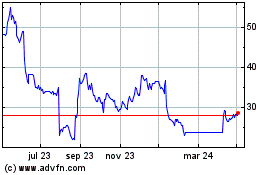

TIDMJSE

RNS Number : 9499Z

Jadestone Energy PLC

20 September 2022

Jadestone Energy

2022 Half Year Results and Interim Dividend Declaration

20 September 2022-Singapore: Jadestone Energy plc (AIM:JSE)

("Jadestone" or the "Company"), an independent oil and gas

production company and its subsidiaries (the "Group"), focused on

the Asia Pacific region, reports today its unaudited condensed

consolidated interim financial statements, as at and for the

six-month period ended 30 June 2022 (the "financial

statements").

Management will host a conference call today at 9:00 a.m. UK

time, details of which can be found in the release below.

Paul Blakeley, President and CEO commented:

"Jadestone delivered record financial results in the first half

of 2022, with production increasing by c.50% compared to the first

half of 2021, driven by a full period contribution from the

Malaysian assets acquired in August 2021 and the impact of the

Montara drilling programme in the second half of 2021, albeit

offset by an unplanned shutdown at Montara early in 2022 due to a

compressor engine failure. Revenues and adjusted EBITDAX increased

by 63% and 113% respectively, due to the increase in production

volumes and higher realised oil prices. As a result, we ended the

period with a net cash balance of US$161.6 million, an increase of

almost 40% compared to year-end 2021. Jadestone remains debt

free.

Despite all this, recent operational performance at Montara has

been disappointing, especially given the substantial upgrade and

repair work done to date. As previously announced, the field is

currently shut-in as we progress a remediation plan for the Montara

Venture FPSO following defects identified earlier this year. The

plan involves emptying, cleaning, inspecting and, where necessary,

resolving any defects in the tanks and hull of the FPSO. In

particular, we are moving ahead with the permanent repair of 2C

crude oil cargo tank and 4S ballast tank whilst prioritising entry

and activity in other tanks in preparation for operational

readiness. As we focus on safety and integrity, this activity will

continue until we can ensure a safe and reliable restart of the

FPSO. In parallel, we are making good progress in the appointment

of, and work scope for, the independent reviewer, who will work

with us to provide final assurance to Jadestone and the regulator

on our remediation plans and operational readiness prior to the

restart of production operations. While we understand that the lack

of a firm restart date is frustrating for many of our stakeholders,

our focus is on the remediation plan and its successful execution

which, in turn, will restore confidence in the significant

remaining value we see at Montara.

We have also initiated a fundamental review of our hull and tank

inspection and repair regime, which will include our maintenance

approach, operating systems and organisational structure. As a

near-term action to assist management, Jadestone's Board of

Directors has established a special subcommittee, which will work

closely with Company's executive and senior operations leadership,

providing both additional support and challenge, while the Montara

FPSO hull and tank remediation work is in progress. This will

include weekly progress updates and reports.

The balance sheet strength we have built in recent years, and

the confidence in our existing asset portfolio and its planned

growth, means we are well-positioned to weather the Montara shut-in

without any anticipated impact on our investment programmes,

inorganic growth, or near-term shareholder returns. We expect

capital expenditures for the year to be in line with guidance of

US$90.0 - 105.0 million. We have also taken the decision to

increase the interim dividend by 10% to US$3.0 million and, subject

to market conditions, we intend to complete the US$25.0 million

share buyback programme launched in August and which has so far

returned an incremental US$4.9 million to shareholders. The next

phase of the shareholder returns strategy announced in June will be

determined by the timing of production restart at Montara, our

portfolio's operational performance, realised oil prices, and the

timing and scale of incremental inorganic growth opportunities.

The Company continues to deliver on its growth strategy. In

June, we took a final investment decision on the Akatara gas

development on the Lemang PSC in Indonesia, with activity at the

site now well underway. Separately, the acquisition of the

outstanding 10% stake in the Lemang PSC is expected to complete

soon. In July, we announced the acquisition of a non-operated

interest in the producing Northwest Shelf ("NWS") oil project

offshore Australia, and are making good progress towards closing

this transaction in Q4 2022.

Our strong balance sheet underlines the success of our business

model, supporting our planned investments for growth, and while the

recent Montara asset incident is unfortunate, we are determined to

fix it and deliver the original value proposition vindicating our

strategy in the Asia Pacific region."

Paul Blakeley

EXECUTIVE DIRECTOR,

PRESIDENT AND CHIEF EXECUTIVE OFFICER

2022 FIRST HALF RESULTS SUMMARY

USD'000 except where indicated H1 2022 H1 2021 FY 2021

-------------------------------------- -------- -------- ---------

Production, boe/day 15,008 9,934 12,545

Realised oil price per barrel of

oil equivalent (US$/boe)(1) 109.52 67.70 74.34

Realised gas price per million

standard cubic feet

(US$/mmscf) 2.03 - 1.61

Revenue 225,639 138,158 340,194

Operating costs per barrel of oil

equivalent (US$/boe)(2) 25.71 28.16 26.22

Adjusted EBITDAX(2) 138,608 65,179 157,948

Profit/(Loss) after tax 49,486 2,495 (13,742)

Earnings/(Loss) per ordinary share:

basic (US$) 0.11 0.01 (0.03)

Earnings/(Loss) per ordinary share:

diluted (US$) 0.10 0.01 (0.03)

Dividend per ordinary share (US

)(3) 0.65 0.59 1.93

Operating cash flows before movement

in working capital 126,481 54,376 96,622

Capital expenditure 13,621 16,221 55,996

Net cash(2) 161,628 48,291 117,865

Operational and financial summary

l Production increased 51% during H1 2022 to 15,008 bbls/d (H1

2021: 9,934 bbl/d). Production benefitted from a full period of the

PenMal Assets acquired in August 2021 and the Montara activity

programme in H2 2021, offset by unscheduled downtime at Montara

early in 2022, a planned maintenance shutdown at Stag in May, and

the shut-in of the non-operated PenMal Assets in February 2022 due

to FPSO class suspension;

l Average realised oil price(1) in H1 2022 was US$109.52/bbl,

62% higher than H1 2021. The realised price includes a weighted

average premium across the assets of US$6.99/bbl (H1 2021:

US$3.12/bbl);

l Revenue of US$225.6 million in H1 2022, up 63% from H1 2021 at

US$138.2 million, due to higher production and higher average

realised prices;

l Closing crude stocks as at 30 June 2022 totalled 417,216 bbls,

which were subsequently sold in the second half of 2022, generating

provisional receipts of US$45.3 million, from a provisional

weighted average realised price of US$108.97/bbl;

l As at 30 June 2022, there was an underlift production

entitlement carried forward of 130,359 bbls at the PenMal Assets,

resulting in a receivable of US$16.8 million, calculated based on

the average June 2022 Dated Brent price plus latest realised

premium;

l Unit operating costs(4) of US$25.71/boe, down 9% from

US$28.16/bbl in H1 2021 due to inclusion of the PenMal Assets,

which have a lower opex/boe compared to the Australian producing

assets;

l Adjusted EBITDAX improved 113% to US$138.6 million compared to

US$65.2 million in H1 2021, predominately due to increased

production, higher oil prices and lower one-off project

expenditures in Other Expenses;

l Net profit after tax in H1 2022 of US$49.5 million compared to

US$2.5 million in H1 2021;

l Operating cash flows before movements in working capital in H1

2022 of US$126.5 million, up 133% compared to H1 2021 ;

l Capital expenditure in H1 2022 of US$13.6 million, down 16%

compared to H1 2021 due to the phasing of expenditure in H2

2022;

l Cash balances of US$161.6 million as at 30 June 2022 (H1 2021:

US$48.3 million), with no debt outstanding; and

l Recommended interim dividend for FY2022 of USc0.65/share(3)

(H1 2021: USc0.59/share), equivalent to a total distribution of

US$3.0 million (H1 2021: US$2.8 million). On 2 August 2022, the

Company announced the launch of a share buyback programme with a

maximum amount of US$25.0 million. As at 16 September 2022, 4.7

million of shares had been acquired at an accumulated cost of

US$4.9 million.

