TIDMFDEV

RNS Number : 0588A

Frontier Developments PLC

21 September 2022

Frontier Developments plc

FY22 Financial Results

Frontier's game portfolio continues to thrive and expand

Frontier Developments plc (AIM: FDEV, 'Frontier', the 'Company',

or the 'Group'), a leading developer and publisher of video games

based in Cambridge, UK, publishes its full-year results for the 12

months to 31 May 2022 ('FY22').

Financial Highlights

FY22 FY21 Year-on-year

change (%)

(12 months (12 months

to 31 May 2022) to 31 May

2021)

Revenue GBP114.0m GBP90.7m 26%

--------------------- --------------- ----------------

Operating Profit GBP1.5m GBP19.9m (92%)

--------------------- --------------- ----------------

EBITDA* GBP41.1m GBP38.1m 8%

--------------------- --------------- ----------------

Adjusted EBITDA** GBP6.7m GBP11.8m (43%)

--------------------- --------------- ----------------

EPS (basic) 24.6p 55.4p (56%)

--------------------- --------------- ----------------

Net Cash Balance at

year end GBP38.7m GBP42.4m (9%)

--------------------- --------------- ----------------

-- The successful release of Jurassic World Evolution 2,

together with the ongoing performance of our established portfolio

of genre-leading games and our Foundry titles, delivered record

revenue in FY22 of GBP114.0 million (growth of 26% over GBP90.7

million in FY21)

-- Adjusted EBITDA** in FY22 was in line with expectations at

GBP6.7 million (FY21: GBP11.8 million), with EBITDA* at GBP41.1

million (FY21: GBP38.1 million)

-- Operating profit in FY22 was reduced to GBP1.5 million

following the previously announced one-off non-cash accounting

charge following the under-performance of the major Elite

Dangerous: Odyssey expansion which released in May 2021 (FY21:

GBP19.9 million)

-- Cash resources remain strong with GBP38.7 million at 31 May

2022 (31 May 2021: GBP42.4 million). The GBP3.7 million reduction

during FY22 reflected a greater investment in significant game

developments for release in future years, working capital

movements, and the GBP5.0 million purchase of shares by the

Employee Benefit Trust undertaken in April 2022. Cash balances at

31 August 2022 were GBP53.1 million

*Earnings before interest, tax, depreciation and

amortisation

** Adjusted EBITDA is earnings before interest, tax,

depreciation and amortisation charges related to game developments

and Frontier's game technology, less investments in game

developments and Frontier's game technology, and excluding

share-based payment charges and other non-cash items

Operational & Strategic Highlights

Frontier's launch and nurture portfolio strategy continues to

deliver

-- Frontier plays to its strengths by creating deep, immersive

and high-fidelity games using a strategic mix of in-house and

licensed IP that builds on its proven capabilities and unique track

record

-- Post-launch, Frontier nurtures its games for many years

through community engagement and additional content

-- Our major game release in FY22, Jurassic World Evolution 2

(November 2021), was the biggest sales contributor to FY22, and in

June 2022, after the end of FY22, we successfully launched a major

themed expansion alongside the Jurassic World Dominion film.

Jurassic World Evolution 2 has so far delivered over GBP60 million

of revenue (as at 31 August 2022)

-- Our portfolio of established titles which released before the

start of FY22 each achieved material revenues in FY22, and each

game continues to deliver sales and reach new players. Planet Zoo

performed especially well in FY22 with an annual revenue sustain

rate of 94%, supported by four new paid-downloadable content (PDLC)

packs released in FY22, alongside free content

-- In August 2022 we successfully released F1(R) Manager 2022.

As expected, initial sales have been strong for this major new

annual game franchise

Frontier Foundry achieves success

-- Our games label for publishing carefully selected partner

developments made good progress in FY22, with three new games

released

-- Warhammer 40,000: Chaos Gate - Daemonhunters has been our

biggest Foundry title to date, releasing in May 2022, to a very

positive reception

-- Foundry is set for future success as a material part of our

business with three more titles releasing in FY23

A strong portfolio and future roadmap

-- Our existing portfolio of games and PDLC continues to perform

well, supported by planned new PDLC for Jurassic World Evolution 2

and Planet Zoo

-- Initial sales for F1(R) Manager 2022, the first title in our

annual Formula 1(R) management game series, have been strong and in

line with our expectations, giving us further confidence as we

continue to develop F1(R) Manager 2023 (for release in FY24)

-- Our first real-time strategy game, using Warhammer Age of

Sigmar IP licensed from Games Workshop(R) will launch in FY24

-- We are already in development for a new title for FY25, as

well as early-stage scoping for another new game in FY26

Current Trading and Outlook

We have achieved a pleasing start to FY23. Our existing

portfolio continues to perform, with Jurassic World Evolution 2

benefitting from our themed PDLC and the hype around the Jurassic

World Dominion film in June 2022, and Planet Zoo also seeing new

PDLC. Our major new game release in FY23, F1(R) Manager 2022,

launched a few weeks ago on 30 August, and initial sales have been

strong, as expected. Foundry looks set for a good year with ongoing

sales from Warhammer 40,000: Chaos Gate - Daemonhunters and three

more titles to come in FY23.

Based on trading performance to date, the Board remains

confident of delivering on current analyst expectations for

FY23.

Over the medium term, the Board expects Frontier to continue to

grow revenue by around 20% on average per annum, with any annual

growth rate variability largely driven by the timing and scale of

new releases in each year.

Jonny Watts , CEO from 10 August 2022, said:

"Our team did a terrific job during FY22 and we were delighted

to achieve record annual revenue with growth of 26%. In the last 12

months we have successfully released three new games with each

achieving chart-topping success; Jurassic World Evolution 2 in

November 2021; Warhammer 40,000: Chaos Gate - Daemonhunters (a

Foundry title) in May 2022; and F1(R) Manager 22, which released

just a few weeks ago at the end of August. We have three more

exciting titles coming in FY23 from Foundry, as well as PDLC for

Jurassic World Evolution 2 and Planet Zoo. For FY24 we have two

more major internally developed titles - our Warhammer Age of

Sigmar real-time strategy game, and F1(R) Manager 23. We look

forward with confidence based on our strong existing portfolio, and

our exciting roadmap of new releases which includes unrevealed

future developments."

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as amended by The

Market Abuse (Amendment) (EU Exit) Regulations 2019. The person

responsible for making this announcement on behalf of the Company

is Alex Bevis.

Enquiries :

Frontier Developments +44 (0)1223 394 300

Jonny Watts, CEO

David Braben, President and Founder

Alex Bevis, CFO

Liberum - Nomad and Joint Broker +44 (0)20 3100 2000

Neil Patel / Cameron Duncan

Jefferies - Joint Broker +44 (0)20 7029 8000

Max Jones / William Brown

Tulchan Communications +44 (0)20 7353 4200

Matt Low / Mark Burgess / Alex Dart

About Frontier Developments plc

Frontier is a leading independent developer and publisher of

videogames founded in 1994 by David Braben, co-author of the iconic

Elite game. Based in Cambridge, Frontier uses its proprietary COBRA

game development technology to create innovative genre-leading

games, primarily for personal computers and videogame consoles. As

well as self-publishing internally developed games, Frontier also

publishes games developed by carefully selected partner studios

under its Frontier Foundry games label.

Frontier's LEI number: 213800B9LGPWUAZ9GX18.

www.frontier.co.uk

Chairman's Statement - David Gammon

In FY22 we achieved record revenue for the second consecutive

year, growing by 26%. This was achieved through the strength in

depth of our portfolio and the success of new titles, most notably

Jurassic World Evolution 2. Our most recent new game release, F1(R)

Manager 2022, launched successfully at the end of August and is set

to deliver a substantial contribution in FY23.

