TIDMESO TIDMEO.P TIDMEL.P

RNS Number : 5883T

EPE Special Opportunities Limited

21 March 2023

EPE Special Opportunities Limited

("ESO" or the "Company")

Annual Reports and Accounts for the year ended 31 January

2023

The Board of EPE Special Opportunities is pleased to announce

the Company's Annual Report and Accounts for the year ended 31

January 2023.

Summary

-- The performance of the Company's portfolio in the year ended

31 January 2023 has been affected by adverse macro-economic

conditions and a recessionary environment. The Board and Investment

Advisor expect these headwinds to continue through the immediate

period but look forward to the normalisation of trading conditions

over the medium term. Notwithstanding these headwinds, the Company

was pleased to announce the completion of a new investment in

Denzel's Limited ("Denzel's") in October 2022. Looking ahead, the

Board and Investment Advisor will continue to adopt a careful

approach, monitoring economic conditions, maintaining a prudent

level of liquidity at the Company and positioning the portfolio to

navigate the complicated operating environment. As a result of the

uncertainty on market outlook, the Board expects a challenging

environment to complete further acquisitions or disposals within

the portfolio in the near term.

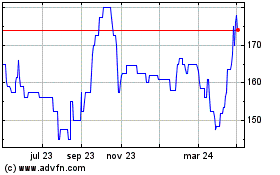

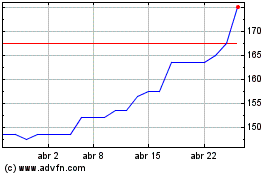

-- The Net Asset Value ("NAV") per share of the Company as at 31

January 2023 was 328 pence, representing a decrease of 28 per cent.

on the NAV per share of 456 pence as at 31 January 2022.

-- The share price of the Company as at 31 January 2023 was 170

pence, representing a decrease of 45 per cent. on the share price

of 309 pence as at 31 January 2022.

-- In March 2023, Luceco plc released its results for the year

ended 31 December 2022. The group announced sales of GBP206

million, with trading impacted by continuing customer destocking.

The business further announced gross margin of 36.0 per cent. and

adjusted operating profit of GBP22 million. The business achieved

record cash generation supporting further deleveraging, with net

debt of 0.8x LTM EBITDA as at 31 December 2022.

-- The Rayware Group's ("Rayware") trading has been impacted by

a confluence of challenges, including customer destocking,

decreased consumer confidence and supply chain disruption. The

business expects performance to strengthen over the coming period,

benefitting from abating input cost, supply chain and customer

destocking pressures. The business has continued to develop its

presence in international markets, and has appointed Alec Taylor,

former director of Bradshaw International, as a non-executive

director and made a number of additions to the US sales team to

support the strategic focus on the US market.

-- Whittard of Chelsea ("Whittard") has performed robustly, with

the business' retail channel trading strongly, benefitting from

strengthening footfall and returning tourist volumes. Whittard has

made encouraging progress in its international channels, with the

business' new South Korean franchise partner progressing its store

rollout, and with new wholesale customers secured in the US and

Europe. The business completed the relocation of its head office to

Milton Park in Oxfordshire in April 2022.

-- David Phillips made good progress, despite the wider

inflationary environment, generating pleasing cash generation in

the period. The business is focussed on achieving further growth in

its existing channels and accessing greater profitability through

efficiencies and scale.

-- Pharmacy2U has continued to experience growth in its core NHS

online prescription channel and has been focussed on building scale

in its primary Bardon facility to increase operational

efficiency.

-- EPIC Acquisition Corp has progressed to advanced discussions

with a number of European consumer brands regarding a potential

business combination. EAC continues to actively source and review a

pipeline of attractive targets. EAC's initial business combination

period ends on the 25 April 2023, with the subsequent option to

extend this period by two intervals of three months.

-- In October 2022, the Company announced a GBP2.0 million

investment in Denzel's. Denzel's is a fast-growing, healthy and

sustainable premium dog snacks brand. Denzel's operates an

omni-channel distribution strategy, underpinned by listings in some

of the UK's leading retailers and hospitality locations as well as

e-commerce channels. The Investment Advisor intends to work closely

with Denzel's to help deliver its growth strategy, which is focused

on the launch of new products, notably high value and functional

dog treats, as well as growth of both offline and online

distribution channels.

-- The Company's investments in Atlantic Credit Opportunities

Fund and Prelude Structured Alternatives Master Fund are in the

process of realisation, with the distribution of proceeds to the

Company to be completed in the coming period.

-- The Company had cash balances of GBP24.5 million(1) as at 31

January 2023. In July 2022, the Company agreed the extension of the

maturity of GBP4.0 million of unsecured loan notes to July 2023,

with an option for the Company to further extend the maturity to

July 2024. The Company has GBP20.7 million zero dividend preference

shares ("ZDP") maturing in December 2026 and no other third-party

debt outstanding.

-- In September and October 2022, the Company completed buybacks

in the market totalling 1.9 million ordinary shares (or 5.4 per

cent. of the Company's issued ordinary share capital) at a weighted

average share price of 139 pence.

-- As at 31 January 2023, the Company's unquoted portfolio was

valued at a weighted average EBITDA to enterprise value multiple of

6.7x (excluding assets investing for growth) and the portfolio had

a low level of third party leverage with net debt at 1.3x EBITDA in

aggregate.

Mr Clive Spears, Chairman, commented: "We have all faced

significant macro-economic headwinds in the period, and the Board

and Investment Advisor have accordingly maintained a careful

approach, positioning the portfolio and the Company. The Company

was pleased to announce the completion of the new investment in

Denzel's and continues to review a pipeline of attractive

investments. The Board would like to note its appreciation of the

Investment Advisor and the portfolio management teams for their

efforts through a complicated period. The Board will monitor the

progress of the portfolio over the coming months and looks forward

to updating shareholders at the half year."

The person responsible for releasing this information on behalf

of the Company is Amanda Robinson of Langham Hall Fund Management

(Jersey) Limited.

Note 1: Company liquidity is stated inclusive of cash held by

subsidiaries in which the Company is the sole investor.

Enquiries:

EPIC Investment Partners LLP +44 (0) 207 269 8865

Alex Leslie

Langham Hall Fund Management (Jersey) Limited +44 (0) 15 3488 5200

Amanda Robinson

Cardew Group Limited +44 (0) 207 930 0777

Richard Spiegelberg

Numis Securities Limited +44 (0) 207 260 1000

Nominated Advisor: Stuart Skinner

Corporate Broker: Charles Farquhar

Chairman's Statement

The performance of the Company's portfolio in the year ended 31

January 2023 has been affected by adverse macro-economic conditions

and a recessionary environment. The Board and Investment Advisor

expect these headwinds to continue through the immediate period but

look forward to the normalisation of trading conditions over the

medium term. Notwithstanding these headwinds, the Company was

pleased to announce the completion of a new investment in Denzel's

Limited ("Denzel's") in October 2022. Looking ahead, the Board and

Investment Advisor will continue to adopt a careful approach,

monitoring economic conditions, maintaining a prudent level of

liquidity at the Company and positioning the portfolio to navigate

the complicated operating environment. As a result of the

uncertainty on market outlook, the Board expects a challenging

environment to complete further acquisitions or disposals within

the portfolio in the near term.

