TIDMIII

RNS Number : 9089F

3i Group PLC

10 November 2022

10 November 2022

3i Group plc announces results for the

six months to 30 September 2022

Resilient performance in a challenging market

-- Total return of GBP1,765 million or 14% on opening

shareholders' funds (September 2021: GBP2,199 million, 24%) and NAV

per share of 1,477 pence (31 March 2022: 1,321 pence), including a

74 pence gain on foreign exchange translation.

-- Our Private Equity business delivered a gross investment

return of GBP1,970 million or 16% (September 2021: GBP2,373

million, 27%). Action continues to perform very strongly and we

continue to see strong earnings growth and momentum in a number of

our portfolio companies in the value-for-money consumer,

healthcare, specialty industrial and business and technology

service sectors. However, a limited number of investments have seen

a deterioration in performance as a result of cost pressures and

reduced demand. 91% of our Private Equity portfolio companies by

value grew earnings in the 12 months to 30 June 2022. Valuation

multiples were reduced for eight portfolio companies.

-- Action 's sales in the nine months ending on 2 October 2022

("P9") grew to EUR6.1 billion (P9 2021: EUR4.8 billion) and

like-for-like sales growth was very strong at 15.7%, with footfall

significantly ahead of last year. Last 12 months' EBITDA to the end

of P9 was EUR1,036 million (P9 2021: EUR765 million), representing

a 35% increase over the same period last year. Action is seeing

strong sales growth across all countries and categories; margins

continue to be well managed, with tight operational cost control

mitigating increased operating costs.

-- In competitive markets the Private Equity team deployed

GBP292 million in four new investments, two portfolio bolt-on

acquisitions and other further investments. In addition, our

portfolio companies completed three self-funded bolt-on

acquisitions. Realisations for the current financial year are off

to a good start, with GBP193 million of proceeds received in the

period and a further GBP476 million received in early October 2022

following the completion of the realisation of Havea, which

achieved a 50% uplift on 31 March 2022 value.

-- Our Infrastructure business generated a gross investment

return of GBP35 million, or 3% (September 2021: GBP60 million, 5%).

We continued to see strong performance across our Infrastructure

portfolios, with assets benefiting from defensive characteristics

and positive correlation to inflation and power prices, however the

return was impacted by a 12.4% decline in 3i Infrastructure plc's

share price, despite the 9.3% total return on its opening NAV it

achieved in the first half.

-- First dividend of 23.25 pence per share for FY2023, set at

50% of the total dividend for FY2022, to be paid in January

2023.

Simon Borrows, 3i's Chief Executive , commented:

"This was a good half for 3i against a tough macroeconomic and

market backdrop. We have carefully constructed our Private Equity

and Infrastructure portfolios over many years with the aim of

generating good returns for our shareholders across the market

cycle. Over the past few years, there have been significant levels

of investment in the private equity industry, at elevated prices

and often with significant leverage. In contrast to many private

equity investors, we were highly selective in the new investments

made in 2020 and 2021, which together account for only 5% by value

of our current investment portfolio.

Action continues to exceed expectations as it expands across

Europe and attracts significant new customer flow through very low

prices and the flexibility of its category format.

We are anticipating difficult macroeconomic conditions in 2023

which will continue to present significant challenges to the

consumer and corporate sector alike and the Group's conservative

capital structure gives us considerable flexibility to respond to

opportunities and developments as they arise. Our near-term

decisions will remain guided by patience and discipline as we

continue to deliver the significant growth potential of our

existing portfolio. "

Summary financial highlights under the Investment basis

3i prepares its statutory financial statements in accordance

with International Financial Reporting Standards as adopted by the

European Union ("IFRS"). However, we also report a non-GAAP

"Investment basis" which we believe aids users of our report to

assess the Group's underlying operating performance. The Investment

basis (which is unaudited) is an alternative performance measure

("APM") and is described on page 20. Total return and net assets

are the same under the Investment basis and IFRS and we provide a

reconciliation of our Investment basis financial statements to the

IFRS statements from page 21. Pages 1 to 17 are prepared on an

Investment basis.

Six months to/as Six months to/as 12 months to/as

at 30 September at 30 September at 31 March

Investment basis 2022 2021 2022

-------------------------------------------------------------- ----------------- ----------------- ----------------

Total return(1) GBP1,765m GBP2,199m GBP4,014m

% return on opening shareholders' funds 14% 24% 44%

Dividend per ordinary share 23.25p 19.25p 46.5p

============================================================== ================= ================= ================

Gross investment return(2) GBP2,016m GBP2,463m GBP4,525m

As a percentage of opening 3i portfolio value 14% 24% 43%

Cash investment(2) GBP298m GBP59m GBP543m

Realisation proceeds GBP193m GBP124m GBP788m

3i portfolio value GBP16,417m GBP12,784m GBP14,305m

Gross debt GBP1,129m GBP975m GBP975m

Net debt (2) GBP1,074m GBP931m GBP746m

Gearing(2) 8% 8% 6%

Liquidity GBP801m GBP544m GBP729m

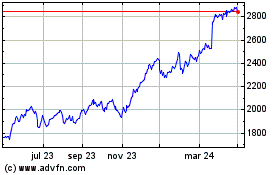

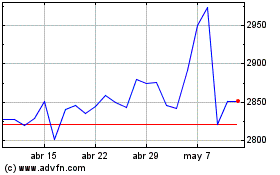

Diluted net asset value per ordinary share ("NAV per share") 1,477p 1,153p 1,321p

============================================================== ================= ================= ================

1 Total return is defined as Total comprehensive income for the year, under both the Investment

basis and the IFRS basis.

2 Financial measure defined as APM. Further information on page 18.

Disclaimer

These half-year results have been prepared solely to provide information to shareholders.

They should not be relied on by any other party or for any other purpose. These half-year

results may contain statements about the future, including certain statements about the future

outlook for 3i Group plc and its subsidiaries ("3i" or "the Group"). These are not guarantees

of future performance and will not be updated. Although we believe our expectations are based

on reasonable assumptions, any statements about the future outlook may be influenced by factors

that could cause actual outcomes and results to be materially different.

Enquiries:

Silvia Santoro, Group Investor Relations Director 020 7975 3258

Kathryn van der Kroft, Communications Director 020 7975 3021

A PDF copy of this release can be downloaded from www.3i.com/investor-relations

For further information, including a live webcast of the results presentation at 10.00am on

10 November 2022, please visit www.3i.com/investor-relations

3i Group Half-year report 2022

Chief Executive's review

Against a tough macroeconomic backdrop, the Group delivered a

good result in the first half of its financial year, generating a

total return of GBP1,765 million, or 14% on opening shareholders'

funds (September 2021: GBP2,199 million, or 24%) . The NAV per

share at 30 September 2022 was 1,477 pence (31 March 2022: 1,321

pence), including a 74 pence gain on foreign exchange translation,

and after payment of the 27.25 pence second FY2022 dividend in July

2022. Our Private Equity and Infrastructure portfolios continue to

perform well and demonstrate their trading resilience. We have

remained active and disciplined investors in more volatile markets,

deploying capital in four new investments for Private Equity and

one new investment for Infrastructure. We also completed or signed

realisations totalling GBP669 million at good premiums to their

carrying values, underlining the quality of our portfolio.

Private Equity

The Private Equity portfolio delivered a gross investment return

("GIR") of GBP1,970 million or 16% on opening value in the period,

including a GBP685 million gain on foreign exchange translation.

