TIDMJAGI

RNS Number : 9173J

JPMorgan Asia Growth & Income PLC

16 December 2022

LONDON STOCK EXCHANGE ANNOUNCEMENT

JPMORGAN ASIA GROWTH & INCOME PLC

FINAL RESULTS FOR THE YEARED 30TH SEPTEMBER 2022

Legal Entity Identifier: 5493006R74BNJSJKCB17

Information disclosed in accordance with the DTR 4.1.3

The Directors of JPMorgan Asia Growth & Income plc announce

the Company's results for the year ended 30th September 2022.

CHAIRMAN'S STATEMENT

Performance

An usually large number of adverse influences conspired to

undermine Asian financial market sentiment in the year ended 30th

September 2022. Rising price pressures, which were compounded by

the war in Ukraine, and global supply chain bottlenecks, compelled

the US Federal Reserve and other western central banks to hike

interest rates more aggressively than previously anticipated.

Higher rates and mounting fears of recession weighed on equity

markets, especially growth stocks whose long-term valuations were

undermined by rising rates. Asian investors faced additional

concerns, most particularly the wide, and possibly long-term

ramifications of China's sharp, self-inflicted slowdown and rising

geo-political tensions between China and the west, in particular,

over China's ambitions in relation to Taiwan and Hong Kong.

Although the inflation picture has been more mixed across Asia than

in the west, the region's equity markets experienced the same

downward pressures as their western counterparts. As elsewhere,

growth stocks, such as those in the technology and media sectors,

were worse hit, especially in China.

As a result, in the year to 30th September 2022, the MSCI All

Countries Asia ex Japan Index, declined 13.9% (in sterling terms).

The Company's performance lagged the benchmark, declining 16.2% in

NAV terms and falling 17.2% in share price terms, reflecting a

further widening of the discount at which the Company's shares

trade relative to NAV. The reasons for this underperformance are

discussed in full in the Investment Managers' Report that follows,

which also reviews the market over the past year and considers the

outlook for 2023.

While disappointing, this year's underperformance needs to be

judged in the context of the Company's longer-term performance

track record, which remains impressive. The Company has provided

shareholders with significant positive returns, and decisively

outperformed its benchmark, over the long term. Its annualised

return over the ten years to end September 2022 was 8.5% on an NAV

basis and 8.9% in share price terms, well above the benchmark's

6.9% return on the same basis.

Dividend Policy

In the absence of unforeseen developments, the Company's

dividend policy aims to pay regular, quarterly dividends, each

equivalent to 1% of the Company's NAV. Payments are set based on

the NAV on the last business day of each financial quarter, being

the end of December, March, June and September, and are funded from

a combination of revenue and capital reserves. Shareholders are

reminded that dividends are based on a percentage of net assets, so

the dividend paid to shareholders will reflect the Company's net

assets at each quarter end. They will therefore be subject to

market and performance fluctuations.

For the year ended 30th September 2022, dividends paid totalled

16.5 pence (2021: 19.3 pence). This is the second lowest level of

dividend paid by the Company since the introduction of its revised

dividend policy, which took effect from the beginning of the

Company's financial year ended 30th September 2017. Although this

is clearly disappointing for shareholders, it reflects recent

market conditions and the Company's performance. In the Board's

view, resetting the dividend quantum each quarter is a prudent way

of delivering an income that tracks performance and does not put

the Company under any undue stress.

Premium/Discount and Share Capital Management

The discount at which the Company's shares trade has widened

during the review period, and although it is broadly in line with

the discounts of its immediate peers, the Board has deemed it

necessary to utilise the Company's buy back powers over the year,

buying in a total of 1,040,725 shares (representing 1.1% of share

capital) and holding them in Treasury. The Board's view is that buy

back activity can help to balance the demand and supply in the

Company's shares, while maintaining underlying liquidity.

Gearing

The Company has in place a multi-currency loan facility with

Scotiabank. The Investment Managers utilise drawdowns from this

loan facility to gear the portfolio during periods when the market

is expected to rise and gearing will thus enhance performance. Over

the reporting year, and at the time of writing, the Company was not

geared and hence gearing did not detract from returns in a falling

market.

Environmental, Social and Governance ('ESG') Issues

As detailed in the ESG Report on pages 15 to 19 of the Company's

Annual Report & Financial Statements for the year ended 30th

September 2022 ('2022 Annual Report'), ESG considerations are

integral to the Manager's investment process and are core to its

stock selection decisions. Please refer to this Report for

comprehensive information on this integration.

Board Succession

The Board plans for succession to ensure it retains an

appropriate balance of skills, knowledge and diversity. To this end

the Board recently announced the appointments of Diana Choyleva and

Kathryn Matthews to the Board with effect from 1st March and 1st

June 2023 respectively.

Diana is a leading expert on China's economy and politics and is

Chief Economist at Enodo Economics, an independent macroeconomic

and political forecasting company. Previously she worked at Lombard

Street Research, most recently as their chief economist and head of

research.

Kathryn brings to the Board many years of experience in the

investment company sector, including directorships of a broad range

of other Asia focused investment companies. Previously, Kathryn

worked for Fidelity International where she was Chief Investment

Officer, Asia Pacific (ex-Japan).

Having served as a Director since 2013 and as Chairman since

2017, I will retire from the Board at the forthcoming Annual

General Meeting and I will be succeeded by Sir Richard Stagg, who

has served on the Board since July 2018. Dean Buckley, the

Company's Audit Chairman and SID, joined the Board in 2014 and it

is the current intention that he will be retiring from the Board at

the Annual General Meeting in 2024.

The Manager and Costs

Through the remit of the Management Engagement Committee ('MEC')

the Board has reviewed the Manager's performance and its fee

arrangements with the Company. Based upon its performance record

and taking all factors into account, including other services

provided to the Company and its shareholders, the MEC and the Board

are satisfied that JPMF should continue as the Company's Manager

and that its ongoing appointment remains in the best interests of

shareholders.

Continuation Vote

Pursuant to the Company's Articles of Association, the Board is

required to put a triennial continuation vote to shareholders.

Since the last time this requirement was enacted by the Company was

in 2020, a continuation vote will be put to shareholders at the

Annual General Meeting to be held on Wednesday, 15th February 2023.