Business development

l On 16 November 2019, the Group executed a sale and purchase

agreement with OMV New Zealand Limited ("OMV"), to acquire an

operated 69% interest in the Maari project, subject to customary

conditions, including government approvals. Following legislative

changes to New Zealand's upstream regulatory framework at the end

of 2021, Jadestone has continually engaged with OMV and the New

Zealand Government to seek clarity on the processes, terms and

associated timeline required to complete the Maari transaction.

Despite these efforts, it remains unclear under what circumstances

and in what timeframe completion of the transaction and transfer of

operatorship can occur;

l On 6 June 2022, the Group announced that a final investment

decision had been taken on the Akatara gas field development

onshore Indonesia, following the receipt of necessary consent from

the Indonesian upstream regulator. The project is now in the

development phase with first gas anticipated in the first half of

2024;

l On 24 November 2021, the Group executed a settlement and

transfer agreement with PT Hexindo Gemilang Jaya to acquire the

remaining 10% interest in the Lemang PSC for US$0.5 million and a

waiver of unpaid amounts related to the PSC. Indonesian government

approval is anticipated in Q4 2022; and

l On 28 July 2022, the Group announced the execution of a sale

and purchase agreement with BP Developments Australia Pty Ltd

("BP") to acquire BP's non-operated 16.67% working interest in the

Cossack, Wanaea, Lambert and Hermes oil fields development offshore

Western Australia, for a total initial headline cash consideration

of US$20.0 million, and certain subsequent contingent and

decommissioning security payments.

Significant events

l On 7 February 2022, the Bunga Kertas FPSO, deployed at the

non-operated PenMal Assets, had its class suspended, resulting in

the non-operated PenMal Assets being shut-in and production

suspended. Production is expected to remain shut-in for the

remainder of 2022. The estimated adjustment to the production

guidance provided in August 2022 to arrive at the current

production guidance for full year 2022 is a reduction of c.720

boe/d;

l As previously announced, on 17 June 2022, between three to

five cubic metres of crude oil was released to sea during a routine

oil transfer between tanks on the Montara Venture FPSO. The

facility was immediately shut-in as a precaution and the relevant

authorities notified. Following a temporary repair and isolation of

the 2C cargo tank where the leak originated, production was

restarted on 4 July 2022 while a permanent repair was being

developed;

l On 12 August 2022, an additional defect was identified in a

ballast water tank on the Montara Venture FPSO during preparation

work for a permanent repair to the 2C cargo tank. The Group took

the decision to temporarily shut-in production at Montara to

prioritise the permanent repairs, removing a number of production

operations personnel in order to provide accommodation for

additional inspection and repair crews due to an inability to

simultaneously accommodate both; and

l On 15 September 2022, Jadestone's Board of Directors

established a temporary special sub-committee to assist management

during the ongoing Montara FPSO hull and tank workstreams. It will

receive weekly progress reports on the Montara FPSO remediation

activities, and interact directly with the Group's senior

operations leadership to review actions and progress towards the

remediation plan's objectives, including the restart of

production.

2022 Guidance

l Production: 11,000 - 13,000 boe/d (as announced on 12

September 2022, the production forecast was decreased due to the

shut-in of production from the Montara fields);

l Unit opex: US$ 31.00 - 37.00/boe (increased from previous

guidance at US$23.00 - US$28.00 primarily due to incorporating the

lower production forecast above) ; and

l Capex: US$90.0 - 105.0 million (unchanged).

(1) Realised oil price represents the actual selling price

inclusive of premiums.

(2) Operating costs per boe, adjusted EBITDAX and net cash are

non-IFRS measures and are explained in further detail below.

(3) Dividend per ordinary share calculated based on outstanding

number of shares at period/year end. The actual dividend per share

will reflect any changes in the shares outstanding between the

period/year end and the associated record date including the shares

buyback.

(4) Unit operating costs per boe before workovers and movement

in inventories but including net lease payments and certain other

adjustments (see non-IFRS measures below).

Enquiries

Jadestone Energy plc.

Paul Blakeley, President and CEO +65 6324 0359 (Singapore)

Bert-Jaap Dijkstra, CFO

Phil Corbett, Investor Relations Manager + 44 7713 687 467 (UK)

ir@jadestone-energy.com

Stifel Nicolaus Europe Limited (Nomad, +44 (0) 20 7710 7600

Joint Broker) (UK)

Callum Stewart / Jason Grossman / Ashton

Clanfield

Jefferies International Limited (Joint +44 (0) 20 7029 8000

Broker) (UK)

Tony White / Will Soutar

Camarco (Public Relations Advisor) +44 (0) 203 757 4980

(UK)

Billy Clegg / Georgia Edmonds / James jadestone@camarco.co.uk

Crothers

Conference call and webcast

The management team will host an investor and analyst conference

call at 9:00 a.m. (London)/4:00 p.m. (Singapore) today, Tuesday, 20

September 2022, including a question-and-answer session.

The live webcast of the presentation will be available at the

below webcast link. Dial-in details are provided below. Please

register approximately 15 minutes prior to the start of the

call.

The results for the financial period ended 30 June 2022 will be

available on the Company's website at:

www.jadestone-energy.com/investor-relations/

Webcast link: https://app.webinar.net/VXGleQG4RWA

Event title: Jadestone Energy plc first-half 2022 results

Time: 9:00 a.m. (UK time) / 4:00 p.m. (Singapore time)

Date: Tuesday, 20 September 2022

Conference ID: 65496332

Dial-in number details:

Country Dial-In Numbers

United Kingdom 08006522435

---------------

Australia 1800076068

---------------

Canada (Toll free) 888-390-0546

---------------

France 0800916834

---------------

Germany 08007240293

---------------

Hong Kong 800962712

---------------

Indonesia 0078030208221

---------------

Japan 006633812569

---------------

Malaysia 1800817426

---------------

Netherlands 08000227908

---------------

New Zealand 0800453421

---------------

Singapore 8001013217

---------------

Spain 900834776

---------------

Sweden 0200899189

---------------

Switzerland 0800312635

---------------

United States (Toll free) 888-390-0546

---------------

DIVID DECLARATION AND PROGRESS SHARE BUYBACK PROGRAMME

On 20 September 2022, the Directors declared a 2022 interim

dividend of 0.65 US cents /share, equivalent to a total

distribution of US$ 3.0 million. The timetable for the dividend

payment is as follows:

l Ex-dividend date: 29 September 2022

l Record date: 30 September 2022

l Payment date: 14 October 2022

The Group's growth-orientated strategy remains unchanged, with

the objective of establishing a leading Asia-Pacific upstream

company through acquiring and maximising the value of producing

fields and development assets. The Group prioritises organic

reinvestment, and maintains a conservative capital structure in

order to capitalise on inorganic growth opportunities as they

arise. Notwithstanding this, the Group believes that its production

and development led business model is fundamentally pre-disposed to

provide meaningful shareholder returns, particularly during times

of higher oil prices. The Company targets a sustainable base

dividend, with a targeted split one-third to an interim dividend

and two-thirds to a final dividend, growing over time in line with

underlying cash flow generation. The base dividend may be augmented

over time by additional shareholder returns (in the form of share

buybacks, special dividends and/or tender offers) if deemed

appropriate by the Company.

The Company does not offer a dividend reinvestment plan and does

not offer dividends in the form of ordinary shares.

On 2 August 2022, the Company announced the launch of a share

buyback programme (the "Programme") in accordance with the

authority granted by the shareholders at the Company's annual

general meeting on 30 June 2022. The maximum amount of the

Programme is US$25.0 million, and the Programme will not exceed

46,574,528 ordinary shares. There is no certainty on the volume of

shares that may be acquired, nor any certainty on the pace and

quantum of acquisitions.

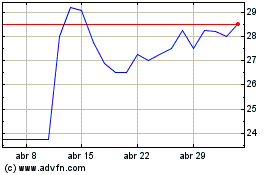

As at 16 September 2022, the Company had acquired 4.7 million

shares at a weighted average cost of GBP 0. 89 per share, resulting

in an accumulated total of US$4.9 million.

