TIDMJOG

RNS Number : 2293A

Jersey Oil and Gas PLC

22 September 2022

22 September 2022

Jersey Oil and Gas plc

("Jersey Oil & Gas", "JOG" or the "Company")

Interim Results for the Six Month Period Ended 30 June 2022

Jersey Oil & Gas (AIM: JOG), an independent upstream oil and

gas company focused on the UK Continental Shelf ("UKCS") region of

the North Sea, is pleased to announce its unaudited Interim Results

for the six month period ended 30 June 2022.

Highlights

-- Favourable fiscal and macroeconomic developments have further

bolstered interest in our on-going "Greater Buchan Area" ("GBA")

farm-out process

-- GBA farm-out process advancing as planned, with continued

active engagement with multiple counterparties

-- Substantial progress has been made, with the majority of

interested parties forecast to complete their technical due

diligence in October 2022

-- Constructive commercial discussions are taking place with

potential counterparties

-- Cash position of approximately GBP8.7 million, with no debt,

as at 30 June 2022 - well ahead of the group's forecast

Andrew Benitz, CEO of Jersey Oil & Gas, commented :

"Great progress is being made with our GBA farm-out process -

the key activity for the Group in 2022. Interest is strong,

technical studies across the various development solutions are well

advanced and commercial discussions are ongoing with serious,

well-funded counterparties. Since launching the process, the

Company's engagement strategy has been broadened to advance a range

of competing development solutions, thereby providing increased

optionality."

Enquiries :

Jersey Oil and Gas plc

Andrew Benitz, CEO - c/o Camarco Tel: 020 3757 4983

Strand Hanson Limited

James Harris / Matthew Chandler / James Bellman Tel: 020 7409

3494

Arden Partners plc

Rory McGirr

Tel: 020 7614 5900

finnCap Ltd

Christopher Raggett / Tim Redfern Tel: 020 7220 0500

Camarco

Billy Clegg / Rebecca Waterworth Tel: 020 3757 4983

Notes to Editors :

Jersey Oil & Gas is a UK E&P company focused on building

an upstream oil and gas business in the North Sea. The Company

holds a significant acreage position within the Central North Sea

referred to as the Greater Buchan Area ("GBA"), which includes

operatorship and 100% working interests in the P2498 Licence Blocks

20/5b and 21/1d that contain the Buchan oil field and J2 oil

discovery and a 100% working interest in the P2170 Licence Blocks

20/5b & 21/1d, that contain the Verbier oil discovery and other

exploration prospects.

JOG is focused on delivering shareholder value and growth

through creative deal-making, operational success and licensing

rounds. Its management is convinced that opportunity exists within

the UK North Sea to deliver on this strategy and the Company has a

solid track-record of tangible success.

Forward-Looking Statements

This announcement may contain certain forward-looking statements

that are subject to the usual risk factors and uncertainties

associated with an oil and gas business. Whilst the Company

believes the expectations reflected herein to be reasonable in

light of the information available to it at this time, the actual

outcome may be materially different owing to factors beyond the

Company's control or otherwise within the Company's control but

where, for example, the Company decides on a change of plan or

strategy.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018, as amended.

Chairman & Chief Executive Officer's Report

GBA Farm-out Process Update

Encouraging progress continues to be made on our GBA farm-out

process, and the Company remains actively engaged with multiple

counterparties. Joint technical studies for the various different

development solutions are now at an advanced stage.

As previously highlighted, since launching the farm-out process,

a broad range of competing development solutions has been generated

to supplement the initial work on the proposed installation of a

new processing platform. The alternative solutions include tiebacks

to existing platforms and the re-use of available floating

production, storage and offloading ("FPSO") vessels.

Since confirming the technical and economic attractiveness of

the potential GBA development solutions earlier this year, JOG's

most recent operational focus has been centred on completing

confirmatory pre-Front End Engineering and Design studies for the

various options with the different counterparties. The studies are

being undertaken in collaboration with the infrastructure owners

and cover areas that serve to validate and de-risk the different

solutions and associated capital expenditure forecasts. While the

precise studies are specific to each potential solution, they

broadly cover work on flow assurance, host facility "brownfield"

modification requirements and potential future electrification

workscopes. This technical work is expected to conclude in October

2022.

