TIDMETX

RNS Number : 2495B

e-Therapeutics plc

30 September 2022

e-therapeutics plc

("e-therapeutics" or "ETX" or the "Company")

Interim results for the six months to 31 July 2022

Period of focus building a pipeline of computationally driven

first-in-class RNAi medicines

Cash position further strengthened through successful fundraise

of GBP13.5million

London, UK, 30 September 2022 - e-therapeutics plc (AIM: ETX;

OTCQX; ETXPF), a company integrating computational power and

biological data to discover life-transforming RNAi medicines,

announces its unaudited interim results for the six months to 31

July 2022.

Operational Highlights

-- RNAi strategy delivering a rapidly growing in-house pipeline

of first-in-class RNAi candidates derived from the Company's

computational platform

-- In-house pipeline progress, advancing experimental evaluation

and prosecution of four novel targets in haematology,

cardiovascular disease and non-alcoholic steatohepatitis ("NASH").

Large portfolio of additional target ideas being discovered and

assessed in silico and experimentally

-- Cutting edge AI approaches that learn from experimental data,

deployed into siRNA (short interfering RNA) drug design

-- Generation of proprietary liver omics data to support disease-related target discovery

-- Ongoing validation of internal computational approaches to disease-process and target ID

-- Full deployment of cloud compute to reduce computational

analysis time from months to hours - enabling further sophisticated

analyses

-- Continued expansion of most comprehensive knowledge base of

hepatocyte-centric biology that currently exists in the world to

understand and model complex biological processes in the liver and

in tissues influenced by the liver

-- Strong progress in immuno-oncology collaboration with iTeos

Therapeutics, Inc. ("iTeos"), with Company delivering against

pre-agreed milestones

-- Successful conclusion of Ga lapagos collaboration in

idiopathic pulmonary fibrosis (" IPF") . All near-term milestones

achieved, demonstrating ETX's ability to effectively identify

potential therapeutic strategies and targets computationally

Post Period Highlights

-- Eight inventions arising from e-therapeutics' proprietary

GalNAc-siRNA technology were the subject of further independent

patent applications filed in the United States ("US") or

internationally ("PCT")

-- First milestone payment received on immune-oncology

collaboration with iTeos following successful identification of

potential targets through the application of ETX's computational

platform. On track to achieve further milestone and additional

payments in the coming weeks

-- Successful fundraise on 30 September 2022 of GBP13.5 million

by way of a conditional direct subscription by funds managed by

M&G Investment Management Limited ("M&G") who are an

institutional investor and an existing shareholder of the

Company

Financial Highlights

-- Revenue of GBP0.3 million (H1 2021: GBP0.4 million)

-- R&D spend GBP3.1 million (H1 2021: GBP2.5 million)

-- Operating loss for the period of GBP4.6 million (H1 2021 loss: GBP3.5 million)

-- Loss after tax for the period of GBP3.8 million (H1 2021 loss: GBP2.8 million)

-- Cash and cash equivalents as at 31 July 2022 GBP21.8 million

(31 January 2022: cash GBP11.6 million plus short term bank deposit

investments GBP15.1 million)

-- R&D tax credit receivable at 31 July 2022 of GBP2.2

million (31 January 2022: GBP1.5 million)

-- Headcount (excluding Non-Executive Directors) at 31 July 2022 was 39 (31 January 2022: 35)

Ali Mortazavi, Chief Executive Officer of e-therapeutics,

commented:

"Having quickly established and validated our proprietary

GalNAc-siRNA technology, the last six months of activity has

focused on execution. We have enhanced and leveraged our

computational biology platform to discover and progress a rapidly

growing set of high conviction hepatocyte targets.

"In the space of two years ETX is now uniquely positioned at the

intersection of computational approaches to drug discovery and

using RNAi as the drug modality of choice. This intersection

provides the advantage of being able to combine the target

differentiation and speed enabled by computation with the

prosecution of therapeutic hypotheses in arguably the fastest

timelines and at the lowest cost of development available in the

industry.