Despite a challenging macroeconomic environment, 91%(1) of our

portfolio companies by value grew earnings in the last 12 months

("LTM") to the end of 30 June 2022. Our portfolio is well

constructed from a thematic, geographic and sector perspective and

continues to demonstrate resilience in the current environment. A

number of our portfolio companies in the value-for-money consumer,

healthcare, specialty industrial and business and technology

service sectors have generated strong earnings growth and have good

momentum as we head into the second half of our financial year. Our

portfolio company management teams have reacted quickly and

decisively taking the necessary actions to partially mitigate the

impact of inflationary pressures and weaker consumer sentiment

across the portfolio. A small number of our portfolio companies

have been disproportionately affected by the current macroeconomic

environment and we continue to actively manage these companies

through this challenging period.

Our Private Equity portfolio is funded with all senior debt

structures, with long-dated maturity profiles and with over 80% of

the total repayable from 2025 and beyond. Average leverage across

our Private Equity portfolio was 2.7x at 30 September 2022 (31

March 2022: 3.3x) or 4.1x excluding Action (31 March 2022: 4.6x).

As part of our active portfolio management, we monitor and manage

our portfolio companies' interest rate related risk. Across our

Private Equity portfolio term debt is well protected against

interest rate rises with over two-thirds of total term debt hedged

at a weighted average tenor of more than 3 years with the interest

rate element capped at a weighted average hedge rate below 2%. The

average margin across the portfolio is under 4%, so the all in debt

cost across the portfolio is capped below 6%.

Action performance

Action continues to trade very strongly, reaffirming the

attractiveness of its low-price format to a wide range of

increasingly price-conscious customers. In the nine months ending

on 2 October 2022 ("P9"), sales grew to EUR6.1 billion (P9 2021:

EUR4.8 billion) and like-for-like sales growth was 15.7%, with

footfall significantly ahead of last year. Action delivered LTM

EBITDA of EUR1,036 million to the end of P9 2022 (P9 2021: EUR765

million), a 35% increase over the same period in the prior year.

Action is seeing strong sales growth across all countries and

categories and margins continue to be well managed, with tight

operational cost control mitigating increased operating costs.

Strong trading continued through to 30 October 2022 ("P10"), with

sales increasing to EUR6.8 billion and LTM EBITDA of EUR1,057

million.

The business has opened 182 new stores in the year to the end of

P10 2022 and is on track to open more stores than it opened in

2021. Store roll-outs across Poland and the Czech Republic are

proceeding well and its new markets of Italy and Spain are showing

strong early trading, underpinning the case for further sizeable

store expansion in these countries. Action strengthened its

distribution infrastructure in the half by opening a new hub in Le

Havre, France and has plans to open three new distribution centres

("DCs") in 2023. The business remains highly cash generative, with

a cash balance of approximately EUR800 million at P10 2022 and net

debt to run-rate EBITDA of under 2.0x.

1.LTM adjusted earnings to June 2022. Includes 31 companies.

Other portfolio performance

SaniSure continues to outperform our expectations, benefiting

from sustained demand for its products in the bioprocessing market.

The business continues to grow its top line and increase capacity

in its manufacturing operations, which will allow it to further

accelerate its growth both organically and through selected bolt-on

acquisitions. nexeye's value-for-money omnichannel proposition

remains very attractive to its customers and the business continues

to expand its store network. The business added 13 stores in the

first six months of its financial year, taking the total number of

stores to 723, with significant expansion potential remaining

across its markets. Since our initial investment in early 2021, we

have seen WilsonHCG continue to prove its value proposition in an

attractive recruitment process outsourcing market, helping its

customers stay ahead of shifting labour market trends globally and

drive better results for reoccurring hiring needs. Tato traded well

through the first six months of 2022, with good overall demand for

its products, and has maintained good levels of supply. Whilst

there are signs of more challenging market conditions into the

second half of 2022, Tato's global footprint and specialty

chemicals focus provide mitigation against potential headwinds. AES

has delivered a strong performance as a result of its leading

position in the global seal market. WP recorded a solid performance

in the period as the business benefits from exposure to

non-discretionary products and its broad geographical

diversification.

We have seen a good increase in demand across our travel-related

assets. Audley Travel has demonstrated an encouraging recovery

profile, particularly in the US. arrivia' s membership bookings

have been ahead of 2019 levels, however cruise travel recovery has

been slower than expected, particularly outside of the US. In

September 2022, the business completed the bolt-on acquisition of

RedWeek, an online timeshare marketplace that connects travellers

to lodging options offered by timeshare owners.

Consumer discretionary spending is increasingly constrained due

to high inflation, cost of living pressures and weakening consumer

sentiment. Like many of its eCommerce peers, Luqom is experiencing

muted demand as consumers react to the current challenging backdrop

and demand normalises from the peak seen during the pandemic.

During the period, the business made significant progress on

strategic and operating initiatives designed to mitigate the

current challenges and further improved its more resilient

Business-to-Business ("B2B") proposition through the acquisition of

Brumberg. Following a solid start to 2022, YDEON (previously known

as GartenHaus) has experienced a decline in order intake as a

result of weaker discretionary consumer spending. The price of

YDEON's main raw material, wood, has normalised at a lower level in

recent months which will help to maintain margins in the near

term.

Investment and realisation activity in the period

The volume of buyout transactions across the market has slowed

considerably compared to 2021 and we continue to maintain

discipline when assessing new and bolt-on investments. We completed

four new Private Equity investments totalling GBP217 million: the

GBP100 million investment in xS uite , an accounts payable process

automation specialist focused on the SAP ecosystem; the GBP60

million investment in Konges Sløjd, a premium brand offering

apparel and accessories for babies and children; the GBP37 million

investment in VakantieDiscounter, a technology-enabled online

travel agency in the Benelux focused on affordable holidays; and

the GBP20 million investment in Digital Barriers, a provider of

unique video compression technology. We also completed five bolt-on

acquisitions for our portfolio companies including two (Luqom's

acquisition of Brumberg and arrivia's acquisition of RedWeek) that

required further funding from 3i and three which were self-funded

by the portfolio companies.

In the period, we completed or signed realisations totalling

GBP669 million. We completed the sale of Q Holding's QSR division,

which we announced in April 2022, for proceeds of GBP190 million

and retained a significant stake in its medical business, QMD. In

June 2022, we agreed the sale of Havea. We delivered a significant

strategic transformation in Havea during our holding period

resulting in double-digit organic growth and the completion of five

bolt-on acquisitions. We received proceeds of GBP476 million from

the sale of Havea in October 2022, representing a 50% uplift on its

31 March 2022 value, resulting in a sterling money multiple of 3.1x

and an IRR of 24%.

Infrastructure

In the six months to 30 September 2022, our Infrastructure

business delivered a GIR of GBP35 million or 3% on opening value,

predominantly driven by a gain on foreign exchange on investments

of GBP58 million and good dividend income offsetting a 12.4%

decrease in the 3i Infrastructure plc ("3iN") share price to 304

pence at 30 September 2022 (31 March 2022: 347 pence).

3iN generated a total return on its opening NAV of 9.3% in the

six months to 30 September 2022 as its underlying portfolio

continues to perform significantly ahead of the expectations set at

the beginning of this financial year. During the period, 3iN

completed its new investment in Global Cloud Xchange ("GCX") and

agreed the acquisition of an additional stake in its existing

portfolio company, TCR. 3iN also completed the sale of its European

projects portfolio to the 3i European Operational Projects Fund

("3i EOPF") for GBP106 million.

