TIDMKGF

RNS Number : 4099H

Kingfisher PLC

24 November 2022

Q3 trading update to 31 October 2022

Resilient sales trends continue; Q3 total sales growth +1.7%

3-year LFL +15.3%

24 November 2022: Kingfisher plc ('Company', 'Group' or

'Kingfisher') is today providing its Q3 22/23 sales.

Key points

-- Third quarter sales of GBP3.3bn; total sales +1.7% in constant currency and LFL +0.2%

-- Sales significantly ahead of pre-pandemic performance (3-year

LFL +15.3%), supported by continued market share gains

-- Good start to trading in the fourth quarter with 3-year LFL +

16.2 % and LFL +2.8 % for the three weeks to 19 November 2022

-- Strong energy efficiency product demand supporting DIY sales

-- Trade customers continuing to see robust pipelines; strong

TradePoint performance (LFL +1.9% and 3-year LFL +29.5%), and

Screwfix gaining significant market share in the UK

-- Opened first two Screwfix store s in France; meaningful

step-up in store roll-outs planned for 2023

-- Strong omni-channel engagement with e-commerce sales 3-year

growth of +138 % (YoY growth of +2.3%) ; representing 16 % of Group

sales (Q3 19/20: 8 % ). Continued growth of B&Q marketplace in

Q3, and successful marketplace launches in Spain and Portugal

-- Continuing to deliver value to customers whilst managing inflation pressures effectively

-- Good product availability and effective supply chain management

-- Anticipate FY 22/23 adjusted pre-tax profit in the range of c.GBP730m to GBP760m(1)

Unaudited Q3 22/23 sales (three months ended 31 October

2022)

Sales % Total % Total % LFL % 3-year LFL

2022/23 Change Change Change( (2) () Change( (3) ()

------------------------- --------- --------- ------------------ ------------------ ------------------

GBPm Reported Constant currency Constant currency Constant currency

UK & Ireland 1,545 +0.1% +0.1% ( 2.3 )% +12.9 %

- B&Q 935 ( 2.8 )% ( 2.7 )% ( 3.5 )% +13.1 %

- Screwfix 610 +4.8% +4.9% ( 0.5 )% +12.4 %

France 1,097 ( 1.2 )% +0.6% +0.5% +14.6 %

- Castorama 564 ( 0.9 )% +0.8% +0.8% +16.6 %

- Brico Dépôt 533 ( 1.5 )% +0.2% +0.2% +12.7 %

Other International 621 + 5.1 % +8.4 % +6.7 % +23.1 %

- Poland 447 + 6.6 % +10.5 % +7.6 % +21.3 %

- Iberia( (4) () 91 +1.6% +3.4% +3.4% +19.8 %

- Romania 80 +2.3% +4.2% +4.2 % +34.6 %

- Other( (5) () 3 n/a n/a n/a n/a

Total Group 3,263 +0.6% +1.7% +0.2% +15.3 %

------------------------- --------- --------- ------------------ ------------------ ------------------

Thierry Garnier, Chief Executive Officer, said:

"Our sales trends continued to be resilient, with like-for-like

sales 15.3% ahead of pre-pandemic levels in the quarter. This was

supported by continued market share growth, including strong gains

at Screwfix, TradePoint and Castorama Poland. While the market

backdrop remains challenging, DIY sales continue to be supported by

new industry trends such as more working from home and a clear

step-up in customer investment in energy saving and efficiency.

DIFM and trade activity also continues to be well supported by

robust pipelines for home improvement work.

"Competitive pricing remains a priority. With our customers

facing rising living costs, we are determined to make home

improvement affordable and accessible - particularly through our

own exclusive brands which represent 45% of our sales.

"We continue to execute our strategy at pace, and to invest for

growth. Last month marked a key moment in our history with the

opening of our first Screwfix store in France, with a total of four

to five stores due to open this financial year and many more

planned for 2023. We launched our e-commerce marketplace in Spain

and Portugal, building upon the early success of B&Q's

marketplace in the UK. We have also launched energy-saving tools in

the UK and France, to help customers diagnose and access products

and services to increase the efficiency of their homes ahead of the

winter. We have seen a very positive take-up of these services so

far, with B&Q, for example, taking nearly 1,000 appointment

bookings within the first three days of launch.

"While we continue to be vigilant against macroeconomic

uncertainty, we remain confident in both the resilience of our

industry and in continuing to grow ahead of our markets."

Current trading and outlook

The fourth quarter has started well, with good trading momentum.

For the three weeks to 19 November 2022(6) LFL sales were +2.8 %

and + 16.2 % on a 3-year basis. Sales remain resilient across our

customer segments (DIY and DIFM/trade) and banners, with ongoing

strength in energy efficiency product sales and demand from the

trade segment.

