TIDMEUZ

RNS Number : 4374G

Europa Metals Ltd

30 March 2022

30 March 2022

Europa Metals Ltd

("Europa Metals", the "Company" or the "Group") (AIM, AltX:

EUZ)

Results for the Half-Year Ended 31 December 2021

Europa Metals, the European focused lead, zinc and silver

developer, is pleased to announce its unaudited results for the

half-year ended 31 December 2021 (the "Half-Year Financial

Report").

Please see below extracts from the Half-Year Financial Report,

being the:

- Chairman and Interim-CEO's Review

- Review and results of operations

- Consolidated Statement of Profit or Loss and Other Comprehensive Income

- Consolidated Statement of Financial Position

- Consolidated Statement of Changes in Equity

- Consolidated Statement of Cash Flows

A copy of the full Half-Year Financial Report is available on

the Company's website at www.europametals.com .

For further information on the Company, please visit www.europametals.com or contact:

Europa Metals Ltd

Dan Smith, Non-Executive Director and Company Secretary

(Australia)

T: +61 417 978 955

Myles Campion, Interim-CEO and Executive Chairman (UK)

T: +44 (0)20 3289 9923

Linkedin: Europa Metals ltd

Twitter: @ltdeuropa

Vox: Europametals

Strand Hanson Limited (Nominated Adviser)

Rory Murphy/Matthew Chandler

T: +44 (0)20 7409 3494

WH Ireland Limited (Broker)

Harry Ansell/Dan Bristowe/Katy Mitchell/Sarah Mather

T: +44 (0)20 7220 1666

Questco Corporate Advisory Proprietary Limited (JSE Sponsor)

Sharon Owens

T (direct): +27 (11) 011 9212

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018, as amended.

Key Extracts from the Company's unaudited Half-Year Financial

Report are set out below :

Chairman and Interim-CEO's Review

During the reporting period, we have continued to advance our

understanding of the Company's wholly owned Toral lead, zinc and

silver project in the Castilla y Léon region, Spain ("Toral" or the

"Toral Project") as a potential future low capex, high margin,

lead, zinc and silver mine within the EU.

During 2021, Europa Metals prosecuted a very successful drilling

and metallurgical campaign involving a series of holes designed to

achieve an increase in the project's indicated resource estimate

and obtain a bulk sample in order to further our understanding of

the process flowsheet.

The drill campaign initiated in the first half of 2021, targeted

the upper more siliceous levels of the resource at Toral, which

exhibits a lower grade and thinner horizon than the lower carbonate

facies. Results from the drilling yielded some tremendous results

with hole TOD-029 intersecting 20.45m @ 2.68% ZnEq(Pb+Ag) and hole

TOD-034 intersecting 14.85m @ 8.36% ZnEq(Pb+Ag).

The results from the campaign were used to commission an

independent updated resource estimate yielding a 55% increase in

the indicated resource to approximately 5.9 Mt @ 7.1%

ZnEq(including Pb credits) within a total resource of approximately

20 Mt @ 6.3% ZnEq(including Pb credits). Europa Metals is utilising

this substantial updated indicated resource in future prospective

mine scheduling and internal reserve calculations for future

feasibility studies. At our envisaged future mining rate of 700ktpa

steady state, the increase covers the first 10 years' of

production, which is a substantial improvement from where the

resource estimate stood only two years ago.

Our drill campaign also successfully obtained a bulk sample from

some of the daughter holes from holes TOD-029 and TOD-034 which

were submitted to Wardell Armstrong International Limited ("WAI")

for further metallurgical evaluation. As part of this testwork, we

also engaged TOMRA GmbH in Germany to complete a programme of X-Ray

transmission ("XRT") or ore sorting work. Previous programmes had

yielded positive results from this siliceous material illustrating

the potential ability for the grade of this zone to be

upgraded.

Accordingly, the Europa Metals team has progressed Toral from

being a collection of historical data points to a project with the

potential for a future development with good margins at long term

average revenue pricing within a first world jurisdiction with

world class infrastructure. Over the coming period, the Board will

continue with its endeavours to establish a clear pathway forward

for Toral to deliver future returns for shareholders.

