TIDMIAT

LEGAL ENTITY IDENTIFIER: 549300YM9USHRKIET173

INVESCO ASIA TRUST PLC

Half-Yearly Financial Report for the Six Months to 31 October 2022

Investment Objective

The Company's objective is to provide long-term capital growth and income by

investing in a diversified portfolio of Asian and Australasian companies. The

Company aims to achieve growth in its net asset value (NAV) total return

in excess of the Benchmark Index, the MSCI AC Asia ex Japan Index

(total return, net of withholding tax, in sterling terms).

Financial Information and Performance Statistics

The benchmark index of the Company is the MSCI AC Asia ex Japan Index (total

return, net of withholding tax, in sterling terms).

Six Months Year ended

to

31 October 30 April

Total Return Statistics(1) (dividends reinvested) 2022 2022

Net asset value (NAV)((2) -13.1% -6.7%

Share price(2) -15.5% -10.0%

Benchmark index(3) -15.3% -12.9%

Capital Statistics

At At

31 October 30 April

2022 2022 change %

Net assets (£'000) 219,021 252,176 -13.1

NAV per share(2) 327.62p 377.21p -13.1

Share price(1) 281.00p 332.50p -15.5

Benchmark index (capital) 851.09 1,023.11 -16.8

Discount(2) per ordinary share (14.2)% (11.9)%

Average discount over the six months/year(1)(2) (12.4)% (9.5)%

Gearing(2):

- gross 4.2% 2.2%

- net 3.6% 1.6%

- net cash nil nil

(1) Source: Refinitiv.

(2) Alternative Performance Measures (APM), see below for the explanation

and reconciliations of APMs. Further details are provided in the Glossary of

Terms and Alternative Performance Measures in the Company's 2022 Annual

Financial Report.

(3) Index returns are shown on a total return basis, with dividends

reinvested net of withholding taxes.

Chairman's Statement

Highlights:

. NAV total return of -13.1% outperformed the benchmark index total return of

-15.3%;

. While the relative performance numbers for the last six months are good, the

absolute falls are clearly not; and

. The fact that Asian stock market valuations are so cheap compared to their

long-term averages is perhaps the most compelling factor.

Performance over the six months to 31 October 2022 was again ahead of our

benchmark: NAV per share total return was -13.1% versus the MSCI AC Asia

ex Japan Index at -15.3%. The share price total return was -15.5% with the

discount widening from 11.9% to 14.2% over the period. Performance numbers are

shown as total return net of withholding tax in sterling terms.

The three-yearly continuation vote was held at the Company's Annual General

Meeting (AGM) on 8 September 2022 and passed with votes in favour representing

99.45% of shareholders. It was pleasing to see so many shareholders attending

the AGM in person once again. We enjoyed answering all of your questions.

A half-yearly dividend of 7.20p was paid on 24 November 2022 in accordance with

our policy of paying two dividends per year each amounting to approximately 2%

of NAV. With the discount at 14.2% at 31 October 2022, this policy puts the

current annual dividend yield on the share price at 5.3%, based on the share

price of 281.00p at 31 October 2022.

In August 2020 the Board undertook to effect a tender offer for up to 25% of

the Company's issued share capital at a discount of 2% to the prevailing NAV

per share (after deduction of tender costs) in the event that the Company's NAV

cum-income total return performance over the five year period to 30 April 2025

fails to exceed the Company's comparator index, the MSCI AC Asia ex Japan Index

(net of withholding tax, total return in sterling terms) by 0.5% per annum over

the five years on a cumulative basis. Shareholders already have the opportunity

to vote on the continuation of the Company every three years, but the Board

believes that also providing shareholders with the option to tender a

proportion of their shares for a cash price close to NAV, if the Company

underperforms, constitutes a pragmatic and attractive initiative, particularly

if the shares were to be trading at a material discount at the time.

We are now halfway through this five-year period over which the performance of

the Company will be assessed: the Company's NAV is up by 26.7% over the 2.5

years while the index is down by 0.6%. On an annualised basis, NAV is up by

9.9% p.a. while the index is down by 0.2% p.a.

The Board has now settled back to its normal number of four Directors. As

planned, and reported in our previous report, Myriam Madden has taken over as

Audit Chair and Vanessa Donegan as both Senior Independent Director and Chair

of the Remuneration Committee. Sonya Rogerson joined us on 26 July 2022 as a

Non-Executive Director. Fleur Meijs retired on 1 August 2022 and Owen Jonathan

retired at the end of the AGM on 8 September 2022. Fleur and Owen leave with

the Company in good shape and we thank them again for their contributions.

Our Co-Portfolio Managers undertake company meetings as a regular part of their

job, sometimes at the companies' headquarters, sometimes elsewhere. Every

two years or so, the Board accompanies them on one of their fact finding trips.

The last trip was to South Korea and Taiwan in November 2019. In January 2023,

we visited companies in Indonesia and Singapore and were all struck by the

sharp contrast between the gloom and doom of the West and the positive outlook

held by nearly everyone we met.

Cumulative Total Return (dividends reinvested) to 31 October 2022(1)

One Three Five Ten

Year Years Years Years

Net asset value -14.2% 18.1% 14.3% 147.8%

(NAV)

Share price -20.0% 16.3% 14.6% 145.9%

Benchmark index -21.4% -3.0% -2.7% 70.9%

(2)

(1) Source: Refinitiv.

(2) The benchmark index of the Company was changed on 1 May 2015 to the MSCI AC

Asia ex Japan Index from the MSCI AC Asia Pacific ex Japan Index (both indices

total return, net of withholding tax, in sterling terms).

Shareholders will know that we believe that the discount is determined by a

combination of demand for Asian equity investment vehicles, the Investment Case

for Invesco Asia Trust and the Corporate Proposition that we offer. In order to

stimulate more demand for the Company's shares, we aim to provide a strong

investment case and a strong corporate proposition at the same time.

The Investment Case rests on accessing the attractions of Asian equity markets

through the institutional expertise of Ian Hargreaves and Fiona Yang's team at

Invesco. The Co-Portfolio Managers' investment process can be summarised as

'valuation not value' and has been very successful in attracting institutional

investors such as pension funds and sovereign wealth investors. In times like

these of great change, we would argue that this forward-looking active approach

(as opposed to a backward-looking index or passive style) is exactly what is

needed. Invesco Asia Trust is the only way for individual investors to access

Ian and Fiona's expertise.

