TIDMEUA

RNS Number : 4730K

Eurasia Mining PLC

21 December 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS DEFINED IN

REGULATION NO. 596/2014 (AS IT FORMS PART OF RETAINED EU LAW AS

DEFINED IN THE EUROPEAN UNION (WITHDRAWAL) ACT 2018) AND IS IN

ACCORDANCE WITH THE COMPANY'S OBLIGATIONS UNDER ARTICLE 7 OF THAT

REGULATION.

21 December 2022

Eurasia Mining Plc

Corporate Update

Eurasia Mining Plc ("Eurasia" or the "Company"), the palladium,

platinum, rhodium, iridium and gold producing company, provides a

general update on operational matters for the Urals and Kola

operations, the possible sale of the Company's Russian assets and

sanctions legislation.

Highlights:

West Kytlim

- Washing of gravels has finished for 202 2 with our team and

machinery now refocussing on the winter stripping programme.

- Total production for the 2022 season is approximately 200kg of

raw platinum concentrate (up 77% from 113kg in 2021) from the

Bolshaya Sosnovka and Kluchiki areas with a total average grade of

363mg/m(3) and a notable high-grade seam at Kluchiki providing

3.7kg raw platinum from just 3,800m(3) of gravels (grading

984mg/m(3) ).

- Grid electric power is now available at site with the power

line construction completed, the high voltage substation

construction completed, and all necessary peripherals completed and

commissioned.

- Electric dragline (70m/11m(3) ) is now fully assembled and is

under final high voltage electrical testing and the contractual

72-hour continuous performance test.

- Eurasia's electric dragline operators have had on the job

training during the circa one year-long assembly period. Another

training programme has just been completed.

- A late season infill drilling programme to determine the final

2023 mine design has been completed.

Monchetundra

- Concluded final infill and geotechnical drilling programmes for both open pits.

- Definitive feasibility study (the "DFS") for the Loipishnune

and West Nittis open pits has been submitted for approval.

Christian Schaffalitzky, Executive Chairman of Eurasia

commented: "We are encouraged by the progress made at both projects

through the course of a challenging year. Our strategy remains as

previously announced - to continue to develop our assets while

working with counterparties in BRICS countries regarding the

possible sale of our Russian assets, a process which we appreciate

has now run on longer than the Company's management team

anticipated."

James Nieuwenhuys, CEO of Eurasia commented: "The West Kytlim

mining season has proven to be a success both in terms of the

smooth running of the mining operation and the implementation of

both the power line and dragline projects over the course of just

one mining season, and this despite geopolitical challenges. We are

grateful to our staff for their dedication and focus to keep these

projects on budget and on time and look forward to the positive

impact of predominantly electrically powered mining and processing

through the 2023 season."

Further detail

West Kytlim

Electric Dragline and Powerline

The dragline operates with a 70m boom and 11m(3) bucket and has

a designed earth-moving capacity of around 150,000m(3) per month.

The machine is intended to replace several diesel-powered

excavator-bulldozer combinations and all of the stripping capacity

contracted out for the 2022 mining season and is also less limited

in terms of stripping depth.

The dragline will operate initially in the Ust-Tylai North area

for the 2023 season. Appropriate upgrades to the mine site's health

and safety protocols, including the appointment of a permanent

health and safety officer, are in place to deal with the potential

hazards of high-voltage electricity required to operate the

machine.

Through the course of the 2022 season, a 35Kv powerline has been

installed from the village of Kytlim to the mine site over a

distance of some 24 kilometres, following the route of a line

operational in the 1970's. The work involved clearing the route,

installation of 286 powerline posts as well as construction and

commissioning of a dedicated sub-station and hook-up point. Power

in the Sverdlvosk Oblast is predominantly renewable and hydro

derived so that the project's overall CO2 emissions from both

diesel machinery and on-site diesel-based electricity generation is

reduced to back-up use only.

The Company has stockpiled all of the mine product (a 'black

sand' concentrate containing platinum, palladium, iridium, rhodium

and gold) from the 2022 mining season at West Kytlim for later

refining. A final decision will shortly be made on the optimal

strategy for refining concentrate with platinum prices now trending

higher, and above US$1,000/oz, following significant price

volatility through the season and USD/RUB exchange rates rebounding

from 50's ruble per US$1 in June 2022 to 60's ruble per US$1 now. A

further announcement regarding the concentrate will be made in due

course.

Some photographic updates of the dragline in a final state of

assembly are available to view on the Company's website via:

https://www.eurasiamining.co.uk/operations/west-kytlim

Monchetundra

DFS

The DFS report for the Loipishnune and West Nittis open pits,

which incorporates work from numerous contractors, consultants and

laboratories has now been completed. Following submission, a notice

has been received from Rosnedra, the relevant state authority,

acknowledging receipt. An independent expert's review of each of

the study's chapters follows, with a final opinion on the study and

agreement of any parameters described within.