Smarte Carte exceeded expectations in the period, as the

business is benefiting from strong US domestic leisure travel

volumes increasing demand for its airport service offering, as well

as from valuable contract improvements. The two assets in our North

American Infrastructure platform are performing well: Regional Rail

has seen good performance across the majority of its freight lines,

largely offsetting inflationary pressures in fuel and labour

expenses; whilst EC Waste is seeing strength in the high margin

landfill segment.

Scandlines

Scandlines delivered a solid performance in the period. Freight

volumes remained strong, ahead of 2021 record levels, and leisure

volumes traded ahead of pre-pandemic levels during the peak summer

months of July and August 2022. The recovery in performance

following the Covid-19 Omicron variant resulted in a GBP12 million

dividend to 3i in the period. Scandlines has good liquidity and is

well equipped to manage potential headwinds as a result of the

uncertain macroeconomic outlook.

Sustainability

We continue to advance our sustainability agenda, with a

near-term focus on the climate topic. We have continued to make

good progress in the collection of greenhouse gas ("GHG") emissions

data from the portfolio with the objective of setting a portfolio

baseline, and are further improving our assessment of

climate-related risks and opportunities in our investment and

portfolio management processes and equipping the teams with the

necessary skills. We intend to report in alignment with the TCFD

framework by the 2024 deadline set by the FCA for asset managers

such as 3i and will report on progress in that direction in our

next annual report.

Balance sheet, liquidity, foreign exchange and dividend

We increased our available liquidity in the period by

introducing an additional two-year GBP400 million tranche to the

existing base GBP500 million RCF; which matures in March 2027. The

GBP400 million additional tranche provides the Group with

additional financial flexibility at low cost.

At 30 September 2022 we had total liquidity of GBP801 million

(31 March 2022: GBP729 million) . Gross debt was GBP1,129 million,

comprising GBP975 million of fixed debt and a GBP154 million RCF

drawdown. Net debt was GBP1,074 million and gearing was 8% (31

March 2022: GBP746 million net debt, gearing 6%), before the

receipt of the Havea proceeds (GBP476 million) in early October

2022.

Post the period end, and in light of significant volatility in

foreign exchange markets, we implemented a medium-term foreign

exchange hedging programme to partially reduce the sensitivity of

the Group's future returns to euro and US dollar exchange

movements. The exposure of the Group's underlying investment

portfolio to euro and US dollar has increased significantly in

recent years through the organic growth of our existing European

and US portfolio companies and due to the majority of our new

investments being denominated in euro and US dollar. At 30

September 2022, 88% of the Group's net assets were denominated in

euros or US dollars . As at 4 November 2022, the notional amount of

the forward foreign exchange contracts held by the Group associated

with this hedging programme was EUR2.0 billion and $1.2 billion. We

do not currently expect to extend this hedging programme materially

beyond these amounts. In addition, we have increased the size of

our hedging programme for Scandlines, increasing the notional

amount from EUR500 million to EUR600 million in September 2022.

Following implementation of the hedging programme, a 1% movement in

the euro and US dollar would now result in a net total return

movement for 3i of GBP83 million and GBP13 million (30 September

2022 excluding hedging programme: GBP101 million and GBP24 million)

respectively.

In line with our dividend policy, we will pay a first FY2023

dividend of 23.25 pence, which is half of our FY2022 total

dividend. This first FY2023 dividend will be paid to shareholders

on 11 January 2023.

Valuation

While the valuation of private assets has become a much debated

subject over the last 12 months, we have not changed our

well-established approach to the valuation of our Private Equity

portfolio. Over many years, our valuation approach has used

"through the cycle" multiples, cross referenced where appropriate

with relevant transaction multiples. In practice, we have seen the

stock market increase in recent years to valuation levels we didn't

view as sustainable or as representative of fair value based on our

cross-cycle marks. Whilst we are not immune from this year's market

correction and economic headwinds, our cross-cycle valuation

approach has limited the impact of the recent market volatility

across our portfolio, however we have reduced valuation multiples

for eight portfolio companies. Where there are limited relevant

public comparables for our portfolio companies, we look at a range

of alternatives that have similar growth and financial profiles.

Our non-Action portfolio companies, comprising businesses that

target a doubling of profitability over a five-year hold period,

are held at a weighted average multiple post liquidity discount of

around 13x EBITDA. This compares favourably with most other Private

Equity portfolios and has consistently delivered strong returns and

healthy premiums on exit, as has recently been demonstrated through

the sales of Q Holding's QSR division and Havea.

Our largest investment, Action, has very few close comparators

of a similar growth and financial profile. Action has outstanding

organic growth potential and is one of those rare retail businesses

that has demonstrated an ability to expand across international

borders. In addition, Action has consistently outperformed the

peers we currently reference across its most important operating

key performance indicators ("KPIs"). We use an 18.5x (post

liquidity discount) LTM run-rate EBITDA multiple to value Action

and take comfort from the fact that its excellent annual growth

over the last 30 years, including the last 11 years under our

ownership, means this 18.5x historic multiple translates to a much

more modest prospective multiple. Action's excellent growth meant

its valuation at 30 September 2021 of 18.5x LTM run-rate EBITDA

translated to 13.8x the run-rate EBITDA achieved one year

later.

Outlook

This was a good half for 3i against a tough macroeconomic and

market backdrop. We have carefully constructed our Private Equity

and Infrastructure portfolios over many years with the aim of

generating good returns for our shareholders across the market

cycle. Over the past few years, there have been significant levels

of investment in the private equity industry, at elevated pricing

and often with significant leverage. In contrast to many private

equity investors, we were highly selective in the new investments

made in 2020 and 2021, which together account for only 5% by value

of our current investment portfolio.

Action continues to exceed expectations as it attracts

significant new customer flow through very low prices and the

flexibility of its category format. Our wider portfolio is trading

resiliently in the current environment, while our investment teams

continue to devote significant time to the assets which have seen a

deterioration in performance as a result of cost pressures and

reduced demand. We will continue to invest capital carefully, as

well as execute realisations selectively in the current volatile

markets.

We are anticipating difficult macroeconomic conditions in 2023

which will continue to present significant challenges to the

consumer and corporate sector alike and the Group's conservative

capital structure gives us considerable flexibility to respond to

opportunities and developments as they arise. Our near-term

decisions will remain guided by patience and discipline as we

continue to deliver the significant growth potential of our

existing portfolio.

Simon Borrows

Chief Executive

9 November 2022

Business and Financial review

Private Equity

Our Private Equity business performed well in the first half,

generating a GIR of GBP1,970 million (September 2021: GBP2,373

million), or 16% of the opening portfolio value (September 2021:

27%), including a gain on foreign exchange on investments of GBP685

million (September 2021: GBP97 million).