The Net Asset Value ("NAV") per share of the Company as at 31

January 2023 was 328 pence, representing a decrease of 28 per cent.

on the NAV per share of 456 pence as at 31 January 2022. The share

price of the Company as at 31 January 2023 was 170 pence,

representing a decrease of 45 per cent. on the share price of 309

pence as at 31 January 2022.

In March 2023, Luceco plc ("Luceco") released its results for

the year ended 31 December 2022. The group announced sales of

GBP206 million, with trading impacted by continuing customer

destocking. The business further announced gross margin of 36.0 per

cent. and adjusted operating profit of GBP22 million. The business

achieved record cash generation supporting further deleveraging,

with net debt of 0.8x LTM EBITDA as at 31 December 2022.

The Rayware Group's ("Rayware") trading has been impacted by a

confluence of challenges, including customer destocking, decreased

consumer confidence and supply chain disruption. The business

expects performance to strengthen over the coming period,

benefitting from abating input cost, supply chain and customer

destocking pressures. The business has continued to develop its

presence in international markets, and has appointed Alec Taylor,

former director of Bradshaw International, as a non-executive

director and made a number of additions to the US sales team to

support the strategic focus on the US market.

Whittard of Chelsea ("Whittard") has performed robustly, with

the business' retail channel trading strongly, benefitting from

strengthening footfall and returning tourist volumes. Whittard has

made encouraging progress in its international channels, with the

business' new South Korean franchise partner progressing its store

rollout, and with new wholesale customers secured in the US and

Europe. The business completed the relocation of its head office to

Milton Park in Oxfordshire in April 2022.

David Phillips made good progress, despite the wider

inflationary environment, generating pleasing cash generation in

the period. The business is focussed on achieving further growth in

its existing channels and accessing greater profitability through

efficiencies and scale.

Pharmacy2U has continued to experience growth in its core NHS

online prescription channel and has been focussed on building scale

in its primary Bardon facility to increase operational

efficiency.

EPIC Acquisition Corp has progressed to advanced discussions

with a number of European consumer brands regarding a potential

business combination. EAC continues to actively source and review a

pipeline of attractive targets. EAC's initial business combination

period ends on the 25 April 2023, with the option to extend this

period by two intervals of three months.

In October 2022, the Company announced a GBP2 million investment

in Denzel's, a premium dog snacks brand with an omni-channel

distribution strategy. Denzel's is focused on delivering its growth

strategy, progressing new product development and expanding its

offline and e-commerce distribution channels.

The Company had cash balances of GBP24.5 million(1) as at 31

January 2023. In July 2022, the Company agreed the extension of the

maturity of GBP4 million of unsecured loan notes to July 2023, with

an option for the Company to further extend the maturity to July

2024. The Company has GBP20.7 million zero dividend preference

shares ("ZDP") maturing in December 2026 and no other third-party

debt outstanding.

The Board would like to note its appreciation of the Investment

Advisor and the portfolio management teams for their efforts

through a complicated period. The Board will monitor the progress

of the portfolio over the coming months and looks forward to

updating shareholders at the half year.

Clive Spears

Chairman

20 March 2023

Investment Advisor's Report

The Company's portfolio has faced challenging operating

conditions in the period, with pressures on demand from decreasing

consumer confidence and profitability impacted by the inflationary

environment. The Investment Advisor, together with portfolio

management teams, has taken mitigating actions to protect

performance in light of these evolving challenges. The Company has

improved its liquidity via the extension of the maturity of its

GBP4 million unsecured loan notes to July 2023 with an option to

extend for a further year, providing additional headroom to support

the portfolio and make new investments. The Company completed a new

growth capital investment in Denzel's in October 2022. The

Investment Advisor will continue to maintain its prudent approach

and will seek to generate improving performance as the

macro-economic environment begins to stabilise .

The Net Asset Value ("NAV") per share of the Company as at 31

January 2023 was 328 pence, representing a decrease of 28 per cent.

on the NAV per share of 456 pence as at 31 January 2022. The share

price of the Company as at 31 January 2023 was 170 pence,

representing a decrease of 45 per cent. on the share price of 309

pence as at 31 January 2022.

The Company maintains strong liquidity and prudent levels of

third party leverage. The Company had cash balances of GBP24.5

million(1) as at 31 January 2022, which are available to support

the portfolio, meet committed obligations and deploy into

attractive investment opportunities. Net debt in the underlying

portfolio stands at 1.3 x EBITDA in aggregate.

The Company's unquoted portfolio is valued at a weighted average

enterprise value to EBITDA multiple of 6.7 x for mature assets

(excluding assets investing for growth). The valuation has been

derived by reference to quoted comparables, after the application

of a liquidity discount to adjust for the portfolio's scale and

unquoted nature. Given the use of quoted comparables and actual

financial results, the valuation reflects the fair value of assets

as at the balance sheet date. The Investment Advisor notes that the

fair market value of the portfolio remains exposed to a volatile

macro environment and equity market valuations.

In September and October 2022, the Company completed buybacks in

the market totalling 1.9 million ordinary shares (or 5.4 per cent.

of the Company's issued ordinary share capital) at a weighted

average share price of 139 pence.

Luceco released its results for the year ended 31 December 2022

in March 2023. Sales performance was impacted by destocking by

customers in the Retail and Hybrid segments, however this dynamic

has receded during 2023. The business achieved gross margin of 36.0

per cent. Gross margin improved to circa 37.5 per cent. in H2 2022,

following the successful implementation of price increases to

mitigate inflationary pressures and benefitting from reducing input

costs. The business announced adjusted operating profit of GBP22

million or 10.7 per cent.. The business generated an exceptionally

strong free cashflow of GBP30 million as a result of working

capital optimisation, supporting continued deleveraging to a net

debt of 0.8x LTM EBITDA. The business announced 2023 trading in

line with expectations, supported by continued improvement in

trends in customer destocking, gross margin and input costs.

The Rayware Group has faced pressures from customer destocking

and the inflationary environment, impacting trading. The business

has made progress in international channels supported by the

appointment of Alec Taylor to the business' board of directors,

benefitting from his significant experience in growing US homewares

brands during his directorship of Bradshaw International.

Whittard of Chelsea has performed resiliently, despite the wider

market headwinds, with the business' retail channel trading ahead

of budget and the prior year. The business' e-commerce channels

have however seen demand normalising as consumers return to offline

channels. Whittard's South Korean franchise partner opened two new

stores in the period including a flagship Seoul store, the largest

Whittard store globally. In April 2022, the business transitioned

its head office to Milton Park in Oxfordshire, providing improved

access to the greater London area .

David Phillips maintained close control of direct and indirect

costs, with pleasing cash generation and improved profitability.

Project based business lines have seen sales impacted by delayed

project timelines and changes in team members. The business has a

healthy pipeline of new project opportunities for the coming

period, with a growing recurring customer base to support future

ambitions.

Pharmacy2U has continued to build scale in its online pharmacy

platform, as well as developing its more nascent services channels.

Looking ahead, the business is seeking to generate a mature

profitability profile, benefitting from operational leverage at

scale .

EPIC Acquisition Corp has engaged with a number of potential

business combination targets, with active discussions continuing.

EAC continues to focus its deal sourcing efforts on European

consumer brands with strong growth potential in Asian geographies.

