TIDMERGO

RNS Number : 7156A

Ergomed plc

27 September 2022

PRESS RELEASE

Interim results for the six months ended 30 June 2022

Strong H1 performance: resilience, sustainable high growth and

positive outlook

-- Total revenue GBP69.9 million, up 24.8% over H1 2021

-- Adjusted EBITDA GBP13.8 million, at 23.0% of Service Fee Revenue

-- Total order book of GBP284.5 million, up 18.7% since 1

January 2022 and up 24.9% over H1 2021, underpins forward

visibility

-- ADAMAS acquisition completed and trading in line with expectations

-- Cash balance of GBP12.0 million (after GBP24.2 million net

cash purchase of ADAMAS) with available debt facilities increased

to GBP80.0 million

-- Trading in line with current market expectations

Guildford, UK - 27 September 2022 : Ergomed plc (LSE: ERGO)

("Ergomed"' or the "Company"), a company focused on providing

specialised services to the global pharmaceutical industry,

announces its interim results for the six months ended 30 June

2022.

Financial Summary

Figures in GBP millions, unless First First %

otherwise stated Half Half change

2022 2021

Total Revenue 69.9 56.0 24.8

Service Fee Revenue (Note 1) 59.8 47.6 25.6

Gross Profit 28.9 23.0 25.7

Gross Margin (%) 41.4% 41.1% 0.3

ppts

Gross Margin Service Fee (%) 48.4% 48.2% 0.2

(Note 2) ppts

Adjusted EBITDA (Note 3) 13.8 12.1 13.6

Cash at 30 June 12.0 24.6 (51.3)

Order book at 30 June 284.5 227.8 24.9

Basic adjusted earnings per

share (pence) (Note 4) 20.4p 16.8p 21.4

---------------------------------- -------- --- -------- --- --------

Notes :

(1) Service Fee Revenue is defined as Total Revenue less

Pass-through Revenue. Pass-through Revenue is revenue earned with

zero-margin.

(2) Gross Margin Service Fee (%) is defined as Service Fee Gross

Profit divided by Service Fee Revenue.

(3) Adjusted EBITDA is defined as operating profit for the

period plus depreciation and amortisation, share-based payment

charge, and other income and costs further detailed in Note 7 to

the financial statements.

(4) Basic adjusted earnings per share is defined as basic

earnings per share after adjustment for certain income and costs

detailed in Note 3 to the financial statements.

Dr Miroslav Reljanović, Executive Chairman of Ergomed, said:

"Ergomed has delivered further significant strategic progress in

H1 2022 with continued strong organic growth, ongoing delivery of

value from recent acquisitions including ADAMAS, and further

organic expansion into new geographies of strategic importance.

Alongside this, we have further strengthened the Company's Board

and leadership team, laying the foundations for the next steps of

our growth strategy. Ergomed has a robust and resilient business

model which is delivering a high level of sustainable growth at a

time of wider challenges in the global macro-environment. We look

forward with confidence to the rest of this year and beyond."

Key Financial Highlights

-- Revenue of GBP69.9 million (H1 2021: GBP56.0 million)

increased by 24.8% (up 20.0% in constant currency)

-- Pharmacovigilance (PV) division delivered strong growth with

revenue up 23.4% (up 18.7% in constant currency) to GBP35.6 million

(H1 2021: GBP28.8 million)

-- Clinical Research Services (CRO) division delivered strong

growth with revenue up 26.2% (up 21.4% in constant currency) to

GBP34.3 million (H1 2021: GBP27.2 million)

-- Gross profit up 25.7% to GBP28.9 million (H1 2021: GBP23.0 million)

-- Adjusted EBITDA at 23% of Service Fee Revenue and up 13.6% to

GBP13.8 million (H1 2021: GBP12.1 million)

-- Basic adjusted EPS up 21.4% to 20.4p (H1 2021: 16.8p)

-- Cash and cash equivalents of GBP12.0 million after payment of

GBP24.2 million net cash for ADAMAS acquisition

Strategic & Operational Highlights

-- Order book of GBP284.5 million future contracted revenue up

18.7% in H1 2022 (31 December 2021: GBP239.7 million) and up 24.9%

over H1 2021

-- North America revenues up 24.7% to GBP44.3 million (H1 2021: GBP35.5 million)

-- Organic investment in complementary geographies, service

offerings, strategic leadership hires and technology

-- Operational integration of ADAMAS into Ergomed's business

well advanced with further significant synergistic benefits

expected

-- Establishment of the Ergomed Rare Disease Innovation Centre

-- Available debt facilities increased to GBP80.0 million

Webcast and conference call for analysts:

A webcast and conference call for analysts will be held at 9.30

am BST today.

Webcast link:

https://www.lsegissuerservices.com/spark/Ergomed/events/750dcfbe-a928-4a7e-9d63-7e60bf93acdd

Conference call registration:

https://cossprereg.btci.com/prereg/key.process?key=P9G9JY8F4

Enquiries:

Ergomed plc Tel: +44 (0) 1483 402

975

Miroslav Reljanović (Executive

Chairman)

Richard Barfield (Chief Financial Officer)

Keith Byrne (Senior Vice President,

Capital Markets & Strategy)

Numis Tel: +44 (0) 20 7260

1000

Freddie Barnfield / Euan Brown (Nominated

Adviser)

James Black (Broker)

Peel Hunt LLP (Joint Broker) Tel: +44 (0) 20 7418

James Steel / Dr Christopher Golden 89 00

Consilium Strategic Communications Tel: +44 (0) 20 3709

5700

Chris Gardner / Matthew Neal ergomed@consilium-comms.com

Angela Gray

About Ergomed plc

Ergomed provides specialist services to the pharmaceutical

industry spanning all phases of clinical development, post-approval

pharmacovigilance and medical information. Ergomed's fast-growing

services business includes an industry-leading suite of specialist

pharmacovigilance (PV) solutions, integrated under the

PrimeVigilance brand, a full range of high-quality clinical

research and trial management services under the Ergomed brand

(CRO) and mission-critical regulatory compliance and consulting

services under the ADAMAS brand. For further information, visit:

http://ergomedplc.com .

Forward-looking Statements

Certain statements contained within the announcement are

forward-looking statements and are based on current expectations,

estimates and projections about the potential results of Ergomed

plc ("Ergomed") and the industry and markets in which Ergomed

operates, the Directors' beliefs and assumptions made by the

Directors. Words such as "expects", "anticipates", "should",

"intends", "plans", "believes", "seeks", "estimates", "projects",

"pipeline" and variations of such words and similar expressions are

intended to identify such forward-looking statements and

expectations. These statements are not guarantees of future

performance or the ability to identify and consummate investments

and involve certain risks, uncertainties, outcomes of negotiations

and due diligence and assumptions that are difficult to predict,

qualify or quantify. Therefore, actual outcomes and results may

differ materially from what is expressed in such forward-looking

statements or expectations. Among the factors that could cause

actual results to differ materially are: the general economic

climate, competition, interest rate levels, loss of key personnel,

the result of legal and commercial due diligence, the availability

of financing on acceptable terms and changes in the legal or

regulatory environment.

These forward-looking statements speak only as of the date of

this announcement. Ergomed expressly disclaims any obligation or

undertaking to disseminate any updates or revisions to any

forward-looking statements contained herein to reflect any change

in Ergomed's expectations with regard thereto, any new information

or any change in events, conditions or circumstances on which any

such statements are based, unless required to do so by law or any

appropriate regulatory authority.