Table 1: Gross investment return for the six months to 30

September

2022 2021

Investment basis GBPm GBPm

===================================================================== ====== ======

Realised (losses)/profits over value on the disposal of investments (4) 12

Unrealised profits on the revaluation of investments 1,244 2,219

Dividends - 10

Interest income from investment portfolio 39 33

Fees receivable 6 2

Foreign exchange on investments 685 97

Gross investment return 1,970 2,373

===================================================================== ====== ======

Gross investment return as a % of opening portfolio value 16% 27%

===================================================================== ====== ======

Investment

Table 2: Private Equity cash investment in the six months to 30

September 2022

Investment Type Business description/ bolt on description Date GBPm

=================== ======== ================================================================ =============== ====

Accounts payable process automation specialist focused on the

xSuite New SAP ecosystem August 2022 100

Premium brand offering apparel and accessories for babies and

Konges Sløjd New children August 2022 60

Online travel agency in the Benelux focused on affordable

VakantieDiscounter New holidays August 2022 37

Digital Barriers New Provider of unique video compression technology August 2022 20

Total new cash investment 217

---------------------------------------------------------------------------------------------------------------- ----

ten23 health Further Biologics drug product CDMO July 2022 13

Other Further Various Various 5

Total further cash investment 18

---------------------------------------------------------------------------------------------------------------- ----

Brumberg: B2B manufacturer and distributor of luminaries and

Luqom Further lighting products June 2022 34

arrivia Further RedWeek: Online timeshare marketplace September 2022 23

------------------- -------- ---------------------------------------------------------------- --------------- ----

Total further cash investment for bolt-on investment 57

---------------------------------------------------------------------------------------------------------------- ----

Total Private Equity Cash investment 292

---------------------------------------------------------------------------------------------------------------- ----

Table 3: Private Equity portfolio bolt-on acquisitions - funded

by the portfolio company

in the six months to 30 September 2022

Asset Name of acquisition Business description of bolt-on investments Date

------- ------------------- ------------------------------------------------------------------------ --------------

MAIT Nittmann & Pekoll Austrian abas ERP partner June 2022

Evernex XS International Specialist in a suite of IT lifecycle services and IT hardware lifecycle September 2022

support

Evernex Integra Provider of IT maintenance and cloud services September 2022

------- ------------------- ------------------------------------------------------------------------ --------------

During the period, our Private Equity business invested GBP292

million (September 2021: GBP58 million), comprising GBP235 million

of new and further investment and GBP57 million of bolt-on

investments.

Our new investments in xSuite, VakantieDiscounter and Digital

Barriers continue to build on our thematic approach of

digitalisation and technological disruption. Our investment in

Konges Sløjd already has a well-established international footprint

and has several organic opportunities to accelerate its growth

across Europe, Asia and North America. A description of the new

investments is provided in Table 2 and in the Chief Executive's

review.

We continued our focus on buy-and-build acquisitions for a

number of our portfolio companies. Luqom completed the acquisition

of Brumberg, a well-known B2B lighting brand in Germany, whilst

arrivia acquired RedWeek, a leading timeshare rental marketplace.

We supported these acquisitions with further investments of GBP34

million and GBP23 million respectively. Our portfolio companies

also completed a number of self-funded bolt-on investments. MAIT

completed its acquisition of Nittmann & Pekoll, the fifth since

our investment, and Evernex completed its acquisitions of XS

International and Integra, enabling the business to expand its

footprint in the US, Nordic and Benelux markets.

We also invested a further GBP13 million in ten23 health to

support the growth of the platform.

Realisations

We recognised total realised proceeds of GBP193 million in the

period (September 2021: GBP118 million), of which GBP190 million

was received following the completion of the sale of Q Holding's

QSR division.

Table 4: Private Equity realisations in the six months to 30

September 2022

31 March Uplift on

Calendar 2022 3i realised Profit/(loss) opening Residual

year value (1) proceeds in the year (2) Value (3) value

Investment Country invested GBPm GBPm GBPm % GBPm

============================ ========= ========== ========== ============ ================ ========== =========

Partial realisations

Q Holding US 2014 189 190 1 1% 272

Other n/a n/a 8 2 (6) n/a n/a

Deferred consideration

OneMed Sweden 2011 - 1 1 n/a -

Total Private Equity realisations 197 193 (4) - 272

=================================================== ========== ============ ================ ========== =========

1 For partial realisations and refinancings, 31 March 2022 value represents

value of stake sold or refinanced.

2 Cash proceeds realised in the period less opening value.

3 Profit in the year over opening value.

In June 2022, we agreed the sale of Havea at a 50% uplift to the

value at 31 March 2022, for proceeds of GBP476 million. These

proceeds were received in October 2022, realising a sterling money

multiple of 3.1x and a sterling IRR of 24%.

Portfolio performance

Table 5: Unrealised profits/(losses) on the revaluation of

Private Equity investments(1) in the six months to 30 September

2022 2021

GBPm GBPm

=============================================== ====== ======

Action

Performance 1,156 1,491

Earnings based valuations (excluding Action)

Performance 142 354

Multiple movements (180) 162

Other bases

Discounted cash flow ("DCF") 4 1

Other movements in unquoted investments (1) -

Imminent sale 154 166

Quoted portfolio (31) 45

============================================== ====== ======

Total 1,244 2,219

=============================================== ====== ======

1 More information on our valuation methodology, including definitions and rationale, is included

in our Annual report and accounts 2022 on pages 212 to 213.

Action valuation and performance

In the 12 months to the end of Action's P9 2022 (which ended 2

October 2022), the business continued to perform ahead of

expectations, with strong sales, earnings growth and cash

generation driving the unrealised value growth of GBP1,156 million

(September 2021: GBP1,491 million), as shown in Table 5. As the

largest Private Equity investment by value, it represented 59% of

the Private Equity portfolio at 30 September 2022 (31 March 2022:

58%). Further information on Action's performance in the period is

provided in the Chief Executive's review.

At 30 September 2022, Action was valued using its LTM run-rate

earnings to the end of P9 2022 of EUR1,135 million. The LTM

run-rate earnings used included our normal adjustment to reflect

stores opened in the year. At 30 September 2022, Action was valued

on a multiple of 18.5x net of the liquidity discount (31 March

2022: 18.5x). This resulted in a valuation of our 52.7% stake in

Action of GBP8,612 million (31 March 2022: GBP7,165 million). As

part of our valuation process, we check our multiple based mark

against the results of a DCF analysis. The assumptions required to

correlate our 30 September 2022 valuation mark through this DCF

analysis are not demanding.

Performance (excluding Action)

Excluding Action, the performance of investments valued on an

earnings basis resulted in unrealised profits of GBP142 million

(September 2021: GBP354 million), primarily driven by strong

earnings growth and cash generation from some of our portfolio

companies operating in the value-for-money consumer, healthcare,

specialty industrials and business and technology service sectors.

This more than offset softer performance from companies in the

discretionary retail sector, which are experiencing challenging

consumer headwinds.

SaniSure 's strong first half performance was driven by robust

industry demand resulting in accelerated top line growth, which it

was able to deliver via investments in capacity and improvements in

operational processes that materially increased output. The company

has had modest exposure to Covid-19 end-demand, which demand across

the industry has moderated, and looking forward SaniSure's core

customer demand and commercial pipeline remain strong. nexeye

continues to perform well. The business has maintained an

attractive price point for customers helping to maintain order

intake, whilst remaining stringent on cost control, leading to good

margins. Eyes + More, part of the nexeye Group, has seen a gradual

recovery in its German market and contributed 12 of the 13 new

stores opened by nexeye in its financial year. WilsonHCG has

capitalised on the expansion of outsourcing in recruitment,

evidenced by expanding the scope of work with its existing

customers and new customer wins. WilsonHCG's onboarding of new

customers, the reoccurring nature of its relationships, and

diversification across industries

will help offset potential headwinds in labour markets. Tato

traded well in the period with good overall demand for its products

and is well positioned to mitigate more challenging market

conditions. AES continues to perform well financially and

operationally, whilst WP recorded a solid performance in the period

as the business benefits from exposure to non-discretionary

products and its broad geographical diversification.