EAC's initial business combination period ends on the 25 April

2023, with the option to extend this period by two intervals of

three months.

The Investment Advisor continues to monitor the Company's credit

fund investments. European Capital Private Debt Fund has completed

its investment period and is distributing capital to the Company.

Investments in Atlantic Credit Opportunities Fund and Prelude

Structured Alternatives Master Fund have been discontinued, with

the vehicles distributing proceeds over the coming period.

In October 2022, the Company completed a GBP2 million investment

in Denzel's as lead investor within a GBP3 million growth capital

raise. Denzel's is a fast-growing, healthy and sustainable premium

dog snacks brand. Denzel's operates an omni-channel distribution

strategy, underpinned by listings in some of the UK's leading

retailers and hospitality locations as well as e-commerce channels.

The Investment Advisor intends to work closely with Denzel's to

help deliver its growth strategy, which is focused on the launch of

new products, notably high value and functional dog snacks, as well

as growth of both offline and online distribution channels.

The Investment Advisor would like to thank the portfolio's

management teams and employees for their hard work during a complex

year. The Investment Advisor would like to express its gratitude

for the continuing support of the Board and the Company's

shareholders.

EPIC Investment Partners LLP

Investment Advisor to the Company

20 March 2023

Note 1: Company liquidity is stated inclusive of cash held by

subsidiaries in which the Company is the sole investor.

Biographies of the Directors

Clive Spears (Non- executive David Pirouet (Non - executive

Chairman) Director)

Clive Spears retired from the David Pirouet retired from PricewaterhouseCoopers

Royal Bank of Scotland International Channel Islands LLP in 2009 after

Limited in December 2003 as being an Audit and Assurance

Deputy Director of Jersey after Partner for over 20 years. During

32 years of service. His main his 29 years at the firm Mr Pirouet

activities prior to retirement specialised in the financial

included Product Development, services sector, in particular

Corporate Finance, Trust and in the alternative investment

Offshore Company Services and management area and also led

he was Head of Joint Venture the business's Hedge Fund and

Fund Administration with Rawlinson business recovery practices for

& Hunter. Mr Spears is an Associate over four years. Mr Pirouet currently

of the Chartered Institute for holds a number of non-executive

Securities & Investments. He positions across private equity,

has accumulated a well spread infrastructure and corporate

portfolio of directorships centring debt. Mr Pirouet's was previously

on private equity, infrastructure non-executive Director and Chair

and corporate debt. His current of the Audit and Risk committee

appointments include Chairman for GCP Infrastructure Investments

of Nordic Capital Limited and (FTSE 250 listed company) until

directorships of a series of he retired in February 2021.

ICG plc sponsored funds and He is a resident of Jersey.

funds managed by Kreos Fund

Management. He is a resident

of Jersey.

--------------------------------------------------

Heather Bestwick (Non - executive Nicholas Wilson (Non - executive

Director) Director)

--------------------------------------------------

Heather Bestwick has been a Nicholas Wilson has over 40 years

financial services professional of experience in hedge funds,

for over 25 years, onshore in derivatives and global asset

the City of London and offshore management. He has run offshore

in the Cayman Islands and Jersey. branch operations for Mees Pierson

She qualified as an English Derivatives Limited, ADM Investor

solicitor, specialising in ship Services International Limited

finance, with City firm Norton and several other London based

Rose, and worked in their London financial services companies.

and Greek offices for 8 years. He is a resident of Isle of Man.

Ms Bestwick subsequently practised

and became a partner with global

offshore law firm Walkers in

the Cayman Islands, and Managing

Partner of the Jersey office.

Ms Bestwick sits on the boards

of the Deutsche Bank company

which managed the dbX fund platform

and Rathbones Investment Management

International Limited. She is

a resident of Jersey.

--------------------------------------------------

Michael Gray ( Non - executive

Director)

Michael Gray was at The Royal

Bank of Scotland for over 30

years, latterly as Managing

Director (Corporate) of RBS

International before retiring

in 2015. During his 32 years

at the firm Michael covered

a broad spectrum of financial

services including corporate

and commercial banking, funds,

trusts and real estate. Mr Gray

currently holds a number of

non-executive positions across

private equity, infrastructure

and fund management. Michael's

appointments currently include

non-executive directorships

of Triton Investment Management

(a Swedish private equity group),

GCP Infrastructure Investments

(a FTSE 250 listed company),

J-Star Jersey Company Limited

(a Japanese private equity group),

Foresight 4 VCT plc (a listed

venture capital fund), Jersey

Finance Limited (a Jersey not-for-profit

promotional company), JTC plc

(a FTSE 250 listed trust and

corporate services company)

and TEAM plc (a listed wealth

management company). He is a

resident of Jersey.

Biographies of the Investment Advisor

Giles Brand Hiren Patel

Giles Brand is a Partner and Hiren Patel is a Partner of EPIC.

the founder of EPIC. He is currently He has worked in the investment

Non-executive Chairman of Whittard management industry for the past

of Chelsea and Luceco plc. Before twenty years. Before joining EPIC,

joining EPIC, Giles was a founding Hiren was Finance Director of EPIC

Director of EPIC Investment Partners, Investment Partners. Prior to this,

a fund management business which Hiren was employed at Groupama

at sale had US$5bn under management. Asset Management where he was the

Prior to this, Giles worked in Group Financial Controller.

Mergers and Acquisitions at Baring

Brothers in Paris and London.

Giles read History at Bristol

University.

---------------------------------------------

James Henderson Alex Leslie

---------------------------------------------

James Henderson is a Managing Alex Leslie is a Managing Director

Director of EPIC. He previously of EPIC. He previously worked in

worked in the Investment Banking Healthcare Investment Banking at

division of Deutsche Bank before Piper Jaffray before joining EPIC.

joining EPIC. Whilst at Deutsche Whilst at Piper Jaffray he worked

Bank he worked on a number of on a number of M&A transactions

M&A transactions and IPOs in and equity fundraisings within

the energy, property, retail the Biotechnology, Specialty Pharmaceutical

and gaming sectors, as well as and Medical Technology sectors.

providing corporate broking advice At EPIC, Alex manages the investment

to mandated clients. At EPIC, in Luceco plc, Rayware, Prelude,

James manages the investment Atlantic Credit Opportunities Fund

in Pharmacy2U, Denzel's and EPIC and European Capital Private Debt

Acquisition Corp. James read Fund. He previously managed the

Modern History at Oxford University Company's investments in Process

and Medicine at Nottingham University. Components, BigHead Industries,

David Phillips and Driver Require.

Alex read Human Biological and

Social Sciences at the University

of Oxford and obtained an MPhil

in Management from the Judge Business

School at the University of Cambridge.

---------------------------------------------

Ian Williams

---------------------------------------------

Ian Williams is a Managing Director

of EPIC. He was previously a

Partner at Lyceum Capital Partners

LLP, responsible for deal origination

and engagement, with a primary

focus on the business services

and software sectors, as well

as financial services, education

and health sectors. Prior to

Lyceum, Ian was a Director at

Arbuthnot Securities, involved

in IPO's, secondary fund raisings

and M&A, focused on the support

services, healthcare, transport

& IT sectors. Ian started his

career at Hambros Bank in the

M&A team. Ian read Politics and

Economics at the University of

Bristol.

