JZ Capital Ptnrs Ltd Extension of Maturity of Subordinated Loan Notes

26 Agosto 2022 - 1:00AM

UK Regulatory

TIDMJZCP TIDMJZCN

JZ CAPITAL PARTNERS LIMITED (the "Company" or "JZCP")

(a closed-ended investment company incorporated with limited liability under

the laws of Guernsey with registered number 48761)

LEI 549300TZCK08Q16HHU44

Extension of Maturity of Subordinated Loan Notes

as a Smaller Related Party Transaction

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF THE MARKET

ABUSE REGULATION (EU) NO. 596/2014, WHICH FORMS PART OF UK LAW BY VIRTUE OF THE

EUROPEAN UNION (WITHDRAWAL) ACT 2018 ("MAR").

26 August 2022

JZ Capital Partners Limited, the London listed fund that has investments in US

and European microcap companies and US real estate, is pleased to provide an

update in relation to its subordinated 6 per cent. loan notes maturing on 11

September 2022 (the "Subordinated Loan Notes") issued to David W. Zalaznick and

John (Jay) Jordan II (who as Shareholders know are the founders and principals

of the Company's investment adviser, Jordan/Zalaznick Advisers, Inc. ("JZAI"))

and their affiliates (together, being the "Subordinated Noteholders").

As announced on 23 June 2022, the Company intended to seek to negotiate an

extension of the maturity of the Subordinated Loan Notes, with the Company now

being pleased to announce that, subject to the satisfaction of certain

conditions, such an extension of just over 12 months' duration has been

secured. The Subordinated Loan Notes will now, subject to the satisfaction of

those conditions, be extended on an interim basis to 30 September 2022 before

being further extended to 30 September 2023. In return and consistent with the

existing Investment Policy of the Company, it has also been agreed that,

subject to the satisfaction of certain of those same conditions and following

the Company's senior facility agreement provided by WhiteHorse Capital

Management, LLC (the "Senior Facility") being paid off in full in due course,

the Company will make mandatory redemptions from time to time of the

Subordinated Loan Notes from the net cash proceeds generated from certain

realisations achieved by the Company. The Company will continue to be able,

subject to compliance with certain financial tests of the Senior Facility, to

make voluntary redemptions of the Subordinated Loan Notes. All other terms of

the Subordinated Loan Notes (including their interest rate at 6 per cent. per

annum payable semi-annually) will remain unchanged and the Subordinated Loan

Notes will continue to be fully subordinated to the Senior Facility.

The amendments to the Subordinated Loan Notes as described in this announcement

is considered to be a smaller related party transaction of the Company pursuant

to chapter 11 of the listing rules made by the Financial Conduct Authority

pursuant to section 73A of the Financial Services and Markets Act 2000, as

amended (the "Listing Rules") (insofar as they apply to the Company by virtue

of its voluntary compliance with the same). As such, whilst shareholder

approval for such amendments is not required, this announcement made in

accordance with Listing Rule 11.1.10 R(2)(c) is required to be made by the

Company. Further details of the amendments, along with the application of the

Listing Rules to the same are set out below.

The extension of the Subordinated Loan Notes is, as previously explained and

subject to the Company's compliance with the financial covenants of the Senior

Facility, expected to facilitate the repayment of the Company's zero dividend

preference shares ("ZDPs") due on 1 October 2022. The extension has also been

negotiated and secured for the reason that, whilst following the

transformational realisation of the Company's interest in Testing Services

Holdings and the anticipated redemption of the ZDPs its cash reserves will be

at a healthy level, the Company needs to maintain cash liquidity to invest in

accordance with its existing Investment Policy to maximise the value of its

existing portfolio investments where appropriate as well as in the current

uncertain economic climate to support them and so as to meet existing

obligations as they fall due. The Company remains focused upon its existing

Investment Policy as approved by Shareholders (which includes not making

further investments outside, as mentioned above, of existing obligations or to

support existing portfolio companies, and with the intention of realising the

maximum value of the Company's investments and, after repayment of all its

indebtedness, to return capital to Shareholders).

