TIDMJLP

RNS Number : 4787V

Jubilee Metals Group PLC

10 August 2022

Jubilee Metals Group PLC

Registration number (4459850)

Altx share code: JBL

AIM share code: JLP

ISIN: GB0031852162

("Jubilee" or "the Company" or "the Group")

Dissemination of a Regulatory Announcement that contains inside

information according to UK Market Abuse Regulations. Not for

release, publication or distribution in whole or in part in, into

or from any jurisdiction where to do so would constitute a

violation of the relevant laws or regulations of such

jurisdiction.

Operations and Projects Update for the six months to 30 June

2022 (H2 FY2022)

Jubilee Metals Group PLC, a diversified leader in metals

processing with operations in Africa (AIM: JLP/Altx: JBL), is

pleased to announce the performance of its operations and progress

on growth projects for the six-month period to 30 June 2022.

Figures in this announcement are unaudited and exclude the effect

of foreign exchange profits or losses.

Jubilee's key achievement during the period was the completion

and early results achieved of its c. GBP 58 million (ZAR1.2

billion) investment programme in South Africa and Zambia that has

reshaped the company, provided expanded production across PGMs,

Chrome, Copper and Cobalt, and laid the platform for the expected

growth during the full FY 2023 period.

Key Achievements for H2 FY2022

-- Jubilee successfully completed its c. GBP 58 million (ZAR 1.2

billion) investment programme to diversify and expand the Company's

PGM, copper and cobalt operational footprint

-- In South Africa, construction and commissioning of the new

45% expanded Inyoni operations were completed in March 2022 with an

annualised nameplate production capacity of 44 000 PGM ounces and a

1.2 million tonnes combined chrome concentrate capacity (up

85%)

-- Jubilee achieved increased production of 21 140 PGM ounces

for the six-month period (up 5% from the previous six-month period)

despite planned operational interruptions to complete the new

Inyoni processing facility

-- Notably 95% of PGM ounces was produced at the new Inyoni

operations during six-month period (compared to 75% in FY2021).

This brings enhanced economics to Jubilee and has mitigated the

impact of softer PGM prices

-- Early results from the new Inyoni operations have

outperformed expectations with a 34% reduction in PGM unit cost

compared with the six-month period ending December 2021, as the

facility benefits from significantly increased operational

footprint and increased contribution from chrome production

-- The enlarged Inyoni delivered an increase in unit earnings

per PGM ounce of 12% compared with the six-month period ending

December 2021, despite the realised PGM basket price reducing 3%

over the period

-- In Zambia, Copper production increased 14% to 1 388 tonnes,

over the previous six-month period

-- Southern Copper Refining Strategy for 12 000 tonnes per annum

of copper was brought onstream with the commissioning of the new

Roan copper concentrator and ramp-up of operations reached 80% of

design capacity in August 2022

Leon Coetzer, CEO, commented: "I am extremely proud of the

Jubilee team's performance, and I thank each one of them for their

dedication and innovation despite the various challenges, including

at times, intense and prolonged supply chain disruptions. The team

has delivered a significantly expanded and further diversified

operational footprint which is already producing material increases

in output and efficiencies.

"The rationale for the investment to expand our Inyoni

operations is best illustrated by the simultaneous increase in not

only the overall PGM production but also the sharp increase in

earnings generated per PGM ounce despite softer metal prices. The

past six months and especially the last quarter has shown a sharp

increase in PGM production and lower costs as Inyoni achieved its

full design capacity with the majority of the PGM production

stemming from this quarter. This performance underpins our target

of reaching 44 000 PGM ounces per annum from our own facilities as

more of our production benefits from our renowned efficiencies.

"Equally in copper following a delayed start due to equipment

deliveries, our Project Roan reached 80% of design capacity during

the first week of August. This puts us on track to achieve our

targeted 3 700 tonnes of copper over the current six-month period

ending December 2022. The increased production rates are expected

to further reduce our unit cost. With the delivery of Project Roan,

we are on track to reach 10 000 tonnes of copper for the full

twelve-month period ending June 2023, while we work to unlock the

cobalt potential.

