TIDMKDNC

RNS Number : 8805Q

Cadence Minerals PLC

01 November 2021

Cadence Minerals Plc

("Cadence Minerals", "Cadence")

Port Concession Update, Amapa Project

Cadence Minerals (AIM/AQX: KDNC; OTC: KDNCY) is pleased to

announce the approval of the change of control request for the

federal port concession owned by DEV Mineração S.A.'s ("DEV")

("Port Change of Control"). Alongside the reinstatement of the life

of mine railway concession by the State of Amapa in December 2019,

details of which can be found here , both these approvals represent

two essential regulatory requirements over the critical

infrastructure to operate the integrated Amapa Iron Ore Mine

("Amapa Project")

DEV, Cadence and Indo Sino Pte. Ltd. ("Indo Sino") have been

liaising with the Agencia Nacional De Transportes Aquaviarios

("ANTAQ") to approve the Port Change of Control. The federal port

concession is one of the licenses required to operate DEV's

privatley owned port in Santana, Amapa. The approved Port Change of

Control will occur once Cadence's and Indo Sino's joint venture

company Pedra Branca Alliance Pte. Ltd. ("JV Co") is the 99.9%

owner of DEV. As part of the Port Change of Control, ANTAQ has

agreed to cease the recommended abrogation of the port concession.

In addition, DEV has agreed to pay the outstanding fines of

approximately US$267,000 to ANTAQ, 30 days after our JV Co takes

control of DEV.

DEV ownership will pass to the JV Co once DEV, Cadence and Indo

Sino have executed the settlement agreement with the secured bank

creditors. Further details of the settlement agreement can be found

here .

This approval represents a significant step forward in the

licensing process to bring the Amapa project back into production.

DEV continues to progress the licensing workstream across the

multiple regulatory authorities, and we will update our

shareholders as this progresses.

Cadence CEO, Kiran Morzaria, commented: "The Port Concession

marks another significant step along the road to bring the Amapa

Project back to life. Licensing and permitting often represent a

substantial risk in the development of mineral projects, but thanks

to the efforts of the team at DEV and its advisors, we have

successfully secured two key concessions critical to the

operational success of the Amapa project."

"On my recent Amapa site visit, I was delighted to see the rapid

progress on the ground, driven by a highly motivated local

management team and staff. I look forward to reporting further

progress."

About the Amapa Project

The Amapa Project commenced operations in December 2007, with

the first iron ore concentrate product of 712 kt shipped in 2008.

In 2008 Anglo American (70%) and Cliffs (30%) acquired the Amapa

Project as part of a larger package of mining assets in Brazil.

Cadence updated the Mineral Resource Estimate on 2 November

2020, increasing the MRE by 21%. The current MRE contains a Mineral

Resource of 176.7 million tonnes grading 39.7% Fe in the Indicated

category and Mineral Resource of 8.7Mt at 36.9% in the Inferred

category, both reported within an optimised pit shell and using a

cut-off grade of 25% Fe.

Production steadily increased to 4.8 Mt and 6.1 Mt of iron ore

concentrate product in 2011 and 2012. During this period, Anglo

American reported operating profits from their 70% ownership in the

Amapa Project of USD 120 million (100% USD 171 million) and USD 54

million (100% USD 77 million).

Before its sale in 2012, Anglo American valued its 70% stake in

Amapa Project at USD 866 million (100% 1.2 billion). It impaired

the asset in its 2012 Annual Accounts to USD 462 million (100% USD

660 million.

DEV filed for judicial protection in August 2015 in Brazil, and

mining ceased at the Amapa Project. A judicial order in early 2019

offered investors and creditors the opportunity to file a revised

JRP. Cadence and Indo Sino filed a conditional JRP, which creditors

approved in August 2019, and since that time, Cadence, Indo Sino

and DEV have continued to develop the Amapa Project and satisfy the

conditions of the JRP.

