TIDMJLP

RNS Number : 1947X

Jubilee Metals Group PLC

24 April 2023

Jubilee Metals Group PLC

Registration number (4459850)

Altx share code: JBL

AIM share code: JLP

ISIN: GB0031852162

("Jubilee" or "the Company" or "the Group")

Dissemination of a Regulatory Announcement that contains inside

information according to UK Market Abuse Regulations. Not for

release, publication or distribution in whole or in part in, into

or from any jurisdiction where to do so would constitute a

violation of the relevant laws or regulations of such

jurisdiction.

COMPANY UPDATE

Jubilee Metals Group PLC (AIM: JLP; Altx: JBL), a leader in

diversified metals processing, with operations in Africa, is

pleased to provide an update on its South African operations and

its Zambian projects for the quarter ended 31 March 2023 ("Q3

FY2023").

Q3 FY2023 OVERVIEW

Operations

-- Lost time injury frequency rate (LTIFR) of 1.0 in South

Africa; LTIFR of 2.3 in Zambia

-- 11 437 PGM oz were sold with PGM operations performing on

target recording 9 019 PGM oz, from own operations, plus an

additional 2 418 PGM oz, through the sale of stock under its JV

Partnership agreement

-- Chrome production of 310 721 tonnes, remains on track to

reach full year guidance of 1.2 million tonnes

-- Contribution from chrome by-product credits to the PGM

operations more than doubled on the back of stronger chrome

production with cost per PGM oz (after chrome by-product credits)

dropping to US$383 per PGM oz

-- Upwards momentum in platinum and palladium prices during the

current period, with chrome and copper prices remaining

resilient

-- Southern Copper Refining project ramp-up resumed end of

February, with a stable supply of water and power fully

restored

-- 494 tonnes of copper sold with a further 202 tonnes of

equivalent copper held in copper concentrate and metal as stock at

the end of the period

-- The flexibility of Sable Refinery offers the ability to pivot

between copper and cobalt production to rapidly respond to changing

market fundamentals. Flexibility used to maximise copper equivalent

production units

o Copper production prioritised due to cobalt prices reducing by

76% from the year's high

o 110 tonnes of Cobalt hydroxide produced prior to pivoting to

copper with a further 70 tonnes of equivalent cobalt units held in

stock

Strategy and growth projects

-- Good progress made with discussions to secure a further PGM

processing footprint in the Eastern Limb, targeting an additional

25 000 PGM oz per annum and expected to commence construction in Q4

CY2023

-- Ramp-up of copper operations at Roan Concentrator in Zambia

progressing well with full output now expected in May 2023

-- Final design reviews for the Northern Refining Strategy are

underway to confirm the implementation schedule and required

investment with further information to be provided to the market by

the full year close in June

Full year Guidance FY2023

-- PGM oz guidance remains unchanged at 38 000 PGM oz with the

potential of upwards revision depending on South Africa's power

supply outlook

-- Chrome operations expected to exceed guidance of 1.2 million

tonnes of chrome concentrate supported by stronger chrome prices

during Q3 FY 2023

-- Copper guidance remains unchanged at 3 000 tonnes

STATEMENT FROM LEON COETZER, CEO:

"Our South African operations continue to deliver a strong

performance recording 9 019 PGM oz from own operations and 2 418

PGM oz through our JV partnership agreement, for the quarter

January to March. The ounces sold under the JV agreement stem from

excess stock held at Inyoni with its capacity fully utilised under

the current agreements. This places our South African operations on

track to meet and potentially exceed the full year guidance of 38

000 PGM oz. Our chrome operations once again exceeded its

operational targets recording 310 721 tonnes of chrome concentrate

and are therefore expected to exceed our full year guidance of 1.2

million tonnes. The continued supportive chrome prices over the

past quarter translated into a more than doubled chrome by-product

credit in our PGM business, which calculates to a cost per PGM oz

of US$383. This confirms the strength of the South African

operation's integrated chrome and PGM business model.