ENVIRONMENT, SOCIAL AND GOVERNANCE ("ESG")

As a responsible upstream operator, Jadestone contributes to an

orderly energy transition by helping to meet regional Asia-Pacific

energy demand whilst minimising the environmental footprint of its

operations. In doing so, Jadestone aims to bring positive social

and economic benefits for its stakeholders, local communities and

people associated with its operations.

Jadestone published its third Sustainability Report in June

2022, which covered the Group's ESG performance in 2021, as well as

commitments to further improvements in 2022 across key focus areas.

This section provides an overview of period-to-date performance of

the Group, representing the Stag and Montara fields, the PenMal

operated assets and, where relevant, the Akatara gas

development.

Net Zero and GHG emissions

The Group committed in June 2022 to achieve Net Zero Scope 1 and

2 GHG emissions from its operated assets by no later than 2040. The

detail of this commitment as well as Jadestone's strategy through

the energy transition can be viewed on Jadestone's website(1) .

A key element of the Net Zero commitment is the development of

an emissions reduction roadmap for Jadestone's operated assets,

which will inform the interim GHG reduction targets for the Group.

Jadestone has engaged a reputable international consultant to

support its Net Zero workstreams, which will be progressed

throughout H2 2022 and into 2023. The Group is on track to publish

its Net Zero roadmap in 2023 and is committed to being transparent

in the implementation of the roadmap on at least an annual

basis.

Illustrative of its efforts to minimise GHG emissions, a solar

photovoltaic installation was piloted at the Akatara gas field

development in Indonesia in April 2022, replacing diesel generators

at four well pads. Solar power now fully meets well pad lighting

and electricity needs, with potentially broader application within

the Akatara development, such as use in the accommodation camp. In

collaboration with other operators in the area, Jadestone is

participating in the planting of over 27,000 mangrove trees to

positively impact the health and wellness of local communities and

environment.

HSE performance

The Group's priority remains the health and safety of its staff

and contractors, along with ensuring that any negative

environmental impacts from operations are minimised.

At the operated PenMal Assets, there have been no recordable

incidents since Jadestone assumed operatorship in August 2021.

Similarly, since construction started at the Akatara gas

development in Indonesia earlier this year, no recordable incidents

have occurred. In Australia, there were three recordable incidents

with one at Stag classified as a Lost Time Injury ("LTI"). The crew

member concerned suffered a minor injury, recovered quickly and is

back to work. The LTI was managed in accordance with Jadestone's

Injury & Illness Management Procedure, with a detailed

investigation completed and ensuing actions and engineering

modifications fully implemented.

(1)

https://www.jadestone-energy.com/jadestone-announces-2040-net-zero-target/

As referenced previously, in June 2022, between three to five

cubic metres of crude oil was released to sea during a routine oil

transfer between tanks on the Montara Venture FPSO. Production

operations resumed on 4 July 2022 but were then shut-in again in

August 2022 after an additional internal defect was identified in a

ballast water tank on the FPSO. The Group took the decision to

temporarily shut-in production at Montara to prioritise permanent

repairs, removing a number of production operations personnel in

order to provide accommodation for additional inspection and repair

crews due to an inability to simultaneously accommodate both.

Governance

On 7 April 2022, the Group announced the immediate appointment

of Jenifer Thien as an independent non-executive director. Jenifer

brings knowledge and experience in environmental, social and

governance ("ESG") strategy. Jenifer joined the Remuneration,

Governance and Nomination, and Health, Safety, Environment and

Climate (HSEC) committees.

On 29 April 2022, Daniel Young stepped down from his role as the

Chief Financial Officer ("CFO") and Executive Director and left the

Group. Michael Horn took the role of interim CFO until 22 August

2022, when Bert-Jaap Dijkstra was appointed by the Board as CFO and

Executive Director.

Jadestone's Board of Directors (the "Board") supports

management's decision to shut-in operations at Montara to focus on

the inspection, maintenance and repair activities associated with

the Montara FPSO hull and tanks , recognising the elevated

requirements to restart operations as outlined within the General

Direction issued by NOPSEMA on 12 September 2022. The Board has

every confidence in the Group's abilities to execute the

remediation plan efficiently and effectively and to the

satisfaction of the regulatory authorities.

D uring this period, a technical subcommittee of the Board will

work more closely with senior management, providing both support

and challenge, while the Montara FPSO hull and tank remediation

plan is in progress. This will include weekly progress updates and

reports.

OPERATIONAL REVIEW

Producing assets

Australia

Montara project

The Montara project, in production licences AC/L7 and AC/L8, is

located 254 km offshore Western Australia, in a water depth of

approximately 77 metres. The Montara project comprises three

separate fields being Montara, Skua and Swift/Swallow, which are

produced through an owned FPSO, the Montara Venture.

As at 31 December 2021, the Montara assets had proven plus

probable reserves of 20.9mm barrels of oil, 100% net to

Jadestone.

The fields produce light sweet crude ( 42(o) API, 0.067% mass

sulphur), which typically sells for average Dated Brent plus the

average Tapis differential of the prior two months before the

lifting date. This premium ranged from US$3.53/bbl to US$6.19/bbl

during H1 2022.

Montara production averaged 7,509 bbls/d in H1 2022 (H1 2021:

7,269 bbls/d). The higher production was a result of the drilling

of H6 and the subsea workovers of Skua 10 and 11 in the second half

of 2021. The additional production was partially offset by an

unplanned gas turbine replacement and a temporary loss of subsea

communication impacting uptime from the Swallow-11 well during H1

2022.

As previously announced, on 17 June 2022, between three to five

cubic metres of crude oil was released to sea during a routine oil

transfer between tanks on the Montara Venture FPSO. The facility

was immediately shut-in as a precaution and the relevant

authorities notified. Following a temporary repair and isolation of

the 2C cargo tank where the leak originated, production was

restarted on 4 July 2022 while a permanent repair was being

developed.

On 12 August 2022, an additional internal defect was identified

in a ballast water tank on the Montara Venture FPSO during

preparation work for a permanent repair to the 2C cargo tank. The

Group took the decision to temporarily shut-in production at

Montara to prioritise permanent repairs, removing a number of

production operations personnel in order to provide accommodation

for additional inspection and repair crews due to an inability to

simultaneously accommodate both.

There were three liftings during H1 2022, resulting in total

sales of 1.3 mmbbls, compared to 1.5 mmbbls during H1 2021 from the

same number of liftings.

Stag oilfield

The Stag oilfield, in production licence WA-15-L, is located 60

km offshore Western Australia in a water depth of approximately 47

metres.

As at 31 December 2021, the field contained total proved plus

probable reserves of 12.6mm barrels of oil, 100% net to

Jadestone.

The Stag oilfield produces heavier sweet crude ( 18(o) API,

0.14% mass sulphur), which historically sells at a premium to Dated

Brent. The premium of the H1 2022 lifting was US$23.72/bbl compared

to a weighted average of US$11.09/bbl in H1 2021, reflecting the

increase in refinery demand for heavy oil with low sulphur

content.

Production during H1 2022 was 2,057 bbls/d, compared to 2,665

bbls/d during H1 2021, due to a scheduled maintenance shutdown in

May 2022. The shutdown was to perform pressure vessel inspections

and occurs once in every three years.

Due to the lifting schedules, there was one lifting in H1 2022

for 0.3 mmbls compared to two in H1 2021 for 0.5mmbls.

Malaysia

Operated: PM 323 and PM 329 PSCs & Non-operated: PM 318 and

AAKBNLP PSCs

The PenMal Assets consist of four licences, two of which are

operated by the Group. The two operated licences comprise a 70%

interest in the PM329 PSC, containing the East Piatu field, and a

60% interest in the PM323 PSC, which contains the East Belumut,

West Belumut and Chermingat fields. Both PSCs are located

approximately 230km northeast of Terengganu in shallow water.

The two non-operated ("OBO") licences consist of 50% working

interests in each of the PM318 PSC and in the Abu, Abu Kecil, Bubu,

North Lukut, and Penara oilfields (the "AAKBNLP") PSC. The two

non-operated PSCs are located in the same region as PM329 and

PM323.