The Company's Corporate Proposition was first introduced in the Half-Yearly

Financial Report to 31 October 2018. Since then the Board has continued to

review and adopt measures intended to create additional demand for the

Company's shares, both from existing and new shareholders, and to reduce the

discount. We have been careful to ensure that the measures chosen are in the

best interests of all shareholders. The intention is that these gains will

combine to make the corporate proposition as compelling as the investment case.

The multiple elements to our Corporate Proposition are detailed in the 2022

Annual Financial Report's Chairman's Statement and include a three-yearly

continuation vote (the next one being due in September 2025), an enhanced

dividend policy, a performance conditional tender, a strong integrated ESG

approach, engaging more individual shareholders, the ability for shareholders

to meet both the Co-Portfolio Managers and the Directors, close management of

ongoing charges and fees, the active use of gearing, the 'skin in the game' of

Directors' and Managers' shareholdings and the authority to buy back shares.

Update

From 31 October 2022 to 25 January 2023, the NAV total return has been 26.4%,

outperforming the index return of 20.4%. The share price total return has been

33.5%, with the discount narrowing to 9.7%.

Outlook

While the relative performance numbers for the last six months are good, the

absolute falls are clearly not. Writing six months ago, I noted surprise that

Asia had held up so well in the face of China tensions, the Russian invasion of

Ukraine and global economic turmoil. With no respite from any of these and new

concerns arising, some stock market weakness was perhaps inevitable. Ian and

Fiona go into detail in their Managers' Report.

Looking forward, I have to start by being honest that the short term outlook

remains highly uncertain. It will not be easy for anyone to perform well over

the next twelve months. However, if you are free from worrying about monthly or

quarterly performance and are able to take a long term view, then the

decision-making seems to become a lot easier. The fact that Asian stock market

valuations are cheap compared to their long-term averages is perhaps the most

compelling factor. Yet by the end of 2023, many of the current headwinds should

have calmed or could even become tailwinds: global inflation is likely to peak

early in 2023. One way or the other, Covid should become less of a problem for

China. The economic strength (and lack of inflation) in many Asian countries

should allow them to grow their economies faster than those in the West.

Remember, stock markets are usually lead indicators.

This is one of the main reasons why the Company has not undertaken any share

buybacks in the last six months even though the discount of the Company's share

price to its NAV is above the Board's target of 10%. We believe that the

Investment Case for the Company is strong and so too is the combination of

policies enshrined in our Corporate Proposition. The next period is quite

likely to be a very attractive long-term opportunity for shareholders. We

simply do not want to stand in their way.

Neil Rogan

Chairman

26 January 2023

Portfolio Managers' Report

Q How has the Company performed in the period under review?

A The Company's net asset value (NAV) decreased by 13.1% (total return, in

sterling terms) over the six months to 31 October 2022, which compares to the

benchmark MSCI AC Asia ex Japan Index return of -15.3%.

It has been a weak and volatile period for global markets. The Russia-Ukraine

conflict and resurfacing US-China tensions have added geopolitical uncertainty

to the backdrop as investors worry about the pace of US Federal Reserve

tightening and the prospect of inflation and recession - or stagflation. Asian

equity markets have generally weakened, as have currencies relative the US

dollar, prompting central banks (China being the notable exception) to tighten

policy in response. However, domestic macro conditions in Asia remained largely

stable, notwithstanding a resurfacing of concerns related to China's property

markets and Zero Covid Policy.

While it is chastening to report a double-digit percentage decline in the

Company's NAV over the period, we have continued to outperform the benchmark

index, benefitting from strong stock selection across different countries and

sectors. Having a balanced portfolio has helped in terms of relative

performance, avoiding expensive areas of the market such as profitless

technology and electric vehicle (EV) companies.

Asian markets have been more volatile than usual in 2022, but we find grounds

for cautious optimism.

Q What have been the biggest contributors?

A India's equity market has proved to be remarkably resilient so far this year,

with the portfolio's holdings in financials and other cyclicals making a strong

contribution to relative performance thanks to some positive earnings results

and the improved macro backdrop.

ICICI Bank was the biggest single contributor: its near-term outlook remains

strong with margins likely to inch up with rising rates, a pick-up in growth

across business lines and, a benign credit cycle. Engineering and construction

conglomerate Larsen & Toubro also benefitted from solid earnings results, with

a healthy orderbook providing growth visibility and, although its valuation is

less attractive after recent share price strength, there is scope for further

positive earnings surprises given the supportive macro backdrop in India.

ASEAN banks contributed positively, as did stock selection in insurers as gains

from QBE Insurance and Samsung Fire & Marine more than offset the drag from

holding Ping An Insurance. The portfolio's overweight position in Indonesia

also continued to add value.

Elsewhere, Samsonite International enjoyed a rebound in sales and raised its

full year revenue guidance given a solid recovery in travel demand in North

America and Europe. Chinese wind turbine manufacturer MingYang Smart Energy

benefitted from expectations of a second half pick-up in installation projects,

while easing commodity prices were seen helping margins recover. Finally, the

portfolio's underweight in the technology sector, particularly semiconductor

companies, benefitted relative performance, with a positive impact from stock

selection in technology hardware, with holdings such as Chroma ATE, Largan

Precision and Hon Hai Precision Industry contributing positively.

Q And detractors?

A China has been the portfolio's biggest source of weakness, with investor and

consumer confidence badly dented by the authorities' adherence to a Zero Covid

Policy. Specific concerns surrounding geopolitical and real estate risks have

compounded macroeconomic uncertainty.

Against this backdrop, the biggest detractors to relative performance were

Chinese internet companies JD.com, NetEase and Tencent, followed by

property-related stocks Suofeiya Home Collection and China Overseas Land &

Investment. While it was disconcerting to see such significant share price

falls, we remained mindful that stock markets are prone to overreaction in

times of uncertainty.

Q How has the portfolio's positioning in China changed?

A Recent market volatility gave us an opportunity to introduce three new

holdings: restaurant operator Jiumaojiu International, China Communications

Services and China Meidong, an auto dealership and maintenance group. We have

also added to the recently introduced Hansoh Pharma and aluminium auto parts

manufacturer Minth. In turn, we sold Pacific Basin Shipping and have taken some

profits from recent outperformers such as Samsonite International, MingYang

Smart Energy and Autohome.

