TIDMKIBO

RNS Number : 1174A

Kibo Energy PLC

21 September 2022

Kibo Energy PLC (Incorporated in Ireland)

(Registration Number: 451931)

(External registration number: 2011/007371/10)

Share code on the JSE Limited: KBO

Share code on the AIM: KIBO

ISIN: IE00B97C0C31

("Kibo" or "the Company")

Dated: 21 September 2022

Kibo Energy PLC ('Kibo' or the 'Company')

Kibo Bolsters its Renewable Energy Strategy with Acquisition of

Advanced UK Waste to Energy Project

Kibo Energy PLC (AIM: KIBO; AltX: KBO) ('Kibo' or the

'Company'), the renewable energy focused development company, is

pleased to announce that it has signed a definitive Share Purchase

Agreement (the 'SPA') to acquire a 100% interest in a waste

reception, Anaerobic Digestor ("AD") and CHP power plant

('Southport' or 'the Project') at Merseyside, United Kingdom.

The acquisition of Southport, a 12MW waste-to-energy project in

the UK, is in line with the Company's refocused strategy to acquire

and develop an energy portfolio centered around sustainable

renewable / clean energy solutions and opportunities, as detailed

in a Company RNS dated 19 April 2021.

Highlights of the Southport SPA:

-- Kibo Energy will acquire 100% of the total issued share

capital of Shankley Biogas Ltd ("Shankley"), which is developing

the Project and who will also be responsible for the construction

and operation of the Project.

-- Southport, an AD and power plant at Mersey Side in the UK,

comprises an 80,000 tonne waste-reception center, with AD

technology that is set to produce 5.5 million m (3) of bio-methane

per annum with a 10 MW installed Combined Heat and Power ("CHP")

plant plus planned 2MW battery storage.

-- Project rights include all technology license agreements,

equipment supply and maintenance agreements, and related project

documentation.

-- The transaction consideration is GBP600,000, payable as

GBP350,000 in ordinary shares of Kibo at an issue price equal to

the 20-day volume-weighted average price ('VWAP') of the 20 days

preceding the closing date of the acquisition, and GBP250,000 in

cash to be paid as GBP50,000 within 14 days of the closing date, an

amount of GBP75,000 on the earlier of the date on which the new

board of directors of Shankley shall have approved a final

financial model and project investor memorandum for debt and

project funding following the closing date, or on financial close,

and GBP125,000 on reaching financial close.

-- Shankley Biogas Ltd has negotiated a Power Purchase Agreement

('PPA') and a Gas Purchase Agreement ('GPA') term sheet on

favourable terms with a blue-chip buyer.

-- The Project has full planning permission as well as grid and

gas connection points already in place.

-- Based on independent financial estimates, prepared by

reputable and appropriately accredited consulting firm, the

projected valuation metrics for the Project are summarised as

follows:

- Internal rate of return ('IRR') of c. 22.78%

- Net Present Value (6%) ('NPV') of c. GBP47 million

- Net Asset Value ('NAV') of c. GBP22 million

- Projected average annual revenue of c. GBP24 million over a

25-year term.

- Estimated Operating margin c. 38%

- Capital estimated of c. GBP.35m

The above financial projections have been provided by Shankley

and its consultants. Whilst these figures have been reviewed by

Kibo, following completion of the transaction further review is

ongoing and these estimates remain subject to change.

Louis Coetzee, CEO of Kibo Energy, says: "We believe this

opportunity supports our strategic intent to significantly advance

and accelerate the development of the Company's renewable energy

portfolio in the United Kingdom. The project further deliberately

and actively drives Kibo's transition from fossil fuel-based energy

solutions to sustainable renewable energy solutions and will now

bring our waste-to-energy ('WTE') portfolio to an aggregate of

c.140,000 MWh per annum, with this entire capacity expected to go

into production over the next 12 to 18 months. The Company

furthermore expects to further advance its renewable / clean energy

portfolio with the ongoing work related to converting its existing

energy projects in Tanzania, as announced in a Company RNS dated 27

May 2022.

This is indeed an exciting new chapter in the business, one that

aligns with the UK's move to an electricity system that is secure,

affordable and employs increasing amounts of variable renewable

energy generation options, as stated in the 2016 report by the

Carbon Trust, in collaboration with the Imperial College, 'An

Analysis of Electricity System Flexibility for Great Britain'".