As at 31 December 2021, the PenMal Assets contained total proved

plus probable reserves of 11.2mmboe, net to Jadestone.

The PenMal Assets produce light sweet crude that is blended to

Tapis grade (43 (o) API, 0.04% mass sulphur). This premium ranged

between US$0.96/bbl to US$6.76/bbl in H1 2022.

During H1 2022, the average production from the PenMal Assets

was 4,578 bbls/d of oil and 5,191 mscf/d of gas, creating a

combined production of 5,443 boe/d , net to Jadestone's working

interest. There was no comparable production in H1 2021 as the

acquisition of the PenMal Assets was completed in August 2021.

On 7 February 2022, the Bunga Kertas FPSO, deployed at the

non-operated assets, had its class suspended, resulting in the

fields having to shut-in and cease production. Since the class

suspension, there has been no production and it is expected that

production will remain shut-in for the remainder of 2022.

Currently, following a subsequent safety incident, the operator has

paused its FPSO repair plan and is assessing the full range of

alternatives, which include a comprehensive programme of repairs,

an asset divestment or, given that the OBO licenses expire in 2024,

a move towards decommissioning the asset 12 months earlier than

originally planned.

There were seven oil liftings during H1 2022, for total sales of

0.5 mmbbls in addition to the sale of 939.7 mmscf of gas.

Pre-production assets

Indonesia

Lemang PSC

The Lemang PSC (Jadestone 90% working interest) is located

onshore Sumatra, Indonesia. The PSC contains the Akatara field,

which has been substantially de-risked with 11 wells drilled into

the structure, plus three years of oil production history, up until

the field ceased oil production in December 2019. Jadestone is

redeveloping Akatara to supply gas, condensate and LPGs for local

and regional use.

The Akatara gas field has been independently estimated to

contain a 2C gross resource (pre local government back-in rights)

of 63.7 bcf of sales gas, 2.5 mmbbls of condensate and 5.6 mmboe of

LPG, equating to a combined 18.7 mmboe of resource, or 16.8 mmboe

net to Jadestone's existing 90% working interest.

On 30 June 2021, the Minister of Mines and Energy of Indonesia

issued a Ministerial decree that facilitates the development and

commercialisation of the Akatara gas field, allocating gas sales

from the gas field in the Lemang PSC to a subsidiary of PT

Perusahaan Listrik Negara, the national electricity utility, and

the associated production and sales of LPG to the local domestic

market in Jambi province, together with condensate sales to a local

buyer. On 1 December 2021, a gas sale agreement was signed between

Jadestone and PT Pelayanan Listrik Nasional Batam, as buyer.

On 24 November 2021, the Group announced the acquisition of the

remaining 10% interest in the PSC from PT Hexindo Gemilang Jaya

("Hexindo"), subject to customary approvals. The transaction was

approved by the shareholders of Hexindo's ultimate parent company,

Eneco Energy Limited, on 20 June 2022 and the government approval,

representing the last required approval for closing, is anticipated

in Q4 2022.

On 6 June 2022, the Group announced that a final investment

decision had been taken on the Akatara field development following

the necessary approvals by the Indonesian upstream regulator. The

Group awarded the engineering, procurement, construction and

installation contract on 3 June 2022 and development activities

have commenced. Jadestone is pursuing a low-cost development for

the field including efficient use of existing wells and

infrastructure thereby minimising the incremental impact on the

local environment. The Akatara gas project remains on track for

first gas in the first half of 2024.

Vietnam

Block 51 and Block 46/07 PSCs

Jadestone holds a 100% operated working interest in the Block

46/07 and Block 51 PSCs, both in shallow water in the Malay Basin,

offshore southwest Vietnam.

The two contiguous blocks hold three discoveries: the Nam Du gas

field in Block 46/07 and the U Minh and Tho Chu gas/condensate

fields in Block 51, with aggregate 2C resources of 93.9 mmboe.

The Tho Chu discovery in Block 51 is currently under a suspended

development area status, with the exploration period expiring in

June 2023.

Jadestone has, in recent months, been negotiating with the

end-user of gas from its offshore discoveries. These discussions

are still at an early stage, but support the prospect of meaningful

progress towards commercialising the significant and strategic

resource in Jadestone's licences. Development of this resource

would lessen Vietnam's future dependence on expensive imports of

natural gas and contribute towards the country's stated goal of net

zero greenhouse gas emission by 2050.

Pending acquisition

Australia

North West Shelf Project

On 28 July 2022, the Group executed a sale and purchase

agreement with BP Developments Australia Pty Ltd to acquire BP's

non-operated 16.67% working interest in the Cossack, Wanaea,

Lambert and Hermes oil field development (the "North West Shelf

Project"), offshore Australia for a total initial headline cash

consideration of US$20.0 million, and certain subsequent contingent

and decommissioning payments.

The economic effective date of the acquisition is 1 January

2020, meaning that the Group will receive all economic benefits

since that date. The Group estimates that the final closing

adjustment will be higher than the initial cash consideration of

US$20.0 million, in effect representing a net cash income to

Jadestone. Upon closing, the Group will pay US$41 million in cash,

representing the first of three instalments to be made relating to

the decommissioning trust fund payment.

The two final instalments of the decommissioning trust fund

payment will be completed through two equal cash contributions of

US$20.5 million which are payable around or before 31 December 2022

and 2023, respectively.

The completion of the acquisition is subject to customary

closing conditions, including various regulatory approvals. The

Group anticipates completion of the transaction in Q4 2022.

New Zealand

Maari project

On 16 November 2019, the Group executed a sale and purchase

agreement with OMV New Zealand Limited ("OMV"), to acquire an

operated 69% interest in the Maari project, located 120 km offshore

New Zealand, subject to customary closing adjustments. The

transaction has achieved several key milestones with regard to

regulatory approvals.

Following legislative changes to New Zealand's upstream

regulatory framework at the end of 2021, Jadestone has continually

engaged with OMV and the New Zealand Government to seek clarity on

the processes, terms and associated timeline required to complete

the Maari transaction. Despite these efforts, it remains unclear

under what circumstances and in what timeframe completion of the

transaction and transfer of operatorship can occur.

FINANCIAL REVIEW

The following table provides selected financial information of

the Group, which was derived from, and should be read in

conjunction with, the unaudited condensed consolidated interim

financial statements for the period ended 30 June 2022.

Twelve

Six months Six months months

ended ended ended

30 June 30 June 31 December

USD'000 except where indicated 2022 2021 2021

----------------------------------------- ----------- ----------- -------------

Sales volume, barrels of oil equivalent

(boe) 2,199,583 2,040,792 4,664,297

Production, boe/d 15,008 9,934 12,545

Realised oil price per barrel of

oil equivalent, US$/boe(1) 109.52 67.70 74.34

Realised gas price per million

standard cubic feet,

US$/mmscf 2.03 - 1.61

Revenue 225,639 138,158 340,194

Production costs (83,401) (62,492) (206,523)

Operating costs per barrel of oil

equivalent (US$/boe)(2) 25.71 28.16 26.22

Adjusted EBITDAX(2) 138,608 65,179 157,948

Unit depletion, depreciation &

amortisation (US$/boe) 12.06 15.70 13.67

Profit before tax 87,253 11,148 1,080

Profit /(Loss) after tax 49,486 2,495 (13,742)

Earnings/(Loss) per ordinary share:

basic (US$) 0.11 0.01 (0.03)

Earnings/(Loss) per ordinary share:

diluted (US$) 0.10 0.01 (0.03)

Dividend per ordinary share (US

)(3) 0.65 0.59 1.93

Operating cash flows before movement

in working capital 126,481 54,376 96,622

Capital expenditure 13,621 16,221 55,996

Net cash(2) 161,628 48,291 117,865

Benchmark commodity price and realised price

The actual average realised oil price in H1 2022 increased by

62% to US$109.52/bbl, compared to US$67.70/bbl during H1 2021.

The average benchmark oil price incorporated into the Group's

liftings was US$102.53/bbl during H1 2022, an increase of 59%

compared to H1 2021 at US$64.58/bbl.