The biggest change over the last two years has been the reduction in the

portfolio's underweight position in China, where valuations had fallen to

deeply discounted levels (see chart in the 2022 Half-Yearly Financial Report).

At times during the recent reporting period that felt increasingly

uncomfortable, as concerns mounted to such an extent that one sell-side analyst

declared China 'uninvestable'. However, we felt comfortable leaning into

weakness for several reasons.

Firstly, we felt that we had passed the peak in regulatory tightening, be that

on 'new economy' sectors or property developers. Geopolitical risk is hard to

analyse. Tensions in China's relationship with Taiwan remain in focus, but

there has been no change in our view that the probability of military conflict

is very low on a medium-term view. The US government's new rules barring China

from accessing technology essential for producing advanced chips are more

tangible, making stock picking ever important. The biggest source of

uncertainty was China's Zero Covid Policy, which was being tightly adhered to.

However, while we could see China learning to live with the virus on a

medium-term view, there was no visibility on how/when restrictions might be

lifted in the near-term.

Events in October 2022 tested our conviction: Xi Jinping's reappointment as

leader of the Communist Party, supported by the Politburo Standing Committee of

his appointed loyalists, was interpreted by the market as offering less

likelihood of any change in direction on government policy. To foreign

investors the prevailing picture has been that President Xi was focused on

political control and stability rather than economic reform and development.

However, we had not been expecting a big change in the direction of economic

policy, rather that the focus was likely to remain on improving the quality,

rather than quantity, of growth and reducing financial risk in the system.

Q Can you update us on recent developments?

A The news flow since the Party Congress concluded has been remarkable, with

markets caught off guard by the speed of change in direction of policy. There

have been three key changes:

a. End of Zero Covid: initially a loosening or 'optimisation' of restrictions,

to help local governments and health authorities tackle the spread of Omicron.

Quarantine requirements have been reduced, with the resumption of international

flights. State media have also started to openly discuss the milder symptoms

associated with Omicron, with greater encouragement for the elderly to get

fully vaccinated.

b. Property sector support: a comprehensive 16-point plan was announced in

November 2022, with measures including an easing of funding constraints for

cash-strapped private developers, a cut in mortgage rates and a loosening of

purchase restrictions to help stimulate demand.

c. Shift to 'pro-growth': the annual Central Economic Work Conference, which

convened in mid-December 2022 shortly after Covid restrictions were abandoned,

set the target of "promoting overall economic improvement," with an emphasis on

boosting consumer confidence and supporting the private sector. There was

support for China's digital economy, with platform enterprises called on to

'fully display their capabilities', and a move to 'normalise' the regulatory

regime.

Q Is the risk-reward in China still attractive?

A The abrupt abandonment of Zero Covid has led to western media headlines about

a pending humanitarian crisis. The hard truth is that China's peak in

hospitalisations and deaths, so far avoided, is happening in a short and sharp

spike, which could be cleared by spring. With fatality rates for Omicron having

collapsed elsewhere, a manageable outcome can be hoped for.

The domestic economy can expect to see a post-pandemic recovery like that seen

in the rest of the world, buoyed by returning consumer confidence. However,

this is coinciding with a slowdown in global growth as developed market demand

rolls over, which will negatively impact China's manufacturing sector. Much

also depends on confidence returning to the residential property market, which

is not a bubble as some would have us believe. Reassuringly, the household

savings ratio in China is estimated to be around 30% of disposable income,

compared to the typical 10-15%, its highest level in a decade.

However, once China's economy reopens fully, it is likely to revert to a slower

growth glide path. While policy is currently being eased, we expect it to

remain orthodox, with the authorities likely to tighten again to avoid any

overheating in the economy. Policy uncertainty risk also lingers longer-term

with regulators remaining active, if more supportive at present. That said,

quality companies that are trading cheaply relative to their own history are

still available in China. Our focus remains on companies facing temporary

challenges that we believe have strong market positions, conservative balance

sheets and under-appreciated earnings growth potential. We are taking care not

to assume reversion to pre-pandemic levels of growth or rating, but even after

the recent rebound, the market continues to trade at deeply discounted levels.

Prospective returns still have the potential to be very strong from here.

Q How has the rest of Asia been dealing with inflation and higher interest

rates?

A Inflation remains a developed market problem. Although food and energy prices

have picked up a bit in Asia, they remain at levels central banks are

comfortable with. Interest rates have been raised in most countries (China the

main exception) to try to counter rising prices and to support currencies,

although there has been little success with the latter. While we continue to

monitor the situation, it is not a great concern. Asian countries are generally

much earlier in their economic cycles, with warning signs such as high credit

growth and deteriorating external accounts still absent, in fact there is slack

in most economies. As inflation shows signs of peaking, expectations are that

tightening will be paused in most of Asia, with room to ease next year should

global growth slow more sharply than expected.

The portfolio has also demonstrated a positive sensitivity to rising interest

rates, with banks such as United Overseas Bank and KB Financial being

beneficiaries. However, there comes a point when rising interest rates begin to

create concern about growth and thus asset quality for banks, which is why we

took the decision to sell KB Financial. Korea has seen a relatively large

expansion in credit over the last two years, making it more vulnerable. In

Singapore, however, the cycle indicators that we track are still pointing to

relatively low risk when it comes to banks. Total credit from banks has barely

increased as a percentage of GDP in the last seven years and retail credit has

declined. Property prices have been declining relative to incomes, another

indicator that the Singapore economy is not over-heating.

Q Where else are you seeing opportunities in Asia?

A We believe there is a definite opportunity in South Korea, one of the worst

performing equity, bond and FX markets in Asia in 2022. This is not overly

surprising given concerns about a global cyclical slowdown, a weakening tech

cycle, and elevated oil prices which hit Korea's external balance. However,

while the near-term outlook remains uncertain, we are very comfortable with the

stocks we hold on a three-to-five-year view.

Detractors are generally quick to point out that Korea has always been cheap,

with a 'Korea discount' due to factors such as geopolitical risk, the cyclical

nature of its economy, as well as governance concerns given low dividend

payouts and the dominance of opaque conglomerates known as chaebols. We believe

there are reasons for the discount to narrow, while also noting that we can

still make attractive absolute returns in Korea without it doing so as

companies grow their earnings.

Over the period we introduced LG Household & Healthcare, a major Korean

consumer goods company that manufacture cosmetics, household products and

beverages. Whilst Covid lockdowns in China and travel disruption have had a

negative impact on sales and earnings, these are temporary issues which we

believe have disproportionately affected the share price. Indeed, around half

of the company's revenue is from the more stable beverage and household goods

segment, which has been resilient in the current environment, while a recovery

in travel demand is likely to bolster demand for China onshore cosmetics.