Extension of Maturity of Subordinated Loan Notes

Shareholders are reminded that the Company's issuance of the Subordinated Loan

Notes to the Subordinated Noteholders was the subject of a circular issued to

Shareholders by the Company dated 28 May 2021 and approved by Shareholders in

an extraordinary general meeting of the Company held on 18 June 2021.

The principal terms of the Subordinated Loan Notes (save for the amendments

thereto as described in this announcement), along with the associated

documentation (including the Note Purchase Agreement ("NPA"), the Security

Documents and the Subordination and Intercreditor Agreement) are as set out in

the aforementioned circular. The only changes made to these arrangements are to

allow for the extension of the maturity of the Subordinated Loan Notes and to

provide for mandatory redemptions of the same in certain circumstances once the

Company's Senior Facility has been paid off in full in due course. All other

terms of the Subordinated Loan Notes (including their interest rate at 6 per

cent. per annum payable semi-annually) will remain unchanged and the

Subordinated Loan Notes will continue to be fully subordinated to the Senior

Facility.

Specifically, the maturity of the Subordinated Loan Notes will, with effect

from 9 September 2022 and subject to the satisfaction of certain conditions

(including (i) the senior lender to the Senior Facility consenting to the

amendments to the Subordinated Loan Notes (which has already been obtained),

and (ii) no event of default under the NPA or the Senior Facility), first be

extended on an interim basis to 30 September 2022, being the time immediately

prior to the repayment of the ZDPs due on 1 October 2022.

Such maturity date will then, with effect from 30 September 2022 and subject to

the satisfaction of certain other conditions (including (i) no event of default

under the NPA or the Senior Facility, (ii) the payment in full of all interest

accrued and then due on the Subordinated Loan Notes, and (iii) compliance with

the covenants in the Senior Facility which demonstrate that the Company is

permitted to effect the repayment of the ZDPs), subsequently be extended by a

further 12 months to 30 September 2023. Shareholders are reminded that the

repayment of ZDPs remains subject to compliance with the financial covenants of

the Senior Facility including the aforementioned covenants demonstrating that

the Company is permitted to effect the repayment of the ZDPs.

In return and consistent with the Company's existing Investment Policy, it has

also been agreed that, with effect from 30 September 2022 and conditional upon

the satisfaction of the same conditions as those applying to the further

extension and following the Senior Facility being paid off in full in due

course, the Company will make mandatory redemptions from time to time of the

Subordinated Loan Notes from the net cash proceeds generated from certain

realisations (being asset sales in excess of $500,000) achieved by the Company.

Any such mandatory redemptions will also be subject to the Company being

permitted, if no event of default under the NPA has occurred and is continuing,

to retain an amount of those net cash proceeds as are necessary for it to be in

compliance with the NPA's minimum liquidity covenants. As mentioned above, the

Company will continue to be able, subject to compliance with certain financial

tests of the Senior Facility, to make voluntary redemptions of the Subordinated

Loan Notes.

In order to effect the above changes, the Company has entered into an amendment

to the existing NPA with the Subordinated Noteholders, with the senior lender

to the Senior Facility also having consented to those amendments. For the

avoidance of doubt, the interim extension is to become effective on 9 September

2022 but remains conditional upon the satisfaction of the conditions applying

to that extension as described above, and the further extension and the

additional mandatory redemption provisions are to become effective on 30

September 2022 but remain conditional upon the satisfaction of the conditions

applying to the further extension as also described above. The Company will

make further announcements in relation to the fulfilment of the conditions and

the effectiveness of the amendments as and when required.

Unless otherwise defined herein, capitalised terms used in this section of this

announcement have the meanings given to them in the aforementioned circular of

the Company dated 28 May 2021.

As mentioned above, the amendments to the Subordinated Loan Notes as described

in this announcement is considered to be a related party transaction under

chapter 11 of the Listing Rules (with which the Company voluntarily complies

and insofar as the Listing Rules are applicable to the Company by virtue of

such voluntary compliance).