Whilst there can be no certainty of a successful conclusion,

constructive commercial discussions are also now well underway.

Regional Electrification Opportunities

The different GBA development solutions that are being assessed

all have the potential to be a component of the future Outer Moray

Firth offshore wind electrification plans that are currently being

considered as part of the Government's Innovation and Targeted Oil

and Gas ("INTOG") leasing round process. As such, we were pleased

to provide a leading offshore wind developer with a letter of

support as a potential power user to assist them in their

application for a lease in the upcoming INTOG offshore wind licence

round. This operator has experience in both development and

operations for floating offshore wind. In addition to the GBA being

a potential off-taker of locally sourced wind power, there are also

complimentary investment opportunities in offshore wind that

require further evaluation.

Licensing activity

JOG continues to work closely and constructively with the North

Sea Transition Authority ("NSTA") on our licence commitments. On

Licence P2498, which includes the Buchan field as well as the J2

and part of the Verbier discoveries, our milestone related to

delivery of a Field Development Plan ("FDP") has been adjusted to

align with the current scheduled licence expiry in August 2023 and,

pending conclusion of a successful farm-out, we are on track to

deliver on this. Upon approval of an FDP, the licence would then

move into the "third phase", which covers all future development

and production activities. On Licence P2170, there is a requirement

to submit an FDP for the Verbier discovery in order to advance the

licence into the third term. Verbier is part of our phased area

wide GBA development plan, with production scheduled to commence

following the start of production from the Buchan field. The P2170

Licence is due to expire on 22 November 2022, therefore we are in

close consultation with the NSTA to agree an appropriate way

forward.

JOG's Acquisition Strategy

JOG's priority is to secure a GBA farm-out and any M&A

activity has been focused around this objective. We have evaluated

potential asset swaps as part of our ongoing discussions, but

remain of the view that an industry farm-out provides the best

solution to advance the planned GBA development and thereby deliver

greater value for shareholders. Building a full cycle upstream

business focused on the UKCS remains the ultimate goal for JOG.

Financial Review

JOG's cash position was approximately GBP8.7 million as of 30

June 2022. The cash spend of the business will continue to be

comfortably below the GBP1.5 million per quarter run rate

previously forecast. As an oil and gas exploration and development

company, JOG had no production revenue during the period and

received only a small amount of interest on its cash deposits.

The loss for the period, before and after tax, was approximately

GBP1.2m (2021: GBP1.9m). The Company's main expenditure during the

first half of 2022 related to technical studies assessing parallel

development options for our GBA Development project. The Company

remains well funded to fulfil its farm-out objective.

Tax

The Energy Profits Levy ("EPL") that was introduced by the

Government in May 2022 caught the industry off guard, particularly

those that have invested and built production portfolios in the

UKCS over the past few years. Fiscal instability has made some

question their North Sea investment strategy. The silver lining,

however, was the introduction of a generous investment allowance

that is specifically ring fenced to attract capital spend into new

investments. A full taxpayer in the North Sea now has the ability

to secure 91% tax relief through investing into new projects,

essentially meaning that for a cost of only 9p a company can get

GBP1 of investment value. Projects of the scale of the proposed GBA

development should benefit from this investment allowance.

Summary and outlook

A significantly improved macroeconomic outlook for the oil and

gas sector compared to last year has ushered in significant profits

for the oil majors. The pandemic and terrible events in Ukraine

have masked the underlying issue that is challenging the upstream

sector - namely, a looming supply crunch. The industry has been

starved of capital since 2015 and this has led to chronic under

investment. Energy transition is an important issue and the oil and

gas industry is at the forefront of the challenges that this

evolution brings. It must be managed appropriately as hydrocarbons

continue to provide the world with approximately 80% of its daily

energy supply. Unfortunately, inflationary pressures resulting from

a restricted energy supply are already being seen and, in turn, the

even more concerning prospect of energy poverty. The world needs

urgent and responsible investment upstream to address the supply

shortfall against a backdrop of significantly increasing global

demand for energy. Consumers, industry and Governments deserve

access to affordable energy to go about their lives during the

energy transition.

It will take time for the supply side to increase, and in the

meantime continued high oil prices are highly likely. The GBA is a

vital resource and is estimated to be the third largest oil

development opportunity in the UKCS. We look forward to concluding

the farm-out process and thereby securing investment to take this

project into development and contributing to ensuring long term

energy supply and security for the UK economy.