"We will continue to build on this progress, further enhancing

our computational platform to advance precision discovery and

invest in our ideas to prosecute multiple high confidence novel

candidates in our in-house pipeline."

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ('MAR') which has

been incorporated into UK law by the European Union (Withdrawal)

Act 2018. Upon the publication of this announcement via Regulatory

Information Service ('RIS'), this inside information is now

considered to be in the public domain.

e-therapeutics plc

Ali Mortazavi, CEO Tel: +44 (0)1993 883

James Chandler, VP IR & Communications 125

www.etherapeutics.co.uk

------------------------------------------------ -------------------------

SP Angel Corporate Finance LLP Tel: +44(0)20 3470 0470

Nominated Adviser and Broker

Matthew Johnson/Caroline Rowe (Corporate

Finance)

Vadim Alexandre/Rob Rees (Corporate Broking)

------------------------------------------------ -------------------------

About e-therapeutics plc

e-therapeutics plc ("ETX") integrates computational power and

biology information to discover life-transforming RNAi medicines.

The Company's technology uses computation to capture and model

human biology, identify novel targets and design RNAi medicines

against those targets that can be rapidly progressed to the

clinic.

ETX's proprietary Computational Biology Platform enables the

generation and analysis of biological network models, providing a

novel and mechanistic approach to drug discovery that explicitly

considers the true complexity of biology and makes more reliable

predictions from large complex data sets and ETX's proprietary

hepatocyte knowledgebase - the world's most comprehensive and

integrated hepatocyte-centric data and information resource. The

Company generates, prioritises and tests millions of hypotheses in

silico to identify better therapeutic targets with higher

confidence.

ETX's proprietary RNAi Platform enables the targeted delivery to

hepatocytes in the liver and the specific silencing of novel

disease-associated genes, identified by ETX's Computational Biology

Platform. The focus on hepatocytes offers the opportunity to work

across a wide variety of diseases. The liver is a highly

metabolically active organ which performs a key role in many

biological processes and vital functions crucial for human health.

ETX's GalNAc-siRNA constructs have demonstrated compelling in vivo

performance in terms of depth of gene silencing and duration of

action.

ETX is progressing a pipeline of first-in-class pre-clinical

RNAi candidates in several therapeutic areas including haematology,

cardiovascular disease and non-alcoholic steatohepatitis ("NASH").

ETX has also partnered with biopharma companies such as Novo

Nordisk, Galapagos NV and iTeos Therapeutics using its

computational network biology approach across a diverse range of

drug discovery projects.

The Company is based in London, UK and listed on the Alternative

Investment Market of the London Stock Exchange ("AIM"), with ticker

symbol ETX. e-therapeutics is also traded on the OTCQX Best Market

(OTCQX) in the United States, under ticker symbol ETXPF.

Chief Executive's Statement

In the 2021/22 period, ETX evolved its strategy to focus on RNA

interference ("RNAi") as a modality of choice and demonstrated

compelling in vivo performance in terms of depth of gene silencing

and duration of action for its proprietary GalNAc-siRNA constructs,

which specifically target hepatocytes in the liver.

The unique advantages of GalNAc-siRNA as a modality allow the

Company to efficiently build a differentiated in-house pipeline

disproportionate to the Company's small size, where novel target

ideas can be prosecuted beyond early discovery to maximise value

retention. The focus on RNAi, in a space with a high barrier to

entry, together with the rapid development of our proprietary

technology presents a highly unusual material opportunity.

The first six months of the new financial year saw a period of

focus in executing this strategy. The Company made significant

progress in extending its computational biology modelling pedigree

to a single cell-focus in hepatocytes in order to derive novel drug

targets from its RNAi platform.

