TIDMINPP

RNS Number : 6861Y

International Public Partnerships

08 September 2022

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS NOT

FOR PUBLICATION, RELEASE, OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN, OR INTO, THE UNITED STATES, AUSTRALIA, CANADA, JAPAN, SOUTH

AFRICA OR ANY JURISDICTION IN WHICH THE SAME WOULD BE UNLAWFUL OR

TO US PERSONS. THE INFORMATION CONTAINED HEREIN DOES NOT CONSTITUTE

AN OFFER OF SECURITIES FOR SALE IN ANY JURISDICTION.

8 September 2022

INTERNATIONAL PUBLIC PARTNERSHIPS LIMITED

('INPP', the 'Company')

HALF-YEAR RESULTS FOR THE SIX MONTHSED 30 JUNE 2022

International Public Partnerships ('INPP', the 'Company'), the

FTSE 250-listed infrastructure investment company, is pleased to

announce its results for the six months to 30 June 2022.

HIGHLIGHTS FOR THE SIX MONTHS TO 30 JUNE 2022

-- NAV increased 18.9% to GBP3.0 billion (31 December 2021:

GBP2.5 billion) whilst NAV per share increased 6.1% to 157.3

pence(31 December 2021: 148.2 pence). The increases were driven by,

among other things, the portfolio's inflation-linkage, the

successful capital raise and the revaluation of the Company's

investment in Tideway during the period.

-- Despite an uncertain macroeconomic backdrop, the Company has

again delivered robust, predictable shareholder returns with a

c.2.5% increase in its H1 2022 dividend to 3.87 pence per share (30

June 2021: 3.78 pence per share). The Board has also reconfirmed

its full-year dividend targets for 2022 and 2023 at 7.74 pence per

share and 7.93 pence per share [i] , respectively. The Company

achieved cash dividend cover in the period of 1.2x [ii] (H1 2021:

1.3x).

-- The Company continued to perform well with the quality of the

portfolio's inflation-linked cash flows highlighted during the

period, and the overall inflation-linkage maintained at 0.7% (31

December 2021: 0.7%) [iii] .

-- The Company's active asset management approach of its

Investment Adviser has ensured all the portfolio's investment

performance objectives were met during the period, including asset

availability of 99.8% achieved against a target of over 98%. Strong

ongoing asset performance continues to create long-term value for

both investors and the local communities which our assets

serve.

-- The Investment Adviser continued to originate high-quality

investments, with the Company making new investments and investment

commitments of GBP56.1 million during the period, covering the

transport, digital, education and waste water sectors.

-- The Company has categorised itself as an 'Article 8'

financial product under the EU's Sustainable Finance Disclosure

Regulation ('SFDR'). This illustrates the Company's continued focus

on ESG and will support its approach to enhancing ESG data

collection to inform both SFDR and the Taskforce on Climate-Related

Financial Disclosures ('TCFD') reporting.

-- The successful completion of the Company's significantly

oversubscribed capital raise totalling GBP325 million (before issue

costs) indicated strong endorsement of the Company's investment

objectives from both existing and new shareholders.

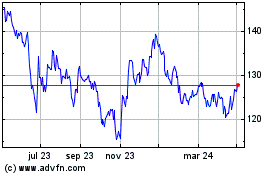

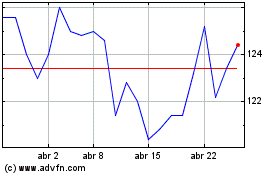

-- The Company has delivered a total shareholder return ('TSR')

of 238.3% since IPO, equivalent to an annualised TSR of 8.1% [iv]

.

-- The Company's GBP250 million corporate debt facility ('CDF')

is undrawn in cash terms, with GBP16.4 million committed in respect

of support for the investment pipeline. The remaining proceeds of

the capital raise total GBP116.9 million, together with the CDF,

can be used to support the investment pipeline.

-- IFRS profit before tax was GBP219.2 million (H1 2021: GBP27.2

million), principally reflective of the unrealised fair value gain

on the portfolio in the period.

Mike Gerrard, Chair of International Public Partnerships, said:

"I am pleased to report another successful six-month period for the

Company, characterised by strong financial and operational

performance. The quality of the portfolio's inflation-linkage cash

flows and their positive impact on the Company's NAV demonstrates

the resilience of our investment case against a volatile economic

backdrop."

INVESTMENT ACTIVITY

The Company's GBP56.1 million of new cash investments and

investment commitments included:

-- Thames Tideway, UK: In June 2022, the Company conditionally

agreed to acquire a further shareholding in Tideway, London's new

"super sewer", increasing its stake to approximately 18% through

the investment of approximately GBP42.0 million of additional

capital. This investment completed on 7 September 2022. The project

remains a key investment for the Company, given its attractive

financial proposition, positive future impact on the environment

and strong engagement with local communities, which closely

reflects the Company's own values as a responsible investor.

-- Gold Coast Light Rail, Australia: The Company announced in

April 2022 that financial close had been reached on Stage 3 of the

Gold Coast Light Rail project, where it will make an additional

investment of c.GBP7.1 million in 2025. The Company's existing

investment into Stages 1 and 2 of the project has seen 60 million

passenger trips in total, with usage increasing by 43% across the

transport network. This has made an important contribution to the

reduction of reliance on car transport in the Gold Coast

region.

-- Other: Further investments totalling GBP7.0 million were made

during the period, including into several availability-based UK

public-private partnership ('PPP') schemes, the Diabolo Rail Link

('Diabolo') and the National Digital Infrastructure Fund

('NDIF').

OPERATIONAL PERFORMANCE AND ASSET STEWARDSHIP

Responsible investment is a core component of the Company's

ability to deliver essential public services, maintain

relationships with its clients and local communities, and preserve

and grow the long-term value of each investment. The references to

SDGs below refer to the contribution of each mentioned asset to

defined UN Sustainable Development Goals.

Social infrastructure | SDG 3, 4, 8 & 16: Good health and

wellbeing; quality education; decent work and economic growth;

peace, justice and strong institutions

Availability-based PPPs account for 29% of the Company's

portfolio by investment fair value with asset availability of 99.8%

achieved against a target of over 98% for those investments. The

Company's public sector clients commissioned and funded over 528

contract variations during the period, at a combined value of GBP7

million. The completed changes ranged from cleaning regimes to

supporting operational assets throughout the pandemic within the

education and healthcare facilities, to the delivery of significant

transport facility upgrades.

Energy transmission | SDG 7: Affordable and clean energy

-- OFTOs, UK: During the period, Ofgem released a second

consultation regarding the potential regulatory developments

underpinning an extension of the OFTO revenue stream. All parties

recognise that the life extension of renewable energy assets

(including offshore transmission assets) is required to meet the

UK's net zero emissions targets. Ofgem expects to publish summaries

of feedback received as well as its decisions in Autumn 2022; the

Investment Adviser continues to be actively engaged with all

relevant industry stakeholders and will keep investors informed of

forthcoming developments.

Transport | SDG 8, 9 & 11: Decent work and economic growth;

industry innovation and infrastructure; sustainable cities and

communities

-- Diabolo Rail Link, Belgium: Passenger numbers as of June 2022

had increased to approximately 85% of pre-Covid levels. Of the

EUR24 million committed to the project by the Company in December

2020, EUR6.7 million remains available to protect Diabolo's

liquidity position and ensure compliance with its debt covenants.

The extent and timing of any further cash injections is dependent

on the trajectory of the recovery in passenger numbers. Traffic

forecasts for Diabolo estimate a return of pre-Covid levels of

usage by 2024. Discussions are continuing with Infrabel, the

Belgian rail network owner, over the implementation of a passenger

fare adjustment which could partially mitigate the impact of lower

passenger numbers seen over the past couple of years.

