TIDMHDT

RNS Number : 1530G

Holders Technology PLC

28 March 2022

Holders Technology plc

("the Group")

Specialised PCB Materials, Lighting and Wireless Control

Solutions

Final results for the year ended 30 November 2021

Holders Technology plc (AIM: HDT) announces its audited results

for the year ended 30 November 2021.

The Group supplies specialty laminates and materials for printed

circuit board manufacture ("PCB") and operates as a Lighting and

Control Solutions ("LCS") provider. The Group operates from the UK

and from Germany, with PCB divisions and LCS divisions in each

country. In addition, LCS operates joint ventures in the UK,

Austria, New Zealand and Australia.

Revenue and profitability for all divisions improved during the

year, helped by a general improvement in economic conditions. On 30

September 2021 the Group disposed of certain commodity PCB assets

from the UK and Germany divisions.

An interim dividend of 0.50p per share was paid on 5 October

2021, and a special dividend of 2.0p per share was paid on 28

January 2022. The directors will recommend payment of a final

dividend of 0.50p per share, a total of 3.0p for the year (2020

total: 0.50p).

The results are summarised below.

2021 2020

GBP'000 GBP'000

--------------- --------

* Revenue PCB 7,920 7,314

LCS 4,466 2,524

--------------- --------

Group 12,386 9,838

* Gross Margins PCB 27.8% 24.4%

LCS 37.3% 36.5%

Group 31.2% 27.5%

* Operating Profit/ (Loss) PCB 434 102

LCS 32 (246)

Central costs (117) (105)

--------------- --------

349 (249)

445 -

* Net Profit on Disposal of Assets*

Finance Costs (10) (16)

Income from Joint Ventures 3 1

Group 787 (264)

* Profit/ (Loss) before Tax (92) -

Tax

Profit/ (Loss) after Tax 695 (264)

16.45p (6.25p)

* Basic and diluted EPS/ (LPS) 3.00p 0.50p

Dividend paid and proposed

Cash 3,192 1,113

* Profit on asset disposal GBP591,000 less related goodwill

impairment GBP146,000

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014 which has been

incorporated into UK law by the European Union (Withdrawal) Act

2018.

For further information, contact:

Holders Technology plc 01896 758781

Rudi Weinreich, Executive Chairman

Victoria Blaisdell, Group Managing Director

Paul Geraghty, Group Finance Director

Website www.holderstechnology.com

SP Angel Corporate Finance LLP - Nominated

Adviser & Broker 020 3470 0470

Matthew Johnson / Caroline Rowe

Chairman's statement

It is pleasing to be able to report that in the year to 30

November 2021, group turnover grew to GBP12,386,000 (2020:

GBP9,838,000), with the major part of that growth coming from our

LCS business.

The year saw a very significant development for the Group with

the sale of our commodity PCB product range. This has enabled us to

concentrate on a number of specialised PCB products whilst further

growing our LCS business. Further details of this transaction are

given in the Operating and Business review and the Financial

Review.

The disposal has further strengthened our cash position, with

cash at the end of the year being GBP3.1m (2020: GBP1.1m). In

recognition of this improved position, a special dividend of 2.0p

per share has been paid with the balance of the disposal proceeds

being available to further strengthen our growing LCS

activities.

LCS activities are primarily based in the Europe but during the

year, in order to extend our geographical coverage, we established

joint venture operations in New Zealand and Australia.

Shareholders will recognise that the expansion of our LCS

business will require significant investment to realise the

expansion which we believe to be possible. We have always been

financially conservative and will continue to be so and will

incline to writing off rather than capitalising such expenditures,

this may impact short term profitability.

The potential impact of recent events in Ukraine inevitably cast

a shadow over the immediate business outlook but we can say that,

in part due to the recent disposal of certain activities, we have a

strong balance sheet, and this coupled with the opportunities we

perceive leaves us, we believe, well positioned to meet the

challenges of the years ahead.

R W Weinreich

Executive Chairman

25 March 2022

Operating and Business Review

Corporate strategy

The Board seeks to enhance shareholder value over the medium to

long term. Our strategy to achieve this is to focus resources on

business activities which can generate profitable and sustainable

growth.

In doing so, we ensure that risk is carefully managed, and that

high standards of corporate governance and transparency are

maintained. Where a suitable investment opportunity is identified,

we invest within the bounds of internally generated cash flow and

bank facilities where appropriate.

