JZ Capital Ptnrs Ltd Further Update in relation to Secondary Sale

23 Mayo 2022 - 1:00AM

UK Regulatory

TIDMJZCP TIDMJZCN

JZ CAPITAL PARTNERS LIMITED (the "Company" or "JZCP")

(a closed-ended investment company incorporated with limited liability under

the laws of Guernsey with registered number 48761)

LEI 549300TZCK08Q16HHU44

Further Update in relation to Secondary Sale

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF THE MARKET

ABUSE REGULATION (EU) NO. 596/2014, WHICH FORMS PART OF UK LAW BY VIRTUE OF THE

EUROPEAN UNION (WITHDRAWAL) ACT 2018 ("MAR").

23 May 2022

JZ Capital Partners Limited, the London listed fund that has investments in US

and European microcap companies and US real estate, is pleased to provide a

further update in relation to its interest in the Secondary Fund, JZHL

Secondary Fund LP, being the fund to which the Company earlier sold its

interests in certain US microcap portfolio companies.

Since the Company's last update announced on 7 April 2022, a portfolio company

of the Secondary Fund has executed an agreement to sell certain of its

interests, with the Secondary Fund expecting to receive a distribution from

such portfolio company of net proceeds it receives in such sale of

approximately US$165-180 million.

Shareholders are reminded that, as detailed in the Company's last update

announced on 7 April 2022 and in its circular dated 29 October 2020, the

Company has a Special LP Interest in the Secondary Fund, which entitles it to

certain rights and obligations from the Secondary Fund, including to

distributions by way of an agreed distribution waterfall. Accordingly, such

portfolio company sale is expected to result in JZCP receiving a distribution

from the Secondary Fund of approximately US$89-94 million, which would

correspond to a NAV uplift to JZCP in the range of approximately 56-63 cents

per ordinary share. JZCP's remaining interest in the Secondary Fund, based on

pro forma financials as at 28 February 2022, is valued at approximately US$71.2

million.

Shareholders should however also be aware that completion of such portfolio

company sale remains subject to certain conditions, including the federal

premerger notification program established by the Hart-Scott-Rodino Act. Whilst

it is expected that completion of the sale will occur, subject to the

satisfaction of the relevant conditions, on or before 30 June 2022, there can

be no assurance that the aforementioned conditions will be satisfied and,

accordingly, that completion of such portfolio company sale (or receipt by the

Company of its distribution) will occur. As such, the Company will make further

announcements at the appropriate time regarding the status of completion of

such portfolio company sale and the distribution of net proceeds related

thereto. Furthermore and as previously announced, the Company will also make

further announcements in relation to any further distributions of the Secondary

Fund as and when appropriate.

For completeness, the Company's key outstanding debt obligations are

approximately US$45.0 million under the Company's Senior Facility provided by

WhiteHorse Capital Management, LLC due on 26 January 2027, approximately £57.6

million of zero dividend preference shares ("ZDPs") due on 1 October 2022, and

approximately US$31.5 million of Subordinated Notes made available by Jay

Jordan and David Zalaznick (and their affiliates) due on 11 September 2022. The

Senior Facility does however (and as previously announced) allow and indeed

requires, subject to compliance with its financial covenants, the repayment of

the Subordinated Notes and the ZDPs on their respective maturities, being 11

September 2022 and 1 October 2022 respectively. Whilst the Company's ability to

repay the Subordinated Notes and the ZDPs does continue to be dependent upon

the Company achieving sufficient realisations in due time, following the

receipt of the expected distribution of the Company's entitlement to a portion

of the Secondary Fund's proceeds of such portfolio company sale, the Company's

obligation to redeem the ZDPs on their due date is expected to be funded,

subject to compliance with the Senior Facility's financial covenants and the

extension of the maturity of the Subordinated Notes. Again, the Company will

make further announcements in relation to its key outstanding debt obligations,

including the status or satisfaction of the same as and when appropriate.

Unless otherwise defined herein, capitalised terms used in this announcement

have the meanings given to them in the announcement of the Company dated 7

April 2022.

Market Abuse Regulation

The information contained within this announcement is considered by the Company

to constitute inside information as stipulated under MAR. Upon the publication

of this announcement, this inside information is now considered to be in the

public domain.

The person responsible for arranging the release of this announcement on behalf

of the Company is David Macfarlane, Chairman of JZCP.

______________________________________________________________________________________

For further information:

Kit Dunford / Ed Berry +44 (0)7717 417 038 / +44 (0)7703

FTI Consulting 330 199

David Zalaznick +1 (212) 485 9410

Jordan/Zalaznick Advisers, Inc.

Sam Walden / Martin Chapman +44 (0) 1481 745385 / +44 (0)1481

Northern Trust International Fund 745183

Administration Services (Guernsey)

Limited

Important Notice

This announcement includes statements that are, or may be deemed to be,

"forward-looking statements". These forward-looking statements can be

identified by the use of forward-looking terminology, including the terms

"believes", "estimates", "anticipates", "expects", "intends", "may", "will" or

"should" or, in each case, their negative or other variations or comparable

terminology. These forward-looking statements relate to matters that are not

historical facts. By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on circumstances that

may or may not occur in the future. Forward-looking statements are not

guarantees of future performance. The Company's actual investment performance,

results of operations, financial condition, liquidity, policies and the

development of its strategies may differ materially from the impression created

by the forward-looking statements contained in this announcement. In addition,

even if the investment performance, result of operations, financial condition,

liquidity and policies of the Company and development of its strategies, are

consistent with the forward-looking statements contained in this announcement,

those results or developments may not be indicative of results or developments

in subsequent periods. These forward-looking statements speak only as at the

date of this announcement. Subject to their legal and regulatory obligations,

each of the Company, Jordan/Zalaznick Advisers, Inc. and their respective

affiliates expressly disclaims any obligations to update, review or revise any

forward-looking statement contained herein whether to reflect any change in

expectations with regard thereto or any change in events, conditions or

circumstances on which any statement is based or as a result of new

information, future developments or otherwise.

END

(END) Dow Jones Newswires

May 23, 2022 02:00 ET (06:00 GMT)

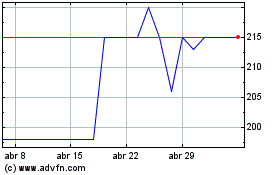

Jz Capital Partners (LSE:JZCP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

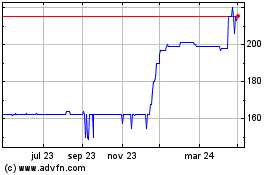

Jz Capital Partners (LSE:JZCP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024