-- Angel Trains, UK: Revenues have continued to be largely

unaffected by the Covid-19 pandemic, on account of the fact the

majority of the asset's revenues are generated from the contractual

leasing of rolling stock to TOCs. Unlike the TOCs, Angel Trains is

not involved in, or directly impacted by, any of the disputes

underpinning the industrial action that occurred during the period,

though the Company continues to monitor the situation. During the

period, Angel Trains successfully acquired the Readypower Group, a

specialist rail and infrastructure services provider specialising

in the supply of on and off-track plant equipment as well as other

maintenance and operating services to the UK rail sector. The

acquisition is evidence of Angel Trains' wider commitment to

investing in and supporting the enhancement of the UK rail

industry.

Gas distribution | SDG 8, 9 & 11: Decent work and economic

growth; industry innovation and infrastructure; sustainable cities

and communities

-- Cadent, UK: Whilst Cadent is largely insulated from changes

in gas prices and the associated energy price caps, aside from

where the changes can cause timing differences in certain cash

flows, the Company continues to closely monitor the implications of

changes in gas prices and other developments in the sector. During

the period, Cadent's proposal to convert 2,000 homes in Ellesmere

Port, Whitby, from natural gas to hydrogen was shortlisted by Ofgem

to be the UK's first ever 'hydrogen village'. Should the proposal

be successful, the 2,000 homes will be supplied with hydrogen for

cooking and heating fuel from 2025. The investment remains the

Company's largest by fair value, representing 15.1% of the

portfolio, and is evidence of the Company's ongoing support of the

UK Government in meeting its net zero targets through the

transition to cleaner fuels.

Wastewater | SDG 6, 8, 9 & 11: clean water and sanitation;

decent work and economic growth; industry innovation and

infrastructure; sustainable cities and communities

-- Tideway, UK: During the period, Tideway reached the end of

the primary tunnelling phase, which was a key milestone for the

project, and over half of the secondary lining had been completed

by the end of the period. Overall construction works were 80%

complete at the end of June 2022, with the focus now principally

being on the completion of the secondary lining as well as the

system commissioning phase. As reported above, an additional stake

was acquired on 7 September 2022.

OUTLOOK

The portfolio has demonstrated its resilience over its

approximately 16-year history by, among other things, consistently

meeting its published forward dividend guidance. The largely

regulated or availability-based nature of the underlying cash

flows, with high levels of inflation-linkage, means the portfolio

is well positioned despite the uncertainty in the wider market.

The outlook for infrastructure investment remains strong. There

continues to be a need for infrastructure investment across the

countries where the Company invests, and the sectors where its

activity is focused continue to drive the transition towards

climate goals. We remain confident in the ability of our Investment

Adviser to continue to generate a high-quality pipeline of future

investment opportunities that will deliver long-term benefits for

all stakeholders.

S

NOTES TO EDITORS

Amber Infrastructure

Erica Sibree / Amy Edwards

+44 (0) 7557 646 499 / (0) 7827 238 355

FTI Consulting

Ed Berry / Mitch Barltrop / Jenny Boyd

+44 (0) 7703 330 199 / (0) 7807 296 032 / (0) 7971 005 577

About International Public Partnerships ('INPP'):

INPP is a listed infrastructure investment company that invests

in global public infrastructure projects and businesses, which

meets societal and environmental needs, both now, and into the

future.

INPP is a responsible, long-term investor in over 140

infrastructure projects and businesses. The portfolio consists of

utility and transmission, transport, education, health, justice and

digital infrastructure projects and businesses, in the UK, Europe,

Australia and North America. INPP seeks to provide its shareholders

with both a long-term yield and capital growth.

Amber Infrastructure Group ('Amber') is the Investment Adviser

to INPP and consists of over 160 staff who are responsible for the

management of, advice on and origination of infrastructure

investments.

Visit the INPP website at

www.internationalpublicpartnerships.com for more information.

Important Information

This announcement contains information that is inside

information for the purposes of the Market Abuse Regulation (EU)

No. 596/2014.

This announcement is an advertisement. It does not constitute a

prospectus relating to the Company and does not constitute, or form

part of, any offer or invitation to sell or issue, or any

solicitation of any offer to purchase or subscribe for, any shares

in the Company in any jurisdiction nor shall it, or any part of it,

or the fact of its distribution, form the basis of, or be relied on

in connection with or act as any inducement to enter into, any

contract therefor.

Forward-looking statements are subject to risks and

uncertainties and accordingly the Company's actual future financial

results and operational performance may differ materially from the

results and performance expressed in, or implied by, the

statements. These forward-looking statements speak only as at the

date of this announcement. The Company, Amber and Numis Securities

expressly disclaim any obligation or undertaking to update or

revise any forward-looking statements contained herein to reflect

actual results or any change in the assumptions, conditions or

circumstances on which any such statements are based unless

required to do so by the Financial Services and Markets Act 2000,

the Prospectus Rules of the Financial Conduct Authority or other

applicable laws, regulations or rules.

[i] Future profit projection and dividends cannot be guaranteed.

Projections are based on current estimates and may vary in

future.

[ii] Cash dividend payments to investors are paid from net

operating cash flows before capital activity.

[iii] Calculated by running a 'plus 1.0%' inflation sensitivity

for each investment and solving each investment's discount rate to

return the original valuation. The inflation-linked return is the

increase in the portfolio weighted average discount rate.

[iv] Since inception in November 2006. Source: Bloomberg. Share

price appreciation plus dividends assumed to be reinvested.

International Public Partnerships Limited

HALF-YEARLY FINANCIAL Report for the SIX MONTHS TO 30 JUNE

2022

Registered number: 45241

www.internationalpublicpartnerships.com

Note: Page references in this announcement refer to the full

formatted Half-Yearly Financial Report for the period ended 30 June

2022 that can be found on the Company's website. Certain charts

cannot be reproduced for the RNS format and can also be seen in the

PDF version of this document available on the Company's

website.

OUR PURPOSE

Our purpose is to invest responsibly in social and public

infrastructure that delivers long-term benefits for all

stakeholders.

We aim to provide our investors with stable, long-term,

inflation-linked returns, based on growing dividends and the

potential for capital appreciation.

We expect to achieve this by investing in a diversified

portfolio of infrastructure assets and businesses which, through

our active management, meets societal and environmental needs both

now and into the future.

COMPANY FACTS

- London Stock Exchange trading code: INPP.L

- Member of the FTSE 250 and FTSE All-Share indices

- GBP3.1 billion market capitalisation at 30 June 2022

- 1,911 million shares in issue at 30 June 2022

- Eligible for ISA/PEPs and SIPPs

- Guernsey incorporated company

- International Public Partnerships Limited ('the Company',

'INPP', the 'Group' (where including consolidated entities)) shares

are excluded from the Financial Conduct Authority's ('FCA')

restrictions, which apply to non-mainstream investment products,

and can be recommended by independent financial advisers to their

clients

RESPONSIBLE INVESMENT

In support of its purpose, the Company is committed to

responsible investment that is beneficial to its shareholders,

communities, society and wider stakeholders. The Company believes

that the financial performance of its investments is linked to

environmental and social success and, as such, the Company

considers issues that have the potential to impact the performance

of its investments, both now and in the future.

The Company draws on several frameworks and benchmarks to

provide direction. These frameworks are reviewed on an annual basis

to ensure that the Company remains at the forefront of sustainable

investment, operations and reporting. The Company has categorised

itself as an 'Article 8' financial product, which was communicated

in the Company's prospectus, published in April 2022. The Company

has also published a website disclosure in accordance with the

Level 1 requirements of the EU Sustainable Finance Disclosure

Regulation ('SFDR').

