TIDMGILD

RNS Number : 0594A

Guild Esports PLC

31 January 2022

Press release

31 January 2022

Guild Esports PLC

("Guild Esports", "Guild", or "the Company")

Annual Results

Guild Esports PLC, a UK-based owner and developer of esports

teams (LSE: GILD, OTCQB: GULDF), is pleased to announce its audited

full-year results from 1 October 2020 to 30 September 2021. All

figures are in GBPmillions (GBPm).

Highlights

-- Raised GBP20m before expenses via a flotation on the London

Stock Exchange on 2 October 2020 to scale the business from

start-up phase to full commercial operations

-- Established a strong global fan base with a network audience

of more than 14.6 million and an owned audience exceeding 1 million

(2020: 25,000)

-- Signed sponsorship deals with world-class consumer brands

Subway, Samsung and HyperX with a total combined contracted revenue

of GBP3.9m over the lifetime of the deals

-- Created five professional esports teams including an

all-female roster for Valorant, comprising a total player count of

19

-- Won two major trophies in Fortnite and one in Rocket League tournaments

-- In May 2021 launched the Guild Academy, the world's most

advanced online portal to nurture budding pro-stars and create a

sustainable pool of talent for the Company

-- Annual revenues increased to GBP1.9m (2020: GBPnil)

reflecting significant contribution from sponsorship income in the

second half despite termination of a large contract by Guild

-- Pre-tax loss of GBP8.8m (2020: GBP2.7m), reflecting major

investment across the business to drive long-term growth

-- Adjusted cash* amounted to GBP11.2m as at financial year end

Post-Period Highlights

-- Signed a GBP4.5m three-year sponsorship deal with BitStamp in

January 2022, the largest contract to date, and 25% more than the

contract terminated by Guild in October 2021 which BitStamp

replaces

-- Launched Apex Legends Team, the Company's sixth pro-team, to

compete in the free-to-play shooter that has a 100 million

worldwide audience, bringing the roster count to 22 players

-- Won fourth major trophy at a prestigious Fortnite tournament in November

-- Shares listed on the USA's OTC market to broaden investor base in North America

-- Signed 10-year lease for Guild Academy and headquarters in

London's Shoreditch, which is expected to become a significant

commercial asset

Outlook

-- Robust pipeline of potential sponsors with several deals at advanced stages of negotiations

-- Confidence in delivering strong growth in sponsorship

revenues with total contracted revenues of GBP8.4m to date and a

current annualised run rate at GBP3.1m for the year ending 30

September 2022

-- Expanding roster of top players means Guild is

well-positioned to achieve high rankings in tournaments and

increase its fan-following further

-- Network audience continues to grow rapidly and on track to broadly double again this year

*Calculated as cash at bank, less trade creditors, accruals and

other taxation, add trade debtors, accrued revenue and VAT

recoverable

Commenting on the results, Guild's Chief Executive Officer, Kal

Hourd, said: "We've made good progress amid challenging trading

conditions in our first full year of operations as a publicly

listed company.

Our network audience and fan base has grown exponentially,

making us the fastest growing esports team organisation in Europe.

The major investment made across the business to scale up our

activities has enabled us to establish a strong foundation for

long-term revenue growth and resulted in three global sponsorship

deals.

We have entered the new year with strong momentum and recently

clinched our fourth and largest sponsorship deal to date. With

Guild performing well operationally, I am confident that the hard

work and investment made thus far will translate into significant

improvements in revenue and value creation and I look forward to

the future with great confidence."

The annual report and accounts will be available for download

from the Company's website (www.guildesports.com) later today.

For further information please contact:

Guild Esports

Kal Hourd via Tancredi +44 207 887

Chief Executive 7633

Neil Thapar

Investor Relations

+44 7876 455 323

-------------------------

Tennyson Securities

-------------------------

Corporate Broker

Peter Krens +44 207 186 9030

-------------------------

Zeus Capital

-------------------------

Corporate Broker

Benjamin Robertson +44 203 829 5000

-------------------------

Tancredi Intelligent Communication

Media Relations

-------------------------

Salamander Davoudi

Emma Valgimigli +44 7957 549 906

Helen Humphrey +44 7727 180 873

guild@tancredigroup.com +44 7449 226 720

-------------------------

About Guild Esports:

Guild Esports PLC is a global fan-focused team organisation and

lifestyle brand that fields professional players in gaming

competitions under the Guild banner. Our in-house training academy

aims to attract and nurture the best esports talent, and our goal

is to provide the ultimate entertainment experience alongside a

distinctive lifestyle brand authentic to the esports community

worldwide. Guild is led by an experienced management team of

esports veterans and co-owned by David Beckham. The Company is

headquartered in the UK and its shares are listed on the main

market of the London Stock Exchange (ticker: GILD) and on the OTCQB

Venture Market in the United States (ticker: GULDF). Please visit

www.guildesports.com for more information.

Chairman's statement

I am pleased to report Guild's maiden full year results since

its flotation on the London Stock Exchange on 2 October 2020. The

period under review saw Guild rapidly scale from start-up phase to

full commercial operations as part of its growth strategy to become

one of the world's leading esports team organisations in the next

few years.

Despite the challenges of building a new business amid a global

pandemic, good progress was made across the business to fulfil that

vision.

The Company generated revenues of GBP1.9m (2020: GBPnil) as it

benefitted from first-time contributions from sponsorship deals

signed earlier in the year. The loss before tax increased to

GBP8.8m (2020: GBP2.7m) which reflects a major investment in

operational infrastructure, esports teams, the Guild Academy,

content creation and the development of Guild merchandising. This

investment is fundamental to Guild's business model and long-term

strategy. It enabled the Company to deliver exponential growth in

its fan base and total audience network in 2021, making it the

fastest growing esports teams organisation in Europe.

Our growing audience of young and hard-to-reach consumers is a

powerful magnet for global brands and sponsors as evidenced by the

quality of the sponsorship deals signed with Subway, Samsung and

Hyper X during the year, followed by BitStamp, a leading

cryptocurrency exchange, in January 2022. I am proud that we have

gained the trust of such marque brands as our sponsorship partners

in a relatively short time.

Guild is still at an early stage in its growth and also well

placed to benefit from long term industry fundamentals driving the

esports sector worldwide. In terms of market size, the electronic

games sector is larger than the Hollywood movie and music

industries combined, as well as one of the fastest growing leisure

and entertainment activities pursued by mainstream consumers. The

recent $69bn cash takeover bid by Microsoft for Activision reflects

how leading consumer facing technology giants see the industry's

long-term prospects.