The focus on hepatocytes offers the opportunity to work across a

large variety of diseases. The liver is a highly metabolically

active organ which performs a key role in many biological processes

and vital functions crucial for human health. Genes expressed in

hepatocytes are important potential targets for a broad set of

therapeutic areas such as cardiovascular disease, metabolic

syndromes, diabetes, haematology, obesity, NASH and rare diseases.

There are potentially thousands of accessible target genes for a

GalNAc-siRNA platform, which is hepatocyte centric and does not

suffer from druggability issues unlike traditional small molecules.

Focussing on this one cell type allows further depth and accuracy

of computational methods and increased generation of bespoke assays

and proprietary experimental datasets.

ETX enlarged and deepened its world-class hepatocyte

knowledgebase, leveraged its computational platform for hepatocyte

specificity and expanded the in-house pipeline of first-in-class

RNAi candidates to treat a wide range of complex diseases. This

period of innovation was evidenced by a continued proactive

approach to intellectual property (IP) with eight further patent

applications being filed to protect the Company's novel RNAi

platform and drug targets.

Our ambition to 'compute the future of medicine' rests on a

fundamental and difficult task - the creation of an entirely new

template for drug discovery led by computation that captures and

models disease complexity, identifies novel targets and designs

drugs against those targets that can be rapidly progressed to the

clinic.

I'm pleased to report that during the period, ETX has

demonstrated promising progress towards the delivery of that

ambition. It's a true "human plus machine" collaboration to

understand biology and nominate the best possible gene targets in

the liver to generate life-transforming RNAi medicines. The Company

is successfully identifying and testing an increasing number of

high confidence target ideas, delivered to one cell type, and

specific to one gene, and prosecuting those ideas to generate

precise gene silencing medicines across a diverse range of

liver-associated disease areas, with accelerated timelines and

lower costs compared to industry standards.

Computational Platform: Human biology modelling and novel target

identification

The Computational Platform enables generation and analysis of

biological network models, providing a novel and mechanistic

approach to drug discovery that explicitly considers the true

complexity of biology. Our computational network models represent,

as closely as possible, the biological systems ETX is seeking to

impact. The approach allows us to identify, prioritise and test

millions of hypotheses in silico to make more reliable predictions

with higher confidence and generate gene target hypotheses based on

large complex data sets.

Our computational platform was built on the Company's previously

established comprehensive proprietary network biology knowledge,

tools and algorithms to model and interrogate human biology. This

powerful modular platform was originally cell type agnostic.

Extensive work has recently been undertaken to extend its

capability and to leverage the focus on a single modality to create

the most comprehensive and integrated proprietary

hepatocyte-centric data resource.

We have invested in the generation of a range of proprietary

liver omics data resources to support disease-related process and

target discovery, particularly in the realm of cardiometabolic

disorders.

The Company's proprietary Knowledge Graph technology has been

further enhanced with additional data derived from both

experimental and natural language processing approaches and through

AI-driven predictive approaches to knowledge inference. This allows

the discovery of non-obvious and hidden relationships in data as

well as providing the capability to impute missing information.

Furthermore, the application of robust standards of validation for

all of our tools and approaches remains an important focus and this

rigor will continue to be a critical part of our development going

forward.

Our platform and data resources are now entirely cloud-based

ushering in a new era of effectively unlimited computational power

and data storage. Using cutting edge technologies we have been able

to speed up our analysis pipelines by orders of magnitude, reducing

compute times from weeks or months to a few hours. This has enabled

the development of proprietary large-scale statistical approaches

to analysis that were previously unfeasible.

We have applied, and continue to develop, cutting edge AI

approaches to address all aspects of siRNA drug design including

prediction of in vivo efficacy and pharmacokinetics directly from

in silico modelling to advance our ambition to move 'straight to in

vivo' from the computer, avoiding the need for multiple costly

large scale screens and allowing targets to be validated directly

in animal models.