The average premium for the period was US$6.99/bbl, compared to

H1 2021 of US$3.12/bbl. The increase reflected the demand for Stag

crude which obtained a premium of US$23.72/bbl (H1 2021:

US$11.09/bbl) and increases in Tapis linked crude with Montara and

the PenMal Assets at US$4.52/bbl (H1 2021: US$1.14/bbl) and

US$3.86/bbl (H1 2021: nil), respectively.

(1) Realised oil price represents the actual selling price

inclusive of premiums.

(2) Operating cost per boe, adjusted EBITDAX and net cash are

non-IFRS measures and are explained below.

(3) Dividend per ordinary share calculated based on outstanding

number of shares at period/year end. The actual dividend per share

will reflect any changes in the shares outstanding between the

period/year end and the associated record date including the shares

buyback.

Production and liftings

The Group generated average production of 15,008 boe/d in H1

2022, compared to 9,934 bbls/d in H1 2021. Production increased due

to the acquisition of the PenMal Assets in August 2021, which

generated additional production of 5,443 boe/d during H1 2022.

Montara increased to 7,509 bbl/d from 7,269 bbl/d in H1 2022 due to

the completion of the drilling of H6 and the subsea workovers of

Skua 10 and 11 at the end 2021 offset by operational issues in H1

2022, in particular downtime associated with changing out the gas

compressor engine on the FPSO. Stag production decreased in H1 2022

to 2,057 bbl/d (H1 2021: 2,665 bbl/d) due to a planned shutdown for

vessel inspections and natural field decline.

The Group had 11 liftings during the period (H1 2021: five),

resulting in sales of 2.0 mmbbls (H1 2021: 2.0 mmbbls). The PenMal

Assets contributed seven oil liftings in H1 2022, representing 0.5

mmbbls. In addition, the PenMal Assets produced and sold 939.7

mmscf (approximately 0.2 mmboe) of natural gas. Lifted volumes were

lower than the comparable period last year at Montara and Stag due

to the phasing of liftings (four in H1 2022 compared to five in H1

2021).

The Australian closing crude inventories of 417,216 bbls were

valued at cost of US$25.9 million, which were subsequently sold in

the second half of 2022, generating provisional receipts of US$45.3

million, from a provisional weighted average realised price of

US$108.97/bbl.

PenMal Assets were in an underlift carried forward position of

130,359 bbls, reflecting a market value of US$16.8 million,

calculated based on the average June 2022 Dated Brent price plus

latest realised premium.

Revenue

The Group generated US$225.6 million of revenue in H1 2022,

compared to US$138.2 million for the same period in 2021, an

increase of 63%. The increase of US$87.4 million is due to:

-- The PenMal Assets generating US$48.3 million of crude oil

revenue (H1 2021: nil) and US$1.9 million of gas revenue (H1 2021:

nil) in H1 2022, following completion of the acquisition in August

2021;

-- Higher average realised oil prices at Montara of US$106.76

bbl (H1 2021: US$66.66 bbl) and Stag at US$128.13 bbl (H1 2021:

US$70.87 bbl) in H1 2022, contributing an additional US$68.0

million; partly offset by

-- A lower lifted volume by 452,795 bbls at Montara and Stag,

representing an estimated decrease of US$30.6 million between the

comparable periods.

Production costs

Production costs in H1 2022 were US$83.4 million (H1 2021:

US$62.5 million), an increase of US$20.9 million, predominately due

to the acquisition of the PenMal Assets which contributed US$24.7

million, and a reduction of US$3.8 million at Montara and Stag.

Production costs included:

-- The PenMal Assets incurred US$16.7 million (H1 2021: nil) of

Malaysian supplementary payments, due to the realised price

exceeding the escalated base price incorporated into the PSC

terms;

-- Repair and maintenance ("R&M") costs of US$25.3 million,

compared to US$12.1 million in H1 2021. The PenMal Assets incurred

routine maintenance of US$2.7 million (H1 2021: nil), Stag an

additional US$4.6 million on structural marine maintenance and

import hose replacement and Montara an additional US$5.9 million

predominately on Skua 11 well subsurface repairs;

-- Operational costs at US$32.6 million, an increase of US$8.3

million compared to H1 2021, predominately associated with the

PenMal Assets;

-- Logistics costs increased by US$5.1 million, with the PenMal

Assets incurring US$2.6 million (H1 2021: nil). Australia increased

by US$2.5 million due to higher fuel costs for operating vessels

and helicopters;

-- Transportation costs of US$2.9 million (H1 2021: US$0.5

million), predominately associated with the PenMal Assets and Stag

offtake arrangements;

-- Workover costs reduced by US$1.6 million due to differences in the phasing of workovers;

-- The PenMal Assets were in an underlift carried forward

position of 130,359 bbls (H1 2021: nil) resulting in a production

credit of US$9.9 million at the end of H1 2022; and

-- Montara and Stag generated a credit net inventory movement of

US$8.5 million, reflecting the increase in closing crude balances

compared to the beginning of the period.

Unit operating costs per boe were US$25.71 bbl (H1 2021:

US$28.16/bbl) before workovers and movement in inventories but

including lease payments and taking into account various other

adjustments (see IFRS measures below).

Depletion, depreciation and amortisation ("DD&A")

The depletion charges of oil and gas properties were US$35.1

million in H1 2022, compared to US$39.7 million in H1 2021.

The depletion cost on a unit basis was US$12.06/boe in H1 2022

(H1 2021: US$15.70/bbl), predominately due to the inclusion of the

PenMal Assets at US$1.61/boe which benefitted from the low cost

base following the acquisition, thus lowering the weighted average

DD&A unit charge. Stag and Montara increased over the

comparable period by US$2.63/bbl and US$1.71/bbl, respectively,

reflecting the completion of development projects and natural

decline of the production profile.

Other expenses

Other expenses represent the Group's general and administrative

("G&A") costs, one-off project costs and other miscellaneous

expenditures. Total other expenses decreased by US$7.0 million in

H1 2022 to US$5.5 million (H1 2021: US$12.5 million) due to lower

G&A, one-off project costs and hedging losses incurred in H1

2021.

Other income

Other income was US$ 5.6 million in H1 2022, an increase of

US$1.9 million (H1 2021: US$3.7 million). The increase was mainly

due to a refund of interest paid to the Australian Taxation Office

as part of an early repayment of outstanding 2019 tax amounts

previously deferred under a COVID-19 arrangement.

Taxation

The tax charge of US$37.8 million in H1 2022 (H1 2021: US$8.7

million) was split between a current tax charge of US$34.9 million

(H1 2021: US$8.9 million) and a deferred tax charge of US$2.8

million (H1 2021: credit of US$0.2 million).

The current tax charge included US$29.2 million (H1 2021:

US$11.4 million) of Australian corporate tax plus Malaysian

Petroleum Income Tax ("PITA") tax of US$5.9 million (H1 2021: nil),

offset by a net Australian Petroleum Resource Rent tax ("PRRT")

credit of US$0.2 million (H1 2021: US$2.5 million).

Australian PRRT

Australian PRRT is a cash-based tax charged to petroleum

operations at the rate of 40% and deductible from income tax. The

current tax credit of US$0.2 million is associated with Stag

operations, due to the utilisation of carried forward PRRT

losses.

Montara is not anticipated to incur PRRT expense in the future,

as it has unutilised PRRT carried forward credits of US$3.4 billion

(H1 2021: US$3.3 billion). Based on management's latest forecasts,

the historical accumulated PRRT net losses will more than offset

PRRT that would arise on future PRRT taxable profits.

Malaysian PITA

Malaysia PITA is imposed at the rate of 38% on income from

petroleum operations in Malaysia, no other taxes are imposed on

income from petroleum operations.

Deferred tax

The deferred tax movement during the period reflects timing

differences for corporate tax, PITA and PRRT. The Group incurred a

deferred tax charge of US$2.8 million in H1 2022 (H1 2021: credit

of US$0.3 million), because of timing differences between the PITA

tax and accounting treatment of the Malaysian crude under-lift

position of US$3.6 million (H1 2021: nil) and a deferred tax credit

in Australia of US$0.8 million from the timing differences of the

accounting and tax bases of the oil and gas properties .

