TIDMJSE

RNS Number : 5854U

Jadestone Energy PLC

02 August 2022

Launch of Share Buyback Programme

2 August 2022 - Singapore: Jadestone Energy plc ("Jadestone" or

the "Company"), an independent oil and gas production company

focused on the Asia-Pacific region, is pleased to announce that it

is today launching a share buyback programme (the "Programme") in

accordance with the authority granted by shareholders at the

Company's Annual General Meeting on 30 June 2022.

The Company will enter into a buyback agreement with Stifel

Nicolaus Europe Limited ("Stifel"), who will conduct the Programme

and repurchase Jadestone's ordinary shares of GBP0.001 each

("Ordinary Shares") on Jadestone's behalf. The buyback agreement

will grant Stifel the authority to enact purchases and make trading

decisions concerning the timing of the purchases under the

Programme independently of the Company. Purchases may therefore

continue during any closed periods of the Company.

The maximum pecuniary amount of the Programme is US$25 million

and, in line with the authority granted to the Company at its

Annual General Meeting on 30 June 2022, the Programme will not

exceed 46,574,528 Ordinary Shares. While the Company has launched

the Programme, there is no certainty on the volume of shares that

may be acquired, nor any certainty on the pace and quantum of

acquisitions.

On 6 June 2022, the Company announced its intention to return up

to US$100 million of cash to shareholders over the course of 12

months, predicated on the Company's strong balance sheet and highly

cash generative nature of its asset base. In conjunction with the

Company's ordinary dividend, today's buyback announcement

represents the next phase of this shareholder returns commitment.

The purpose of the Programme is to reduce the share capital of

Jadestone.

The Programme will be conducted within certain pre-set

parameters in accordance with Jadestone's general authority to

repurchase up to 46,574,528 Ordinary Shares, and will be carried

out on the London Stock Exchange. It is intended that the Programme

will be conducted within the parameters prescribed by the Market

Abuse Regulation 596/2014 (as in force in the UK by virtue of the

European Union (Withdrawal) Act 2018 and as amended by the Market

Abuse (Amendment) (EU Exit) Regulations 2019) (the "Regulation"),

the Commission Delegated Regulation (EU) 2016/1052 (as in force in

the UK by virtue of the European Union (Withdrawal) Act 2018 and as

amended by the FCA's Technical Standards (Market Abuse Regulation)

(EU Exit) Instrument 2019) (the "Delegated Regulation"). The

Company will retain the ability to make purchases under the

Programme which exceed the average daily volume limits established

by the Delegated Regulation and therefore the Programme may not

fall within the safe harbour provisions of the Regulation where

appropriate.

Any market repurchase of Ordinary Shares will be announced no

later than 7:30 a.m. on the business day following the calendar day

on which the repurchase occurred. All Ordinary Shares repurchased

will be cancelled.

Paul Blakeley, President and Chief Executive Officer of

Jadestone commented:

"Following on from last week's announced acquisition of an

interest in the North West Shelf oil assets, we are very pleased to

be able to launch this buyback programme now. This delivers on our

commitment, originally announced in early June 2022, to

significantly increase returns to shareholders, as well as clearly

demonstrating that significant M&A activity and enhanced

returns are not mutually exclusive. We believe this is a

differentiating factor in our investment case, and we look forward

to growing our business further, while at the same time ensuring

that shareholders benefit directly from the positive impact of

higher oil prices on our cash flows."

For further information, please contact:

Jadestone Energy plc

Paul Blakeley, President and CEO +65 6324 0359 (Singapore)

Phil Corbett, Investor Relations Manager +44 7713 687467 (UK)

ir@jadestone-energy.com

Stifel Nicolaus Europe Limited (Nomad, +44 (0) 20 7710 7600 (UK)

Joint Broker)

Callum Stewart

Jason Grossman

Ashton Clanfield

Jefferies International Limited (Joint +44 (0) 20 7029 8000 (UK)

Broker)

Tony White

Will Soutar

Camarco (Public Relations Advisor) +44 (0) 203 757 4980 (UK)

Billy Clegg jse@camarco.co.uk

Georgia Edmonds

James Crothers

About Jadestone Energy

Jadestone Energy plc is an independent oil and gas company

focused on the Asia-Pacific region. It has a balanced, low risk,

full cycle portfolio of development, production and exploration

assets in Australia, Malaysia, Indonesia and Vietnam.

The Company has a 100% operated working interest in the Stag

oilfield and in the Montara project, both offshore Australia. Both

the Stag and Montara assets include oil producing fields, with

further development and exploration potential. The Company also has

interests in four oil producing licences offshore Peninsula

Malaysia; two operated and two non-operated positions. Further, the

Company has a 100% operated working interest in two gas development

blocks in Southwest Vietnam, and an operated 100% interest

(assuming completion of the Hexindo stake acquisition, as announced

in November 2021) in the Lemang PSC, onshore Sumatra, Indonesia,

which includes the Akatara gas field.

In addition, the Company has executed a sale and purchase

agreement ("SPA") to acquire a 16.67% working interest in the North

West Shelf Oil Project, offshore Western Australia, which is

expected to complete in the fourth quarter of 2022. The Company has

also signed an SPA to acquire a 69% operated working interest in

the Maari Project, shallow water offshore New Zealand, and is

working with the seller to obtain final New Zealand government

approvals.

Led by an experienced management team with a track record of

delivery, who were core to the successful growth of Talisman's

business in Asia, the Company is pursuing an acquisition strategy

focused on growth and creating value through identifying,

acquiring, developing and operating assets in the Asia-Pacific

region.

Jadestone Energy plc is listed on the AIM market of the London

Stock Exchange. The Company is headquartered in Singapore. For

further information on the Company please visit

www.jadestone-energy.com .

The information contained within this announcement is considered

to be inside information prior to its release, as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 which is part

of UK law by virtue of the European Union (Withdrawal) Act2018.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCSSASMEEESEIA

(END) Dow Jones Newswires

August 02, 2022 03:04 ET (07:04 GMT)

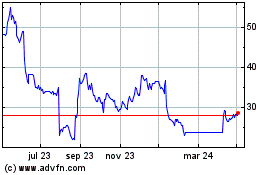

Jadestone Energy (LSE:JSE)

Gráfica de Acción Histórica

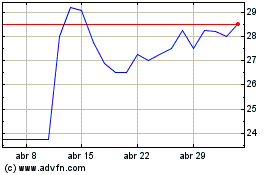

De Mar 2024 a Abr 2024

Jadestone Energy (LSE:JSE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024