"I am very excited by what the FY 2023 period holds. It offers

tremendous potential growth for our Company as it benefits from the

foundation laid during the FY2022 period, with the full exposure of

our enlarged South African operations as well as the commissioning

of our new 12 000 tonnes per annum Southern Copper Refining

operations and the realisation of our cobalt production."

OPERATIONAL KEY PERFORMANCE INDICATORS

COMBINED OPERATIONAL

PERFORMANCE (UNAUDITED)

12 months six months six months % change

KEY UNITS OF PRODUCTION Unit to to to H2 vs H1

30 Jun 30 Jun 31 Dec

2022 FY2022 2022 (H2) 2021 (H1)

-------- ------------- ----------- ----------- ----------

PGM ounces:

-------- ------------- ----------- ----------- ----------

* Inyoni Oz 35 188 20 036 15 152 32%

-------- ------------- ----------- ----------- ----------

* Third party JV Oz 6 268 1 104 5 164 (79%)

-------- ------------- ----------- ----------- ----------

Total PGM ounces Oz 41 456 21 140 20 316 4%

-------- ------------- ----------- ----------- ----------

Copper tonnes Tonne 2 604 1 388 1 216 14%

-------- ------------- ----------- ----------- ----------

UNIT REVENUE

-------- ------------- ----------- ----------- ----------

Revenue per PGM ounce $/oz 1 609 1 586 1 632 (3%)

-------- ------------- ----------- ----------- ----------

Revenue per copper tonne $/t 9 195 8 903 9 527 (7%)

-------- ------------- ----------- ----------- ----------

UNIT COSTS

-------- ------------- ----------- ----------- ----------

Net cost per PGM ounce

(after by-product credits

chrome) (1) $/oz 447 358 540 (34%)

-------- ------------- ----------- ----------- ----------

Net cost per copper

tonne (after by-product

credits cobalt) $/t 5 371 4 931 5 873 (16%)

-------- ------------- ----------- ----------- ----------

UNIT EARNINGS(2)

-------- ------------- ----------- ----------- ----------

Net earnings per PGM

ounce $/oz 1 162 1 228 1 092 12%

-------- ------------- ----------- ----------- ----------

Net earnings per copper

tonne $/t 3 824 3 972 3 654 9%

-------- ------------- ----------- ----------- ----------

COMBINED KEY FINANCIAL HIGHLIGHTS FROM OPERATIONS

-- Operational earnings totalled GBP 24 million (ZAR 480

million) for the six-month period ending June 2022 (up 24% from the

previous six-month period)

-- Revenue from operations totalled GBP 76 million (ZAR 1.5

billion) for the six-month period ending June 2022 (up 21% from the

previous six-month period)

-- PGM unit cost of production reduced by 34% driven by

increased PGM operational footprint and increased contribution of

chrome by-product credits

-- The group cash and cash equivalents as at 30 June 2022, stood

at GBP 16 million (FY2021 GBP 19.6 million)