H1 2022 RECONCILIATION OF CASH

US$'000 US$'000

--------------------------------------------- --------- ---------

Total cash and cash equivalent, 31 December

2021 117,865

Revenue 225,639

Other operating income 3,524

Production costs (83,401)

Administrative staff costs (14,482)

General and administrative expenses (4,799)

Operating cash flows before movements

in working capital 126,481

Movements in working capital (22,658)

Net tax paid (34,177)

Interest paid (600)

Purchases of intangible exploration assets,

oil and gas properties, and

plant and equipment(1) (13,364)

Other investing activities 170

Financing activities (12,089)

---------

Total cash and cash equivalent, 30 June

2022 161,628

=========

NON-IFRS MEASURES

The Group uses certain performance measures that are not

specifically defined under IFRS, or other generally accepted

accounting principles. These non-IFRS measures comprise operating

cost per barrel of oil equivalent (opex/boe), adjusted EBITDAX and

net cash.

The following notes describe why the Group has selected these

non-IFRS measures.

(1) Total capital expenditure was US$13.6 million, comprising

total capital expenditure paid of US$13.4 million, plus accrued

capital expenditure of US$0.2 million.

Operating costs per barrel of oil equivalent (Opex/boe)

Opex/boe is a non-IFRS measure used to monitor the Group's

operating cost efficiency, as it measures operating costs to

extract hydrocarbons from the Group's producing reservoirs on a

unit basis.

Opex/boe is defined as total production costs excluding crude

inventories movement, underlift/overlift, workovers (to facilitate

better comparability period to period), non-recurring R&M,

supplementary payments, DD&A, transportation, and short term

COVID-19 incentives. It includes lease payments related to

operational activities, net of any income earned from right-of-use

assets involved in production.

The adjusted production cost is divided by total produced

barrels of oil equivalent for the prevailing period to determine

the unit operating cost per boe.

Six months Six months Twelve

ended ended months ended

30 June 30 June 31 December

USD'000 except where indicated 2022 2021 2021

---------------------------------------- ----------- ----------- -------------

Production costs (reported) 83,401 62,492 206,523

Adjustments

Lease payments related to

operating activities(1) 6,371 6,444 10,619

Underlift, overlift and crude

inventories

movement(2) 18,412 (5,642) (9,680)

Workover costs(3) (8,435) (10,027) (67,006)

Other income(4) (2,410) (2,286) (4,512)

Non-recurring repair and maintenance(5) (5,510) - (6,593)

Australian transportation

costs (510) (541) (1,231)

PenMal Assets supplementary

payments(6) (16,731) - (8,255)

Australian Government JobKeeper

scheme - 196 196

PenMal non-operated assets

FPSO rectification

costs(7) (4,748) - -

Adjusted production costs 69,840 50,636 120,061

----------- ----------- -------------

Total production (barrels

of oil equivalent) 2,716,436 1,797,989 4,578,962

Operating costs per barrel

of oil equivalent 25.71 28.16 26.22

=========== =========== =============

(1) Lease payments related to operating activities are payments

considered to be operating costs in nature, including leased

helicopters for transporting offshore crews.

(2) Underlift, overlift and crude inventories movement are added

back to the calculation to match the full cost of production with

the associated production volumes (i.e., numerator to match

denominator).

(3) Workover costs are excluded to enhance comparability. The

frequency of workovers can vary significantly, across periods.

(4) Other income represents the rental income from a helicopter

rental contract (a right-of-use asset) to a third party.

(5) Non-recurring repair and maintenance costs in H1 2022

related to the Montara Skua 11 well subsurface repairs and Stag

structural marine maintenance and import hose replacement. The

costs from the year ended 2021 related to the Montara Swift North

SCM change out and facility integrity baseline survey.

(6) The supplementary payments are required under the terms of

PSCs based on Jadestone's profit oil after entitlements between the

government and joint venture partners.

(7) PenMal non-operated assets FPSO rectification costs refer to

the costs incurred to repair the FPSO BUK CLASS at PM318 and

AAKBNLP PSCs following its suspension in February 2022.

Adjusted EBITDAX

Adjusted EBITDAX is a non-IFRS measure which does not have a

standardised meaning prescribed by IFRS. This non-IFRS measure is

included because management uses the information to analyse cash

generation and financial performance of the Group.

Adjusted EBITDAX is defined as profit from continuing activities

before income tax, finance costs, interest income, DD&A, other

financial gains, non-recurring expenses and exploration assets

write-offs.

The calculation of adjusted EBITDAX is as follows:

Six months Six months Twelve

ended ended months ended

30 June 30 June 31 December

USD'000 2022 2021 2021

Revenue 225,639 138,158 340,194

Production costs (83,401) (62,492) (206,523)

Administrative staff costs (15,165) (12,067) (25,068)

Other expenses (5,503) (12,501) (26,181)

Other income, excluding interest

income 3,528 3,643 7,602

Other financial gains - - 266

----------- ----------- --------------

Unadjusted EBITDAX 125,098 54,741 90,290

Non-recurring

Net loss from oil price derivatives - 4,633 4,633

Non-recurring opex(1) 13,135 1,574 53,096

Intangible exploration assets

written off - - 5,260

Loss on contingent considerations - - 438

Other 375 4,231 4,231

----------- ----------- --------------

13,510 10,438 67,658

----------- ----------- --------------

Adjusted EBITDAX 138,608 65,179 157,948

=========== =========== ==============

(1) Non-recurring opex represents one-off major maintenance/well

intervention activities, in particular the Montara Skua 11 well

subsurface repairs and Stag structural marine maintenance and

import hose replacement . The H1 2021 non-recurring costs mainly

consisted of workover campaigns at Skua 10 & 11, while Swift

North SCM change out and facility integrity baseline survey were

included in the 2021 full year costs.

Net cash

Net cash is a non-IFRS measure which does not have a

standardised meaning prescribed by IFRS. Management uses this

measure to analyse the financial strength of the Group. The measure

is used to ensure capital is managed effectively in order to

support its ongoing operations, and to raise additional funds, if

required.

30 June 30 June 31 December

USD'000 2022 2021 2021

--------------------------- --------- -------- -----------

Cash and cash equivalents,

representing net

cash of the Group 161,628 48,291 117,865

========= ======== ===========

The cash and cash equivalents for the period ended 30 June 2021

includes restricted cash of US$1.0 million associated with an

Indonesian performance bond that was returned in Q3 2021.

2022 PRINCIPAL FINANCIAL RISKS AND UNCERTAINTIES

The Group manages principal risks and uncertainties via its risk

management framework. The Group is exposed to a variety of

political, technological, environmental, operational and financial

risks which are monitored and/or mitigated to acceptable

levels.

The Group's risk management framework provides a systematic

process for the identification of the principal risks which have

the possibility of impacting the Group's strategic objectives. The

Board regularly reviews the principal risks and defines corporate

targets based on acceptable levels of risk. The Board assesses

material risks quarterly with a full review of the risk matrix at

least twice per year.

Details of the principal risks and uncertainties faced by the

Group as at 30 June 2022 remain unchanged from the risks disclosed

in the 2021 Annual Report pages 57 to 63. The Group's risk

mitigation activities also remain unchanged.

GOING CONCERN

The Directors have adopted the going concern basis in preparing

these unaudited condensed consolidated interim financial

statements, having considered the principal financial risks and

uncertainties of the Group.

The Directors believe that the Group is well placed to manage

its financing and other business risks satisfactorily. The

Directors have a reasonable expectation that the Group will have

adequate resources to continue in operation for at least 18 months

from the date of these unaudited condensed consolidated interim

financial statements. They therefore consider it appropriate to

adopt the going concern basis of accounting in preparing these

financial statements.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The Directors confirm that to the best of their knowledge:

a. the condensed consolidated interim set of financial

statements has been prepared in accordance with IAS 34 Interim

Financial Reporting ;

b. the interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year); and

c. the interim management report includes a true and fair review

of the information required by DTR 4.2.8R (disclosure of related

parties' transactions and changes therein).