We appreciate the ongoing commitment of our dedicated team and

the professionalism they have displayed throughout our industry and

stakeholder engagement. We also thank our shareholders for their

ongoing and unstinting support as we continue to advance our GBA

farm-out process.

Les Thomas Andrew Benitz

Non-Executive Chairman Chief Executive Officer

22 September 2022

JERSEY OIL AND GAS PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 JUNE 2022

6 months 6 months Year to

to to

30/06/22 30/06/21 31/12/21

(unaudited) (unaudited) (audited)

Notes GBP GBP GBP

CONTINUING OPERATIONS

Revenue - - -

Cost of sales - 66,403 (101,079)

GROSS PROFIT/(LOSS) - 66,403 (101,079)

Exploration write-off/licence

relinquishment - - (447,812)

Administrative expenses (1,200,589) (1,986,483) (3,672,135)

OPERATING LOSS (1,200,589) (1,920,080) (4,221,026)

Finance income 17,050 1,127 1,807

Finance expense (2,839) (2,788) (6,098)

LOSS BEFORE TAX (1,186,377) (1,921,741) (4,225,317)

Tax 4 - - -

LOSS FOR THE PERIOD (1,186,377) (1,921,741) (4,225,317)

OTHER COMPREHENSIVE INCOME - - -

TOTAL COMPREHENSIVE LOSS

FOR THE PERIOD (1,186,377) (1,921,741) (4,225,317)

============ ============ =================

Total comprehensive loss attributable

to:

Owners of the parent (1,186,377) (1,921,741) (4,225,317)

============ ============ =================

Loss per share expressed

in pence per share:

Basic 5 (3.64) (7.15) (14.48)

Diluted 5 (3.64) (7.15) (14.48)

============ ============ =================

The above consolidated statement of comprehensive income should

be read in conjunction with the accompanying notes.

JERSEY OIL AND GAS PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2022

30/06/22 30/06/21 31/12/21

(unaudited) (unaudited) (audited)

Notes GBP GBP GBP

NON-CURRENT ASSETS

Intangible assets - Exploration

costs 6 22,752,129 17,359,856 21,514,153

Property, plant and equipment 7 24,633 57,187 40,077

Right-of-use assets 133,168 125,415 185,008

Deposits 31,112 28,420 31,112

------------- ------------- -------------

22,941,042 17,570,878 21,770,350

------------- ------------- -------------

CURRENT ASSETS

Trade and other receivables 8 346,631 593,643 353,114

Cash and cash equivalents 9 8,666,792 17,056,538 13,038,388

------------- ------------- -------------

9,013,423 17,650,181 13,391,502

------------- ------------- -------------

TOTAL ASSETS 31,954,465 35,221,059 35,161,852

============= ============= =============

EQUITY

SHAREHOLDERS' EQUITY

Called up share capital 10 2,573,395 2,566,795 2,573,395

Share premium account 110,309,524 110,358,234 110,309,524

Share options reserve 1,708,075 2,308,462 1,397,287

Accumulated losses (82,738,107) (80,431,559) (81,551,730)

Reorganisation reserve (382,543) (382,543) (382,543)

------------- ------------- -------------

TOTAL EQUITY 31,470,344 34,419,389 32,345,933

------------- ------------- -------------

NON-CURRENT LIABILITIES

Lease liabilities 18,830 74,200 83,012

------------- ------------- -------------

18,830 74,200 83,012

------------- ------------- -------------

CURRENT LIABILITIES

Trade and other payables 11 334,198 643,419 2,603,707

Lease liabilities 131,093 84,051 129,200

------------- ------------- -------------

465,291 727,470 2,732,907

------------- ------------- -------------

TOTAL LIABILITIES 484,121 801,670 2,815,919

------------- ------------- -------------

TOTAL EQUITY AND LIABILITIES 31,954,465 35,221,059 35,161,852

============= ============= =============

The above consolidated statement of financial position should be

read in conjunction with the accompanying notes.