Given the performance returns over the medium and long term, your

Board has no hesitation in recommending to shareholders that they

vote in favour of the Company continuing as an investment trust for

a further three-year period.

Keeping in Touch

The Board and the Investment Managers are also keen to increase

dialogue with the Company's existing shareholders. Investors

holding their shares through online platforms will shortly receive

a letter inviting them to sign up to receive email updates from the

Company. These updates will deliver regular news and views, as well

as the latest performance statistics. If shareholders wish to sign

up to receive these communications, please visit

https://tinyurl.com/d95jkrzx or scan the QR code that can be found

on page 9 of the 2022 Annual Report.

Annual General Meeting

The Company's Annual General Meeting will be held on Wednesday,

15th February 2023 at 11.00 a.m. at 60 Victoria Embankment, London

EC4Y 0JP.

The Investment Managers will give a presentation to

shareholders, reviewing the past year and commenting on the outlook

for the current year. We look forward to seeing as many

shareholders as possible at the AGM.

For shareholders wishing to follow the AGM proceedings but

choosing not to attend, we will be able to welcome you through

conferencing software. Details on how to register, together with

access details, will be available on the Company's website:

www.jpmasiagrowthandincome.co.uk, or by contacting the Company

Secretary at invtrusts.cosec@jpmorgan.com

As is normal practice, all voting on the resolutions will be

conducted by a poll. Shareholders viewing the meeting via

conferencing software will not be able to vote on the poll and we

therefore encourage all shareholders, and particularly those who

cannot physically attend, to exercise their votes in advance of the

meeting by completing and submitting their form of proxy.

If you have any detailed or technical questions, it would be

helpful if you could raise them in advance with the Company

Secretary at 60 Victoria Embankment, London EC4Y 0JP or via the

'Ask a Question' link on the Company's website. Shareholders who

are unable to attend the AGM are encouraged to use their proxy

votes.

Outlook

It is difficult to recall a time when the uncertainties

permeating global financial markets have been greater or more

varied. Yet despite the near-term gloom, Asia's long-term growth

prospects remain bright. JPMorgan Asia Growth and Income is a

low-cost way for investors to gain diversified exposure to the

region's best businesses, while also providing shareholders with a

competitive income of approximately 4%. And with share price

valuations now at historical lows in many regional markets, we

share the Investment Managers' excitement about the many

opportunities now available to purchase interesting, world-class

companies in various sectors across Asia, at particularly

attractive prices. Such acquisitions will leave the Company even

better positioned to capitalise on Asia's long-term growth story,

to the continued benefit of patient shareholders willing to

tolerate bouts of market turbulence.

As this is my last Chairman's statement before retiring, I would

like to conclude by thanking my fellow Directors and the team at

JPMorgan for their support and contribution during my time on the

Board and I would also like to extend my thanks to our shareholders

for their ongoing support. I wish the Company's fortunes well for

the future.

Bronwyn Curtis OBE

Chairman 15th December 2022

INVESTMENT MANAGERS' REPORT

Introduction

In this report we review the Company's investment performance

for the 12 months to 30th September 2022. We examine the market

backdrop over this period, and the factors that impacted

performance. Finally, we consider the outlook for Asian equities

over the coming six months and beyond.

The market environment

In the 12 months ended 30th September 2022, investor sentiment

in Asian markets deteriorated significantly, causing a 13.9%

decline in the MSCI AC Asia ex Japan Index in sterling terms. This

sell-off was driven by a number of factors. Starting from a global

perspective, the invasion of Ukraine drove up energy and commodity

prices, while supply chain logjams, especially shortages of

semi-conductors and other components for electronic products,

worsened due to Chinese factory closures, as the country doggedly

pursued its 'zero COVID' policy. These developments compounded the

inflationary pressures that were already worrying investors.

Markets were surprised by the willingness of central banks, led by

the US Federal Reserve, to tighten monetary policy aggressively to

combat these inflation pressures, and this in turn raised fears of

recession. Global equity markets plunged, with the valuations of

long-term growth stocks hit especially hard, while the US dollar

hit multi-decade highs against other currencies.

Asian investors had additional worries, mainly related to China,

where the outlook for growth has worsened over both the short and

longer term. China's GDP in calendar year 2022 is forecasted to

grow by only 3%, compared to 8% in 2021. The total containment of

COVID-19 remains a key priority for the Communist Party leadership.

In contrast to Western economies and other parts of Asia, the

Chinese government seems determined to persist with this policy,

even at the expense of economic growth, and it is unclear when

restrictions will ease. China is also facing its first largescale

residential property market correction. By some estimates this

sector accounts for 25% of economic output, so any major setback

will have significant implications for domestic growth. The

correction was triggered by a government crackdown on borrowing

within the sector, which caused a liquidity crisis among the

country's largest and most geared developers, and reduced the

supply of mortgages to homebuyers. New homes sales have fallen by

nearly 30 % over the past year. Thirdly, US government sanctions

against Chinese tech companies are disrupting the supply of

components for Chinese high performance computers and products

relying on cutting edge logic and memory capabilities. While these

issues may prove relatively short-lived, China's longer-term growth

prospects will be challenged by its worsening demographics.

Other Asian countries, most notably South Korea and Taiwan, are

bracing for a decline in export demand, as higher interest rates

slow global growth and tip some economies into recession. South

Korea's exports recovered strongly in 2021, with gross exports

growing nearly 11%, but the outlook for 2022 is for a more moderate

4.5% increase in exports. In Taiwan, Taiwan Semiconductor

Manufacturing Company Ltd ('TSMC'), one of the world's leading

producers of semiconductors, and the Company's largest position as

at the end of September 2022, continues to demonstrate a strong

competitive advantage in leading-edge chip manufacturing. TSMC's Q3

results showed sales growth of 47% year over year, driven by demand

for their industry-leading chips, which account for more than 50%

of revenues during the period. From a geographic perspective, sales

to North American clients remain by far the largest source of

income, making up 70% of sales, followed by Asia Pacific at 10% and

China at 8%. However, the company did highlight weakness on the

horizon by cutting capital expenditures and forecasting lower

utilisation rates for chips used in personal computers and smart

phones. Elsewhere in the region, the majority of South East Asian

markets performed well, led by Indonesia, where growth has been

particularly strong in the resources and energy sectors, as well as

banking, the latter of which has benefited from strong loan demand

and strong execution in online and digital banking strategies.