"The ramp-up of operations at the Roan copper concentrator and

integration with the Sable refinery resumed from the end of

February and recorded 494 tonnes of copper units sold for Q3 FY2023

with a further 202 tonnes of copper held in stock at Roan. The

leadership of our Zambian operations team has been strengthened to

ensure that the team is better structured to deliver on the

expected performance targets, with results already seen.

"Final design reviews for our Northern Refining Strategy are

underway to confirm the implementation schedule and required

investment. I hope to provide further clarity on this at the

completion of the revised capital program which is expected by the

full year close in June."

KEY OPERATIONAL NUMBERS

COMBINED OPERATIONAL PERFORMANCE 3 months 6 months

to to

Unit 31 Mar 2023 31 Dec

2022

(Q3 FY2023) (H1 FY2023)*

Unaudited Unaudited

-------- -------------- ---------------

KEY UNITS OF PRODUCT

-------- -------------- ---------------

PGM ounces:

-------- -------------- ---------------

* Inyoni Facility Oz 9 019 18 208

-------- -------------- ---------------

Oz 2 418 -

* Third party JV

-------- -------------- ---------------

Total PGM ounces Oz 11 437 18 208

-------- -------------- ---------------

Chrome tonnes Tonne 310 721 634 111

-------- -------------- ---------------

Copper tonnes Tonne 494** 915

-------- -------------- ---------------

Copper tonnes held in stock Tonne 202 280

-------- -------------- ---------------

UNIT REVENUE

-------- -------------- ---------------

PGM revenue per ounce US$/oz 1 285*** 1 453

-------- -------------- ---------------

Chrome revenue per PGM ounce US$/oz 2 317*** 2 292

-------- -------------- ---------------

Copper revenue per tonne US$/t 8 459**** 7 953

-------- -------------- ---------------

UNIT COST

-------- -------------- ---------------

Cost per PGM ounce (after chrome

by-product credits) US$/oz 383*** 608

-------- -------------- ---------------

Cost per copper tonne US$/t 6 236**** 6 468*

-------- -------------- ---------------

UNIT EARNINGS

-------- -------------- ---------------

Earnings per PGM ounce US$/oz 902*** 845

-------- -------------- ---------------

Earnings per copper tonne US$/t 2 223** 1 485

-------- -------------- ---------------

* Numbers are as per the half year operational update prior to

capitalisation of proportional Roan output

** Includes total copper tonnes sold inclusive of Roan produced

tonnes which are capitalised prior to full commercialisation of the

project expected by end May 2023

*** PGM cost, revenue and earnings are accounted for based on the combined 11 437 PGM oz

Total chrome credits account to US$402 per oz of total PGM oz

sold during the period. Inyoni unit cost before chrome credits were

US$708 per PGM oz

**** Copper revenue and cost represent total copper tonnes sold

and include capitalised cost of Project Roan

SOUTH AFRICA

Jubilee's Inyoni Facility continued to deliver a strong

performance in line with expectations. The Inyoni operations

achieved 9 019 PGM oz for the quarter (100% from own operations)

and additionally, sold the equivalent of 2 418 PGM oz from excess

feedstock through its JV partner agreement. At the Company's Inyoni

operations, the operational cost remained tightly under control

despite the inflationary pressure and benefitted from the chrome

offset on the back of the strong performance.

The chrome operations, as a by-product of the PGM operations,

continued to perform, delivering 310 721 tonnes of chrome

concentrate over the period against a targeted 300 000 tonnes. This

strong performance coupled with increased chrome prices during the

past quarter, resulted in a more than doubling of contribution from

chrome credits towards the PGM operations, equating to US$402 per

PGM oz, and resulting in a cost per PGM oz (after chrome by-product

credits) of US$383 All in unit cost for the Inyoni operation

inclusive of feed material purchases and before accounting for the

chrome credits, totalled US$708 per PGM oz.

Chrome prices remain robust with strong demand from China

coupled with constrained supply. PGM basket prices remained lower

at US$1 297 per oz net of all refining charges.