By order of the Board,

Paul Blakeley

Executive Director

President & Chief Executive Officer

20 September 2022

Condensed Consolidated Statement of Profit or Loss and Other

Comprehensive Income

for the six months ended 30 June 2022

Six months Six months Twelve

ended ended months ended

30 June 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

Notes USD'000 USD'000 USD'000

----------------------------------- ------ ----------- ----------- --------------

Consolidated statement

of profit or loss

Revenue 225,639 138,158 340,194

Production costs 5 (83,401) (62,492) (206,523)

Depletion, depreciation

and amortisation 5 (35,135) (39,697) (80,215)

Administrative staff costs (15,165) (12,067) (25,068)

Other expenses 5 (5,503) (12,501) (26,181)

Other income 5,602 3,681 7,682

Finance costs 6 (4,784) (3,934) (9,075)

Other financial gains - - 266

----------- ----------- --------------

Profit before tax 87,253 11,148 1,080

Income tax expense 7 (37,767) (8,653) (14,822)

----------- ----------- --------------

Profit/(Loss) for the

period/year,

representing total comprehensive

income

for the year 49,486 2,495 (13,742)

=========== =========== ==============

Earnings/(Loss) per ordinary

share

Basic (US$) 8 0.11 0.01 (0.03)

=========== =========== ==============

Diluted (US$) 0.10 0.01 (0.03)

=========== =========== ==============

Condensed Consolidated Statement of Financial Position as at 30

June 2022

30 June 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

Notes USD'000 USD'000 USD'000

---------------------------------- ------ ---------- ---------- ------------

Assets

Non-current assets

Intangible exploration

assets 9 77,027 96,443 93,241

Oil and gas properties 10 350,404 303,625 353,592

Plant and equipment 10 8,896 1,584 8,963

Right-of-use assets 10 9,288 18,358 13,852

Other receivables and prepayment 11 46,817 4,451 48,500

Deferred tax assets 14,366 16,318 25,278

---------- ---------- ------------

Total non-current assets 506,798 440,779 543,426

---------- ---------- ------------

Current assets

Inventories 38,162 34,812 23,299

Trade and other receivables 11 28,588 63,135 37,951

Tax recoverable 7 8,162 - 9,367

Restricted cash - 1,000 -

Cash and cash equivalents 161,628 47,291 117,865

---------- ---------- ------------

Total current assets 236,540 146,238 188,482

---------- ---------- ------------

Total assets 743,338 587,017 731,908

========== ========== ============

Equity and liabilities

Equity

Capital and reserves

Share capital 12 1,229 391 559

Share based payments reserve 26,619 25,625 25,936

Merger reserve 14 146,270 146,270 146,270

Retained earnings/(Accumulated

losses) 11,553 (12,710) (31,692)

---------- ---------- ------------

Total equity 185,671 159,576 141,073

---------- ---------- ------------

Non-current liabilities

Provisions 15 413,451 290,693 410,697

Lease liabilities 1,154 9,086 4,504

Deferred tax liabilities 59,032 54,564 67,097

---------- ---------- ------------

Total non-current liabilities 473,637 354,343 482,298

---------- ---------- ------------

30 June 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

Notes USD'000 USD'000 USD'000

---------------------------------- ------ ---------- ---------- ------------

Current liabilities

Lease liabilities 9,576 11,625 11,161

Trade and other payables 16 46,575 22,760 69,090

Provisions 15 3,503 3,091 1,947

Tax liabilities 7 24,376 35,622 26,339

---------- ---------- ------------

Total current liabilities 84,030 73,098 108,537

---------- ---------- ------------

Total liabilities 557,667 427,441 590,835

---------- ---------- ------------

Total equity and liabilities 743,338 587,017 731,908

========== ========== ============

Condensed Consolidated Statement of Changes in Equity

for the six months ended 30 June 2022

Non-distributable

reserve

Share

based Distributable reserves

Share payments Merger Accumulated

capital reserve reserve losses Total

USD'000 USD"000 USD'000 USD'000 USD'000

-------------------- ---------- ------------------ --------- -------------- ---------

As at 1 January

2021 466,979 24,985 - (331,322) 160,642

Profit for

the period,

representing

total

comprehensive

income for

the

period - - - 2,495 2,495

---------- --------- -------------- ---------

Dividend paid - - - (5,000) (5,000)

Share-based

compensation - 640 - - 640

Shares issued 799 - - - 799

Capital reduction (467,387) - 146,270 321,117 -

------------------ ---------

Total transactions

with owners,

recognised

directly

in equity (466,588) 640 146,270 316,117 (3,561)

---------- ------------------ --------- -------------- ---------

As at 30 June

2021 391 25,625 146,270 (12,710) 159,576

========== ================== ========= ============== =========

As at 1 January

2021 466,979 24,985 - (331,322) 160,642

Loss for the

year,

representing

total

comprehensive

income for

the year - - - (13,742) (13,742)

---------- -------------- ---------

Capital reduction (467,387) - 146,270 321,117 -

Dividend paid - - - (7,745) (7,745)

Share-based

compensation - 951 - - 951

Shares issued 967 - - - 967

---------- ------------------ --------- -------------- ---------

Total transactions

with owners,

recognised

directly

in equity (466,420) 951 146,270 313,372 (5,827)

---------- -------------- ---------

As at 31 December

2021 559 25,936 146,270 (31,692) 141,073

========== ================== ========= ============== =========

Non-distributable

reserve Distributable reserves

Share (Accumulated

based losses)/

Share payments Merger Retained

capital reserve reserve earnings Total

USD'000 USD"000 USD'000 USD'000 USD'000

-------------------- ---------- ------------------ --------- -------------- ---------

As at 1 January

2022 559 25,936 146,270 (31,692) 141,073

Profit for

the period,

representing

total

comprehensive

income for

the

period - - - 49,486 49,486

---------- ------------------ --------- -------------- ---------

Dividend paid - - - (6,241) (6,241)

Share-based

compensation - 683 - - 683

Shares issued 670 - - - 670

------------------ ---------

Total transactions

with owners,

recognised

directly

in equity 670 683 - (6,241) (4,888)

---------- ------------------ --------- -------------- ---------

As at 30 June

2022 1,229 26,619 146,270 11,553 185,671

========== ================== ========= ============== =========

Condensed Consolidated Statement of Cash Flows for the six

months ended 30 June 2022

Six months Six months Twelve

months

ended ended ended

30 June 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

Notes USD'000 USD'000 USD'000

------------------------------------ ------ ----------- ----------- ------------

Operating activities

Profit before tax 87,253 11,148 1,080

Adjustments for:

Depletion, depreciation

and amortisation 5 28,988 33,338 69,024

Depreciation of right-of-use 5 /

assets 10 6,147 6,359 11,191

Other finance costs 6 4,643 3,784 8,487

Share-based payments 683 640 951

Provision for doubtful

debts 446 201 -

Unrealised foreign exchange

loss/(gain) 241 (735) (1,838)

Interest expense 6 141 150 150

Assets written off 13 - 5,332

Interest income (2,074) (38) (80)

Reversal of fair value

loss on oil derivatives - (471) (471)

Accretion income on non-current

VAT

receivables - - (266)

Change in fair value of

contingent payments - - 438

Allowance for slow moving

inventories - - 2,624

Operating cash flows before

movements in

working capital 126,481 54,376 96,622

Decrease/(Increase) in trade

and other

receivables 10,505 (53,777) (11,975)

(Increase)/Decrease in inventories (10,774) 5,719 9,152

(Decrease)/Increase in trade

and other

payables (22,389) (5,196) 21,631

----------- ----------- ------------

Cash generated from operations 103,823 1,122 115,430

Interest paid (600) (768) (1,505)

Tax refunded 12 - 3,652

Tax paid (34,189) (8,004) (15,486)

----------- ----------- ------------

Net cash generated/(used

in) from operating

activities 69,046 (7,650) 102,091

----------- ----------- ------------

Six months Six months Twelve

months

ended ended ended

30 June 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

Notes USD'000 USD'000 USD'000

------------------------------------ ------ ----------- ----------- ------------

Investing activities

Cash received from acquisition

of Peninsular

Malaysia assets - - 29,252

Cash paid for acquisition

of Peninsular

Malaysia assets - - (20,033)