The Company's Investment Adviser, Amber Infrastructure Limited

('Amber') is a signatory of the UN-backed Principles for

Responsible Investment ('PRI').

The Company supports the 2030 Agenda for Sustainable Development

adopted by the UN Member States in 2015. Alignment with the UN

Sustainable Development Goals ('SDGs') is a key part of the

Company's approach to environmental, social and governance ('ESG')

integration. The Company contributes towards the SDGs in two main

ways: the positive impact investments have on sustainable

development and our aim to manage investments sustainably.

The Company has taken steps to strengthen the alignment of its

investment activity with the objectives of the Paris Agreement and

is a supporter of the recommendations of the Task Force on

Climate-related Financial Disclosures ('TCFD').

GLOSSARY

Certain words and terms used throughout this Half-yearly

Financial Report are defined in the glossary on page 67. Where

alternative performance measures ('APMs') are used, these are

identified by being marked with an * and further information on the

measure can be found in the glossary.

COVER IMAGE

Thames Tideway Tunnel, UK

Photo credit: Tideway

HALF-YEAR FINANCIAL HIGHLIGHTS

We aim to provide our investors with stable, long-term,

inflation-linked returns, based on growing dividends and the

potential for capital appreciation.

DIVIDS

3.87p - H1 2022 dividend per share(1)

7.74p - 2022 full-year dividend target per share(2)

7.93p - 2023 full-year dividend target per share(2)

c.2.5% - H1 2022 dividend growth

1.2x - H1 2022 cash dividend cover(3) (H1 2021: 1.3x)

NET ASSET VALUE ('NAV') (4)

GBP3.0bn - NAV at 30 June 2022 (4) (31 December 2021:

GBP2.5bn)

157.3p - NAV per share at 30 June 2022(4) (31 December 2021:

148.2p)

18.9% - Increase in NAV for the six months to 30 June 2022 (31

December 2021: 6.1%)

6.1% - Increase in NAV per share for the six months to 30 June

2022 (31 December 2021: 0.7%)

PORTFOLIO ACTIVITY

GBP56.1m - Cash investments and new commitments made during H1

2022 (31 December 2021: GBP252.7m)(5)

INFLATION-LINKAGE

0.7% - Portfolio inflation-linkage at 30 June 2022(6) (31

December 2021: 0.7%)

TOTAL SHAREHOLDER RETURN ('TSR')

238.3% - TSR since Initial Public Offering ('IPO')(7)

8.1% p.a. - Annualised TSR since IPO(7)

PROFIT

GBP219.2m - H1 2022 profit before tax (H1 2021: GBP27.2m)

1 The forecast date for payment of the dividend relating to the

six months to 30 June 2022 is 18 November 2022.

2 Future profit projection and dividends cannot be guaranteed.

Projections are based on current estimates and may vary in

future.

3 Cash dividend payments to investors are paid from net

operating cash flow before capital activity* as detailed on pages

23 to 24.

4 The methodology used to determine the NAV is described in detail on pages 25 to 32.

5 As at 31 December 2021, this includes cash investments made only.

6 Calculated by running a 'plus 1.0%' inflation sensitivity for

each investment and solving each investment's discount rate to

return the original valuation. The inflation-linked return is the

increase in the portfolio weighted average discount rate.

7 Since inception in November 2006. Source: Bloomberg. Share

price appreciation plus dividends assumed to be reinvested.

COMPANY OVERVIEW

CONSISTENT AND SUSTAINED RETURNS

INPP Dividend Payments

[Diagram can be found in PDF version of this document on the

Company's website].

PREDICTABLE portfolio performance

P rojected Investment Receipts

[Diagram can be found in PDF version of this document on the

Company's website].

Note: This chart is not intended to provide any future profit

forecast. Cash flows shown are projections based on the current

individual asset financial models and may vary in the future. Only

investments committed as at 30 June 2022 are included.

LOW RISK AND DIVERSIFIED PORTFOLIO

Sector Breakdown

Energy Transmission 21%

--------------------- ----

Transport 20%

--------------------- ----

Education 17%

--------------------- ----

Gas Distribution 15%

--------------------- ----

Waste Water 13%

--------------------- ----

Health 4%

--------------------- ----

Military Housing 3%

--------------------- ----

Digital 2%

--------------------- ----

Courts 2%

--------------------- ----

Other 3%

142 investments in infrastructure investments and businesses

across a variety of sectors(1)

Geographic Split

UK 76%

----------- ----

Australia 8%

----------- ----

Belgium 7%

----------- ----

Germany 4%

----------- ----

US 3%

----------- ----

Canada 2%

----------- ----

Ireland <1%

----------- ----

Denmark <1%

Invested in selected global regions that meet INPP's specific

risk and return requirements

Investment Type Risk Capital(2) 92%

----------------- ----

Senior Debt 8%

Invested across the capital structure, taking into account appropriate

risk-return profiles

Investment Ownership

100% 45%

--------- ----

50%-100% 6%

--------- ----

<50% 49%

Preference to hold majority stakes

Mode of Acquisition/Investment Status

Construction 13%

------------------------- ----

Operational 87%

------------------------- ----

Early Stage Investor(3) 66%

------------------------- ----

Later Stage Investor(4) 34%

Early stage investment gives first mover advantage maximises

capital growth opportunities

Investment Life

<20 years 46%

------------- ----

20-30 years 19%

------------- ----

>30 years 35%

Weighted average portfolio life of 37 years(5)

1 The majority of projects and businesses benefit from

availability-based or regulated revenues.

2 Risk Capital includes both investment and business level

equity and subordinated shareholder debt.

3 'Early Stage Investor' - investments developed or originated

by the Investment Adviser or predecessor team in primary or early

phase investments.

4 'Later stage investor' -investments acquired from a third

party investor in the secondary market.

5 Includes non-concession entities which have potentially a

perpetual life but assumed to have finite lives for this

illustration.

International Public Partnerships invests in high-quality

infrastructure assets and businesses that are resilient over the

long term

We have a long-standing relationship with Amber, the Company's

Investment Adviser

Amber has sourced and managed the Company's assets since IPO in

2006

- Amber is a specialist international infrastructure investment

manager and one of the largest independent teams in the sector with

over 160 employees working internationally. It is a leading

investment originator, asset and fund manager with a strong track

record

- Amber applies an active asset management approach to the

underlying investments to support environmental and social

characteristics of its investments

- The Company has first right of refusal over qualifying

infrastructure assets identified by Amber and for US investments,

by Amber's long-term investor, US Group, Hunt Companies LLC

('Hunt')

Relationship with the Investment Adviser

[Diagram can be found in PDF version of this document on the

Company's website].

OUR STRENGTHS

- Long-term alignment of interests between the Company, Amber and other key suppliers

- Amber has physical presence in all of the major countries in

which we invest, which provides local insights and

relationships

- A vertically integrated model with direct relationships with public sector authorities

- Experienced team in all aspects of infrastructure development, investment and management

- Active approach to investment stewardship which is the cornerstone of successful investment

- Consideration and integration of material ESG risks and

opportunities throughout the investment lifecycle

- Active engagement with all key stakeholders

- Strong independent Board (six of the seven Directors are

independent) with a diversity of experience and strong corporate

governance

BUSINESS MODEL

DELIVERING long-term benefits

OUR PURPOSE

Our purpose is to invest responsibly in social and public

infrastructure that delivers long-term benefits for all

stakeholders.

We aim to provide our investors with stable, long-term,

inflation-linked returns, based on growing dividends and the

potential for capital appreciation.

