itim Group PLC Trading Update (6310C)

24 Febrero 2022 - 1:00AM

UK Regulatory

TIDMITIM

RNS Number : 6310C

itim Group PLC

24 February 2022

24 February 2022

itim Group plc

("itim" or "the Company" and together with its subsidiaries "the

Group")

Trading Update

itim Group plc, a SaaS based technology company that enables

store-based retailers to optimise their businesses to improve

financial performance, is pleased to provide the following

unaudited trading update for the financial year ended 31 December

2021.

Group highlights

-- Successful IPO in June 2021 raising GBP8m (before expenses)

-- Year to 31 December 2021 revenue in line with expectations

at circa GBP13.4m (unaudited), illustrating 14% year on

year growth (FY 2020: GBP11.8m)

-- Annual recurring revenue ("ARR") at the year-end stood

at a record circa GBP11.1m (unaudited), (FY2020: GBP9.6m)

providing a strong revenue base going into 2022 (16% year

on year growth)

-- EBITDA (excluding IPO costs) for the year will exceed

market expectations at GBP2.1m (unaudited), demonstrating

year on year growth in excess of 40% (FY 2020: GBP1.5m)

-- The Group ended the year with net cash balances of GBP6.2m

(unaudited) (FY2020: GBP0.2m) with no outstanding loans.

Itim has widened its product offering to its existing client

base during the period creating deeper relationships; and continues

to provide a range of its services to more than 50 major retailers

including John Lewis, Sainsbury's, JD Sports, WH Smith and Majestic

Wine amongst many others. Working with many well-known brands

provides valuable insights into the retail industry enabling the

Group to enhance its offering.

itim's expectations that omni-channel retailing excellence

allows retailers to drive organic growth are beginning to be

reflected in the performance of those major high street retailers

that have embraced the technology. The Group is seeing the results

in the trading within their customer base, many of whom are

committed to opening more stores due to its success. As such, we

believe that ITIM's technology solutions provide a lasting value

added service to its client base.

In line with our strategy set out at the time of the IPO, itim

is continuing to invest in new product development to further

develop our technology proposition. We previously announced our

Chameleon 360 range of store systems, which power our customers to

omni-channel excellence. Furthermore, we expect to launch the

itim-hub later this year, a supplier collaboration portal that

enables our customers to launch their own marketplaces, as well as

the 'itim smart route', enabling the facilitation of last mile

delivery. Additionally, we are investing in technologies to improve

stock distribution to support a much more complex omni-channel

world; supporting despatch from store in addition to despatch from

warehouse. Finally, we are reviewing the potential to partner with

open-banking Fintec businesses to reduce the costs of supplier

payments, as our software already automatically approves supplier

invoices for 30 major retailers in the UK. Each of these

investments will provide additional enhancements for both our

existing and new customers, thereby providing further

differentiation for itim's solution.

Last month we created a new 'retail advisory committee' to help

guide the development and direction of itim moving forward. The

initial members of the new retail advisory committee are t op

industry leaders in retail , including the Company's directors

Justin King and Lee Williams, as well as a number of other

high-profile advisors including Beth Butterwick, CEO of Jigsaw,

Simon Forster, former CEO at Selfridges and Chris Brook-Carter, CEO

at the Retain Trust. The quality of this advisory committee is

testament to the strength of itim's offering and it s underlying

strategy.

Ali Athar, Chief Executive Officer, commented : "I am delighted

with itim's performance throughout 2021 and the future growth

opportunities we see in front of us. This underpins our confidence

in our new customer pipeline to enable us to deliver a near

doubling of our ARR by 2024 through organic growth. Trends in the

retail market are driving more and more store based retailers to

invest in omni-channel technology, enabling them to fight back

against online only players and itim is ideally positioned to

benefit from these trends through its proprietary technology

solutions."

Enquiries:

Ali Athar, CEO

Itim Group plc Ian Hayes CFO 0207 598 7700

Katy Mitchell

WH Ireland (NOMAD & Harry Ansell

Broker) Darshan Patel 0207 220 1666

Graham Herring

IFC Advisory Florence Chandler 0207 3934 6630

ABOUT ITIM

itim was established in 1993 by its founder, and current Chief

Executive Officer, Ali Athar. itim was initially formed as a

consulting business, helping retailers effect operational

improvement. From 1999 the Company began to expand into the

provision of proprietary software solutions and by 2004 the Company

was focused exclusively on digital technology. itim has grown both

organically and through a series of acquisitions of small, legacy

retail software systems and associated applications which itim has

redeveloped to create a fully integrated end to end Omni-channel

platform.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAPADALNAEFA

(END) Dow Jones Newswires

February 24, 2022 02:00 ET (07:00 GMT)

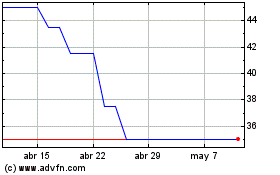

Itim (LSE:ITIM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Itim (LSE:ITIM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024