JZAI is as also earlier mentioned the Company's investment adviser pursuant to

an investment advisory and management agreement dated 23 December 2010 between

the Company and JZAI, as amended from time to time, and, under the Listing

Rules, would therefore be considered a related party of the Company (as defined

in the Listing Rules). As founders and principals of JZAI, Messrs Zalaznick and

Jordan are associates of JZAI and would also be considered related parties of

the Company. In addition, each of them are substantial Shareholders of the

Company as they are each entitled to exercise or to control the exercise of 10

per cent. or more of the votes able to be casted at a general meeting of the

Company. As such, each of them would be considered to be related parties of the

Company on this basis as well. The amendments to the Subordinated Loan Notes as

described in this announcement, which involve Messrs Zalaznick and Jordan as

related parties of the Company, would be considered to involve a transaction or

arrangement between the Company and its related parties. Accordingly, Messrs

Zalaznick and Jordan as related parties and such amendments as described herein

as a transaction or arrangement between them would be considered to be a

related party transaction under Chapter 11 of the Listing Rules.

Such amendments to the Subordinated Loan Notes as described in this

announcement do however fall within Listing Rule 11.1.10 R and constitute a

smaller related party transaction under the Listing Rules. This announcement is

therefore being made in accordance with Listing Rule 11.1.10 R(2)(c).

Market Abuse Regulation

The information contained within this announcement is considered by the Company

to constitute inside information as stipulated under MAR. Upon the publication

of this announcement, this inside information is now considered to be in the

public domain.

The person responsible for arranging the release of this announcement on behalf

of the Company is David Macfarlane, Chairman of JZCP.

______________________________________________________________________________________

For further information:

Kit Dunford / Ed Berry +44 (0)7717 417 038 / +44 (0)7703

FTI Consulting 330 199

David Zalaznick +1 (212) 485 9410

Jordan/Zalaznick Advisers, Inc.

Sam Walden / Martin Chapman +44 (0) 1481 745385 / +44 (0)1481

Northern Trust International Fund 745183

Administration Services (Guernsey)

Limited

Important Notice

This announcement includes statements that are, or may be deemed to be,

"forward-looking statements". These forward-looking statements can be

identified by the use of forward-looking terminology, including the terms

"believes", "estimates", "anticipates", "expects", "intends", "may", "will" or

"should" or, in each case, their negative or other variations or comparable

terminology. These forward-looking statements relate to matters that are not

historical facts. By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on circumstances that

may or may not occur in the future. Forward-looking statements are not

guarantees of future performance. The Company's actual investment performance,

results of operations, financial condition, liquidity, policies and the

development of its strategies may differ materially from the impression created

by the forward-looking statements contained in this announcement. In addition,

even if the investment performance, result of operations, financial condition,

liquidity and policies of the Company and development of its strategies, are

consistent with the forward-looking statements contained in this announcement,

those results or developments may not be indicative of results or developments

in subsequent periods. These forward-looking statements speak only as at the

date of this announcement. Subject to their legal and regulatory obligations,

each of the Company, Jordan/Zalaznick Advisers, Inc. and their respective

affiliates expressly disclaims any obligations to update, review or revise any

forward-looking statement contained herein whether to reflect any change in

expectations with regard thereto or any change in events, conditions or

circumstances on which any statement is based or as a result of new

information, future developments or otherwise.

END

(END) Dow Jones Newswires

August 26, 2022 02:00 ET (06:00 GMT)

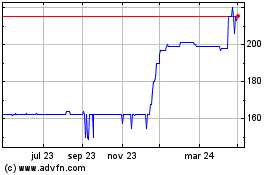

Jz Capital Partners (LSE:JZCP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

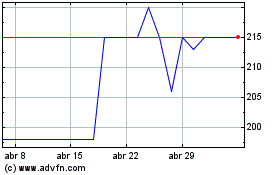

Jz Capital Partners (LSE:JZCP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024