TIDMJSE

RNS Number : 2264B

Jadestone Energy PLC

10 February 2022

Jadestone Energy

2022 Operating and Financial Guidance

10 February 2022 - Singapore: Jadestone Energy plc ("Jadestone"

or the "Company"), an independent oil and gas production company

focused on the Asia-Pacific region, is pleased to provide its

guidance outlook for 2022.

Paul Blakeley, President and CEO commented:

"Our strong balance sheet and unhedged exposure to rising oil

prices will comfortably underpin our activity levels in 2022, which

incorporates two infill wells at Stag and initial development

activity at the Akatara gas project in Indonesia. We expect

production to increase 36% in 2022 at the midpoint of the

15,500-18,500 boe/d guidance range, which excludes any contribution

from Maari.

We welcome the greater clarity that the revised New Zealand

hydrocarbon legislation provides, and with Jadestone and OMV both

committed to the Maari transaction, we are ready to work with the

government to expedite the completion of this deal. However, given

that the exact schedule to completion is dependent on the New

Zealand upstream regulator's implementation of the recent

legislative changes, it feels prudent to exclude Maari from our

production guidance at this point. In the meantime, Jadestone

continues to benefit from the project's strong cash generation.

In Indonesia, we have continued to advance the Akatara project

with pre-project activity moving ahead on schedule, while in

Vietnam, we are continuing to engage with the government on the Nam

Du/U Minh project. We are also encouraged by the M&A pipeline

in the Asia-Pacific region, and are currently assessing several

opportunities, all subject to our strict investment criteria.

Maintaining a conservative balance sheet remains a priority, in

order that we comfortably meet our capital commitments and retain

funding flexibility for accretive growth opportunities. However,

based on our spending forecasts, we expect to generate material

incremental cash in 2022 at current oil prices and premiums, and as

a result, an increase in shareholder returns, either through

increased dividends and/or share buy-backs, may be considered later

in the year."

2022 operating and financial guidance

l 2022 production is expected to average 15,500-18,500 boe/d, a

36% increase on 2021, with the majority (c.95%) oil. The range

reflects planned maintenance shutdowns at Montara, Stag and the

operated Peninsular Malaysia assets during the year. It also

includes reduced production from the Montara field over a three to

four-week period in early 2022, due to an engine failure in the gas

reinjection compressor and the necessary works to restore

production to full capacity.

l The Maari field is expected to average 4,500-4,700 bbls/d

(gross) in 2022 but has been excluded from production guidance

pending further clarity on the timing of closing the

acquisition.

l The strength in crude premiums seen in late 2021 has continued

into early 2022. The most recent liftings from Stag (December 2021)

and Montara (January 2022) achieved premiums of US$12.70/bbl and

US$3.80/bbl respectively.

l Unit operating costs(1) are expected to average

US$23.00-28.00/boe in 2022, representing an c.10% reduction on 2021

levels, primarily due to higher average production expected in the

year, partially offset by the planned major three-year maintenance

programmes.

l Capital expenditure guidance is set at US$90-105 million,

comprising mainly the Stag infill programme, which develops two

million barrels of reserves, and the first phase of the Akatara gas

project, which is expected to be sanctioned during H1 2022.

o The cost of the Stag infill programme is immediately

deductible under the current Australia tax incentive for qualifying

investment, and is expected to reduce overall Australia corporate

income tax paid in 2022.

l The Company is currently unhedged, although hedging will be

contemplated in line with any debt funding arranged for the Akatara

gas development.

l The Company is committed to pay a 2022 cash dividend, in

keeping with the dividend policy, to maintain and grow dividends in

line with underlying cashflow generation.

Net zero GHG target update

As previously announced, the Company plans to convert its 2021

net zero ambition into a clear net zero greenhouse gas commitment

later in the first half of 2022. This will include interim

milestones and associated workstreams which are well advanced.

Jadestone's corporate strategy of maximising recovery from existing

fields while minimising their emissions, and a move towards more

gas in the portfolio over time, is both responsible and appropriate

in the context of managing climate change. This also strikes the

right balance in delivering secure and affordable energy in parts

of Southeast Asia where either an energy shortage exists or where

coal may be used as an alternative. Jadestone believes it can play

an important role during this period of energy transition, while

also demonstrating resilience and longevity to its business.

Gas developments

Following signature of the gas sales agreement for the Akatara

field in December 2021, the Company has been progressing the FEED

optimisation and preparing for the EPC contract tender, which will

commence shortly. A final investment decision is still expected in

the first half of 2022, which would maintain the project schedule

for first gas in H1 2024.

Jadestone remains committed to commercialising its offshore

Vietnam gas resources and continues to collaborate with the

government regarding the proposed Nam Du/U Minh field development.

The Company is pursuing a strategy of agreeing a production profile

for the fields as a precursor to a gas sales contract and

ultimately attaining government sanction for the development.

Jadestone believes that development of the Nam Du/U Minh gas fields

will increase Vietnam's energy independence, support the country's

growing economy, and assist in the country's energy transition

following Vietnam's recent commitment to carbon neutrality by

2050.

Conference call and webcast

The management team will host an investor and analyst conference

call to accompany the announcement at 09:00 (London) / 17:00

(Singapore) today, Thursday 10 February 2022, including a question

and answer session.

The call is accessible by dial-in and through a live audio

webcast as detailed below. Please register approximately 15 minutes

prior to the start of the event.

