TIDMITS

RNS Number : 9904I

In The Style Group PLC

08 December 2022

THIS IS AN ANNOUNCEMENT UNDER RULE 2.4 OF THE CITY CODE ON

TAKEOVERS AND MERGERS (THE "CODE") AND IS NOT AN ANNOUNCEMENT OF A

FIRM INTENTION TO MAKE AN OFFER UNDER RULE 2.7 OF THE CODE. THERE

CAN BE NO CERTAINTY THAT SUCH AN OFFER WILL BE MADE, NOR AS TO THE

TERMS ON WHICH ANY OFFER MIGHT BE MADE.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE UK VERSION OF THE EU MARKET ABUSE REGULATION

WHICH IS PART OF UK LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018, AS AMED AND SUPPLEMENTED FROM TIME TO TIME

INCLUDING BY THE MARKET ABUSE (AMMENT) (EU EXIT) REGULATIONS 2019

(SI 2019/ 310).

8 December 2022

In The Style Group plc

Strategic review

Trading update

Board changes

In The Style Group plc (AIM:ITS) ("In The Style", the "Company"

or, together with its subsidiary undertakings, the "Group"), the

disruptive and inclusive digital womenswear fashion brand,

announces changes to its Board of Directors (the "Board" or the

"Directors"), the commencement of a strategic review and a business

update.

In a separate announcement the Company has also today announced

its interim results for the six months ended 30 September 2022 (the

"Interim Results") together with a trading update and outlook

statement, some of which is repeated below.

Strategic review

The Board believes that there has been limited liquidity for In

The Style's shareholders for some time and that the current market

capitalisation of the Company does not properly reflect the

underlying growth potential of the Group which may be better

realised under an alternative ownership structure.

The Board has, therefore, decided to conduct a strategic review

of the Group's business as a whole (the "Strategic Review") and has

appointed Lincoln International to assist with this process. The

outcome of the Strategic Review may or may not result in a sale of

the Company or some or all of the Group's business and assets. The

Company is not in talks with any potential offeror and is not in

receipt of any approach with regard to a possible offer.

As a consequence of this announcement, an 'offer period' has now

commenced in respect of the Company in accordance with the rules of

the Code and the attention of shareholders is drawn to the

disclosure requirements of Rule 8 of the Code, which are summarised

below.

Current trading and FY23 outlook

-- The Board confirms that its expectation for full year Adjusted EBITDA remains unchanged.

-- Trading within our direct-to-consumer ("DTC") channel through

the important peak period of November has been strong. In

particular, In The Style is pleased to have delivered a record

Black Friday Cyber Fortnight, as follows:

- gross order value 6% higher than 2021 (12% higher than 2020);

- average order value up 12% on 2021 (24% up on 2020); and

- gross margin 1.8%pts above that achieved in 2021, with a lower level of discounting.

Nevertheless, consumer sentiment remains uncertain and so the

Company now expects DTC revenue for the full year to be broadly

similar to that achieved in FY22.

-- Wholesale is likely to continue to be a challenge and the

Company would expect revenue in H2 2023 to be similar to that

achieved in H1 2023.

-- Stock levels heading into Christmas period are being well

managed with stock volume at the end of November being 8% less than

the prior year.

-- Cash position improved to GBP4.4 million at 30 November 2022,

due to favourable working capital movements with an additional

GBP1.1million available through the invoice discounting

facility.

-- Underpinned by the Group's distinctive brand and

differentiated model, the Board looks forward to continuing the

strong strategic momentum delivered throughout H1 2023 and is

confident of the long-term growth prospects of the Group.

Board changes

Sam Perkins has informed the Board of his intention to step down

as Group Chief Executive Officer ("CEO"). Sam will leave In The

Style on 31 December 2022. During Sam's tenure as CEO, the Group

has developed and begun to implement several strategic initiatives

to support the Group's future growth.

Adam Frisby, the Company's founder, will return to the role of

CEO on an interim basis. Adam led the Group as CEO for nine years

until January 2022. Since then, Adam has held the role of Chief

Brand Officer, with responsibility for developing the Group's

influencer partnerships and the brand's creative direction.

Jim Sharp, Chair of In The Style said:

"On behalf of the Board, I would like to place on record my

thanks to Sam for his contributions during his time as the Group's

CEO. Adam is excited to return to the role of CEO at this important

time. As the Group's founder and major shareholder, Adam is well

placed to lead the business and ensure it delivers its considerable

potential."