With the re-opening of key travel destinations, Audley Travel

benefited from increased departure revenue and an increase in

bookings in the period. Detail on Audley Travel's valuation can be

found under the DCF heading below. arrivia 's acquisition of

RedWeek increases its exposure to the resilient timeshare rentals

end market where arrivia has strong customer relationships. The

business has seen an increase in memberships in the period, however

its recovery in cruise has been slower than expected.

Luqom has seen a normalisation in demand from the peak levels

achieved during the pandemic, as well as muted customer sentiment

as a result of ongoing pressures on disposable incomes. The

business has made significant operational and strategic

improvements across sourcing, operations and pricing and its

acquisition of Brumberg increases its exposure to the more

resilient business-to-business segment. YDEON (formerly known as

GartenHaus) has faced similar headwinds to Luqom, with significant

pressure on its order book. As a result YDEON is initiating a broad

set of measures to improve sales, reduce the cost base and develop

further international expansion opportunities. Mepal has also seen

softening demand from smaller offline retail customers and in

non-core markets.

Overall, 91%(1) of our portfolio companies by value in our

Private Equity portfolio grew their earnings in the 12 months to 30

June 2022.

Table 6: Portfolio earnings growth of the top 20 Private Equity

investments(1)

3i carrying value

Number of companies at 30 September 2022

at 30 September 2022 GBPm

========= ===================== =====================

<0% 5 1,076

0 - 9% 4 1,170

10 - 19% 3 1,136

20 - 29% 2 279

>=30% 6 9,733

--------- --------------------- ---------------------

1 Includes top 20 Private Equity companies by value excluding Havea, which was valued on imminent

sale basis and Audley Travel, which was valued on a DCF basis. This represents 92% of the

Private Equity portfolio by value (31 March 2022: 96%). LTM adjusted earnings to 30 June 2022

and Action based on LTM run-rate earnings to P9 2022. P9 2022 runs to 2 October 2022.

Our Private Equity portfolio is funded with all senior debt

structures, with long-dated maturity profiles with over 80%

repayable from 2025 and beyond. Across our Private Equity portfolio

term debt is well protected against interest rate rises with over

two-thirds of total term debt hedged at a weighted average tenor of

more than 3 years with the interest rate element capped at a

weighted average hedge rate below 2%. The average margin across the

portfolio is under 4%, so the all in debt cost across two thirds of

the portfolio is capped below 6%. Average leverage was 2.7x at 30

September 2022 (31 March 2022: 3.3x). Excluding Action, leverage

across the portfolio was 4.1x (31 March 2022: 4.6x). Table 7 shows

the ratio of net debt to adjusted earnings by portfolio value at 30

September 2022.

1.LTM adjusted earnings to June 2022. Includes 31 companies.

Table 7: Ratio of net debt to adjusted earnings(1)

3i carrying value

Number of companies at 30 September 2022

at 30 September 2022 GBPm

======= ===================== =====================

1 - 2x 3 8,984

2 - 3x 5 890

3 - 4x 6 1,449

4 - 5x 5 743

5 - 6x 1 314

>6x 3 234

======= ===================== =====================

1 This represents 87% of the Private Equity portfolio by value (31 March 2022: 92%). Quoted

holdings, assets valued on an imminent sale basis, and companies with net cash are excluded

from the calculation. Net debt and adjusted earnings as at 30 June 2022. Action based on net

debt at P9 2022 and LTM run-rate earnings to P9 2022.

Multiple movements

We continue our approach of taking a long-term through the cycle

view on the multiples used to value our portfolio companies,

consistent with our approach to value creation. When selecting

multiples to value our portfolio companies we consider a number of

factors including recent performance and outlook, comparable recent

transactions and exit plans, and the performance of quoted

comparable companies. Since the start of this calendar year,

capital markets have been volatile, particularly since Russia's

invasion of Ukraine, with significant inflation and central bank

interventions resulting in expectations for lower growth or even

contraction across major markets. As a consequence, we have seen a

derating of quoted comparable company multiples across the majority

of the portfolio, especially those with discretionary spending

exposure. The consistency of our long-term, through the cycle

approach to the setting of valuation multiples has enabled us

largely to mitigate the impact of recent market volatility. Whilst

our portfolio companies often outperform their quoted peers, we do

take into account the derating of comparable companies when

determining the level of our multiples. As a result, we adjusted

eight of the valuation multiples for our portfolio companies,

recognising a decrease in value due to multiple movements of GBP180

million (September 2021: GBP162 million value growth increase).

Action continues to trade strongly across all important KPI's

and its relative performance continues to compare favourably to any

of its quoted comparable peer group. As a result, we made no change

to the multiple used to value Action at 30 September 2022. Based on

the valuation at 30 September 2022, a 1.0x movement in Action's

post-discount multiple would increase or decrease the valuation of

3i's investment by GBP526 million.

DCF

Audley Travel remains valued on a DCF basis. Audley Travel's

performance has improved significantly since the lifting of

Covid-19 related travel restrictions. We expect the travel market

to continue to recover into 2023.

Imminent sale

At 30 September 2022, Havea was valued on an imminent sale basis

after we agreed a sale of the business at a 50% uplift to the 31

March 2022 value. The uplift reflects Havea's strong organic

growth, investments made in the business during our ownership, and

the strategic value of the business. We received proceeds of GBP476

million in October 2022 from this divestment.

Quoted portfolio

Basic-Fit is the only quoted investment in our Private Equity

portfolio. We recognised an unrealised value loss of GBP31 million

from Basic-Fit in the period (September 2021: unrealised value gain

of GBP45 million) as its share price decreased to EUR30.98 at 30

September 2022 (31 March 2022: EUR40.42). At 30 September 2022, our

residual 5.7% shareholding was valued at GBP103 million (31 March

2022: GBP129 million).

Assets under management

The value of the Private Equity portfolio, including third-party

capital, increased to GBP19.6 billion (31 March 2022: GBP16.7

billion) principally due to unrealised value movements in the

period.

Table 8: Private Equity 3i vintage carrying value and money

multiple

3i carrying value (3) Vintage 3i carrying value (3) Vintage

30 September 2022 money multiple (4) 31 March 2022 money multiple (4)

Vintages (1) GBPm 30 September 2022 GBPm 31 March 2022

=================== ====================== =================== ====================== ===================

Buyouts 2010-2012 2,959 13.3x 2,462 12.3x

Growth 2010-2012 26 2.2x 18 2.1x

2013-2016 934 2.4x 1,022 2.3x

2016-2019 2,445 1.9x 2,210 1.8x

2019-2022 1,497 1.5x 1,319 1.3x

2022-2025 223 1.0x - -

Other(2) 6,399 n/a 5,389 n/a

=================== ====================== =================== ====================== ===================

Total 14,483 12,420

=================== ====================== =================== ====================== ===================

1 Assets included in these vintages are disclosed in the Glossary o n pages 47 and 49 .

2 Includes value of GBP5,653 million (31 March 2022: GBP4,703 million) held in Action through

the 2020 Co-investment vehicles and 3i.

3 3i carrying value is the unrealised value for the remaining investments in each vintage.

4 Vintage money multiple (GBP) includes realised value and unrealised value as at the reporting

date.