Although inflation concerns have risen sharply in many developed

countries, the inflation picture in Asia has been more mixed. In

India and South Korea, price rises are testing ten-year highs,

while in China and Indonesia, inflation pressures have been

limited. However, despite this varied regional picture, Asian

equity markets have still been dragged down by the sell-off in

Western markets, with the valuations of high growth stocks in the

tech and media sectors hit hardest, as in Western markets. This has

weighed particularly heavily on markets such as China and Taiwan,

whose indices have a high proportion of tech and other growth

stocks.

Performance

Against this mixed and challenging backdrop, the Company

underperformed its Index over the period, declining by 16.2% on a

net asset value ('NAV') total return basis, and by 17.2% in share

price terms. We are of course disappointed by this outcome, but

given the extraordinary volatility of recent market conditions, and

our long-term investment horizon, we believe it is more meaningful

to judge performance over longer periods. On this basis, the

Company has delivered significant positive returns for shareholders

in absolute terms, and outperformed the benchmark, over five and

ten years. Over the ten years to the end September 2022, the

Company has generated an annualised return of 8.5% in NAV terms,

and 8.9% on a share price basis, compared to a benchmark return of

6.9%, measured on the same basis.

Performance attribution

30th September 2022

% %

---------------------------------------------- ------ -------

Contributions to total returns

---------------------------------------------- ------ -------

Benchmark return -13.9%

---------------------------------------------- ------ -------

Stock selection -2.3%

---------------------------------------------- ------ -------

Currency effect 0.1%

---------------------------------------------- ------ -------

Gearing/(net cash) 0.3%

---------------------------------------------- ------ -------

Investment Manager contribution -1.9%

---------------------------------------------- ------ -------

Dividends/residual 0.2%

---------------------------------------------- ------ -------

Portfolio return -15.6%

---------------------------------------------- ------ -------

Management fee/Other expenses -0.7%

---------------------------------------------- ------ -------

Share buy-back/issuance 0.1%

---------------------------------------------- ------ -------

Return on net assets(APM) -16.2%

---------------------------------------------- ------ -------

Effect of movement in discount over the year -1.0%

---------------------------------------------- ------ -------

Return to shareholders(APM) -17.2%

---------------------------------------------- ------ -------

Source: FactSet, JPMAM and Morningstar. All figures are on a

total return basis.

Performance attribution analyses how the Company achieved its

recorded performance relative to its benchmark index.

APM Alternative Performance Measure ('APM').

A glossary of terms and APMs is provided on pages 93 and 94 of

the 2022 Annual Report.

Major Contributors and Detractors to Performance

One of the largest detractors from the Company's performance

versus the Index over the financial year was the portfolio's

underweight allocation to India, which outperformed the Asian

market index by approximately 25% over the period. Our stock

selection in China and Taiwan also hurt performance, due to our

exposure to higher growth issuers which de-rated so sharply over

this period, as discussed above. This sell-off impacted portfolio

holdings across a number of sectors including healthcare (Pharmaron

Beijing, WuXi Biologics), textile manufacturing (Shenzhou

International), and internet conglomerates (Alibaba, Tencent).

On the positive side, the Company's large overweight allocation

to financials contributed positively to returns, thanks to its

holdings in bank names in Indonesia, China, and Singapore. Broadly,

regional banks have performed well, driven by the economic

recovery, which has been especially robust in Indonesia. In

particular, Bank Central Asia has benefitted from a strong economy,

higher interest rates and more company specific reasons, including

its push into digital banking. This has led to a sharp decline in

customer acquisition costs, with total cost to income ratios

falling from previous levels of 40-45%, to 35-40%. As discussed in

previous reports, we see the digitalisation of the Indonesian

economy as a key driver for growth across a myriad of sectors.

Within the broader financial sector, our structural underweight

allocation to Chinese property was also a positive contributor,

given the contraction in activity in this industry, discussed

above. Despite the weak economic back drop in China, there are a

selection of well-run businesses that have navigated the

challenging environment extremely well. One such example is Yum

China, a restaurant chain operator, which has performed well in the

face of falling sales by continuing to innovate on the food

delivery side and by improving in-store offerings, with the outcome

that profit margins have recovered to pre-COVID levels while

revenues are still 15% lower.

Portfolio activity and positioning over the past six months

While recent market volatility has been challenging for

investors, it has created opportunities for us to purchase

interesting businesses at compelling valuation levels. For example,

the Company initiated a new position in Largan Precision, a

Taiwanese manufacturer of lenses for use in smart phones and

automobiles. At the time of purchase, this company's valuation was

extremely attractive, and half of its market capitalisation was in

net cash. Looking ahead, we believe that phone cameras will rely

more heavily on the kind of high-end lenses Largan produces, so we

are positive about the company's longer-term growth prospects. The

Company also added to its position in Sany Heavy Industry ('Sany'),

a cyclical Chinese business which is a leading manufacturer of

construction machinery such as excavators, cranes and road building

equipment. The company is facing weak demand conditions, but there

are signs of a bottoming in year-on-year excavator sales declines,

which were down 20% in the year to July 2022, compared to a decline

of 60% in the previous year. Sany's valuation is also

attractive.

Key outright sales used to fund these and other acquisitions

included the disposal of Kakao Corp, a South Korean internet

content company which offers services under several brand names. We

sold the holding due to rising concerns about the management's

capital allocation decisions and the risk of a widening

conglomerate discount. We also secured profits by exiting several

names which had performed relatively strongly versus the index.

Such disposals included Meituan, a Chinese internet retailer, Delta

Electronics, a Taiwanese electronics components producer, and

Airports of Thailand, which benefitted from resumption of

international travel.

We have not made any major changes to the portfolio at the

sector level over the review period. The Company's largest

overweight allocations are to financials (+4.9%), and consumer

discretionary (+4.7%) and it has more modest overweight allocations

to industrials (+2.8%) and information technology (+1.8%). We have

also maintained underweight allocations to consumer staples (-3.0%)

and materials (-2.9%), motivated by the fact that these sectors are

either overvalued or profits are running well ahead of trend

levels. The portfolio is also underweight energy (-2.0%), mainly

due to the underweight in the Indian conglomerate Reliance and

Chinese government owned energy firms, and real estate (-1.9%),

reflecting our concerns around the Chinese property sector where

most developers are heavily indebted and the outlook for demand in

the long-term continues to deteriorate.