We expect to achieve this by investing in a diversified

portfolio of infrastructure assets and businesses which, through

our active management, meets societal and environmental needs both

now and into the future.

what we do

SOURCE

The Company operates a rigorous framework of governance,

incorporating a streamlined screening, diligence and execution

process. This includes substantive input from the Company's

Investment Adviser and, as appropriate, external advisers, with the

Company's Board providing robust challenge and scrutiny

INVEST

We seek new investments through our extensive relationships,

knowledge and insights to:

- Enhance long-term, inflation-linked cash flows*

- Provide opportunities to create long-term value and enhance returns

- Ensure ESG is core to the investment process

OPTIMISE

Using the Investment Adviser's highly experienced in-house asset

management team, we seek to actively manage the Company's

investments, balancing risk and return, and using detailed research

and analysis to optimise the Company's financial and ESG

performance

DELIVER

Together with our Investment Adviser's active asset management

of our investments, we aim to deliver strong ongoing asset

performance for stakeholders and achieve target returns from the

portfolio for investors

VALUE-FOCUSED PORTFOLIO DEVELOPMENT

- We seek a portfolio of investments with no or low exposure to

market demand risks and for which financial, macroeconomic,

regulatory, ESG and country risks are well understood and

manageable

- The Investment Adviser has a strong investment team that

originates unique opportunities in line with the Company's

investment strategy

- We continually monitor opportunities to enhance the Company's existing investments

- The Company draws on the Investment Adviser's award-winning

sustainability programme, 'Amber Horizons', to inform areas for

future investment

ACTIVE ASSET MANAGEMENT

- The Investment Adviser has an in-house asset management team

dedicated to managing the Company's investments

- Where possible, through the Investment Adviser, we manage the

day-to-day activities of each of our investments internally

- We carry out extensive monitoring, including asset level board

and management meetings occur on a quarterly basis

- The Company works with public sector clients, partners and

service providers to ensure investments are being managed both

responsibly and efficiently to deliver the required outputs

- We focus on investment stewardship across the portfolio and

recognise the broader value created from our investments

efficient financial management

- Efficient financial management of investment cash flows and working capital

- Maintaining cash covered dividends

- Ensuring cost-effective operations

CONTINUOUS risk management

- Robust risk analysis during investment origination ensures strong portfolio development

- Integrated risk management throughout the investment cycle to support strategic objectives

- Ongoing risk assessment and mitigation ensures successful ongoing performance

RESPONSIBLE INVESTMENT

- Integrated ESG considerations across the investment lifecycle

- Robust ESG objectives to build resilience and drive environmental and social progress

- Upholding high standards of business integrity and governance

VALUE CREATION

investor returns

Continuing to deliver consistent financial returns for investors

through dividend growth* and inflation-linked returns* from

underlying cash flows and provide opportunities for capital

appreciation

PUBLIC SECTOR AND OTHER CLIENTS

Providing responsible investment in infrastructure to support

the delivery of essential public services and broader societal

objectives (e.g. supporting the path to net zero). Our ability to

deliver services and maintain relationships with our clients and

other key stakeholders is vital for the long-term prosperity of

each investment

communities

Delivering sustainable social infrastructure for the benefit of

local communities. The Company's investments provide vital public

assets which strengthen communities, and seek to provide additional

benefits through deploying investment in local economies, for

example via job creation

SUPPLIERS AND THEIR EMPLOYEES

The performance of our service providers, supply chain and their

employees is crucial for the long-term success of our investments.

The Company promotes a progressive approach to:

- Corporate social responsibility

- Safe, healthy, inclusive workplaces

- Opportunities for professional development

- Staff engagement

OBJECTIVES AND PERFORMANCE

The value we provide to our investors is monitored using our Key

Performance Indicators ('KPIs'). The delivery of value to both

investors and our wider stakeholders is achieved by carefully

monitoring our performance against related strategic

priorities.

INVESTOR RETURNS Delivering long-term, - Target an annual - c.2.5% Dividend increase

inflation-linked dividend increase achieved for H1 2022

returns to investors of 2.5% (H1 2021: 2.7%)

- Target a long-term - 7.9% p.a. IRR achieved

total return of since IPO to 30 June 2022(1)

at least 7.0% per (31 December 2021: 7.7% p.a.)

annum

- 0.7% Inflation-linked

returns on a portfolio basis

at 30 June 2022

- Inflation-linked (31 December 2021: 0.7%)

returns on a portfolio

basis

-------------------- ---------------------------- ------------------------ ------------------------------------

Value-focused Originate investments New investments 100% of the investments made

portfolio with stable, long-term meet at least three in H1 2022 met at least three

development cash flows and of six attributes: of the six attributes

potential growth 1. Stable, long-term (H1 2021: 100%)

attributes, whilst returns

maintaining a balanced 2. Inflation-linked

portfolio of assets investor cash flows

3. Early stage

investor

4. Investment secured

through preferential

access

5. Other capital

enhancement attributes

6. Positive SDG

contribution

-------------- ---------------------------------- ------------------------ ------------------------------------

ACTIVE ASSET Managing strong - Strong ongoing - 100% Forecast portfolio

MANAGEMENT ongoing asset performance asset performance distributions received for

as demonstrated H1 2022(2)

by: (H1 2021: 100%)

- 0.1% Asset performance

deductions achieved against

a target of <3% during H1

2022

(H1 2021: 0.1%)

- 99.8% Asset availability

achieved against a target

of >98% during H1 2022

(H1 2021: 99.7%)

Responsible Management of material - Robust integration - A+ The Company's Investment

Investment ESG factors(3) of ESG into investment Adviser's score for the UN-backed

lifecycle PRI 2020 assessment for both

the Strategy and Governance

and the Infrastructure modules(4)

- Positive SDG - 100% Percentage of investments

contribution for in the period that positively

new investments support targets outlined

by the SDGs(5)

-------------- ---------------------------------- ------------------------ ------------------------------------

efficient Making efficient - Cash covered - 1.2x Dividends fully cash

financial use of the Company's dividends covered for H1 2022

management finances and working (H1 2021: 1.3x)

capital - Competitive - 1.09% Ongoing charges

ongoing charges ratio for H1 2022

(H1 2021: 1.25%)

-------------- ---------------------------------- ------------------------ ------------------------------------

1 Calculated by reference to the November 2006 IPO issue price

of 100p and reflecting NAV* appreciation plus dividends paid.

2 Measured by comparing forecast portfolio distributions against

actual portfolio distributions received. In the current year,

actual portfolio distributions exceeded forecast.

3 Please refer to page 36 for additional ESG KPIs that are

linked to the Company's approach to asset management

4 In its first year of participation, the Company's Investment

Adviser achieved A+ in the UN-backed PRI 2020 assessment for both

the strategy and governance and the Infrastructure modules.

5 The Company aims to manage and monitor any potential adverse

impacts as outlined on page 36.

CHAIR'S LETTER

Dear Shareholders,

I am pleased to report another successful six-month period for

the Company to 30 June 2022. INPP has continued to deliver strong

financial and operational performance, with its portfolio of over

140 infrastructure projects and businesses demonstrating resilience

in an uncertain macroeconomic environment.

There have been a number of notable highlights during the

period, including:

(-) Delivering a TSR since IPO in November 2006 to 30 June 2022

of 238.3% or 8.1% on an annualised basis(1)

- The successful completion of a significantly oversubscribed

GBP325 million capital raising, exceeding the initial target of

GBP250 million, demonstrating strong support from both existing and

new shareholders

- Over GBP56 million of new investments and commitments

- Continued strong inflation linkage (0.7%)(2)

- Enhanced ESG considerations including the Company being

classified as an Article 8 financial product under SFDR

The portfolio continues to exhibit resilient cash flows and the

Company remains confident that its business model and investment

objectives remain attractive for its investors.