As ever, our financial success is a testament to the talent and

hard work of our great team of people. I'd like to thank everyone

at Frontier for their dedication and teamwork, continuing to

support our games, our players and each other.

I believe our chosen business model and strategy - developing,

launching and nurturing genre-leading games which best fit our

expertise and competitive advantages - will continue to deliver

long-term value to our stakeholders. We have an exciting roadmap of

future content alongside our existing portfolio.

As announced on 10 August, in December 2022 I will be retiring

from Frontier's Board after 10 years, most of which I have spent as

Chairman. I am privileged to have been a witness to the success of

Frontier's transition from a third-party developer to a publisher

of its own titles. I am delighted to be passing my Chairman

responsibility to the excellent David Wilton, who joins our Board

as Non-Executive Director and Chairman Designate on 22 September

2022.

The news of my planned retirement has coincided with the

announcement of another significant Board change. On 10 August

2022, Frontier's Founder, David Braben, who has been CEO since the

foundation of the Company in 1994, passed the CEO baton to his

long-time colleague, and proven deliverer of multiple genre-leading

games, Jonny Watts, our former Chief Creative Officer. David will

continue to add huge strategic value to Frontier in his new role of

President and Founder. He will remain an Executive Director on the

Board.

As CEO, Jonny has assumed responsibility for day-to-day

management of the business and delivery of Frontier's operational

and longer-term strategic plans. I am looking forward to seeing

Jonny now take the Company on to even greater success.

On 10 August 2022 we also announced two further Board-related

changes, with James Dixon stepping up to become Chief Operating

Officer (an Executive Director position on the Board), and Jessica

Bourne promoted to General Counsel and Company Secretary, taking on

company secretarial responsibilities from our Chief Financial

Officer, Alex Bevis.

Our Board has always benefitted from a diverse membership of

highly experienced, capable and motivated individuals. I believe

the changes we have announced in the last 12 months, including the

appointment of the terrific Ilse Howling as a Non-Executive

Director in March 2022, have, and will, strengthen it even

further.

It is with sadness that I sign off my last Chairman's Statement

for Frontier's Annual Report. I'd like to thank David Braben for

his entrepreneurial brilliance and support throughout my tenure. I

cannot thank my Board colleagues enough for letting me watch, learn

at and chair their meetings. I leave Frontier in a confident mood

with a very talented senior leadership team. I look forward to

watching Frontier's continued growth and evolution!

Chief Executive Officer's Statement - David Braben (CEO for

FY22, President and Founder from 10 August 2022)

Our great teams have worked hard and successfully delivered

another great year. It has been a year of change - with Frontier

adapting successfully to new working practices and moving into new

adjacent game genres - while growing and delivering great new games

like Jurassic World Evolution 2. Revenue was up by 26%

year-on-year, and headcount grew by over 25% - which is a real

investment, increasing our development firepower for future

titles.

Hybrid working

During FY22 we emerged from the 2020 and 2021 Covid-19

restrictions of home working and into the new mixed model of hybrid

working of in the office and at home. Our diverse teams of people

were able to connect with each other both virtually and in person,

with the ability once again to use our splendid studio facility. I

feel those opportunities to reconnect are important for people's

personal development and wellbeing, as well as being important for

successful delivery of our complex content.

Like many companies we are still refining the new ways of remote

and hybrid working, but we believe we are getting the balance

right, which puts us in a strong position to continue to deliver

great games and content which benefits all of our stakeholders. We

put a lot of effort into fostering team engagement through

communication and social opportunities. In July 2022 we held our

biggest ever party, which saw almost 900 people (staff plus

partners/families) attend a summer event which celebrated all of

our games with themed zones.

Our people

We saw record numbers of people join us during the last 12

months, with net headcount growing by 158 people or over 25% during

FY22. The benefit of this increased headcount will help us grow in

future years. Growing and investing in our people is a crucial

element of our strategy, and like many companies we have

experienced strong competition for talent, which when combined with

the negative impact of coronavirus on staff engagement and

connectivity has created some challenges for staff retention. We

continue to believe that our sophisticated and diverse portfolio of

genre-leading games, together with our self-publishing business

model and our competitive reward packages, provides an attractive

home for talent, but of course we can never be complacent and we

will continue to review opportunities to improve our offering.

Our players

Our players have continued to support us, and the wonderful

communities around each of our games have continued to grow, with

total all-time base game unit sales having increased by over 30% in

the period. Though there is some overlap between our different

titles, many of these are new players joining these communities for

the first time. These communities continue to evolve over the years

- many players have been members of the Elite Dangerous community

for around 10 years since it started in 2012, while other

communities, like that for F1(R) Manager are still in their early

stages. I would like to thank all our players for their continued

support, and we look forward to many further adventures together in

the future.

Our portfolio

FY22 saw the delivery of great games and content from our teams,

most notably with Jurassic World Evolution 2 releasing in November

2021 and Planet Zoo benefitting from four new PDLC packs during the

financial year. The success of these new releases, when combined

with our existing portfolio, drove a 26% growth in revenue to a

record GBP114.0 million in FY22, and we are well set to deliver

another record performance in FY23.

Our teams have delivered more great content already in FY23,

with the Jurassic World Evolution 2: Dominion Biosyn Expansion

releasing in June 2022 alongside Universal Pictures and Amblin

Entertainment's Jurassic World Dominion film, another excellent

PDLC pack for Planet Zoo, and a major new game release through the

launch of F1(R) Manager 2022 at the end of August 2022 (all after

the end of FY22). I am particularly pleased with initial player

engagement with F1(R) Manager 2022, since this is a major new

sports franchise for Frontier, with annual titles scheduled for at

least the next three years (2023, 2024 and 2025).

As previously reported, the one area of disappointment in FY22

was the lower than expected level of player engagement with our

major Elite Dangerous: Odyssey expansion. Our team did a terrific

job with that very ambitious expansion, which made the decision to

cancel future console development and to focus our attention on PC

even more difficult. We are supporting and growing our Elite

Dangerous player community and will build on the narrative aspects

of Elite Dangerous during FY23.

During FY22 our team working on our Warhammer Age of Sigmar

real-time strategy game made good progress, and we look forward to

bringing that game to market in FY24. Looking a little further out,

we have now started development of a new internal title for FY25

and are scoping out another new game for FY26.

I think it's fair to say that we have our strongest ever release

line-up, supported by our superb existing portfolio. Looking

further out into 2023 and beyond, I am delighted to say that we

continue to have even more great game opportunities.

Frontier Foundry

Frontier Foundry is our own games label for third-party

publishing, which leverages our publishing capability, industry

experience, commercial partnerships and financial resources to

supplement our own development roadmap by partnering with other

high-quality developers to bring more games to market. We take a

developer-led approach to publishing, benefitting from our long and

varied experience of being a developer under a variety of different

business models.

Foundry released three titles in FY22, with Warhammer 40,000:

Chaos Gate - Daemonhunters quickly becoming our biggest selling

Foundry title to date. Our approach to third-party publishing is

resonating well with our existing and potential new partners. We

have three games releasing from Foundry in FY23, Stranded: Alien

Dawn (from Haemimont Games), Deliver Us Mars (from KeokeN

Interactive) and The Great War: The Western Front (from Petroglyph

Games), and we continue to expect Foundry to build and become a

material part of our overall business over time.