China's extremely poor short-term growth prospects, combined

with mounting geo-political tensions related to Taiwan and Hong

Kong, led us to eliminate our overweight allocation to China and

Hong Kong on a combined basis. The portfolio is now neutral on

these markets, and almost neutral in relation to Taiwan, as we

believe valuations reflect the poor short-term outlook for these

respective markets. The portfolio continues to have an underweight

allocation to India given the view that this market is expensive

relative to historical levels and compared to other regional

markets - for instance the MSCI India index trades at 3.5x price to

book (as of writing) while the average valuation for the regional

index is 1.25x. As we observed in our half-yearly report, India is

also especially vulnerable to higher commodity prices due to its

heavy reliance on imported resources.

The portfolio's largest overweight allocations at the country

level are to South Korea and Indonesia. The 3.5% overweight

allocation to South Korea is motivated by several factors. Firstly,

we are attracted by the fact that this market includes some of the

world's most competitively positioned hardware technology

companies, such as consumer electronics giant Samsung Electronics

and SK Hynix, a semiconductor producer, as well as manufacturers in

the electric vehicle battery supply chain, such as SK IE

Technology. In addition, the valuations of these issuers are

presently attractive in both absolute and relative terms, so the

portfolio holds all these names. Our 3.0% Indonesian overweight

allocation is driven by more top-down, macroeconomic considerations

- the country's fiscal situation is improving as rising energy

prices bolster government revenues. We also like the fact that the

country has several well-run banks that have consistently generated

high growth and solid returns.

Outlook: Low valuations provide great opportunities to invest at

compelling prices

In our view, the past year's sharp share price declines mean

markets across the region now mostly reflect the deterioration in

the economic environment and the many uncertainties and risks

ahead. This view is supported by current valuations. The MSCI AC

Asia ex Japan Index is trading at a price to book ratio of 1.25x,

close to the previous historical lows seen in 2008 and 2016, and

looking more deeply into the Index's geographical constituents,

valuations in South Korea, Hong Kong and China are also either

close to or below their historical lows in price to book terms.

India remains the sole market trading above its ten-year historical

average valuation levels.

Despite the myriad of near-term uncertainties underpinning

current low valuations in many markets, we stand by our conviction

that Asian equities continue to provide attractive long-term

investment opportunities. From a top-down perspective, Asian

countries have large and growing economies, accounting for roughly

40% of the world's GDP. Major structural and social changes will

ensure the region continues to grow rapidly, with domestic demand

supported by the increasing prosperity of Asia's burgeoning middle

class. Furthermore, the region is also home to many innovative and

dynamic companies that are leading the world in a wide range of

industries, including semiconductor manufacturing, healthcare,

renewable energy, next generation automotive production and

financials.

While we have already taken the chance provided by current low

valuations to add new names to the portfolio at good prices, and

top up existing holdings, as discussed above, there are many other

exciting opportunities still available to invest in companies

well-placed to benefit from Asia's positive long term growth

outlook. We remain confident that our long experience, our presence

on the ground in local markets and our focus on the fundamental

analysis of specific stocks, will allow us to keep identifying the

best investment opportunities on offer across the region, ensuring

the Company's portfolio continues to provide our investors with

attractive returns and outperformance over the long-term.

Ayaz Ebrahim

Robert Lloyd

Investment Managers 15th December 2022

PRINCIPAL AND EMERGING RISKS

The Directors confirm that they have carried out a robust

assessment of the principal risks facing the Company, including

those that would threaten its business model, future performance,

solvency or liquidity. With the assistance of JPMF, the Audit

Committee has drawn up a risk matrix, which identifies the key

risks to the Company. The risks identified and the broad categories

in which they fall, and the ways in which they are managed or

mitigated are summarised below. The AIC Code of Corporate

Governance requires the Audit Committee to put in place procedures

to identify emerging risks. The key emerging risks identified are

also summarised below.

Principal Risk Description Mitigating Activities

----------------------- ------------------------------- ----------------------------------------------------

Investment Management

and Performance

----------------------- ------------------------------- ----------------------------------------------------

Underperformance Poor implementation The Board manages these risks by diversification

of the investment of investments and through its investment

strategy, for example restrictions and guidelines, which are

as to thematic exposure, monitored and reported on by the Manager.

sector allocation, The Manager provides the Directors with

stock selection, timely and accurate management information,

undue concentration including performance data and attribution

of holdings, factor analyses, revenue estimates, liquidity

risk exposure or reports and shareholder analyses. The

the degree of total Board monitors the implementation and

portfolio risk, may results of the investment process with

lead to underperformance the Investment Managers, at least one

against the Company's of whom attends all Board meetings, and

benchmark index and reviews data which show measures of the

peer companies. Company's risk profile. The Investment

Managers employ the Company's gearing

tactically, within a strategic range set

by the Board.

----------------------- ------------------------------- ----------------------------------------------------

Discount Control Investment trust The Board monitors the level of both the

Risk shares often trade absolute and sector relative premium/discount

at discounts to their at which the shares trade. The Board reviews

underlying NAVs, both sales and marketing activity and

although they can sector relative performance, which it

also trade at a premium. believes are the primary drivers of the

Discounts and premiums relative discount level. In addition,

can fluctuate considerably the Company has authority, when it deems

leading to volatile appropriate, to buy back its existing

returns for shareholders. shares to enhance the NAV per share for

remaining shareholders and to reduce the

absolute level of discount and discount

volatility.