RNAi Liver Platform and therapeutic progress

ETX uses its proprietary GalNAc-siRNA platform to target

hepatocytes in the liver and specifically silence novel

disease-associated genes, identified by the Company's computational

platform. ETX is able to rapidly design GalNAc-siRNA drug

candidates, leveraging the reproducible and scalable nature of this

powerful and validated modality.

Over the last six months, the Company has delivered robust

evidence and data, in addition to the extensive original

benchmarking studies previously reported, that demonstrate our

ability to join up computationally-driven target identification

with advanced bioinformatic design of siRNA sequences and

chemistries, and experimental prosecution. Importantly, this

establishes a template we can follow with all our pipeline

candidates to optimise execution and continue to maximise our

computational edge across all stages of the R&D process.

ETX is now actively generating valuable data packages on

multiple target genes . The Company is evaluating two gene targets

in vivo in haematology with a large portfolio of other prospects

being both assessed in experimental target validation studies and

considered in silico. In particular, two further targets are in

late-stage experimental and in vivo validation studies, one in

cardiovascular disease and one in NASH.

Intellectual Property

The Company has filed international ("PCT"), United Kingdom

("UK") and United States ("US") patent applications arising from

the Company's inventions across its enabling GalNAc-siRNA platform

and its early pipeline of pre-clinical siRNA candidates in several

therapeutic areas. These patent applications cover thirteen

inventions arising from innovation around novel target ideas and

associated disease-relevant biology identified using the Company's

Biology Platform, novel siRNA therapeutics and novel siRNA

chemistries associated with such siRNA therapeutics and novel

GalNAc-siRNA silencing construct designs.

This is a very active IP strategy and it is indicative of both

the high volume of novel innovations being generated and the

critical importance ETX attributes to protecting its inventions.

ETX's IP strategy has an added significant advantage in that it

enables the Company to leverage its computational edge. Network

biology expertise and computational tools are integrated with IP to

map and track the patent landscape, drive computational innovation

and unlock the opportunity for early filings.

Partnerships and Collaborations

As indicated in the Post Period section of this statement, the

collaboration with iTeos announced on 5 April 2022 to discover

highly differentiated immuno-oncology therapeutics, is progressing

well against the pre-defined plans and milestones. As well as

receiving near-term cash payments material to the revenue of the

Company, ETX is also eligible to receive undisclosed milestone

payments through pre-clinical and clinical development, in addition

to regulatory milestones, per programme.

The collaboration with Galapagos NV ("Galapagos") in idiopathic

pulmonary fibrosis ("IPF") has now successfully concluded and

offers further evidence and third-party validation of ETX's ability

to effectively identify potential therapeutic strategies and

targets computationally. ETX achieved all near-term milestones

resulting in several cash payments to the Company. ETX successfully

characterised the mechanism of action of hit compounds ("hits")

identified earlier in the collaboration, with the hit rate in

identification of active compounds being several orders of

magnitude higher than industry standard. The future of the

identified hits and targets will be determined by Galapagos

according to its strategic priorities. If progressed, ETX is

eligible to receive further milestones throughout development and

commercial stages.

Although our collaborations with iTeos and Galapagos focus on

small molecules as the therapeutic modality, we have consistently

demonstrated our ability to discover novel targets. These

partnerships have provided valuable learnings and validation of

ETX's proprietary computational tools, which are being used for the

discovery of novel hepatocyte targets for prosecution with the

Company's RNAi platform to build its in-house asset portfolio.

Exploring opportunities to collaborate remains a key component

of the Company's strategy. Future collaborations will be in line

with our current liver and RNAi focus, with an expectation for

later-stage partnerships that maximise value retention and reflect

the development of ETX's early in-house RNAi pipeline. A balance

will be found between pre-clinical assets to partner and assets

that the Company will progress to early clinical trials to reach a

more significant value inflection point.

Organisation

A key asset of e-therapeutics is its multi-disciplinary team.

The Company continues to drive the seamless integration of its

unique informatic and biology centric functions, from software

engineering to therapeutic discovery, to maximise synergistic

collaboration and expert knowledge transfer.