We also added to existing holdings, including another LG company. LG Chemical

is the largest maker of EV batteries outside China, leaving it well positioned

to benefit from geopolitical concerns as US car companies look to source EV

batteries from outside China. LG Chemical also has a very promising business

providing some of the chemicals and materials which go into EV batteries - a

separately listed subsidiary trading at double the company's market

capitalisation.

Q Do you still favour Indonesia?

A Very much so. The market has performed well so far this year, with the

economy appearing to have scope for better growth after a weak period,

supported by the commodity cycle and current account surplus. Near-term

uncertainty is starting to lift and valuations still appear attractive. We have

sold Telkom Indonesia, which had outperformed and was appearing fully valued,

and trimmed exposure to PT Bank Negara Indonesia Persero and Astra

International, taking advantage of share price strength.

In turn, we have added Semen Indonesia, the country's largest cement company

with about 50% market share. There is no new capacity coming in Indonesia and

with no new disruptors entering the market we believe we can see an improvement

in the company's utilisation rates, margins and profitability. Free cash flow

generation looks strong, the balance sheet is relatively healthy with low debt

levels and the valuation multiples are low - price to book ratio is 0.9x. (See

ESG section in the 2022 Half-Yearly Financial Report for more perspective on

our evaluation of investment risk here).

Q Finally, you remain underweight tech, is there an opportunity to add

exposure?

A Weakness in the tech sector is bringing valuation levels down to more

reasonable levels. It is an area we are monitoring closely but have yet to take

any action, with the exception of adding to Samsung Electronics, which is

trading at close to trough valuations in terms of price/book. The memory

semiconductor market is going through a sharp downturn at present, as is normal

for the industry, but these downcycles tend to be relatively short in duration,

and we know that an upcycle is inevitable at some stage in our investment

horizon. The first signs of an end to the downcycle are capex cuts from weaker

players in the market, and the very recent news is encouraging on this front.

Expectations are for flat capex growth in 2022 after 25% growth in 2021, and

2023 will almost certainly be down on 2022.

Buying Samsung at or close to book value has always been a strategy that has

made attractive returns in the past. The company is also well positioned to win

more customers in the current geopolitical climate where Western companies are

wary of depending too much on Chinese or Taiwanese suppliers.

Recent news-flow also suggests that Samsung plans to set up a task force to

enhance shareholder returns. The recent growth in retail ownership has

coincided with a falling share price, with analysts estimating that 5.9 million

of the new entrants on its shareholder register are in loss making territory,

which is equivalent to 12% of the population of Korea. The company has plenty

of options with US$100 billion of cash on the balance sheet, so a dividend hike

seems a natural solution.

Q Final thoughts?

A Asian equity markets are not immune to global macro headwinds, but conditions

in Asia should continue to remain largely stable in 2023. Many countries in the

region are at an earlier stage in their economic cycle, with rising incomes and

consumer penetration a tailwind to structural demand.

The improved visibility on China's reopening is a significant positive and

combined with the property market support and signs that regulatory headwinds

are abating, provides us grounds to believe that the outlook for corporate

earnings and broader economic growth should be supportive after downgrades in

2022.

Although equity market valuations for Asia, as measured by traditional metrics

such as price to book ratios, have recovered in recent months from deeply

discounted to more reasonable levels, they continue to trade at a significant

discount to US and world equity market averages. Asia's underperformance has

lasted more than a decade. Although this was justifiably driven by lower

earnings growth compared to US equities when denominated in US-dollars, this

may change. US-dollar strength is being challenged by an imminent recession in

the US to root out inflation. While inflation in the US may be stickier than

expected it is declining, which may lead to an easing of financial conditions

at a time when Asia is recovering. Inflation is less of an issue in Asia which

provides some policy flexibility. We believe there is great potential for a

narrowing of Asia's valuation discount.

Ian Hargreaves & Fiona Yang

Portfolio Managers

26 January 2023

Principal Risks and Uncertainties

The Board has carried out a robust assessment of the principal and emerging

risks facing the Company. These include those that would threaten its business

model, future performance, solvency and liquidity. In carrying out this

assessment, the Board together with the Manager have considered emerging risks

such as geopolitical risks, evolving cyber threats and climate related risks.

These risks also form part of the principal risks identified and the mitigating

actions are detailed below. In the view of the Board, these principal risks and

uncertainties are as much applicable to the remaining six months of the

financial year as they were to the six months under review.

Category and Principal Risk Description Mitigating Procedures and Controls Risk trend

during the

period

Strategic Risk

Market Risk The Company has a diversified investment Increased

The Company's investments are mainly portfolio by country, sector and stock.

traded on Asian and Australasian stock Its investment trust structure means no

markets as well as the UK. The forced sales need to take place and

principal risk for investors in the investments can be held over a longer

Company is a significant fall and/or a term horizon. However, there are few

prolonged period of decline in these ways to mitigate absolute market risk

markets. This could be triggered by because it is engendered by factors

unfavourable developments within the which are outside the control of the

region or events outside it. Board and the Manager. These factors

include the general health of the world

economy, interest rates, inflation,

government policies, industry

conditions, and changing investor demand

and sentiment. Such factors may give

rise to high levels of volatility in the

prices of investments held by the

Company.

Geopolitical Risk The Manager evaluates and assesses Increased

Political developments can create risks political risk as part of the stock

to the value of the Company's assets, selection and asset allocation policy

such as political changes in the US and which is monitored at every Board

Asia regions, and the war in Ukraine. meeting. This includes political,

Political risk has always been a military and diplomatic events and

feature of investing in stock markets changes to legislation. Balancing

and it is particularly so in Asia. Asia political risk and reward is an

encompasses a variety of political essential part of the active management

systems. There are many examples of process.

diplomatic skirmishes and military

tensions and sometimes these resort to

military engagement. Moreover, the

involvement in Asian politics of the US

and European countries can reduce or

raise tensions.

Investment Objectives and Strategy The Board receives regular reports Unchanged

The Company's investment objectives and reviewing the Company's investment

structure are no longer meeting performance against its stated

investors' demands. objectives and peer group, and reports

from discussions with its brokers and

major shareholders. The Board also has a

separate annual strategy meeting.