South African Operations

Operational Highlights

-- South African operations maintained a strong safety

performance over the six-month period with 162 days worked without

any LTI

-- Jubilee's PGM operations delivered 21 140 PGM ounces of which

95% was delivered by the expanded Inyoni operations for the

six-month period. This equates to an increase of 32% compared with

Inyoni's previous best performance of 15 152 PGM ounces

-- Third party JV ounces decreased 79% as part of the strategy

to migrate to Inyoni only production

Operational Financial Highlights

-- Early results from the expanded Inyoni operations exceed

expectations with a reduction of 34% in PGM unit cost of operations

due to the increased PGM processing capacity and a sharp increase

in the contribution from chrome by-product operations

-- Net revenue from South African operations over the six-month

period increased to GBP 67 million (ZAR 1.3 billion) up 21% from

the previous six-month period

-- Net operational earnings from South Africa for the six-month

period reached GBP 20 million (ZAR 400 million) maintaining a

strong margin of 30% and up 23% from the previous six-month

period

Zambian Operations

Project and Operational Highlights

-- Zambian operations maintained a strong safety performance

achieving 124 days worked without any LTI

-- 12 000 tonne per annum Southern Copper Refining Strategy

brought into operation with the integration of the newly

commissioned Roan copper concentrator with Sable Refinery

-- Ramp-up of the Roan concentrator reaches 80% of design

capacity at the time of this announcement

-- Copper tonnes sold during the six-month period as part of

operational trials increased to 1 388 tonnes, up 14% over the

previous six-month period

Operational Financial Highlights

-- Net revenue from Zambian operations increased to GBP 10

million (ZAR 200 million) for the six-month period, up 16% from the

previous six-month period

-- Net operational earnings from Zambian operations increased to

GBP 4.2 million (ZAR 84 million) up 30% from the previous six-month

period

Prospects for FY2023

South Africa

-- The new enlarged PGM and chrome operations have set the

platform to deliver 44 000 PGM ounces and 1.2million tonnes of

chrome concentrate per annum from Jubilee's own capacity. The PGM

production benefits from the increased efficiencies of this new

enlarged facility, which is significantly subsidised by the

increased chrome production as highlighted by the results for the

H2 six-month period. FY2023 offers strong potential for growth in

earnings as it benefits from the full exposure of our enlarged

South African operations

-- Jubilee continues to progress discussions to secure a further

PGM processing footprint in the Eastern Limb of the Bushveld

(north-eastern region of South Africa's chrome and PGM mining

region). Jubilee has already secured significant tailings resources

with further expansion opportunities in the area. Jubilee is

reviewing the option to either secure a decommissioned PGM facility

that will be repurposed by Jubilee, or to construct a new facility

in the region

Zambia

-- The Southern Copper Refining Strategy targets to produce 3

700 tonnes of copper within the first half of FY2023 ramping up to

target 10 000 tonnes of copper for the full FY2023 year. If

achieved this equates to a 284% increase in copper output

-- In addition, the Company looks to complete the testing and

commissioning of the cobalt circuit on the back of the completed

ramp up of Project Roan offering the potential of significant

earnings contribution

-- Jubilee's technical and projects team can now dedicate their

focus on the development and execution of the Northern Copper

Refining Strategy

Please refer to the Appendices for a detailed breakdown of the

performance achieved during H2 FY2022.

10 August 2022

For further information visit www.jubileemetalsgroup.com or contact:

Jubilee Metals Group PLC

Leon Coetzer

Tel: +27 (0) 11 465 1913

PR & IR Adviser - Tavistock

Jos Simson/ Gareth Tredway/ Adam Baynes

Tel: +44 (0) 207 920 3150

Nominated Adviser - SPARK Advisory Partners Limited

Andrew Emmott/ James Keeshan

Tel: +44 (0) 20 3368 3555

Joint Broker - Berenberg

Matthew Armitt/ Jennifer Lee/ Detlir Elezi

Tel +44 (0) 20 3207 7800

Joint Broker - WHIreland

Harry Ansell/ Katy Mitchell

Tel: +44 (0) 20 7220 1670/+44 (0) 113 394 6618

Joint Broker - Shard Capital Partners LLP

Damon Heath/ Erik Woolgar

Tel +44 (0) 20 7186 9900

JSE Sponsor - Questco Corporate Advisory Proprietary Limited

Sharon Owens

Tel: +27 (11) 011 9212

APPICES

SUMMARY OF OPERATIONAL AND FINANCIAL PERFORMANCE

South African Operations

USD Pound Sterling

FY2022 6 6 % change Unit UNAUDITED Unit % change 6 6 FY2022

months months months months

to end to end to end to end

Dec Jun Jun Dec

2021 2022 2022 2021

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

PRODUCTION

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

Inyoni ounces

35 188 15 152 20 036 32% oz sold oz 32% 20 036 15 152 35 188

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

Third party

JV ounces

6 268 5 164 1 104 (79%) oz sold oz (79%) 1 104 5 164 6 268

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

Total PGM

41 456 20 316 21 140 4% oz ounces sold oz 4% 21 140 20 316 41 456

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

1 222 619 By-product 602 619 1 222

452 900 602 552 (3%) tonne tonnes (chrome) tonne (3%) 552 900 452

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

FINANCIALS

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

REVENUE

FROM OPERATIONS

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

66 703 33 164 33 539 1% $'000 PGM revenue GBP'000 6% 25 820 24 330 50 150

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

By-product

94 370 41 487 52 883 27% $'000 revenue (chrome) GBP'000 34% 40 712 30 436 71 148

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

161

073 74 650 86 422 16% $'000 Net revenue GBP'000 21% 66 532 54 766 121 298

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

OPERATING

COSTS

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

26 162 13 823 12 340 (11%) $'000 * Processing cost GBP'000 (6%) 9 500 10 141 19 640

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

4 654 1 534 3 120 103% $'000 * Transport costs Eastern Limb GBP'000 113% 2 402 1 125 3 528

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

82 103 37 102 45 001 21% $'000 * By-product costs (chrome) GBP'000 27% 34 644 27 219 61 863

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

Total PGM

112 operating

919 52 458 60 461 15% $'000 costs GBP'000 21% 46 546 38 485 85 031

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

OPERATIONAL

EARNINGS

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

35 886 17 807 18 079 2% $'000 PGM earnings GBP'000 7% 13 918 13 064 26 982

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

By-product

PGM earnings

12 267 4 385 7 882 80% $'000 (chrome) GBP'000 89% 6 068 3 217 9 285

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

Net earnings

48 153 22 192 25 961 17% $'000 from operations GBP'000 23% 19 986 16 281 36 267

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

FINANCIAL

RESULTS PER

OUNCE

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

Revenue per

1 609 1 632 1 586 (3%) $/oz PGM ounce GBP/oz 2% 1 221 1 198 1 210

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

By-product

PGM revenue

per ounce

2 276 2 042 2 502 22% $/oz (chrome) GBP/oz 29% 1 926 1 498 1 716

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

Net revenue

3 885 3 675 4 088 11% $/oz per PGM ounce GBP/oz 17% 3 147 2 696 2 926

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

Operating

cost per

PGM ounce:

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

631 680 584 (14%) $/oz * Processing cost GBP/oz (10%) 449 499 474

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

112 75 147 96% $/oz * Transport costs Eastern Limb GBP/oz 107% 114 55 85

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

1 980 1 826 2 129 17% $/oz * By-product cost (chrome) GBP/oz 22% 1 639 1 340 1 492

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

Total operating

cost per

2 723 2 583 2 860 11% $/oz PGM ounce GBP/oz 16% 2 202 1 894 2 051

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

Net earnings

per PGM ounce

after by-product

1 162 1 092 1 228 12% $/oz credit (chrome) GBP/oz 18% 945 801 875

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

Cost per

PGM Ounce

net of by-

product credit

447 540 358 (34%) $/oz (chrome) GBP/oz (30%) 276 396 335

-------- -------- --------- ----------------- ----------------------------------- -------- --------- -------- -------- --------

Health and Safety

The South African operations maintained their record of no

reportable occupational health or environmental incidents over the

six-month period. The combined operations have achieved 162 days

without a lost time injury (LTI) with a lost time injury frequency

rate (LTIFR) of 2.0. Over the period 217 128 tonnes of historical

tailings were uplifted, processed and placed on a modern tailings

facility by the Jubilee tailings operations.

Operational Performance

In South Africa, Jubilee delivered on its strategy to maximize

the processing of historical tailings through its own operations,

rather than utilizing the processing capacity offered by third

party processing facilities through existing joint venture

agreements. Jubilee's new Inyoni processing facility significantly

outperforms the efficiencies achieved at the third-party

facilities.

