TIDMKDNC

RNS Number : 5570G

Cadence Minerals PLC

30 March 2022

Cadence Minerals Plc

("Cadence Minerals", "Cadence" or "the Company")

Cadence enters into a Conditional Sale Agreement of its 31.5%

Equity Stake in Lithium Technologies and Lithium Supplies

Cadence is pleased to announce that along with all the Lithium

Technologies and Lithium Supplies ("LT and LS") shareholders; we

have reached an agreement to sell 100% of the equity of LT and

LS.

Highlights :

-- Cadence and all LT and LS shareholders have entered into a

conditional agreement to sell 100% of LT and LS for up to A$21.05

million (GBP11.82 million)

-- Cadence owns 31.5% of LT and LS and would receive up to

A$6.63 million (GBP3.72 million)

-- The consideration payable to LT and LS shareholders will be

via a mixture of cash and shares

-- The Buyer will spend a minimum of A$4 million over three

years from the completion of the sale on the exploration of the

Litchfield lithium prospect ("Litchfield") in Northern

Australia.

Cadence CEO Kiran Morzaria commented: "On behalf of the Cadence

board and the other LT and LS shareholders, we are pleased to

report that we have reached a conditional agreement with a public,

unlisted Australian company to sell LT and LS."

"Recent exploration and sampling work at the Litchfield project

and the project's proximity to Core Lithium's assets have led us to

believe that Litchfield has considerable potential to host lithium

mineralisation. In addtion to this the other lithium assets held by

LT and LS provides the Buyer with several attractive targets to

explore and develop."

"For Cadence, this transaction is, we believe, an excellent

balance of risk and reward. Firstly it provides an initial

consideration that more than covers our book investment. Secondly,

by partly paying the consideration in shares in the buyer and cash

payment on milestones we are exposed the the exploration upside.

Lastly, given the commitment of at least A$ 4 million to explore

the primary assets, this mitigates dilution to Cadence

shareholders."

"Moreover, this transaction will also allow our management team

to focus on delivering additional value through our ongoing

involvement in developing our flagship Amapa Iron Ore project.

"

The consideration for LT and LS is up to A$ 21.05 million

(GBP11.82 million). Cadence has 31.5% of LT and LS and would

receive up to A$ 6.63 (GBP3.72 million). The Buyer is a public,

unlisted company in Australia ("Buyer").

LT and LS, through their subsidiaries, are the holders of two

prospective exploration licenses and one exploration application in

Australia and a further seven exploration license applications in

Argentina.

All of the licenses and applications target prospective hard

rock lithium deposits. The most significant of these is the

Litchfield lithium prospect, which is contiguous to Core Lithium's

(ASX: CXO) strategic Finniss Lithium Project (JORC compliant ore

reserves: 7.4Mt @ 1.3% Li2O)2.

The acquisition of LT and LS has several conditions precedent,

including the completion of due diligence and the relevant

regulatory approval. Assuming this is successful, the Buyer will

acquire 100% of LT and LS through a mixture of cash and shares

partially paid on completion of the sale of LT and LS and the

remainder paid on the achievement of key performance

milestones.

The net loss of LT and LS were A$1,560 and A$1,306,

respectively, for the year ended 30 June 2021. As such, the net

loss attributable to the Company (being 31.5% of LT and LS) was

A$903 (GBP516). As of 31 December 2020, the carrying values of LT

and LS in the Company's balance sheet was approximately GBP337,000

and GBP237,000, respectively.

Timing Cash / Shares Share Price Value Approximate

Shares (A$) (A$) value to

KDNC (A$)

Completion of

Sale Cash N/A N/A 1,050,000 330,750

--------- ----------- ------------ ----------- ------------

Completion of

Sale Shares 45,000,000 0.20 9,000,000 2,835,000

--------- ----------- ------------ ----------- ------------

Milestone One

Payment Cash N/A N/A 2,500,000 787,500

--------- ----------- ------------ ----------- ------------

Milestone Two

Payment Cash N/A N/A 2,500,000 787,500

--------- ----------- ------------ ----------- ------------

Milestone Three

Payment Cash N/A N/A 3,000,000 945,000

--------- ----------- ------------ ----------- ------------

Milestone Four

Payment Cash N/A N/A 3,000,000 945,000

--------- ----------- ------------ ----------- ------------

Total 21,050,000 6,630,750

----------- ------------ ----------- ------------

The first three milestone payments are payable once a JORC

resource is of not less than 12 million tonnes of lithium oxide is

proved at Litchfield. The fourth milestone payment is payable on

completing a definitive feasibility study on Litchfield. The Buyer

can also pay the milestones payments in equity, using a defined

pricing mechanism.

The Buyer has committed to spending at least A$4 million on the

exploration of Litchfield during the three years post the

completion of the sale. Should the milestones not be achieved

during this period, the respective consideration will not be

payable.

The proceeds received by the Company will be used for

reinvestment as per our investment strategy, which is available

here . In relation to the shares received as part of the

consideration, the Company will be bound by an escrow agreement

with the Buyer as per the regulatory authorities in Australia and

will be in the form and substance consistent with the ASX Listing

Rules. After the lapse of the escrow arrangement, Cadence will

retain or dispose of these shares as per our investment strategy,

which is available here .

- Ends -

For further information: Cadence Minerals plc +44 (0) 7879 584153

Andrew Suckling

Kiran Morzaria

WH Ireland Limited (NOMAD

& Broker) +44 (0) 207 220 1666

James Joyce

Darshan Patel

Novum Securities Limited

(Joint Broker) +44 (0) 207 399 9400

Jon Belliss

Qualified Person

Kiran Morzaria B.Eng. (ACSM), MBA, has reviewed and approved the

information contained in this announcement. Kiran holds a Bachelor

of Engineering (Industrial Geology) from the Camborne School of

Mines and an MBA (Finance) from CASS Business School.

Forward-Looking Statements:

Certain statements in this announcement are or may be deemed to

be forward-looking statements. Forward-looking statements are

identi ed by their use of terms and phrases such as "believe"

"could" "should" "envisage" "estimate" "intend" "may" "plan" "will"

or the negative of those variations or comparable expressions

including references to assumptions. These forward-looking

statements are not based on historical facts but rather on the

Directors' current expectations and assumptions regarding Cadence

Minerals Plc's future growth results of operations performance,

future capital and other expenditures (including the amount. nature

and sources of funding thereof), competitive advantages business

prospects and opportunities. Such forward-looking statements re ect

the Directors' current beliefs and assumptions and are based on

information currently available to the Directors. Many factors

could cause actual results to differ materially from the results

discussed in the forward-looking statements, including risks

associated with vulnerability to general economic and business

conditions, competition environmental and other regulatory changes

actions by governmental authorities, the availability of capital

markets, reliance on key personnel uninsured and underinsured

losses and other factors many of which are beyond the control of

Cadence Minerals Plc. Although any forward-looking statements

contained in this announcement are based upon what the Directors

believe to be reasonable assumptions. Cadence Minerals Plc cannot

assure investors that actual results will be consistent with such

forward-looking statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGRJMMATMTTJMFT

(END) Dow Jones Newswires

March 30, 2022 02:00 ET (06:00 GMT)

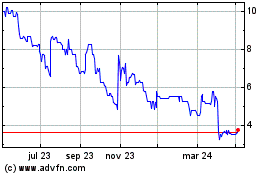

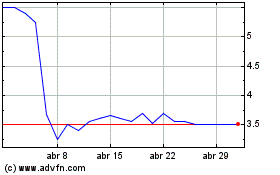

Cadence Minerals (LSE:KDNC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Cadence Minerals (LSE:KDNC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024