Wide Discount The Board receives regular reports from Increased

Lack of liquidity and lack of both the Manager and the Company's

marketability of the Company's shares broker on the Company's share price

leading to stagnant share price and performance, level of share price

wide discount. discount to NAV and recent trading

activity in the Company's shares. The

A persistently high discount may lead Board has introduced initiatives to help

to buybacks of the Company's shares and address the Company's share rating

result in the shrinkage of the Company. including a performance conditional

tender in 2025 and the enhanced dividend

policy. It may seek to reduce the

volatility and absolute level of the

share price discount to NAV for

shareholders through buying back shares

within the stated limit. The Board also

receives regular reports on marketing

meetings with shareholders and

prospective investors and works to

ensure that the Company's investment

proposition is actively marketed through

relevant messaging across many

distribution channels.

Investment Management Risk

Performance The Board regularly compares the Unchanged

That the Portfolio Managers Company's NAV performance over both the

consistently underperform the benchmark short and long term to that of the

and/or peer group over 3-5 years. benchmark and peer group as well as

reviewing the portfolio's performance

against benchmark (attribution) and risk

adjusted performance (volatility, beta,

tracking error, Sharpe ratio) of the

Company and its peers.

ESG including climate risk ESG considerations are integrated as Unchanged

Risks associated with climate change part of the investment decision-making

and ESG considerations could affect the in constructing the portfolio. Such

valuation of the Company's holdings. investment decisions include the

transactions undertaken in the period,

the review of active portfolio positions

and consideration of the gearing

position and, if applicable, hedging.

The process around ESG is described in

the ESG Monitoring and Engagement

section in the 2022 Half-Yearly

Financial Report.

Key Person Dependency The appointment of Fiona Yang as Unchanged

Either or both of the Portfolio Co-Portfolio Manager has mitigated the

Managers (Ian Hargreaves and risk of key person dependency. Also, the

Fiona Yang) ceases to be Portfolio Portfolio Managers work within and are

Manager or are incapacitated or supported by the wider Invesco Asian and

otherwise unavailable. Emerging Markets Equities team, with Ian

Hargreaves and William Lam as Co-Heads

of this team.

Currency Fluctuation Risk With the exception of borrowings in Unchanged

Exposure to currency fluctuation risk foreign currency, the Company does not

negatively impacts the Company's NAV. normally hedge its currency positions

The movement of exchange rates may have but may do so should the Portfolio

an unfavourable or favourable impact on Managers or the Board feel this to be

returns as nearly all of the Company's appropriate. Contracts are limited to

assets are non-sterling denominated. currencies and amounts commensurate with

the asset exposure. The foreign currency

exposure of the Company is reviewed at

Board meetings.

Third-Party Service Providers Risk

Unsatisfactory Performance of Details of how the Board monitors the Unchanged

Third-Party Service Providers services provided by the Manager and

Failure by any third-party service other third-party service providers, and

provider to carry out its obligations the key elements designed to provide

to the Company in accordance with the effective internal control, are included

terms of its appointment could have a in the internal control and risk

materially detrimental impact on the management section in the 2022 Annual

operations of the Company and could Financial Report on page 23.

affect the ability of the Company to

successfully pursue its investment

policy and expose the Company to

reputational risk. Disruption to the

accounting, payment systems or custody

records could prevent the accurate

reporting and monitoring of the

Company's financial position.

Information Technology Resilience and The Board receives regular updates on Unchanged

Security the Manager's information and cyber

The Company's operational structure security. This includes updates on the

means that all cyber risk (information cyber security framework, staff resource

and physical security) arises at its and training, and the testing of its

Third Party Service Providers ('TPPs'). security systems designed to protect

This cyber risk includes fraud, against a cyber security attack.

sabotage or crime perpetrated against

the Company or any of its TPPs. As well as conducting a regular review

of TPPs audited service organisation

control reports by the Audit Committee,

the Board monitors TPPs' business

continuity plans and testing including

the TPPs' and Manager's regular 'live'

testing of workplace recovery

arrangements should a cyber event occur.

Operational Resilience The Manager's business continuity plans Unchanged

The Company's operational capability are reviewed on an ongoing basis and the

relies upon the ability of its TPPs to Directors are satisfied that the Manager

continue working throughout the has in place robust plans and

disruption caused by a major event such infrastructure to minimise the impact on

as the Covid-19 pandemic. its operations so that the Company can

continue to trade, meet regulatory

obligations, report and meet shareholder

requirements.

The Manager has arrangements and

prioritises between work deemed

necessary to be carried out on business

premises and work from home arrangements

should it be necessary, for instance due

to further restrictions. Any meetings

are held in person, virtually or via

conference calls. Similar working

arrangements are in place for the

Company's third-party service providers.

The Board receives regular update

reports from the Manager and TPPs on

business continuity processes.

Twenty-five Largest Holdings

At 31 October 2022

Ordinary shares unless stated otherwise

? The sector group is based on MSCI and Standard & Poor's Global Industry

Classification Standard.

At

Market

Value % of

Company Sector? Country £'000 Portfolio

Samsung Electronics Technology Hardware and Equipment South 15,469 6.8

Korea

Taiwan Semiconductor Semiconductors and Semiconductor Taiwan 13,332 5.9

Manufacturing Equipment

TencentR Media and Entertainment China 10,334 4.5

Housing Development Banks India 9,912 4.4

Finance Corporation

AlibabaR Retailing China 7,947 3.5

AIA Insurance Hong Kong 7,178 3.2

ICICI Bank - ADR Banks India 6,718 2.9

Astra International Automobiles and Components Indonesia 6,703 2.9

JD.comR Retailing China 6,202 2.7

MingYang Smart EnergyA Capital Goods China 5,634 2.5

United Overseas Bank Banks Singapore 5,597 2.4

QBE Insurance Insurance Australia 5,025 2.2

PT Bank Negara Indonesia Banks Indonesia 4,984 2.2

Persero

POSCO Materials South 4,758 2.1

Korea

Gree Electrical Consumer Durables and Apparel China 4,737 2.1

AppliancesA

Aurobindo Pharma Pharmaceuticals, Biotechnology India 4,735 2.1

and Life Sciences

Shriram Transport Finance Diversified Financials India 4,515 2.0

CK Asset Real Estate Hong Kong 4,392 1.9

KasikornbankF Banks Thailand 4,381 1.9

Larsen & Toubro Capital Goods India 4,300 1.9

NetEaseR Media and Entertainment China 4,288 1.9

Uni-President Food, Beverage and Tobacco Taiwan 4,238 1.8

Ping An InsuranceH Insurance China 3,857 1.7

LG Chemical Materials South 3,823 1.7

Korea

Hyundai Motor - preference Automobiles and Components South 3,687 1.6

shares Korea

156,746 68.8

Other Investments (32) 70,950 31.2

Total Holdings (57) 227,696 100.0

ADR: American Depositary Receipts - are certificates that represent shares in

the relevant stock and are issued by a US bank. They are denominated and pay

dividends in US dollars.