Business strategy

The Group has operated for many years as a distributor of

specialised materials to the PCB industry in the UK and continental

Europe. The European PCB industry has strengths in the defence,

aerospace, automotive and medical sectors. The Group acts as an

exclusive supplier of technically sophisticated products to this

sector, providing technical support and local warehousing of

stock.

With volume PCB manufacture moving to China, the Group views the

PCB business as a steady revenue stream, but not one which will

provide significant growth to the Group. However, the Group does

expect future strong growth from the LCS divisions.

The Group's LCS products range from the sale of lighting

components to supporting customers with the design and assembly of

complete light engines. LCS divisions also offer a complete

ecosystem of wireless control solutions, project services and data

analytic solutions.

The Group's lighting components strategy is to provide a

competitive premium product range and value-added services to

lighting manufacturers in our markets. The Group's wireless

lighting controls strategy is to focus on the specification of the

wireless technology, as well as all project and data analytic

services to lighting specifiers, M & E consultants, as well as

building engineering companies.

The Group continues to expand its wireless controls business

into other geographical territories. In August 2021 the Group

established Holders Technology (New Zealand) Ltd and Holders

Technology Australia PTY Ltd, which sell wireless lighting control

solutions and all related project services and data analytics in

New Zealand and Australia.

Market Overview

PCB divisions in 2021 experienced significant instability, with

widespread raw material shortages and marked cost increases for

goods and freight. Alternative materials were sourced where

available, and existing goods were re-priced where possible. By the

year end, revenue had increased from GBP7.3m to GBP7.9m and

operating profitability improved from GBP102,000 to GBP554,000.

LCS divisions in 2021 recovered strongly after the effects of

the Covid-19 pandemic in 2020. LCS divisions' revenue grew from

GBP2.5m to GBP4.5m and operating profitability improved from

GBP246,000 loss to GBP32,000 profit.

Business Review

In 2021, the Group divested certain assets of its PCB business.

This enabled the Group to remain focused on the retained and more

technically sophisticated PCB products, rather than the more

commodity and lower margin products. This also provided the company

with additional cash reserves to invest in the higher growth LCS

divisions.

2021 was an exciting year in terms of our development and growth

of the LCS divisions. Highlights included the following:

-- Successful implementation of large commercial, industrial,

retail and hospitality projects with wireless controls hardware

provided by the Group, as well as a full range of project services.

These are a combination of new build as well as retrofit

projects.

-- Announcement of a strategic partnership with Tridonic, a

global leading provider of wireless emergency lighting systems. The

partnership enables Holders Technology to promote wireless

technology not only for standard luminaires, but also for emergency

luminaires within a building.

-- Acquisition of first customers for the Holders Technology

Data Analytics solution. Using the wireless lighting control

infrastructure, we are able to supply customers with energy,

lighting, and occupancy.

-- Broadening of our range of wireless control products and

supplier relationships, to ensure the largest and most complete

portfolio of products available in our markets.

-- Further investment in knowledgeable and experienced sales and

technical staff, across the Group.

-- Expansion outside of Europe to New Zealand and Australia,

leveraging our supplier base and European expertise to these new

joint venture companies.

Conclusion

2021 was a transitional year for the Group with divestment of

certain PCB assets and strengthening of our LCS businesses. In

2022, we expect our PCB business to have continuing strong demand

for the products we offer. For the LCS business, we plan further

staff recruitment and technology investment, to strengthen our

business and further enhance our product and services

portfolio.

Victoria Blaisdell

Group Managing Director

25 March 2022

Financial Review

Key performance indicators

The Board believes that the following key performance indicators

are of most significance to assessment of the Group's performance

and financial position:

-- Revenue

The turnover level is an important indication of the strength of

the Group's product range and coverage.

-- Profitability

Profitability is largely a function of the gross margins

achieved and management's success in containing administrative

expenses in relation to turnover.

-- Liquidity

The Group operates in a cyclical industry and the directors have

consistently adopted a conservative approach to financing the

Group's activities. The key measure is net liquid funds, as

described below.

-- Efficiency

Production efficiency is important in a competitive PCB

market.

Revenue

Group revenue from continuing operations increased from GBP9.8m

to GBP12.4m. Overall PCB revenue increased by 8.3%, whilst Lighting

and Controls revenue increased by 76.9%.