ETX continues to invest in and attract leading industry talent

adding to an existing world class multi-disciplinary team of

experts in computational biology and RNAi therapeutics. The team

has worked hard to deliver the progress highlighted in this

statement and I should like to thank them for their continued

commitment and dedication in helping ETX to deliver on its strategy

and key objectives.

At a Board level, open positions include both a permanent CFO

and an additional independent NED to broaden the Board experience

further and adhere to best practice corporate governance

guidelines.

Post Period

Reflecting the Company's ongoing commitment to proactively

protecting its inventions, on 1 August 2022, ETX announced it had

filed eight further patent applications in the US to protect

innovation arising from e-therapeutics' proprietary GalNAc-siRNA

technology.

On 25 August 2022, ETX successfully achieved a milestone in its

immune-oncology collaboration with iTeos Therapeutics, resulting in

a cash payment. The Company is on track in achieving a further

milestone and an additional payment in the coming weeks. These

milestones relate to the identification of potential targets and

compounds through the application of ETX's computational platform.

iTeos is proceeding with experimental evaluation and screening as

set forth in the research collaboration agreement.

Today, on 30 September 2022, ETX announced it had successfully

completed a Fundraise of GBP13.5 million before expenses, by by way

of a subscription for new ordinary shares of 0.1p each ("Ordinary

Shares") in the Company (the "Subscription") at a price of 20p per

Ordinary Share by funds managed by M&G an institutional

investor and an existing shareholder of the Company.

The net proceeds of the Subscription will be utilised by the

Company to facilitate a number of initiatives with a focus on

expanding the Company's platform capabilities; executing

pre-clinical and clinical development of its in-house pipeline of

first-in-class RNAi candidates derived from ETX's computational

platform; and general working capital including additional

headcount.

Outlook

While being cognisant of the macro challenges associated with

the global economy and biotech sector, ETX remains confident in its

strategy, business model and investment proposition. ETX expects to

continue its rapid progress throughout the financial year and

execute its business plan effectively and efficiently while

maintaining a pragmatic balance between execution and cash

preservation.

Despite the extremely challenging backdrop of the last twelve

months, as a validated new class of therapeutic, RNAi has been a

clear positive outlier in the biotechnology sector. This has been

corroborated by significant data as well as corporate transactions

in the field. As a result, we are seeing significant interest in

our differentiated computational biology approach and liver RNAi

chemistry platform. Consequently, we look forward to the future

with confidence.

Ali Mortazavi

Chief Executive Officer

Financial Review

Period end cash of GBP21.8m and an operating loss of GBP4.6m in

H1 FY2023.

The Company continues to manage the underlying cash burn

carefully whilst focusing on expanding its RNAi and computational

platform capabilities, as well as generating income and achieving

external commercial validation with our partners.

Revenue

The Company reached a final milestone in its initial

identification and validation of hit compounds under the Galapagos

collaboration, resulting in the recognition of GBP0.2 million of

revenue (H1 2021: GBP0.5m). In addition, the Company successfully

entered into a new collaboration agreement with iTeos during April

2022 which has generated H1 revenues of GBP0.1 million. The

collaboration will focus on the discovery of novel therapeutic

approaches and targets in immuno-oncology. The Company is eligible

to receive undisclosed milestone payments through pre-clinical and

clinical development, as well as on first regulatory approval for

commercial sale.

Research and Development

Research and development expenditure in H1 2022 increased to

GBP3.1 million (H1 2021: GBP2.5m). The increase reflects an

increase in scientific headcount and in outsourced CRO costs in

relation to our computational and RNAi platforms, as well as a

continued focus on patent applications and related IP

expenditure.

We are expecting the R&D in H2 2023 to increase as we

continue to accelerate investment in our RNAi platform.