INTERIM MANAGEMENT REPORT

OPERATIONAL REVIEW

Introduction

Ergomed continued to make significant strategic progress in the

first half of 2022, delivering a further period of robust

operational and financial performance. These results demonstrate

Ergomed's resilient business model, which has enabled us to

continue to deliver strong growth and invest for the future during

a period of significantly more challenging macro-economic

circumstances. Alongside high organic revenue and adjusted EBITDA

growth, the Company achieved further growth through the acquisition

of ADAMAS, acquired with cash generated organically by the

business. This strong financial performance underlines the value of

Ergomed's robust services model and the strength of the Company's

foundations for continued long-term growth.

Notwithstanding the wider macro-economic situation, the first

half of 2022 saw continuing favourable market dynamics within

Ergomed's specialist areas of rare disease, oncology,

pharmacovigilance and GXP audit. The global regulatory environment

continues to evolve, with increasing legislation that creates

complexity and drives the need for specialised outsourcing. In both

clinical trials and pharmacovigilance, innovation and the adoption

of digital technologies are increasing, with added impetus for

these trends driven by the COVID-19 pandemic. Ergomed has continued

to strengthen its position in its chosen markets with ongoing

organic investment in complementary geographies, service offerings,

strategic leadership hires and technology, to take advantage of

these favourable market trends and build for the future. This has

been further augmented by the addition to the Group of the ADAMAS

business and its strong brand. These operational improvements

across the Group are contributing to the increased order book and

driving sustainable growth.

Financial summary

Ergomed reported a strong financial performance in the first

half of 2022 with total revenues of GBP69.9 million (H1 2021:

GBP56.0 million), an increase of 24.8% (20.0% in constant

currency). Service fee revenues of GBP59.8 million (H1 2021:

GBP47.6 million) were up 25.6% (20.7% in constant currency) over H1

2021. This increase in revenues was driven by a robust order book

at the beginning of 2022, combined with substantial levels of new

business wins throughout the first half. Revenue growth in North

America continued and was up 24.7% compared to H1 2021.

Adjusted EBITDA in H1 2022 was 23.0% of service fee revenues in

the first half of 2022 and was up 13.6% to GBP13.8 million compared

to GBP12.1 million in H1 2021.

Cash generation in H1 2022 continued to be strong. After the

payment of GBP24.2 million net cash on the ADAMAS acquisition,

funded internally through organic cash generation, cash and cash

equivalents at 30 June 2022 was GBP12.0 million (H1 2021: GBP24.6

million). The Company continues to be debt free with available

banking facilities of GBP80.0 million, comprising a GBP50.0 million

facility and an additional GBP30.0 million accordion, available to

support continued growth.

Operational summary

Ergomed had an excellent first half, demonstrating strong

overall growth in revenue underpinned by strong demand for its

services across all areas of the business.

Ergomed has continued to develop internationally to meet global

demand for its services in both the Clinical Research Services and

PrimeVigilance divisions. Growth in the US is continuing, with

strong organic growth supported by recent acquisitions with US

presence, including ADAMAS. The Company's new operation in Japan,

the fourth largest pharmaceutical market in the world, is

continuing to grow, and recently opened subsidiaries to develop

operational capabilities in key European countries which have

further bolstered international growth and future prospects.

A strong business development performance saw net sales of new

business for H1 2022 increase by 19.8% to GBP108.8 million (H1

2021: GBP90.8 million), benefiting from continuing investment in

business development in both the CRO and PrimeVigilance businesses

and the significantly strengthened US and international presence.

The order book continues to grow and reached GBP284.5 million at

the end of H1 2022, up 18.7% from GBP239.7 million at 31 December

2021 and up 24.9% over H1 2021, providing excellent visibility of

contracted revenues into the second half of 2022 and beyond.

The increase in total revenues of 24.8% to GBP69.9 million (H1

2021: GBP56.0 million) was achieved with notable growth in both the

PrimeVigilance and Clinical Research Services businesses.

PrimeVigilance

Ergomed's pharmacovigilance (PV) business saw total revenue

increase to GBP35.6 million in H1 2022 from GBP28.8 million in H1

2021, up by 23.4% (18.7% in constant currency). Reported gross

profit increased from GBP14.7 million to GBP18.3 million, up 24.8%,

whilst gross margin increased to 51.4% (H1 2021: 50.7%).

The significant increase in PrimeVigilance revenue in the first

half of 2022 was driven by steady sales and repeat business, as the

division continued to demonstrate its long-term resilience and

ability to generate sustained growth during a time of macroeconomic

challenges. Further substantial progress was achieved in the

development and deployment of proprietary automation technology.

PrimeVigilance also invested further in training and skills

development across its existing team, whilst continuing to attract

senior industry experts to join the business. These investments

enabled organisational improvements to further enhance efficiency

and productivity.

Alongside this, client engagement through strategic partnerships

and governance oversight has continued to foster long-term

alignment and commitment to drive future growth. Service expansion

has been attained through a strategy of differentiated product

focus, enabling delivery of tailored solutions to meet the

increasingly complex global pharmacovigilance regulations.

Clinical Research Services (CRO)

Ergomed's CRO business saw total revenue increase to GBP34.3

million in H1 2022 from GBP27.2 million in H1 2021, up by 26.2%

(21.4% in constant currency). Reported gross profit increased by

27.2% to GBP10.6 million (H1 2021: GBP8.4 million) and service fee

gross margin remained robust at 43.4% (H1 2021: 44.2%).

The CRO business has seen further robust growth in the first

half of 2022, including a number of major new contract awards.

Ergomed's CRO business recently celebrated 25 years since its

foundation and has continued its long tradition of specialism and

innovation with the launch in February 2022 of the Ergomed Rare

Disease Innovation Centre, providing tailored and innovative

solutions for sponsors of rare disease drug development

programmes.

M&A Activity

Ergomed completed the acquisition of ADAMAS, an international

specialist consultancy offering a full range of independent quality

assurance services, on 9 February 2022. The operational integration

of ADAMAS into Ergomed's business is well advanced, with further

significant synergistic benefits expected. The acquisition was

completed using internally generated cash resources. The Company

continues to review acquisition opportunities to further grow the

CRO and PV businesses and deliver enhanced shareholder value, in

line with its disciplined M&A strategy.

Strengthening of the Board and senior leadership team

During the first half of 2022, John Dawson, CBE joined the Board

as an independent Non-Executive Director and Chair of the Audit

Committee, and Anne Whitaker joined as an independent Non-Executive

Director. The Company has continued to attract senior executives

with highly relevant experience and expertise in our areas of CRO

and PV specialisation, with recent key appointments in commercial

leadership roles.

Current trading and outlook

Ergomed has delivered further significant strategic progress in

H1 2022 with continued strong organic growth, ongoing delivery of

value from recent acquisitions including ADAMAS, and further

organic expansion into new geographies of strategic importance.

Alongside this, we have further strengthened the Company's Board

and leadership team, laying the foundations for the next steps of

our growth strategy. Ergomed has a robust and resilient business

model and is delivering a high level of sustainable growth at a

time of wider challenges in the global macro-environment. The

Company is trading in line with current market expectations and we

look forward with confidence to the rest of this year and

beyond.