Our strategy and business model

We have a repeatable business model of releasing and supporting

high- quality games in under-served genres where we have relevant

experience, and where there is a reasonable expectation of our

title becoming the dominant game in that sector. We build a

community around the title, and continue to support it with free

and paid content over many years, to create the longevity we have

already seen with our existing titles, and hope to see with those

in the future. We will use our key expertise and where applicable

valuable external IP to deliver highly differentiated,

best-in-class player experiences. Frontier's games are set in rich

environments and take a long time to fully master, thereby yielding

longevity and great value for players. This long-term engagement

and loyalty of our passionate player communities will help further

build the Company over the long term.

We believe that publishing our own games, and selectively those

of other high-quality development studios, is the best way to

maximise the benefit of our core skills, our assets and our COBRA

game development technology platform. The Company's focus is on

identifying, developing and delivering top-quality titles with long

play times.

We will continue to follow our repeatable model to support our

games over many years with new releases and updates to create

long-term sustainable growth which benefits all of our key

stakeholders, through successfully publishing a growing portfolio

of games. To achieve our strategic objective, we focus on three key

areas:

-- our portfolio strategy for our internal developments;

-- our strategy for our Foundry games label; and

-- our people strategy

This third key area is crucial for our long-term success. We

must continue to grow and invest in our teams so that we can

continue to support our existing games while also increasing the

frequency of major new releases. The increase in the number of

releases supporting our existing games, such as major PDLC

launches, helps to smooth revenue, but major releases of new games

are still a significant factor in the revenue stream, as we have

just seen with Jurassic World Evolution 2 in FY22 and we are seeing

with F1(R) Manager 2022 in FY23.

We are growing our portfolio, and consequently we are increasing

our development, publishing and other teams to enable us to support

additional games while generating new updates for our existing

titles. We will continue to grow our resources and capability to

enable us to scale-up the number of major releases we are able to

deliver each year. This will not require us to increase our

workforce linearly because supporting an existing title typically

requires fewer staff than creating a new one.

Board changes

As previously announced, after over 28 years as Frontier's CEO,

in August 2022 I changed my role to become President and Founder.

The excellent Jonny Watts has taken over as CEO, taking over the

day-to-day Company activities, many of which he has already been

doing. I will remain at Frontier, and will still be actively

involved, retaining oversight and involvement in strategic

direction and key external relationships.

I'd like to say a massive thank you to David Gammon, our

departing Chairman, and a big welcome to David Wilton, our new

Chairman. This will be my last CEO's Statement in our Annual

Report, and I'd just like to thank everyone at Frontier and all of

our partners and stakeholders, for your support over my many

decades as Frontier's CEO. I will be actively engaged with Frontier

for the foreseeable future, so you will still hear from me on a

regular basis.

Chief Financial Officer's Statement - Alex Bevis

The combination of ongoing contributions from our existing

titles (games which released in earlier financial years), the

significant sales delivered by new game Jurassic World Evolution 2,

and revenue achieved by our Foundry games label resulted in a

record revenue performance in FY22 of GBP114.0 million, 26% ahead

of the preceding financial year (FY21: GBP90.7 million).

Our strategy of developing, launching and nurturing

genre-leading games continues to deliver financial performance for

our shareholders, financial returns and audience expansions for our

IP partners, compelling content for our players, and engaging and

challenging projects for our people.

Adjusted EBITDA*, a measure of cash operating profit whereby

game development costs are expensed as they are incurred, was in

line with expectations in FY22 at GBP6.7 million (FY21: GBP11.8

million). The year-on-year reduction reflects greater investment in

significant game developments for release in future years,

including F1(R) Manager 2022 which successfully released in August

2022 (in FY23), and our Warhammer Age of Sigmar real-time strategy

game for FY24.

Due to the lower than expected engagement with Elite Dangerous:

Odyssey on PC, and the decision to cancel further console

development of this major expansion, the Elite Dangerous: Odyssey

capitalised intangible asset was fully amortised in FY22, resulting

in an additional one-off impairment charge of GBP7.4 million.

This non-cash accounting adjustment had no impact on cashflow,

cash balances or Adjusted EBITDA, but reduced operating profit as

reported under IFRS to GBP1.5 million (FY21: GBP19.9 million).

Frontier continues to benefit from a strong balance sheet, with

total cash balances at 31 May 2022 of GBP38.7 million (31 May 2021:

GBP42.4 million) and balances of GBP53.1 million at 31 August 2022.

The small reduction in cash during FY22 reflected a greater

investment in significant game developments for release in future

years, and the GBP5.0 million purchase of shares by the Employee

Benefit Trust undertaken in April 2022 to satisfy future share

option exercises by employees.

* Adjusted EBITDA is earnings before interest, tax, depreciation

and amortisation charges related to game developments and

Frontier's game technology, less investments in game developments

and Frontier's game technology, and excluding share-based payment

charges and other non-cash items

Trading

Jurassic World Evolution 2

FY22 benefitted from the release of another successful new

Frontier title, Jurassic World Evolution 2, which has continued to

attract an expanding player base since its launch in November 2021.

By 31 May 2022 Jurassic World Evolution 2 had achieved over 1.3

million base game units sold across all platforms and formats,

excluding base game digital downloads through Microsoft's Game Pass

subscription service, through which the base game became available

on 17 May 2022.

The development and release of paid-downloadable content (PDLC)

and free content has, as usual, been an important element of our

strategy in continuing to engage and entertain existing Jurassic

World Evolution 2 players while attracting new ones. We saw strong

uptake of the three separate PDLC packs available as at 31 May

2022.

In June 2022, after the end of FY22, we saw strong engagement

with our compelling new PDLC, the Jurassic World Evolution 2:

Dominion Biosyn Expansion, which released alongside Universal

Pictures and Amblin Entertainment's Jurassic World Dominion film.

This major new expansion for Jurassic World Evolution 2 delivered a

strong start for FY23, and additional PDLC will be released during

FY23.

Jurassic World Evolution 2 had so far delivered over GBP60

million of total cumulative revenue as at 31 August 2022, a period

covering its first 10 months from release.

Our existing game portfolio

Our portfolio of internally developed titles which released

before FY22 - Elite Dangerous, Planet Coaster, Jurassic World

Evolution and Planet Zoo - continues to reach new audiences, and

each delivered material revenues in FY22. Most notably, Planet Zoo

performed especially well, with an annual revenue sustain rate of

94% (FY22 vs. FY21), supported by four new PDLC packs releasing in

FY22, alongside free content. We have new PDLC packs for Planet Zoo

in FY23.

As previously reported, following the launch of the major

Odyssey expansion in May 2021, Elite Dangerous revenue in FY22 fell

below our original expectations. We are focussing on supporting and

growing our player community, and will build on the narrative

aspects of Elite Dangerous during FY23.

Frontier Foundry

Alongside our internally developed titles, Frontier Foundry, our

games label for publishing carefully selected partner developments,

made good progress in FY22, with three new game releases.

Our most recent Frontier Foundry title, Warhammer 40,000: Chaos

Gate - Daemonhunters, received a very positive reception at its

launch on 5 May 2022. It quickly became our most successful

Frontier Foundry title to date, with performance above

expectations.

We have three more Frontier Foundry titles planned for release

in FY23, and we continue to expect Frontier Foundry to become a

material part of our business.