JERSEY OIL & GAS PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2022

Called Share Share Re-

up share premium options Accumulated organisation Total

capital account reserve Losses reserve equity

GBP GBP GBP GBP GBP GBP

(unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited)

At 1 January

2021 2,466,144 93,851,526 2,109,969 (78,509,819) (382,543) 19,535,277

Loss for the

period

and total

comprehensive

income - - - (1,921,741) - (1,921,741)

Issue of share

capital 100,651 16,506,709 - - - 16,607,360

Share based

payments - - - 198,493 - - 198,493

------------- ------------- ------------- -------------- -------------- -------------

At 30 June 2021 2,566,795 110,358,235 2,308,462 (80,431,560) (382,543) 34,419,389

============= ============= ============= ============== ============== =============

At 1 January

2022 2,573,395 110,309,524 1,397,287 (81,551,730) (382,543) 32,345,933

Loss for the

period

and total

comprehensive

income - - - (1,186,377) - (1,186,377)

Share based

payments - - - 310,788 - - 310,788

------------- ------------- ------------- -------------- -------------- -------------

At 30 June 2022 2,573,395 110,309,524 1,708,075 (82,738,107) (382,543) 31,470,344

============= ============= ============= ============== ============== =============

The following describes the nature and purpose of each reserve

within owners' equity:

Reserve Description and purpose

Called up share capital Represents the nominal value of shares

issued

Share premium account Amount subscribed for share capital in

excess of nominal value

Share options reserve Represents the accumulated balance of

share based payment charges recognised in respect of share options

granted by the Company less transfers to retained deficit in

respect of options exercised or cancelled/lapsed

Accumulated losses Cumulative losses recognised in the

Consolidated Statement of Comprehensive Income

Reorganisation reserve Amounts resulting from the restructuring

of the Group

The above consolidated statement of changes in equity should be

read in conjunction with the accompanying notes

JERSEY OIL AND GAS PLC

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 2022

6 months 6 months Year

to to to

30/06/22 30/06/21 31/12/21

(unaudited) (unaudited) (audited)

Notes GBP GBP GBP

CASH FLOWS FROM OPERATING ACTIVITIES

Cash used in operations 12 (3,085,544) (2,196,448) (1,495,899)

Net interest received 17,050 1,127 1,807

Net interest paid (2,839) (2,788) (6,098)

--------------- ------------

Net cash used in operating activities (3,071,333) (2,198,109) (1,500,190)

--------------- ----------------- ------------

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of intangible assets 6 (1,237,976) (2,368,561) (6,970,670)

Net cash used in investing activities (1,237,976) (2,368,561) (6,970,670)

--------------- ----------------- ------------

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds of issue of shares - 16,607,360 16,565,248

Principal elements of lease payments (62,289) (65,667) (137,516)

Net cash generated from financing

activities (62,289) 16,541,693 16,427,732

INCREASE/(DECREASE) IN CASH AND

CASH EQUIVALENTS (4,371,596) 11,975,023 7,956,873

CASH AND CASH EQUIVALENTS AT BEGINNING

OF PERIOD 13,038,388 5,081,515 5,081,515

--------------- ----------------- ------------

CASH AND CASH EQUIVALENTS AT

OF PERIOD 9 8,666,792 17,056,538 13,038,388

=============== ================= ============

The above consolidated statement of cash flows should be read in

conjunction with the accompanying notes

JERSEY OIL AND GAS PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 30 JUNE 2022

1. GENERAL INFORMATION

Jersey Oil and Gas plc (the "Company") and its subsidiaries

(together, "the Group") are involved in the upstream oil and gas

business in the UK.

The Company is a public limited company incorporated and

domiciled in the United Kingdom and quoted on AIM, a market

operated by London Stock Exchange plc. The address of its

registered office is 10 The Triangle, ng2 Business Park,

Nottingham, NG2 1AE.

The Group's half year condensed financial statements for the six

months ended 30 June 2022 were authorised for issue in accordance

with a resolution of the Board of Directors on 22 September

2022.

2. BASIS OF PREPARATION AND ACCOUNTING POLICIES

Basis of Preparation

The interim condensed consolidated financial statements for the

six months ended 30 June 2022 have been prepared in accordance with

International Accounting Standard 34 "Interim Financial

Reporting".