Table 9: Private Equity assets by geography

3i carrying value

at 30 September 2022

3i office location Number of companies GBPm

==================== ==================== =====================

Netherlands 10 9,872

France 2 792

Germany 8 850

UK 9 1,056

US 9 1,882

Other 3 31

==================== ==================== =====================

Total 41 14,483

==================== ==================== =====================

Table 10: Private Equity assets by sector

3i carrying value

at 30 September 2022

Sector Number of companies GBPm

================================ ==================== =====================

Action (Consumer) 1 8,612

Consumer 14 1,965

Industrial Technology 7 1,128

Business & Technology Services 13 895

Healthcare 6 1,883

Total 41 14,483

================================ ==================== =====================

Infrastructure

Our Infrastructure portfolio generated a GIR of GBP35 million in

the period, or 3% on the opening portfolio value (September 2021:

GBP60 million, 5%) , including a gain on foreign exchange on

investments of GBP58 million (September 2021: GBP7 million).

Table 11: Gross investment return for the six months to 30

September

2022 2021

Investment basis GBPm GBPm

=============================================================== ===== =====

Realised profits - 3

Unrealised (losses)/profits on the revaluation of investments (47) 30

Dividends 16 15

Interest income from investment portfolio 8 5

Foreign exchange on investments 58 7

Gross investment return 35 60

=============================================================== ===== =====

Gross investment return as a % of opening portfolio value 3% 5%

=============================================================== ===== =====

Fund management

3iN

3iN 's portfolio continues to perform strongly, demonstrating a

positive correlation between inflation, power prices and total

portfolio value and is significantly ahead of the expectations set

at the beginning of this financial year. In the six months to 30

September 2022, 3iN generated a total return on opening NAV of 9.3%

(September 2021: 10.6%) and is on track to meet its dividend target

for the year to 31 March 2023 of 11.15 pence per share, up 6.7%

year-on-year.

In the period, 3iN completed its $377 million investment to

acquire a 100% stake in GCX and agreed to acquire an additional

stake in TCR for EUR394 million, in a transaction that closed in

October 2022. 3iN also completed the sale of its European projects

portfolio to the 3i European Operational Projects Fund ("3i EOPF")

for GBP106 million.

As 3iN's investment manager, 3i received a management fee of

GBP23 million in the period (September 2021: GBP16 million).

North American Infrastructure platform

Both assets within our North American Infrastructure platform

are performing well. Regional Rail benefited from strong freight

volumes from food and agriculture customers, largely offsetting

increased fuel and wage expenses. In the period, Regional Rail

agreed to acquire a portfolio of rail assets located across central

Canada, further diversifying its geographical footprint. EC Waste

saw good performance from its landfill segment with an increase in

special waste volumes. Both assets were valued on a DCF basis at 30

September 2022.

Other funds

Following the acquisition of the European projects portfolio

from 3iN, 3i EOPF has now deployed 85% of its total commitments.

Both 3i EOPF and the 3i Managed Infrastructure Acquisitions LP

performed in line with expectations in the period.

Assets under management

Infrastructure AUM was GBP5.9 billion at 30 September 2022 (31

March 2022: GBP5.7 billion) and we generated fee income of GBP30

million from our fund management activities in the period

(September 2021: GBP23 million).

Table 12: Assets under management as at 30 September 2022

Fee

income

% invested (2) at earned in

Close 3i commitment/ Remaining 3i September AUM the period

Fund/strategy date Fund size share commitment 2022 GBPm GBPm

================== ============ ========== =============== ============= ================== ======= ===========

3iN(1) Mar 07 n/a GBP817m n/a n/a 2,706 23

3i Managed

Infrastructure

Acquisitions LP Jun 17 GBP698m GBP35m GBP5m 87% 1,160 2

3i European

Operational

Projects Fund Apr 18 EUR456m EUR40m EUR5m 85% 353 1

BIIF May 08 GBP680m n/a n/a 91% 479 2

3i India Mar 08 US$1,195m US$250m n/a 73% - -

Infrastructure

Fund

3i managed

accounts various n/a n/a n/a n/a 518 1

3i North American

Infrastructure

platform Mar-22(3) US$495m US$300m US$116m 58% 377 1

US Infrastructure Nov-17 n/a n/a n/a n/a 304 -

================== ============ ========== =============== ============= ================== ======= ===========

Total 5,897 30

================================ ========== =============== ============= ================== ======= ===========

1 AUM based on the share price at 30 September 2022.

2 % invested is the capital deployed into investments against the total Fund commitment.

3 First close completed in March 2022.

3i's Infrastructure investment portfolio

Quoted stake in 3iN

3iN's share price decreased by 12.4% in the period, closing at

304 pence on 30 September 2022 (31 March 2022: 347 pence),

resulting in the recognition of a GBP117 million unrealised value

loss (September 2021: GBP20 million unrealised value gain) on our

3iN investment. We partially offset this unrealised value loss with

GBP14 million of dividend income in the period (September 2021:

GBP13 million). At 30 September 2022, our investment in 3iN was

valued at GBP817 million (31 March 2022: GBP934 million).

Smarte Carte

Smarte Carte has outperformed compared to expectations, due to

the strong recovery in the domestic US travel market and resulting

demand for its airport service offering. As at 30 September 2022,

Smarte Carte was valued on a DCF basis in line with our policy for

infrastructure assets.

Table 13: Unrealised (losses)/profits on the revaluation of

Infrastructure investments(1) in the six months to 30 September

2022 2021

GBPm GBPm

============ ====== =====

Quoted (117) 20

DCF 63 8

Fund/other 7 2

Total (47) 30

============ ====== =====

1 More information on our valuation methodology, including definitions and rationale, is included

in our Annual report and accounts 2022 on pag es 212 to 213.

Scandlines

Scandlines generated a GIR of GBP11 million (September 2021:

GBP30 million) or 2% of opening portfolio value in the period

(September 2021: 7%).

Table 14: Gross investment return for the six months to 30

September

2022 2021

Investment basis GBPm GBPm

=========================================================== ===== =====

Unrealised profit on the revaluation of investments - 30

Dividends 12 -

Foreign exchange on investments 21 4

Movement in the fair value of derivatives (22) (4)

=========================================================== ===== =====

Gross investment return 11 30

=========================================================== ===== =====

Gross investment return as a % of opening portfolio value 2% 7%

=========================================================== ===== =====

Performance

Scandlines delivered a solid performance in the period. Freight

volumes remained strong, ahead of 2021 record levels, and leisure

volumes were ahead of pre-pandemic levels during the peak summer

months of July and August 2022. The business remains cash

generative and we received a dividend of GBP12 million in the

period. At 30 September 2022, Scandlines was valued at GBP554

million (31 March 2022: GBP533 million) on a DCF basis and this

valuation reflects the proven resilience the business continues to

demonstrate and its ability to manage through potential short-term

pressure on freight and leisure volumes as a result of current

macroeconomic headwinds.

Foreign exchange

We hedge the balance sheet value of our investment in Scandlines

for foreign exchange translation risks. In September 2022, we

increased the size of this hedging programme from EUR500 million to

EUR600 million to cover the higher underlying valuation of our

investment.

We recognised a GBP21 million gain on foreign exchange

translation (September 2021: GBP4 million) offset by a GBP22

million fair value loss (September 2021: GBP4 million) from

derivatives in our hedging programme.

Overview of financial performance

We generated a total return of GBP1,765 million, or a profit on

opening shareholders' funds of 14%, in the six months to 30

September 2022 (September 2021: GBP2,199 million, or 24%). The

diluted NAV per share at 30 September 2022 increased to 1,477 pence

(31 March 2022: 1,321 pence) including the 74 pence gain on foreign

exchange translation in the period, and after the payment of the

second FY2022 dividend of GBP262 million, or 27.25 pence per share

in July 2022 (September 2021: GBP203 million, 21.0 pence per

share).

