TIDMJSE

RNS Number : 8368V

Jadestone Energy PLC

12 August 2022

Montara Operations and Corporate Update

12 August 2022-Singapore: Jadestone Energy plc ("Jadestone", or

the "Company") an independent oil and gas production company

focused on the Asia-Pacific region, provides the following update

on Montara operations as well as a general corporate overview ahead

of its H1 2022 results, which will be released on 20 September

2022.

Montara Operations Update

Further to the announcement in June 2022 reporting a small leak

of oil from a crude oil tank on the Montara Venture FPSO, followed

by an interim repair and subsequent restart of production from

Montara, the Company has been working to complete a permanent

repair to tank 2C. During preparations for this repair, an

additional internal defect in water ballast tank 4S was detected

and this will also be included in the workscope of repairs. There

has also been a focus on the remaining scheduled inspection and

repair activities to the FPSO crude oil tanks and production

facilities which, as previously announced, have been delayed by

limitations on available personnel during the COVID-19

pandemic.

Over the past several weeks, the permanent repair to tank 2C has

been developed, though delayed due to weather, manpower and

logistics issues, further complicated while the facility remains in

production operations. This has resulted in an inability to

simultaneously accommodate the increased number of inspection and

repair crews alongside production operations.

As a result, the Company has taken the decision to temporarily

shut-in production from Montara and reorganise offshore manpower on

the FPSO enabling priority and focus on maintenance and inspection

crews. This is the most practical and efficient way to complete

tank repairs whilst progressing ongoing inspection and remediation

to other tanks in the FPSO and to complete key remaining scheduled

inspection and repair activities planned for this year.

It is currently anticipated that these inspection and repair

activities will result in production being shut-in during the

remainder of August and potentially through September 2022. It is

currently anticipated that prioritising the activity referenced

above will result in incremental costs of US$2-4 million.

Production Guidance and Share Buyback Programme

As a result of the Montara shut-in referred to above, and the

performance of the wider production portfolio year-to-date, the

Company now expects that 2022 production will average between

13,000 and 14,000 boe/d. This compares to the announcement on 20

June 2022, which signalled that 2022 production would likely be

around 15,500 boe/d, being the lower end of the previous guidance

range. The revised 2022 production guidance reflects the Company's

assumption that production from its non-operated assets offshore

Peninsular Malaysia will now remain shut in for the remainder of

2022, due to ongoing delays in reinstating operations.

The Company is confident that by taking this approach at

Montara, the necessary work required to deliver long-term asset

integrity can be safely and efficiently completed. The impact is

short-term and there is no reduction in reserves. As a result, and

given its strong balance sheet, the Company intends to continue the

share buy-back programme announced on 2 August 2022.

H1 2022 trading Update

The Company provides the following operational and financial

metrics ahead of its first-half 2022 results, which are scheduled

for release on 20 September 2022. This information has not been

audited and may be subject to further review.

-- H1 2022 production of 15,008 boe/d, with a preliminary breakdown as follows

! Australia: 9,565 bbls/d

! Peninsular Malaysia: 5,443 boe/d

-- Liftings: 2.0 mmbbl of oil and 0.9 bcf of gas

-- Realised prices:

! Oil: US$109.52/bbl

! Gas: US$2.17/mscf

-- Total H1 2022 revenues: US$225.6 million

-- End H1 2022 cash balance: US$161.1 million

Paul Blakeley, President and CEO commented:

"Safety to personnel and facility integrity are key foundational

principles at the heart of our operating philosophy, and after

experiencing ongoing delays to the permanent repair on tank 2C, and

to the wider inspection and repair programme on the Montara Venture

FPSO, we believe we had to approach this work scope in a different

way.

A temporary shut-in of Montara production, in order to replace

production crews with maintenance and inspection teams, is the most

practical solution which will allow us to apply the necessary

additional manpower to accelerate key maintenance and repair

activities and restore facility integrity. There can be no short

cuts, and while we have made very significant progress in restoring

the FPSO to the standard which we expect, the limited FPSO

accommodation, as well as other factors such as COVID-19, have been

impeding our progress. Our decision will reverse this trend. This

represents production deferred, rather than barrels lost, and we

are working hard to restore Montara production as soon as

possible."