---------------------------------------------

Risk and Audit Committee Report

The Risk and Audit Committee is chaired by David Pirouet and

comprises all other Directors. Mr Pirouet was appointed as Chairman

of the Committee on 28 June 2019.

The Risk and Audit Committee's main duties are:

-- To review and monitor the integrity of the interim and annual

financial statements, interim statements, announcements and matters

relating to accounting policy, laws and regulations of the

Company;

-- To evaluate the risks to the quality and effectiveness of the financial reporting process;

-- To review the effectiveness and robustness of the internal

control systems and the risk management policies and procedures of

the Company;

-- To review the valuation of portfolio investments;

-- To review corporate governance compliance, including the

Company's compliance with the QCA Corporate Governance Code;

-- To review the nature and scope of the work to be performed by

the Auditors, and their independence and objectivity; and

-- To make recommendations to the Board as to the appointment

and remuneration of the external auditors.

The Risk and Audit Committee has a calendar which sets out its

work programme for the year to ensure it covers all areas within

its remit appropriately. It met four times during the period under

review to carry out its responsibilities and senior representatives

of the Investment Advisor attended the meetings as required by the

Risk and Audit Committee. In between meetings, the Risk and Audit

Committee chairman maintains ongoing dialogue with the Investment

Advisor and the lead audit partner via regular calls and physical

meetings.

During the past year the Risk and Audit Committee carried out an

ongoing review of its own effectiveness. These concluded that the

Risk and Audit Committee is satisfactorily fulfilling its terms of

reference and is operating effectively. In addition, the Committee

undertook a review of the Company's corporate governance and

compliance with the QCA Corporate Governance Code.

Significant accounting matters

The primary risk considered by the Risk and Audit Committee

during the period under review in relation to the financial

statements of the Company is the valuation of unquoted

investments.

The Company's accounting policy for valuing investments is set

out in notes 3i and 12.The Risk and Audit Committee examined and

challenged the valuations prepared by the Investment Advisor,

taking into account the latest available information on the

Company's investments and the Investment Advisor's knowledge of the

underlying portfolio companies through their ongoing monitoring.

The Risk and Audit Committee satisfied itself that the valuation of

investments had been carried out consistently with prior accounting

periods, or that any change in valuation basis was appropriate, and

was conducted in accordance with published industry guidelines.

The Auditors explained the results of their review of the

procedures undertaken by the Investment Advisor in preparation of

valuation recommendations for the Risk and Audit Committee. On the

basis of their audit work, no material adjustments were identified

by the Auditor.

External audit

The Risk and Audit Committee reviewed the audit plan and fees

presented by the auditors, PricewaterhouseCoopers CI LLP ("PwC"),

and considered their report on the financial statements. The fee

for the audit of the annual report and financial statements of the

Company (and subsidiaries) for the year ended 31 January 2023 is

GBP61,350 (2022: GBP68,095).

The Risk and Audit Committee reviews the scope and nature of all

proposed non-audit services before engagement, with a view to

ensuring that none of these services have the potential to impair

or appear to impair the independence of their audit role. The Risk

and Audit Committee receives an annual assurance from the auditors

that their independence is not compromised by the provision of such

services, if applicable. During the period under review, the

auditors provided non-audit services to the Company in relation to

taxation, the Interim Review and Reporting Accountant work

representing total fees of GBP17,000 (2022: GBP75,825 including the

Interim Review, taxation and reporting accountant work).

On 22 April 2022, PwC were appointed as auditors to the Company

for the audit of the year ended 31 January 2023. The Risk and Audit

Committee regularly considers the need to put the audit out to

tender, the auditor's fees and independence, alongside matters

raised during each audit.

The audit was put out to tender by the Committee in September

2021, and at the conclusion of the process it was resolved that

PricewaterhouseCoopers CI LLP be appointed as the Company's Auditor

for the current year.

Other service providers

The Board will review the performance and services offered by

Langham Hall, as fund administrator and EPIC Administration as fund

sub-administrator on an ongoing basis. EPIC Administration

completed its triennial agreed upon procedures review during the

year ended 31 January 2021.

Risk management and internal control

The Company does not have an internal audit function. The Risk

and Audit Committee believes this is appropriate as all of the

Company's operational functions are delegated to third party

service providers who have their own internal control and risk

monitoring arrangements. A report on these arrangements is prepared

by each third party service provider and submitted to the Risk and

Audit Committee which it reviews on behalf of the Board to support

the Directors' responsibility for overall internal control. The

Company does not have a whistleblowing policy and procedure in

place. The Company delegates this function to the Investment

Advisor who is regulated by the FCA and has such policies in place.

The Risk and Audit Committee has been informed by the Investment

Advisor that these policies meet the industry standards and no

whistleblowing took place during the year.

David Pirouet

Chairman of the Risk and Audit Committee

20 March 2023

Corporate Governance

The Board of EPE Special Opportunities is pleased to update

shareholders of the Company's compliance with the 2018 Quoted

Companies Alliance Corporate Governance Code (the "QCA Code").

The Company is committed to the highest standards of corporate

governance, ethical practices and regulatory compliance. The Board

believe that these standards are vital to generate long-term,

sustainable value for the Company's shareholders. In particular the

Board is concerned that the Company is governed in a manner to

allow ef cient and effective decision making, with robust risk

management procedures.

As an investment vehicle, the Company is reliant upon its

service providers for many of its operations. The Board maintains

ongoing and rigorous review of these providers. Speci cally the

Board reviews the governance and compliance of these entities to

ensure they meet the high standards of the Company.

The Board is dedicated to upholding these high standards and

will look to strengthen the Company's governance on an ongoing

basis.

The Company's compliance with the QCA Code is available on the

Company's website (www.epespecialopportunities.com). The Company

will provide annual updates on changes to compliance with the QCA

Code.

Clive Spears

Chairman

20 March 2023

Report of the Directors

Principal activity

EPE Special Opportunities Limited (the "Company") was

incorporated in the Isle of Man as a company limited by shares

under the Laws with registered number 108834C on 25 July 2003. On

23 July 2012, the Company re-registered under the Isle of Man

Companies Act 2006, with registration number 008597V. On 11

September 2018, the Company re-registered under the Bermuda

Companies Act 1981, with registration number 53954. The Company's

ordinary shares are quoted on AIM, a market operated by the London

Stock Exchange, and the Growth Market of the Aquis Stock Exchange

(formerly the NEX Exchange).

The principal activity of the Company and its Subsidiaries is to

arrange income yielding financing for growth, buyout and special

situations and holding the investments with a view to exiting in

due course at a profit.

Incorporation

The Company was incorporated on 25 July 2003 and on 11 September

2018, registered under the Bermuda Companies Act 1981. The

Company's registered office is:

Clarendon House, 2 Church Street, Hamilton HM11, Bermuda.

Place of business

During the year, the Company solely operated out of and was

controlled from:

Liberation House, Castle Street, St Helier, Jersey JE1 2LH

Results of the financial year

Results for the year are set out in the Statements of

Comprehensive Income and in the Statement of Changes in Equity.

Dividends

The Board does not recommend a dividend in relation to the

current year (2022: nil) (see note 10 for further details).