In late October 2021, the Company secured a GBP1.5m (gross)

equity financing, through its new broker, WH Ireland Limited ("WH

Ireland"), with the net proceeds to be utilised to further progress

and de-risk Toral and for general working capital purposes, but

also to add additional focus on business development. To this end,

the management team has reviewed over 10 projects, with two being

discussed and evaluated at Board level, and we intend to continue

such activity and to identify, investigate and assess additional

opportunities of potential interest. Further updates will be

provided as and when appropriate.

Myles Campion

Interim-CEO and Executive Chairman

29 March 2022

Review and results of operations

Europa Metals is a European focused lead, zinc and silver

developer.

Operating Results

During the half-year from 1 July 2021 to 31 December 2021, the

Group recorded a net loss after tax of AUD1,357,379 (1 July 2020 to

31 December 2020: net loss of AUD1,647,142).

Toral Lead-Zinc-Silver Project, Spain ("Toral" or the "Toral

Project")

Following the completion of the Scoping Study announced by the

Company in December 2018, workstreams have focused on additional

resource drilling, geotechnical drilling, metallurgical testwork

and environmental baseline studies.

Updated Mineral Resource Estimate

On 1 October 2021, the Company announced an updated independent

mineral resource estimate ("MRE") for Toral. The updated MRE showed

a 55% increase in the indicated resource to approximately 5.9

million tonnes ("Mt") @ 7.1% zinc equivalent ("ZnEq") (including Pb

credits) and 27g/t Ag. In summary, the updated MRE represented an

approximate:

-- 55% increase in Indicated resource tonnes;

-- 39% increase in Indicated contained tonnes of zinc to approximately 251,000 tonnes;

-- 30% increase in Indicated contained tonnes of lead to approximately 196,000 tonnes; and

-- 40% increase in Indicated contained ounces of silver to approximately 5.2 million ounces.

A total resource was reported of approximately 20Mt @ 6.3% zinc

equivalent (including Pb credits), 3.9% Zn, 2.7% Pb and 22g/t Ag,

including:

o 790,000 tonnes of zinc, 550,000 tonnes of lead and 14 million

ounces of silver.

The MRE was reported in accordance with JORC(2012) and

incorporated data obtained from, inter alia:

o 172 diamond drill holes (including wedges) and 4 reverse

circulation (RC) drill holes totalling 59,658.73 metres of drilling

(including environmental drillholes); and

o 19 underground channels for 18.75 metres.

*Zn Eq % is the calculated Zn equivalent incorporating lead

credits; (Zn Eq (Pb)% = Zn + Pb*0.867). Zn Eq (PbAg)% is the

calculated Zn equivalent incorporating silver credits as well as

lead; (Zn Eq (PbAg)% = Zn + Pb*0.867 + Ag*0.027). Zn equivalent

calculations were based on 3-year trailing average price statistics

obtained from the London Metal Exchange and London Bullion Market

Association giving an average Zn price of US$2,516/t, Pb price of

US$1,961/t and Ag price of US$19.4/oz.

http://www.rns-pdf.londonstockexchange.com/rns/4374G_1-2022-3-29.pdf

Image 1: showing Addison Mining Services Limited's ("AMS")

resource block model for Toral as a 3D view looking north, by

resource category

Metallurgical work programme

Summary of ore sorting

Ore sorting has been identified as having the potential to

unlock value in the shallower, lower grade zones previously not

considered to be economically mineable in the 2018 Scoping Study.

Testing was therefore undertaken to investigate the potential of

pre-concentrate material from the Toral deposit by means of

sensor-based sorting. If successful, pre-concentration of the ore

could provide a number of potential benefits for the project

including:

-- Reducing the size of the requisite process plant (crushing,

grinding and dewatering circuits) whilst maintaining the same

overall throughput;

-- Enabling ore that may otherwise be sub-economic based on grade to be processed; and

-- Allowing higher mining rates without necessarily having to

increase the size of the processing plant.