Profitability

The operating profit was GBP469,000 compared to an operating

loss of GBP249,000 in 2020. The gross profit margin was 31.2%

compared to 27.5% in 2020. Administration costs increased from

GBP2.6m to GBP3.0m (2020 costs were lower due to the implementation

of measures in response to the Covid-19 pandemic.) Administration

costs, however, fell as a proportion of revenue from 26.0% in 2020

to 24.2% in 2021.

PCB Asset Disposal

On 31 September 2021 the Group disposed of various PCB assets in

the UK and Germany comprising machinery and commercial information

relating to commodity materials used in the production of PCBs in

the European market. Proceeds of the disposal were GBP1,634,000 and

the profit on disposal was GBP471,000. Goodwill of GBP146,000

relating to the Germany PCB acquisition in 2003 was written off

following the disposal.

Post tax result

The profit for the financial year after tax, attributable to

equity shareholders was GBP695,000 (2020: loss of GBP264,000). The

basic and fully diluted earnings per share was 16.45p (2020: 6.25p

loss per share).

Principal risks and uncertainties

The directors believe that the following are the principal risks

and uncertainties faced by the Group:

-- Competition

Both the PCB and Lighting and Controls sectors are highly

competitive, and the Group faces competition from a wide range of

companies. The Group continually seeks the most cost-effective

sources for its products in order to remain competitive.

-- Customers

The Group is exposed to the risk of bad debts. Within the major

European markets, the Group uses credit analysis data to monitor

customer risk levels and maintain appropriate credit limits. Credit

insurance is used for UK and European customers whenever it is

economically available.

-- Suppliers

As with any distribution business, the Group is dependent on

maintaining supply. The Group has diversified its product range and

sources in order not to be overly dependent on any single

supplier.

-- Key Management

In order to ensure retention of key management, the Group offers

competitive remuneration, a stimulating working environment and

clear two-way communication.

-- Business Interruption

In order to minimise the impact of business interruption, the

Group offers dual capacity in UK and Germany, and holds appropriate

business interruption insurance.

-- Financial Control

Internal controls and multiple authorisation levels, with

monthly review of results and cash, are used to combat fraud and

potential misstatement of results.

-- Covid-19

The Covid-19 pandemic has created risks in terms of market

disruption and health risk to our workforce. The Group continues to

follow government health advice in respect of the Covid-19

virus.

Cash flow, liquidity and financing

The Group's cash position improved during the year. Cash

balances increased from GBP1,113,000 to GBP3,192,000. The

improvement principally arose from operating profits plus proceeds

from the PCB asset disposal. The Group does not currently require

or maintain an overdraft facility. A trade financing facility is

used for occasional letters of credit.

At 30 November 2021 the Group had net liquid funds (trade and

other receivables plus cash minus current liabilities excluding

lease liabilities) of GBP3.1m (2020: GBP1.3m). Net assets per

ordinary share at 30 November 2021 were GBP1.07 (2020:

GBP0.95).

Derivatives and other financial instruments

Operations are financed from retained profits. The Group's

financial instruments, other than forward currency contracts,

comprise cash and items, such as trade receivables and payables

that arise directly from its operations. The main purpose of these

instruments is to provide finance for operations if necessary. It

is, and has been throughout the period under review, the Group's

policy that no trading in financial instruments shall be

undertaken.

Currency risk and exposure

The Group enters into forward currency contracts that are used

to manage the currency risks arising from purchases from foreign

suppliers where the products are sold in local currencies. The

overseas sales operations during the year were predominantly in the

European Union. The Group has currency exposures primarily in US

dollars and Euros. Although daily transactional exposures are

regularly covered by forward contracts, the Group has an underlying

exposure, particularly to the Euro.

Net assets

Net assets at the 2021 year-end were GBP4,528,000 (2020:

GBP3,999,000).

Conclusion

The Group enters 2021 with a stronger balance sheet and

increased capacity for investment as new opportunities are

identified.