H: H-Shares - shares issued by companies incorporated in the People's

Republic of China ('PRC') and listed on the Hong Kong Stock Exchange.

R: Red Chip Holdings - holdings in companies incorporated outside the

PRC, listed on the Hong Kong Stock Exchange, and controlled by PRC entities by

way of direct or indirect shareholding and/or representation on the board.

A: A-shares are shares that denominated in Renminbi and traded on the

Shanghai and Shenzhen stock exchanges.

F: F-Shares - shares issued by companies incorporated in Thailand that

are available to foreign investors only. Thai laws have imposed restrictions on

foreign ownership of Thai companies so there is a pre-determined limit of these

shares. Voting rights are retained with these shares.

Governance

Going Concern

The financial statements have been prepared on a going concern basis.

During the period, the Directors took into consideration the continuation vote

for the Company; the uncertain economic outlook following the ongoing

consequences of the Covid-19 pandemic and the conflict in Ukraine; and consider

the preparation of the financial statements on a going concern basis to be the

appropriate basis. The Directors have a reasonable expectation that the Company

has adequate resources to continue in operational existence for the foreseeable

future, being taken as at least 12 months after signing the financial

statements for the same reasons as set out in the Viability Statement in the

Company's 2022 Annual Financial Report. The Directors took into account the

diversified portfolio of readily realisable securities which can be used to

meet the net current liability position of the Company as at the balance sheet

date; and revenue forecasts for the forthcoming year. An ordinary resolution

was proposed and approved at the 2022 AGM to release the Directors from their

obligation to convene a meeting in 2023 at which a special resolution for the

wind up of the Company would have been proposed.

Related Party Transactions

Under United Kingdom Generally Accepted Accounting Practice (UK Accounting

Standards and applicable law), the Company has identified the Directors and

their dependents as related parties. No other related parties have been

identified. No transactions with related parties have taken place which have

materially affected the financial position or the performance of the Company.

Directors' Responsibility Statement

In respect of the preparation of the half-yearly financial report

The Directors are responsible for preparing the half-yearly financial report

using accounting policies consistent with applicable law and UK Accounting

Standards.

The Directors confirm that to the best of their knowledge:

- the condensed set of financial statements contained within the half-yearly

financial report have been prepared in accordance with the FRC's FRS 104

Interim Financial Reporting;

- the interim management report includes a fair review of the information

required by 4.2.7R and 4.2.8R of the FCA's Disclosure Guidance and Transparency

Rules; and

- the interim management report includes a fair review of the information

required on related party transactions.

The half-yearly financial report has not been audited nor reviewed by the

Company's auditor.

Signed on behalf of the Board of Directors.

Neil Rogan

Chairman

26 January 2023

Condensed Income Statement

For the Six Months ended 31 October

2022 2021

Revenue Capital Total Revenue Capital Total

return return return return return return

£'000 £'000 £'000 £'000 £'000 £'000

Losses on investments held at fair - (36,228) (36,228) - (17,938) (17,938)

value

Losses on foreign exchange - (316) (316) - (27) (27)

Income - note 2 5,285 51 5,336 3,981 62 4,043

Investment management fee - note 3 (222) (666) (888) (247) (740) (987)

Other expenses (332) (2) (334) (326) (3) (329)

Net return before finance costs and 4,731 (37,161) (32,430) 3,408 (18,646) (15,238)

taxation

Finance costs - note 3 (24) (72) (96) (5) (15) (20)

Return on ordinary activities before 4,707 (37,233) (32,526) 3,403 (18,661) (15,258)

taxation

Tax on ordinary activities - note 4 (450) (179) (629) (345) - (345)

Return on ordinary activities after 4,257 (37,412) (33,155) 3,058 (18,661) (15,603)

taxation for the financial period

Return per ordinary share

Basic 6.37p (55.96)p (49.59)p 4.57p (27.91)p (23.34)p

Weighted average number of ordinary 66,853,287 66,853,287

shares in issue during the period

The total column of this statement represents the Company's profit and loss

account, prepared in accordance with UK Accounting Standards. The return on

ordinary activities after taxation is the total comprehensive income and

therefore no additional statement of other comprehensive income is presented.

The supplementary revenue and capital columns are presented for information

purposes in accordance with the Statement of Recommended Practice issued by the

Association of Investment Companies. All items in the above statement derive

from continuing operations of the Company. No operations were acquired or

discontinued in the period.

Condensed Statement of Changes in Equity

For the Six Months ended 31 October

Capital

Share Redemption Special Capital Revenue

Capital Reserve Reserve Reserve Reserve Total

£'000 £'000 £'000 £'000 £'000 £'000

For the six months ended 31

October 2022

At 30 April 2022 7,500 5,624 34,827 202,814 1,411 252,176

Return on ordinary - - - (37,412) 4,257 (33,155)

activities

At 31 October 2022 7,500 5,624 34,827 165,402 5,668 219,021

For the six months ended 31

October 2021

At 30 April 2021 7,500 5,624 34,827 229,438 3,863 281,252

Return on ordinary - - - (18,661) 3,058 (15,603)

activities

At 31 October 2021 7,500 5,624 34,827 210,777 6,921 265,649

Condensed Balance Sheet

Registered Number 3011768

At 31 October At 30 April

2022 2022

£'000 £'000

Fixed assets

Investments held at fair value through profit or loss - 227,696 256,686

note 7

Current assets

Amounts due from brokers - 1,746

Overseas withholding tax recoverable 120 163

VAT recoverable 23 16

Prepayments and accrued income 163 567

Cash and cash equivalents 1,303 738

1,609 3,230

Creditors: amounts falling due within one year

Bank facility (8,400) (5,610)

Amounts due to brokers - (780)

Bank overdraft (694) -

Accruals (578) (657)

(9,672) (7,047)