Guild's own investment in the business in 2021 provides a solid

platform for long term growth and build media value necessary to

drive sponsorship revenue in the year ahead and beyond. Our new

business pipeline remains robust and we are at an advanced stage of

negotiations with multiple partners which provides great confidence

for Guild's prospects.

As a young teams organisation, Guild's fast growing audience of

keen and loyal fans is the life blood of the Company. Our expanding

roster of pro-players achieved notable success in several major

tournaments and their continued success is of great pride for all

Guild fans and supporters alike.

We are confident that we have laid the foundation to provide

tremendous value to our brand partners and as well as create

long-term shareholder value.

Our staff numbers have increased from just a handful to more

than 35 full-time staff at present and I commend all our employees,

players and partners for their hard work and dedication which has

positioned the Company for growth in the years ahead.

Mr D Lew

Non-Executive Chairman

......................

Operational review

Good progress was made in our first full year, with growth in

operations, esports, the launch of the Guild academy, and a growing

fanbase which generates the media value needed to attract brand

sponsors and generate revenue for the Company.

The esports sector grew by 14.5 per cent in 2021 and is now a

$1bn industry. The growth is expected to continue according to

Newzoo and is predicted to reach $1.6bn by 2024. Total viewing

audience is estimated to increase from more than 400 million to

approximately 650 million in the same period.

Sponsorship

Guild secured three sponsorships totalling contracted revenues

of GBP3.9m since its stock market debut with leading high-profile

brands in their respective industry sectors.

Hyper X, a leading gaming peripherals brand recently acquired by

HP Inc from Kingston Technologies, which has a long association

with the esports sector, became Guild's exclusive peripherals

partner in Jan 2021. As part of the two-year agreement, HyperX

products will be used by our pro-players, content-creators and

academy students as well as to fit out our London headquarters.

Subway, the world's largest submarine sandwich franchise signed

as a main sponsor March 2021, becoming Guild's Official

Quick-Service Restaurant Partner as well as an Official Academy

Partner of Guild Esports in more than 50 EMEA markets. The

agreement provides Subway marketing exposure on Guild's team

jersey, bespoke branded content, its London headquarters, and

player and content creator channels, along with exclusive esports

activations.

In June 2021, Guild signed with Samsung, world-leader in

transformative technologies, as its Official Display Partner. The

agreement provides best-in-class products for our players, content

creators, academy students and the London Headquarters and will

provide exposure for Samsung across Guild's digital and social

eco-system.

Together these sponsorship deals have laid a strong foundation

for growth in sponsorship revenues from this year following their

first-time contribution to revenues in the second half of 2021.

The Company's pipeline of new business from other potential

sponsors and advertisers has also strengthened significantly.

Discussions are currently at an advanced stage with several such

prospects. These potential sponsors are engaged in multiple

industries and have shown great interest in partnering with Guild

as we emerge as a leading esports brand and expand our audience in

a rapidly growing esports sector.

In October 2021, Guild announced the termination of a

sponsorship deal with a European Fintech company totalling GBP3.6m

over three years. Despite working with the brand for over a year

through their financial difficulties induced by Covid-19, Guild

took the decision to cancel the deal due to lack of certainty of

their launch date, and delay in contractual payments. Guild's

robust pipeline and growing interest from a range of other fintech

prospects gave comfort that a replacement would be secured

soon.

Although termination of the contract held back our revenue

growth in 2021 we bounced back with a substantially larger GBP4.5m

sponsorship deal with BitStamp in January 2022, which will start

making a significant contribution to revenues in the current year.

BitStamp is one of the world's longest established cryptocurrency

exchanges, and has also opened up potentially further opportunities

in the fintech sector. Taking this win into account, the total

contracted revenues at the date of this report is GBP8.4m.

Rapidly growing audience

Guild is building its endemic audience through the creation of

original content, signing of top-tier players and working with

influencers and content creators, with David Beckham's social posts

bringing in fans from different segments. Guild's fanbase and

social reach has grown significantly, with Guild's owned audience

making the Company the fastest growing esports organisation in

Europe in 2021.

Subscribed fans in 2021 exceeded 1.1 million, video views

surpassed 38.5 million, and social impressions of almost 500

million. With the Company's roster of players and content-creators,

Guild has a network audience with direct access to over 14.6

million fans (not including David Beckham's own followers) via

social media posts, an essential and attractive asset for potential

sponsors.

30 September 30 September

2021 2020

Sponsorships

Partnership revenues

- earned during the year GBP1.0m -

Contracted partnerships

- total contracted sponsorship GBP7.5m -

revenue to date*

Viewership

Guild fans

- Individuals who have opted into

Guild channels (e.g. YouTube, Instagram,

Twitter, Twitch etc.) 1.1m 25k

Guild network

- Individuals subscribed to the

network of Guild teams, influencers

and content creators 14.6m 0.5m

- Guild social reach on David Beckham's

channels 127.7m 123.0m

Social impressions

- Display of Guild content on individuals'

social feeds 472.7m 7.6m

Video views

- Views of videos on Guild channels 38.5m 0.6m

Viewership of Guild events

- Views of live Guild events (online) 1m+ 148k

*Subsequent to the year end, on 22 October 2021, Guild terminated

a GBP3.6m, three-year sponsorship deal with a European fintech company

following delays in the sponsor's launch and the payment of sums due

under the contract. On 18 January 2022, Guild signed a GBP4.5m, three-year

sponsorship deal with BitStamp - one of the world's longest-running

crypto exchanges. The total contracted revenues at the date of this

report is GBP8.4m.

This is in addition to brand exposure provided by media coverage

of Guild's teams competing in esports games and tournaments.

Guild's current games are widely covered by specialist media via

platforms such as Twitch and YouTube, where Rocket League and

Valorant saw over 100,000 concurrent viewers during peak matches.

There has been increasing coverage from mainstream media outlets

such as BBC Sport, who live-streamed a number of Guild's Rocket

League fixtures in January 2021.

Expansion of teams continues at pace

Our esports audience is expanding partly due to the step-up in

recruitment of outstanding professional players. The total roster

of talent has increased from four in September 2020, to 22 players

currently. They are organised in teams specialising in five major

games franchises (FIFA, Fortnite, Rocket League, Apex Legends and

Valorant) and compete in tournaments for trophies and prize

money.

Guild has also started a programme to manage and drive players'

social channels and digital content creation, expanding the reach

of Guild and further increasing its fanbase. The Company is

considering expansion into new games and new markets, giving access

to larger audiences and partnership opportunities.

