International Public Partnerships Further Investment into Gold Coast Light Rail (7964G)

31 Marzo 2022 - 5:49AM

UK Regulatory

TIDMINPP

RNS Number : 7964G

International Public Partnerships

31 March 2022

FURTHER INVESTMENT INTO GOLD COAST LIGHT RAIL

31 March 2022

International Public Partnerships Limited ('INPP' or 'the

Company'), the FTSE 250 listed infrastructure investment company,

is pleased to announce that it has reached financial close on Stage

3 of the Gold Coast Light Rail project (the 'Project').

The follow-on investment in the Project has arisen through the

Company's existing 30% interest in the Project.

The Project extends the existing Gold Coast Light Rail network

(known as G:link) a further 6.7 kilometres south from Broadbeach to

Burleigh Heads. It will include eight new stations, five additional

light rail trams, new bus and light rail connections at Burleigh

and Miami, and an upgrade of existing depot and stabling

facilities.

At completion of Stage 3 in 2025, Queensland's only light rail

system will have a route 27 kilometres long from Helensvale to

Burleigh Heads, stopping at 27 stations and serviced by 23

trams.

Stage 1 and 2 of the Gold Coast G:link light rail system has

become a resounding success with more than 60 million passenger

trips to date. One of the many benefits of the rail system has been

an overall increase in public transport use on the Gold Coast with

a 43 percent uplift for combined tram and bus use since light rail

opened in 2014. The Company will look to support the delivery of

the project in line with its Sustainability Policy Aims, with a

particular focus on reducing embodied carbon as far as

practical.

Gold Coast Light Rail is a public-private-partnership ('PPP')

between the Queensland Government and GoldlinQ - a consortium of

which INPP is a member. The consortium has successfully designed,

constructed, financed, operated, and maintained the project since

2011. In addition to private financing, the project received

funding from the Federal and Queensland Governments and the City of

Gold Coast.

Under the terms of the acquisition the Company will make an

investment totalling approximately A$13.5 million. (c.GBP7.7

million at current exchange rates). The return profile of the

investment is expected to be consistent with the returns being

generated by the Company on its existing investment in the Project.

Following financial close of the acquisition the Company will be

approximately GBP173.1 million drawn against its GBP250 million

corporate debt facility including GBP16.9 million drawn under

letter of credit.

Mike Gerrard, Chair of INPP, said: "INPP's now ten year

investment in Gold Coast Light Rail reflects its continued

contribution to developing sustainable, reliable modes of transport

in one of Australia's fastest-growing areas. It is also an example

of the importance of public-private sector collaboration in

delivering outcomes for society. Reaching financial close on the

third stage of its development reflects our long-term commitment to

the Project, and our confidence in its ability to continue

transforming the way people move around the city in line with

sustainable goals."

ENDS.

For further information:

Erica Sibree/Amy Edwards +44 (0) 7557 646 499 / (0) 7827 238

355

Amber Fund Management Limited

Hugh Jonathan +44 (0)20 7260 1263

Numis Securities

Ed Berry/Mitch Barltrop +44 (0) 7703 330 199 / (0) 7807 296

032

FTI Consulting

About International Public Partnerships:

INPP is a listed infrastructure investment company that invests

in global public infrastructure projects and businesses, which

meets societal and environmental needs, both now, and into the

future.

INPP is a responsible, long-term investor in over 140

infrastructure projects and businesses. The portfolio consists of

utility and transmission, transport, education, health, justice and

digital infrastructure projects and businesses, in the UK, Europe,

Australia and North America. INPP seeks to provide its shareholders

with both a long-term yield and capital growth.

Amber Infrastructure Group ('Amber') is the Investment Adviser

to INPP and consists of over 150 staff who are responsible for the

management of, advice on and origination of infrastructure

investments.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBKDBQDBKDPNN

(END) Dow Jones Newswires

March 31, 2022 07:49 ET (11:49 GMT)

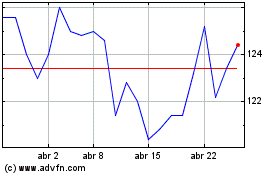

International Public Par... (LSE:INPP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

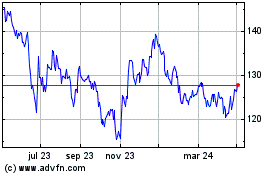

International Public Par... (LSE:INPP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024