As reported last year, the sorting results for both the hole

TOD-024 and hole TOD-025L samples were considered to be excellent,

with between 45% - 50% of the mass rejected at, for the hole

TOD-024 sample, 98% Pb recovery, 97% Zn recovery and 92% Ag

recovery, and at, for the hole TOD-025L sample, 98% Pb recovery,

94% Zn recovery and 82% Ag recovery.

The increasing head assay was also pleasing with the hole

TOD-024 sample increasing from 1.04% Pb and 1.01% Zn in the feed to

2.34% Pb and 2.15% Zn and an approximate doubling of the grade in

the sorter product. In the hole TOD-025L sample the increase in

grade was more pronounced with uplifts in the Pb grade from 1.13%

Pb to 4.03% and Zn grade from 0.62% Zn in the feed to 2.06% Zn in

the sorter product.

Ore sorting process

Ore sorting by means of XRT is an established process for

sorting Pb/Zn ores by way of rejecting waste dilution from ores at

low cost prior to more conventional processing by flotation.

Sensor-based sorting was selected for WAI's investigation as it

offers a number of benefits over alternative pre-concentration

methods, such as Dense Media Separation (DMS), including the

ability to change the sorting criteria depending on the feed

material and target specific metals/minerals of interest along with

the added flexibility of not having to be continuously

operated.

Toral ore sorting analysis

On 23 March 2022, the Company announced further positive results

in respect of the XRT ore sorting testwork, carried out by TOMRA

GmbH ("TOMRA") in Germany and overseen by WAI in Cornwall. The

results followed on from the abovementioned previous, encouraging

testwork.

A bulk sample of siliceous mineralisation and two further

discrete carbonate samples (from holes TOD-025D and TOD-028) from

the indicated mineral resource zone at Toral were evaluated by

TOMRA. Such XRT testwork forms part of a wider metallurgical

programme that includes locked cycle flotation testwork and

tailings evaluation for backfill.

The key highlights are summarised as follows:

-- Results from the siliceous bulk sample showed:

o Excellent recovery of 95.7% Pb and 94.3% Zn metal

o 43.7% mass rejection of waste

o An overall enrichment ratio of 1.7 for both the lead and

zinc

o Zn Equivalent (Pb+Ag) grade increased from 3.56% to 6.00%

-- Results from hole TOD-025D revealed:

o Excellent recovery of 98.9% Pb and 94.7% Zn metal

o 46.8% mass rejection of waste

o An overall enrichment ratio of 1.9 for lead and 1.8 for

zinc

o Zn Equivalent (Pb+Ag) grade increased from 6.57% to 12.00%

-- Results from hole TOD-028 demonstrated:

o Excellent recovery of 96.6% Pb and 96.1% Zn metal

o 47.7% mass rejection of waste

o An overall enrichment ratio of 1.8 for both the lead and

zinc

o Zn Equivalent (Pb+Ag) grade increased from 4.24% to 7.67%

Hydrogeological programme

On 13 December 2021, the Company announced the successful

completion and results of an independent hydrogeological study on

Toral, commissioned from CRS Ingenieria, following a five month

programme. The objective was to assess water conditions and

drainage relating to the planned further development of the

project. The bore hole and piezometer programme involved a series

of pumping tests and live monitoring utilising indicator dyes to

assess sub-surface water flows and rates. The results were in line

with the hydrogeological conditions assumed within the Company's

pre-existing planned development model. Piezometers continue to

monitor water levels in line with the Company's ongoing compliance

with hydrogeological regulations within the region and Spain.

CDTI Loan Funding

On 19 October 2020, the Company announced that following an

extensive submission process, an interest -free loan by way of a

grant of EUR466,801.50 (the "Grant") had been awarded to the

Company by the Centre for the Development of Industrial Technology

(CDTI) for use towards research and development ("R&D") at

Toral.

The CDTI is a Public Business Entity in Spain, under the

auspices of the Ministry of Science and Innovation, which fosters

the technological development and innovation of Spanish companies.

The Grant is categorised as a partly refundable loan (with a nil

per cent. interest rate) with the funds received to be allocated

towards the development of R&D technologies relating to the

recording and correction of drillhole deviation at the Toral

Project. Application for the Grant was made further to ongoing work

by Europa Metals and the AIR Institute, linked to the Salamanca

University, and drilling contractors Sondeos y Perforaciones

Industriales de Bierzo SA ("SPI").