Payment for oil and gas

properties 10 (10,687) (14,173) (51,380)

Payment for plant and equipment 10 (253) (216) (682)

Payment for intangible exploration

assets 9 (2,424) (1,476) (3,858)

Transfer from debt service

reserve account - 7,445 8,445

Interest received 170 38 80

----------- ----------- ------------

Net cash used in investing

activities (13,194) (8,382) (38,176)

----------- ----------- ------------

Financing activities

Net proceeds from issuance

of shares 670 799 967

Dividends paid (6,241) (5,000) (7,745)

Repayment of borrowings - (7,356) (7,296)

Repayment of lease liabilities (6,518) (6,116) (12,972)

Net cash used in financing

activities (12,089) (17,673) (27,046)

----------- ----------- ------------

Net increase/(decrease)

in cash and cash

equivalents 43,763 (33,705) 36,869

Cash and cash equivalents

at beginning of the

period/year 117,865 80,996 80,996

----------- ----------- ------------

Cash and cash equivalents

at end of the

period/year 161,628 47,291 117,865

=========== =========== ============

Explanation Notes to the Condensed Consolidated Interim

Financial Statements

for the six months ended 30 June 2022

1. GENERAL INFORMATION

Jadestone Energy plc (the "Company" or "Jadestone") is an oil

and gas company incorporated in the United Kingdom and registered

in England and Wales. The company registration number is 13152520

and the Company's shares are traded on AIM under the symbol

"JSE".

The financial statements are expressed in United States

Dollars.

The Group is engaged in production, development, exploration and

appraisal activities in Australia, Malaysia, Vietnam and Indonesia.

The Group's producing assets are in the Vulcan (Montara) and

Carnarvon (Stag) basins, located in shallow water offshore of

Western Australia, and in the East Piatu, East Belumut, West

Belumut and Chermingat fields, located in shallow water offshore

Peninsular Malaysia.

The Company's head office is located at 3 Anson Road, #13-01

Springleaf Tower, Singapore 079909. The registered office of the

Company is Suite 1, 3rd Floor, 11 - 12 St James's Square, London

SW1Y 4LB.

These financial statements were authorised for issue and release

by the Company's Board of Directors on 20 September 2022.

2. SIGNIFICANT EVENT DURING THE PERIOD

Montara operations update

On 17 June 2022, between three to five cubic metres of crude oil

was released to sea during a routine oil transfer between tanks on

the Montara Venture FPSO. The facility was immediately shut-in as a

precaution and the relevant authorities notified. Following a

temporary repair and isolation of the 2C tank, production was

restarted on 4 July 2022 while a permanent repair was being

developed.

On 12 August 2022, an additional defect was identified in a

ballast water tank on the Montara Venture FPSO during preparation

work for a permanent repair to the 2C tank. The Group took the

decision to temporarily shut-in production at Montara to prioritise

the permanent repairs due to an inability to simultaneously

accommodate production and inspection and repair crews.

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BASIS OF PREPARATION

These unaudited condensed consolidated interim financial

statements (the "financial statements") are prepared in accordance

with International Accounting Standard IAS 34 Interim Financial

Reporting, as adopted by the European Union, on a going concern

basis under the historical cost convention.

These unaudited condensed consolidated interim financial

statements do not comprise statutory accounts within the meaning of

section 435 of the Companies Act 2006 ("the Act"). They do not

contain all disclosures required by IFRS for annual financial

statements and should be read in conjunction with Jadestone's

audited consolidated financial statements for the year ended 31

December 2021. Jadestone's auditors reported on those accounts;

their report was unqualified and did not draw attention to any

matters by way of emphasis.

These financial statements have been prepared on an historical

cost basis, except for financial instruments classified as

financial instruments at fair value, which are stated at their fair

values, and operating leases which are stated at the present value

of future cash payments.

In addition, these financial statements have been prepared using

the accrual basis of accounting.

GOING CONCERN

As at 30 June 2022, the Group has a total cash and cash

equivalents of US$161.6 million, and the Group managed to keep the

cash levels within the range of US$110.0 - 160.0 million between

July and August 2022, after the settlements of trade related

expenditure. The average Dated Brent crude price in July and August

2022 was US$102.73/bbl, largely aligned with the average price

during the first half of 2022. Hence the Group was able to continue

to generate material cash inflows from the liftings in Australia

and Malaysia subsequent to June 2022 end.

The Group regularly monitors its cash, funding and liquidity

position. Near term cash projections are revised and underlying

assumptions reviewed, generally monthly, and longer-term

projections are also updated regularly. All principal risk and

uncertainties faced by the Group are disclosed in the 2021 Annual

Report pages 57 to 63 and have been considered in the Group's near

and longer term cash projections. The principal risk and

uncertainties remain unchanged at the current period end. For the

purposes of the Group's going concern assessment, we have reviewed

cash projections for the period from 1 July 2022 to 31 December

2023, the 'going concern period'.

Having taken into consideration the above factors, the Directors

have reasonable expectation that the Group has adequate resources

to continue in operational existence for the going concern period.

Accordingly, they adopted the going concern basis in preparing

these unaudited condensed consolidated interim financial

statements.

Adoption of new and revised standards

New and amended IFRS standards that are effective for the

current period

The Group has applied the following amendment that is relevant

to the Group for the first time with effect from 1 January

2022.

- Amendments to IAS 37 Onerous Contracts - Cost of Fulfilling a Contract

- Amendments to IFRS 3 Reference to Conceptual Framework

- Amendments to IFRSs Annual Improvements to IFRS Standards 2018 - 2020

The amendments are effective for annual periods beginning on 1

January 2022 and require prospective application. The adoption of

these amendments has not resulted in changes to the Group's

accounting policies.

4. CRITICAL ACCOUNTING JUDGMENTS AND KEY SOURCES OF ESTIMATION

UNCERTAINTY

Climate change and energy transition

The Group has assessed the potential impacts of climate change

and the transition to a lower carbon economy in preparing these

financial statements. The Group's assumptions relating to demand

for oil and gas and their impact on the Group's long-term price

assumptions remain the same as disclosed in the Jadestone's audited

consolidated financial statements for the year ended 31 December

2021. The Group also takes into consideration the forecasted

long-term prices and demand for oil and gas under the Paris aligned

scenarios. The forecasted long-term prices and demand for oil and

gas under the Paris aligned scenarios remain the same as disclosed

in Jadestone's audited consolidated financial statements for the

year ended 31 December 2021 .

Details of the Group's environment, social and governance

("ESG") plans and activities are disclosed in the 2021 Annual

Report pages 26 to 49 and the ESG section above.

Critical accounting judgments and key sources of estimation

uncertainty

In the application of the Group's accounting policies,

management is required to make judgments, estimates and assumptions

about the carrying amounts of assets and liabilities that are not

readily apparent from other sources. The estimates and associated

assumptions are based on historical experience and other factors

that are considered to be relevant. Actual results may differ from

these estimates.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised, if the revision

affects only that period, or in the period of the revision and

future periods, if the revision affects both current and future

periods.

The key judgements and sources of estimation uncertainty remain

the same as disclosed in Jadestone's audited consolidated financial

statements for the year ended 31 December 2021 .

5. OPERATING COSTS

Six months Six months Twelve

ended ended months ended

30 June 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

USD'000 USD'000 USD'000

------------------------------- ----------- ----------- --------------

Production costs 80,533 61,951 203,714

Tariffs and transportation

costs 2,868 541 2,809

----------- ----------- --------------

Total production costs 83,401 62,492 206,523

=========== =========== ==============

Depletion and amortisation

of oil and

gas properties 28,681 33,054 68,516

Depreciation of plant

equipment and

right-of-use assets 6,454 6,643 11,699

----------- ----------- --------------

Total depletion, depreciation

and

amoritisation 35,135 39,697 80,215

=========== =========== ==============

Corporate costs 5,057 12,230 21,548

Other operating expenses 446 271 4,633

----------- ----------- --------------

Total other expenses 5,503 12,501 26,181

=========== =========== ==============

6. FINANCE COSTS

Six months Six months Twelve