Net current liabilities (8,063) (3,817)

Total assets less current liabilities 219,633 252,869

Creditors: amounts falling due after more than one year

Provision for deferred Indian capital gains tax (612) (693)

Net assets 219,021 252,176

Capital and reserves

Share capital 7,500 7,500

Other reserves:

Capital redemption reserve 5,624 5,624

Special reserve 34,827 34,827

Capital reserve 165,402 202,814

Revenue reserve 5,668 1,411

Total shareholders' funds 219,021 252,176

Net asset value per ordinary share

Basic 327.62p 377.21p

Number of 10p ordinary shares in issue at the period end - 66,853,287 66,853,287

note 6

Notes to the Condensed Financial Statements

1. Accounting Policies

The condensed financial statements have been prepared in accordance with

applicable United Kingdom Accounting Standards and applicable law (UK Generally

Accepted Accounting Practice), including FRS 102 The Financial Reporting

Standard applicable in the UK and Republic of Ireland, FRS 104 Interim

Financial Reporting and the Statement of Recommended Practice Financial

Statements of Investment Trust Companies and Venture Capital Trusts, issued by

the Association of Investment Companies in April 2021. The financial statements

are issued on a going concern basis.

The accounting policies applied to these condensed financial statements are

consistent with those applied in the Company's 2022 Annual Financial Report.

2. Income

Six months to Six months to

31 October 31 October

2022 2021

£'000 £'000

Income from investments:

Overseas dividends - ordinary 4,956 3,689

Overseas dividends - special 327 292

Deposit interest 2 -

Total income 5,285 3,981

Special dividends of £51,000 were recognised in capital during the period (31

October 2021: £62,000).

3. Management Fee, Performance Fees and Finance Costs

Investment management fee and finance costs on any borrowings are charged 75%

to capital and 25% to revenue. A management fee is payable quarterly in arrears

and is equal to 0.75% per annum of the value of the Company's total assets less

current liabilities (including any short term borrowings) under management at

the end of the relevant quarter and 0.65% per annum for any net assets over £

250 million.

4. Taxation and Investment Trust Status

It is the intention of the Directors to conduct the affairs of the Company so

that it satisfies the conditions for approval as an investment trust company.

As such, the Company has not provided any UK corporation tax on any realised or

unrealised capital gains or losses arising on investments. The Company's tax

charge represents withholding tax suffered on overseas income and Indian

capital gains tax paid and provided for due to the holding of Indian equity

investments which are subject to Indian Capital Gains Tax Regulations. Further

details can be found in Note 6(d) of the Company's 2022 Annual Financial Report

on page 62.

5. Dividends paid on Ordinary Shares

As noted in the Chairman's Statement, an interim dividend of 7.20p per share

was paid on 24 November 2022 to shareholders on the register on 4 November

2022. Shares were marked ex-dividend on 3 November 2022.

In accordance with accounting standards, dividends payable after the period end

have not been recognised as a liability.

6. Share Capital, including Movements

Share capital represents the total number of shares in issue, including

treasury shares.

(a) Ordinary Shares of 10p each

Six months to Year to

31 October 30 April

2022 2022

Number of ordinary shares in issue:

Brought forward 66,853,287 66,853,287

Shares bought back into treasury - -

Carried forward 66,853,287 66,853,287

(b) Treasury Shares

Six months to Year to

31 October 30 April

2022 2022

Number of treasury shares held:

Brought forward 8,146,594 8,146,594

Shares bought back into treasury - -

Carried forward 8,146,594 8,146,594

Total ordinary shares 74,999,881 74,999,881

During the period the Company has not bought back or re-issued any shares into

or from treasury (30 April 2022: nil).

Subsequent to the period end 31 October 2022 no ordinary shares were issued,

bought back into treasury or cancelled.

7. Classification Under Fair Value Hierarchy

FRS 102 sets out three fair value levels. These are:

Level 1 - The unadjusted quoted price in an active market for identical assets

that the entity can access at the measurement date.

Level 2 - Inputs other than quoted prices included within Level 1 that are

observable (i.e. developed using market data) for the asset or liability,

either directly or indirectly.

Level 3 - Inputs are unobservable (i.e. for which market data is unavailable)

for the asset or liability.

The fair value hierarchy analysis for investments and related forward currency

contracts held at fair value at the period end is as follows:

31 October 30 April

2022 2022

£'000 £'000

Financial assets designated at fair value through

profit or loss:

Level 1 223,218 250,748

Level 2 4,381 5,837

Level 3 97 101

Total for financial assets 227,696 256,686

The Level 2 investment consists of one holding in Kasikornbank (30 April 2022:

Two holdings in the Invesco Liquidity Funds - US Dollar money market fund and

Kasikornbank).

The Level 3 investment consists of one holding in Lime Co. (30 April 2022: Lime

Co.).

8. Status of Half-Yearly Financial Report

The financial information contained in this half-yearly report does not

constitute statutory accounts as defined in section 434 of the Companies Act

2006. The financial information for the half years ended 31 October 2022 and 31

October 2021 has not been audited. The figures and financial information for

the year ended 30 April 2022 are extracted and abridged from the latest audited

accounts and do not constitute the statutory accounts for that year. Those

accounts have been delivered to the Registrar of Companies and included the

Report of the Independent Auditor, which was unqualified and did not include a

statement under section 498 of the Companies Act 2006.

The Half-Yearly Financial Report for the Six Months to 31 October 2022 will be

available to shareholders, and copies may be obtained during normal business

hours from the Company's Registered Office, from its correspondence address,

43-45 Portman Square, London W1H 6LY, and via www.invesco.co.uk/invescoasia.

A copy of the Half-Yearly Financial Report will be submitted shortly to the

National Storage Mechanism ("NSM") and will be available for inspection at the

NSM, which is situated at https://data.fca.org.uk/#/nsm/

nationalstoragemechanism.

By order of the Board

Invesco Asset Management Limited

Company Secretary

26 January 2023

Glossary of Terms and Alternative Performance Measures

Alternative Performance Measure (APM)

An APM is a measure of performance or financial position that is not defined in

applicable accounting standards and cannot be directly derived from the

financial statements. The calculations shown in the corresponding tables are

for the six months ended 31 October 2022 and the year ended 30 April 2022. The

APMs listed here are widely used in reporting within the investment company

sector and consequently aid comparability.