OPERATIONAL AND FINANCIAL UPDATE

CONSISTENT AND PREDICTABLE RETURNS

Over the six months to 30 June 2022, NAV per share increased by

9.1 pence to 157.3 pence (31 December 2021: 148.2 pence), with the

NAV increasing to GBP3.0 billion. The Company reported a profit for

the six months to 30 June 2022 of GBP219.2 million (30 June 2021:

GBP27.2 million) which reflects the increase in the fair value of

the Company's investments over the period driven by, among other

factors, the updated near-term inflation assumptions and the

revaluation of the Company's investment in Tideway (more

information on these changes can be found on page 17).

I am pleased to also announce that the Company has achieved cash

dividend cover of 1.2x(3) , while delivering further dividend

growth. As a result of the Company's performance, the Board has

declared a dividend of 3.87 pence per share(4) for the six months

to 30 June 2022, in line with its stated dividend target of 7.74

pence per share(5) for the 2022 financial year. This represents

c.2.5% growth on the prior corresponding period and is consistent

with the c.2.5% average annual dividend growth that has been

delivered since the Company's inception. The dividend will be paid

on 18 November 2022. The Board is also pleased to reaffirm its

dividend target for 2022 of 7.74 pence per share and reaffirm its

guidance of 7.93 pence per share for 2023.

INVESTMENT ACTIVITY

Since the beginning of 2022, the Company has made new

investments and investment commitments of GBP56.1 million covering

the transport, digital, education and waste water sectors.

During the period, the Company conditionally agreed to acquire a

further shareholding in Tideway, the London waste water project,

increasing its stake to approximately 18% through the investment of

approximately GBP42 million of additional capital. At the time of

writing, we expect this investment to complete on or around the

publication date of this report. We are very pleased to make this

additional investment in Tideway. The project is seen by the

Company as financially attractive and, moreover, its positive

impact on the environment and strong engagement with local

communities, are closely aligned with the Company's own values as a

responsible investor.

In addition, the Company has announced that financial close had

been reached on Stage 3 of the Gold Coast Light Rail project where

it will make an additional investment totalling c.GBP7.1 million.

The Company's existing investment into Stages 1 and 2 of the

project has seen over 60 million passenger trips, with combined

tram and bus usage increasing 43% across the Gold Coast transport

network since the light rail project opened in 2014, making an

important contribution to reduced reliance on car transport.

Further investments totalling GBP7.0 million were made during

the period, including in a UK public-private partnership ('PPP')

portfolio, Diabolo Rail Link ('Diabolo') and National Digital

Infrastructure Fund ('NDIF') which the Company committed to in July

2017. More information on these investments is available on pages

14 to 15.

Post-period end, minority interests in four Lancashire Building

Schools for Future ('BSF') projects were successfully sold, with

GBP8.5 million being realised, and aligned with the carrying value

on the disposal date. While the sales values were relatively minor

in the context of the overall portfolio, it was nevertheless a

reassuring demonstration of the continued quality of the portfolio.

As part of its active asset management approach and through the

lens of its divestment policy, the Company regularly reviews its

portfolio and, in these cases, determined that a sale was in the

best interests of the Company.

As previously reported, the Company is preferred bidder on two

more offshore transmission projects ('OFTOs') - Moray East and East

Anglia One - which will be the tenth and eleventh OFTO projects in

the Company's portfolio. These projects are progressing well and

continue to be in line with the Company's investment objectives,

with availability-based revenue streams, protected downside and

inflation-linkage. The Company's current OFTO portfolio has the

capacity to transmit enough renewable electricity to power c.2.1

million homes, in support of the UK's transition to net zero. This

will increase to 3.7 million once the two preferred bidder OFTOs

have been acquired. Please see more information on the Company's

investment activity on pages 14 to 15.

Following the successful capital raise, proceeds were partially

utilised to repay the drawn balance on the Corporate Debt Facility

('CDF'), and the remaining capital is earmarked to support the

current pipeline.

PORTFOLIO OVERVIEW

The priority for the Company's Investment Adviser, Amber

Infrastructure, is meeting or exceeding the Company's investment

performance objectives, and creating value for investors and

communities. Its active asset management approach has been

fundamental to the Company's successful performance since IPO in

2006. It is this performance that has enabled the Company to build

a reputation for delivering transparent, responsible stewardship of

public infrastructure assets that support essential services.

The following sets out some key updates over the six months to

30 June 2022.

The Company continues to monitor the energy regulator, Ofgem's,

further consultation on the OFTO regime that will apply once the

contracted revenue period comes to an end. In July 2021, Ofgem

released its first decision document, the contents of which were

consistent with our expectations and, in June 2022, Ofgem released

a second consultation document regarding the potential regulatory

developments underpinning an extension of the OFTO revenue stream.

The Investment Adviser continues to be actively engaged with all

relevant industry stakeholders. All parties recognise that the life

extension of renewable energy assets (including offshore

transmission assets owned by the Company) is required to meet the

UK net zero emissions targets. The consultation is the second in a

proposed multi-part consultation on the end of tender revenue

process and focuses on the regulatory financial arrangements. Ofgem

expects to publish summaries of the non-confidential feedback and

any updates on the issues covered in a further publication in

Autumn 2022. We will seek to keep investors informed of forthcoming

developments.

The Company's Investment Adviser continues to monitor Diabolo,

the strategic rail transportation asset linking Brussels Airport

with Belgium's national rail network, as it recovers from the

reduction in demand as a result of Covid-19 restrictions. Further

to the EUR24 million committed to the project in December 2020,

EUR6.7 million remains available to protect Diabolo's liquidity

position and ensure compliance with its debt covenants. Of the

EUR24 million, EUR17.3 million has been drawn to date, of which

EUR5.0 million(6) was drawn during the period. The extent and

timing of any further cash injections is dependent upon the

trajectory of the recovery in passenger numbers, which at the end

of June were approximately c.85% of pre-Covid levels. The latest

traffic forecast report for Diabolo assumes a return of pre-Covid

levels by 2024. Discussions are continuing with Infrabel, the

Belgian rail network owner, over the implementation of a passenger

fare adjustment which could partially mitigate the impact of lower

passenger numbers.

Cadent continues to actively support the UK Government in

meeting its net zero target, by working on various initiatives to

enable the transition to cleaner fuels, including being shortlisted

by Ofgem to develop the UK's first ever 'hydrogen village', which

is discussed further on page 39. Whilst Cadent is largely insulated

from changes in gas prices and the associated energy price caps,

aside from where the changes can cause timing differences in

certain cash flows, the Company continues to closely monitor the

implications of changes in gas prices and other developments within

the sector.

INVESTMENT STEWARDSHIP AND ESG

The Company considers sustainability and ESG integration to be

fundamental parts of its approach to investment risk management,

investment origination and value creation. During the period, the

Company chose to categorise itself as an Article 8 financial

product, following an internal assessment of the application of the

SFDR.

In line with this new commitment, the Company's Investment

Adviser is further refining its ESG data collection policies and

processes to support enhanced disclosures under SFDR and TCFD. The

aim of this will be to provide investors, and other key

stakeholders, with more granular information about the Company's

ESG risks and opportunities.

The Company's Investment Adviser continues to engage with its

public sector partners and key suppliers to ensure that the

projects and businesses in which the Company invests remain

available and operational to deliver for the communities which they

serve, to the greatest extent possible, whilst protecting the

health and safety of staff and users. For those investments

measured by both availability and performance standards, for the

six months to 30 June 2022, the availability of those assets was

99.8% (30 June 2021: 99.7%) and there were performance deductions

of no more than 0.1% (31 December 2021: 0.1%). Both of these

measures represent outperformance relative to the Company's targets

and are a testament to the Investment Adviser's active asset

management approach.