The Grant monies can be drawn down by Europa Metals in up to

three tranches subject to certain, pre-defined, operational

milestones being met, with the first tranche of EUR163,380.53

received by the Company prior to the last financial year end.

On 19 July 2021, the Company announced that it had completed the

requisite work and collated and submitted all the relevant

documentation to the CDTI in relation to the Stage 1 milestone of

the Grant.

The core objectives of the Innovation Programme are to retrieve

and process data from drilling at Toral in order to develop

algorithmic software for use in future exploration campaigns to

correct drilling deviation. Biannual repayments of EUR21,822 begin

in 2024, running for 7 years until 2031, with a fixed interest rate

of nil per cent.

On 8 November 2021, the Company announced that the CDTI had

approved the requisite documentation submitted in relation to the

Stage 1 milestone and that the Company had therefore drawn down and

received the second tranche of the Grant being EUR158,628.60.

Stage 2 work will see Toral continue to be used as a live

testing environment by the partnership as the University of

Salamanca continues its analysis and any future commercial benefit

from an eventual product will be shared by the partners. On

completion of the Stage 2 work, currently expected to occur during

2022, a third, and final, tranche of EUR144,792.37 will then be

available for draw down subject to a review by the CDTI confirming

that the requisite criteria of the innovation programme have been

met.

Once the funds have demonstrably been spent on appropriate

R&D exploration activity at the Toral Project by the Company,

70 per cent. of the total Grant will be repayable with the

balancing 30 per cent. then not required to be repaid.

Coronavirus (COVID-19) impact on operations

The Board is actively monitoring the impact of COVID-19 on the

group's operations on an ongoing basis.

The Company's response to the global coronavirus (COVID-19)

health event involved safeguarding key personnel at all sites and

limiting travel, including to work at its sites, further to the

advice and guidance issued by all relevant health authorities and

the Spanish and UK governments.

There does not currently appear to be any material impact on the

Company or any significant uncertainties with respect to events or

conditions which may impact the Company unfavourably as at the

reporting date or subsequently as a result of the Coronavirus

(COVID-19) pandemic.

Competent Person's statement

The information above that relates to Exploration Results is

based on information compiled by Mr J.N. Hogg, MSc. MAIG Principal

Geologist for Addison Mining Services Limited ("AMS"), an

independent Competent Person within the meaning of the JORC (2012)

code and qualified person under the AIM guidance note for mining

and oil & gas companies. Mr Hogg has reviewed and verified the

technical information that forms the basis of, and has been used in

the preparation of, the significant intercepts referred to in this

announcement, including all analytical data, diamond drill hole

logs, QA/QC data, density measurements, and sampling, diamond

drilling and analytical techniques. Mr Hogg consents to the

inclusion of the matters based on the information, in the form and

context in which it appears. Mr Hogg has also reviewed and approved

the technical information in his capacity as a qualified person

under the AIM Rules for Companies.

Corporate

Board changes

Post the reporting period end, on 3 February 2022, the Company

announced that Mr Laurence Read had resigned as CEO and as a

director of the Company and its subsidiaries with effect from 2

February 2022. Accordingly, Mr Myles Campion had assumed the role

of interim-CEO with immediate effect.

Capital raising

On 26 October 2021, the Company announced that it had raised, in

aggregate, gross proceeds of GBP1.5 million through the placing of

19,527,920 new ordinary shares to certain institutional and other

investors and a subscription by certain other investors directly

with the Company of a further 10,472,080 new ordinary shares in

each case at a price of 5 pence per share (the "Fundraising").

The Fundraising was conducted in two tranches, with the initial

tranche of new ordinary shares being issued under the Company's

pre-existing share capital authorities, and the second tranche

issued following the receipt of shareholder approval at the

Company's 2021 Annual General Meeting held on 30 November 2021.

Issue of options

Following the approval of resolution 3 at the Company's Annual

General Meeting, the Company proceeded to issue 1,500,000 adviser

options to Bennelong Corporate Limited, exercisable at 5 pence each

on or before 2 years from their date of issue, and also issued

1,500,000 broker warrants to WH Ireland Limited, exercisable at 5

pence each on or before 3 years from their date of issue.