(Discount)/Premium (APM)

Discount is a measure of the amount by which the mid-market price of an

investment company share is lower than the underlying net asset value (NAV) of

that share. Conversely, Premium is a measure of the amount by which the

mid-market price of an investment company share is higher than the underlying

net asset value of that share. In this interim financial report the discount is

expressed as a percentage of the net asset value per share and is calculated

according to the formula set out below. If the shares are trading at a premium

the result of the below calculation will be positive and if they are trading at

a discount it will be negative.

At 31 At 30 April

October

2022 2022

Share price a 281.00p 332.50p

Net asset value per share b 327.62p 377.21p

Discount c = (a-b)/b (14.2)% (11.9)%

The average discount for the period/year is the arithmetic average, over a

period/year, of the daily discount calculated on the same basis as shown above.

Gearing

The gearing percentage reflects the amount of borrowings that a company has

invested. This figure indicates the extra amount by which net assets, or

shareholders' funds, may move if the value of a company's investments were to

rise or fall. A positive percentage indicates the extent to which net assets

are geared; a nil gearing percentage, or 'nil', shows a company is ungeared. A

negative percentage indicates that a company is not fully invested and is

holding net cash as described below.

There are several methods of calculating gearing and the following has been

used in this report:

Gross Gearing (APM)

This reflects the amount of gross borrowings in use by a company and takes no

account of any cash balances. It is based on gross borrowings as a percentage

of net assets. As at 31 October 2022 the Company had £9,094,000 gross

borrowings (30 April 2022: £5,610,000).

At 31 At 30 April

October

2022 2022

£'000 £'000

Bank facility 8,400 5,610

Overdraft 694 -

Gross borrowings a 9,094 5,610

Net assets b 219,021 252,176

Gross gearing c = a/b 4.2% 2.2%

Net Gearing or Net Cash (APM)

Net gearing reflects the amount of net borrowings invested, i.e. borrowings

less cash and cash equivalents (incl. investments in money market funds). It is

based on net borrowings as a percentage of net assets. Net cash reflects the

net exposure to cash and cash equivalents, as a percentage of net assets, after

any offset against total borrowings.

At 31 At 30 April

October

2022 2022

£'000 £'000

Bank facility 8,400 5,610

Overdraft 694 -

Less: cash and cash equivalents (1,303) (738)

including margin

Less: Invesco Liquidity Fund - US - (846)

Dollar (money market fund)

Net borrowings a 7,791 4,026

Net assets b 219,021 252,176

Net gearing c = a/b 3.6% 1.6%

Leverage

Leverage, for the purposes of the Alternative Investment Fund Managers

Directive ('AIFMD'), is not synonymous with gearing as defined above. In

addition to borrowings, it encompasses anything that increases the Company's

exposure, including foreign currency and exposure gained through derivatives.

Leverage expresses the Company's exposure as a ratio of the Company's net asset

value. Accordingly, if a Company's exposure was equal to its net assets it

would have leverage of 100%. Two methods of calculating such exposure are set

out in the AIFMD, gross and commitment. Under the gross method, exposure

represents the aggregate of all the Company's exposures other than cash

balances held in base currency and without any offsetting. The commitment

method takes into account hedging and other netting arrangements designed to

limit risk, offsetting them against the underlying exposure.

Net Asset Value (NAV)

Also described as shareholders' funds, the NAV is the value of total assets

less liabilities. The NAV per share is calculated by dividing the net asset

value by the number of ordinary shares in issue. The number of ordinary shares

for this purpose excludes those ordinary shares held in treasury.

Portfolio Beta

The portfolio beta is a measure of the portfolio's sensitivity to market

movements. The beta of the market is 1.00 by definition. A beta of 1.10 shows

that the portfolio is predicted to perform 10% better than its benchmark index

in rising markets and 10% worse in falling markets, assuming all other factors

remain constant. Conversely, a beta of 0.90 indicates that the portfolio is

expected to perform 10% worse than the benchmark index during rising markets

and 10% better during falling markets. The beta of the Company's portfolio was

1.11 as at 31 October 2022.

Return

The return generated in a period from the investments including the increase

and decrease in the value of investments over time and the income received.

Capital Return

Reflects the return on NAV, from the increase and decrease in the value of

investments, but excluding any dividends reinvested.

Total Return

Total return is the theoretical return to shareholders that measures the

combined effect of any dividends paid, together with the rise or fall in the

share price or net asset value per share. In this half-yearly financial report

these return figures have been sourced from Refinitiv who calculate returns on

an industry comparative basis.

Net Asset Value Total Return (APM)

Total return on net asset value per share, assuming dividends paid by the

Company were reinvested into the shares of the Company at the NAV per share at

the time the shares were quoted ex-dividend.

Share Price Total Return (APM)

Total return to shareholders, on a mid-market price basis, assuming all

dividends received were reinvested, without transaction costs, into the shares

of the Company at the time the shares were quoted ex-dividend.

Net Asset Share

Six Months Ended 31 October 2022 Value Price

As at 31 October 2022 327.62p 281.00p

As at 30 April 2022 377.21p 332.50p

Change in period a -13.1% -15.5%

Impact of dividend reinvestments(1) b 0.0% 0.0%

Total return for the period c = a+b -13.1% -15.5%

Net Asset Share

Year Ended at 30 April 2022 Value Price

As at 30 April 2022 377.21p 332.50p

As at 30 April 2021 420.70p 386.00p

Change in year a -10.3% -13.9%

Impact of dividend reinvestments(1) b 3.6% 3.9%

Total return for the year c = a+b -6.7% -10.0%

(1) No dividends have been paid during six months to 31 October 2022 (year

to 30 April 2022: 15.30p). NAV or share price movements subsequent to the

reinvestment date further impact the returns, rising if the NAV or share price

rises and falling if the NAV or share price falls.

Benchmark

The benchmark of the Company is the MSCI AC Asia ex Japan Index (total return,

net of withholding tax, in sterling terms). Total return on the benchmark is on

a mid-market value basis, assuming all dividends received were reinvested,

without transaction costs, into the shares of the underlying companies at the

time the shares were quoted ex-dividend.

END

(END) Dow Jones Newswires

January 27, 2023 02:00 ET (07:00 GMT)

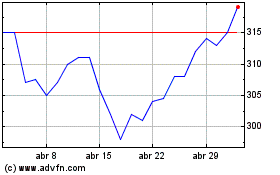

Invesco Asia (LSE:IAT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Invesco Asia (LSE:IAT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024