Table 15: Gross investment return for the six months to 30

September

2022 2021

Investment basis GBPm GBPm

=========================================================== ====== ======

Private Equity 1,970 2,373

Infrastructure 35 60

Scandlines 11 30

Gross investment return 2,016 2,463

=========================================================== ====== ======

Gross investment return as a % of opening portfolio value 14% 24%

----------------------------------------------------------- ------ ------

Total comprehensive income ("Total return") 1,765 2,199

=========================================================== ====== ======

Total return on opening shareholders' funds 14% 24%

=========================================================== ====== ======

GIR was GBP2,016 million in the period (September 2021: GBP2,463

million) driven by the strong performance of Action and some of our

portfolio companies operating in the value-for-money consumer,

healthcare, specialty industrial and business and technology

service sectors . The GIR also includes a GBP742 million net

foreign exchange gain on translation of our investments (September

2021: GBP104 million gain). Further information on the Private

Equity, Infrastructure and Scandlines valuations is included in the

business reviews.

Operating cash loss

Table 16: Operating cash loss for the six months to 30

September

2022 2021

GBPm GBPm

======================================= ===== =====

Cash fees from external funds 33 24

Cash portfolio fees 1 3

Cash portfolio dividends and interest 33 26

======================================= ===== =====

Cash income 67 53

Cash operating expenses(1) (84) (72)

======================================= ===== =====

Operating cash loss (17) (19)

======================================= ===== =====

1 Cash operating expenses include operating expenses paid and lease payments.

We generated an operating cash loss of GBP17 million in the

period (September 2021: GBP19 million). Cash income increased to

GBP67 million (September 2021: GBP53 million) principally due to an

increase in dividend income and third-party fee income compared to

the same period last year. Cash operating expenses incurred during

the period increased to GBP84 million (September 2021: GBP72

million) driven principally by higher compensation costs. We expect

to report an operating cash profit at 31 March 2023, due to a good

pipeline of cash income.

Net foreign exchange movements

At 30 September 2022, 88% of the Group's net assets were

denominated in euros or US dollars (31 March 2022: 86%). The Group

recorded a total foreign exchange translation gain of GBP711

million net of derivatives during the period (September 2021: GBP98

million) as a result of the weakening of sterling against the euro

and US dollar.

Post the period end, and in light of significant volatility in

foreign exchange markets, we implemented a medium-term foreign

exchange hedging programme to partially reduce the sensitivity of

the Group's future returns to euro and US dollar exchange

movements. The exposure of the Group's underlying investment

portfolio to euro and US dollar has increased significantly in

recent years through the organic growth of our existing European

and US portfolio companies and due to the majority of our new

investments being denominated in euro and US dollar. As at 4

November 2022, the notional amount of the forward foreign exchange

contracts held by the Group associated with this hedging programme

was EUR2.0 billion and $1.2 billion. We do not currently expect to

extend this hedging programme materially beyond these amounts. The

total notional amount of the forward foreign exchange contracts

held by the Group, including the Scandlines hedging programming, is

EUR2.6 billion and $1.2 billion.

Table 17 sets out the sensitivity of net assets to foreign

exchange movements at 30 September 2022 and post 30 September 2022

including the hedging programme.

Table 17: Net assets and sensitivity by currency at 30 September

2022

Net 1% 1%

assets sensitivity sensitivity (2) (after

hedging programme

implemented post

30 September 2022)

FX rate GBPm % GBPm GBPm

============== ======== ======= ==== ============ =======================

Sterling n/a 1,500 10% n/a n/a

Euro(1) 1.1387 10,104 71% 101 83

US dollar 1.1162 2,365 17% 24 13

Danish krone 8.4681 238 2% 2 2

Other n/a 33 - n/a n/a

============== ======== ======= ==== ============ =======================

Total 14,240

============== ======== ======= ==== ============ =======================

1 Sensitivity impact is net of derivatives at 30 September 2022.

2 Sensitivity based on net assets at 30 September 2022 including the

impact of the hedging programme implemented post 30 September 2022.

Euro and US dollar sensitivity is net of derivatives.

Carried interest and performance fees

We pay carried interest to participants in plans relating to our

proprietary capital invested. We also receive performance fees from

third-party funds and pay a portion of those performance fees to

participants in our carry plans. Carried interest at 30 September

2022 was calculated assuming that remaining assets in the portfolio

were realised

at their fair value at that date.

Table 18: Carried interest and performance fees for the six

months to 30 September

Investment basis Statement of comprehensive income 2022 2021

GBPm GBPm

==================================================== ====== ======

Carried interest and performance fees receivable

Private Equity 2 2

==================================================== ====== ======

Total 2 2

==================================================== ====== ======

Carried interest and performance fees payable

Private Equity (157) (194)

Infrastructure (5) (6)

==================================================== ====== ======

Total (162) (200)

==================================================== ====== ======

Net carried interest payable (160) (198)

==================================================== ====== ======

Table 19: Carried interest and performance fees

Investment basis Statement of financial position 30 September 31 March

2022 2022

GBPm GBPm

================================================== ============= =========

Carried interest and performance fees receivable

Private Equity 10 8

Infrastructure - 51

Total 10 59

================================================== ============= =========

Carried interest and performance fees payable

Private Equity (1,106) (926)

Infrastructure (8) (37)

================================================== ============= =========

Total (1,114) (963)

================================================== ============= =========

In Private Equity, we typically accrue net carried interest

payable at between 10% and 13% of GIR. We accrued carried interest

payable of GBP157 million (September 2021: GBP194 million) for

Private Equity in the period. This was driven by the continued

strong performance of the 2010-12 vintage, which includes Action,

as well as by the return generated by other Private Equity carry

vintages.

Carried interest is paid to participants when cash proceeds have

actually been received following a realisation, refinancing event

or other cash distribution and performance hurdles are passed in

cash terms. Due to the time between investment and realisation, the

schemes are usually active for a number of years. Their

participants are both current and previous employees of 3i. Total

carried interest and performance fee cash paid in the period was

GBP39 million (30 September 2021: GBP13 million), and total

performance fee cash received in the period was GBP51 million (30

September 2021: GBP8 million).

Overall, the effect of the income statement charge, the cash

payments, as well as the currency translation meant that the

balance sheet carried interest and performance fees payable

increased to GBP1,114 million at 30 September 2022 (31 March 2022:

GBP963 million).

Balance sheet

Table 20: Simplified consolidated balance sheet

30 September 31 March

2022 2022

Investment basis GBPm GBPm

================================================== ============= =========

Investment portfolio 16,417 14,305

Gross debt (1,129) (975)

Cash and deposits 55 229

================================================== ============= =========

Net debt (1,074) (746)

================================================== ============= =========

Carried interest and performance fees receivable 10 59

Carried interest and performance fees payable (1,114) (963)

Other net assets 1 99

================================================== ============= =========

Net assets 14,240 12,754

================================================== ============= =========

Gearing(1) 8% 6%

================================================== ============= =========

1 Gearing is net debt as a percentage of net assets.

The investment portfolio value increased to GBP16,417 million at

30 September 2022 (31 March 2022: GBP14,305 million) driven by

unrealised profit of GBP1,197 million and gains on foreign exchange

translation.

At 30 September 2022, the Group had net debt of GBP1,074 million

(31 March 2022: GBP746 million) after the payment of the second

FY2022 dividend of GBP262 million.

Going concern and liquidity

The Half-year consolidated financial statements are prepared on

a going concern basis following the assessment by the Directors,

taking into account the Group's current performance and

outlook.