Looking ahead, we remain mindful of the current backdrop of

heightened macroeconomic uncertainty. We continue to focus on

offering customers value at all price points, whilst also managing

inflationary pressures effectively. We are confident in our diverse

and resilient business model, and our priority remains consistent

execution against our strategy to drive top line and market share

growth. Furthermore, we remain committed to active and responsive

management of our costs, and are on track with our plans to sell

through a large part of the 'buffer' stock held as of 31 July

2022.

Regarding our profit guidance for this year, we anticipate FY

22/23 adjusted pre-tax profit to be in the range of c.GBP730m to

GBP760m (1) . This includes additional P&L investments to

strengthen our Screwfix France store opening plan, additional wage

support for colleagues, and slightly higher energy costs.

Additional financial guidance for FY 22/23 is provided on page 4 of

this announcement.

Q3 trading highlights

All commentary below is in constant currency.

UK & IRELAND

Total sales +0.1% (LFL - 2.3% ; 3-year LFL + 12.9 % ) , with

trading in Q3 adversely impacted by the abnormally warmer weather

in October. Store closures across the UK in relation to Her

Majesty's funeral impacted UK & Ireland LFL sales in Q3 by

-0.6%.

-- B&Q sales -2.7%. LFL -3.5% (3-year LFL +13.1%), with

sales in line with expectations across all categories. In

particular, building & joinery continues to see strong

momentum, with a positive LFL supported by demand from trade

customers and from high demand of insulation. Showroom sales

performed well in the quarter, with resilient demand in the

bathroom & storage category. Whilst outdoor sales were down YoY

given a strong comparative from the prior year's clearance

activity, sales remain strong versus pre-pandemic levels. Overall,

LFL sales of weather-related categories were -11.5% (+14.6% on a

3-year LFL basis). LFL sales of non-weather-related categories were

-1.9% (+11.6% on a 3-year LFL basis). B&Q's total e-commerce

sales moved into positive YoY growth in Q3, driven by its

marketplace proposition which continues to see strong growth since

its launch in March. Marketplace reached a penetration of 13% in

October (i.e., B&Q's marketplace gross sales divided by

B&Q's total e-commerce sales). TradePoint, B&Q's

trade-focused banner, continued to outperform with LFL sales +1.9%

and 3-year LFL sales +29.5%. TradePoint sales were 23% of B&Q

sales (Q3 21/22: 22%).

-- Screwfix sales +4.9%. LFL -0.5% (3-year LFL +12.4%), with

demand from trade customers supporting a strong YoY performance in

the building & joinery and bathroom & storage categories.

The business saw resilient sales from its tools & hardware and

EPHC (electricals, plumbing, heating & cooling) categories.

Screwfix opened 17 new stores in Q3 in the UK and Republic of

Ireland, with 48 new stores opened in the year to date, and remains

on track to open 80 new stores in these countries during this

financial year. In addition, Screwfix opened its first two stores

in France (in October and November respectively), with a total of

four to five openings planned for this financial year. Note that

the results of Screwfix France are recorded within the 'Other

International' division.

FRANCE

Total sales +0.6 % (LFL +0.5%; 3-year LFL +14.6%). The home

improvement industry in France was adversely impacted by abnormally

warmer weather in October, as well as strikes across petrol

stations in France affecting customer footfall.

-- Castorama sales +0.8%. LFL +0.8% (3-year LFL +16.6%),

reflecting resilient sales from both DIY and DIFM/trade customers.

Most categories saw good 3-year growth, with sales from the

building & joinery and EPHC categories particularly strong YoY,

and with the latter seeing robust growth in heating products and

more energy-efficient solutions. LFL sales of weather-related

categories were +2.9% (+30.8% on a 3-year LFL basis). LFL sales of

non-weather-related categories were flat (+13.2% on a 3-year LFL

basis).

-- Brico Dépôt sales +0.2 %. LFL +0.2% (3-year LFL +12.7%),

reflecting resilient sales and YoY growth from most categories. The

business achieved strong YoY and 3-year growth across EPHC and

building & joinery through an impressive performance in

insulation sales. Brico Dépôt continues to drive increased customer

engagement and improved price perception, as the business focuses

on further strengthening its discounter credentials and

differentiating its ranges.

OTHER INTERNATIONAL

-- Poland sales +10.5%. LFL +7.6% (3-year LFL +21.3%), supported

by strong market share gains. Positive LFL and strong 3-year

performance across all categories, with exceptional growth in the

kitchen category supported by the development of our new ranges and

customer journey. LFL sales of weather-related categories were

+21.7% (+45.3% on a 3-year LFL basis). LFL sales of

non-weather-related categories were +5.2% (+17.7% on a 3-year LFL

basis). A further two new stores opened in Poland in Q3, with five

new stores opened in the year to date.