Details of the Joint Venture Agreement

The agreement with our joint venture partner, Indo Sino, is to

invest in and acquire up to 27% of a (JV Co. On completion and

registration of the settlement agreement with the bank creditors,

the equity of DEV will be transferred to the JV Co, at which point

it will own 99.9% of the Amapa Project. Should Indo Sino seek

further investors or an investment in the JV Co, the agreement also

provides Cadence with a first right of refusal to increase its

stake to 49%.

To acquire its 27% interest, Cadence will invest US$ 6 million

over two stages in JV Co. The first stage is for 20% of the JV Co's

consideration, which is US$2.5 million. The second stage of

investment is for a further 7% of JV Co for a consideration of

US$3.5 million. If Cadence is unable to complete the second stage

of the investment or not exercise its right of first refusal under

the terms of the Agreement, Indo Sino will have a twelve-month

option to buy the shares in JV Co held by Cadence for 1.5 (1 1/2 )

times the price paid by Cadence for such shares.

Cadence's investment is conditional on several material

preconditions, including the grant of key operating licences and

the release of bank securities over the asset. Upon completing

Cadence's investment (not including the first right of refusal),

our joint venture partner Indo Sino will own 73% of JV Co. The

Agreement also contains security and default clauses which, if

triggered, causes an upwards adjustment mechanism to allow Cadence

to either receive cash from JV Co or receive additional shares in

JV Co. In the latter case, Cadence's shareholding in the JV Co will

not go above 49.9%.

Upon completing the US$ 6 million investment, Cadence will have

the right to appoint two members to a five-member board. The

remaining three members will comprise one member jointly appointed

by Cadence and Indo Sino and two appointed by Indo Sino.

- Ends -

For further information: Cadence Minerals plc +44 (0) 7879 584153

Andrew Suckling

Kiran Morzaria

WH Ireland Limited (NOMAD

& Broker) +44 (0) 207 220 1666

James Joyce

Darshan Patel

Novum Securities Limited

(Joint Broker) +44 (0) 207 399 9400

Jon Belliss

Qualified Person

Kiran Morzaria B.Eng. (ACSM), MBA, has reviewed and approved the

information contained in this announcement. Kiran holds a Bachelor

of Engineering (Industrial Geology) from the Camborne School of

Mines and an MBA (Finance) from CASS Business School.

Forward-Looking Statements:

Certain statements in this announcement are or may be deemed to

be forward-looking statements. Forward-looking statements are

identi ed by their use of terms and phrases such as "believe"

"could" "should" "envisage" "estimate" "intend" "may" "plan" "will"

or the negative of those variations or comparable expressions

including references to assumptions. These forward-looking

statements are not based on historical facts but rather on the

Directors' current expectations and assumptions regarding Cadence

Minerals Plc's future growth results of operations performance

future capital and other expenditures (including the amount. nature

and sources of funding thereof) competitive advantages business

prospects and opportunities. Such forward-looking statements re ect

the Directors' current beliefs and assumptions and are based on

information currently available to the Directors. Many factors

could cause actual results to differ materially from the results

discussed in the forward-looking statements including risks

associated with vulnerability to general economic and business

conditions competition environmental and other regulatory changes

actions by governmental authorities the availability of capital

markets reliance on key personnel uninsured and underinsured losses

and other factors many of which are beyond the control of Cadence

Minerals Plc. Although any forward-looking statements contained in

this announcement are based upon what the Directors believe to be

reasonable assumptions. Cadence Minerals Plc cannot assure

investors that actual results will be consistent with such

forward-looking statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCKZMGMRMRGMZG

(END) Dow Jones Newswires

November 01, 2021 05:01 ET (09:01 GMT)

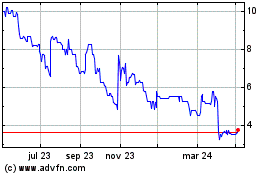

Cadence Minerals (LSE:KDNC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

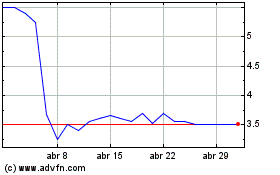

Cadence Minerals (LSE:KDNC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024