Liquidity increased to GBP801 million at 30 September 2022 (31

March 2022: GBP729 million) and comprised cash and deposits of

GBP55 million (31 March 2022: GBP229 million) and a facility of

GBP746 million (31 March 2022: GBP500 million). Net debt was

GBP1,074 million (31 March 2022: GBP746 million) and gearing was 8%

(31 March 2022: 6%).

In July 2022, we increased our available liquidity by

introducing an additional two-year GBP400 million tranche to the

existing base GBP500 million RCF which matures in March 2027. At 30

September 2022, GBP154 million was drawn. The RCF drawdown was

repaid in October 2022.

Alternative Performance Measures ("APMs") .

We assess our performance using a variety of measures that are

not specifically defined under IFRS and are therefore termed APMs.

The APMs that we use may not be directly comparable with those used

by other companies. Our Investment basis is itself an APM.

The explanation of and rationale for the Investment basis and

its reconciliation to IFRS is provided from page 20 . The table

below defines our additional APMs and should be read in conjunction

with our Annual report and accounts 2022.

APM Purpose Calculation Reconciliation

to IFRS

Gross investment A measure of the performance It is calculated The equivalent balances

return as a percentage of our investment portfolio. as the gross investment under IFRS and the

of opening portfolio For further information, return, as shown reconciliation to

value see the Group KPIs in the Investment the Investment basis

in our Annual report basis Consolidated are shown in the

and accounts 2022. statement of comprehensive Reconciliation of

income, as a % of consolidated statement

the opening portfolio of comprehensive

value. income and the Reconciliation

of consolidated

statement of financial

position respectively.

================================ =========================== ==============================

Cash realisations Cash proceeds from The cash received The equivalent balance

our investments support from the disposal under IFRS and the

our returns to shareholders, of investments in reconciliation to

as well as our ability the period as shown the Investment basis

to invest in new opportunities. in the Investment is shown in the

For further information, basis Consolidated Reconciliation of

see the Group KPIs cash flow statement. consolidated cash

in our Annual report flow statement.

and accounts 2022.

================================ =========================== ==============================

Cash investment Identifying new opportunities The cash paid to The equivalent balance

in which to invest acquire investments under IFRS and the

proprietary capital and recognising reconciliation to

is the primary driver syndications in the Investment basis

of the Group's ability the period as shown is shown in the

to deliver attractive on the Investment Reconciliation of

returns. For further basis Consolidated consolidated cash

information, see the cash flow statement. flow statement.

Group KPIs in our Annual

report and accounts

2022.

================================ =========================== ==============================

Operating cash By covering the cash The cash income The equivalent balance

profit/(loss) cost of running the from the portfolio under IFRS and the

business with cash (interest, dividends reconciliation to

income, we reduce the and fees) together the Investment basis

potential dilution with fees received is shown in the

of capital returns. from external funds Reconciliation of

For further information, less cash operating consolidated cash

see the Group KPIs expenses and leases flow statement.

in our Annual report payments as shown

and accounts 2022. on the Investment

basis Consolidated

cash flow statement.

The calculation

is shown in Table

16 of the Overview

of financial performance.

================================ =========================== ==============================

Net cash/(net A measure of the available Cash and cash equivalents The equivalent balance

debt) cash to invest in the plus deposits less under IFRS and the

business and an indicator loans and borrowings reconciliation to

of the financial risk as shown on the the Investment basis

in the Group's balance Investment basis is shown in the

sheet. Consolidated statement Reconciliation of

of financial position. consolidated statement

of financial position.

================================ =========================== ==============================

Gearing A measure of the financial Net debt (as defined The equivalent balance

risk in the Group's above) as a % of under IFRS and the

balance sheet. the Group's net reconciliation to

assets under the the Investment basis

Investment basis. is shown in the

It cannot be less Reconciliation of

than zero. consolidated statement

of financial position.

================================ =========================== ==============================

Principal risks and uncertainties

3i's risk appetite statement, approach to risk management and

governance structure are set out in the Risk section of the Annual

report and accounts 2022, which can be accessed on the Group's

website at www.3i.com .

Notwithstanding increased market volatility, global economic

uncertainty and current geopolitical tensions, the principal risks

to the achievement of the Group's strategic objectives are

unchanged from those reported on pages 67 to 71 of the Annual

report and accounts 2022 and remain broadly stable in terms of

impact and likelihood. Given the challenging external operating

environment and uncertain outlook, the Group's principal risks

continue to be closely monitored and may be subject to change.

Principal risks

External - Risks arising from external factors including

political, legal, regulatory, economic and competitor changes,

which affect the Group's investment portfolio and operations.

As noted above, there is considerable uncertainty in the outlook

for the global economy, impacted by a range of factors including

increased cost of living, higher interest rates and lower forecast

economic growth. These economic headwinds have the potential to

affect trading performance, liquidity and valuations in varying

degrees across 3i's investment portfolio. As outlined below, 3i has

a well-funded balance sheet and a diverse portfolio of

international companies operating in a range of different sectors,

which has continued to perform well overall.

Investment - Risks in respect of specific asset investment

decisions, the subsequent performance of an investment or exposure

concentrations across business line portfolios.

The portfolio continues to perform well in the current economic

conditions. However, some portfolio companies are potentially more

exposed to the adverse effects of, for example, higher energy

prices and the impact of higher living costs on consumer

discretionary spend. This is being closely monitored. The current

economic and market uncertainties add complexity to transactions;

for example, pricing and the setting of investment case

assumptions. In addition, changes to the availability and pricing

of debt could potentially impact investment activity or refinancing

plans.

Operational - Risks arising from inadequate or failed processes,

people and systems or from external factors affecting these.

The Group's day-to-day operations have been stable in the

period. This includes the continued resilience and security of the

Group's IT systems and maintenance of robust processes and internal

controls. Staff turnover rates have been stable notwithstanding a

competitive recruitment market.

Capital management - Risks in relation to the management of

capital resources including liquidity risk, currency exposures and

leverage risk

3i's approach to capital management remains conservative, with a

well-funded balance sheet and low company debt. The company

increased available liquidity in July 2022 by way of an additional

two-year GBP400 million tranche to the existing base GBP500 million

RCF which matures in March 2027. This provides the Company with

additional financial flexibility at low cost. The investment and

divestment pipeline and balance of investment and realisation flows

are subject to regular reviews.

Post the period end, the Group implemented a medium-term foreign

exchange hedging programme to partially reduce the sensitivity of

the Group's future returns to euro and US dollar exchange movements

as part of its overall capital management approach.

The Half-year report provides an update on 3i's strategy and

business performance, as well as on market conditions, which is

relevant to the Group's overall risk profile and should be viewed

in the context of the Group's risk management framework and

principal risks as disclosed in the Annual report and accounts

2022.

Reconciliation of the Investment basis to IFRS

Background to Investment basis numbers used in the Half-year

report

The Group makes investments in portfolio companies directly,

held by 3i Group plc, and indirectly, held through intermediate

holding company and partnership structures ("investment entity

subsidiaries"). It also has other operational subsidiaries, which

provide services and other activities such as employment,

regulatory activities, management and advice ("trading

subsidiaries"). The application of IFRS 10 requires us to fair

value a number of investment entity subsidiaries that were

previously consolidated line by line. This fair value approach,

applied at the investment entity subsidiary level, effectively

obscures the performance of our proprietary capital investments and

associated transactions occurring in the investment entity

subsidiaries.

The financial effect of the underlying portfolio companies and

fee income, operating expenses and carried interest transactions