International Public Partnerships 2022 First Half Year Dividend (6537Y)

08 Septiembre 2022 - 1:01AM

UK Regulatory

TIDMINPP

RNS Number : 6537Y

International Public Partnerships

08 September 2022

8 September 2022

2022 First Half Year Dividend

The Board of International Public Partnerships Limited ('INPP',

'the Company'), the FTSE 250 listed infrastructure investment

company, declares a distribution covering the period:

Distribution period: 1 January 2022 - 30 June 2022

Distribution amount per share: 3.87 pence

Ex-dividend date: 15 September 2022

Dividend record date: 16 September 2022

Circulation of Scrip Election Forms and Circular: 6 October 2022

Last date to elect/revoke elections: 28 October 2022

Payment date/Allotment of scrip: 18 November 2022

Scrip Alternative in operation: Yes (subject to the average of

the middle market prices of the Company's Shares derived from the

Daily Official List of the London Stock Exchange for the

Ex-Dividend Date and the four subsequent dealing days being at a

premium to the last published NAV calculated on a per share

basis)

The 2022 first half year distribution of 3.87 pence per share is

in line with the target previously outlined by the Directors and,

as per previous periods, has been entirely funded through operating

cash flow from the underlying projects.

Scrip Dividend Alternative

The Board intend to offer a scrip dividend alternative for this

distribution to those eligible INPP investors who wish to receive

additional INPP securities in lieu of a cash payment. In line with

prior dividends, the Company has implemented an online process,

reducing the need for paperwork and allowing eligible INPP

shareholders access to a web-based service to elect the scrip

dividend alternative. Details will be sent to all eligible INPP

shareholders on the register as at the record date for the dividend

being 16 September 2022 with the scrip dividend circular being

mailed on or about 6 October 2022, the terms of the scrip dividend

alternative will also be available on the INPP website.

Shareholders wishing to access the web-based service and receive

electronic communications from the Company can do so at

www.signalshares.com .

2022 and 2023 Full Year Distributions

The Board of Directors reaffirms that it has established a

target for 2022 and 2023 distributions of 7.74 and 7.93 pence per

share, respectively, providing additional guidance to investors as

to the Company's future intentions and the overall continued

performance of its portfolio. The targeted payments would represent

a c.2.5% increase on the preceding distributions and would continue

to be in line with the growth target indicated at the time of

INPP's IPO in 2006.

Note: The above distribution guidance is provided by the Company

in consultation with its Investment Adviser as a target only and is

not a profit forecast. There can be no assurance that this target

will be met or that the Company will make any distributions

whatsoever. The times and dates in this announcement are expected

times and dates only and are subject to change. The Board will

continue to review whether scrip dividends are appropriate for

future dividends. Any such changes will be notified to shareholders

through a regulatory information service.

ENQUIRIES:

Amber Fund Management Limited

Erica Sibree / Amy Edwards

T: +44 (0) 7557 676 499/+44 (0) 7827 238 355

ABOUT INTERNATIONAL PUBLIC PARTNERSHIPS:

INPP is a listed infrastructure investment company that invests

in global public infrastructure projects and businesses, which

meets societal and environmental needs, both now, and into the

future.

INPP is a responsible, long-term investor in over 140

infrastructure projects and businesses. The portfolio consists of

utility and transmission, transport, education, health, justice and

digital infrastructure projects and businesses, in the UK, Europe,

Australia and North America. INPP seeks to provide its shareholders

with both a long-term yield and capital growth.

Amber Infrastructure Group ('Amber') is the Investment Adviser

to INPP and consists of over 160 staff who are responsible for the

management of, advice on and origination of infrastructure

investments.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DIVBXGDCRGGDGDR

(END) Dow Jones Newswires

September 08, 2022 02:01 ET (06:01 GMT)

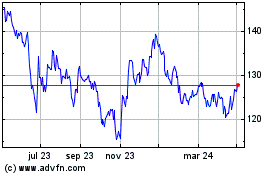

International Public Par... (LSE:INPP)

Gráfica de Acción Histórica

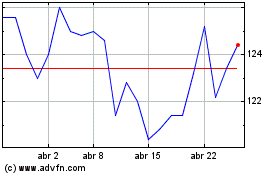

De Mar 2024 a Abr 2024

International Public Par... (LSE:INPP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024