----------------------- ------------------------------- ----------------------------------------------------

Market and Economic Market risk arises This risk is managed to some extent by

Risk from uncertainty diversification of investments and by

about the future regular communication with the Manager

prices of the Company's on matters of investment strategy and

investments, which portfolio construction which will directly

may reflect underlying or indirectly include an assessment of

uncertainties arising these risks. The Board receives regular

from economic, social, reports from the Manager regarding market

fiscal, climate and outlook and gives the Investment Mangers

regulatory changes. discretion regarding acceptable levels

In the past few years of gearing and/or cash. Currently the

Brexit and the ongoing Company's gearing policy is to operate

COVID-19 pandemic within a range of 10% net cash to 20%

have been major sources geared.

of uncertainty and The Board considers thematic and factor

have contributed risks, stock selection and levels of gearing

to elevated levels on a regular basis and has set investment

of market volatility. restrictions and guidelines which are

In particular China's monitored and reported on by the Manager.

zero-Covid policy The Board can, with shareholder approval,

is impacting economic look to amend the investment policy and

activity and squeezing objectives of the Company to gain exposure

supply chains, which to or mitigate the risks arising from

is significantly geopolitical instability.

slowing economic

growth in China.

Geopolitical risks

have risen markedly

this year with the

Russian invasion

of Ukraine. While

direct linkages to

the UK from Russia

tend to be small,

the impact of sanctions

is significant and

the rise in commodity

prices has caused

further disruption

to supply chains

which in turn is

exacerbating inflationary

pressure.

These risks represent

the potential loss

the Company might

suffer through holding

investments in the

face of negative

market movements.

----------------------- ------------------------------- ----------------------------------------------------

Investment Management

and Performance

----------------------- ------------------------------- ----------------------------------------------------

Loss of investment A sudden departure The Board seeks assurance that the Manager

team or portfolio of a Portfolio Manager takes steps to reduce the risk arising

manager or several members from such an event by ensuring appropriate

of the investment succession planning and the adoption of

management team could a team based approach, as well as special

result in a short efforts to retain key personnel. The Board

term deterioration engages with the senior management of

in investment performance. the Manager in order to mitigate this

risk.

----------------------- ------------------------------- ----------------------------------------------------

Operational

Risks

----------------------- ------------------------------- ----------------------------------------------------

Cyber Crime The threat of cyber The Company benefits directly and/or indirectly

attack is regarded from all elements of JPMorgan's Cyber

as at least as important Security programme. The information technology

as more traditional controls around physical security of JPMorgan's

physical threats data centres, security of its networks

to business continuity and security of its trading applications,

and security. are tested by independent auditors and

In addition to threatening reported every six months against the

the Company's operations, AAF Standard.

such an attack is

likely to raise reputational

issues which may

damage the Company's

share price and reduce

demand for its shares.

----------------------- ------------------------------- ----------------------------------------------------

Regulatory Risk

----------------------- ------------------------------- ----------------------------------------------------

Regulatory Risk The Company's business The Board receives regular reports from

model could become its broker, depositary, registrar and

non-viable as a result Manager as well as its legal advisers

of new or revised and the Association of Investment Companies

rules or regulations on changes to regulations which could

arising from, for impact the Company and its industry. The

example, policy change Company monitors events and relies on

or financial monitoring the Manager and its other key third party

pressure. providers to manage this risk by preparing

Regulatory risk arising for any changes.

from investing in The Company holds a diversified portfolio

China has increased of stocks across a number of sectors of

significantly over strategic importance to China and the

the last few years. Investment Managers are supported by an

As witnessed in the extensive network of Asian market specialists

education-for-profit around the world which has the ability

sector, the ability to understand events in China and assess

of China's centralised the implications on sectors and companies

government system to try and mitigate stock specific risk.

to enact regulation

rapidly that can

quickly and adversely

affect sectors or

individual companies

and therefore their

stock market prices

negatively.

----------------------- ------------------------------- ----------------------------------------------------

Economic and

Geopolitical

----------------------- ------------------------------- ----------------------------------------------------

Global Geopolitical Geopolitical Risk There is little direct control of risk

Risk is the potential possible. The Company addresses these

for political, socio-economic global developments in regular questioning

and cultural events of the Manager and will continue to monitor

and developments these issues, should they develop.

to have an adverse The Board has the ability, with shareholder

effect on the value approval, to amend the policy and objectives

of the Company's of the Company to mitigate the risks arising

assets. from geopolitical concerns.

The Company and its

assets may be impacted

by geopolitical instability,

in particular concerns

over global economic

growth. The crisis

in Ukraine has already

affected energy and

commodity markets

and may cause further

damage to the global

economy.

The ongoing conflict

between Russia and

Ukraine has heightened

the possibility that

tensions will spill

over and intensify

geo-political unrest

between other countries

sharing a common

border.

----------------------- ------------------------------- ----------------------------------------------------

Emerging Risk

----------------------- ------------------------------- ----------------------------------------------------

Environmental

----------------------- ------------------------------- ----------------------------------------------------

Policy and regulatory Climate change, which Financial returns for long-term diversified

risk arising barely registered investors should not be jeopardised given

from climate with investors a the investment opportunities created by

change decade ago, has today the world's transition to a low-carbon

become one of the economy. The Board is also considering

most critical issues the threat posed by the direct impact

confronting asset on climate change on the operations of

managers and their the Manager and other major service providers.

investors. Investors As extreme weather events become more

can no longer ignore common, the resiliency, business continuity

the impact that the planning and the location strategies of

world's changing the Company's services providers will

climate will have come under greater scrutiny. In particular

on their portfolios, also the Board receives ESG reports from

with the impact of the Manager on the portfolio and the way

climate change on ESG considerations are integrated into

returns now inevitable. the investment decision-making.

----------------------- ------------------------------- ----------------------------------------------------

Global

----------------------- ------------------------------- ----------------------------------------------------

Social dislocation Social dislocation/civil The Manager's market strategists are available

& conflict unrest may threaten for the Board and can discuss market trends.

global economic growth External consultants and experts can be

and, consequently, accessed by the Board. The Board can,

companies in the with shareholder approval, look to amend

portfolio. the investment policy and objectives of

the Company to gain exposure to or mitigate

the risks arising from geopolitical instability

although this is limited if it is truly

global.

----------------------- ------------------------------- ----------------------------------------------------

Rising competition China is emerging The Board has access to a range of expert

between China as a challenger to resources and strategists in the UK and

and western economies the western hegemony in the Asian region to provide long term

of recent decades. insight and guidance on geopolitical developments.