Webcast link:

https://produceredition.webcasts.com/starthere.jsp?ei=1524328&tp_key=4ea3072531

Event conference title: Jadestone Energy plc. - Guidance

update

Start time: 09:00 (London) / 17:00 (Singapore)

Date: Thursday, 10 February 2022

Conference ID: 68604466

United Kingdom 08006522435

Australia 1800076068

Canada (Toll free) 8883900546

France 0800916834

Germany 08007240293

Hong Kong 800962712

Indonesia 0018030208221

Japan 006633812569

Malaysia 1800817426

Netherlands 08000227908

New Zealand 0800453421

Singapore 8001013217

Spain 900834776

Sweden 0200899189

Switzerland 0800312635

USA (Toll free) 8883900546

Area access numbers are subject to carrier capacity and call

volumes.

(1) Unaudited operating expense is a non-GAAP financial measure

which does not have a standardised meaning prescribed by IFRS. This

non-GAAP financial measure is included because management uses this

information to analyse financial performance and efficiency and it

may be useful to investors on the same basis. Unaudited operating

expense is a non-GAAP measure which should not be considered an

alternative to, or more meaningful than, "production cost" as

determined in accordance with IFRS, as an indicator of financial

performance. Unaudited operating expense equals production cost

plus the net impact of opex related foreign exchange gains and

losses and adjusted for certain non-routine maintenance items and

workover costs. Because non-GAAP financial measures do not have a

standardised meaning prescribed by IFRS, they are unlikely to be

comparable to similar measures presented by other companies and

should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with IFRS.

Production cost will be disclosed along with the Company's full

year financial and operating results, including audited

consolidated group financial statements, in April 2022.

For further information, please contact:

Jadestone Energy plc

Paul Blakeley, President and CEO +65 6324 0359 (Singapore)

Phil Corbett, Investor Relations Manager +44 7713 687467 (UK)

ir@jadestone-energy.com

Stifel Nicolaus Europe Limited (Nomad, +44 (0) 20 7710 7600 (UK)

Joint Broker)

Callum Stewart

Jason Grossman

Ashton Clanfield

Jefferies International Limited (Joint +44 (0) 20 7029 8000 (UK)

Broker)

Tony White

Will Soutar

Camarco (Public Relations Advisor) +44 (0) 203 757 4980 (UK)

Billy Clegg jse@camarco.co.uk

James Crothers

About Jadestone Energy

Jadestone Energy plc is an independent oil and gas company

focused on the Asia-Pacific region. It has a balanced, low risk,

full cycle portfolio of development, production and exploration

assets in Australia, Malaysia, Indonesia, Vietnam and the

Philippines.

The Company has a 100% operated working interest in the Stag

oilfield and in the Montara project, both offshore Australia. Both

the Stag and Montara assets include oil producing fields, with

further development and exploration potential. The Company also has

interests in four oil producing licences offshore Peninsula

Malaysia; two operated and two non-operated positions. Further, the

Company has a 100% operated working interest in two gas development

blocks in Southwest Vietnam, and an operated 100% interest

(assuming completion of the Hexindo stake acquisition, as announced

in November 2021) in the Lemang PSC, onshore Sumatra, Indonesia,

which includes the Akatara gas field.

In addition, the Company has executed a sale and purchase

agreement to acquire a 69% operated working interest in the Maari

Project, shallow water offshore New Zealand, and is working with

the seller to obtain final New Zealand government approvals.

Led by an experienced management team with a track record of

delivery, who were core to the successful growth of Talisman's

business in Asia, the Company is pursuing an acquisition strategy

focused on growth and creating value through identifying,

acquiring, developing and operating assets in the Asia-Pacific

region.

Jadestone Energy plc is listed on the AIM market of the London

Stock Exchange. The Company is headquartered in Singapore. For

further information on the Company please visit

www.jadestone-energy.com .

Cautionary statements

This announcement may contain certain forward-looking statements

with respect to the Company's expectations and plans, strategy,

management's objectives, future performance, production, reserves,

costs, revenues and other trend information. These statements are

made by the Company in good faith based on the information

available at the time of this announcement, but such statements

should be treated with caution due to inherent risks and

uncertainties. These statements and forecasts involve risk and

uncertainty because they relate to events and depend upon

circumstances that may occur in the future. There are a number of

factors which could cause actual results or developments to differ

materially from those expressed or implied by these forward-looking

statements and forecasts. The statements have been made with

reference to forecast price changes, economic conditions and the

current regulatory environment. Nothing in this announcement should

be construed as a profit forecast. Past share performance cannot be

relied upon as a guide to future performance. The Company does not

assume any obligation to publicly update the information, except as

may be required pursuant to applicable laws.

Henning Hoeyland of Jadestone Energy plc, a Subsurface Manager

with a Masters degree in Petroleum Engineering, who is a member of

the Society of Petroleum Engineers and who has been involved in the

energy industry for more than 20 years, has read and approved the

technical disclosure in this regulatory announcement.

The information contained within this announcement is considered

to be inside information prior to its release, as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 which is part

of UK law by virtue of the European Union (Withdrawal) Act

2018.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGZGGZFLMGZZZ

(END) Dow Jones Newswires

February 10, 2022 02:00 ET (07:00 GMT)

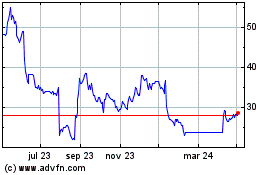

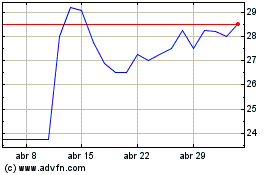

Jadestone Energy (LSE:JSE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Jadestone Energy (LSE:JSE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024