Business summary

In The Style is an innovative, inclusive online women's clothing

brand. The Company is differentiated by its innovative social media

influencer collaborations and engaging brand campaigns on key

issues that matter to its customers.

-- The Group was founded by Adam Frisby in 2013 and since then

has delivered eight consecutive years of unbroken revenue growth,

reporting net sales of GBP57 million in the year ended 31 March

2022).

-- In The Style's in house design team works with social media

influencers to design clothing collections which are manufactured

by third parties predominantly in the UK and Far East.

-- In The Style has a highly engaged active customer base of

over 750,000 who purchase directly from the Company through its

proprietary app and its website www.inthestyle.com . In addition,

the Company sells through digital wholesale partners.

-- In The Style is an industry champion for female empowerment,

body confidence and real beauty with a proactive sustainability

agenda. Inclusivity is at the core of the In The Style brand, which

actively promotes products for a wide range of body types and

styles.

The Company announced this morning its interim results for the

six months ended 30 September 2022. These included the following

highlights:

-- DTC revenue remained broadly flat at GBP22.8 million (H1

2022: GBP23.0 million). In a challenging market, the Group

continues to leverage its distinctive influencer collaboration

model to drive real interest in the product that it designs for

consumers.

-- The Group launched 72 collections with 19 distinct influencers through its distinctive social collaboration model. To complement this, the Group increased the level of reach generated through its micro-influencer network, engaging with over 140 different micro-influencers with a combined reach of over 2.8 million followers.

-- The successful launch of 'FITS', a collection of own-brand

wardrobe staples, providing the Group with additional opportunities

to engage with customers and to improve profitability. The FITS

brand debuted in August 2022 and the Group has released over 160

products to date with over 5,900 customers purchasing at least one

of these products.

-- The Group is proud to have collaborated with the late Dame

Deborah James to raise GBP1.7 million for the Bowelbabe fund for

Cancer Research UK.

-- The successful relocation to a larger 84,000 sq. ft.

warehouse at the end of August 2022 provides an opportunity for

operational efficiencies and sufficient capacity for future

growth.

The person responsible for arranging the release of this

announcement on behalf of the Company is Richard Monaghan, the

Chief Financial Officer of the Company.

For media enquiries:

In The Style Group plc Via Hudson Sandler

Jim Sharp, Chairman

Rich Monaghan, Chief Financial Officer

Hudson Sandler +44 (0)20 7796 4133

Alex Brennan inthestyle@hudsonsandler.com

Lucy Wollam

Ben Wilson

Lincoln International LLP (Financial Adviser) +44 (0)20 7022 9880

Harry Kalmanowicz

Julian Tunnicliffe

Liberum Capital Limited (Nomad and Broker) +44 (0)20 3100 2000

Clayton Bush

Scott Mathieson

Miquela Bezuidenhoudt

About In The Style

In The Style is a fast-growing digital womenswear fashion brand

with an innovative social media influencer collaboration model.

Founded in 2013 by entrepreneur Adam Frisby, the brand champions

inclusivity, body positivity and real beauty.

The brand's innovative and highly adaptable influencer

collaboration model, which sees it work with influencers on a

long-term basis to collaboratively design, develop and promote

branded collections, differentiates it from competitors. In The

Style currently partners with a stable of 25+ influencers,

including Jac Jossa, Stacey Solomon and Perrie Sian.

For more information, please visit

https://corporate.inthestyle.com/about/ .

IMPORTANT NOTICES

General

This announcement is for information purposes only. It does not

constitute an offer or form part of any offer or an invitation to

purchase, subscribe for, sell or issue any securities or a

solicitation of any offer to purchase, subscribe for, sell or issue

any securities pursuant to this announcement or otherwise in any

jurisdiction in which such offer or solicitation is unlawful. The

distribution of this announcement in jurisdictions outside the

United Kingdom may be restricted by law and therefore persons into

whose possession this announcement comes should inform themselves

about, and observe such restrictions. Any failure to comply with

the restrictions may constitute a violation of the securities law

of any such jurisdiction.