Dr Miroslav Reljanović

Executive Chairman

FINANCIAL REVIEW

The primary financial statements of Ergomed plc for the six

months ended 30 June 2022 are presented later in this announcement

along with the key accounting policies, notes to the financial

statements and the independent review report from KPMG.

Key performance indicators

The Directors consider the principal financial performance

indicators of the Group to be:

GBP million (unless stated otherwise) H1 2022 H1 2021

------------------------------------------- --- -------- --------

Total revenue 69.9 56.0

Gross profit 28.9 23.0

Gross margin % on service fee revenue 48.4% 48.2%

Profit after tax 7.3 6.6

Adjusted EBITDA (Note 7) 13.8 12.1

Cash and cash equivalents 12.0 24.6

Cash generated from operating activities 12.0 11.0

Basic adjusted earnings per share

(Note 3) 20.4p 16.8p

------------------------------------------------ -------- --------

Consolidated income statement

Total revenue on a reported basis for the six months ended 30

June 2022 was GBP69.9 million (H1 2021: GBP56.0 million), an

increase of 24.8% (20.0% on a constant currency basis), driven by

growth in the PV division (up 23.4%) and the CRO division (up

26.2%), including revenues of GBP4.0 million in ADAMAS acquired on

9 February 2022. Revenues in the key North American market grew by

24.7% to GBP44.3 million (H1 2021: GBP35.5 million).

Gross profit was GBP28.9 million and service fee gross margin

was 48.4% (H1 2021: gross profit GBP23.0 million and service fee

gross margin 48.2%), the slightly higher gross margin percentage

being an anticipated result of favourable foreign exchange and

underlying organic revenue growth. Selling, general and

administration expenses including acquisition related costs were

GBP20.2 million (H1 2021: GBP14.8 million). Research and

development costs expensed in the period were GBP0.05 million (H1

2021: GBP0.04 million).

Adjusted EBITDA increased by 13.6% to GBP13.8 million in H1 2022

from GBP12.1 million in H1 2021, with profit after tax up 10.3% at

GBP7.3 million (H1 2021: GBP6.6 million). Basic adjusted earnings

per share was up 21.4% to 20.4p (H1 2021: 16.8p).

Consolidated balance sheet

Net assets increased by GBP7.9 million during the first half of

2022 and amounted to GBP75.1 million at 30 June 2022 (31 December

2021: GBP67.2 million) including net cash and cash equivalents of

GBP12.0 million (31 December 2021: GBP31.2 million).

Consolidated cash flow statement

At 30 June 2022, the Group's net cash balance was GBP12.0

million, after the GBP24.2 million net cash purchase of ADAMAS in

February 2022.

Cash generated from operating activities was GBP12.0 million (H1

2021: GBP11.0 million) before changes in working capital,

representing 86.9% of adjusted EBITDA in H1 2022. Ergomed has no

debt and has increased its multi-currency revolving credit facility

(RCF) from GBP30.0 million to GBP80.0 million, comprising a GBP50.0

million facility and an additional GBP30.0 million accordion.

Net outflows from investing activities increased to GBP24.7

million (H1 2021: GBP0.9 million) due to the GBP24.2 million net

cash purchase of ADAMAS. Net outflows on financing activities for

the period of GBP1.0 million were primarily related to lease costs

and interest paid.

Richard Barfield

Chief Financial Officer

Independent Review Report to Ergomed plc

Conclusion

We have been engaged by the Ergomed plc ("the Entity" or "the

Group") to review the Entity's condensed set of consolidated

financial statements in the half-yearly financial report for the

six months ended 30 June 2022 which comprises condensed

Consolidated Income Statement, condensed Consolidated Statement of

Comprehensive Income, condensed Consolidated Balance Sheet,

condensed Consolidated Statement of Changes in Equity, Consolidated

Cash Flow Statement a summary of significant accounting policies

and other explanatory notes.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of consolidated

financial statements in the half-yearly financial report for the

six months ended 30 June 2022 is not prepared, in all material

respects in accordance with International Accounting Standard 34

Interim Financial Reporting ("IAS 34") as contained in the UK

adopted International Accounting Standards and the AIM Rules.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410 Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity ("ISRE (UK) 2410") issued for use in the UK. A review of

interim financial information consists of making enquiries,

primarily of persons responsible for financial and accounting

matters, and applying analytical and other review procedures.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK) and

consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

We read the other information contained in the half-yearly

financial report to identify material inconsistencies with the

information in the condensed set of consolidated financial

statements and to identify any information that is apparently

materially incorrect based on, or materially inconsistent with, the

knowledge acquired by us in the course of performing the review. If

we become aware of any apparent material misstatements or

inconsistencies we consider the implications for our report.

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

conclusion section of this report, nothing has come to our

attention that causes us to believe that the directors have

inappropriately adopted the going concern basis of accounting, or

that the directors have identified material uncertainties relating

to going concern that have not been appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410. However, future events or

conditions may cause the Entity to cease to continue as a going

concern, and the above conclusions are not a guarantee that the

Entity will continue in operation.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the AIM Rules.

The directors are responsible for preparing the condensed set of

consolidated financial statements included in the half-yearly

financial report in accordance with IAS 34 as contained in the UK

adopted International Accounting Standards .

As disclosed in note 1, the annual financial statements of the

Entity for the year ended 31 December 2021 are prepared in

accordance with UK-adopted international accounting standards.

In preparing the condensed set of consolidated financial

statements, the directors are responsible for assessing the

Entity's ability to continue as a going concern, disclosing, as

applicable, matters related to going concern and using the going

concern basis of accounting unless the directors either intend to

liquidate the Entity or to cease operations, or have no realistic

alternative but to do so.

Our responsibility

Our responsibility is to express to the Entity a conclusion on

the condensed set of consolidated financial statements in the

half-yearly financial report based on our review.

Our conclusion, including our conclusions relating to going

concern, are based on procedures that are less extensive than audit

procedures, as described in the Basis for conclusion section of

this report.

The purpose of our review work and to whom we owe our

responsibilities

This report is made solely to the Entity in accordance with the

terms of our engagement. Our review has been undertaken so that we

might state to the Entity those matters we are required to state to

it in this report and for no other purpose. To the fullest extent

permitted by law, we do not accept or assume responsibility to

anyone other than the Entity for our review work, for this report,

or for the conclusions we have reached.

KPMG 26 September 2022

Chartered Accountants

1 Stokes Place

St Stephen's Green

Dublin 2,

Ireland.

Condensed Consolidated Income Statement

For the six months ended 30 June 2022

Note Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 2022 30 June 31 December

2021 2021

GBP000s

GBP000s GBP000s

REVENUE 2 69,917 56,042 118,581

Cost of sales (30,851) (24,671) (52,191)

Reimbursable expenses (10,139) (8,354) (18,028)

GROSS PROFIT 28,927 23,017 48,362

Selling, general and administrative

expenses (20,163) (14,848) (34,877)

Selling, general and administrative

expenses comprises:

Other selling, general and administrative

expenses (17,363) (13,201) (27,736)

Amortisation of acquired intangible

assets (1,404) (728) (1,599)

Share-based payment charge (557) (431) (817)

Contingent consideration for

acquisitions - - (2,949)

Acquisition costs 6 (839) (488) (1,776)

--------------------------------------------- ---- ------------- ----------- ------------

Research and development expenses (47) (36) (130)

Net impairment reversal/(loss)

on trade receivable and contract

assets 287 (533) (324)

Other operating income 5 385 926 1,593

OPERATING PROFIT 9,389 8,526 14,624

Finance income - 1 1

Finance costs 4 (239) (213) (361)

PROFIT BEFORE TAXATION 9,150 8,314 14,264

Taxation 8 (1,836) (1,681) (1,590)

PROFIT FOR THE PERIOD 7,314 6,633 12,674

All activities in the current and prior periods relate to

continuing operations.