Corporate governance principles

The Directors, place a high degree of importance on ensuring

that the Company maintains high standards of Corporate Governance

and have therefore adopted the Quoted Companies Alliance 2018

Corporate Governance Code (the "QCA Code").

The Board holds at least four meetings annually and has

established Audit and Risk and Investment committees. The Board

does not intend to establish remuneration and nomination committees

given the current composition of the Board and the nature of the

Company's operations. The Board reviews annually the remuneration

of the Directors and agrees on the level of Directors' fees.

Composition of the Board

The Board currently comprises five non-executive directors, all

of whom are independent. Clive Spears is Chairman of the Board,

David Pirouet is Chairman of the Audit and Risk Committee and

Heather Bestwick is Chair of the Investment Committee.

Audit and Risk Committee

The Audit and Risk Committee comprises David Pirouet (Chairman

of the Committee) and all other Directors. The Audit and Risk

Committee provides a forum through which the Company's external

auditors report to the Board.

The Audit and Risk Committee meets twice a year, at a minimum,

and is responsible for considering the appointment and fee of the

external auditors and for agreeing the scope of the audit and

reviewing its findings. It is responsible for monitoring compliance

with accounting and legal requirements, ensuring that an effective

system of internal controls is maintained and for reviewing the

annual and interim financial statements of the Company before their

submission for approval by the Board. The Audit and Risk Committee

has adopted and complied with the extended terms of reference

implemented on the Company's readmission to AIM in August 2010, as

reviewed by the Board from time to time.

The Board is satisfied that the Audit and Risk Committee

contains members with sufficient recent and relevant financial

experience.

Investment Committee

The Board established an Investment Committee, which comprises

Heather Bestwick (Chair of the Committee) and all the other

Directors. The purpose of this committee is to review the portfolio

of the Company, new investment opportunities and evaluate the

performance of the Investment Advisor.

The Board is satisfied that the Investment Committee contains

members with sufficient recent and relevant experience.

Significant holdings

Significant shareholdings are analysed in unaudited schedule of

shareholders holding over 3% of issued shared. The Directors are

not aware of any other holdings greater than 3 per cent. of issued

shares.

Directors

The Directors of the Company holding office during the financial

year and to date are:

Mr. C.L. Spears (Chairman)

Mr. N.V. Wilson

Ms. H. Bestwick

Mr. D.R. Pirouet

Mr. M.M Gray

Staff and Secretary

At 31 January 2023 the Company employed no staff (2022:

none).

Independent Auditors

The current year is the first year in which

PricewaterhouseCoopers CI LLP are undertaking the audit for the

Company. PricewaterhouseCoopers CI LLP have indicated willingness

to continue in office.

On behalf of the Board

Heather Bestwick

Director

20 March 2023

Statement of Directors' Responsibilities

in respect of the Annual Report and the Financial Statements

The Directors are responsible for preparing the Annual Report

and the financial statements in accordance with applicable law and

regulations.

The Directors are required to prepare financial statements for

each financial year. As required by the AIM Rules of the London

Stock Exchange they are required to prepare the financial statement

in accordance with International Financial Reporting Standards

("IFRS") and applicable legal and regulatory requirements of

Bermuda Companies Act 1981.

The Directors must not approve the financial statements unless

they are satisfied that they give a true and fair view of the state

of affairs of the Company and of its profit or loss for that

period. In preparing the Company's financial statements, the

Directors are required to:

-- make judgements and estimates that are reasonable, relevant and reliable;

-- state whether they have been prepared in accordance with IFRS;

-- assess the Company's ability to continue as a going concern,

disclosing, as applicable, matters related to going concern;

and

-- use the going concern basis of accounting unless they either

intend to liquidate the Company or to cease operations, or have no

realistic alternative but to do so.

The Directors confirm that they have complied with the above

requirements in preparing the financial statements.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

its financial statements comply with the Bermuda Companies Act

1981. They are responsible for such internal control as they

determine is necessary to enable the preparation of financial

statements that are free from material misstatement, whether due to

fraud or error, and have general responsibility for taking such

steps as are reasonably open to them to safeguard the assets of the

Company and to prevent and detect fraud and other

irregularities.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website. Legislation in Bermuda governing the preparation

and dissemination of financial statements may differ from

legislation in other jurisdictions.

Independent auditor's report to the members of EPE Special

Opportunities Limited

Report on the audit of the financial statements

Our opinion

In our opinion, the financial statements give a true and fair

view of the financial position of EPE Special Opportunities Limited

(the "Company") as at 31 January 2023, and of its financial

performance and its cash flows for the year then ended in

accordance with International Financial Reporting Standards and

have been properly prepared in accordance with the requirements of

Companies Act 1981 (Bermuda).

What we have audited

The Company's financial statements comprise:

-- the statement of assets and liabilities as at 31 January 2023;

-- the statement of comprehensive income for the year then ended;

-- the statement of changes in equity for the year then ended;

-- the statement of cash flows for the year then ended; and

-- the notes to the financial statements, which include

significant accounting policies and other explanatory

information.

Basis for opinion

We conducted our audit in accordance with International

Standards on Auditing ("ISAs"). Our responsibilities under those

standards are further described in the Auditor's responsibilities

for the audit of the financial statements section of our

report.

We believe that the audit evidence we have obtained is

sufficient and appropriate to provide a basis for our opinion.

Independence

We are independent of the Company in accordance with the

International Code of Ethics for Professional Accountants

(including International Independence Standards) issued by the

International Ethics Standards Board for Accountants (IESBA Code).

We have fulfilled our other ethical responsibilities in accordance

with the IESBA Code.

Our audit approach

Overview

Audit scope

* The Company is registered in Bermuda but operates

from Jersey. We conducted our audit work in Jersey.

* We tailored the scope of our audit taking into

account the type of investments held by the Company,

the accounting processes and controls, and the

industry in which the Company operates.

* We have audited the financial statements of the

Company prepared by its financial administrator in

London.

------------------------------------------------------------------

Key audit matters

* Valuation of the underlying Level 2 and Level 3

investments recognised as part of the Investments at

fair value through profit or loss.

------------------------------------------------------------------

Materiality

* Overall materiality: GBP1,948,000 based on 2% of net

assets.

* Performance materiality: GBP974,000.

The scope of our audit

As part of designing our audit, we determined materiality and

assessed the risks of material misstatement in the financial

statements. In particular, we considered where the directors made

subjective judgements; for example, in respect of significant

accounting estimates that involved making assumptions and

considering future events that are inherently uncertain. As in all

of our audits, we also addressed the risk of management override of

internal controls, including among other matters, consideration of

whether there was evidence of bias that represented a risk of

material misstatement due to fraud.

Key audit matters

Key audit matters are those matters that, in our professional

judgement, were of most significance in our audit of the financial

statements of the current period and include the most significant

assessed risks of material misstatement (whether or not due to

fraud) identified by the auditors, including those which had the

greatest effect on: the overall audit strategy; the allocation of

resources in the audit; and directing the efforts of the engagement

team. These matters, and any comments we make on the results of our

procedures thereon, were addressed in the context of our audit of

the financial statements as a whole, and in forming our opinion

thereon, and we do not provide a separate opinion on these

matters.