Paul Geraghty

Group Finance Director

25 March 2022

Group income statement for the year ended 30 November 2021

Note 2021 2020

GBP'000 GBP'000

--------------------------------------------- ----- -------- --------

Revenue 12,386 9,838

Cost of sales (8,516) (7,135)

----------------------------------------------- ----- -------- --------

Gross profit 3,870 2,703

Distribution costs (408) (348)

Administrative expenses (3,001) (2,562)

Impairment of goodwill (146) -

Other operating (expenses)/ income 8 (42)

----------------------------------------------- ----- -------- --------

Operating profit/ (loss) 323 (249)

Profit on disposal of assets 471 -

Income from joint ventures 3 1

Finance expense (10) (16)

----------------------------------------------- ----- -------- --------

Profit/ (loss) before taxation 787 (264)

Tax expense 2 (92) -

----------------------------------------------- ----- -------- --------

Profit/ (loss) after taxation

attributable to equity shareholders 695 (264)

----------------------------------------------- ----- -------- --------

Basic and diluted earnings/ (loss) per share 4 16.45p (6.25p)

----------------------------------------------- ----- -------- --------

Group statement of comprehensive income for the year ended 30

November 2021

2021 2020

GBP'000 GBP'000

-------------------------------------------- --------- ---------

Profit for the year 695 (264)

Items that may be reclassified subsequently

to profit or loss:

Exchange differences on translating

foreign operations (134) 120

---------------------------------------------- --------- ---------

Total comprehensive income/ (loss)

for the year 561 (144)

---------------------------------------------- --------- ---------

Statement of changes in equity for the year ended 30 November

2021

Group Share capital Share Capital Translation Retained Total equity

premium redemption reserve earnings

account reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- -------------- ------------- ------------- -------------- -------------- -----------------------

Balance at 1

December 2019 422 1,590 1 128 2,023 4,164

Dividends - - - - (21) (21)

Transactions

with owners - - - - (21) (21)

Loss for the

year - - - - (264) (264)

Exchange

differences

on

translating

foreign

operations - - - 120 - 120

--------------- -------------- ------------- ------------- -------------- -------------- -----------------------

Total

comprehensive

(loss)/

income for

the year - - - 120 (264) (144)

--------------- -------------- ------------- ------------- -------------- -------------- -----------------------

Balance at 30

November 2020 422 1,590 1 248 1,738 3,999

--------------- -------------- ------------- ------------- -------------- -------------- -----------------------

Dividends - - - - (32) (32)

Transactions

with owners - - - - (32) (32)

Loss for the

year - - - - 695 695

Exchange

differences

on

translating

foreign

operations - - - (134) - (134)

--------------- -------------- ------------- ------------- -------------- -------------- -----------------------

Total

comprehensive

income/

(loss) for

the year - - - (134) 695 561

--------------- -------------- ------------- ------------- -------------- -------------- -----------------------

Balance at 30

November 2021 422 1,590 1 114 2,401 4,528

--------------- -------------- ------------- ------------- -------------- -------------- -----------------------

Group balance sheet at 30 November 2021

2021 2020

GBP'000 GBP'000

---------------------------------- -------- --------

Assets

Non-current assets

Intangible fixed assets 220 381

Property, plant and equipment 82 219

Leased assets 97 341

Investments in joint ventures 111 28

Deferred tax assets 12 12

------------------------------------- -------- --------

512 981

---------------------------------- -------- --------

Current assets

Inventories 1,180 2,340

Trade and other receivables 1,593 1,420

Cash and cash equivalents 3,192 1,113

------------------------------------- -------- --------

5,965 4,873

Liabilities

Current liabilities

Trade and other payables (1,661) (1,274)

Lease liabilities (58) (105)

------------------------------------- -------- --------

(1,719) (1,379)

Net current assets 4,246 3,494

------------------------------------- -------- --------

Non-current liabilities

Retirement benefit liability (186) (223)

Lease liabilities (58) (244)

Deferred tax liabilities (9) (9)

------------------------------------- -------- --------

(230) (476)

---------------------------------- -------- --------

4,528 3,999

---------------------------------- -------- --------

Shareholders' equity

Share capital 422 422

Share premium account 1,590 1,590

Capital redemption reserve 1 1

Retained earnings 2,401 1,738

Cumulative translation adjustment

reserve 114 248

------------------------------------- -------- --------

4,528 3,999

---------------------------------- -------- --------

Statement of cash flows for the year ended 30 November 2021

2021 2020

GBP'000 GBP'000

----------------------------------------------------- -------- --------

Cash flows from operating activities

Profit/ (loss) before tax from

continuing operations 787 (264)