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2022

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 2022 30 June 2021 31 December

2021

GBP000s GBP000s

GBP000s

OTHER COMPREHENSIVE INCOME

Profit for the period 7,314 6,633 12,674

Exchange differences on translation

of foreign operations 2,121 (1,001) (682)

Other comprehensive income for

the period net of tax 2,121 (1,001) (682)

Total comprehensive profit for

the period 9,435 5,632 11,992

All activities in the current and prior periods relate to

continuing operations.

Note Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 2022 30 June 2021 31 December

2021

GBP000s GBP000s

GBP000s

EARNINGS PER SHARE 3

Basic 14.8p 13.6p 26.1p

Diluted 14.2p 13.0p 25.1p

Note Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 2022 30 June 2021 31 December

2021

GBP000s GBP000s

GBP000s

ADJUSTED EARNINGS PER SHARE 3

Basic 20.4p 16.8p 41.1p

Diluted 19.6p 16.1p 39.4p

ADJUSTED EBITDA

(Adjusted Earnings Before Interest,

Tax, Depreciation and Amortisation) 713,760 12,111 25,423

Condensed Consolidated Balance Sheet

As at 30 June 2022

Unaudited Unaudited Audited

Note 30 June 2022 30 June 2021 31 December

2021

GBP000s GBP000s

GBP000s

Non-current assets

Goodwill 9 41,076 25,646 23,903

Other intangible assets 10 16,910 7,683 7,653

Property, plant and equipment 1,974 1,957 1,966

Right-of-use assets 2,639 3,731 2,691

Deferred tax asset 6,999 5,343 9,433

69,598 44,360 45,646

Current assets

Trade and other receivables 11 30,653 21,966 25,143

Contract assets (accrued revenue) 9,198 4,268 3,958

Cash and cash equivalents 12 11,973 24,571 31,243

51,824 50,805 60,344

Total assets 121,422 95,165 105,990

Current liabilities

Lease liabilities (1,322) (1,338) (1,249)

Trade and other payables 13 (15,469) (13,082) (14,946)

Derivative Liability (783) (98) (261)

Contract liabilities (deferred

revenue) (22,975) (15,489) (17,752)

Current tax liability (468) (1,676) (1,172)

(41,017) (31,683) (35,380)

Net current assets 10,807 19,122 24,964

Non-current liabilities

Lease liabilities (1,264) (2,429) (1,432)

Provisions (19) (19) (19)

Deferred tax liability (4,069) (2,101) (1,920)

(5,352) (4,549) (3,371)

Total liabilities (46,369) (36,232) (38,751)

Net assets 75,053 58,933 67,239

Equity

Share capital 14 499 490 493

Share premium account 711 116 545

Merger reserve 1,349 1,349 1,349

Share-based payment reserve 6,416 5,473 5,859

Translation reserve 2,054 (386) (67)

Retained earnings 64,024 51,891 59,060

Total equity 75,053 58,933 67,239

Condensed Consolidated Statement of Changes in Equity

For the six months ended 30 June 2022

Share Share Merger Share-based Translation Retained Total

capital premium reserve payment reserve earnings

account reserve

GBP000s

GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s

Balance at 1 January 2021 489 3 1,349 5,042 615 45,368 52,866

Profit for the period - - - - - 6,633 6,633

Other comprehensive income

for the period - - - - (1,001) - (1,001)

Total comprehensive income

for the period - - - - (1,001) 6,633 5,632

Shares issued on exercise

of share options 1 113 - - - - 114

Equity-settled share-based

payment charge - - - 431 - - 431

Deferred tax credit taken

directly to equity - - - - - (110) (110)

Total transactions with shareholders

in their capacity as shareholders 1 113 - 431 - (110) 435

Balance at 30 June 2021 490 116 1,349 5,473 (386) 51,891 58,933

Profit for the period - - - - - 6,041 6,041

Other comprehensive income

for the period - - - - 319 - 319

Total comprehensive income

for the period - - - - 319 6,041 6,360

Shares issued on exercise

of share options 3 429 - - - - 432

Equity-settled share-based

payment charge - - - 386 - - 386

Deferred tax credit taken

directly to equity - - - - - 1,128 1,128

Total transactions with shareholders

in their capacity as shareholders 3 429 - 386 - 1,128 1,946

Balance at 31 December 2021 493 545 1,349 5,859 (67) 59,060 67,239

Profit for the period - - - - - 7,314 7,314

Other comprehensive income

for the period - - - - 2,121 - 2,121

Total comprehensive income

for the period - - - - 2,121 7,314 9,435

Shares issued on exercise

of share options 6 166 - - - - 172

Share-based payment charge - - - 557 - - 557

Deferred tax credit taken

directly to equity - - - - - (2,350) (2,350)

Total transactions with shareholders

in their capacity as shareholders 6 166 - 557 - (2,350) (1,621)

Balance at 30 June 2022 499 711 1,349 6,416 2,054 64,024 75,053

Condensed Consolidated Cash Flow Statement

For the six months ended 30 June 2022

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 2022 30 June 2021 31 December

2021

GBP000s GBP000s

GBP000s

Cash flows from operating activities

Profit for the period 7,314 6,633 12,674

Adjustment for:

Amortisation and depreciation 2,937 2,623 5,046

Profit on disposal of non-current

assets (28) (145) (413)

Share-based payment charge 557 431 817

RDEC income (293) (559) (956)

Finance costs 239 213 361

Other non-cash movements (609) 162 (25)

Exceptional Items (Earn-out on acquisitions) - - 2,949

Tax expense 1,836 1,681 1,590

Operating cash flow before changes

in working capital and provisions 11,953 11,039 22,043

Decrease/(increase) in trade, other

receivables and accrued revenue (8,765) 1,672 367

(Decrease)/increase in trade, other

payables and deferred revenue 4,536 (1,833) 217

(Decrease)/increase in provisions - (298) (298)

Cash generated from operating activities 7,724 10,580 22,329

Taxation paid (2,346) (2,059) (3,646)

Net cash from operating activities 5,378 8,521 18,683

Cash flows from investing activities

Finance income received - 1 1

Acquisition of intangible assets (124) (14) (30)

Acquisition of property, plant and

equipment (344) (545) (953)

Proceeds from the sale of property,

plant and equipment 6 14 103

Acquisition of subsidiaries, net

of cash acquired (24,243) - -

Acquisition related earn-out paid - (318) (3,267)

Net cash used in investing activities (24,705) (862) (4,146)

Cash flows from financing activities

Proceeds from the issue of new ordinary

shares 172 114 546

Finance costs paid (169) (105) (169)

Payment of lease liabilities (964) (1,607) (2,490)

Proceeds from borrowings 15,000 - -

Repayment of borrowings (15,000) - -

Net cash (used in)/from financing

activities (961) (1,598) (2,113)

Net (decrease)/ increase in cash

and cash equivalents (20,288) 6,061 12,424

Effect of foreign currency on cash

balances 1,018 (484) (175)

Cash and cash equivalents at start

of the period 31,243 18,994 18,944

Cash and cash equivalents at end

of period 11,973 24,571 31,243

Notes to the Condensed Consolidated Financial Statements

For the six months ended 30 June 2022

1. BASIS OF PREPARATION AND ACCOUNTING POLICIES

The condensed consolidated financial statements have been

prepared in accordance with the recognition and measurement

requirements of International Financial Reporting Standards (IFRS)

and IFRIC interpretations issued by the International Accounting

Standards Board (IASB) adopted by the UK.