Key audit matter How our audit addressed the

Key audit matter

----------------------------------------- ------------------------------------------------------------------

Valuation of the underlying We evaluated the investment valuation

Level 2 and Level 3 investments accounting policy for compliance

recognised as part of the Investments with IFRS and IPEV Guidelines.

at fair value through profit We also tested that the investment

or loss valuations were accounted for

The Company's Investments at in accordance with their stated

fair value through profit or policy.

loss include underlying Level We obtained an understanding

2 and Level 3 investments amounting and performed an evaluation of

to GBP5,495,557 and GBP50,568,639 the Investment Advisor's processes,

respectively, as at 31 January key controls and methodology

2023. These underlying investments applied in determining the fair

are held through the Company's value of the investment portfolio,

subsidiaries. Details of these along with the subsequent consideration

investments including the valuation and approval by the Directors.

techniques used in determining We tested the classification,

the fair value are disclosed approach and valuation basis

in Note 12 to the financial statements. of the underlying Level 2 and

The Company's underlying investment Level 3 investments held through

in a listed special purpose acquisition the Company's subsidiaries.

company ("SPAC") is classified Level 2

as Level 2 whilst those unquoted Investment in the SPAC - Shares

investments in private equity in the SPAC have limited trading

("direct PE investments") including activity and are therefore classified

the Sponsor of the SPAC and other as Level 2. The fair value for

fund investments are classified this asset is calculated with

as Level 3. reference to the latest observable

The valuation of these investments, market price on the Euronext

where material, has been assessed exchange which is then adjusted

as a key audit matter due to based upon advice from the Investment

the significant judgement required Advisor to reflect the limited

and assumptions applied in determining trading volumes.

the fair value as at 31 January We agreed the market price to

2023. a third party source and challenged

the extent of the adjustment

factor applied to reflect the

limited trading volumes.

Level 3

Investment in Direct PE investments

- We evaluated the appropriateness

of the valuation methodology

for each investment. This included:

* testing the financial metrics applied using

independently obtained latest financial information

from portfolio companies;

* assessing the suitability of selected peers; checking

the valuation multiples used to third party sources;

and

* challenging the reasonableness of the significant

unobservable inputs into the valuation models.

Investment in fund investments

- We obtained the latest audited

financial statements and capital

accounts for all investments

and performed an assessment of

the appropriateness of the confirming

parties supplying us with the

requested valuation support.

We considered the quality of

information obtained through

our confirmation process, as

well as the date of the latest

available information used to

support these valuations at year

end. This included a review of

the latest audited financial

statements of the underlying

investment companies or funds

and an assessment of the appropriateness

of the confirming parties supplying

us with the requested valuation

support.

We have not identified any matters

to report to those charged with

corporate governance.

----------------------------------------- ------------------------------------------------------------------

How we tailored the audit scope

We tailored the scope of our audit to ensure that we performed

enough work to be able to give an opinion on the financial

statements as a whole, taking into account the structure of the

Company, the accounting processes and controls, and the industry in

which the Company operates.

Materiality

The scope of our audit was influenced by our application of

materiality. We set certain quantitative thresholds for

materiality. These, together with qualitative considerations,

helped us to determine the scope of our audit and the nature,

timing and extent of our audit procedures on the individual

financial statement line items and disclosures and in evaluating

the effect of misstatements, both individually and in aggregate on

the financial statements as a whole.

Based on our professional judgement, we determined materiality

for the financial statements as a whole as follows:

Overall materiality GBP1,948,000

How we determined it 2% of net assets

------------------------------------------

Rationale for the materiality We believe that net assets is the most

benchmark appropriate benchmark because this is

the key metric of interest to investors.

It is also a generally accepted measure

used for companies in this industry.

------------------------------------------

We use performance materiality to reduce to an appropriately low

level the probability that the aggregate of uncorrected and

undetected misstatements exceeds overall materiality. Specifically,

we use performance materiality in determining the scope of our

audit and the nature and extent of our testing of account balances,

classes of transactions and disclosures, for example in determining

sample sizes. Our performance materiality was 50% of overall

materiality, amounting to GBP974,000 for the financial

statements.

In determining the performance materiality, we considered a

number of factors - risk assessment and aggregation risk and the

effectiveness of controls - and concluded that an amount at the

lower end of our normal range was appropriate.

We agreed with the Risk and Audit committee and those charged

with governance that we would report to them misstatements

identified during our audit above GBP97,000, as well as

misstatements below that amount that, in our view, warranted

reporting for qualitative reasons.

Reporting on other information

The other information comprises all the information included in

the Report and Accounts (the "Annual Report") but does not include

the financial statements and our auditor's report thereon. The

directors are responsible for the other information.

Our opinion on the financial statements does not cover the other

information and we do not express any form of assurance conclusion

thereon.

In connection with our audit of the financial statements, our

responsibility is to read the other information and, in doing so,

consider whether the other information is materially inconsistent

with the financial statements or our knowledge obtained in the

audit, or otherwise appears to be materially misstated. If, based

on the work we have performed, we conclude that there is a material

misstatement of this other information, we are required to report

that fact. We have nothing to report based on these

responsibilities.

Responsibilities for the financial statements and the audit

Responsibilities of the directors for the financial

statements

As explained more fully in the Statement of Directors'

Responsibilities, the directors are responsible for the preparation

of the financial statements that give a true and fair view in

accordance with International Financial Reporting Standards, the

requirements of Bermuda law and for such internal control as the

directors determine is necessary to enable the preparation of

financial statements that are free from material misstatement,

whether due to fraud or error.

In preparing the financial statements, the directors are

responsible for assessing the Company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the Company or to cease

operations, or has no realistic alternative but to do so.

Auditor's responsibilities for the audit of the financial

statements

Our objectives are to obtain reasonable assurance about whether

the financial statements as a whole are free from material

misstatement, whether due to fraud or error, and to issue an

auditor's report that includes our opinion. Reasonable assurance is

a high level of assurance, but is not a guarantee that an audit

conducted in accordance with ISAs will always detect a material

misstatement when it exists. Misstatements can arise from fraud or

error and are considered material if, individually or in aggregate,

they could reasonably be expected to influence the economic

decisions of users taken on the basis of these financial

statements.

Our audit testing might include testing complete populations of

certain transactions and balances, possibly using data auditing

techniques. However, it typically involves selecting a limited

number of items for testing, rather than testing complete

populations. We will often seek to target particular items for

testing based on their size or risk characteristics. In other

cases, we will use audit sampling to enable us to draw a conclusion

about the population from which the sample is selected.

As part of an audit in accordance with ISAs, we exercise

professional judgement and maintain professional scepticism

throughout the audit. We also:

-- Identify and assess the risks of material misstatement of the

financial statements, whether due to fraud or error, design and

perform audit procedures responsive to those risks, and obtain

audit evidence that is sufficient and appropriate to provide a

basis for our opinion. The risk of not detecting a material

misstatement resulting from fraud is higher than for one resulting

from error, as fraud may involve collusion, forgery, intentional

omissions, misrepresentations, or the override of internal

control.

-- Obtain an understanding of internal control relevant to the

audit in order to design audit procedures that are appropriate in

the circumstances, but not for the purpose of expressing an opinion

on the effectiveness of the Company's internal control.

-- Evaluate the appropriateness of accounting policies used and

the reasonableness of accounting estimates and related disclosures

made by the directors.