Financial Performance

Our record revenue of GBP114.0 million in FY22 (FY21: GBP90.7

million) delivered a record gross profit of GBP73.6 million (FY21:

GBP63.2 million) with gross margin of 65% (FY21: 70%). Our gross

margin percentage tends to vary across different periods based on

five factors: the split of own-IP versus licensed IP game revenue

(since licensing IP attracts royalty costs), the proportion of

revenue from Foundry (which tends to attract developer royalties),

variations in commission rates on digital stores (for example Steam

versus Epic), revenue from subscription models such as Microsoft's

Game Pass, and the proportion of revenue derived from the sale of

physical discs. The reduction in our gross margin percentage in

FY22 versus FY21 was mainly the result of a higher proportion of

sales from licensed IP games, most notably through the release of

Jurassic World Evolution 2.

Gross research and development (R&D) expenses in the period

grew by 37% to GBP47.5 million (FY21: GBP34.9 million). The

substantial year-on-year growth reflected our continued investment

to support our growth strategy through three main areas: investment

in our team including significant headcount growth; investment in

our portfolio through greater outsourcing activity which allows our

internal teams to focus on the most value-adding development work;

and investment in Frontier Foundry development partner projects.

Outsourced work for our F1(R) Manager 2022 game was particularly

significant, driven by the need to deliver a large volume of assets

to support the modelling of 22 race circuits and their surrounding

environments. We'll be able to leverage that investment across our

future F1(R) Manager titles.

Capitalisation of costs for game development related intangible

assets, together with continued investment in our leading game

technology, accounted for GBP35.2 million in the period (FY21:

GBP27.8 million). Costs related to the development of new

chargeable Frontier or Foundry content, or the development of

technology to support new content, are typically capitalised,

subject to the usual criteria set out under accounting standard IAS

38. Development costs associated with the development or support of

existing products are generally expensed as incurred. Costs

capitalised in FY22 represented 74% of gross R&D expenditure

which is broadly consistent with prior periods (FY21: 80%, FY20:

80%).

Amortisation and impairment charges for game developments and

Frontier's game technology related intangible assets grew

significantly to GBP33.9 million in total for the period (FY21:

GBP14.9 million), with Elite Dangerous: Odyssey accounting for the

majority of the increase.

Amortisation charges for the Elite Dangerous: Odyssey expansion

accounted for GBP8.4 million in FY22. Additionally, a one-off,

non-cash impairment charge of GBP7.4 million was recorded in FY22,

which resulted from lower than expected engagement with Elite

Dangerous: Odyssey on PC following its launch in May 2021, and the

decision to cancel further console development of this major

expansion.

New games and PDLC content released in FY22 was also a factor in

the year-on-year growth in the total amortisation charge, with the

launch of Jurassic World Evolution 2, three Foundry titles, and

PDLC packs for Planet Zoo and Jurassic World Evolution 2.

Net research and development expenses recorded in the income

statement, being gross spend, less capitalised costs, plus

amortisation and impairment charges, increased to GBP46.2 million

in FY22 (FY21: GBP22.0 million). The substantial rise reflected a

combination of our increased investment in newly released and

future content, together with the large one-off, non-cash Elite

Dangerous: Odyssey charge.

Sales, marketing and administrative expenses grew to GBP25.9

million in FY22 (FY21: GBP21.2 million) as a result of greater

investment in marketing to support the launch of Jurassic World

Evolution 2, our major new game release in the year, new Foundry

titles, and our existing game portfolio including new PDLC releases

and price promotion events.

Overall net operating expenditure in FY22 grew to GBP72.1

million (FY21: GBP43.2 million) with higher costs across all three

areas: R&D, sales and marketing, and administration. The Elite

Dangerous: Odyssey charge was also a large factor in the increase.

After taking account of that charge, operating profit as reported

under IFRS was reduced to GBP1.5 million (FY21: GBP19.9

million).

Adjusted EBITDA*, a measure of cash operating profit whereby

game development costs are expensed as they are incurred, was in

line with expectations in FY22 at GBP6.7 million (FY21: GBP11.8

million). The year-on-year reduction reflects greater investment in

significant game developments for release in future years,

including F1(R) Manager 2022 which successfully released in August

2022 (in FY23), and our Warhammer Age of Sigmar real-time strategy

game for FY24.

During FY21, Frontier elected into HMRC's Patent Box regime and

made a Patent Box claim on patent-related profits from FY19

onwards. Patent Box has delivered future benefits in FY21 and FY22,

including in the form of enhancements to the value of tax losses

carried forward to future periods. The full effect of the benefits

of the Patent Box claim will therefore be realised through cash tax

benefits in the future.

Frontier also benefits from enhanced corporate tax deductions on

certain expenditures under the Video Games Tax Relief (VGTR) scheme

and under the R&D tax credits scheme, both of which help to

reduce taxable profits. Frontier also benefitted during the period

from tax deductions related to employee share option gains. The

combination of the enhanced tax deductions on expenditures and

share option tax deductions in the period, together with tax

adjustments for prior periods, generated a corporation tax credit

of GBP8.7 million in the income statement in FY22 (FY21: GBP2.4

million).

Profit after tax for FY22 was GBP9.6 million (FY21: GBP21.6

million) and basic earnings per share was 24.6p (FY21: 55.4p).

Balance sheet and cashflow

We continue to benefit from a strong balance sheet, with GBP38.7

million of cash at 31 May 2022 (31 May 2021: GBP42.4 million) and

GBP53.1 million at 31 August 2022. The GBP3.7 million reduction

during FY22 reflected a greater investment in significant game

developments for release in future years, working capital

movements, and the GBP5.0 million purchase of shares by the

Employee Benefit Trust undertaken in April 2022.

Our intangible asset values include game technology, internal

game developments, Frontier Foundry game developments, third-party

software and IP licences. Total intangible assets actually reduced

slightly during the period to GBP70.8 million at 31 May 2022 (31

May 2021: GBP71.3 million). Significant investments in new content

and technology were offset by total amortisation and impairment

charges of GBP15.8 million for Elite Dangerous: Odyssey. Our

investments in the period related to our own internally developed

titles, including new content for our existing portfolio, our

technology, and support for our Frontier Foundry partner

developments.

Tangible assets relate mainly to IT equipment and the fit-out of

the leased office facility, which the Company occupied in April

2018. The net balance at 31 May 2022 was GBP6.6 million (31 May

2021: GBP6.1 million).

Following the adoption of IFRS 16 "Leases" effective for

Frontier from 1 June 2019, the Company's balance sheet at 31 May

2022 includes a right-of-use asset valued at GBP19.5 million (31

May 2021: GBP21.1 million) for the Company's lease over its

headquarters office building in Cambridge. A similar figure (the

difference related to timing of actual rental payments) of GBP20.7

million at 31 May 2022 (31 May 2021: GBP22.2 million) is recorded

on the balance sheet as a lease liability, split between current

and non-current liabilities.

Trade and other receivables due within one year totalled GBP24.7

million at 31 May 2022 (31 May 2021: GBP13.7 million) with the

majority of the balance related to gross revenue due from digital

distribution partners. The year-on-year increase reflected strong

sales activity and content releases towards the end of FY22,

including the launch of Warhammer: Chaos Gate - Daemonhunters in

May 2022, and amounts due for Jurassic World Evolution 2 entering

Microsoft's Game Pass subscription service in May 2022.

Trade and other payables due within one year totalled GBP21.8

million at 31 May 2022 (31 May 2021: GBP14.8 million), being mostly

made up of distribution platform commissions, IP licence royalties

and developer royalties due on the sales transactions not yet

settled, and bonus costs and other staff-related accruals. The

increase in liabilities reflected the strong trading performance

towards the end of the financial year, as mentioned above.

Within non-current liabilities (amounts due after 12 months) a

balance of GBP6.1 million is held at 31 May 2022 (31 May 2021:

GBP9.2 million) which includes IP licence costs for the minimum

guaranteed royalties payable on the licences with Formula 1(R) and

Games Workshop(R).