This brings with The Managers investment process incorporates

it increased competition non-financial measures and risks in the

in political and assessment of investee companies to allow

military affairs the portfolio to adapt to changing competitive

alongside the development and political landscapes.

of a major trading

bloc operating to

different cultural,

legal political and

technological norms

and standards. These

areas of conflict

may give rise to

geopolitical crises

that threaten the

markets in which

investee companies

operate and fragment

previously global

markets into more

isolated trading

blocs which may limit

the opportunity of

investee companies

to grow and thrive.

----------------------- ------------------------------- ----------------------------------------------------

TRANSACTIONS WITH THE MANAGER AND RELATED PARTIES

Details of the management contract are set out in the Directors'

Report on page 39 of the 2022 Annual Report. The management fee

payable to the Manager for the year was GBP2,155,000 (2021:

GBP2,727,000) of which GBPnil (2021: GBPnil) was outstanding at the

year end.

During the year GBP2,000 (2021: GBPnil), was payable to the

Manager for the administration of savings scheme products, of which

GBPnil (2021: GBPnil) was outstanding at the year end.

Safe custody fees amounting to GBP169,000 (2021: GBP181,000)

were payable to JPMorgan Chase Bank N.A. during the year of which

GBP42,000 (2021: GBP93,000) was outstanding at the year end.

The Manager may carry out some of its dealing transactions

through group subsidiaries. These transactions are carried out at

arm's length. The commission payable to JPMorgan Securities Limited

for the year was GBP7,000 (2021: GBP1,000) of which GBPnil (2021:

GBPnil) was outstanding at the year end.

Handling charges on dealing transactions amounting to GBP28,000

(2021: GBP24,000) were payable to JPMorgan Chase Bank N.A. during

the year of which GBP7,000 (2021: GBP9,000) was outstanding at the

year end.

During the year the Company held cash in the JPMorgan US Dollar

Liquidity Fund, which is managed by JPMorgan. At the year end this

was valued at GBP9,000 (2021: GBP964,000). Interest amounting to

GBP10,000 (2021: GBP3,000) was receivable during the year of which

GBPnil (2021: GBPnil) was outstanding at the year end.

Stock lending income amounting to GBP92,000 (2021: GBP48,000)

were receivable by the Company during the year.

JPMAM commissions in respect of such transactions amounted to

GBP10,000 (2021: GBP5,000).

At the year end, total cash of GBP445,000 (2021: GBP532,000) was

held with JPMorgan Chase Bank N.A. A net amount of interest of

GBPnil (2021: GBPnil) was receivable by the Company during the year

of which GBPnil (2021: GBPnil) was outstanding at the year end.

Full details of Directors' remuneration and shareholdings can be

found on pages 50 and 52 and in note 6 on page 70 of the 2022

Annual Report.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The Directors are responsible for preparing the Annual Report

and the financial statements in accordance with applicable law and

regulation.

Company law requires the Directors to prepare financial

statements for each financial year. Under that law the Directors

have prepared the financial statements in accordance with United

Kingdom Generally Accepted Accounting Practice (United Kingdom

Accounting Standards, comprising FRS 102 'The Financial Reporting

Standard applicable in the UK and Republic of Ireland' and

applicable law). Under company law the Directors must not approve

the financial statements unless they are satisfied that they give a

true and fair view of the state of affairs of the Company and of

the profit or loss of the Company for that period. In preparing the

financial statements, the Directors are required to:

-- select suitable accounting policies and then apply them consistently;

-- state whether applicable United Kingdom Accounting Standards,

comprising FRS 102, have been followed, subject to any material

departures disclosed and explained in the financial statements;

-- make judgements and accounting estimates that are reasonable and prudent; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business, and the Directors confirm that they have done

so.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the financial statements and the Directors' Remuneration Report

comply with the Companies Act 2006.

The Directors are also responsible for safeguarding the assets

of the Company and hence for taking reasonable steps for the

prevention and detection of fraud and other irregularities.

The Directors are responsible for the maintenance and integrity

of the Company's website. Legislation in the United Kingdom

governing the preparation and dissemination of financial statements

may differ from legislation in other jurisdictions.

Under applicable law and regulations the Directors are also

responsible for preparing a Strategic Report, a Directors' Report

and Directors' Remuneration Report that comply with the law and

those regulations.

Each of the Directors, whose names and functions are listed in

Directors' Report confirm that, to the best of their knowledge:

-- the Company's financial statements, which have been prepared

in accordance with United Kingdom Generally Accepted Accounting

Practice (United Kingdom Accounting Standards, comprising FRS 102

'The Financial Reporting Standard applicable in the UK and Republic

of Ireland', and applicable law), give a true and fair view of the

assets, liabilities, financial position and profit of the Company;

and

-- the Directors' Report includes a fair review of the

development and performance of the business and the position of the

Company, together with a description of the principal risks and

uncertainties that it faces.

The Directors consider that the Annual Report & Financial

Statements, taken as a whole, is fair, balanced and understandable

and provides the information necessary for shareholders to assess

the Company's performance, business model and strategy.

For and on behalf of the Board

Bronwyn Curtis OBE

Chairman

15th December 2022

STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 30TH SEPTEMBER 2022

2022 2021

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------- --------- ---------- ---------- --------- -------- -----------

(Losses)/gains on investments

held at fair value

through profit or loss - (75,909) (75,909) - 50,965 50,965

Net foreign currency gains/(losses) - 220 220 - (151) (151)

Income from investments 7,882 - 7,882 6,799 - 6,799

Interest receivable and similar

income 102 - 102 51 - 51

------------------------------------- --------- ---------- ---------- --------- -------- -----------

Gross return/(loss) 7,984 (75,689) (67,705) 6,850 50,814 57,664

Management fee (2,155) - (2,155) (2,727) - (2,727)

Other administrative expenses (698) - (698) (697) (90) (787)

------------------------------------- --------- ---------- ---------- --------- -------- -----------

Net return/(loss) before finance

costs and taxation 5,131 (75,689) (70,558) 3,426 50,724 54,150

Finance costs (43) - (43) (41) - (41)

------------------------------------- --------- ---------- ---------- --------- -------- -----------

Net return/(loss) before taxation 5,088 (75,689) (70,601) 3,385 50,724 54,109

Taxation (125) (389) (514) (670) (171) (841)

------------------------------------- --------- ---------- ---------- --------- -------- -----------

Net return/(loss) after taxation 4,963 (76,078) (71,115) 2,715 50,553 53,268

------------------------------------- --------- ---------- ---------- --------- -------- -----------

Return/(loss) per share (note

2) 5.09p (77.95)p (72.86)p 2.84p 52.81p 55.65p

A fourth quarterly dividend of 3.7p (2021: 4.6p) per share has

been declared in respect of the year ended 30th September 2022,

totalling GBP3,569,000 (2021: GBP 4,494,000). Further details are

given in note 10 on page 72 of the 2022 Annual Report.