The condensed consolidated financial statements have been

prepared in accordance with International Accounting Standard 34

("IAS 34") - Interim Financial Reporting, and should be read in

conjunction with the Group's last annual consolidated financial

statements as at and for the year ended 31 December 2021. Selected

explanatory notes are included to explain events and transactions

that are significant to an understanding of the changes in the

Group's financial position and performance since the last annual

financial statements.

The condensed consolidated financial statements have been

prepared under the historical cost convention, except for the fair

value of certain financial instruments which are further detailed

in note 16.

The same accounting policies, presentation and methods of

computation have been followed in these condensed consolidated

financial statements as were applied in the preparation of the

Group's financial statements for the year ended 31 December

2021.

These condensed consolidated financial statements do not

comprise statutory accounts within the meaning of section 434 of

the Companies Act 2006. A copy of the Group's audited statutory

accounts for the year ended 31 December 2021 were approved by the

Board of Directors and have been delivered to the Registrar of

Companies. The audit report on those accounts was unqualified, did

not draw attention to any matters by way of emphasis and did not

contain any statement under section 498(2) or (3) of the Companies

Act 2006.

Risks and uncertainties

An outline of the key risks and uncertainties faced by the Group

was described in the Annual Report and Accounts 2021 which is

available on the Company website (www.ergomedplc.com). The

principle risks were: Cancellation or delay of clinical trials or

projects by customers including as a result of COVID-19; Lower

contacted order book realisation of sales pipeline to contract;

significant regional or national event (pandemic, natural disaster,

conflict or terrorism; Quality and third party oversight ('TPO');

Information security; Access to capital; Retention of senior and

key employees; Dependence on a limited number of key clients; and

Data privacy.

Critical accounting judgements and key sources of estimation

uncertainty

In preparing these interim financial statements, management has

made judgements and estimates that affect the application of

accounting policies and the reported amounts of assets and

liabilities, income and expense.

The significant judgements made by management in applying the

Group's accounting policies and the key sources of estimation

uncertainty were the same as those described in the last annual

financial statements and are summarised below.

Source of estimation

uncertainty Overview

-------------------- ----------------------------------------------------------

Bad debt provision The Group had provisions against trade receivables at

the period end of GBP344,000 (2021: GBP627,000) which

resulted in a credit to the Income Statement in the

period of GBP287,000 (2020: charge of GBP533,000).

-------------------- ----------------------------------------------------------

Impairment of The impairment provision against goodwill at the period

goodwill end was GBP2,143,000 (2021: GBP2,143,000) and related

fully against the investment in Haemostatix Limited.

GBPnil (2021: GBPnil) was charged to the Income Statement

in the period.

-------------------- ----------------------------------------------------------

Revenue from Revenue for CRO services is recognised based on the

customer costs incurred on a project as a proportion of total

contracts expected costs to determine a percentage of completion

which is applied to the estimate of the transaction

price. Given the long-term nature and complexity of

clinical trials, estimation is used to determine the

forecast costs to complete, which can impact the timing

and value of revenue recognised for the CRO business.

-------------------- ----------------------------------------------------------

Going concern

The interim financial statements have been prepared on the going

concern basis, which assumes that the Group will have sufficient

funds to continue in operational existence for the foreseeable

future, being a period of no less than 12 months from the date

these interim financial statements are approved. The Directors have

reviewed cash flow forecasts for the period through to 31 December

2025, which is derived from the 2022 Board approved budget and a

medium-term cash flow forecast through to 31 December 2025, which

is an extrapolation of the approved budget under multiple scenarios

and growth rates. The 2022 budget and medium -- term forecast

represents the Directors' best estimate of the Group's future

performance and necessarily includes a number of assumptions,

including the level of revenues. The 2022 budget and medium-term

forecast demonstrate that the Directors have a reasonable

expectation that the Group will be able to meet its liabilities as

they fall due for a period of at least 12 months from

the date these interim financial statements are approved.

On the basis of the above factors and, having made appropriate

enquiries, the Directors have a reasonable expectation that the

Group has adequate resources to continue in operational existence

for the foreseeable future. Accordingly, they continue to adopt the

going concern basis in preparing the interim financial

statements.

Business Combinations

Acquisitions of subsidiaries and businesses are accounted for

using the acquisition method. The consideration transferred on

acquisition is the fair value at the date of transaction for assets

and liabilities transferred. All acquisition related costs are

expensed as incurred.

Goodwill arises as the excess of acquisition cost over the fair

value of the assets transferred at the date of transaction.

Goodwill is reviewed for impairment annually and is carried at cost

less accumulated impairment losses. Impairment losses are not

reversed in subsequent periods.

Goodwill arising on the acquisition of a foreign operation,

including any fair value adjustments to the carrying amounts of

assets or liabilities on the acquisition, are treated as assets and

liabilities of that foreign operation in accordance with IAS 21 and

as such are translated at the relevant foreign exchange rate at the

statement of financial position date.

2. REVENUE AND OPERATING SEGMENTS

The Group's revenue is disaggregated by geographical market and

major service lines:

30 June 2022 Geographical market and major service lines

CRO services PV services Total services

GBP000s GBP000s GBP000s

Geographical market by client

location

UK 6,046 4,021 10,067

Rest of Europe, Middle East and

Africa 6,180 6,470 12,650

North America 20,231 24,026 44,257

Asia 1,868 935 2,803

Australia 4 136 140

34,329 35,588 69,917

30 June 2021 Geographical market and major service lines

CRO services PV services Total services

GBP000s GBP000s GBP000s

Geographical market by client

location

UK 2,444 4,534 6,978

Rest of Europe, Middle East and

Africa 4,058 6,243 10,301

North America 18,843 16,661 35,504

Asia 1,860 1,399 3,259

Australia - - -

27,205 28,837 56,042

31 December 2021 Geographical market and major service lines

CRO services PV services Total services

GBP000s GBP000s GBP000s

Geographical market by client

location

UK 5,415 8,785 14,200

Rest of Europe, Middle East and

Africa 9,585 12,981 22,566

North America 38,388 36,028 74,416

Asia 4,687 2,532 7,219

Australia 2 178 180

58,077 60,504 118,581

Operating segments

Information reported to the Company's Board, which is the chief

operating decision maker ('CODM'), for the purpose of resource

allocation and assessment of segment performance, is focused on the

Group operating as two business segments, being Clinical Research

Services ('CRO') and Pharmacovigilance ('PV'). All revenues arise

from direct sales to customers. The segment information reported

below all relates to continuing operations. Following the

acquisition of ADAMAS by the Group in February 2022, the associated

revenues have been allocated between CRO and PV based on the nature

of the revenues generated.