Our expansion into Fortnite with four esports athletes has given

us Europe's number 1 roster with a significant social following,

and a track record of wins and trophies in global competitions. Our

FIFA roster, with the addition of Argentinian player Nico, places

our duo among the top ranks globally. Our Valorant roster has now

qualified for the EMEA Challengers league after a roster

restructuring and is on track to becoming a global powerhouse in

2022. In Rocket League, our squad continues to develop, and with

the growth in the title globally, it is an area of focus for the

Company in the short term. Winning is important for the growth of

the Company, and with our approach to player development, we are

confident in adding more trophies to the current four we hold.

In the year to 30 September 2021, Guild teams contributed

GBP0.72m in prize money wins to revenues, before players' share of

winnings.

Merchandising

The first ranges of Guild-branded apparel went on sale on the

Company's website in November 2020. A second line of products went

on sale in May 2021. Sales volumes, as expected, were modest as

these are still early days for the Company's merchandising

operations.

In terms of apparel, we have been making strategic decisions on

releasing products that assist with the progression of brand

conversations. An example of this is the team jersey where we now

have a product for our players to wear while playing, and brands

can see the physical product that will display their logos.

Our strategy in 2022 is to launch additional product lines to

our now larger and growing fanbase, and look to partner with

existing brands and distribution networks to introduce products

that not only appeal to those looking for fanwear, but also those

that are passionate about fashion and culture.

The Guild Academy

A key element to Guild is with the vision to find and nurture

new talent by adopting the proven academy system pioneered by

Premier League football clubs such as Manchester United. On launch,

the Academy saw rapid uptake with over 3,000 sign-ups and

engagement from all across the world. Alongside the learning

platform, the Guild Academy Tournaments running each week have

thousands of unique players, with the final tournament of 2021,

Apex Legends, oversubscribed days before it started.

The focus for 2022 is growing the Academy in two areas. One is

focusing on providing added value to the casual gamer, and the

other is identifying and developing aspiring professionals through

the player development system. In terms of player development and

platform growth, we continue to improve by taking key learnings

from last year to develop the product with gamification and

collaboration front of mind.

Complementing the Academy learning is pro player and

content-creator driven workshops, using Guild's extensive roster of

influencers to provide one-of-a-kind experiences to students.

The second element is with schools and colleges, where we are

seeing strong appetite for esports engagement resulting in

partnering with five colleges in January 2022. Guild aims to be the

largest provider of school-based learning for esports through

2022.

Outlook

Significant progress has been made to execute Guild's growth

strategy, and the Company is well positioned to attract more brand

partners in 2022.

Earlier this month the Company's largest single sponsorship

contract, a three-year GBP4.5m sponsorship with BitStamp was

signed, providing a head start for the current year. In addition,

the pipeline of potential sponsors remains robust with several

deals at advanced stages of negotiations.

This provides the Company with confidence in adding significant

sponsorship revenues to the current annualised revenue run rate at

GBP3.1m for the year ending 30 September 2022, based on total

contracted sponsorship revenues of GBP8.4m to date.

An expanding roster of top players means Guild is also

well-positioned to achieve high rankings in tournaments and drive

its fan base. Guild's network audience continues to grow rapidly

and on track to broadly double again this year. As a result, the

Company looks to the future with great confidence.

Kal Hourd

Chief Executive

..............................

INDEPENT AUDITOR'S REPORT

The Company's auditor has reported on the accounts and their

audit report is unqualified. The independent auditor's report is

set out in full in the Annual Report and Financial Statements,

available on the Company's website.

DIRECTORS' RESPONSIBILITIES STATEMENT

The directors are responsible for preparing the Annual Report

and the financial statements in accordance with applicable law and

regulations.

Company law requires the directors to prepare financial

statements for each financial period. Under that law the directors

have prepared the Company financial statements in accordance with

International Financial Reporting Standards in conformity with the

requirements of the Companies Act 2006. Under company law the

directors must not approve the financial statements unless they are

satisfied that they give a true and fair view of the state of

affairs of the Company and of the profit and loss of the Company

for that period.

In preparing these financial statements, the directors are

required to:

-- Select suitable accounting policies and then apply them consistently;

-- Make judgements and accounting estimates that are reasonable and prudent;

-- State whether applicable accounting standards have been

followed, subject to any material departures disclosed and

explained in the financial statements; and

-- Prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business.

The directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the company's

transactions and disclose with reasonable accuracy at any time the

financial position of the company and company and enable them to

ensure that the financial statements comply with the Companies Act

2006. They are also responsible for safeguarding the assets of the

company and company and hence for taking reasonable steps for the

prevention and detection of fraud and other irregularities.

INCOME STATEMENT

FOR THE YEARED 30 SEPTEMBER 2021

Year Period

ended ended

30 September 30 September

2021 2020

Notes GBP GBP

Revenue 3 1,901,557 -

Cost of sales (802,361) -

Gross profit 1,099,196 -

Operating and administrative

expenses (9,925,280) (2,727,324)

Operating loss 5 (8,826,084) (2,727,324)

Interest received 8 10,151 129

Loss before taxation (8,815,933) (2,727,195)

Taxation 9 - -

Loss and total comprehensive

income for the year/period (8,815,933) (2,727,195)

Earnings per share attributable

to equity owners 10

Basic and diluted earnings per

share (pence) (1.70) (1.70)

The income statement has been prepared on the basis that all operations

are continuing operations.

There are no recognised gains or losses other than those passing

through the income statement.

STATEMENT OF FINANCIAL POSITION

AS AT 30 SEPTEMBER 2021

2021 2020

Notes GBP GBP

Non-current assets

Intangible assets 12 49,879 36,001

Property, plant and equipment 13 29,597 4,342

79,476 40,343

Current assets

Trade and other receivables 14 3,542,983 2,065,626

Cash and cash equivalents 10,071,655 2,517,734

13,614,638 4,583,360

Total assets 13,694,114 4,623,703

Current liabilities

Trade and other payables 16 837,051 2,092,720

Deferred revenue 17 783,288 -

1,620,339 2,092,720

Net current assets 11,994,299 2,490,640

Total liabilities 1,620,339 2,092,720

Net assets 12,073,775 2,530,983

Equity

Share capital 19 518,617 264,617

Share premium 19 22,642,717 4,880,511

Share-based payment reserve 419,003 113,050

Retained earnings (11,506,562) (2,727,195)

Total equity 12,073,775 2,530,983

The financial statements were approved by the board of directors

and authorised for issue on 28 January 2022 and are signed on its

behalf by:

Mr J Savage

Finance Director

Company Registration No. 12187837

STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 30 SEPTEMBER 2021

Share capital Share Share-based Retained Total

premium payment earnings

account reserve

Notes GBP GBP GBP GBP GBP

Balance at 3 September

2019 - - - - -

Period ended 30

September

2020:

Loss and total

comprehensive

income for the period - - - (2,727,195) (2,727,195)

Issue of share capital 19 264,617 5,034,923 - - 5,299,540

Share-based payments - - 113,050 - 113,050

Share issue costs - (154,412) - - (154,412)

Balance at 30

September

2020 264,617 4,880,511 113,050 (2,727,195) 2,530,983

Year ended 30

September

2021:

Loss and total

comprehensive

income - - - (8,815,933) (8,815,933)

Issue of share capital 19 254,000 19,836,000 - - 20,090,000

Share-based payments - - 342,519 - 342,519

Other movements for exercised

and lapsed warrants - - (36,566) 36,566 -

Share issue costs - (2,073,794) - - (2,073,794)

Balance at 30 September 2021 518,617 22,642,717 419,003 (11,506,562) 12,073,775

STATEMENT OF CASH FLOWS

FOR THE YEARED 30 SEPTEMBER 2021

2021 2020

Notes GBP GBP GBP GBP

Cash flows from operating activities

Cash absorbed by operations 25 (10,686,474) (2,439,079)

Net cash outflow from operating

activities (10,686,474) (2,439,079)

Investing activities

Purchase of intangible assets (34,903) (39,078)

Purchase of property, plant and

equipment (33,313) (4,466)

Interest received 10,151 129

Net cash used in investing

activities (58,065) (43,415)

Financing activities

Proceeds from issue of shares

(net of issue costs) 18,298,460 5,000,228

Net cash generated from financing

activities 18,298,460 5,000,228

Net increase in cash and cash

equivalents 7,553,921 2,517,734

Cash and cash equivalents at beginning

of year 2,517,734 -

Cash and cash equivalents

at end of year 10,071,655 2,517,734

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARED 30 SEPTEMBER 2021

1. Accounting policies

Company information

Guild Esports PLC is a public limited company incorporated in

England and Wales and domiciled in the United Kingdom. The

registered office is Craven House, 16 Northumberland Avenue,

London, WC2N 5AP. The Company's principal activities and nature of

its operations are disclosed in the Directors' Report.

1.1 Basis of preparation

The financial statements have been prepared in accordance with

international accounting standards in conformity with the

requirements of the Companies Act 2006 and with those parts of the

Companies Act 2006 applicable to companies reporting under IFRS,

except as otherwise stated.

The financial statements are prepared in sterling, which is the

functional currency of the Company. Monetary amounts in these

financial statements are rounded to the nearest GBP.

The financial statements have been prepared under the historical

cost convention. The principal accounting policies adopted are set

out below.

The Company has adopted the applicable amendments to standards

effective for accounting periods commencing on 1 October 2020. The

nature and effect of these changes as a result of the adoption of

these amended standards did not have an impact on the financial

statements of the Company and, hence, have not been disclosed. The

Company has not early adopted any standards, interpretations or

amendments that have been issued but are not yet effective.

1.2 Going concern

The preparation of financial statements requires an assessment

on the validity of the going concern assumption.

The directors have a reasonable expectation that the Company has

adequate cash resources to continue in operational existence for a

period of at least one year from the date of approval of these

financial statements. The Company, therefore, has adopted the going

concern basis in preparing its financial statements.

The directors have reviewed the ongoing situation with Covid-19

and do not consider its effects to have a material impact on the

Company's going concern. The directors note that esports

tournaments which would have normally taken place in a physical

location, have been adapted to take place virtually, in light of

the practical restrictions enforced by regulations. Whilst this has

hindered merchandise sales during the year, and live events where

Guild can interact with the community, its fanbase has continued to

grow. The Company looks forward to working alongside gaming

developers as physical events begin to take place again, with

limited restrictions.

1.3 Reporting period

The Company was incorporated on 3 September 2019. The figures in

these financial statements represent the 12-month period ended 30

September 2021. Comparative figures presented in these financial

statements are for the period from 3 September 2019 to 30 September

2020 and are therefore not entirely comparable.

1.4 Revenue

Revenue is measured based on the consideration specified in a

contract with a customer and excludes amounts collected on behalf

of third parties. The company recognises revenue when it transfers

control of a product or service to a customer.

When cash inflows are deferred and represent a financing

arrangement, the fair value of the consideration is the present

value of the future receipts. The difference between the fair value

of the consideration and the nominal amount received is recognised

as interest income.

Sale of goods

Revenue is recognised when the significant risks and rewards of

ownership have been transferred to the customer, recovery of the

consideration is probable, the associated costs and possible return

of goods can be estimated reliably, there is no continuing

management involvement with the goods and the amount of revenue can

be measured reliably. Revenue is measured net of returns, trade

discounts and volume rebates.

Royalties

The Company receives royalties from in-game digital products

branded with the Guild logo. The rights to the digital products are

held by the game developers, and Guild is not deemed to be the

principal in such transactions. Therefore, the revenue recognised

from the sale of these digital products is the net amount of

commission earned by the Company.

Prize money

The Company operates esports teams in several game titles which

each have multiple tournaments with varying amounts of prize pools.

The Company recognises total prize winnings as revenue at the point

that its esports teams' placing is confirmed in a tournament. Prize

pool amounts payable to the Company's esports teams as part of the

players' contracts are shown in cost of sales.

Long-term partnership contracts

The Company enters into partnership deals which provide rights

over services and assets operated and owned by Guild. Contracts may

include both fixed-price and variable-price services. Revenue from

providing services is recognised in the accounting period in which

the services are rendered. For fixed-price contracts, revenue is

recognised based on the actual service provided to the end of the

reporting period as a proportion of the total services to be

provided, because the customer receives and uses the benefits

simultaneously. This is determined based on actual services

provided relative to the total expected services expected as part

of the contract. The rights over services and assets are subject to

minimum monthly commitments and as such, these fixed-price

contracts accrue materially evenly over the life of the

contract.

1.5 Intangible assets other than goodwill

Intangible assets acquired separately from a business are

recognised at cost and are subsequently measured at cost less

accumulated amortisation and accumulated impairment losses.

Amortisation is recognised so as to write off the cost or

valuation of assets less their residual values over their useful

lives. Website costs are amortised on a 33% per annum,

straight-line basis.

1.6 Property, plant and equipment

Property, plant and equipment are initially measured at cost and

subsequently measured at cost or valuation, net of depreciation and

any impairment losses.