The current tax asset balance as at 31 May 2022 of GBP7.9

million (31 May 2021: GBP6.5 million) relates to the filed tax

returns, including VGTR claims, for FY21, and the draft tax returns

for FY22. In July 2022, GBP4.0 million was received from HMRC

related to the FY21 tax returns.

The net balance for deferred tax assets less deferred tax

liabilities recorded as at 31 May 2022 totalled GBP1.3 million (31

May 2021: GBP0.4 million). Deferred tax assets and liabilities have

been recorded as at 31 May 2022 for the estimated values of

temporary differences, and the potential value of tax deductions

relating to future share option exercises. A deferred tax asset

valued at GBP1.0 million was recognised as at 31 May 2022 for

carried forward tax losses from the Jurassic World Evolution 2 VGTR

income stream. The recognition of this asset is based on a high

level of certainty that the accumulated losses will be utilised

against the taxable profits projected to be generated in FY23 and

FY24 by Jurassic World Evolution 2.

Frontier's tax arrangements concerning income streams under VGTR

and Patent Box enhancements can be complex, and as at 31 May 2022

there was insufficient certainty concerning the utilisation of

other tax losses to create any other deferred tax assets related to

accumulated losses. Frontier's total unrecognised tax losses as at

31 May 2022 were GBP50.2 million (31 May 2021: GBP55.1

million).

CONSOLIDATED INCOME STATEMENT

FOR THE YEARED 31 MAY 2022

12 months 12 months

to 31 May to 31 May

2022 2021

Notes GBP'000 GBP'000

-------------------------------------------------- ------ ------------- -------------

Revenue 3 114,032 90,688

Cost of sales (40,420) (27,538)

-------------------------------------------------- ------ ------------- -------------

Gross profit 73,612 63,150

Research and development expenses (46,179) (22,025)

Sales and marketing expenses (12,339) (7,269)

Administrative expenses (13,558) (13,940)

-------------------------------------------------- ------ ------------- -------------

Operating profit 1,536 19,916

Net finance costs (592) (731)

-------------------------------------------------- ------ ------------- -------------

Profit before tax 944 19,185

Income tax 4 8,684 2,373

-------------------------------------------------- ------ ------------- -------------

Profit for the year attributable to shareholders 9,628 21,558

-------------------------------------------------- ------ ------------- -------------

Earnings per share

Basic earnings per share 5 24.6 55.4

Diluted earnings per share 5 23.7 53.3

-------------------------------------------------- ------ ------------- -------------

All the activities of the Group are classified

as continuing.

The accompanying accounting policies and notes form part of this financial

information.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 MAY 2022

12 months 12 months

to to

31 May 2022 31 May 2021

GBP'000 GBP'000

-------------------------------------------------- ------ ------------- -------------

Profit for the year 9,628 21,558

Other comprehensive income

Items that will be reclassified subsequently

to profit or loss:

Exchange differences on translation of

foreign operations (19) 23

-------------------------------------------------- ------ ------------- -------------

Total comprehensive income for the year

attributable to the equity holders of

the parent 9,609 21,581

-------------------------------------------------- ------ ------------- -------------

The accompanying accounting policies and notes form part of this

financial information.

CONSOLIDATED STATEMENT OF FINANCIAL

POSITION

AS AT 31 MAY 2022

(REGISTERED COMPANY NO: 02892559)

31 May 2022 31 May 2021

Notes GBP'000 GBP'000

--------------------------------------------- -------- ------------ ------------

Non-current assets

Intangible assets 6 70,833 71,318

Property, plant and equipment 6,640 6,078

Right-of-use asset 19,484 21,108

Deferred tax asset 1,348 384

Total non-current assets 98,305 98,888

--------------------------------------------- -------- ------------ ------------

Current assets

Trade and other receivables 24,705 13,741

Current tax asset 7,867 6,468

Cash and cash equivalents 38,699 42,423

--------------------------------------------- -------- ------------ ------------

Total current assets 71,271 62,632

--------------------------------------------- -------- ------------ ------------

Total assets 169,576 161,520

--------------------------------------------- -------- ------------ ------------

Current liabilities

Trade and other payables (21,797) (14,768)

Lease liability (1,461) (1,419)

Deferred income (2,466) (2,180)

Total current liabilities (25,724) (18,367)

--------------------------------------------- -------- ------------ ------------

Net current assets 45,547 44,265

--------------------------------------------- -------- ------------ ------------

Non-current liabilities

Provisions (56) (41)

Lease liability (19,278) (20,739)

Other payables (6,148) (9,219)

Total non-current liabilities (25,482) (29,999)

--------------------------------------------- -------- ------------ ------------

Total liabilities (51,206) (48,366)

--------------------------------------------- -------- ------------ ------------

Net assets 118,370 113,154

--------------------------------------------- -------- ------------ ------------

Equity

Share capital 197 197

Share premium account 36,468 36,079

Equity reserve (12,769) (9,351)

Foreign exchange reserve (18) 1

Retained earnings 94,492 86,228

--------------------------------------------- -------- ------------ ------------

Total equity 118,370 113,154

--------------------------------------------- -------- ------------ ------------

The accompanying accounting policies and notes form part of this

financial information.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 MAY 2022

Share Foreign

Share premium Equity exchange Retained

capital account reserve reserve earnings Total equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 31 May 2020 195 34,589 (925) (22) 62,897 96,734

-------------------------- -------------- --------------- --------------- --------------- --------------- -------------

Profit for the year - - - - 21,558 21,558

Other comprehensive

income:

Exchange differences on

translation

of foreign operations - - - 23 - 23

Total comprehensive

income

for the year - - - 23 21,558 21,581

-------------------------- -------------- --------------- --------------- --------------- --------------- -------------

Issue of share capital

net

of expenses 2 1,490 - - - 1,492

Share-based payment

charges - - 2,155 - - 2,155

Share-based payment

transfer

relating to option

exercises

and lapses - - (1,770) - 1,770 -

Employee Benefit Trust

cash

outflows from share

purchases - - (10,000) - - (10,000)

Employee Benefit Trust

net

cash inflows from option

exercises - - 1,189 - - 1,189

Deferred tax movements

posted

directly to reserves - - - - 3 3

-------------------------- -------------- --------------- --------------- --------------- --------------- -------------

Transactions with owners 2 1,490 (8,426) - 1,773 (5,161)

-------------------------- -------------- --------------- --------------- --------------- --------------- -------------

At 31 May 2021 197 36,079 (9,351) 1 86,228 113,154

-------------------------- -------------- --------------- --------------- --------------- --------------- -------------

Profit for the year - - - - 9,628 9,628

Other comprehensive

income:

Exchange differences on

translation

of foreign operations - - - (19) - (19)

Total comprehensive

income

for the year - - - (19) 9,628 9,609

-------------------------- -------------- --------------- --------------- --------------- --------------- -------------

Issue of share capital

net

of expenses - 389 - - - 389

Share-based payment

charges - - 2,452 - - 2,452

Share-based payment

transfer

relating to option

exercises

and lapses - - (1,376) - 1,376 -

Employee Benefit Trust

cash

outflows from share

purchases - - (5,000) - - (5,000)

Employee Benefit Trust

net

cash inflows from option

exercises - - 506 - - 506

Deferred tax movements

posted

directly to reserves - - - - (2,740) (2,740)

-------------------------- -------------- --------------- --------------- --------------- --------------- -------------

Transactions with owners - 389 (3,418) - (1,364) (4,393)

-------------------------- -------------- --------------- --------------- --------------- --------------- -------------

At 31 May 2022 197 36,468 (12,769) (18) 94,492 118,370

-------------------------- -------------- --------------- --------------- --------------- --------------- -------------

The accompanying accounting policies and notes form part of this

financial information.