The social considerations implicit in ESG are as important as

the environmental considerations, recognising that there can be

much overlap between the two. A good example of this would be the

Investment Adviser's activities at one of the Company's social

accommodation investments, where it is working with a specialist

agent to donate equipment no longer required to good causes.

Through this one initiative, over GBP194,000 of in-kind donations

have been made to 10 charities, over 45 tonnes of waste has been

diverted from landfill, and over 61 tonnes of greenhouse gas

emissions have been avoided. Please refer to the Responsible

Investment section on pages 33 to 42 for more information

CORPORATE GOVERNANCE

At the Annual General Meeting ('AGM') in May, Claire Whittet

retired from the Board having completed nine years of service for

the Company, during which time she held various roles including

Senior Independent Director and Chair of the Management Engagement

Commitment. I and my fellow Directors, past and present, would like

to thank Claire for her commitment and highly valued contribution

to the success of the Company during these years.

As a result of her retirement and the importance of ongoing

Board rotation, the following changes in Board responsibilities

took place during the period:

- Meriel Lenfestey was appointed Chair of the Management Engagement Committee;

- John Le Poidevin was appointed to the role of Senior Independent Director; and

- Stephanie Coxon was appointed Chair of the Nomination and

Remuneration Committee, replacing Julia Bond who remains Chair of

the ESG Committee.

In addition, the Company's Board of Directors continue to

actively engage with the Company's portfolio companies and during

the period carried out a Cadent site visit as well as meeting with

Cadent colleagues.

CURRENT ENVIRONMENT AND OUTLOOK

The outlook for infrastructure investment remains strong, and I

am pleased to observe continued positive macro fundamentals that

support the Company's portfolio. Whilst the Company continues to

manage and mitigate risk, the portfolio has further demonstrated

its resilience in the current macroeconomic environment. The result

of the Company's capital raising activities during the period is a

strong indication of the attractiveness of the Company's investment

case and we were encouraged by the support from new and existing

investor groups.

The Company maintains a high-quality pipeline of future

investment opportunities. Through the Investment Adviser, we are

committed to ensuring new and existing investments remain focused

on the key characteristics required to meet the Company's

investment criteria, including yields that are attractive relative

to asset risk profile, the likelihood of long-term stable cash

flows, high barriers to entry to competition, strong ESG

credentials and opportunities to enhance the value of individual

investments and the portfolio overall.

There continues to be a need for infrastructure investment

across the countries in which the Company invests. Governments

internationally have acknowledged the key role infrastructure

spending will play in driving economic recovery, the creation of

jobs and our ability to address key challenges such as climate

change. The sectors in which the Company invests continue to drive

the transition towards climate goals, for example in energy

transition, digital connectivity and social infrastructure. The

Company is also well positioned to take advantage of any future

opportunities that may emerge. As at the current date, the

Company's GBP250 million revolving credit facility was undrawn in

cash terms, with GBP16.4 million committed in respect of letters of

credit to support our investment pipeline. The proceeds of the

capital raise, completed during the period, can be used to support

our current pipeline.

This year has seen rapidly increasing energy prices, growing

concerns about energy security and resurgent general inflation

across the geographies in which the Company invests, much of which

can be traced back to the war in Ukraine and, in the case of

inflation, also to the ongoing fall-out from the Covid-19 pandemic

and the associated global recovery. Whilst the Company is well

positioned to mitigate these risks, it is not insulated from their

effects especially as it relates to the staff of our projects and

investee businesses, their supply chains, users of these

infrastructure assets and their wider stakeholders. At such a time,

the importance of social aspects of our commitment to ESG best

practices, as described above, is clear. For more information

please see the current market and future opportunities section of

this report on pages 16 to 17.

I and my fellow Directors thank you for your continued

support.

Mike Gerrard

Chair

7 September 2022

1 Since inception in November 2006. Source: Bloomberg. Share

price appreciation plus dividends assumed to be reinvested.

2 Calculated by running a 'plus 1.0%' inflation sensitivity for

each investment and solving each investment's discount rate to

return the original valuation. The inflation-linked return is the

increase in the portfolio weighted average discount rate. Please

refer to pages 29 to 30 for further detail.

3 Cash dividend payments to investors are paid from net

operating cash flow before capital activity as detailed on pages 23

to 24.

4 The forecast date for payment of the dividend relating to the

six months to 30 June 2022 is 18 November 2022.

5 Future profit projection and dividends cannot be guaranteed.

Projections are based on current estimates and may vary in

future.

6 An additional EUR0.5 million was drawn post-period end in July 2022.

tOP 10 INVESTMENTS

The Company's top ten investments by fair value at 30 June 2022

are summarised below. A complete listing of the Company's

investments is available on the Company's website (

www.internationalpublicpartnerships.com ).

Status % holding % investment % investment

at at fair value fair value

Name of 30 June 30 June 30 June 31 December SDG

Investment Location Sector 2022 2022(1) 2022 2021 Supported

-------------- ----------- -------------- -------------- ------------- ------------- ------------- ------------

Gas 7% Risk

Cadent UK distribution Operational Capital 15.1% 15.5% 9

-------------- ----------- -------------- -------------- ------------- ------------- ------------- ------------

Cadent owns four of the UK's eight regional gas distribution networks

('GDNs') and in aggregate provides gas to approximately 11 million

homes and businesses.

----------------------------------------------------------------------------------------------------------------------

Waste Under 16% Risk

Tideway UK water Construction Capital(2) 13.0% 9.1% 6

-------------- ----------- -------------- -------------- ------------- ------------- ------------- ------------

Tideway is the trading name of the company that was awarded the licence

to design, build, finance, commission and maintain a new 25km 'super-sewer'

under the River Thames.

----------------------------------------------------------------------------------------------------------------------

100% Risk

Diabolo Belgium Transport Operational Capital 7.3% 7.0% 11

-------------- ----------- -------------- -------------- ------------- ------------- ------------- ------------

Diabolo integrates Brussels Airport with the national rail network

allowing passengers to access high-speed trains, such as Amsterdam-Brussels-Paris

and NS International trains.

----------------------------------------------------------------------------------------------------------------------

10% Risk

Angel Trains UK Transport Operational Capital 6.7% 7.1% 11

-------------- ----------- -------------- -------------- ------------- ------------- ------------- ------------

Angel Trains is a rolling stock leasing company which owns more than

4,000 vehicles. Angel Trains has invested over GBP5 billion in new

rolling stock and refurbishment since 1994, and is the second largest

investor in the industry after Network Rail.

----------------------------------------------------------------------------------------------------------------------

Energy 100% Risk

Lincs OFTO UK transmission Operational Capital 6.6% 6.9% 7

-------------- ----------- -------------- -------------- ------------- ------------- ------------- ------------

The project connects the 270MW Lincs offshore wind farm, located 8km

off the east coast of England, to the National Grid. The transmission

assets comprise the onshore and offshore substations and under-sea

cables, 100km in length.

----------------------------------------------------------------------------------------------------------------------

100% Risk

Capital

and 100%

Ormonde Energy senior

OFTO UK transmission Operational debt 3.9% 4.2% 7

-------------- ----------- -------------- -------------- ------------- ------------- ------------- ------------

The project connects the 150MW Ormonde offshore wind farm, located

10km off the Cumbrian coast, to the National Grid. The transmission

assets comprise the onshore and offshore substations and under-sea

cables, 41km in length.