Depreciation is recognised so as to write off the cost or

valuation of assets less their residual values over their useful

lives on the following bases:

Office equipment 33% straight-line per annum

The gain or loss arising on the disposal of an asset is

determined as the difference between the sale proceeds and the

carrying value of the asset, and is recognised in the income

statement.

1.7 Impairment of tangible and intangible assets

At each reporting end date, the Company reviews the carrying

amounts of its tangible and intangible assets to determine whether

there is any indication that those assets have suffered an

impairment loss. If any such indication exists, the recoverable

amount of the asset is estimated in order to determine the extent

of the impairment loss (if any). Where it is not possible to

estimate the recoverable amount of an individual asset, the Company

estimates the recoverable amount of the cash-generating unit to

which the asset belongs.

Intangible assets with indefinite useful lives and intangible

assets not yet available for use are tested for impairment

annually, and whenever there is an indication that the asset may be

impaired.

If the recoverable amount of an asset (or cash-generating unit)

is estimated to be less than its carrying amount, the carrying

amount of the asset (or cash-generating unit) is reduced to its

recoverable amount. An impairment loss is recognised immediately in

profit or loss, unless the relevant asset is carried at a revalued

amount, in which case the impairment loss is treated as a

revaluation decrease.

Where an impairment loss subsequently reverses, the carrying

amount of the asset (or cash-generating unit) is increased to the

revised estimate of its recoverable amount, but so that the

increased carrying amount does not exceed the carrying amount that

would have been determined had no impairment loss been recognised

for the asset (or cash-generating unit) in prior years. A reversal

of an impairment loss is recognised immediately in profit or loss,

unless the relevant asset is carried at a revalued amount, in which

case the reversal of the impairment loss is treated as a

revaluation increase.

1.8 Cash and cash equivalents

Cash and cash equivalents comprise cash at bank and in hand and

demand deposits with banks and other financial institutions, that

are readily convertible into known amounts of cash and which are

subject to an insignificant risk of changes in value. The Company

monitors both short-term and long-term credit ratings of the

financial institutions it banks with. During the period, the

Company banked with NatWest Group Plc which has a high rating from

Fitch Ratings Inc, being 'F1' short-term and 'A' long-term.

1.9 Financial assets

Financial assets are recognised in the Company's statement of

financial position when the Company becomes party to the

contractual provisions of the instrument. Financial assets are

classified into specified categories, depending on the nature and

purpose of the financial assets.

At initial recognition, financial assets classified as fair

value through profit and loss are measured at fair value and any

transaction costs are recognised in profit or loss. Financial

assets not classified as fair value through profit and loss are

initially measured at fair value plus transaction costs.

Financial assets at fair value through profit or loss

When any of the above-mentioned conditions for classification of

financial assets is not met, a financial asset is classified as

measured at fair value through profit or loss. Financial assets

measured at fair value through profit or loss are recognized

initially at fair value and any transaction costs are recognised in

profit or loss when incurred. A gain or loss on a financial asset

measured at fair value through profit or loss is recognised in

profit or loss, and is included within finance income or finance

costs in the statement of income for the reporting period in which

it arises.

Financial assets held at amortised cost

Financial instruments are classified as financial assets

measured at amortised cost where the objective is to hold these

assets in order to collect contractual cash flows, and the

contractual cash flows are solely payments of principal and

interest. They arise principally from the provision of goods and

services to customers (eg trade receivables). They are initially

recognised at fair value plus transaction costs directly

attributable to their acquisition or issue, and are subsequently

carried at amortised cost using the effective interest rate method,

less provision for impairment where necessary.

Financial assets at fair value through other comprehensive

income

Debt instruments are classified as financial assets measured at

fair value through other comprehensive income where the financial

assets are held within the Company's business model whose objective

is achieved by both collecting contractual cash flows and selling

financial assets, and the contractual terms of the financial asset

give rise on specified dates to cash flows that are solely payments

of principal and interest on the principal amount outstanding.

A debt instrument measured at fair value through other

comprehensive income is recognised initially at fair value plus

transaction costs directly attributable to the asset. After initial

recognition, each asset is measured at fair value, with changes in

fair value included in other comprehensive income. Accumulated

gains or losses recognised through other comprehensive income are

directly transferred to profit or loss when the debt instrument is

derecognised.

Impairment of financial assets

Financial assets, other than those measured at fair value

through profit or loss, are assessed for indicators of impairment

at each reporting end date.

Financial assets are impaired where there is objective evidence

that, as a result of one or more events that occurred after the

initial recognition of the financial asset, the estimated future

cash flows of the investment have been affected.

Derecognition of financial assets

Financial assets are derecognised only when the contractual

rights to the cash flows from the asset expire, or when it

transfers the financial asset and substantially all the risks and

rewards of ownership to another entity.

1.10 Financial liabilities

The Company recognises financial debt when the Company becomes a

party to the contractual provisions of the instruments. Financial

liabilities are classified as either 'financial liabilities at fair

value through profit or loss' or 'other financial liabilities'.

Financial liabilities at fair value through profit or loss

Financial liabilities are classified as measured at fair value

through profit or loss when the financial liability is held for

trading. A financial liability is classified as held for trading

if:

-- it has been incurred principally for the purpose of selling

or repurchasing it in the near term, or

-- on initial recognition it is part of a portfolio of

identified financial instruments that the Company manages together

and has a recent actual pattern of short-term profit taking, or

-- it is a derivative that is not a financial guarantee contract

or a designated and effective hedging instrument.

Financial liabilities at fair value through profit or loss are

stated at fair value with any gains or losses arising on

remeasurement recognised in profit or loss.

Other financial liabilities

Other financial liabilities, including trade payables and other

short-term monetary liabilities, are initially measured at fair

value net of transaction costs directly attributable to the

issuance of the financial liability. They are subsequently measured

at amortised cost using the effective interest method. For the

purposes of each financial liability, interest expense includes

initial transaction costs and any premium payable on redemption, as

well as any interest or coupon payable while the liability is

outstanding.

Derecognition of financial liabilities

Financial liabilities are derecognised when, and only when, the

Company's obligations are discharged, cancelled, or they

expire.

1.11 Equity and reserves

The share capital reserve represents the nominal value of equity

shares. The share premium reserve is the amount subscribed for

share capital in excess of nominal value. Ordinary shares are

classified as equity. Incremental costs directly attributable to

the issue of new shares or options are shown in equity as a

deduction from the proceeds. Share based payments relating to

incentive schemes or advisor warrants have been recognised at their

fair value at grant within the share based payment reserve in line

with IFRS2. The retained earnings reserve represents the cumulative

net gains and losses and other transactions with equity holders not

recognised elsewhere.