CONSOLIDATED STATEMENT OF CASHFLOWS

FOR THE YEARED 31 MAY 2022

12 months 12 months

to to

31 May 2022 31 May 2021

GBP'000 GBP'000

--------------------------------------------------- --------------- -------------

Profit before taxation 944 19,185

Adjustments for :

Depreciation and amortisation 32,199 18,167

Impairment of intangible assets 7,398 -

Movement in unrealised exchange losses/(gains)

on forward contracts 474 (223)

Share-based payment expenses 2,452 2,155

Interest expense - 88

Interest received (57) (48)

Payment of interest element of lease liabilities 649 691

Research and Development Expenditure Credit (375)

(RDEC) -

Working capital changes:

Change in trade and other receivables (10,964) (1,233)

Change in trade and other payables 4,465 119

Change in provisions 15 15

--------------------------------------------------- --------------- -------------

Cash generated from operations 37,200 38,916

Taxes received 3,956 38

Net cash flows from operating activities 41,156 38,954

--------------------------------------------------- --------------- -------------

Investing activities

Purchase of property, plant and equipment (2,500) (1,375)

Expenditure on intangible assets (36,243) (31,502)

Interest received 57 48

Net cash flows used in investing activities (38,686) (32,829)

--------------------------------------------------- --------------- -------------

Financing activities

Proceeds from issue of share capital 389 1,492

Employee Benefit Trust cash outflows from share

purchases (5,000) (10,000)

Employee Benefit Trust cash inflows from option

exercises 506 1,189

Payment of principal element of lease liabilities (1,419) (1,377)

Payment of interest element of lease liabilities (649) (691)

Interest paid - (88)

Net cash flows used in financing activities (6,173) (9,475)

--------------------------------------------------- --------------- -------------

Net change in cash and cash equivalents from

continuing operations (3,703) (3,350)

Cash and cash equivalents at beginning of year 42,423 45,751

Exchange differences on cash and cash equivalents (21) 22

Cash and cash equivalents at end of year 38,699 42,423

--------------------------------------------------- --------------- -------------

The accompanying accounting policies and notes form part

of this financial information.

NOTES TO THE FINANCIAL INFORMATION

1. CORPORATE INFORMATION

Frontier Developments plc (the 'Group') develops and publishes

video games for the interactive entertainment sector. The Company

is a public limited company and is incorporated and domiciled in

the United Kingdom.

The address of its registered office is 26 Science Park, Milton

Road, Cambridge CB4 0FP.

The Group's operations are based in the UK and its North

American subsidiary, Frontier Developments Inc., in the US.

2. BASIS OF PREPARATION AND STATEMENT OF COMPLIANCE

The financial information contained in this preliminary

announcement of audited results does not constitute the Group's

statutory accounts for the years ended 31 May 2022 and 31 May 2021.

The accounts for the year ended 31 May 2021 have been delivered to

the Registrar of Companies. The statutory accounts for the year

ended 31 May 2022 have been reported on by the Company's auditors.

The report on these accounts was unqualified, did not draw

attention to any matters by way of emphasis and did not contain any

statement under section 498(2) or (3) of the Companies Act 2006 or

equivalent preceding legislation.

The statutory accounts for the year ended 31 May 2022 are

expected to be posted to shareholders in due course and will be

delivered to the Registrar of Companies after they have been laid

before the shareholders in a general meeting on 8 November 2022.

Copies will be available from the registered office of the Company,

26 Science Park, Milton Road, Cambridge CB4 0FP and will be

accessible on the Frontier Developments website,

https://www.frontier.co.uk . The registered number of Frontier

Developments plc is 02892559.

The basis of preparation and going concern policies applied in

the preparation of these financial statements are set out below.

These policies have been consistently applied to all the periods

presented, unless otherwise stated.

Basis of preparation

The consolidated financial statements of the Group have been

prepared in accordance with International Accounting Standards

(IASs) in conformity with the requirements of the Companies Act

2006 and in accordance with UK-adopted IASs. The financial

information has been prepared on the basis of all applicable IFRSs,

including all IASs, Standing Interpretations Committee (SIC)

interpretations and International Financial Reporting

Interpretations Committee (IFRIC) interpretations issued by the

International Accounting Standards Board (IASB) that are applicable

to the financial period.

Except for the application of UK-adopted IASs, for which there

are no material differences from IFRSs as issued by the IASB and

adopted by the EU when applied to the Group, accounting policies

have been applied consistently to all years presented unless

otherwise stated.

The financial information has been prepared on a going concern

basis under the historical cost convention, except for financial

instruments held at fair value. The financial information is

presented in Sterling, the presentation and functional currency for

the Group and Company. All values are rounded to the nearest

thousand pounds (GBP'000)

except when otherwise indicated.

Going concern basis

The Group and Company's forecasts and projections, taking

account of current cash resources and reasonably possible changes

in trading performance, support the conclusion that there is a

reasonable expectation that the Group and Company has adequate

resources to continue in operational existence for the period to 30

November 2023 ('the going concern period'). The Group and Company

therefore continue to adopt the going concern basis in preparing

their financial statements.

The Group's day-to-day working capital requirements are expected

to be met through the current cash and cash equivalent resources

(including treasury deposits) at the balance sheet date of 31 May

2022 of GBP38.7 million along with expected cash inflows from

current business activities. The Annual Plan approved by the Board

of Directors, which has been used to assess going concern,

incorporates the impacts and considerations to revenue and costs

due to Covid-19 and the current macroeconomic conditions arising

from the ongoing Ukraine crisis. The Annual Plan also reflects

assessments of current and future market conditions and the impact

this may have on cash resources.

The Group has also performed stress testing on the Annual Plan

in respect of potential downside scenarios to identify the break

point of current cash resources and to identify when current

liquidity resources may fall short of requirements.

The scenarios both consider a reduction in predicted revenues,

however the reduction would need to be severe in order to prevent

the Group from continuing as a going concern and is considered to

be highly unlikely to occur. The Group have also identified

mitigating actions that could be reasonably taken, if required, to

offset the reduction of cash inflows, to enable it to continue its

operations for the period to 30 November 2023.

The sensitivities included in the stress testing include the

following potential scenarios to revenue:

-- severe operational disruption across all third-party

distributors resulting in a significant reduction of revenue for

the Group; and

-- some operational disruption across all third-party

distributors resulting in a reduction of revenue for the Group.

As expected, the scenarios resulted in an accelerated use of

current cash resources, however, in all scenarios tested the

current cash resources were sufficient to support the Group's

activities. This is due to a variety of factors:

-- the Group currently has significant cash reserves to maintain

the current level of operations;

-- the Group has been able to continue with current headcount

growth plans and has sustained a high level of recruitment to

support the roadmap;

-- there has been no impact to debtor recoverability; and

-- should a more extreme downside scenario occur the Group could

take further mitigating actions by reducing discretionary

spend.

Having considered all of the above, including the current strong

cash position, no current impact on debtor recoverability and the

continued strong trading performance for the Group, the Directors

are satisfied that there are sufficient resources to continue

operations for the period to 30 November 2023. The financial

statements for the year ended 31 May 2022 are therefore prepared

under the going concern basis.

3. SEGMENT INFORMATION

The Group identifies operating segments based on internal

management reporting that is regularly reviewed by the chief

operating decision maker and reported to the Board. The chief

operating decision maker is the Chief Executive Officer.

