International Public Partnerships INPP grows investment portfolio in United States (5213I)

05 Diciembre 2022 - 1:00AM

UK Regulatory

TIDMINPP

RNS Number : 5213I

International Public Partnerships

05 December 2022

INPP GROWS INVESTMENT PORTFOLIO IN UNITED STATES

5 December 2022

International Public Partnerships Limited , the listed

infrastructure investment company (' INPP ' or the ' Company '),

has announced a follow-on investment in Family Housing for Service

Personnel ('FHSP'), one of the longest-standing social

infrastructure sectors in United States ('US') Public-Private

Partnerships ('PPP'), or P3.

The Company has invested approximately US$45 million (c.GBP37

million) into two additional interest-bearing subordinated debt

instruments underpinned by security over seven operational P3 FHSP

projects, comprising c.21,800 housing units located across the

US.

The additional investment marks the continued growth of the

Company's investment portfolio in the US, with approximately 4 per

cent of the portfolio by investment fair value invested in the US.

The introduction of private sector capital and resources to provide

housing for service personnel was established by US Congress in

1996 and has attracted capital in excess of US$30 billion from

domestic and international institutional investors to date.

The investment meets the environmental and social

characteristics under Article 8 of the EU Sustainable Finance

Disclosure Regulation ('SFDR') designation.

The FHSP projects have the following characteristics:

-- A secure revenue stream to 2052 by way of the direct

assignment of the Basic Allowance for Housing for the service

personnel who live on the bases, which is paid by the US

government;

-- High barriers to entry as the number of on- facility housing units is limited;

-- Positive social credentials through provision of family housing;

-- No residual value exposure; and

-- A geographically diverse portfolio of housing units across the US.

The investment was sourced by the Company's investment adviser,

Amber Fund Management Limited ('Amber') and was acquired from

Amber's affiliate, Hunt Companies Inc. ('Hunt'). Hunt is one of the

largest owners, managers and providers of ongoing services in the

sector, with interests in approximately 51,800 units in the US. The

Hunt group will asset manage and property manage the projects that

relate to this transaction.

In accordance with the Company's procedures for related-party

transactions, the Company sought an independent valuation. In

addition, this transaction is deemed a smaller related party

transaction within Listing Rule 11.1.10R and therefore the Company

obtained a fair and reasonable opinion in relation to the

transaction.

As at 2 December 2022, the Company's GBP250 million revolving

credit facility was undrawn, with c.GBP17 million committed via

letters of credit for near-term pipeline investments.

Mike Gerrard, Chair of INPP, said: "The Company is well

positioned to originate new investment opportunities in North

America, given the strength of its Investment Adviser's local

presence. With an additional investment into family housing, the

Company is increasing its portfolio allocation to the US. Since our

first investment into the US Family Housing for Service Personnel

sector in 2015, our investments have performed strongly and we are

confident of their continued long-term resilience".

ENDS.

For further information:

Erica Sibree/Amy Edwards +44 (0) 7557 676 499 / (0) 7827 238

355

Amber Fund Management Limited

Hugh Jonathan +44 (0)20 7260 1263

Numis Securities

Ed Berry/Mitch Barltrop +44 (0) 7703 330 199 / (0) 7807 296

032

FTI Consulting

About International Public Partnerships:

INPP is a listed infrastructure investment company that invests

responsibly in global public infrastructure projects and

businesses, which meets societal and environmental needs, both now,

and into the future.

INPP is a responsible, long-term investor in over 140

infrastructure projects and businesses. The portfolio consists of

utility and transmission, transport, education, health, justice and

digital infrastructure projects and businesses, in the UK, Europe,

Australia and North America. INPP seeks to provide its shareholders

with both growing dividends and the potential for capital

appreciation.

Amber Infrastructure Group ('Amber') is the Investment Adviser

to INPP and consists of over 170 staff who are responsible for the

management of, advice on and origination of infrastructure

investments.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQBZLLBLLLEFBF

(END) Dow Jones Newswires

December 05, 2022 02:00 ET (07:00 GMT)

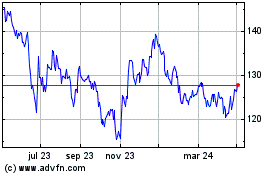

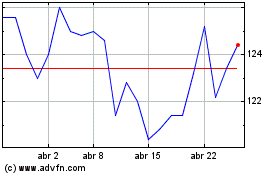

International Public Par... (LSE:INPP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

International Public Par... (LSE:INPP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024