TIDMERGO

RNS Number : 0878B

Ergomed plc

09 February 2022

PRESS RELEASE

Ergomed acquires ADAMAS, a leading global regulatory compliance

provider

-- Acquisition adds new complementary offering, strengthening

Ergomed's premium consulting services and bolstering its position

as a specialised pharmaceutical services provider

-- Further enhances Ergomed's global reach in the US, Europe and APAC

-- ADAMAS recorded GBP8.5 million of revenue in 2021, an

increase of 31% over the prior year with GBP1.8 million of adjusted

EBITDA in 2021 (unaudited)

-- Acquisition is expected to be immediately accretive to Ergomed's earnings

Guildford, UK - 9 February 2022 : Ergomed plc (LSE: ERGO)

("Ergomed" or the "Group"), a company focused on providing

specialised services to the pharmaceutical industry , today

announces the acquisition of ADAMAS Consulting Group Limited

("ADAMAS"), an international specialist consultancy offering a full

range of independent quality assurance services and specialising in

the auditing of pharmaceutical manufacturing processes, as well as

auditing clinical trials and pharmacovigilance systems. The

acquisition has been completed for a cash consideration of GBP25.6

million, representing an enterprise value of GBP24.2m and cash

acquired of GBP1.4 million, paid at completion. The transaction is

expected to be immediately accretive to Ergomed's future earnings,

with further growth synergies and strategic benefits expected in

future years.

Details of acquisition and strategic rationale

ADAMAS is a well-established, leading provider of

mission-critical regulatory compliance and consulting services to

the global pharmaceutical industry. It operates across Good

Clinical Practice (GCP), Good Pharmacovigilance Practice (GVP),

Good Manufacturing Practice (GMP), Good Laboratory Practice (GLP)

and Computer Systems Compliance (CSC) (together, GxP). ADAMAS has a

broad, established client base, with an expansive global reach,

including the US, Europe and APAC, with over 100 currently active

clients and having worked with over 700 pharmaceutical companies

including 40 of the 50 largest global pharma and biotech

companies.

ADAMAS will continue to operate as an independent consulting

business following the acquisition. The existing senior executive

team will continue in their current positions in the business, led

by Ian Montague who will become President of ADAMAS Consulting,

having been with the business for eight years and as Chief

Executive Officer for the past three years. For reporting purposes,

ADAMAS financial results will be allocated as appropriate across

Ergomed's existing businesses.

The acquisition aligns with Ergomed's strategy to secure M&A

transactions that further enhance the Group's global presence and

broaden the service offering to clients, whilst ensuring quality

and compliance are central to its operational growth strategy.

ADAMAS is focused on ensuring that the highest standards of best

practice are attained across the pharmaceutical sector and the

acquisition will therefore keep Ergomed at the forefront of

specialist service provision.

Dr Miroslav Reljanović, Executive Chairman of Ergomed, said :

"This value-enhancing acquisition aligns with our disciplined

M&A strategy, strengthening our position as a focussed premium

pharmaceutical services business, whilst further building our

Group's scale in the strategically important US, Europe and APAC

regions. With this deal we are addressing the pharmaceutical

industry's ever-growing need for best practice quality assurance

due to the increasing complexity of drug development,

pharmacovigilance and manufacturing processes and associated

regulatory requirements. We look forward to working with Ian and

the ADAMAS management team as we invest in and support this

business to deliver a broader service offering to clients."

Ian Montague, Chief Executive Officer of ADAMAS, said : "

Ergomed is a highly regarded business that shares our commitment to

delivering regulatory compliance as well as the highest quality

services to the global healthcare industry. Joining the Ergomed

Group provides us with an even stronger platform and increased

investment from which to grow our customer base, develop and scale

up our offering and continue to deliver gold standard quality

assurance services."

Dr Patricia Fitzgerald, Founder and Executive Chairman of

ADAMAS, said: "ADAMAS has gone from strength to strength over the

last 25 years and has established a global reputation for providing

excellent research quality assurance services to the life sciences

industry. ADAMAS has been successful in building an extensive and

stable client base and has inspired a high level of trust and

confidence with many long-term relationships. It has been an

exciting and challenging journey and I know that ADAMAS,

accelerated by strong support from Ergomed, will continue to grow

and offer outstanding QA support to its clients worldwide."

Acquisition terms and ADAMAS trading history

Under the terms of the purchase agreement, Ergomed has acquired

ADAMAS for a cash consideration of GBP25.6 million, representing an

enterprise value of GBP24.2m and cash acquired of GBP1.4 million,

paid at completion. The acquisition will be wholly funded from the

Group's existing cash resources and bank facilities.

In its financial year ended 31 December 2021, ADAMAS recorded

(unaudited) total revenues of GBP8.5 million, up 31% over 2020

total revenues, with adjusted EBITDA of GBP1.8 million.

Webcast and conference call for analysts:

A webcast and conference call for analysts will be held today, 9

February 2022, at 10am GMT.

Webcast link:

https://www.lsegissuerservices.com/spark/Ergomed/events/7ef82c4e-0fb7-4506-a420-16d1e3150aac

Conference call registration: https://cossprereg.btci.com/prereg/key.process?key=PF7ULG6HM

A copy of the presentation will be made available on the Ergomed

website before the webcast, under Reports and Presentations, here:

https://www.ergomedplc.com/investor-relations/reports-and-presentations/

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as amended by The

Market Abuse (Amendment) (EU Exit) Regulations 2019. On the

publication of this announcement via the Regulatory Information

Service, this inside information is now considered to be in the

public domain.

ENDS

Enquiries:

Ergomed plc Tel: +44 (0) 1483 402

975

Miroslav Reljanović (Executive

Chairman)

Richard Barfield (Chief Financial Officer)

Numis Securities Limited (Nominated Tel: +44 (0) 20 7260

Adviser and Joint Broker) 1000

Freddie Barnfield / Euan Brown (Nominated

Adviser)

James Black (Broker)

Peel Hunt LLP (Joint Broker) Tel: +44 (0) 20 7418

James Steel / Dr Christopher Golden 8900

Consilium Strategic Communications Tel: +44 (0) 20 3709

- for UK enquiries 5700

Chris Gardner / Matthew Neal ergomed@consilium-comms.com

/ Angela Gray

About Ergomed plc

Ergomed provides specialist services to the pharmaceutical

industry spanning all phases of clinical development, post-approval

pharmacovigilance and medical information. Ergomed's fast-growing

services business includes an industry-leading suite of specialist

pharmacovigilance (PV) solutions, integrated under the

PrimeVigilance brand and a full range of high-quality clinical

research and trial management services under the Ergomed brand

(CRO). For further information, visit: http://ergomedplc.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQBKFBBBBKBNBK

(END) Dow Jones Newswires

February 09, 2022 02:00 ET (07:00 GMT)

Ergomed (LSE:ERGO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

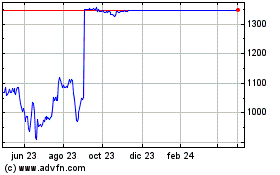

Ergomed (LSE:ERGO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024