Management information is reported as one operating segment,

being revenue from publishing games and revenue from other streams

such as royalties and licensing.

The Group does not provide any information on the geographical

location of sales as the majority of revenue is through third-party

distribution platforms which are responsible for the sales data of

consumers. The cost to develop this information internally would be

excessive.

All of the Group's non-current assets are held within the

UK.

All material revenue is categorised as either publishing revenue

or other revenue.

The Group typically satisfies its performance obligations at the

point that the product becomes available to the customer.

Other revenue mainly related to royalty income in both FY22 and

FY21.

12 months 12 months

to 31 May to 31 May

2022 2021

GBP'000 GBP'000

-------------------------------------------------- ----------- -----------

Publishing revenue 113,555 90,471

Other revenue 477 217

-------------------------------------------------- ----------- -----------

Total revenue 114,032 90,688

-------------------------------------------------- ----------- -----------

Cost of sales (40,420) (27,538)

-------------------------------------------------- ----------- -----------

Gross profit 73,612 63,150

-------------------------------------------------- ----------- -----------

Research and development expenses (46,179) (22,025)

Sales and marketing expenses (12,339) (7,269)

Administrative expenses (13,558) (13,940)

-------------------------------------------------- ----------- -----------

Operating profit 1,536 19,916

-------------------------------------------------- ----------- -----------

Net finance costs (592) (731)

-------------------------------------------------- ----------- -----------

Profit before tax 944 19,185

-------------------------------------------------- ----------- -----------

Income tax 8,684 2,373

-------------------------------------------------- ----------- -----------

Profit for the year attributable to shareholders 9,628 21,558

-------------------------------------------------- ----------- -----------

4. TAXATION ON ORDINARY ACTIVITIES

The major components of the income tax credit for FY22 and FY21

are:

12 months 12 months

Consolidated income statement to 31 May to 31 May

2022 2021

GBP'000 GBP'000

---------------------------------------------- ----------- -----------

Current tax:

Credit in respect of current year (3,471) (2,512)

Adjustments in respect of prior years (1,509) (1,616)

---------------------------------------------- ----------- -----------

Total current tax (4,980) (4,128)

---------------------------------------------- ----------- -----------

Deferred tax:

(Credit)/charge in respect of current year (4,507) 684

Adjustments in respect of prior years 552 1,071

Relating to changes in tax rates 251 -

---------------------------------------------- ----------- -----------

Total deferred tax (3,704) 1,755

---------------------------------------------- ----------- -----------

Total taxation credit reported in the income

statement (8,684) (2,373)

---------------------------------------------- ----------- -----------

Consolidated equity 12 months 12 months

to 31 May to 31 May

2022 2021

GBP'000 GBP'000

---------------------------------------------- ----------- -----------

Deferred tax related to items recognised in

equity during the year:

Net change in share option exercises 2,740 (3)

---------------------------------------------- ----------- -----------

Reconciliation of total tax credit at statutory tax rates:

12 months 12 months

to 31 May to 31 May

2022 2021

GBP'000 GBP'000

-------------------------------------------------- ----------- -----------

Profit on ordinary activities before taxation 944 19,185

Tax on profit on ordinary activities at standard

statutory tax rate 19% (2021: 19%) 179 3,652

Factors affecting tax expense for the year:

Expenses not deductible for tax purposes 80 13

Adjustments in respect of prior years (957) (545)

Tax rate benefit on surrender of tax losses (850) (415)

Losses on which deferred tax previously not (878) -

recognised

Research and development tax credits - (816)

Video Games Tax Relief enhanced deductions

on which credits claimed (3,864) (2,430)

Benefit of Patent Box (2,665) (1,430)

Deferred tax not recognised 20 (402)

Effect of changes in tax rate 251 -

-------------------------------------------------- ----------- -----------

Taxation credit (8,684) (2,373)

-------------------------------------------------- ----------- -----------

In the Spring Budget 2021, the Government announced that from 1

April 2023 the corporation tax rate will increase to 25%. At the

balance sheet date, deferred taxes have therefore been measured

using the tax rate at the date that the deferred tax asset or

liability unwinds of 19-25% (31 May 2021: 19%).

For FY22 the Group has recorded a total corporation tax credit

of GBP8.7 million (FY21: GBP2.4 million). The Group benefits from

the enhanced tax deductions available from the Video Games Tax

Relief (VGTR) scheme. The Group also benefits from the Patent Box

relief that reduced the taxable profits for Jurassic World

Evolution, Jurassic World Evolution 2 and Planet Zoo during the

year.

The Group recognised a prior year adjustment of GBP957k during

the year as a result of Jurassic World Evolution 2's Video Games

Tax Relief claim in the final FY21 corporation tax return after

receiving the final certificate from the British Film Institute

(BFI) in March 2022, in which the surrender of losses were carried

forward.

The tax rate benefit on surrender of tax losses of GBP850k is

the additional 6% tax benefit received in respect of surrendering

the current year losses for the VGTR tax credit at 25% for the

following trades: Elite Dangerous, F1(R) Manager 2022 and Warhammer

Age of Sigmar.

Due to the increased certainty of the Jurassic World Evolution 2

forecast for FY23 and FY24, the Group recognised a deferred tax

asset of GBP878k in respect of the GBP4.6 million of losses carried

forward for this VGTR trade.

The Group claimed research and development tax relief under the

Small or Medium-sized Enterprise (SME) scheme in FY21. The Group

elected into the Research and Development Expenditure Credit (RDEC)

scheme in FY22. The Research and Development (R&D) tax credit

in FY22 is offset against and recognised in research and

development expenses. The tax charge applied to R&D tax credit

is currently included within the deferred tax assets, which is due

to the Group making a taxable loss in FY22.

During the year, deferred tax not recognised relates to the tax

effected tax saving on the employee share scheme deduction of

GBP78k, netting off with the unrecognised tax losses movement of

GBP58k for trades other than Jurassic World Evolution 2. The

movement on employee share scheme deduction of GBP78k is the

deferred tax movement of GBP306k posted to the income statement at

a tax rate of 19%, less the current tax deduction of GBP228k.

Unrecognised tax losses movement of GBP58k is the net of GBP5.0

million brought forward losses now utilised and the GBP4.7 million

current year loss carried forward, tax effected at 19%.

The losses do not have an expiry date.

5. EARNINGS PER SHARE

The calculation of the basic earnings per share is based on the

profits attributable to the shareholders of Frontier Developments

plc divided by the weighted average number of shares in issue

during the year.

12 months 12 months

to 31 May to

2022 31 May 2021

----------------------------------------------- ------------- ---------------

Profit attributable to shareholders (GBP'000) 9,628 21,558

Weighted average number of shares 39,172,987 38,909,932

----------------------------------------------- ------------- ---------------

Basic earnings per share (p) 24.6 55.4

----------------------------------------------- ------------- ---------------

The calculation of the diluted earnings per share is based on the

profits attributable to the shareholders of Frontier Developments

plc divided by the weighted average number of shares in issue during

the year as adjusted for the dilutive effect of share options.