The accounting policies of the reportable segments are the same

as the Group's accounting policies. Segment profit represents the

gross profit earned by each segment. Other amounts, including

selling, general and administration expenses were not allocated to

a segment. This was the measure reported to the CODM for the

purpose of resource allocation and assessment of segment

performance.

Consolidated

CRO PV total

30 June 2022 GBP000s GBP000s GBP000s

------------------------------------------ -------- -------- ------------

Segment revenues 34,329 35,588 69,917

Cost of sales (13,830) (17,021) (30,851)

------------------------------------------ -------- -------- ------------

Reimbursable expenses (9,858) (281) (10,139)

------------------------------------------ -------- -------- ------------

Segment gross profit 10,641 18,286 28,927

------------------------------------------ -------- -------- ------------

Selling, general and administration

expenses (20,163)

------------------------------------------ -------- -------- ------------

Selling, general and administration

expenses comprises:

------------------------------------------ ------------

Other selling, general and administration

expenses (17,363)

------------------------------------------ ------------

Amortisation of acquired fair valued

intangible assets (1,404)

------------------------------------------ ------------

Share-based payment charge (557)

------------------------------------------ ------------

Acquisition costs (839)

------------------------------------------ -------- -------- ------------

Research and development expenses (47)

Net impairment reversal/(loss) on trade

receivable and contract assets 287

------------------------------------------ -------- -------- ------------

Other operating income 385

------------------------------------------ -------- -------- ------------

Operating profit 9,389

Finance income -

Finance costs (239)

------------------------------------------ -------- -------- ------------

Profit before tax 9,150

------------------------------------------ -------- -------- ------------

Consolidated

CRO PV total

30 June 2021 GBP000s GBP000s GBP000s

------------------------------------------ -------- -------- ------------

Segment revenues 27,205 28,837 56,042

Cost of sales (10,664) (14,007) (24,671)

------------------------------------------ -------- -------- ------------

Reimbursable expenses (8,176) (178) (8,354)

------------------------------------------ -------- -------- ------------

Segment gross profit 8,365 14,652 23,017

------------------------------------------ -------- -------- ------------

Selling, general and administration

expenses (14,848)

------------------------------------------ -------- -------- ------------

Selling, general and administration

expenses comprises:

------------------------------------------ ------------

Other selling, general and administration

expenses (13,201)

------------------------------------------ ------------

Amortisation of acquired fair valued

intangible assets (728)

------------------------------------------ ------------

Share-based payment charge (431)

------------------------------------------ ------------

Acquisition costs (488)

------------------------------------------ -------- -------- ------------

Research and development expenses (36)

------------------------------------------ -------- -------- ------------

Net impairment reversal/(loss) on trade

receivable and contract assets (533)

------------------------------------------ -------- -------- ------------

Other operating income 926

------------------------------------------ -------- -------- ------------

Operating profit 8,526

Finance income 1

Finance costs (213)

------------------------------------------ -------- -------- ------------

Profit before tax 8,314

------------------------------------------ -------- -------- ------------

Consolidated

CRO PV total

31 December 2021 GBP000s GBP000s GBP000s

------------------------------------------ -------- -------- ------------

Segment revenues 58,077 60,504 118,581

Cost of sales (22,906) (29,285) (52,191)

------------------------------------------ -------- -------- ------------

Reimbursable expenses (17,621) (407) (18,028)

------------------------------------------ -------- -------- ------------

Segment gross profit 17,550 30,812 48,362

------------------------------------------ -------- -------- ------------

Selling, general and administration

expenses (34,877)

------------------------------------------ -------- -------- ------------

Selling, general and administration

expenses comprises:

------------------------------------------ ------------

Other selling, general and administration

expenses (27,736)

------------------------------------------ ------------

Amortisation of acquired fair valued

intangible assets (1,599)

------------------------------------------ ------------

Share-based payment charge (817)

------------------------------------------ ------------

Contingent consideration for acquisitions (2,949)

------------------------------------------ -------- -------- ------------

Acquisition costs (1,776)

------------------------------------------ -------- -------- ------------

Research and development expenses (130)

Net impairment reversal/(loss) on trade

receivable and contract assets (324)

------------------------------------------ -------- -------- ------------

Other operating income 1,593

------------------------------------------ -------- -------- ------------

Operating profit 14,624

Finance income 1

Finance costs (361)

------------------------------------------ -------- -------- ------------

Profit before tax 14,264

------------------------------------------ -------- -------- ------------

Segment net assets

31 December

30 June 2022 30 June 2021 2021

GBP000s GBP000s GBP000s

------------------------------ ------------ ------------ -----------

CRO 34,939 27,609 28,531

------------------------------ ------------ ------------ -----------

PV 40,114 31,324 38,708

------------------------------ ------------ ------------ -----------

Consolidated total net assets 75,053 58,933 67,239

------------------------------ ------------ ------------ -----------

3. EARNINGS PER SHARE

The calculation of the basic and diluted earnings per share is

based on the following data:

Unaudited Unaudited Unaudited

Six months Six months Year

ended ended ended

30 June 2022 30 June 2021 31 December

2021

GBP000s GBP000s

GBP000s

EARNINGS

Earnings for the purposes of

basic and diluted earnings per

share being net profit attributable

to owners of the Company 7,314 6,633 12,674

Adjustments to earnings:

Amortisation of acquired fair

valued intangible assets 1,404 728 1,605

Share-based payment charge 557 431 817

Acquisition costs (note 6) 839 488 1,776

Acquisition-related contingent

consideration - - 2,949

Pay in lieu and non-compete compensation 38 45 211

Tax effect of adjusting items (66) (101) (102)

Adjusted earnings for the purposes

of basic and diluted earnings

per share 10,086 8,224 19,930

No. No. No.

NUMBER OF SHARES

Weighted average number of shares

for the purposes of basic earnings

per share 49,520,505 48,910,834 48,466,740

Dilution effect of:

Share options 1,822,690 2,293,726 2,102,588

Weighted average number of shares

for the purposes of diluted earnings

per share 51,343,195 51,204,560 50,569,328

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 2022 30 June 2021 31 December

2021

GBP000s GBP000s

GBP000s

EARNINGS PER SHARE

Basic 14.8p 13.6p 26.1p

Diluted 14.2p 13.0p 25.1p

ADJUSTED EARNINGS PER SHARE

Basic 20.4p 16.8p 41.1p

Diluted 19.6p 16.1p 39.4p

4. FINANCE COSTS

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 2022 30 June 2021 31 December

GBP000s GBP000s 2021

GBP000s

Interest on lease liabilities 70 108 191

Other Interest payable 169 105 170

239 213 361

5. OTHER OPERATING INCOME

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 2022 30 June 2021 31 December

GBP000s GBP000s 2021

GBP000s

Foreign grant income 78 298 629

RDEC income 293 559 956

Other income 14 69 8

385 926 1,593

6. ACQUISITION COSTS

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 2022 30 June 2021 31 December

2021

GBP000s GBP000s GBP000s

Acquisition of ADAMAS 700 - 240

Acquisition of MedSource - 327 406

Aborted and other acquisition

costs 139 161 1,130

839 488 1,776

7. EBITDA and Adjusted EBITDA

Unaudited Unaudited Unaudited

Six months Six months Year

ended ended ended

30 June 2022 30 June 2021 31 December

2021

GBP000s GBP000s GBP000s

Operating profit 9,389 8,526 14,624

Adjusted for:

Depreciation and amortisation

charges within Other selling,

general & administration expenses 1,533 1,895 3,447

Amortisation of acquired fair

valued intangible assets 1,404 728 1,599

EBITDA 12,326 11,149 19,670

Adjusted for:

Share-based payment charge 557 431 817

Acquisition related contingent

compensation - - 2,949

Acquisition costs (note 6) 839 488 1,776

Pay in lieu and non-compete compensation 38 43 211

Adjusted EBITDA 13,760 12,111 25,423

The Directors make certain adjustments to EBITDA to derive

Adjusted EBITDA, which they consider are more reflective of the

Group's underlying trading performance, enabling comparisons to be

made with prior periods.