The Project

Southport is located at Merseyside in Northwest England, United

Kingdom, and comprises a waste-reception centre designed to accept

up to 80,000 tonnes of 'trommel fines' (also known as municipal

solid waste or 'MSW fines') per annum. The waste reception centre

and power plant utilise anaerobic digestion technology that will

create 5.5 million cubic metres (m (3) ) of bio-methane combined

with a 10 MW CHP plant. The primary purpose of the plant will be to

produce an organic fraction from the incoming waste, which will be

processed through anaerobic digestion to generate bio-methane that

will, in turn, be exported to the UK's national gas grid network.

The CHP plant will generate electricity to be utilized for internal

usage of the AD facility (c.2 MW) and to be exported to the local

grid (c.8 MW). Southport is also planning a 2MW battery storage

facility.

The Transaction

The Company continues to advance its strategy to rapidly grow

its renewable energy portfolio and capitalise on sustainable growth

that will deliver long-term value for shareholders. In line with

this, the Company has signed an SPA to acquire the Southport waste

gasification and power plant.

Under the terms of the Agreement, Kibo Energy will acquire 100%

of Shankley Biogas Ltd, including all its rights and obligations

for the development, construction and operation of Southport. The

purchase consideration is GBP600,000 with GBP350,000 payable as

ordinary shares of the Company at an issue price equal to the

20-day volume-weighted average price ('VWAP') of the 20 days

preceding the closing date of the acquisition. The balance of

GBP250,000 payable in cash, is to be paid as GBP50,000 within 14

days of the closing date, an amount of GBP75,000 on the earlier of

the date on which the new board of directors of Shankley shall have

approved a final financial model and project investor memorandum

for debt and project funding following the closing date, or on

financial close, and GBP125,000 on reaching financial close.

Project rights include all technology license agreements, all

equipment supply and maintenance agreements, held by Shankley

Biogas Ltd. This includes the agreed projects configuration ('scope

of work') with Anaergia Ltd, a global technology and process

engineering company that provides integrated solutions and

technologies for the processing of waste streams. The scope of work

includes the full engineering, procurement and construction of the

Southport plant based on a fixed-price, lump-sum contract for the

capital works scope and a separate minimum five-year duration

contract to technically operate the Southport plant in its

entirety.

In addition to negotiating a Power Purchase Agreement ('PPA')

and a Gas Purchase Agreement ('GPA') term sheet on favourable terms

with a blue-chip buyer, Shankley Biogas Ltd has already secured

import and export grid connection points for both gas and

electricity. The Project furthermore has planning permission in

place that considers the ecological, safety and sustainable

improvements as well as development of the local environment.

Shankley Biogas Ltd as at 31 December 2020 had total assets of

GBP66,339 and total net liabilities of GBP650. Losses of GBP750

were noted in the 12 months to 31 December 2020.

Important Information for Shareholders

Kibo shareholders should be aware that all financial numbers as

stated herein remain subject to change until such a time as actual

production figures are available, following a suitable period of

steady state operation. The projected returns are also subject to

Project funding being secured on terms in line with the Board's

current expectation on equity, debt levels and rates, in which case

the Project's returns, as set out above, could be materially

impacted.

**S**

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014 and is

announced in accordance with the Company's obligations under

Article 17 of the specified Regulation.

For further information please visit www.kibo.energy or

contact:

Louis Coetzee info@kibo.energy Kibo Energy PLC Chief Executive Officer

Andreas Lianos +357 99 53 1107 River Group JSE Corporate and Designated

Adviser

-------------------------------- ----------------------- -----------------------------

Claire Noyce +44 (0) 20 3764 2341 Hybridan LLP Joint Broker

-------------------------------- ----------------------- -----------------------------

Damon Heath +44 207 186 9952 Shard Capital Partners Joint Broker

LLP

-------------------------------- ----------------------- -----------------------------

Bhavesh Patel +44 20 3440 6800 RFC Ambrian Ltd NOMAD on AIM

/ Stephen

Allen

-------------------------------- ----------------------- -----------------------------

Zainab Slemang zainab@lifacommunications.co.za Lifa Communications Investor and Media Relations

van Rijmenant Consultant

-------------------------------- ----------------------- -----------------------------

Johannesburg

21 September 2022

Corporate and Designated Adviser

River Group

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQQFLBLLKLXBBZ

(END) Dow Jones Newswires

September 21, 2022 02:45 ET (06:45 GMT)

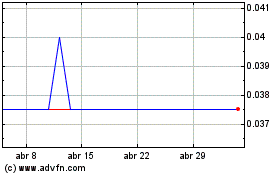

Kibo Energy (LSE:KIBO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Kibo Energy (LSE:KIBO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024