1.12 Financial risk management

Equity instruments issued by the Company are recorded at the

proceeds received, net of transaction costs. Dividends payable on

equity instruments are recognised as liabilities once they are no

longer at the discretion of the Company. Incremental costs directly

attributable to the issue of new shares or options are shown in

equity as a deduction, net of tax, from the proceeds.

Financial risk factors

The Company's activities expose it to a variety of financial

risks: market risk (price risk), credit risk and liquidity risk.

The Company's overall risk management programme seeks to minimise

potential adverse effects on the Company's financial performance.

The Company has no borrowings but is exposed to market risk in

terms of foreign exchange risk. Risk management is undertaken by

the board of directors.

Market risk - price risk

The Company is exposed to price risk primarily for the costs of

operating in the Esports industry.

Credit risk

Credit risk arises from outstanding receivables. Management does

not expect any losses from non-performance of these receivables.

The amount of exposure to any individual counter party is subject

to a limit, which is assessed by the board. The Company considers

the credit ratings of banks in which it holds funds in order.

Liquidity risk

Liquidity risk arises from the Company's management of working

capital. It is the risk that the Company will encounter difficulty

in meeting its financial obligations as they fall due. Controls

over expenditure are carefully managed, in order to maintain its

cash reserves.

Capital risk management

The Company's objectives when managing capital is to safeguard

the Company's ability to continue as a going concern, in order to

provide returns for shareholders and benefits for other

stakeholders, and to maintain an optimal capital structure. The

Company has no borrowings. In order to maintain or adjust the

capital structure, the Company may adjust the amount of dividends

paid to shareholders, return capital to shareholders or issue new

shares. The Company monitors capital on the basis of the total

equity held by the Company.

1.13 Taxation

The tax expense/credit represents the sum of the tax currently

payable/receivable and deferred tax.

Current tax

The tax currently payable/receivable is based on taxable

profit/loss for the year. Taxable profit/loss differs from net

profit/loss as reported in the income statement because it excludes

items of income or expense that are taxable or deductible in other

years and it further excludes items that are never taxable or

deductible. The Company's asset or liability for current tax is

calculated using tax rates that have been enacted or substantively

enacted by the reporting end date.

Deferred tax

Deferred tax is the tax expected to be payable or recoverable on

differences between the carrying amounts of assets and liabilities

in the financial statements and the corresponding tax bases used in

the computation of taxable profit, and is accounted for using the

balance sheet liability method. Deferred tax liabilities are

generally recognised for all taxable temporary differences and

deferred tax assets are recognised to the extent that it is

probable that taxable profits will be available against which

deductible temporary differences can be utilised. Such assets and

liabilities are not recognised if the temporary difference arises

from goodwill or from the initial recognition of other assets and

liabilities in a transaction that affects neither the tax profit

nor the accounting profit.

The carrying amount of deferred tax assets is reviewed at each

reporting end date and reduced to the extent that it is no longer

probable that sufficient taxable profits will be available to allow

all or part of the asset to be recovered. Deferred tax is

calculated at the tax rates that are expected to apply in the

period when the liability is settled or the asset is realised.

Deferred tax is charged or credited in the income statement, except

when it relates to items charged or credited directly to equity, in

which case the deferred tax is also dealt with in equity. Deferred

tax assets and liabilities are offset when the Company has a

legally enforceable right to offset current tax assets and

liabilities and the deferred tax assets and liabilities relate to

taxes levied by the same tax authority.

1.14 Retirement benefits

Payments to defined contribution retirement benefit schemes are

charged as an expense as they fall due.

1.15 Share-based payments

Equity-settled share-based payments are measured at fair value

at the date of grant by reference to the fair value of the equity

instruments granted using the Black-Scholes option pricing model.

The fair value determined at the grant date is expensed on a

straight-line basis over the vesting period, based on the estimate

of shares that will eventually vest. A corresponding adjustment is

made to equity.

When the terms and conditions of equity-settled share-based

payments at the time they were granted are subsequently modified,

the fair value of the share-based payment under the original terms

and conditions and under the modified terms and conditions are both

determined at the date of the modification. Any excess of the

modified fair value over the original fair value is recognised over

the remaining vesting period in addition to the grant date fair

value of the original share-based payment. The share-based payment

expense is not adjusted if the modified fair value is less than the

original fair value.

Cancellations or settlements (including those resulting from

employee redundancies) are treated as an acceleration of vesting

and the amount that would have been recognised over the remaining

vesting period is recognised immediately.

1.16 Foreign exchange

Transactions in currencies other than pounds sterling are

recorded at the rates of exchange prevailing at the dates of the

transactions. At each reporting end date, monetary assets and

liabilities that are denominated in foreign currencies are

retranslated at the rates prevailing on the reporting end date.

Gains and losses arising on translation in the period are included

in profit or loss.

2 Critical accounting estimates and judgements

In the application of the Company's accounting policies, the

directors are required to make judgements, estimates and

assumptions about the carrying amount of assets and liabilities

that are not readily apparent from other sources. The estimates and

associated assumptions are based on historical experience and other

factors that are considered to be relevant. Actual results may

differ from these estimates.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised, if the revision

affects only that period, or in the period of the revision and

future periods if the revision affects both current and future

periods.

During the year, the Company issued warrants. The directors have

applied the Black-Scholes pricing model to assess the costs

associated with the share-based payments. The Black-Scholes model

is dependent upon several inputs where the directors must exercise

their judgement, specifically: risk-free investment rate; expected

share price volatility at the time of the grant; and expected level

of redemption. The assumptions applied by the directors, and the

associated costs recognised in the financial statements are

outlined in these financial statements.

3 Revenue

The Company derives revenue from various sources, including

revenue from contracts with customers. These revenue sources

involve the transfer of goods and/or services over time and at a

point in time in the following major product lines and geographical

regions.