Shareholder Meeting

On 30 November 2021, the Company held its Annual General Meeting

whereby all resolutions were duly approved by shareholders by way

of a poll.

Events subsequent to the reporting date

On 26 January 2022, the Company provided a corporate and

operational update, which included details of various cost saving

measures and ongoing work streams at Toral.

On 3 February 2022, the Company announced that Mr Laurence Read

had resigned as CEO and as a director of the Company and its

subsidiaries, with effect from 2 February 2022. Accordingly, Mr

Myles Campion had assumed the role of interim-CEO with immediate

effect.

On 23 February 2022, the Company provided an update on, inter

alia, the timing of geotechnical and resource drilling programmes

at Toral, as well as progress on metallurgical testwork.

On 23 March 2022, the Company announced further positive ore

sorting testwork results from TOMRA, which highlighted that the ore

at Toral is amenable to simple beneficiation techniques. It was

also announced that WH Ireland had assumed the role of sole-broker

to the Company with immediate effect.

No other matters or circumstances have arisen since the

reporting date that may significantly affect the operations of the

Company, the results of those operations, or the Company's state of

affairs in future financial years.

Daniel Smith

Director

29 March 2022

Consolidated Statement of Profit or Loss and Other Comprehensive

Income

for the half-year ended 31 December 2021

6 months 6 months

to to

31 December 31 December

2021 2020

AUD AUD

---------------------------------------------------- ------------- -------------

Revenue from continuing operations

Revenue - -

- -

Exploration expenditure (711,643) (950,854)

Foreign exchange (loss)/gain 22,477 (73,865)

Other expenses (668,213) (622,423)

Loss before income tax (1,357,379) (1,647,142)

Income tax (expense)/benefit - -

------------- -------------

Net loss after income tax (1,357,379) (1,647,142)

------------- -------------

Other comprehensive income

Items that may be reclassified subsequently

to profit or loss:

Net exchange (loss)/gain on translation of foreign

operation 8,844 (285,969)

Other comprehensive (loss)/profit for

the period, net of tax 8,844 (285,969)

Total comprehensive loss for the period (1,348,535) (1,933,111)

============= =============

Net (loss) for the period attributable

to shareholders of the Company: (1,357,379) (1,647,142)

------------- -------------

(1,357,379) (1,647,142)

============= =============

Total comprehensive (loss) for the period

attributable to shareholders of the

Company: (1,348,535) (1,933,111)

------------- -------------

(1,348,535) (1,933,111)

------------- -------------

(Loss) per share attributable to the ordinary equity holders

of the Company

Cents per Cents per

Loss per share share share

* basic (loss) per share (2.31) (3.67)

* diluted (loss) per share (2.31) (3.67)

The above Consolidated Statement of Profit or Loss and Other

Comprehensive Income should be read in conjunction with the

accompanying notes in the full Half-Year Financial Report.

Consolidated Statement of Financial Position as at 31 December

2021

31 December 30 June

2021 2021

AUD AUD

------------------------------- ------------- -------------

Current Assets

Cash and short-term deposits 2,525,030 1,180,768

Trade and other receivables 372,974 84,720

Total Current Assets 2,898,004 1,265,488

------------- -------------

Non-current Assets

Plant and equipment 54,789 66,718

Other receivables - 190,523

Right of use assets 19,519 29,277

Capitalised exploration 1,258,838 1,276,964

Total Non-current Assets 1,333,146 1,563,482

------------- -------------

Total Assets 4,231,150 2,828,970

============= =============

Current Liabilities

Trade and other payables 60,536 261,886

Lease liabilities 4,255 16,505

Unearned income 158,382 -

Total Current Liabilities 223,173 278,391

------------- -------------

Non-current Liabilities

Borrowings 212,152 121,727

Total Non-current Liabilities 212,152 121,727

------------- -------------

Total Liabilities 435,325 400,118

============= =============

NET ASSETS 3,795,825 2,428,852

============= =============

Equity

Contributed equity 48,227,649 45,695,303

Accumulated losses (47,737,983) (46,380,604)

Reserves 3,306,159 3,114,153

TOTAL EQUITY 3,795,825 2,428,852

============= =============

The above Consolidated Statement of Financial Position should be

read in conjunction with the accompanying notes in the full

Half-Year Financial Report.

