR2,082,441 (31 December 2021:

EUR1,538,420) of receivable from Logik WTE Limited. This loan was

issued with no interest and no fixed repayment date; however, the

Group can elect to use this investment raised directly at the

Project SPV level as consideration towards the acquisition of Logik

WTE Limited.

During the six-month period ended 30 June 2022, the Group

advanced EUR187,586 (or GBP157,954) (H1 2021: EUR339,930 (or

GBP295,135)) to Shankley Biogas Limited to advance the development

of the Southport project. Included in the loans receivable from

project development undertakings is EUR1,011,428 (31 December 2021:

EUR848,371) of receivable from Shankley Biogas Limited. This loan

was issued with no interest and no fixed repayment date.

20. EVENTS AFTER THE BALANCE SHEET DATE

Share placements

On 13 July 2022, the Company announced its intention to raise a

minimum of GBP3 million before expenses, by way of (i) a placing of

new Ordinary Shares ("Placing Shares") at a fixed price of 0.5

pence per share (the "Issue Price") to institutional and other

investors (the "Placing"), (ii) an offer for subscription of new

Ordinary Shares by PrimaryBid ("PrimaryBid Shares") at the Issue

Price to retail investors (the "PrimaryBid Offer"), and (iii)

direct subscriptions with the Company of new Ordinary Shares (the

"Subscription" and, together with the Placing and the PrimaryBid

Offer, the "Fundraising").

On 14 July 2022, the Company announced that the Fundraising

raised GBP3.75 million (before expenses) through the placing of

233,385,650 Placing Shares, subscription for 73,614,350 PrimaryBid

Shares and subscription for 443,000,000 Subscription Shares, in

each case at an Issue Price of 0.5 pence per share. In addition, a

further 32,657,286 shares were issued to suppliers at the Issue

Price to settle debts totalling GBP163,286.

On 01 September 2022, the Company announced that it is issuing,

in aggregate, 20,100,000 new Ordinary Shares (the "Supplier

Shares") to certain strategic service providers providing business

development and advisory services to the Group in satisfaction of

fees due to them. The issue of the Supplier Shares will further

align the interests of strategic advisers and service providers

with those of the Company and its shareholders.

Deeside Project Share Purchase Agreement and Sale of

Project:

On 01 September 2022, the Company announced that, further to its

announcement on 30 June 2022, Deeside WTV Limited ("Deeside WTV"),

a wholly owned subsidiary of EQTEC, and Logik Developments Limited

("Logik") were in advanced discussions with a third party for the

sale of Deeside Project.

On 26 September 2022, the Company announced that the Company,

Deeside WTV and Logik have signed non-binding Heads of Terms

("HoTs") for the acquisition by a publicly quoted corporate

investor ("Investor") of the project at Deeside, Flintshire, UK

that comprises a waste reception plant, anaerobic digestion

facility and EQTEC Advanced Gasification Technology facility (the

"Project").

To facilitate this transaction, Deeside WTV and Logik have

agreed to extend the longstop date specified in the Share Purchase

Agreement they signed on 07 December 2020 (the "SPA"), to 28

February 2023 (the "Long Stop Date").

Rationalisation and focus of Southport Project Ownership:

On 21 September 2022, the Company announced that it has executed

with Rotunda Group Limited ("Rotunda") and certain of its

subsidiaries a series of legal agreements to accelerate development

of the Southport Hybrid Energy Park (the "Project"), absolve the

Company of the requirement to purchase Shankley Biogas Limited

("Shankley") for Phase 1 of the Project and secure the Company's

right to develop Phase 2 of the Project through an Option to Lease,

valid through August 2025, signed between a newly-created and

wholly-owned subsidiary, EQTEC Southport H2 MDC Limited ("Southport

H2") and Rotunda. Following the cancellation of the Share Purchase

Agreement with Rotunda, the Company will secure the outstanding

GBP2,500,000 of development services fees in the form of a secured

convertible loan note ("CLN") with Shankley. The CLN, which bears

no interest, is due to be paid to the Company, following sale of or

investment into Shankley by any third party.

No other adjusting or significant non-adjusting events have

occurred until the date of authorisation of these financial

statements.

EQTEC plc

Notes to the unaudited condensed consolidated financial

statements

21. APPROVAL OF FINANCIAL STATEMENTS

The condensed consolidated financial statements for the six

months ended 30 June 2022, which comply with IAS 34, were approved

by the Board of Directors on 28 September 2022.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KVLFLLKLBBBB

(END) Dow Jones Newswires

September 29, 2022 02:00 ET (06:00 GMT)

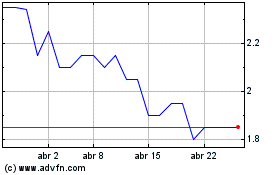

Eqtec (LSE:EQT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Eqtec (LSE:EQT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024