2021 2020

GBP GBP

Revenue analysed by class of business

Sponsorship revenue- Over time 976,712 -

Sponsorship revenue- Point in time 28,008 -

Campaigns- Point in time 50,000 -

Prize winnings- Point in time 717,454 -

Other revenue- Point in time 129,383 -

1,901,557 -

2021 2020

GBP GBP

Revenue analysed by geographical market

UK 804,740 -

EMEA 380,155 -

USA 716,662 -

1,901,557 -

4 Expense analysis

Cost of sales 2021 2020

GBP GBP

Player prize money 665,336 -

Sponsorship direct costs 87,838 -

Other direct costs 49,187 -

Total cost of sales 802,361 -

Administrative expenses 2021 2020

GBP GBP

Directors fees and payments 870,234 247,157

Esports and content creator costs 1,645,531 246,439

Ambassador fees 2,333,048 1,359,287

Academy costs 671,978 -

Legal, professional and regulatory fees 894,471 620,408

Marketing, promotion and content production

costs 1,760,938 -

Staff and operations costs 1,659,732 134,587

Depreciation and amortisation 29,083 3,201

Share based payment charge 60,265 113,050

Total administrative expenses 9,925,280 2,724,129

5 Operating loss

2021 2020

GBP GBP

Operating loss for the year is stated after charging:

Exchange losses 10,348 -

Fees payable to the Company's auditor for

the audit of the financial statements 23,500 23,500

Fees payable to the Company's auditor for

work in respect of the IPO - 60,000

Depreciation of property, plant and equipment 8,058 124

Amortisation of intangible assets (included

within administrative expenses) 21,025 3,077

Share-based payments 60,265 113,050

==============

6 Employees

The average monthly number of persons (excluding directors) employed

by the company during the year was:

2021 2020

Number Number

Management 5 -

Operations 17 -

Total 22 -

Their aggregate remuneration comprised:

2021 2020

GBP GBP

Wages and salaries 1,372,616 -

Social security costs 151,574 -

Pension costs 15,770 -

1,539,960 -

Settlement and termination agreements during the period amounted

to GBP170,100 (2020: GBPnil), included within the totals above.

7 Directors' remuneration

2021 2020

GBP GBP

Remuneration for qualifying services 608,693 247,157

Amounts paid in respect of departure agreement 258,923 -

Company pension contributions to defined contribution

schemes 2,618 -

870,234 247,157

Remuneration disclosed above include the following

amounts paid to the highest-paid director:

Remuneration for qualifying services 158,693 58,157

During the year, the Company ceased using the servicers of Carleton

Curtis, leading to a payment of 52 weeks' notice and other benefits,

totalling GBP258,923.

8 Finance income

2021 2020

GBP GBP

Interest income

Bank deposits 10,151 129

Total interest income for financial assets that are not held

at fair value through profit or loss was GBP10,151.

9 Taxation

The charge/credit for the year can be reconciled to the loss per

the income statement as follows:

2021 2020

GBP GBP

Loss before taxation (8,815,933) (2,727,195)

Expected tax credit based on a corporation tax

rate of 19% (2020: 19%) (1,675,027) (518,167)

Effect of expenses not deductible in determining

taxable profit 38,815 57,562

Unutilised tax losses carried forward 1,630,086 440,036

Permanent capital allowances in excess of depreciation (5,324) (911)

Share-based payment charge 11,450 21,480

Taxation charge/credit for the year/period - -

The Company has tax losses of GBP10,885,738 (2020: GBP2,306,341)

available to be carried forward against trading profits arising

in future periods. At this time, a deferred tax asset has not

been recognised due to insufficient certainty over the level of

future profits to utilise against this amount.

10 Earnings per share

The basic earnings per share is calculated by dividing the loss

attributable to equity shareholders by the weighted average

number of shares in issue.

2021 2020

No. No.

Number of shares

Weighted average number of ordinary shares

for basic earnings per share 515,708,522 160,342,559

Earnings GBP GBP

Loss for the period from continued operations (8,815,933) (2,727,195)

Earnings for basic and diluted earnings per

share being net loss attributable to equity

shareholders of the Company for continued operations (8,815,933) (2,727,195)

Earnings per share for continuing operations

Basic and diluted earnings per share pence (1.70) (1.70)

Outstanding warrants are non-dilutive given the loss for the

period.

11 Share-based payments

The following warrants over ordinary shares have been granted

by the Company and are outstanding:

Options/warrants Grant date Expiry period Exercise Outstanding Exercisable

price at 30 September at 30

2021 September

2021

24 months from the

18 February first anniversary

Warrants 2020 of admission GBP0.01 3,250,000 3,250,000

13 March 36 months from the

Warrants 2020 first vesting date GBP0.01 75,000 50,000

30 March

Warrants 2020 36 months GBP0.01 1,000,000 1,000,000

Warrants 9 June 2020 36 months GBP0.01 250,000 250,000

36 months from the

Warrants 18 June 2020 first vesting date GBP0.06 1,666,666 1,666,666

Warrants 19 June 2020 5 years from issue GBP0.06 6,963,000 6,963,000

36 months from the

Warrants 29 June 2020 first vesting date GBP0.06 250,000 83,333

36 months from the

Warrants 7 July 2020 first vesting date GBP0.06 225,000 75,000

5 August

Warrants 2020 36 months GBP0.06 250,000 250,000

7 August 36 months from the

Warrants 2020 first vesting date GBP0.06 500,000 166,667

14 August 36 months from the

Warrants 2020 first vesting date GBP0.06 750,000 250,000

17 August 36 months from the

Warrants 2020 first vesting date GBP0.06 1,000,000 333,333

20 August 36 months from the

Warrants 2020 first vesting date GBP0.06 1,000,000 333,333

28 August 36 months from the

Warrants 2020 first vesting date GBP0.06 150,000 50,000

2 October

Warrants 2020 5 years from issue GBP0.104 20,584,694 20,584,694

37,914,360 35,306,026

11 Share-based payments

Number of options Weighted

and warrants average

exercise

price

2021 2021

No. GBP

Brought forward at 1 October

2020 26,163,000 0.04

Granted in the

period 20,584,694 0.104

Forfeited in the period - -

Exercised in the period (3,000,000) 0.01

Lapsed in the period (5,833,334) 0.04

Outstanding at 30 September

2021 37,914,360 0.08

Exercisable at 30 September

2021 35,306,026 0.08

The weighted average remaining contractual life of options and

warrants as at 30 September 2021 is 3.3 years.

If the exercisable shares had been exercised on 30 September 2021

this would have represented 6.37% of the enlarged share capital.

At the grant date, the fair value of the warrants issued have

been determined using the Black-Scholes option pricing model.

Volatility was calculated based on data from comparable esports

companies, with an appropriate discount applied due to being an

unlisted entity at the grant date, if applicable. Risk-free interest

has been based on UK Government Gilt rates. The Company intends

to introduce a share-based payment scheme for employees, whereby

options are granted between 75,000 and 250,000 shares at an exercise

price of GBP0.08, vesting over three years.