12 months 12 months

to 31 May to

2022 31 May 2021

----------------------------------------------- ------------- -------------

Profit attributable to shareholders (GBP'000) 9,628 21,558

Diluted weighted average number of shares 40,606,756 40,471,633

----------------------------------------------- ------------- -------------

Diluted earnings per share (p) 23.7 53.3

----------------------------------------------- ------------- -------------

The reconciliation of the average number of Ordinary Shares used for

basic and diluted earnings per share is as follows:

-----------------------------------------------------------------------------

12 months 12 months

to to

31 May 2022 31 May 2021

----------------------------------------------- ------------- -------------

Weighted average number of shares 39,172,987 38,909,932

Dilutive effect of share options 1,433,769 1,561,701

----------------------------------------------- ------------- -------------

Diluted average number of shares 40,606,756 40,471,633

----------------------------------------------- ------------- -------------

6. INTANGIBLE ASSETS

GROUP AND COMPANY

The Group and Company intangible assets comprise game

technology, game developments, third-party software and IP

licences. Game technology includes Frontier's COBRA game engine and

other technology which supports the development and publication of

games. The game developments category includes capitalised

development costs for base game and PDLC assets for both internally

developed games and games developed by partners within the Frontier

Foundry third-party publishing games label. Third-party software

includes subscriptions to development and business software.

Intangible assets for IP licences are recognised at the execution

of the licence, based on the minimum guarantees payable by Frontier

to the IP owner.

Game technology Game developments Third-party

GBP'000 GBP'000 software IP licences Total

GBP'000 GBP'000 GBP'000

----------------------------- ---------------- ------------------ ------------ -------------- ----------

Cost

At 31 May 2020 9,158 72,328 1,093 10,824 93,403

Additions 7,851 25,138 620 361 33,970

Transfer - (347) 347 - -

----------------------------- ---------------- ------------------ ------------ -------------- ----------

At 31 May 2021 17,009 97,119 2,060 11,185 127,373

Additions 2,724 32,496 330 - 35,550

Disposals - (222) - - (222)

----------------------------- ---------------- ------------------ ------------ -------------- ----------

At 31 May 2022 19,733 129,393 2,390 11,185 162,701

----------------------------- ---------------- ------------------ ------------ -------------- ----------

Amortisation and impairment

At 31 May 2020 5,589 33,007 803 1,336 40,735

Amortisation charges 1,469 13,427 424 - 15,320

----------------------------- ---------------- ------------------ ------------ -------------- ----------

At 31 May 2021 7,058 46,434 1,227 1,336 56,055

Amortisation charges 2,115 24,360 424 1,738 28,637

Impairment charge - 7,398 - - 7,398

Disposals - (222) - - (222)

----------------------------- ---------------- ------------------ ------------ -------------- ----------

At 31 May 2022 9,173 77,970 1,651 3,074 91,868

Net book value at 31

May 2022 10,560 51,423 739 8,111 70,833

----------------------------- ---------------- ------------------ ------------ -------------- ----------

Net book value at 31

May 2021 9,951 50,685 833 9,849 71,318

----------------------------- ---------------- ------------------ ------------ -------------- ----------

The majority of amortisation charges for intangible assets are

expensed within research and development expenses. Amortisation

charges for IP licences are typically charged to cost of sales,

which reflects the IP licence royalties which the minimum

guarantees relate to.

The Group recognised an impairment loss of GBP7.4 million during

FY22 in respect of Elite Dangerous: Odyssey as a result of lower

than expected engagement with Elite Dangerous: Odyssey on PC

following its launch in May 2021 and the decision to cancel further

console development of this major expansion. The value in use

recoverable amount of Elite Dangerous: Odyssey at 31 May 2022 is

GBPnil (31 May 2021: no impairment charge) using a pre-tax discount

rate of 9% (31 May 2021: 9%). No reasonable possible change in key

assumptions for other intangible assets would result in an

impairment charge.

7. KEY PERFORMANCE INDICATORS - NON STATUTORY MEASURES

In addition to measures of financial performance derived from

IFRS reported results - revenue, operating profit, operating profit

margin percentage, earnings per share and net cash balance -

Frontier publishes, and provides commentary on, financial

performance measurements derived from non-statutory calculations.

Frontier believes these supplementary measures, when read in

conjunction with the measures derived directly from statutory

financial reporting, provide a better understanding of Frontier's

overall financial performance.

EBITDA

EBITDA, being earnings before tax, interest, depreciation and

amortisation, is commonly used by investors when assessing the

financial performance of companies. It attempts to arrive at a

'cash profit' figure by adjusting operating profit for non-cash

depreciation and amortisation charges. In Frontier's case, EBITDA

does not provide a clear picture of the Group's cash profitability,

as it adds back amortisation charges relating to game developments,

but without deducting the investment costs for those developments,

resulting in a profit measure which does not take into account any

of the costs associated with developing games. Since EBITDA is a

commonly used financial performance measure, it has been included

below for the benefit of readers of the accounts who may value that

measure of performance.

12 months 12 months

to to

31 May 2022 31 May 2021

GBP'000 GBP'000

--------------------------------- ------------- -------------

Operating profit 1,536 19,916

Depreciation and amortisation 32,199 18,167

Impairment of intangible assets 7,398 -

EBITDA 41,133 38,083

--------------------------------- ------------- -------------

Adjusted EBITDA

Frontier also discloses an Adjusted EBITDA measure which, in the

Company's view, provides a better representation of 'cash profit'

than EBITDA. Adjusted EBITDA for Frontier is defined as earnings

before interest, tax, depreciation and amortisation charges related

to game developments and Frontier's game technology, less

investments in game developments and Frontier's game technology,

and excluding share-based payment charges and other non-cash items.

This effectively provides the cash profit figure that would have

been achieved if Frontier expensed all game development investment

as it was incurred, rather than capitalising those costs and

amortising them over several years.

12 months

to 12 months

31 May to 31 May

2022 2021

GBP'000 GBP'000

---------------------------------------------------- ------------ ------------

Operating profit 1,536 19,916

Add back non-cash intangible asset amortisation

charges for game developments and Frontier's

game technology 26,475 14,896

Add back non-cash intangible asset impairment 7,398 -

charge for game developments

Deduct capitalised investment costs in game

developments and Frontier's game technology (35,220) (27,793)

Add back non-cash depreciation charges 3,562 2,847

Add back non-cash movements in unrealised exchange

losses/(gains) on forward contracts 474 (223)

Add back non-cash share-based payment expenses 2,452 2,155

Adjusted EBITDA 6,677 11,798

---------------------------------------------------- ------------ ------------

Research and development (R&D) expenses

Research and development (R&D) expenses recorded in

Frontier's income statement are arrived at after capitalising game

development costs and after recording amortisation charges for

games which have been released. Similar to the principles of the

Adjusted EBITDA measure showing financial performance as if all

game development investments were expensed as incurred, Frontier

provides commentary on the difference between gross R&D

expenses (before capitalisation/amortisation) and net R&D

expenses (after capitalisation/ amortisation). The net R&D

expenses figure aligns with the R&D expenses recorded in the

income statement, whereas the gross R&D expenses figure

provides a better representation of 'cash spend' on R&D

activities.

12 months 12 months

to to

31 May 2022 31 May 2021

GBP'000 GBP'000

--------------------------------------------------- --------------- -------------

Gross R&D expenses 47,526 34,922

Capitalised investment costs in game developments

and Frontier's game technology (35,220) (27,793)

Amortisation charges for game developments and

Frontier's game technology 26,475 14,896

Impairment of intangible assets 7,398 -

Net R&D expenses 46,179 22,025

--------------------------------------------------- --------------- -------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR LMMPTMTTTBLT

(END) Dow Jones Newswires

September 21, 2022 02:02 ET (06:02 GMT)

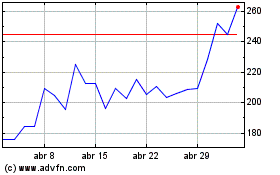

Frontier Developments (LSE:FDEV)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024