Consolidated Statement of Changes in Equity for the half-year

ended 31 December 2021

Employee

Share

Issued Accumulated Incentive Option Foreign Exchange Total

Capital Losses Reserve Reserve Reserve Equity

AUD AUD AUD AUD AUD AUD

-------------------------------- ----------- ------------- ----------- ---------- ----------------- ------------

At 1 July 2020 42,489,962 (43,121,940) 491,577 2,154,254 485,517 2,499,370

----------- ------------- ----------- ---------- ----------------- ------------

(Loss) for the period - (1,647,142) - - - (1,647,142)

Other comprehensive income (net

of tax) - - - - (285,969) (285,969)

Total comprehensive loss (net

of tax) - (1,647,142) - - (285,969) (1,933,111)

Transaction with owners in their capacity

as owners

Shares issued net of

transaction

costs 3,380,570 - - 162,787 - 3,543,357

Options issued to brokers (174,639) - - 174,639 - -

At 31 December 2020 45,695,893 (44,769,082) 491,577 2,491,680 199,548 4,109,616

=========== ============= =========== ========== ================= ============

At 1 July 2021 45,695,303 (46,380,604) 491,577 2,520,528 102,048 2,428,852

----------- ------------- ----------- ---------- ----------------- ------------

(Loss) for the period - (1,357,379) - - - (1,357,379)

Other comprehensive income (net

of tax) - - - - 8,844 8,844

Total comprehensive loss (net

of tax) - (1,357,379) - - 8,844 (1,348,535)

Transaction with owners in their capacity

as owners

Shares issued net of

transaction

costs 2,532,346 - - - - 2,532,346

Options issued to directors and

management - - - 28,848 - 28,848

Options issued to brokers and

corporate advisers - - - 154,314 - 154,314

At 31 December 2021 48,227,649 (47,737,983) 491,577 2,703,690 110,892 3,795,825

=========== ============= =========== ========== ================= ============

The above Consolidated Statement of Changes in Equity should be

read in conjunction with the accompanying notes in the full

Half-Year Financial Report.

Consolidated Statement of Cash Flows for the half-year ended 31

December 2021

6 months to 6 months

31 December to 31 December

2021 2020

AUD AUD

--------------------------------------------- ------------- ----------------

Cash flows from operating activities

Payments to suppliers and employees (567,590) (416,600)

Payment for exploration and evaluation

costs (890,067) (886,241)

Net cash flows used in operating activities (1,457,657) (1,302,841)

------------- ----------------

Cash flows from investing activities

Payments for plant and equipment (616) (7,698)

Net cash flows used in investing activities (616) (7,698)

------------- ----------------

Cash flows from financing activities

Lease principal repayments (12,853) (13,229)

Proceeds from issue of shares 2,760,272 3,597,214

Costs of capital raising (138,369) (253,101)

Proceeds from borrowings 251,705 260,617

Net cash flows from financing activities 2,860,755 3,591,501

------------- ----------------

Net increase / (decrease) in cash

and cash equivalents 1,402,482 2,280,962

Cash and cash equivalents at beginning

of period 1,180,768 700,642

Effect of foreign exchange on cash

and cash equivalents (58,220) (83,220)

------------- ----------------

Cash and cash equivalents at end of

the period 2,525,030 2,898,384

============= ================

The above Consolidated Statement of Cash Flows should be read in

conjunction with the accompanying notes in the full Half-Year

Financial Report.

- ENDS -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BXGDXGSDDGDC

(END) Dow Jones Newswires

March 30, 2022 02:00 ET (06:00 GMT)

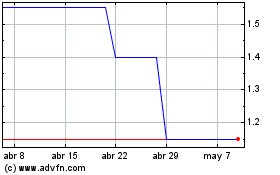

Europa Metals (LSE:EUZ)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Europa Metals (LSE:EUZ)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024