----------------------------------------------------------------------------------------------------------------------

Reliance 33% Risk

Rail Australia Transport Operational Capital 3.2% 3.7% 11

-------------- ----------- -------------- -------------- ------------- ------------- ------------- ------------

Reliance Rail is responsible for financing, designing, delivering

and ongoing maintenance of 78 next-generation, electrified, 'Waratah'

train sets serving Sydney in New South Wales, Australia.

----------------------------------------------------------------------------------------------------------------------

100% Risk

BeNEX Germany Transport Operational Capital 2.8% 2.8% 11

-------------- ----------- -------------- -------------- ------------- ------------- ------------- ------------

BeNEX is both a rolling stock leasing company as well as an investor

in train operating companies ('TOCs'), providing approximately 42

million train km of annual rail transport.

----------------------------------------------------------------------------------------------------------------------

US Military Military 100% Risk

Housing(3) US housing Operational Capital 2.6% 2.5% 11

-------------- ----------- -------------- -------------- ------------- ------------- ------------- ------------

Two tranches of mezzanine debt underpinned by security over seven

operational PPP military housing projects, relating to a total of

19 operational military bases in the US and comprising c.21,800 individual

housing units.

----------------------------------------------------------------------------------------------------------------------

Beatrice Energy 100% Risk

OFTO UK transmission Operational Capital 1.8% 2.0% 7

-------------- ----------- -------------- -------------- ------------- ------------- ------------- ------------

The project connects the 588MW Beatrice offshore wind farm, located

13.5km off the Caithness coastline of Scotland, to the National Grid.

The transmission assets comprise the onshore and offshore substations,

20km of onshore export cables and 70km of offshore export cables.

----------------------------------------------------------------------------------------------------------------------

1 Risk Capital includes both project level equity and subordinated shareholder debt.

2 Upon completion of the Company's further investment in

Tideway, which was announced in June 2022, the Risk Capital will

increase to approximately 18%.

3 Includes two tranches of mezzanine debt into US military housing.

More detail on significant movements in the Company's portfolio

for the six months to 30 June 2022 can be found on pages 13 to 15

of the Operating Review.

OPERATING REVIEW

Value -Focused Portfolio Development

New investments that meet the Company's Investment Policy are

made after assessing their risk and return profile relative to the

existing portfolio. In particular, we seek investments that

complement the existing portfolio through enhancing long-term,

inflation-linked cash flows and/or to provide the opportunity for

higher capital growth. The Board regularly reviews the overall

composition of the portfolio to ensure it continues to remain

aligned with the Company's investment objectives and ensure it is

achieving a broad balance of risk in the Company's portfolio.

Desirable key attributes for the portfolio include:

1. Long-term, stable returns

2. Inflation-linked investor cash flows

3. Early stage investor (e.g. the Company is an early stage

investor in a new opportunity developed by our Investment

Adviser)

4. Investment secured through preferential access (e.g. sourced

through pre-emptive rights or through the activities of our

Investment Adviser)

5. Other capital enhancement attributes (e.g. potential for

additional capital growth through 'de-risking' or the potential for

residual/terminal value growth)

6. Positive SDG contribution

Performance against strategic priority KPIs: 100% of investments

made in H1 2022 met at least three of the six attributes (31

December 2021: 100%)

During the six months to 30 June 2022, the Company invested or

made investment commitments up to GBP56.1 million (30 June 2021:

GBP22.3 million). These opportunities were sourced by the

Investment Adviser through existing commitments or increasing its

interest in existing investments. These origination approaches

avoid bidding in the competitive secondary market and are preferred

routes to market for the Company. Details of investment activity

for the six months to 30 June 2022, and post-period end, are

provided below.

The investments made by the Company during the period, meet or

exceed the Company's performance indicator of having at least three

of the required six key investment attributes. Please refer to the

key performance indicators on pages 6 to 7. Further details for

each of these transactions are provided below.

INVESTMENTS LOCATION KEY ATTRIBUTES OPERATIONAL INVESTMENT INVESTMENT

MADE DURING STATUS DATE

THE SIX

MONTHS

TO 30 JUNE

2022

1 2 3 4 5 6

-------------------------- ------- ------- ------- ------- ------- ------- ------------ ----------- -----------

UK PPP UK ü ü ü ü Operational GBP1.5 June 2022

Portfolio(1) million

-------------- ---------- ------- ------- ------- ------- ------- ------- ------------ ----------- -----------

Diabolo Belgium ü ü ü Operational GBP4.3 June 2022

million(2,

3)

-------------- ---------- ------- ------- ------- ------- ------- ------- ------------ ----------- -----------

NDIF UK ü ü ü ü Operational GBP1.2 Various

million

-------------- ---------- ------- ------- ------- ------- ------- ------- ------------ ----------- -----------

GBP7.0

million

---------------------------------------------------------------------------------------------- ----------- -----------

INVESTMENT LOCATION KEY ATTRIBUTES OPERATIONAL INVESTMENT INVESTMENT

COMMITMENTS STATUS DATE

MADE DURING

THE SIX

MONTHS

TO 30 JUNE

2022

1 2 3 4 5 6

-------------------------- ------- ------- ------- ------- ------- ------- ------------- ----------- -----------

Gold Coast Australia ü ü ü ü ü In GBP7.1 March 2022

Light construction million(2)

Rail -

Stage

3

Tideway(4) UK ü ü ü ü ü ü In c.GBP42.0 June 2022

construction million

c.GBP49.1

million

------------------------- ------- ------- ------- ------- ------- ------- ------------- ----------- -----------

1 Portfolio includes interests in Durham BSF and Nottingham BSF Phase 1 and Phase 2.

2 GBP translated value of investment.

3 A further GBP0.4 million (EUR0.5 million) was drawn in July

2022, post-period end. In addition, a contingent commitment of

GBP5.8 million (EUR6.7 million) is available, if required.

4 This investment is expected to complete on or around the

publication date of this report.

INVESTMENTS MADE DURING THE PERIOD

Uk PPP portfolio, uk

As previously reported, in December 2021, the Company acquired a

small portfolio of UK PPP investments, including initial interests

in Townlands Community Hospital in Henley, Eltham Community

Hospital and minority interests in BSF projects. Of those, STaG 1

and 2 were acquired in December 2021 with the remainder to be

acquired in 2022. In June 2022, the Company acquired an additional

8% of Durham BSF and an additional 18% of Nottingham BSF phase 1

and phase 2, taking the Company's ownership in each of those three

schemes to 100%. These investments totalled c.GBP1.5 million. The

portfolio was accretive to the Company's returns and provides

education facilities to over 3,880 pupils.

Primary SDG supported: 4

Diabolo, Belgium

Diabolo is a rail infrastructure investment which integrates

Brussels Airport with Belgium's national rail network. The majority

of the revenues generated by Diabolo are linked to passenger use of

either the rail link itself or the wider Belgian rail network.

Accordingly, Diabolo has been impacted by the restrictions on

international travel and national lockdowns implemented in Belgium

as a result of the Covid-19 pandemic and we see the timing of the

recovery of Diabolo as directly linked to the resumption of

pre-pandemic levels of use of Brussels Airport.

As previously disclosed, the Company committed a further EUR24.0

million to the Diabolo project in December 2020, and up to EUR6.7

million remains available to protect Diabolo's liquidity position

and ensure compliance with its debt covenants and, based on current

analysis, this is considered to be adequate. Of the EUR24 million,

EUR17.3 million has been drawn to date, of which EUR5.0 million(1)

was drawn during the period. The extent and timing of any further

cash injections is dependent upon the trajectory of the recovery in

passenger numbers, which at the end of June 2022 were at

approximately c.85% of pre-Covid levels.