-- Iberia sales +3.4%. LFL +3.4% (3-year LFL +19.8%), supported

by strong growth in seasonal categories, especially in outdoor and

EPHC given the extended heatwave across August. Good 3-year

performance in the building & joinery, outdoor and EPHC

categories.

-- Romania sales +4.2%. LFL +4.2% (3-year LFL +34.6%),

reflecting robust sales across most categories with notable

strength in kitchens and surfaces & décor.

FY 2022/23 Technical guidance

New guidance, or significant updates to our previous guidance,

are noted below in italics . Please refer to page 6 for further

details regarding forward-looking statements.

Income statement:

-- Space

- Net space growth to impact total sales by c.+1.5% , largely from Screwfix and Poland

-- Gross margin %

- In line with pre-pandemic level (FY 19/20: 37.0%)

-- New businesses

- 'Other' retail losses of c.GBP35m (FY 21/22: GBP10m) (previous

guidance c.GBP30m, with increase driven by additional investment in

Screwfix France) . 'Other' consists of the consolidated results of

Screwfix International, NeedHelp, and franchise agreements,

recorded within the 'Other International' division

- Retail loss of c.GBP5m in relation to investment in B&Q's

e-commerce marketplace, recorded within the results of B&Q in

the 'UK & Ireland' division

-- Central costs

- Broadly flat YoY (FY 21/22: GBP60m)

-- Net finance costs

- Decrease by c.GBP20m mainly as a result of lower interest

expense on lease liabilities (FY 21/22: GBP137m)

-- Adjusted pre-tax profit

- Full year adjusted pre-tax profit in the range of c.GBP730m to

GBP760m(1) (previously c.GBP770m, with trading scenarios for the

balance of H2 providing a potential range of outcomes of c.GBP730m

to GBP770m)

-- Tax rate

- Group adjusted effective tax rate of c.22% (7) (FY 21/22: 22%)

Balance sheet and cash flow:

-- Inventory - anticipate reduction of stock levels in H2 22/23

related to sell-through of a large part of 'buffer' stock

previously held to protect product availability

-- Capital expenditure - targeting gross capex of c.3.5% of

total sales (FY 21/22: GBP397m; c.3.0% of total sales)

-- Tax - in February 2022, a payment of EUR40m (c.GBP34m) was

made to the French tax authorities with regards to a historic tax

liability. The amount was fully provided for in prior periods

-- Share buybacks - c.GBP315m outflow for share buybacks

(c.GBP145m for the first GBP300m programme completed in April, and

a further c.GBP170m related to the second GBP300m programme )

(previous guidance c.GBP325m outflow)

-- Dividends - GBP246m outflow for dividends (GBP172m related to

the FY 21/22 final dividend of 8.60p, and GBP74m related to the FY

22/23 interim dividend of 3.80p). For the total dividend in respect

of FY 22/23, our dividend policy target cover range remains 2.25 to

2.75 times, based on adjusted basic earnings per share

Footnotes

(1) Guidance assumes current exchange rates.

(2) LFL (like-for-like) sales growth represents the constant

currency, year on year sales growth for stores that have been open

for more than one year. Stores temporarily closed or otherwise

impacted due to COVID are also included.

(3) 3-year LFL is calculated by compounding the current and

prior two periods' LFL growth. For example, Q3 22/23 LFL growth of

5%, Q3 21/22 LFL growth of 4%, and Q3 20/21 LFL growth of 3%,

results in 3-year LFL growth of 12.5%. Russia (sale completed on 30

September 2020) is excluded from Group and Other International

3-year LFL calculations.

(4) Brico Dépôt Spain and Portugal.

(5) 'Other' consists of the consolidated results of Screwfix

International, NeedHelp, and revenue from franchise agreements.

(6) 'Q4 22/23 LFL sales (to 19 November 2022 )' represents the

period from 30 October 2022 to 19 November 2022 compared against

the equivalent period in the prior year (i.e., 31 October 2021 to

20 November 2021). The corresponding 3-year LFL represents the

period 30 October 2022 to 19 November 2022 compared against the

equivalent period in FY 19/20 (i.e ., 3 November 2019 to 23

November 2019 ). The figures are provisional and exclude certain

non-cash accounting adjustments relating to revenue

recognition.

(7) Subject to the blend of profit within the Group's various

jurisdictions.

Contacts

Tel: Email:

Investor Relations +44 (0) 20 7644 investorenquiries@kingfisher.com

1082

Media Relations +44 (0) 20 7644 corpcomms@kingfisher.com

1030

Teneo +44 (0) 20 7420 kfteam@teneo.com

3184

Q3 trading update and data tables

This announcement and data tables for Q3 22/23 sales can be

downloaded from www.kingfisher.com/investors .