These unaudited interim consolidated financial statements of the

Group have been prepared following the same accounting policies and

methods of computation as the consolidated financial statements for

the year ended 31 December 2021. These unaudited interim

consolidated financial statements do not include all the

information and footnotes required by generally accepted accounting

principles for annual financial statements and therefore should be

read in conjunction with the consolidated financial statements and

the notes thereto in the Company's annual report for the year ended

31 December 2021.

The financial information contained in this announcement does

not constitute statutory financial statements within the meaning of

section 435 of the Companies Act 2006.

Consolidated statutory accounts for the year ended 31 December

2021, on which the auditors gave an unqualified audit report, have

been filed with the registrar of Companies. The report of the

auditors included in that 2021 Annual Report was unqualified and

did not contain a statement under either Section 498(2) or Section

498(3) of the Companies Act 2006.

Going Concern

The Group has no material firm work commitments on any of the

Group's licences, other than ongoing Operator overheads and licence

fees. Other work that the Group is undertaking in respect of the

GBA licences and surrounding areas is modest relative to its

current cash reserves. The Group expects to be able to manage its

estimated cash outflows such that its current cash reserves are

expected to more than exceed its estimated cash outflows in all

reasonable scenarios for at least 12 months following the date of

issue of these interim financial statements. Based on these

circumstances, the Directors have considered it appropriate to

continue to adopt the going concern basis of accounting in

preparing these interim financial statements.

Accounting policies

The accounting policies adopted in the preparation of the

interim condensed consolidated financial statements are consistent

with those followed in the preparation of the Group's annual

financial statements for the year ended 31 December 2021. No new

standards, amendments or interpretations have had a material impact

on the Group's interim consolidated financial statements for the

period ended 30 June 2022.

The impact of seasonality or cyclicality on operations is not

considered significant on the interim consolidated financial

statements.

3. SEGMENTAL REPORTING

The Directors consider that the Group operates in a single

segment, that of oil and gas exploration, appraisal, development

and production, in a single geographical location, the North Sea of

the United Kingdom and do not consider it appropriate to

disaggregate data further from that disclosed.

JERSEY OIL AND GAS PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 30 JUNE 2022

4. TAX

Jersey Oil and Gas plc is a trading company but no liability to

UK corporation tax arose on its ordinary activities for the period

ended 30 June 2022 due to trading losses. As at 31 December 2021,

the Group held tax losses of approximately GBP57 million (2020:

GBP46 million).

On 26 May 2022, the UK Government announced the introduction of

an Energy Profits Levy ('EPL') on the UK ring fence profits of oil

and gas producers with effect from 26 May 2022. The legislation

introducing the EPL was substantively enacted on 11 July 2022. The

EPL is charged at the rate of 25% on taxable profits in addition to

ring fence corporation tax of 30% and Supplementary Charge of 10%,

making a total rate on ring fence profits of 65%.

Qualifying capital expenditure may be offset against the 25% EPL

at an uplifted rate of 1.8 times. When combined with the existing

Investment Allowance uplift of 6.25% this results in an overall

91.25% tax relief on new qualifying capital expenditure.

5. EARNINGS/(LOSS) PER SHARE

Basic loss per share is calculated by dividing the losses

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period.

Diluted loss per share is calculated using the weighted average

number of shares adjusted to assume the conversion of all dilutive

potential ordinary shares.

Earnings Weighted

attributable average

to ordinary number Per share

shareholders of shares amount

GBP Pence

Period ended 30 June

2022

Basic and Diluted

EPS

Loss attributable to

ordinary shareholders (1,186,377) 32,554,293 (3.64)

============== =========== ==========

JERSEY OIL AND GAS PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED 30 JUNE 2022

6. INTANGIBLE ASSETS

Exploration

Costs

GBP

COST

At 1 January 2022 21,689,394

Additions 1,237,976

At 30 June 2022 22,927,370

============

ACCUMULATED AMORTISATION

At 1 January 2022 175,241

At 30 June 2022 175,241

============

NET BOOK VALUE at 30

June 2022 22,752,129

============

This represents the work capitalised on the GBA assets.

7. PROPERTY, PLANT AND EQUIPMENT

Computer

and office

equipment

GBP

COST

At 1 January 2022 228,447

Additions -

At 30 June 2022 228,447

============

ACCUMULATED AMORTISATION, DEPLETION AND

DEPRECIATION

At 1 January 2022 188,370

Charge for period 15,444

At 30 June 2022 203,814

==========

NET BOOK VALUE at 30 June

2022 24,633

==========

This represents the capitalised cost of computer equipment and

fixtures.