NKT/Monchetundra Flanks

Work continues on the assessment of the NKT Project, contained

within the Flanks license adjacent the Monchetundra (West Nittis

and Loipishnune) mining license, which may be developed as a

standalone project or as a project combined with Monchetundra (West

Nittis and Loipishnune) deposits. In accordance with the

exploration license's requirements, a diamond core drilling

programme at several locations has so far produced 5,488m of drill

core testing for both near surface high-grade veins and

disseminated Ni, Cu, PGE mineralisation, as well as greater width

'bottom lode' mineralisation as a possible continuation on strike

of the mineralisation at West Nittis. A study undertaken by Wardell

Armstrong International in the Second Half of 2021 (please refer

for details to our website at

https://www.eurasiamining.co.uk/investors/technical-reports )

demonstrates the economic potential of the bottom lode

mineralisation as an underground room and pillar mining operation,

with a potential overlying or concurrent open pit operation.

Rosgeo and other exploration license interests on the Kola

Peninsula

A new application for an exploration license for the Nyud area

has been progressed by Rosgeo and the Company will update

shareholders on receipt of this license in due course. The Nyud

project will form the basis for the evaluation of other projects

within the Rosgeo Agreement. Separately, the Company, through its

subsidiaries, is advancing a 100% owned exploration license

application in the Monchegorsk area which is currently being

reviewed by the relevant authorities. The exploration and mining

license tenements held by Eurasia and under application position

Eurasia at the forefront of Kola Ni, Cu and PGE exploration.

Possible sale of Russian assets

The Company continues to focus on selling its Russian assets, a

process led by Mergers and Acquisitions Officer Dmitry Suschov with

support from Artem Matyushok, Non-Executive Director of the

Company, as well as from the Company's Representative Office in

Japan.

At present there can be no guarantee that the Company will enter

into any binding agreements regarding the sale of these assets.

Further updates regarding the sale process will be made as

appropriate.

Cash Position

The Company's cash position (to mid-December), following

expenditure on key capital items for the West Kytlim Mine,

including the dragline and powerline project, stands at

approximately GBP4 million held in sterling and dollar denominated

accounts outside of Russia. Additionally, the Company holds the

2022 West Kytlim mine product with an approximate value of GBP5.6

million, with additional VAT credits of circa GBP2 million

available against future production. Following the acquisition of

additional diesel machinery and the dragline during 2022, the mine

at West Kytlim is now fully equipped for the 2023 mining

season.

Sanctions

Following the update provided in the Company's Interim Results

announcement dated 30 September 2022, the Company continues to

monitor and review all relevant sanctions legislation with its

legal advisers.

Further announcements regarding the potential impact of any

further UK or EU sanctions will be made as appropriate.

A copy of this announcement is also available on Eurasia's

website at:

https://www.eurasiamining.co.uk/investors/news-announcements

For further information, please contact:

Eurasia Mining Plc +44 (0) 20 7932 0418

Christian Schaffalitzky / Keith

Byrne

SP Angel (Nominated Advisor and

Joint Broker)

Jeff Keating / David Hignell /

Adam Cowl +44 (0) 20 3470 0470

Optiva Securities (Joint Broker)

Christian Dennis +44 (0) 20 3137 1902

NOTES TO EDITORS

About Eurasia Mining Plc

Eurasia Mining plc is a palladium, platinum, rhodium, iridium

and gold producing company, operating the established West Kytlim

Mine in the Urals, and also the operator of the Monchetundra

Project comprising two predominantly palladium open pit deposits

located 3km away from Severonickel, one of Norilsk Nickel's largest

base metals and PGM processing facilities, near the town of

Monchegorsk on the Kola Peninsula.

A parallel business development strategy based on the Hydrogen

Economy forms a new development arm of the Company. The Company's

more recent focus on the international hydrogen and alternative

fuel supply markets has been strengthened by the appointment of two

Japan-based Directors, Tamerlan Abdikeev and Kotaro Kosaka, as well

as the creation of a representative office in Japan (noting the

Japanese government's commitments to the hydrogen supply chain and

hydrogen as the primary alternative to fossil fuel based

combustion), and more recently, the appointment of Artem Matyushok,

a senior hydrogen industry executive.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFLFIIFFLLFIF

(END) Dow Jones Newswires

December 21, 2022 05:05 ET (10:05 GMT)

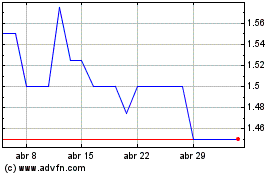

Eurasia Mining (LSE:EUA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Eurasia Mining (LSE:EUA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024