For further information, please contact:

Jadestone Energy plc

Paul Blakeley, President and CEO +65 6324 0359 (Singapore)

Phil Corbett, Investor Relations Manager +44 7713 687467 (UK)

ir@jadestone-energy.com

Stifel Nicolaus Europe Limited (Nomad, +44 (0) 20 7710 7600 (UK)

Joint Broker)

Callum Stewart

Jason Grossman

Ashton Clanfield

Jefferies International Limited (Joint +44 (0) 20 7029 8000 (UK)

Broker)

Tony White

Will Soutar

Camarco (Public Relations Advisor) +44 (0) 203 757 4980 (UK)

Billy Clegg jse@camarco.co.uk

Georgia Edmonds

James Crothers

About Jadestone Energy

Jadestone Energy plc is an independent oil and gas company

focused on the Asia-Pacific region. It has a balanced, low risk,

full cycle portfolio of development, production and exploration

assets in Australia, Malaysia, Indonesia and Vietnam.

The Company has a 100% operated working interest in the Stag

oilfield and in the Montara project, both offshore Australia. Both

the Stag and Montara assets include oil producing fields, with

further development and exploration potential. The Company also has

interests in four oil producing licences offshore Peninsular

Malaysia; two operated and two non-operated positions. Further, the

Company has a 100% operated working interest in two gas development

blocks in Southwest Vietnam, and an operated 100% interest

(assuming completion of the Hexindo stake acquisition, as announced

in November 2021) in the Lemang PSC, onshore Sumatra, Indonesia,

which includes the Akatara gas field development.

In addition, the Company has executed a sale and purchase

agreement ("SPA") to acquire a 16.67% working interest in the North

West Shelf Oil Project, offshore Western Australia, which is

expected to complete in the fourth quarter of 2022. The Company has

also signed an SPA to acquire a 69% operated working interest in

the Maari Project, shallow water offshore New Zealand, and is

working with the seller to obtain final New Zealand government

approvals.

Led by an experienced management team with a track record of

delivery, who were core to the successful growth of Talisman's

business in Asia, the Company is pursuing an acquisition strategy

focused on growth and creating value through identifying,

acquiring, developing and operating assets in the Asia-Pacific

region.

Jadestone Energy plc is listed on the AIM market of the London

Stock Exchange. The Company is headquartered in Singapore. For

further information on the Company please visit

www.jadestone-energy.com .

Cautionary Statements

This announcement may contain certain forward-looking statements

with respect to the Company's expectations and plans, strategy,

management's objectives, future performance, production, reserves,

costs, revenues and other trend information. These statements are

made by the Company in good faith based on the information

available at the time of this announcement, but such statements

should be treated with caution due to inherent risks and

uncertainties. These statements and forecasts involve risk and

uncertainty because they relate to events and depend upon

circumstances that may occur in the future. There are a number of

factors which could cause actual results or developments to differ

materially from those expressed or implied by these forward-looking

statements and forecasts. The statements have been made with

reference to forecast price changes, economic conditions and the

current regulatory environment. Nothing in this announcement should

be construed as a profit forecast. Past share performance cannot be

relied upon as a guide to future performance. The Company does not

assume any obligation to publicly update the information, except as

may be required pursuant to applicable laws.

The information contained within this announcement is considered

to be inside information prior to its release, as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 which is part

of UK law by virtue of the European Union (Withdrawal) Act

2018.

Glossary

bbl barrel of oil

bbls/d barrels per day

--------------------------------------------------

bcf billion cubic feet of gas

--------------------------------------------------

boe barrel of oil equivalent

--------------------------------------------------

boe/d barrels of oil equivalent per day

--------------------------------------------------

FPSO floating production storage and offloading vessel

--------------------------------------------------

mmbbl million barrels of oil

--------------------------------------------------

mscf millon standard cubic feet of gas

--------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEASPAFSPAEEA

(END) Dow Jones Newswires

August 12, 2022 02:00 ET (06:00 GMT)

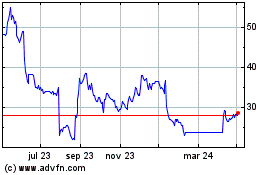

Jadestone Energy (LSE:JSE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

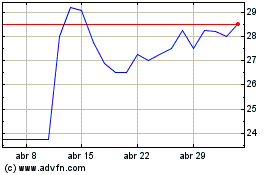

Jadestone Energy (LSE:JSE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024