8. INCOME TAX EXPENSE

Income tax expense is recognised at an amount determined by

multiplying the profit before tax for the interim reporting period

by management's best estimate of the weighted-average annual income

tax rate, adjusted for the tax effect of certain items recognised

in full in the interim period. As such, the effective tax rate in

the interim financial statements may differ from management's

estimate of the effective tax rate for the annual financial

statements.

The Group's consolidated effective tax rate in respect of

continuing operations for the six months ended 30 June 2022 was

20.1% (six months ended 30 June 2021: 20.2%).

9. GOODWILL

Reconciliation of carrying amount: Total

GBP000s

Balance at 1 January 2022 23,903

Arising on business combinations 15,820

Translation movement 1,353

Balance at 30 June 2022 41,076

As at 30 June 2022, the Group performed an assessment to

identify indicators of impairment relating to goodwill allocated to

cash generating units (CGUs). This included a review of internal

and external indicators of impairment including considering the

year-to-date performance of the relevant CGUs and any changes in

key assumptions. The outcome of this assessment was that there were

no indications of impairment which could reasonably be expected to

eliminate the headroom computed at 31 December 2021. As a result of

this assessment no impairment charges were recorded in the first

half of 2022 (2021: first half GBPnil; full-year GBPnil).

A full detailed impairment review will be conducted on all CGUs

at 31 December 2022.

10. OTHER INTANGIBLE ASSETS

Total

GBP000s

Cost

At 1 January 2022 33,943

Acquisitions through business combinations 10,106

Additions 124

Disposals -

Translation movement 895

At 30 June 2022 45,068

Amortisation

At 1 January 2022 26,290

Charge for the period 1,673

Disposals -

Translation movement 195

At 30 June 2022 28,158

Net Book Value

At 30 June 2022 16,910

At 31 December 2021 7,653

At 30 June 2021 7,683

11. TRADE AND OTHER RECEIVABLES

Unaudited Unaudited Audited

30 June 2022 30 June 2021 31 December

GBP000s GBP000s 2021

GBP000s

Trade receivables 25,265 18,900 20,234

Other receivables 1,451 834 869

Derivative asset - Foreign currency

forward contracts 15 13 -

Prepayments 1,884 1,572 1,818

Corporation tax receivable 2,038 647 2,222

30,653 21,966 25,143

Trade receivables is recorded net of impairment losses of

GBP344,000 (2021: GBP627,000),

12. CASH AND CASH EQUIVALENTS AND BORROWINGS

On 1 February 2022, Ergomed plc drew down GBP15 million against

the multi-currency revolving credit facility ("RCF") available with

the Company's bankers, HSBC to part fund the acquisition of ADAMAS.

The interest rate payable on this borrowing was SONIA plus 2.1%. As

at 30 June 2022 the entire drawdown of GBP15 million was repaid and

the full RCF is undrawn. On 22 July 2022 the Group has increased

its multi-currency rolling credit facility (RCF) from GBP30.0

million to GBP80.0 million, comprising a GBP50.0 million facility

with an additional GBP30.0 million accordion.

Unaudited Unaudited Audited

30 June 2022 30 June 2021 31 December

GBP000s GBP000s 2021

GBP000s

Cash and cash equivalents 11,973 24,571 31,243

Borrowings - - -

Cash and cash equivalents net

of borrowings 11,973 24,571 18,994

13. TRADE AND OTHER PAYABLES

Unaudited Unaudited Audited

30 June 2022 30 June 2021 31 December

GBP000s GBP000s 2022

GBP000s

Trade payables 4,915 3,435 3,102

Amounts payable to related parties - 52 3

Social security and other taxes 1,356 859 1,302

Other payables 2,077 1,451 1,541

Customer advances - 247 47

Accruals 7,121 7,038 8,951

15,469 13,082 14,946

14. ORDINARY SHARE CAPITAL

Number GBP000s

Ordinary shares of GBP0.01 each

Balance at 30 June 2021 48,955,339 490

Exercise of share options 338,290 3

Balance at 31 December 2021 49,293,629 493

Exercise of share options 586,400 6

Balance at 30 June 2022 49,880,029 499

15. ACQUISITION OF SUBSIDIARY - ADAMAS

On 9 February 2022, the Group acquired all of the issued share

capital in ADAMAS Consulting Group Limited and its subsidiaries

("ADAMAS"). The acquisition has been completed for a cash

consideration of GBP25.6 million, representing an enterprise value

of GBP24.2 million and cash acquired of GBP1.4 million. Ergomed Plc

drew down on its GBP15.0 million on multi-currency rolling credit

facility ('RCF) on 1 February 2022 and utilised the funds and

existing Group cash reserves to fund the acquisition.

ADAMAS is an international specialist consultancy offering a

full range of independent quality assurance services and

specialising in the audit of pharmaceutical manufacturing

processes, as well as auditing clinical trials and

pharmacovigilance systems.

In the period from 9 February 2022 to 30 June 2022, ADAMAS

contributed revenue of GBP4.0 million and profit of GBP0.1 million

to the Group's results. If the acquisition had occurred on 1

January 2022, management estimates that consolidated revenue would

have been GBP4.7 million, and profit for the period would have been

GBP0.1 million. In determining these amounts, management has

assumed that the fair value adjustments, determined provisionally,

that arose on the date of acquisition would have been the same if

the acquisition had occurred on 1 January 2022.

Identifiable assets acquired and liabilities assumed Provisional

valuation

GBP000s

Intangible assets 10,106

Property, plant and equipment 19

Deferred tax assets 4

Trade and other receivables 1,876

Contract asset (accrued income) 233

Cash and equivalents 1,411

Trade and other payables (1,246)

Contract liability (deferred revenue) (14)

Taxation payable (121)

Deferred tax liability (2,434)

Total identifiable net assets 9,834

Goodwill 15,820

Total consideration 25,654

Satisfied by

Cash consideration 25,654

Total consideration 25,654

Net cash outflow arising on acquisition

Cash consideration 25,654

Less: cash and cash equivalent

balances acquired (1,411)

Transaction expenses 940

25,183

Included within intangible assets are customer relationships of

GBP8,630,000, brand of GBP730,000 and contracted orderbook of

GBP735,000 recognised on acquisition. The Group incurred

acquisition related costs of GBP240,000 related to due diligence

and legal activities in the year ended 31 December 2021 and

GBP700,000 in period to 30 June 2022. These costs have been

included in acquisition costs within selling and administrative

expenses in the Group's consolidated income statement.

The fair value of ADAMAS's intangible assets (customer

relationships, brand and contracted orderbook) has been measured

provisionally, pending completion of an independent valuation. The

Group has a 12-month measurement period from the date of

acquisition ending on 9 February 2023.

