Cadence Minerals PLC Result of Placing & Subscription and TVR (5353A)

03 Febrero 2022 - 12:59AM

UK Regulatory

TIDMKDNC

RNS Number : 5353A

Cadence Minerals PLC

03 February 2022

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED

STATES, AUSTRALIA, CANADA, JAPAN, NEW ZEALAND, SOUTH AFRICA OR ANY

OTHER JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR

DISTRIBUTION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

ITSELF CONSTITUTE AN OFFER FOR SALE OR SUBSCRIPTION OF ANY

SECURITIES IN THE COMPANY. THIS ANNOUNCEMENT DOES NOT CONSTITUTE OR

CONTAIN ANY INVITATION, SOLICITATION, RECOMMENDATION, OFFER OR

ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE OR DISPOSE

OF ANY SECURITIES OF CADENCE MINERALS PLC IN ANY JURISDICTION IN

WHICH ANY SUCH OFFER OR SOLICITATION WOULD BE UNLAWFUL.

Cadence Minerals Plc

("Cadence Minerals", "Cadence" or the "Company")

Result of Placing & Subscription and Total Voting Rights

Cadence Minerals (AIM/AQX: KDNC; OTC: KDNCY) is pleased to

announce that it has successfully raised gross proceeds of GBP4.1

million in an oversubscribed fundraising as announced yesterday

(the "Placing").

A total of 19,512,180 Placing Shares in the Company have been

placed by WH Ireland Limited ("WH Ireland") with new and existing

investors at a price of 20.5 pence per share (the "Issue

Price").

In addition, the Company has secured a further GBP0.1 million

via a direct subscription (the "Subscription") of 487,805 shares at

the Issue Price (the "Subscription Shares").

The fundraise was significantly oversubscribed in both the

Placing and Subscription and the Directors of the Company are

delighted by the support from existing shareholders and new

investors, including institutional investors.

Application will be made to the London Stock Exchange for the

Placing Shares and Subscription Shares to be admitted to trading on

AIM and to the AQSE Growth Market and it is anticipated that

dealings in the Placing and Subscription Shares will commence on

AIM at 8.00 a.m. on 10 February 2022 ("Admission"). The Placing and

Subscription Shares will represent approximately 11.9 per cent. of

the Company's issued share capital following completion of the

Placing ("Enlarged Share Capital"). The Issue Price represents a

discount of approximately 17.1 per cent. to the closing mid-market

price of Cadence's existing ordinary shares of 24.75 pence on 1

February 2022 (being the last business day prior to the

announcement of the Placing yesterday).

Following Admission, the Company's issued and fully paid share

capital will consist of 168,049,083 Ordinary Shares, all of which

carry one voting right per share. The Company does not hold any

Ordinary Shares in treasury. The figure of 168,049,083 Ordinary

Shares may be used by shareholders as the denominator for the

calculation by which they will determine if they are required to

notify their interest in, or a change to their interest in, the

share capital of the Company under the Disclosure Guidance and

Transparency Rules of the Financial Conduct Authority.

Capitalised terms used but not defined in this announcement have

the meanings given to them in the Company's announcement released

earlier today in respect of the Placing unless the context provides

otherwise.

Enquiries:

Cadence Minerals plc +44 (0) 207 440 0647

Andrew Suckling

Kiran Morzaria

WH Ireland Limited (NOMAD & Broker) +44 (0) 207 220 1666

James Joyce / Darshan Patel

Harry Ansell / Daniel Bristowe

Novum Securities Limited (Joint Broker) +44 (0) 207 399 9400

Jon Belliss

This announcement includes inside information as defined in

Article 7 of the UK version of Market Abuse Regulation No. 596/2014

as it forms part of UK law as retained EU law as defined in, and by

virtue of, the European Union (Withdrawal) Act 2018, as amended,

and is disclosed in accordance with the Company's obligations under

Article 17 of those Regulations.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCTTMBTMTIMTAT

(END) Dow Jones Newswires

February 03, 2022 01:59 ET (06:59 GMT)

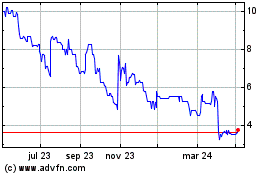

Cadence Minerals (LSE:KDNC)

Gráfica de Acción Histórica

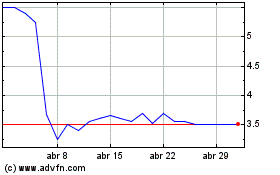

De Mar 2024 a Abr 2024

Cadence Minerals (LSE:KDNC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024