All revenue and capital items in the above statement derive from

continuing operations. No operations were acquired or discontinued

in the year.

The 'Total' column of this statement is the profit and loss

account of the Company and the 'Revenue' and 'Capital' columns

represent supplementary information prepared under guidance issued

by the Association of Investment Companies.

The net return/(loss) after taxation represents the

profit/(loss) for the year and also the total comprehensive

income.

STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 30TH SEPTEMBER 2022

Called Exercised Capital

up

share Share warrant redemption Capital Revenue

capital premium reserve reserve reserves(1) reserve(1) Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- -------- -------- ---------- ----------- ------------ ----------- ----------

At 30th September 2020 23,762 31,646 977 25,121 315,134 - 396,640

Issue of Ordinary shares 687 12,980 - - - - 13,667

Issue of shares from

Treasury - 2,079 - - 2,892 - 4,971

Repurchase of shares

into Treasury - - - - (299) - (299)

Net return - - - - 50,553 2,715 53,268

Dividends paid in the

year (note 3) - - - - (15,332) (2,715) (18,047)

-------------------------- -------- -------- ---------- ----------- ------------ ----------- ----------

At 30th September 2021 24,449 46,705 977 25,121 352,948 - 450,200

Repurchase of shares

into Treasury - - - - (3,534) - (3,534)

Net (loss)/return - - - - (76,078) 4,963 (71,115)

Dividends paid in the

year (note 3) - - - - (12,028) (4,963) (16,991)

-------------------------- -------- -------- ---------- ----------- ------------ ----------- ----------

At 30th September 2022 24,449 46,705 977 25,121 261,308 - 358,560

-------------------------- -------- -------- ---------- ----------- ------------ ----------- ----------

1 These reserves form the distributable reserves of the Company

and may be used to fund distributions to investors.

STATEMENT OF FINANCIAL POSITION

AT 30TH SEPTEMBER 2022

2022 2021

GBP'000 GBP'000

------------------------------------------------------- --------- --------

Fixed assets

Investments held at fair value through profit or loss 358,303 448,721

------------------------------------------------------- --------- --------

Current assets

Derivative financial assets 2 -

Debtors 587 507

Cash and cash equivalents 454 1,496

------------------------------------------------------- --------- --------

1,043 2,003

Current liabilities

Creditors : amounts falling due within one year (786) (524)

------------------------------------------------------- --------- --------

Net current assets 257 1,479

------------------------------------------------------- --------- --------

Total assets less current liabilities 358,560 450,200

------------------------------------------------------- --------- --------

Net assets 358,560 450,200

------------------------------------------------------- --------- --------

Capital and reserves

Called up share capital 24,449 24,449

Share premium 46,705 46,705

Exercised warrant reserve 977 977

Capital redemption reserve 25,121 25,121

Capital reserves 261,308 352,948

------------------------------------------------------- --------- --------

Total equity shareholders' funds 358,560 450,200

------------------------------------------------------- --------- --------

Net asset value per share 370.6p 460.7p

STATEMENT OF CASH FLOWS

FOR THE YEARED 30TH SEPTEMBER 2022

2022 2021

GBP'000 GBP'000

------------------------------------------------------- ----------- -----------

Net cash outflow from operations before dividends and

interest (2,761) (3,346)

Dividends received 7,007 6,327

Interest received 10 3

Overseas taxation recovered 272 23

Interest paid (43) (40)

------------------------------------------------------- ----------- -----------

Net cash inflow from operating activities 4,485 2,967

------------------------------------------------------- ----------- -----------

Purchases of investments (196,879) (166,687)

Sales of investments 211,835 160,862

Settlement of foreign currency trades (4) (111)

------------------------------------------------------- ----------- -----------

Net cash inflow/(outflow) from investing activities 14,952 (5,936)

------------------------------------------------------- ----------- -----------

Dividends paid (16,991) (18,047)

Ordinary Shares issued (including from Treasury) - 18,638

Repurchase of shares into Treasury (3,679) -

------------------------------------------------------- ----------- -----------

Net cash (outflow)/inflow from financing activities (20,670) 591

------------------------------------------------------- ----------- -----------

Decrease in cash and cash equivalents (1,233) (2,378)

------------------------------------------------------- ----------- -----------

Cash and cash equivalents at start of year 1,496 3,966

Unrealised return/(loss) on foreign currency cash and

cash equivalents 191 (92)

------------------------------------------------------- ----------- -----------

Cash and cash equivalents at end of year 454 1,496

------------------------------------------------------- ----------- -----------

(Cash and cash equivalents consist of:

Cash and short term deposits 445 532

Cash held in JPMorgan US Dollar Liquidity Fund 9 964

------------------------------------------------------- ----------- -----------

Total 454 1,496

------------------------------------------------------- ----------- -----------

Reconciliation of net debt

As at Other As at

30th September non-cash 30th September

2021 Cash flows charges 2022

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- --------------- ----------- --------- ---------------

Cash and cash equivalents

Cash 532 (299) 212 445

Cash equivalents 964 (934) (21) 9

--------------------------- --------------- ----------- --------- ---------------

Total 1,496 (1,233) 191 454

--------------------------- --------------- ----------- --------- ---------------

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARED 30TH SEPTEMBER 2022

1. Accounting policies

(a) Basis of accounting

The financial statements are prepared under the historical cost

convention, modified to include fixed asset investments at fair

value, and in accordance with the Companies Act 2006, United

Kingdom Generally Accepted Accounting Practice ('UK GAAP'),

including FRS 102 'The Financial Reporting Standard applicable in

the UK and Republic of Ireland' and with the Statement of

Recommended Practice 'Financial Statements of Investment Trust

Companies and Venture Capital Trusts' (the 'SORP') issued by the

Association of Investment Companies in April 2021.

All of the Company's operations are of a continuing nature.