12 Intangible assets

Website

costs

GBP

Cost

At 30 September 2020 39,078

Additions 34,903

At 30 September 2021 73,981

Amortisation and impairment

At 30 September 2020 3,077

Charge for the year 21,025

At 30 September 2021 24,102

Carrying amount

At 30 September 2021 49,879

At 30 September 2020 36,001

13 Property, plant and equipment

Office

equipment

GBP

Cost

At 30 September 2020 4,466

Additions 33,313

At 30 September 2021 37,779

Accumulated depreciation and impairment

At 30 September 2020 124

Charge for the year 8,058

At 30 September 2021 8,182

Carrying amount

At 30 September 2021 29,597

At 30 September 2020 4,342

14 Trade and other receivables

2021 2020

GBP GBP

Trade receivables 972,000 -

VAT recoverable 962,633 579,288

Other receivables 22,650 -

Prepayments 1,585,700 1,486,338

3,542,983 2,065,626

The directors consider that the carrying amount of trade and other

receivables is approximately equal to their fair value. No significant

receivable balances are impaired at the reporting date.

15 Financial instruments

2021 2020

GBP GBP

Financial assets measured

at amortised cost 11,043,655 2,517,734

Financial liabilities measured

at amortised cost 1,620,338 2,092,720

The directors consider the carrying amounts of financial instruments

in the financial statements approximate to their fair values.

16 Trade and other payables

2021 2020

GBP GBP

Trade payables 555,828 79,746

Accruals 146,527 227,974

Social security and other taxation 134,696 -

Other payables - 1,785,000

837,051 2,092,720

Other payables in 2020 relates to amounts paid in advance for

share capital issued post-period end.

17 Deferred revenue

2021 2020

GBP GBP

Arising from sponsorship income 783,288 -

All deferred revenues are expected to be recognised within 12

months from the reporting date.

18 Retirement benefit schemes

Defined contribution schemes

The Company operates a defined contribution pension scheme for

all qualifying employees. The assets of the scheme are held separately

from those of the Company in an independently administered fund.

The total costs charged to income in respect of defined contribution

plans is GBP18,388 (2020: GBPnil)

19 Share capital and premium

Number of Share capital Share premium Total

shares

No. GBP GBP GBP

At 1 October 2020 264,617,362 264,617 4,880,511 5,145,128

Issue of ordinary shares

(02/10/2020) 250,000,000 250,000 19,750,000 20,000,000

Issue of ordinary shares

(22/10/2020) 1,500,000 1,500 13,500 15,000

Issue of ordinary shares

(07/01/2021) 2,500,000 2,500 72,500 75,000

Share issue costs deducted

from share premium - - (2,073,794) (2,073,794)

At 30 September 2021 518,617,362 518,617 22,642,717 23,161,334

On 2 October 2020, in the Company's initial public offering,

250,000,000 ordinary shares were issued at GBP0.08 each (premium

of GBP0.079 per share). 4,000,000 ordinary shares have also been

issued which includes 3,000,000 on the exercise of Director warrants.

20 Operating lease commitments

Subsequent to the year end, the Company entered into a lease

for a 9,831 square foot building in a prime location in London's,

Shoreditch. The lease agreement is for ten years, which includes

a 26-month rent free period and has a five year break clause.

2021 2020

GBP GBP

Within one year - -

Between two and five years 1,900,000 -

In over five years - -

1,900,000 -

21 Financial commitments

In May 2020, the Company entered into an influencer agreement

with Footwork Productions Limited. Pursuant to this agreement,

Footwork will procure that David Beckham provides certain personal

services to the Company, including personal appearances and social

media posts. In addition Footwork will provide the Company with

a non-exclusive, non-transferable licence to use David Beckham's

name, voice, biography, image and likeness and signature to advertise

and promote the Company for a five-year term. In consideration

for these services the Company will pay Footwork an annual fee

equal to 15% of the net proceeds of all of the Company's merchandising

sales and 15% of all sponsorship revenue received in respect

of contracts entered into during the term. Such payments will

be subject to a minimum payment of GBP2,250,000 in the first

twelve-month period, and further annual minimum payments of GBP2,500,000

in the second year, GBP3,000,000 in the third year, GBP3,500,000

in the fourth year and GBP4,000,000 in the final year of the

term. Of these amounts, GBP10,500,000 is remaining as payable

over the next three years.

22 Events after the reporting date

In January 2022, the Company signed a new sponsorship deal with

BitStamp, one of the world's longest running crypto exchanges.

BitStamp will be given marketing rights and prominent exposure

across Guild's team jersey and digital content. The deal will

generate GBP4.5m in revenue for the Company over three years.

In December 2021, the Company entered into a lease for a 9,831

square foot building in a prime location in London's, Shoreditch.

The lease agreement is for ten years, which includes a 26-month

rent free period and has a five year break clause. When fully

operational, the building will be Guild's main headquarters,

featuring state-of-the-art spaces for Guild's pro teams, training

academy, event space, operations, and an entertainment hub. The

Guild headquarters is a major sponsorship asset.

23 Controlling party

The directors do not consider there to be an ultimate controlling

party.

24 Related-party transactions

During the period to 30 September 2021, Bad Moon Talent LLC,

a company for which Andrew Drake (non-executive director of Guild

Esports plc) is the CEO and 55% shareholder provided esports

consulting and talent agent services to the Company. The total

amount paid during the year was GBP37,475 and no amounts remained

payable at the year end.

During the period, Derek Lew and Andrew Drake (non-executive

directors of the Company) each exercised warrants of 1,500,000

ordinary shares at an exercise price of GBP0.01, on 22 October

2020 and 7 January 2021 respectively. The share price on these

dates was GBP0.07 and GBP0.06 respectively.

25 Cash absorbed by operations

2021 2020

GBP GBP

Loss for the year after tax (8,815,933) (2,727,195)

Adjustments for:

Investment income (10,151) (129)

Amortisation and impairment of intangible assets 21,025 3,077

Depreciation and impairment of property, plant

and equipment 8,058 124

Services settled by issue of shares - 144,900

Services settled by issue of warrants 60,265 113,050

Movements in working capital:

Increase in trade and other receivables (1,477,357) (2,065,626)

(Decrease)/increase in trade and other payables (1,255,669) 2,092,720

Increase in deferred revenue 783,288 -

Cash absorbed by operations (10,686,474) (2,439,079)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR BMMRTMTJJBJT

(END) Dow Jones Newswires

January 31, 2022 01:59 ET (06:59 GMT)

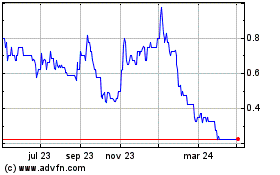

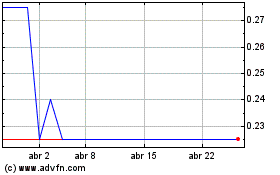

Guild Esports (LSE:GILD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Guild Esports (LSE:GILD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024