We can be followed on Twitter (@kingfisherplc) with the Q3

results tag #KingfisherResults.

Full year 22/23 results

Our next scheduled results announcement will be our results for

the year ending 31 January 2023, on 21 March 2023.

American Depository Receipts

Kingfisher American Depository Receipts are traded in the US on

the OTCQX platform: (OTCQX: KGFHY)

http://www.otcmarkets.com/stock/KGFHY/quote .

About Kingfisher plc

Kingfisher plc is an international home improvement company with

approximately 1,530 stores, supported by a team of over 80,000

colleagues. We operate in eight countries across Europe under

retail banners including B&Q, Castorama, Brico Dépôt, Screwfix,

TradePoint and Koçta . We offer home improvement products and

services to consumers and trade professionals who shop in our

stores and via our e-commerce channels. At Kingfisher, our purpose

is to help make better homes accessible for everyone.

Forward-looking statements

You are not to construe the content of this announcement as

investment, legal or tax advice and you should make your own

evaluation of the Company and the market. If you are in any doubt

about the contents of this announcement or the action you should

take, you should consult a person authorised under the Financial

Services and Markets Act 2000 (as amended) (or if you are a person

outside the UK, otherwise duly qualified in your jurisdiction).

This announcement has been prepared in relation to sales for the

quarter ended 31 October 2022. The financial information referenced

in this announcement is not audited and does not contain sufficient

detail to allow a full understanding of the results of the Group.

Nothing in this announcement should be construed as either an offer

or invitation to sell or any offering of securities or any

invitation or inducement to any person to underwrite, subscribe for

or otherwise acquire securities in any company within the Group or

an invitation or inducement to engage in investment activity under

section 21 of the Financial Services and Markets Act 2000 (as

amended) (or, otherwise under any other law, regulation or exchange

rules in any other applicable jurisdiction).

Certain information contained in this announcement may

constitute "forward-looking statements" (including within the

meaning of the safe harbour provisions of the United States Private

Securities Litigation Reform Act of 1995), which can be identified

by the use of terms such as "may", "will", "would", "could",

"should", "expect", "anticipate", "project", "estimate", "intend",

"continue", "target", "plan", "goal", "aim", forecast, or "believe"

(or the negatives thereof) or other variations thereon or

comparable terminology. These forward-looking statements are based

on currently available information and our current assumptions,

expectations and projections about future events. These

forward-looking statements include all matters that are not

historical facts and include statements which look forward in time

or statements regarding the Company's intentions, beliefs or

current expectations and those of our Officers, Directors and

employees concerning, amongst other things, the Company's results

of operations, financial condition, changes in global or regional

trade conditions (including a downturn in the retail or financial

services industries), competitive influences, changes in tax rates,

exchange rates or interest rates, changes to customer preferences,

the state of the housing and home improvement markets, share

repurchases and dividends, capital expenditure and capital

allocation, liquidity, prospects, growth and strategies, litigation

or other proceedings to which we are subject, acts of war or

terrorism worldwide, work stoppages, slowdowns or strikes, public

health crises, outbreaks of contagious disease (including but not

limited to the COVID pandemic) , environmental disruption or

political volatility. By their nature, forward-looking statements

are not guarantees of future performance and are subject to future

events, risks and uncertainties - many of which are beyond our

control, dependent on actions of third parties, or currently

unknown to us - as well as

potentially inaccurate assumptions that could cause actual

events or results or actual performance of the Group to differ

materially from those reflected or contemplated in such

forward-looking statements. For further information regarding risks

to Kingfisher's business, please consult the risk management

section of the Company's Annual Report (as published). No

representation, warranty or other assurance is made as to the

achievement or reasonableness of, and no reliance should be placed

on, such forward-looking statements.

The forward-looking statements contained in this announcement

speak only as of the date of this announcement and the Company does

not undertake any obligation to update or revise any

forward-looking statement to reflect any new information, change in

circumstances, or change in the Company's expectations to reflect

events or circumstances after the date of this announcement or to

reflect the occurrence of unanticipated events.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUOABRUOUAUAA

(END) Dow Jones Newswires

November 24, 2022 02:00 ET (07:00 GMT)

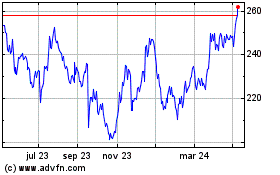

Kingfisher (LSE:KGF)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

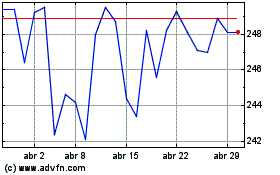

Kingfisher (LSE:KGF)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024