International Public Partnerships OFGEM Announcement on Rampion OFTO Investment (4245N)

29 Septiembre 2021 - 8:57AM

UK Regulatory

TIDMINPP

RNS Number : 4245N

International Public Partnerships

29 September 2021

OFGEM ANNOUNCEMENT ON RAMPION OFTO INVESTMENT

29 September 2021

International Public Partnerships Limited ('INPP' or 'the

Company'), the listed infrastructure investment company, notes that

Ofgem, as anticipated, published a notice under Section 8A of the

Electricity Act 1989 on 28 September 2021 relating to the Rampion

Offshore Transmission project ('OFTO') [1] . This is a key step

towards reaching financial close on the investment that the Company

expects to make in the project. As previously reported, the Company

expects to invest c.GBP40 million into the project upon financial

close, anticipated to be in November 2021.

The project will be the Company's ninth OFTO investment and

relates to the transmission cable connection to the offshore wind

farm located 13km off the Sussex coast. The wind farm consists of

116 x 3.45MW wind turbine generators with an installed capacity of

400MW connected to the offshore substation platforms ('OSP')

located within the boundaries of the Rampion wind farm.

This investment will further increase the Company's contribution

to the UK's transition to a zero-carbon economy. The Rampion OFTO

will transmit green electricity equivalent to around 350,000 UK

homes, increasing the number of homes that are powered by the

Company's OFTO portfolio to approximately 2.1 million homes.

The Company takes no exposure to electricity production or price

risk but is paid a pre-agreed, availability-based revenue stream

over 20 years which is fully linked to UK inflation ('RPI').

As previously announced, the Company is also preferred bidder on

East Anglia One OFTO.

ENDS.

For further information:

Erica Sibree/Amy Edwards +44 (0)20 7939 0558/0587

Amber Fund Management Limited

Hugh Jonathan +44 (0)20 7260 1263

Numis Securities

Ed Berry/Mitch Barltrop +44 (0) 20 3727 1046/1039

FTI Consulting

About International Public Partnerships (INPP):

INPP is a listed infrastructure investment company that invests

in global public infrastructure projects and businesses, which

meets societal and environmental needs, both now, and into the

future.

INPP is a responsible, long-term investor in over 130

infrastructure projects and businesses. The portfolio consists of

utility and transmission, transport, education, health, justice and

digital infrastructure projects and businesses, in the UK, Europe,

Australia and North America. INPP seeks to provide its shareholders

with both a long-term yield and capital growth.

Amber Infrastructure Group ('Amber') is the Investment Adviser

to INPP and consists of 150 staff who are responsible for the

management of, advice on and origination of infrastructure

investments.

[1] Offshore electricity transmission owner licensed entity.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STRDKCBPNBKDPCB

(END) Dow Jones Newswires

September 29, 2021 09:57 ET (13:57 GMT)

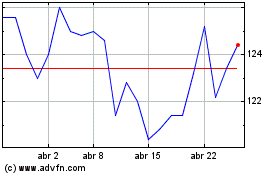

International Public Par... (LSE:INPP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

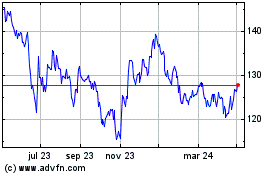

International Public Par... (LSE:INPP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024