The financial statements have been prepared on a going concern

basis. In forming this opinion, the Directors have considered any

potential impact of the COVID-19 pandemic (although it is noted

that any negative impact is now much reduced), the direct and

indirect consequences arising from the Russian invasion of Ukraine

and the geopolitical uncertainty in China on the going concern and

viability of the Company. The Directors have also reviewed the

compliance with debt covenants in assessing the going concern and

viability of the Company. The Directors have also reviewed income

and expense projections and the liquidity of the investment

portfolio in making their assessment. Finally, the Board has also

taken into account the fact that the Company has a continuation

vote to be considered by shareholders at the Company's 2023 Annual

General Meeting and the likelihood of shareholders voting in favour

of continuation. Having consulted the Company's major shareholders

through the remit of its advisers, the Directors have a reasonable

belief that the continuation vote will be supported by the majority

of shareholders. The disclosures on going concern on page 47 of the

Directors' Report in the 2022 Annual Report form part of these

financial statements.

The policies applied in these financial statements are

consistent with those applied in the preceding year.

2. (Loss) return per share

2022 2021

GBP'000 GBP'000

--------------------------------------------------- ------------ -----------

Revenue return 4,963 2,715

Capital (loss)/return (76,078) 50,553

--------------------------------------------------- ------------ -----------

Total (loss)/return (71,115) 53,268

--------------------------------------------------- ------------ -----------

Weighted average number of shares in issue during

the year 97,596,359 95,724,531

Revenue return per share 5.09p 2.84p

Capital (loss)/return per share (77.95)p 52.81p

--------------------------------------------------- ------------ -----------

Total (loss)/return per share (72.86)p 55.65p

--------------------------------------------------- ------------ -----------

3. Dividends

(a) Dividends paid and declared

2022 2021

GBP'000 GBP'000

----------------------------------------------------- -------- --------

Dividends paid

2021 fourth quarterly dividend of 4.6p (2020: 4.2p) 4,494 3,951

First quarterly dividend of 4.5p (2021: 4.8p) 4,396 4,537

Second quarterly dividend of 4.2p (2021: 4.9p) 4,103 4,690

Third quarterly dividend of 4.1p (2021: 5.0p) 3,998 4,869

----------------------------------------------------- -------- --------

Total dividends paid in the period 16,991 18,047

----------------------------------------------------- -------- --------

Dividend declared

Fourth quarterly dividend declared of 3.7p (2021:

4.6p) per share 3,569 4,494

----------------------------------------------------- -------- --------

A fourth quarterly dividend of 3.7p has been declared and was

paid on 23rd November 2022 for the financial year ended 30th

September 2022. The fourth quarterly dividend has not been included

as a liability in the financial statements.

In accordance with the accounting policy of the Company, this

dividend will be reflected in the financial statements for the year

ending 30th September 2023.

(b) Dividend for the purposes of Section 1158 of the Corporation Tax Act 2010 ('Section 1158')

The requirements of Section 1158 are considered on the basis of

the dividend proposed in respect of the financial year, shown

below.

The aggregate of the distributable reserves is GBP252,678,000

(2021: GBP237,228,000).

2022 2021

GBP'000 GBP'000

--------------------------------------------------------- -------- --------

First quarterly dividend of 4.5p (2021: 4.8p) 4,396 4,537

Second quarterly dividend of 4.2p (2021: 4.9p) 4,103 4,690

Third quarterly dividend of 4.1p (2021: 5.0p) 3,998 4,869

Fourth quarterly dividend declared of 3.7p (2021: 4.6p) 3,569 4,494

--------------------------------------------------------- -------- --------

Total dividends for Section 1158 purposes 16,066 18,590

--------------------------------------------------------- -------- --------

The aggregate of the distributable reserves after the payment of

the final dividend will amount to GBP249,110,000 (2021:

GBP232,733,000).

4. Net asset value per share

2022 2021

--------------------------- ------------ -----------

Net assets (GBP'000) 358,560 450,200

Number of shares in issue 96,756,268 97,725,197

--------------------------- ------------ -----------

Net asset value per share 370.6p 460.7p

--------------------------- ------------ -----------

5. Status of results announcement

2022 Financial Information

The figures and financial information for 2022 are extracted

from the Annual Report and Financial Statements for the year ended

30th September 2022 and do not constitute the statutory accounts

for the year. The Annual Report and Financial Statements for the

year ended 30th September 2021 include the Report of the

Independent Auditors which is unqualified and does not contain a

statement under either section 498(2) or section 498(3) of the

Companies Act 2006. The Annual Report and Financial Statements for

the year ended 30th September 2022 will be delivered to the

Register of Companies in due course.

2021 Financial Information

The figures and financial information for 2021 are extracted

from the published Annual Report and Financial Statements for the

year ended 30th September 2021 and do not constitute the statutory

accounts for that year. The Annual Report and Financial Statements

for the year ended 30th September 2021 has been delivered to the

Registrar of Companies and included the Report of the Independent

Auditors which was unqualified and did not contain a statement

under either section 498(2) or section 498(3) of the Companies Act

2006.

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) is incorporated into, or forms part of, this

announcement.

15th December 2022

For further information:

Alison Vincent

JPMorgan Funds Limited

020 7742 4000

ENDS

A copy of the 2021 Annual Report will shortly be submitted to

the FCA's National Storage Mechanism and will be available for

inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

The 2021 Annual Report will shortly be available on the

Company's website at www.jpmasiagrowthandincome.co.uk where

up-to-date information on the Company, including daily NAV and

share prices, factsheets and portfolio information can also be

found.

JPMORGAN FUNDS LIMITED

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR TABLTMTJBBMT

(END) Dow Jones Newswires

December 16, 2022 02:00 ET (07:00 GMT)

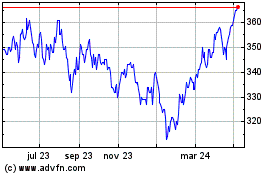

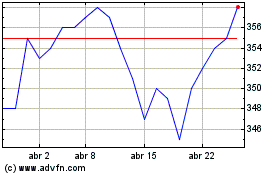

Jpmorgan Asia Growth & I... (LSE:JAGI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Jpmorgan Asia Growth & I... (LSE:JAGI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024