The PGM operational processing capacity has been increased by

45% to 75 000 tonnes per month which holds the potential to produce

44 000 PGM ounces per annum. The expansion program included the

expansion of the chrome processing operations by approximately 80%

to 250 000 tonnes per month which holds the potential to produce

1.2 million tonnes of chrome concentrate per annum. The chrome

operations play an important role in Jubilee's PGM operations by

not only acting as a feeder system to the PGM operations but also

subsidising the PGM unit cost through the sales of chrome

concentrate.

Jubilee achieved the production of 21 140 PGM ounces for

six-month period. Notably 95% of the PGM production stemmed from

the new Inyoni operations, exceeding Inyoni's previous best

performance by 32%. Q4 of FY2022 saw a significant jump in PGM

production as the new Inyoni operations reached its full design

capacity. The enlarged facility benefits from the scale of

operations with the unit cash cost to produce a PGM ounce reducing

to US$ 358 over the six-month period. The cash cost per PGM ounce

for the six-month period benefitted from the increased contribution

from the sale of chrome concentrate accounting for US$ 373 per PGM

ounce or GBP 6.1 million (ZAR 122 million).

While PGM production over the six-month period continued to be

impacted by the ramp-up of the new Inyoni processing facility,

production of PGMs is expected to continue to sharply increase as

the new Inyoni facility operates at full design capacity.

The Company confirms its guidance of 44 000 PGM ounces from own

production for FY2023 with an option to add a further 8 000 PGM

ounces from third party processing agreements dependent on stock

availability.

Zambian Operations

USD

Pound Sterling

FY2022 6 months 6 months % change UNAUDITED % change 6 months 6 months FY2022

to end to end Unit Unit to end to end

Dec 2021 Jun 2022 Jun 2022 Dec 2021

--------- --------- --------- ------- ------------- -------- --------- --------- --------- -------

PRODUCTION

--------- --------- --------- ------- ------------- -------- --------- --------- --------- -------

Copper

tonnes

2 604 1 216 1 388 14% Tonnes sold Tonnes 14% 1 388 1 216 2 604

--------- --------- --------- ------- ------------- -------- --------- --------- --------- -------

FINANCIALS

--------- --------- --------- ------- ------------- -------- --------- --------- --------- -------

REVENUE

FROM

OPERATIONS

--------- --------- --------- ------- ------------- -------- --------- --------- --------- -------

Copper

23 943 11 585 12 358 7% $'000 revenue GBP'000 12% 9 514 8 499 18 013

--------- --------- --------- ------- ------------- -------- --------- --------- --------- -------

By-product

copper

revenue

441 - 441 100% $'000 (cobalt) GBP'000 100% 339 - 339

--------- --------- --------- ------- ------------- -------- --------- --------- --------- -------

Net copper

24 384 11 585 12 799 10% $'000 revenue GBP'000 16% 9 853 8 499 18 352

--------- --------- --------- ------- ------------- -------- --------- --------- --------- -------

OPERATING

COSTS

--------- --------- --------- ------- ------------- -------- --------- --------- --------- -------

Total copper

operating

13 985 7 141 6 844 (4%) $'000 costs GBP'000 1% 5 269 5 239 10 508

--------- --------- --------- ------- ------------- -------- --------- --------- --------- -------

OPERATIONAL

EARNINGS

--------- --------- --------- ------- ------------- -------- --------- --------- --------- -------

Copper

earnings

--------- --------- --------- ------- ------------- -------- --------- --------- --------- -------

By-product

copper

earnings

(cobalt)

--------- --------- --------- ------- ------------- -------- --------- --------- --------- -------

Net copper

9 958 4 444 5 514 24% $'000 earnings GBP'000 30% 4 245 3 260 7 505

--------- --------- --------- ------- ------------- -------- --------- --------- --------- -------

FINANCIAL

RESULTS PER

TONNE

--------- --------- --------- ------- ------------- -------- --------- --------- --------- -------

Revenue per

9 195 9 527 8 903 (7%) $/t copper tonne GBP/t (2%) 6 854 6 989 6 917

--------- --------- --------- ------- ------------- -------- --------- --------- --------- -------