16. FINANCIAL INSTRUMENTS

Categories of financial instruments

The following table shows the carrying amounts and fair values

of financial assets and financial liabilities at the reporting

date.

Carrying amount Fair value

------------------------------------ ----------------------------------------------------------- ----------

Financial Financial

assets liabilities

at fair at

value Financial Financial fair value

through assets liabilities through

profit at at profit

and amortised amortised and

loss cost cost loss Total Total

30 June 2022 GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s

------------------------------------ --------- ---------- ------------ ------------ -------- ----------

Financial assets

Equity investments - - - - - 38

Trade receivables - 25,265 - - 25,265 25,265

Contract assets (accrued revenue) - 9,198 - - 9,198 9,198

Other receivables - 1,451 - - 1,451 1,451

------------------------------------ --------- ---------- ------------ ------------ -------- ----------

Derivative asset - Foreign currency

forward contracts 15 - - - 15 15

------------------------------------ --------- ---------- ------------ ------------ -------- ----------

Cash and cash equivalents - 11,973 - - 11,973 11,973

------------------------------------ --------- ---------- ------------ ------------ -------- ----------

15 47,887 - - 47,902 47,940

------------------------------------ --------- ---------- ------------ ------------ -------- ----------

Financial liabilities

Lease liabilities - - 2,586 - 2,586 2,586

Trade payables - - 4,915 - 4,915 4,915

Amounts payable to related parties - - - - - -

Other payables - - 2,077 - 2,077 2,077

Derivative liability - Foreign

currency forward contracts - - - 783 783 783

Accruals - - 7,121 - 7,121 7,121

------------------------------------ --------- ---------- ------------ ------------ -------- ----------

- - 16,699 783 17,482 17,482

------------------------------------ --------- ---------- ------------ ------------ -------- ----------

Carrying amount Fair value

---------------------------------- ----------------------------------------------------------- ----------

Financial Financial

assets liabilities

at fair at

value Financial Financial fair value

through assets liabilities through

profit at at profit

and amortised amortised and

loss cost cost loss Total Total

30 June 2021 GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s

---------------------------------- --------- ---------- ------------ ------------ -------- ----------

Financial assets

Equity investments - - - - - -

Trade receivables - 18,900 - - 18,900 18,900

Contract assets (accrued revenue) - 4,268 - - 4,268 4,268

Other receivables - 834 - - 834 834

---------------------------------- --------- ---------- ------------ ------------ -------- ----------

Derivative asset - Foreign

currency forward contracts 13 - - - 13 13

---------------------------------- --------- ---------- ------------ ------------ -------- ----------

Cash and cash equivalents - 24,571 - - 24,571 24,571

---------------------------------- --------- ---------- ------------ ------------ -------- ----------

13 48,573 - - 48,586 48,586

---------------------------------- --------- ---------- ------------ ------------ -------- ----------

Financial liabilities

Lease liabilities - - 3,767 - 3,767 3,767

Trade payables - - 3,435 - 3,435 3,435

Amounts payable to related

parties - - 52 - 52 52

Other payables - - 1,698 - 1,698 1,698

Derivative liability - Foreign

currency forward contracts - - - 98 98 98

Accruals - - 7,038 - 7,038 7,038

---------------------------------- --------- ---------- ------------ ------------ -------- ----------

- - 15,990 98 16,088 16,088

---------------------------------- --------- ---------- ------------ ------------ -------- ----------

Carrying amount Fair value

------------------------------- ----------------------------------------------------------- ----------

Financial Financial

assets liabilities

at fair at

value Financial Financial fair value

through assets liabilities through

profit at at profit

and amortised amortised and

loss cost cost loss Total Total

31 December 2021 GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s

------------------------------- --------- ---------- ------------ ------------ -------- ----------

Financial assets

Equity investments - - - - - 45

Trade receivables - 20,234 - - 20,171 20,171

Accrued revenue (contract

asset) - 3,958 - - 3,958 3,958

Other receivables - 692 - - 692 692

------------------------------- --------- ---------- ------------ ------------ -------- ----------

Cash and cash equivalents - 31,243 - - 31,243 31,243

------------------------------- --------- ---------- ------------ ------------ -------- ----------

- 56,127 - - 56,064 56,109

------------------------------- --------- ---------- ------------ ------------ -------- ----------

Financial liabilities

Lease liabilities - - 2,681 - 2,681 2,681

Trade payables - - 3,102 - 3,102 3,102

Amounts payable to related

parties - - 3 - 3 3

Other payables - - 1,587 - 1,587 1,587

Derivative liability - Foreign

currency forward contracts - - - 261 261 261

Accruals - - 8,951 - 8,951 8,951

------------------------------- --------- ---------- ------------ ------------ -------- ----------

- - 16,324 261 16,585 16,585

------------------------------- --------- ---------- ------------ ------------ -------- ----------

Financial instruments measured at fair value

The financial instruments measured at fair value have been

categorised within the fair value hierarchy based on the valuation

technique used to determine fair value at the reporting date.

30 June 31 December

2022 30 June 2021 2021

GBP000s GBP000s GBP000s

----------------------------------- -------- ------------ -----------

Financial assets

Equity investments - Level 1 38 - 45

Equity investments - Level 3 - - -

Foreign currency forward contracts

used for hedging - Level 2 15 13 -

----------------------------------- -------- ------------ -----------

Financial assets measured at fair

value 53 13 45

----------------------------------- -------- ------------ -----------

Financial liabilities

Foreign currency forward contracts

used for hedging - Level 2 783 98 261

Financial liabilities measured at

fair value 783 98 261

----------------------------------- -------- ------------ -----------

Foreign currency forward contracts (Level 2)

The Group's foreign currency forward contracts are not traded in

active markets. These contracts have been fair valued using

observable forward exchange rates and interest rates corresponding

to the maturity of the contract. The effects of non-observable

inputs are not significant for foreign currency forward

contracts.

Equity investments (Level 1 and 3)

Equity investments which are publicly quoted are measured based

on the quoted market price. Unlisted equity investments are

measured based on the market price of recent share issuances or,

where not available, managements best estimate of the realisable

value of those investments. The level 1 investment held as at 30

June 2021 related to Modus Therapeutics Holding AB, which was

transferred to level 1 on 20 July 2021 when the shares were listed

on the Nasdaq First North Growth Market. Given the lack of

liquidity in Modus' stock, management continue to hold the

value of the investment at GBPnil (the fair value at the

reporting date was GBP38,000). The Modus investment was fully

impaired during prior financial periods after the results of

completed clinical trials in those periods were published.

17. SUBSEQUENT EVENTS

On 22 July 2022 the Group has increased its multi-currency

rolling credit facility (RCF) from GBP30.0 million to GBP80.0

million, comprising a GBP50.0 million facility with an additional

GBP30.0 million accordion.

There were no other material post balance sheet events between

the balance sheet date and the date of this

report.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAENKALEAEAA

(END) Dow Jones Newswires

September 27, 2022 02:01 ET (06:01 GMT)

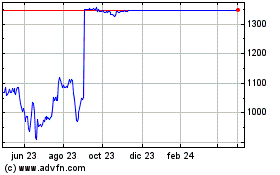

Ergomed (LSE:ERGO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Ergomed (LSE:ERGO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024