Financial and other advisers

Lincoln International LLP ("Lincoln"), which is authorised and

regulated in the United Kingdom by the Financial Conduct Authority,

is acting exclusively as financial adviser to In The Style Group

plc and no one else in connection with the Strategic Review and

will not be responsible to anyone other than In The Style Group plc

for providing the protections afforded to clients of Lincoln nor

for providing advice in relation to the Strategic Review or any

other matters referred to in this announcement. Neither Lincoln nor

any of its affiliates owes or accepts any duty, liability or

responsibility whatsoever (whether direct or indirect, whether in

contract, in tort, under statute or otherwise) to any person who is

not a client of Lincoln in connection with this announcement, any

statement contained herein or otherwise.

Liberum Capital Limited ("Liberum"), which is authorised and

regulated in the United Kingdom by the Financial Conduct Authority,

is acting exclusively as nominated adviser and corporate broker to

In The Style Group plc and no one else in connection with the

Strategic Review and will not be responsible to anyone other than

In The Style Group plc for providing the protections afforded to

clients of Liberum nor for providing advice in relation to the

Strategic Review or any other matters referred to in this

announcement. Neither Liberum nor any of its affiliates owes or

accepts any duty, liability or responsibility whatsoever (whether

direct or indirect, whether in contract, in tort, under statute or

otherwise) to any person who is not a client of Liberum in

connection with this announcement, any statement contained herein

or otherwise.

Disclosure requirements of the Code

Rule 2.9 disclosure

In accordance with Rule 2.9 of the Code, the Company confirms

that, as at the date of this announcement, its issued and fully

paid share capital consists of 52,499,998 ordinary shares with par

value of GBP0.0025. The International Securities Identification

Number (ISIN) for the ordinary shares is GB00BMXMR838.

Rule 8.3 disclosure

Under Rule 8.3(a) of the Code, any person who is interested in

1% or more of any class of relevant securities of an offeree

company or of any securities exchange offeror (being any offeror

other than an offeror in respect of which it has been announced

that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer

period and, if later, following the announcement in which any

securities exchange offeror is first identified. An Opening

Position Disclosure must contain details of the person's interests

and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s). An Opening Position Disclosure by a

person to whom Rule 8.3(a) of the Code applies must be made by no

later than 3.30 pm (London time) on the 10th business day following

the commencement of the offer period and, if appropriate, by no

later than 3.30 pm (London time) on the 10th business day following

the announcement in which any securities exchange offeror is first

identified. Relevant persons who deal in the relevant securities of

the offeree company or of a securities exchange offeror prior to

the deadline for making an Opening Position Disclosure must instead

make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes,

interested in 1% or more of any class of relevant securities of the

offeree company or of any securities exchange offeror must make a

Dealing Disclosure if the person deals in any relevant securities

of the offeree company or of any securities exchange offeror. A

Dealing Disclosure must contain details of the dealing concerned

and of the person's interests and short positions in, and rights to

subscribe for, any relevant securities of each of (i) the offeree

company and (ii) any securities exchange offeror, save to the

extent that these details have previously been disclosed under Rule

8 of the Code. A Dealing Disclosure by a person to whom Rule 8.3(b)

of the Code applies must be made by no later than 3.30 pm (London

time) on the business day following the date of the relevant

dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3 of the Code.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and 8.4 of

the Code).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at www.thetakeoverpanel.org.uk,

including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. You should contact the Takeover Panel's Market

Surveillance Unit on +44 (0)20 7638 0129 if you are in any doubt as

to whether you are required to make an Opening Position Disclosure

or a Dealing Disclosure.

Rule 26.1 disclosure

In accordance with Rule 26.1 of the Code, a copy of this

announcement will be available (subject to certain restrictions

relating to persons resident in restricted jurisdictions) on the

website of In The Style at https://corporate.inthestyle.com

promptly and by no later than 12 noon (London time) on the business

day following this announcement. The content of the website

referred to in this announcement is not incorporated into and does

not form part of this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDBBDDBUGDGDR

(END) Dow Jones Newswires

December 08, 2022 02:00 ET (07:00 GMT)

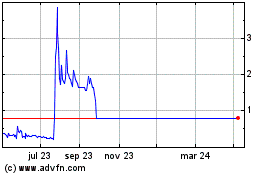

Itsarm (LSE:ITS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

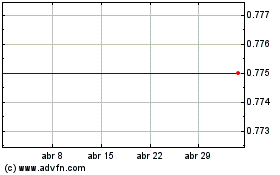

Itsarm (LSE:ITS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024