By-product

revenue per

copper tonne

169 - 318 100% $/t (cobalt) GBP/t 100% 245 - 130

--------- --------- --------- ------- ------------- -------- --------- --------- --------- -------

Net revenue

per copper

9 364 9 527 9 221 (3%) $/t tonne GBP/t 2% 7 099 6 989 7 048

--------- --------- --------- ------- ------------- -------- --------- --------- --------- -------

Net earnings

per copper

tonne after

by-product

credit

3 824 3 654 3 973 9% $/t (cobalt) GBP/t 14% 3 058 2 681 2 882

--------- --------- --------- ------- ------------- -------- --------- --------- --------- -------

Cost per

copper tonne

net of by-

product

credit

5 371 5 873 4 931 (16%) $/t (cobalt) GBP/t (12%) 3 796 4 308 3 905

--------- --------- --------- ------- ------------- -------- --------- --------- --------- -------

Health and Safety

The Zambian operations maintained their record of no reportable

occupational health or environmental incidents over the six-month

period. The combined operations and projects have achieved 124 days

without a LTI with a LTIFR of 2.9.

Operational Performance

Jubilee's copper strategy in Zambia includes, as its first

phase, the implementation of its Southern Copper Refining Strategy

which targets to produce up to 12 000 tonnes (design capacity of 14

000 tonnes) of copper units per annum including a cobalt by-product

from certain cobalt containing feed streams. The fully integrated

Southern Copper Refining Strategy is a significant step for Jubilee

as it diversifies its processing footprint across commodities and

jurisdictions. It also holds the potential to significantly grow

Jubilee's earnings in a commodity such as copper supported by

strong fundamentals.

The strategy integrates the upgraded Sable Refinery with Project

Roan, a new copper concentrator processing both Run-Of-Mine copper

ore as well as tailings to produce copper concentrates for refining

at Sable (10 000 tonnes per annum), which complements the existing

supply of third-party feed to Sable refinery (2 000 tonnes per

annum). Total capital spent to end June 2022 to deliver the

integrated Southern Copper Refining Strategy's capital allocation

totalled c. GBP 36.1 million (ZAR 721 million).

Jubilee's project execution team broke ground for the

construction of the new copper concentrator, Project Roan, in June

2021 and despite the challenges caused by the COVID 19 pandemic and

its effect on supply chains the team was able to commence testing

of certain equipment within seven months and completed all

construction activity within eleven months which remains a

remarkable achievement. Despite a slight delay in start-up Project

Roan has reached a production throughput level of 80% of design

capacity.

In addition to the copper refining capacity at Sable, Jubilee

approved the implementation of a cobalt refining circuit at Sable

which at full design capacity holds the potential to produce up to

1 200 tonnes of cobalt product per annum. Testing and ramp-up of

the cobalt circuit will follow the completed Roan concentrator

ramp-up to ensure stable feed to the circuit.

Crucially, and in line with Jubilee's goals to promote

sustained, inclusive economic growth, the Southern Copper Refining

Strategy has resulted in significant job creation, with total jobs

filled in Zambia reaching over 700 during the last twelve months.

Jubilee has prioritised sourcing of skills and services from its

local communities and has in many instances partnered with local

firms to assist in their growth and development to offer a

sustained service to its projects.

Over the six-month period the Company sold 1 388 tonnes of

copper at a unit cost of US$ 4 931 per tonne of copper cathode. The

majority of the production stems from operational trails as part of

ensuring operational readiness at the Sable Refinery for Project

Roan.

The Company targets the production of 3 700 tonnes of copper for

the 6-month period ending December 2022 in-line with the ramp-up to

full production of Project Roan.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDPLMBTMTBMTJT

(END) Dow Jones Newswires

August 10, 2022 02:00 ET (06:00 GMT)

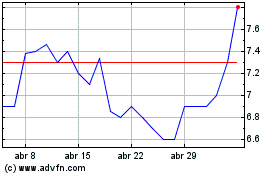

Jubilee Metals (LSE:JLP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Jubilee Metals (LSE:JLP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024