General & Administrative expenses

General and administrative expenses in the first half of the

financial year amounted to GBP1.7m (H1 2021: GBP1.5m). The small

increase mainly reflects higher office lease rental expenditure

following the move to the new London office in late 2021 in line

with our growth strategy.

R&D tax credits and loss for the half year

The consolidated income statement includes an R&D tax credit

of GBP0.7m ( H1 2021: GBP0.7m) to be received in relation to the

current year, bringing down the loss after tax for the half year to

GBP3.9m (H1 2021: GBP2.8m).

Cash flow

Cash as at 31 July 2022 stood at GBP21.8m, which is GBP4.9m

lower than the start of the year (cash plus short term bank deposit

investments as at 31 January 2022: GBP26.7m). The reduction

reflects an operating cash out flow of GBP4.1m, net of non -cash

share based employee option charges and depreciation and

amortisation, coupled with working capital outflows of GBP0.6m and

purchase additions of GBP0.2m to fixed and intangible assets. Cash

balances are expected to benefit by a cash receipt of GBP1.5m in

the last quarter of the current financial year in respect of the

R&D tax credit relating to FY2022.

Financial outlook

Our current expectations for underlying cash burn in the second

half of the financial year will be higher than that incurred in H1

2022 as we further progress our R&D activities and build

infrastructure capable of supporting the scaling of the

business.

CONSOLIDATED INCOME STATEMENT FOR THE PERIODED 31 JULY 2022

---------------------------------------------------------------------------------------------------

6 months

6 months ended ended 31 Year ended

31 July 2022 July 2021 31 January

2022

(un audited) (un audited) (audited)

GBP'000 GBP'000 GBP'000

Revenue 295 477 477

Cost of sales - - -

-------------------------------------- ---------------- -------------------- -------------------

Gross profit 295 477 477

Research and development expenditure (3,123) (2,512) (6,109)

Administrative expenses (1,727) (1,470) (3,938)

-------------------------------------- ---------------- -------------------- -------------------

Operating loss (4,555) (3,505) (9,570)

Interest income 46 44 61

Interest expense (12) - (10)

-------------------------------------- ---------------- -------------------- -------------------

Loss before tax (4,521) (3,461) (9,519)

Taxation 709 673 1,449

-------------------------------------- ---------------- -------------------- -------------------

Loss for the period/year attributable

to equity holders of the Company (3,812) (2,788) (8,070)

-------------------------------------- ---------------- -------------------- -------------------

Loss per share: basic and diluted (0.74)p (0.54)p (1.65)p

-------------------------------------- ---------------- -------------------- -------------------

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE SIX MONTHSED 31

JULY 2022

-----------------------------------------------------------------------------------

Year ended

6 months ended 6 months ended 31 January

31 July 2022 31 July 2021 2022

(un audited) (un audited) (audited)

GBP'000 GBP'000 GBP'000

Loss for the period (3,812) (2,788) (8,070)

Other comprehensive income - - -

--------------------------------- ---------------- ---------------- ------------

Total comprehensive income for

the period/year attributable to

equity

holders of the Company (3,812) (2,788) (8,070)

--------------------------------- ---------------- ---------------- ------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE PERIODED

31 JULY

2022

----------------------------------------------------------------------------------------------

Share capital Share Retained

premium earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

As at 1 February 2021 421 77,668 (64,205) 13,884

Total comprehensive income for

the period

Loss for the period - - (2,788) (2,788)

---------------------------------------- ---------------- ------------- ---------- -------

Total comprehensive income for

the period - - (2,788) (2,788)

Transactions with owners, recorded

directly in equity

Issue of ordinary shares 94 21,562 - 21,656

Equity-settled share-based payment

transactions - - 251 251

---------------------------------------- ---------------- ------------- ---------- -------

Total contributions by and distribution

to owners 94 21,562 251 21,907

---------------------------------------- ---------------- ------------- ---------- -------

As at 31 July 2021 515 99,230 (66,742) 33,003

Total comprehensive income for

the period

Loss for the period - - (5,282) (5,282)