As previously announced, Jubilee has made good progress with

discussions to secure a further PGM processing footprint in the

Eastern Limb of the Bushveld complex (the north-eastern region of

South Africa's chrome and PGM mining region), with final design

reviews completed for the chrome beneficiation facility that will

precede the PGM facility in the Eastern Limb. The Company targets

to commence with the construction of the chrome beneficiation

circuit as soon as regulatory approvals are secured, which is

expected during Q3 of the 2023 calendar year. The construction of

the circuit is budgeted to be completed over a six-month period.

The Eastern Limb PGM facility offers the opportunity to further

increase Jubilee's PGM operational footprint by 25 000 PGM

ounces.

ZAMBIA

Jubilee's 780 000 tonnes per annum Roan copper concentrator

forms part of its fully integrated Southern Copper Refining

Strategy which integrates the Sable Refinery and the Roan

Concentrator with a total capacity of 12 000 tonnes of copper per

annum.

At the end of February, with the power and water disruptions

across Zambia now resolved, Project Roan re-commenced with ramping

up to full production and commercialisation of the Southern Copper

Refining project. The project sold 494 copper tonnes over the

period with a further 202 tonnes of equivalent copper contained in

copper concentrate and copper cathode. To date, a total capital

investment of US$48.2 million has been made for the construction,

implementation, commissioning and ramp-up of the integrated Roan

project towards reaching commercialisation. Upon reaching

commercial production, the Roan copper concentrator is expected to

contribute 550 tonnes of copper per month to the production of the

Sable Refinery with a further 130 tonnes per month of copper from

third party supplies.

As announced on 20 March 2023, the upgrade of the power and

water infrastructure at Project Roan offered the potential for the

simplification of the Northern Copper Refining Strategy by

utilising Roan's expanded infrastructure to establish a central

copper concentrating hub at Roan which would significantly reduce

the required capital investment and project timelines.

The Company will provide further clarity on the expected capital

investment and updated timelines for the implementation of the

Northern Copper Refining Strategy at the completion of the revised

capital program which is expected by the end of the current

reporting period.

At Sable, Jubilee successfully completed the first cobalt

production runs from waste and looks to increase the capacity to be

able to produce 450 tonnes per month of cobalt hydroxide (125

tonnes of contained cobalt) from recycled waste alone by the end of

May 2023. This additional capability offers Jubilee the flexibility

to pivot between copper and cobalt production guided by prevailing

market conditions. Cobalt prices have depreciated sharply over the

period with cobalt hydroxide prices reducing by 76% from its highs

during April 2022. Cobalt production has therefore been halted and

will resume once the market displays signs of recovery.

24 April 2023

FOR FURTHER INFORMATION VISIT WWW.JUBILEEMETALSGROUP.COM OR

PLEASE CONTACT:

Jubilee Metals Group PLC Tel: +27 (0) 11 465 1913

Leon Coetzer

PR & IR Adviser - Tavistock Tel: +44 (0) 20 7920 3150

Jos Simson/ Gareth Tredway

Nominated Adviser - SPARK Advisory Tel: +44 (0) 20 3368 3555

Partners Limited

Andrew Emmott/ James Keeshan

Joint Broker - Berenberg Tel: +44 (0) 20 3207 7800

Matthew Armitt/ Jennifer Lee/ Detlir

Elezi

Joint Broker - WHIreland Tel: +44 (0) 20 7220 1670/

Harry Ansell/ Katy Mitchell +44 (0) 113 394 6618

JSE Sponsor - Questco Corporate Advisory Tel: +27 (0) 11 011 9207

Pty Ltd

Alison McLaren

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFIFSESSISFIV

(END) Dow Jones Newswires

April 24, 2023 02:00 ET (06:00 GMT)

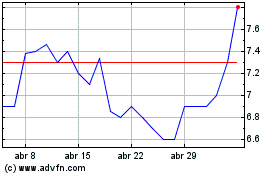

Jubilee Metals (LSE:JLP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Jubilee Metals (LSE:JLP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024