JERSEY OIL AND GAS PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED 30 JUNE 2022

8. TRADE AND OTHER RECEIVABLES

30/06/22 30/06/21 31/12/21

(unaudited) (unaudited) (audited)

GBP GBP GBP

Other receivables 30 30 30

Prepayments and accrued income 268,323 270,019 119,249

Deposits - 54,222 -

Value added tax 78,278 269,372 233,835

346,631 593,643 353,114

============ ============ ==========

As at 30 June 2022, there were no trade receivables past due nor

impaired. There are immaterial expected credit losses recognised on

these balances.

9. CASH AND CASH EQUIVALENTS

The amounts disclosed in the consolidated statement of cash

flows in respect of cash and cash equivalents are in respect of

these consolidated statement of financial position amounts:

Period ended 30 30/06/22 30/06/21 31/12/21

June 2022

(unaudited) (unaudited) (audited)

GBP GBP GBP

Cash and cash equivalents 8,666,792 17,056,538 13,038,388

------------ ------------

8,666,792 17,056,538 13,038,388

============ ============ ===========

10. CALLED UP SHARE CAPITAL

30/06/22 30/06/21 31/12/21

(unaudited) (unaudited) (audited)

GBP GBP GBP

Issued and fully paid:

Number: 32,554,293 (2021:

31,894,293)

Ordinary class 2,573,395 2,566,795 2,573,395

2,573,395 2,566,795 2,573,395

============ ============ ==========

11. TRADE AND OTHER PAYABLES

30/06/22 30/06/21 31/12/21

(unaudited) (unaudited) (audited)

GBP GBP GBP

Trade payables 111,041 267,385 1,211,220

Accrued expenses 135,770 303,979 1,021,105

Other payables - 4 -

Taxation and Social Security 87,387 72,051 371,381

334,198 643,419 2,603,706

============ ============ ==========

JERSEY OIL AND GAS PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED 30 JUNE 2022

12. NOTES TO THE CONSOLIDATED STATEMENT OF CASH FLOWS

RECONCILIATION OF LOSS BEFORE TAX TO CASH USED IN OPERATIONS

30/06/22 30/06/21 31/12/21

(unaudited) (unaudited) (audited)

GBP GBP GBP

Loss for the period before

tax (1,186,377) (1,921,741) (4,225,317)

Adjusted for:

Depreciation 15,444 17,362 34,472

Impairments - - 447,812

Depreciation right-of-use

asset 51,840 71,959 138,176

Share based payments (net) 310,788 198,493 470,724

Finance costs 2,839 2,788 6,098

Finance income (17,050) (1,127) (1,807)

------------ ------------ ------------

(822,516) (1,632,266) (3,129,842)

Decrease in inventories

(Increase)/decrease in trade

and other receivables 6,482 (137,980) 99,856

Increase/(decrease) in trade

and other payables (2,269,509) (426,202) 1,534,087

------------ ------------ ------------

Cash used in operations (3,085,544) (2,196,448) (1,495,899)

============ ============ ============

13. POST BALANCE SHEET EVENTS

None.

14. AVAILABILITY OF THE INTERIM REPORT 2022

A copy of these results will be made available for inspection at

the Company's registered office during normal business hours on any

weekday. The Company's registered office is at 10 The Triangle, ng2

Business Park, Nottingham, Nottinghamshire NG2 1AE. A copy can also

be downloaded from the Company's website at

www.jerseyoilandgas.com. Jersey Oil and Gas plc is registered in

England and Wales with registration number 7503957.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFLLLLKLEBBD

(END) Dow Jones Newswires

September 22, 2022 02:01 ET (06:01 GMT)

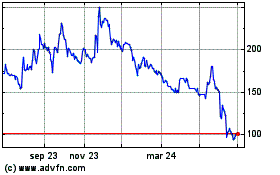

Jersey Oil And Gas (LSE:JOG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

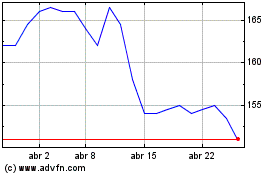

Jersey Oil And Gas (LSE:JOG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024