Depreciation 168 292

Gain on disposal of property,

plant and equipment (471) -

Impairment of goodwill 146 -

Decrease in inventories 1,093 284

(Increase)/ decrease in trade

and other receivables (527) 385

Increase/ (decrease) in trade

and other payables

Interest expense 702 (50)

10 16

----------------------------------------------------- -------- --------

Cash generated from operations 1,907 663

Interest paid (10) (16)

Tax paid (92) -

Income from investments (3) (1)

Net cash (used in)/ generated

from operations 1,801 646

-------------------------------------------------------- -------- --------

Cash flows from investing activities

Purchase of property, plant

and equipment (65) (25)

Investment in Joint Venture (80) (27)

Proceeds from sale of property, plant 553 -

and equipment

Net cash (used in)/generated from

investing activities 408 (52)

-------------------------------------------- --------- -------- --------

Cash flows from financing activities

Repayment of leases (37) (213)

Equity dividends paid (32) (21)

-------------------------------------------------------- -------- --------

Net cash used in financing activities (69) (234)

-------------------------------------------------------- -------- --------

Net change in cash and cash

equivalents 2,139 360

Cash and cash equivalents at

start of period 1,113 734

Effect of foreign exchange rates (61) 19

-------------------------------------------------------- -------- --------

Cash and cash equivalents at

end of period 3,192 1,113

-------------------------------------------------------- -------- --------

Notes

1. Basis of preparation

The Group and parent company financial statements have been

prepared in accordance with International Accounting Standards

(IAS), in conformance with the requirements of the Companies Act

2006. All accounting standards and interpretations issued by the

International Accounting Standards Board effective at the time of

preparing these financial statements have been applied.

2. Taxation

2021 2020

GBP'000 GBP'000

----------------------------------------------------------------- --------------- --------------

Analysis of the charge in the period

Current tax - Current period 92 -

Deferred tax charge - -

----------------------------------------------------------------- --------------- --------------

Total tax 92 -

----------------------------------------------------------------- --------------- --------------

Tax reconciliation

The tax for the period is lower (2020: lower) than the standard rate of corporation tax in

the UK, effectively 19.0% (2020: 19.0%) for the company's financial year. The differences

are explained below:

2021 2020

GBP'000 GBP'000

------------------------------------------------------------------------------------------------ --------- ---------

Profit/ (loss) before taxation 787 (264)

------------------------------------------------------------------------------------------------ --------- ---------

Profit/ (loss) before taxation multiplied by the rate of corporation tax in the UK of 19.0%

(2020: 19.0%) 150 (50)

Effects of:

Adjustment from prior years - -

Taxation losses (58) 50

Taxation 92 -

------------------------------------------------------------------------------------------------ --------- ---------

3. Dividends

The directors have proposed a final dividend of 0.50p per share

payable on 31 May 2022 to shareholders on the register at close of

business on 13 May 2022. The total dividend for the year, including

the interim dividend of 0.50p (2020: 0.25p) per share paid on 5

October 2021, and the special dividend of 2.00p (2020: nil) per

share paid on 28 January 2022, amounts to GBP127,000 (2020:

GBP21,000), which is equivalent to 3.00p (2020: 0.50p) per

share.

4. The basic and diluted earnings per share are based on the

profit for the financial year of GBP787,000 (2020: loss of

GBP264,000) and on ordinary shares of 4,224,164 (2020: 4,224,164

shares), the weighted average number of shares in issue during the

year. There were no share options in issue during either year.

5. This statement, which has been approved by the Board on 25

March 2022, is not the Company's statutory accounts. The statutory

accounts for each of the two years to 30 November 2020 and 30

November 2021 received audit reports which were unqualified and did

not contain statements under section 498(2) and section 498(3) of

the Companies Act 2006. The 2020 accounts have been filed with the

registrar of Companies, but the 2021 statutory accounts are not yet

filed.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UBSWRUSUOUAR

(END) Dow Jones Newswires

March 28, 2022 02:00 ET (06:00 GMT)

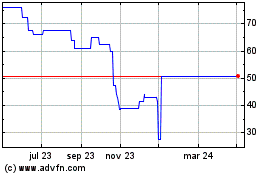

Holders Technology (LSE:HDT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Holders Technology (LSE:HDT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024