---------------------------------------- ---------------- ------------- ---------- -------

Total comprehensive income for

the period - - (5,282) (5,282)

Transactions with owners, recorded

directly in equity

Issue of ordinary shares - 13 - 13

Equity-settled share-based payment

transactions - - 239 239

---------------------------------------- ---------------- ------------- ---------- -------

Total contributions by and distribution

to owners - 13 239 252

---------------------------------------- ---------------- ------------- ---------- -------

As at 31 January 2022 515 99,243 (71,785) 27,973

Total comprehensive income for

the period

Loss for the period - - (3,812) (3,812)

---------------------------------------- ---------------- ------------- ---------- -------

Total comprehensive income for

the period - - (3,812) (3,812)

Transactions with owners, recorded

directly in equity

Issue of ordinary shares - 8 - 8

Equity-settled share-based payment

transactions - - 196 196

---------------------------------------- ---------------- ------------- ---------- -------

Total contributions by and distribution

to owners - 8 196 204

---------------------------------------- ---------------- ------------- ---------- -------

As at 31 July 2022 515 99,251 (75,401) 24,365

---------------------------------------- ---------------- ------------- ---------- -------

CONSOLIDATED BALANCE SHEET AS AT 31 JULY 2022

---------------------------------------------------------------------------------

(*Restated)

31 July 31 July 31 January

2022 2021 2022

Note (un audited) (un audited) (audited)

GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 182 88 102

Property, plant and equipment 617 74 805

------------------------------ --- ----------------- ------------ -----------

799 162 907

------------------------------ --- ----------------- ------------ -----------

Current assets

Tax receivable 2,184 1,442 1,474

Trade and other receivables 188 229 231

Prepayments 563 416 501

Cash and cash equivalents 21,813 25,568 11,598

Short term investments - 6,037 15,051

------------------------------ --- ----------------- ------------ -----------

24,748 33,692 28,855

------------------------------ --- ----------------- ------------ -----------

Total assets 25,547 33,854 29,762

------------------------------ --- ----------------- ------------ -----------

Current liabilities

Trade and other payables 688 851 1,103

Lease Liability 405 - 391

Contract liabilities - - -

------------------------------ --- ----------------- ------------ -----------

1,093 851 1,494

------------------------------ --- ----------------- ------------ -----------

Non-current liabilities

Lease Liability 89 - 295

------------------------------ --- ----------------- ------------ -----------

Total liabilities 1,182 851 1,789

------------------------------ --- ----------------- ------------ -----------

Net assets 24,365 33,003 27,973

------------------------------ --- ----------------- ------------ -----------

Equity

Share capital 2 515 515 515

Share premium 99,251 99,230 99,243

Retained earnings (75,401) (66,742) (71,785)

------------------------------ --- ----------------- ------------ -----------

Total equity attributable to

equity

holders of the Company 24,365 33,003 27,973

------------------------------ --- ----------------- ------------ -----------

CONSOLIDATED CASH FLOW STATEMENT FOR THE PERIODED 31 JULY 2022

(*Restated)

6 months ended 6 months ended Year ended

31 January

31 July 31 July 2022

2022 2021

(un audited) (un audited) (audited)

GBP'000 GBP'000 GBP'000

Loss for the period/year (3,812) (2,788) (8,070)

Adjustments for:

Depreciation, amortisation and impairment 242 44 218

Interest income (46) (44) (61)

Interest expense 12 - 10

Equity-settled share-based payment

expenses 196 251 490

Taxation (709) (673) (1,484)

-------------------------------------------- ------------ ---------------- ------------

Operating cash flows before movements

in working capital (4,117) (3,210) (8,897)

(Increase)/Decrease in trade and

other receivables (19) (292) (379)

Increase/(Decrease) in trade and

other payables (608) 425 699

Tax received - - 779

-------------------------------------------- ------------ ---------------- ------------