Primary SDG supported: 11

DIGITAL INFRASTRUCTURE, UK

In July 2017, the Company agreed to invest up to GBP45 million

in UK digital infrastructure alongside the UK Government, through

NDIF. During the period, an additional GBP1.2 million was approved

for investment into one of NDIF's existing investments, toob. toob

is a UK full fibre broadband provider delivering broadband to

homes, businesses, public service and community groups in the South

of England.

The Company's commitment to digital infrastructure will

contribute to transition the UK to full-fibre at a time when

reliance on digital infrastructure and connectivity continue to be

of the utmost importance. There has been increased recognition that

digital infrastructure is becoming a more defensive asset class as

the critical nature of digital connectivity services has been

amplified by the number of people that are working from home.

Primary SDG supported: 9

INVESTMENT COMMITMENTS MADE DURING THE PERIOD

GOLD COAST LIGHT RAIL - STAGE 3, aUSTRALIA

In March 2022, the Company reached financial close on Stage 3 of

the Gold Coast Light Rail project. Under the terms of the

acquisition the Company will make an investment totalling

approximately A$12.5 million (c.GBP7.1 million at current exchange

rates) in addition to the Company's existing 30% interest. The

project extends the existing Gold Coast Light Rail network (known

as G:link) a further 6.7km south from Broadbeach to Burleigh Heads.

It will include eight new stations, five additional light rail

trams, new bus and light rail connections at Burleigh and Miami,

and an upgrade of existing depot and stabling facilities.

Queensland's only light rail system will have a route 27km long

from Helensvale to Burleigh Heads, stopping at 27 stations and

serviced by 23 trams, at completion of Stage 3 in 2025. This

further investment follows the success of Stages 1 and 2, in which

the Company is invested. Over 60 million passenger trips have taken

place to date and one of the many benefits of the rail system has

been an overall increase in public transport use on the Gold Coast

with a 43% uplift for combined tram and bus use since light rail

opened in 2014.

Primary SDG supported: 11

TIDEWAY, UK

In June 2022, the Company conditionally agreed to acquire a

further shareholding in Tideway. The investment opportunity arose

as a consequence of another existing investor having to dispose of

its stake, due to the maturing of an underlying investment fund.

The investment, which is expected to complete on or around the

publication date of this report, would result in the Company

increasing its stake in Tideway to approximately 18% and deploying

approximately GBP42 million of additional capital. The remainder of

the stake is being acquired by the other continuing investors in

Tideway. Tideway continues to be a successful investment for the

Company and will provide several significant environmental and

social benefits once operational. Please see more information on

pages 19 to 20.

Primary SDG supported: 6

1 An additional EUR0.5 million was drawn post-period end in July 2022.

Current market environment and future opportunities

The portfolio has continued to demonstrate its resilience in the

current macroeconomic environment. The year to date has seen

rapidly increasing energy prices, growing concerns about energy

security and growing inflation across the geographies in which the

Company invests, much of which can be traced back to the war in

Ukraine and, in the case of inflation, also a result of the

Covid-19 pandemic and the global recovery therefrom. Whilst the

Company has shown resilience, it continues to manage and mitigate

risk, whilst carefully monitoring the implications of a higher

inflationary environment and interest rates reaching the highest

level, since early 2009.

The nature of the Company's investments in long-term public and

social infrastructure assets and related businesses, provides its

investors with a stream of relatively predictable and long-term

cash flows; and whilst the duration of this high inflationary

period remains uncertain, we take comfort from the strong

inflation-linked returns of the Company's income streams (0.7%) and

its mitigated exposure to demand risks within the portfolio. Whilst

the Company is well positioned to mitigate these risks, it is not

insulated from their effects on our projects and investee

businesses, their supply chains, users of these infrastructure

assets, their staff and their wider stakeholders.

The need for infrastructure investment across the geographies in

which the Company invests remains strong and investor appetite

remains high for the type of infrastructure assets the Company

invests in. This was demonstrated by both the volume and pricing of

transactions in the market and further supported by the completion

of the Company's capital raise, which was significantly

oversubscribed, indicating strong support from both existing and

new shareholders.

Governments internationally have acknowledged the key role

infrastructure spending will play in driving economic recovery, the

creation of jobs and our ability to address key challenges such as

climate change. Developments in sustainable finance legislation,

including the EU's Taxonomy Regulation, will further guide

investment towards sustainable economic activities, including

infrastructure that supports the transition to net zero.

Initiatives in the geographies where the Company invests support

this, including in the UK, Europe, the US and Australia, for

instance:

- The UK Infrastructure Bank Bill was introduced in May 2022, to

establish a bank which supports the UK reaching its net zero

targets and that will have GBP22 billion of capital resources; the

UK Infrastructure Bank will also draw private sector finance to

invest into sectors the Company targets, including energy, water,

waste, transport and digital;

- The European Commission has announced a number of initiatives,

under the Connecting Europe Facility, including the EU committing

to invest EUR5.4 billion in sustainable, safe and efficient

transport infrastructure;

- The US Bipartisan Infrastructure Law has been secured and the

Biden-Harris Administration has announced over $110 billion to

rebuild roads and bridges, modernise ports and airports, replace

lead pipes to deliver clean water and expand high-speed internet.

The US has a poor infrastructure rating and will require state and

local governments, as well as alternative procurement models such

as Progressive Development, which leverages the expertise of the

private sector, in order to deliver this goal; and

- Australia has announced an additional A$18 billion for

infrastructure projects across the country, and the federal

government's rolling ten-year infrastructure investment has

increased investments from A$110 billion to over A$120 billion to

help drive economic recovery following Covid-19.

The Company maintains a high-quality pipeline of future

investment opportunities. Through the Investment Adviser, we are

committed to ensuring new and existing investments remain focused

on the key characteristics required to meet the Company's

investment criteria, including yields that are attractive relative

to asset risk profile, the likelihood of long-term stable cash

flows, high barriers to entry, strong ESG credentials and

opportunities to enhance the value of investments.

CURRENT PIPELINE

The Company's performance does not depend upon additional

investments to deliver current projected returns. Further

investment opportunities will be judged by their anticipated

contribution to overall portfolio returns relative to risk.

Selected commitments and future opportunities that may be

considered for investment in due course, as identified by the

Investment Adviser, are outlined below.

KNOWN/COMMITTED LOCATION ESTIMATED INVESTMENT(1) EXPECTED INVESTMENT INVESTMENT STATUS

OPPORTUNITIES PERIOD

-------------------- ---------- -------------------------- -------------------- ------------------------

Diabolo Belgium Up to GBP5.8 million(2) 26 years A further contingent

commitment available,

if required

-------------------- ---------- -------------------------- -------------------- ------------------------

Gold Coast Light Australia GBP7.1 million 5 years Investment commitment

Rail - Stage made. Expected

3 to be funded

in 2025

-------------------- ---------- -------------------------- -------------------- ------------------------

UK PPP Portfolio UK Up to GBP1.7m 12-13 years Investment expected

over the course

of 2022

-------------------- ---------- ------------------- ----- -------------------- ------------------------

Tideway(3) UK c.GBP42.0 million 120 years Conditionally

agreed to acquire

a further shareholding

-------------------- ---------- -------------------------- -------------------- ------------------------

Moray East OFTO UK Up to GBP75 million 24 years Preferred bidder.

Investment expected

Q4 2022 / Q1

2023

-------------------- ---------- -------------------------- -------------------- ------------------------

East Anglia UK Up to GBP90 million 21.5 years Preferred bidder.

One OFTO Investment expected

Q4 2022

-------------------- ---------- -------------------------- -------------------- ------------------------

Flinders University Australia GBP9.8 million 25 years Investment commitment

Health and Medical made. Expected

Research Building to be funded

('HMRB') in 2024

-------------------- ---------- -------------------------- -------------------- ------------------------