-- Conclude on the appropriateness of the directors' use of the

going concern basis of accounting and, based on the audit evidence

obtained, whether a material uncertainty exists related to events

or conditions that may cast significant doubt on the Company's

ability to continue as a going concern over a period of at least

twelve months from the date of approval of the financial

statements. If we conclude that a material uncertainty exists, we

are required to draw attention in our auditor's report to the

related disclosures in the financial statements or, if such

disclosures are inadequate, to modify our opinion. Our conclusions

are based on the audit evidence obtained up to the date of our

auditor's report.

-- Evaluate the overall presentation, structure and content of

the financial statements, including the disclosures, and whether

the financial statements represent the underlying transactions and

events in a manner that achieves fair presentation.

We communicate with those charged with governance regarding,

among other matters, the planned scope and timing of the audit and

significant audit findings, including any significant deficiencies

in internal control that we identify during our audit.

We also provide those charged with governance with a statement

that we have complied with relevant ethical requirements regarding

independence, and to communicate with them all relationships and

other matters that may reasonably be thought to bear on our

independence, and where applicable, actions taken to eliminate

threats or safeguards applied.

From the matters communicated with those charged with

governance, we determine those matters that were of most

significance in the audit of the financial statements of the

current period and are therefore the key audit matters. We describe

these matters in our auditor's report unless law or regulation

precludes public disclosure about the matter or when, in extremely

rare circumstances, we determine that a matter should not be

communicated in our report because the adverse consequences of

doing so would reasonably be expected to outweigh the public

interest benefits of such communication.

Use of this report

This independent auditor's report, including the opinions, has

been prepared for and only for the members as a body in accordance

with Section 90 of the Companies Act 1981 (Bermuda) and for no

other purpose. We do not, in giving these opinions, accept or

assume responsibility for any other purpose or to any other person

to whom this report is shown or into whose hands it may come save

where expressly agreed by our prior consent in writing.

Michael Byrne

For and on behalf of PricewaterhouseCoopers CI LLP

Chartered Accountants

Jersey, Channel Islands

20 March 2023

Statement of Comprehensive Income

For the year ended 31 January 2023

31 January 31 January

2023 2022

Total Total

Note GBP GBP

---------------------------------------- ------------- ------------

Income

4 Interest income 79,899 514

11 Net fair value movement on investments* (39,438,551) 10,280,363

---------------------------------------- ------------- ------------

Total (loss) / income (39,358,652) 10,280,877

---------------------------------------- ------------- ------------

Expenses

5 Investment advisor's fees (1,755,442) (2,054,555)

6 Directors' fees (172,000) (149,000)

7 Share based payment expense (555,225) (822,166)

8 Other expenses (557,416) (1,052,268)

---------------------------------------- ------------- ------------

Total expense (3,040,083) (4,077,989)

---------------------------------------- ------------- ------------

(Loss) / profit before finance

costs and tax (42,398,735) 6,202,888

------------- ------------

Finance charges

Interest on unsecured loan note

15 instruments (309,382) (319,685)

Zero dividend preference shares

15 finance charge (1,128,093) (156,983)

(Loss) / profit for the year

before taxation (43,836,210) 5,726,220

9 Taxation - -

---------------------------------------- ------------- ------------

(Loss) / profit for the year (43,836,210) 5,726,220

---------------------------------------- ------------- ------------

Other comprehensive income - -

---------------------------------------- ------------- ------------

Total comprehensive (loss) /

income (43,836,210) 5,726,220

---------------------------------------- ------------- ------------

Basic (loss) / earnings per

17 ordinary share (pence) (141.77) 17.86

---------------------------------------- ------------- ------------

Diluted (loss) /earnings per

17 ordinary share (pence) (141.77) 17.86

---------------------------------------- ------------- ------------

* The net fair value movements on investments is allocated to

the capital reserve and all other income and expenses are allocated

to the revenue reserve in the statement of changes in equity. All

items derive from continuing activities.

Statement of Assets and Liabilities

At 31 January 2023

31 January 31 January

2023 2022

Note GBP GBP

-------------------------------- -------------------------- -----------------

Non-current assets

Investments at fair value

11 through profit or loss 100,412,977 140,525,060

-------------------------------- -------------------------- -----------------

100,412,977 140,525,060

-------------------------------- -------------------------- -----------------

Current assets

13 Cash and cash equivalents 22,226,008 27,545,042

Trade and other receivables

and prepayments 87,899 95,147

-------------------------------- -------------------------- -----------------

22,313,907 27,640,189

-------------------------------- -------------------------- -----------------

Current liabilities

14 Trade and other payables (596,790) (982,655)

15 Unsecured loan note instruments (3,987,729) (3,977,427)

-------------------------------- -------------------------- -----------------

(4,584,519) (4,960,082)

-------------------------------- -------------------------- -----------------

Net current assets 17,729,388 22,680,107

-------------------------------- -------------------------- -----------------

Non-current liabilities

Zero dividend preference

15 shares (20,721,001) (19,580,190)

-------------------------------- -------------------------- -----------------

(20,721,001) (19,580,190)

-------------------------------- -------------------------- -----------------

Net assets 97,421,364 143,624,977

-------------------------------- -------------------------- -----------------

Equity

16 Share capital 1,730,828 1,730,828

Share premium 13,619,627 13,619,627

Capital reserve 97,139,389 136,577,940

Revenue reserve and other

equity (15,068,480) (8,303,418)

-------------------------------- -------------------------- -----------------

Total equity 97,421,364 143,624,977

-------------------------------- -------------------------- -----------------

Net asset value per share

18 (pence) 328.41 455.66

-------------------------------- -------------------------- -----------------

The financial statements were approved by the Board of Directors

on 20 March 2023 and signed on its behalf by:

Clive Spears David Pirouet

Director Director

Statement of Changes in Equity

For the year ended 31 January 2023

Year ended 31 January 2023

Revenue

reserve

and

Share Share Capital other

capital premium reserve equity Total

Note GBP GBP GBP GBP GBP

------------------------- ---------- ----------- ---------------- ------------- -------------

Balance at 1 February

2022 1,730,828 13,619,627 136,577,940 (8,303,418) 143,624,977

Total comprehensive

loss for the year - - (39,438,551) (4,397,659) (43,836,210)

------------------------- ---------- ----------- ---------------- ------------- -------------

Contributions by and

distributions to owners

Share-based payment

7 charge - - - 555,225 555,225

Share ownership scheme

participation - - - 149,568 149,568

16 Purchase of shares - - - (2,587,375) (2,587,375)

Share acquisition for

16 JOSP scheme - - - (484,821) (484,821)

------------------------- ---------- ----------- ---------------- ------------- -------------

Total transactions

with owners - - - (2,367,403) (2,367,403)

------------------------- ---------- ----------- ---------------- ------------- -------------

Balance at 31 January

2023 1,730,828 13,619,627 97,139,389 (15,068,480) 97,421,364

------------------------- ---------- ----------- ---------------- ------------- -------------

Year ended 31 January 2022

Revenue

reserve

and

Share Share Capital other

capital premium reserve equity Total

Note GBP GBP GBP GBP GBP

---------------------------------- ---------- ----------- --------------- ------------ ------------