Net cash from operating activities (4,744) (3,077) (7,798)

-------------------------------------------- ------------ ---------------- ------------

Interest received 46 44 61

Interest paid (12) - (10)

Acquisition of property, plant and

equipment (51) (30) (908)

Acquisition of other intangible

assets (83) (15) (55)

Movement in short term investments 15,051 (15) (9,029)

-------------------------------------------- ------------ ---------------- ------------

Net cash from investing activities 14,951 (16) (9,941)

-------------------------------------------- ------------ ---------------- ------------

Net proceeds from issue of share

capital 8 21,656 21,669

Payments under lease liabilities - - 793

Repayment of lease liability - - (130)

-------------------------------------------- ------------ ---------------- ------------

Net cash from financing activities 8 21,656 22,332

-------------------------------------------- ------------ ---------------- ------------

Net decrease in cash and cash equivalents 10,215 18,563 4,593

Cash and cash equivalents at the

beginning of the period/year 11,598 7,005 7,005

-------------------------------------------- ------------ ---------------- ------------

Cash and cash equivalents at the

end of the period/year 21,813 25,568 11,598

-------------------------------------------- ------------ ---------------- ------------

*Restatements reflect a simple reclassification of bank deposits

on 95 days' notice as short-term investments

Notes

1. Basis of Preparation

These unaudited interim financial statements do not comprise

statutory accounts as defined within section 434 of the Companies

Act 2006. The Company is a public limited company; it is listed on

the London Stock Exchange's AIM market and is incorporated and

domiciled in the United Kingdom. The address of its registered

office is 4 Kingdom Street, Paddington, London, W2 6BD, UK.

Statutory accounts for the year ended 31 January 2022 were

approved by the Board of Directors on 4 May 2022 and delivered to

the Registrar of Companies. The report of the Auditor on the

accounts was unqualified, did not contain an emphasis of matter

paragraph and did not contain any statement under section 498 of

the Companies Act 2006.

While this interim statement, which is neither audited nor

reviewed, has been prepared in accordance with the recognition and

measurement criteria of international accounting standards in

conformity with the requirements of the Companies Act 2006 this

announcement does not in itself contain sufficient information to

comply with IFRS. It does not include all the information required

for the full annual financial statements and should be read in

conjunction with the financial statements of the Group as at, and

for the year ended, 31 January 2022. It does not comply with

International Accounting Standard ("IAS") 34 'Interim Financial

Reporting' as is permissible under the rules of AIM.

The accounting policies applied in preparing these interim

financial statements are the same as those applied in the

preparation of the annual financial statements for the year ended

31 January 2022 (as defined therein) other than standards,

amendments and interpretations which became effective after

1 February 2022 and were adopted by the Group.

New standards, amendments and interpretations not adopted in the

current financial year have not been disclosed as they are not

expected to have a material impact on the Group's financial

statements.

2. Share Capital

31 July 2022 31 July 2021 31 January

2022

(unaudited) (un audited) (audited)

------------------ -------------- ------------

In issue - fully paid

Ordinary shares of GBP0.001

each (number) 514,614,982 514,553,598 514,571,069

-------------------------------- ------------------ -------------- ------------

Allotted, called up and fully

paid

Ordinary shares of GBP0.001

each (GBP'000) 515 515 515

-------------------------------- ------------------ -------------- ------------

During the six month period to 31 July 2022, 43,913 new ordinary

shares of 0.1p each were issued at a price of 17.22p each in lieu

of fees payable to a non-executive director in accordance with his

service agreement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUQABUPPGMB

(END) Dow Jones Newswires

September 30, 2022 02:00 ET (06:00 GMT)

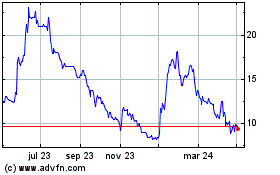

E-therapeutics (LSE:ETX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

E-therapeutics (LSE:ETX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024