Balance at 1 February

2021 1,730,828 13,619,627 126,297,577 (955,424) 140,692,608

Total comprehensive income/(loss)

for the year - - 10,280,363 (4,554,143) 5,726,220

---------------------------------- ---------- ----------- --------------- ------------ ------------

Contributions by and

distributions to owners

7 Share-based payment charge - - - 822,166 822,166

Share ownership scheme

participation - - - 625 625

16 Purchase of shares - - - (2,117,866) (2,117,866)

Share acquisition for

16 JOSP scheme - - - (1,498,776) (1,498,776)

---------------------------------- ---------- ----------- --------------- ------------ ------------

Total transactions with

owners - - - (2,793,851) (2,793,851)

---------------------------------- ---------- ----------- --------------- ------------ ------------

Balance at 31 January

2022 1,730,828 13,619,627 136,577,940 (8,303,418) 143,624,977

---------------------------------- ---------- ----------- --------------- ------------ ------------

Statement of Cash Flows

For the year ended 31 January 2023

31 January 31 January

2023 2022

Note GBP GBP

-------------------------------------- ----------------------- ---------------------

Operating activities

Interest income received 79,899 514

Expenses paid (2,853,467) (3,231,866)

11 Purchase of investments (3,174,948) (31,253,480)

11 Proceeds from investments 3,848,880 18,364,193

-------------------------------------- ----------------------- ---------------------

19 Net cash used in operating activities (2,099,636) (16,120,639)

-------------------------------------- ----------------------- ---------------------

Financing activities

Unsecured loan note interest

paid (299,080) (299,080)

Purchase of shares (3,072,196) (3,616,642)

Issue of zero dividend preference

shares - 20,000,000

Issue costs for zero dividend

preference shares - (273,923)

Share ownership scheme participation 149,568 625

-------------------------------------- ----------------------- ---------------------

Net cash (used in) / generated

from financing activities (3,221,708) 15,810,980

-------------------------------------- ----------------------- ---------------------

Decrease in cash and cash equivalents (5,321,344) (309,659)

Effect of exchange rate fluctuations

on cash and cash equivalents 2,310 -

Cash and cash equivalents at

start of year 27,545,042 27,854,701

-------------------------------------- ----------------------- ---------------------

Cash and cash equivalents at

13 end of year 22,226,008 27,545,042

-------------------------------------- ----------------------- ---------------------

Comparative cash flows have been restated to reclassify Purchase

of investments and Proceeds from investments previously presented

under Investing activities section to Operating activities

section.

Reconciliation of net debt

Cash and cash equivalents On 31 January Cash flows Other non-cash On 31 January

2022 charge 2023

GBP GBP GBP GBP

--------------------------- -------------- ------------ --------------- --------------

Cash at bank 27,545,042 (5,321,344) 2,310 22,226,008

Unsecured loan note

instruments (3,977,427) 299,080 (309,382) (3,987,729)

Zero dividend preference

shares (19,580,190) - (1,140,811) (20,721,001)

--------------------------- -------------- ------------ --------------- --------------

Net debt 3,987,425 (5,022,264) (1,447,883) (2,482,722)

--------------------------- -------------- ------------ --------------- --------------

Notes to the Financial Statements

For the year ended 31 January 2023

1 General Information

The Company was incorporated with limited liability in the Isle

of Man on 25 July 2003. The Company then re-registered under the

Isle of Man Companies Act 2006, with registration number 008597V.

On 11 September 2018, the Company re-registered under the Bermuda

Companies Act 1981, with registration number 53954. The Company

moved its operations to Jersey with immediate effect on 17 May 2017

and has subsequently operated from Jersey only.

The Company's ordinary shares are quoted on AIM, a market

operated by the London Stock Exchange, and the Growth Market of the

Aquis Stock Exchange (formerly the NEX Exchange).

The Company's portfolio investments are held in three

subsidiaries, ESO Investments 1 Limited, ESO Investments 2 Limited

and ESO Alternative Investments LP (together the

"Subsidiaries").

Direct interests in the individual portfolio investments are

held by the following Subsidiaries;

-- ESO Investment 1 Limited: Rayware, Whittard, David Phillips and Denzel's

-- ESO Investments 2 Limited: Luceco and Pharmacy2U

-- ESO Alternative Investments LP: European Capital Private Debt

Fund LP, EPE Junior Aggregator LP, Atlantic Credit Opportunities

Fund Limited, EPIC Acquisition Corp and EAC Sponsor Limited

The principal activity of the Company is to arrange income

yielding financing for growth, buyout and special situations

investments with a view to exiting in due course at a profit.

The Company has no employees.

2 Basis of prepa ration

a. Statement of compliance

The financial statements have been prepared in accordance with

International Financial Reporting Standards ("IFRS") and applicable

legal and regulatory requirements of Bermuda Companies Act 1981.

They were previously prepared in accordance with IFRS as adopted by

the EU until 31 January 2021. This change has had no impact on the

financial statements. The following accounting policies have been

adopted and applied consistently. The financial statements comply

with IFRS as issued by the International Accounting Standards Board

(IASB).

b. Basis of measurement

The financial statements have been prepared on the historical

cost convention except for financial instruments at fair value

through profit or loss which are measured at fair value (note 12).

T he following are amendments that the Company has decided not to

adopt early:

-- Standards and amendments to existing standards effective 1 January 2022

There are no standards, amendments to standards or

interpretations that are effective for annual periods beginning on

1 January 2022 that have a material effect on the financial

statements of the Company.

-- New standards, amendments and interpretations effective after

1 January 2022 and have not been early adopted

A number of new standards, amendments to standards and

interpretations are effective for annual periods beginning after 1

January 2022, and have not been early adopted in preparing these

financial statements. None of these are expected to have a material

effect on the financial statements of the Company.

c. Functional and presentation currency

These financial statements are presented in Sterling, which is

the Company's functional and presentation currency. All financial

information presented in Sterling has been rounded to the nearest

pound.

'Functional currency' is the currency of the primary economic

environment in which the Company operates. The expenses (including

investment advisory and administration fees) and investments are

denominated and paid in Sterling. Accordingly, management has

determined that the functional currency of the Company is

Sterling.

A foreign currency transaction is recorded initially at the rate

of exchange at the date of the transaction. Assets and liabilities

are translated from foreign currency to the functional currency at

the closing rate at the end of the reporting period. The resulting

gains or losses are included in the statement of comprehensive

income.

d. Use of estimates and judgements

The preparation of financial statements in conformity with IFRS

requires the Directors and the Investment Advisor to make

judgements, estimates and assumptions that affect the application

of policies and the reported amounts of assets and liabilities,

income and expense. The estimates and associated assumptions are

based on historical experience and various other factors that are

believed to be reasonable under the circumstances, the results of

which form the basis of making the judgements about carrying values

of assets and liabilities that are not readily apparent from other

sources. The Directors have, to the best of their ability, provided

as true and fair a view as is possible. Actual results may differ

from these estimates.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised if the revision affects

only that period or in the period of the revision and future

periods if the revision affects both current and future

periods.

e. Critical accounting estimates and assumption

Critical accounting estimates and assumptions made by Directors

and the Investment Advisor in the application of IFRS that have a

significant effect on the financial statements and estimates with a

significant risk of material adjustments in the year relate to the