TIDMKNB

RNS Number : 8673P

Kanabo Group PLC

22 October 2021

Kanabo Group PLC

Half Yearly Report (Unaudited)

For the Period Ended 30 June 2021

Kanabo Group plc ("Kanabo" or the "Company") announces today its

Interim results for the period ended 30 June 2021.

Period Highlights

-- The company completed the Reverse Take-Over of Kanabo

Research Ltd on 16 February 2021 and raised GBP6.0 million gross

through a placing and subscription. For additional information

regarding the Reverse Take-Over transaction refer to note 7.

-- On 24 May 2021, the company raised an additional GBP1.0

million and used GBP750,000 of the funds to make a Pre-IPO

acquisition investment in Hellenic Dynamics S.A.

-- A further GBP374,000 was raised during the period from the exercise of warrants.

-- The Company's cash balance at the end of the period was GBP5.9 million.

Post-Period Highlights

-- In July 2021, Kanabo signed a non-binding term sheet with

Materia, to acquire Materia's European businesses. The proposed

acquisition is to be fully satisfied through the issue of Kanabo

shares.

-- The first shipment of medical cannabis cartridges for

distribution through LYPHE Group clinics and dispensaries was

delivered.

Kanabo Group Plc

Meirav Horn Via Vox Markets

Peterhouse Capital Ltd

Eran Zucker / Guy Miller (Financial Tel: +44 (0)20 7469 0930

Adviser)

Lucy Williams / Charles Goodfellow Tel: +44 (0)20 7469 0930

(Corporate Broker)

Vox Markets (Investor Relations)

Kat Perez KanaboGroup@voxmarkets.co.uk

About Kanabo Group Plc

Kanabo Group Plc is an R&D company currently selling a range

of THC-Free Retail CBD Products in the Primary Markets and is in

the process of developing further Medical Cannabis Products. The

company's core strategy is to increase revenues from the sale of

its Retail CBD Products in the wellness sector and to grow the

Kanabo brand through its marketing initiatives. Learn more here;

https://www.voxmarkets.co.uk/listings/LON/KNB/

Chairman's Review

This has been an exciting half year for Kanabo. Our reverse

takeover of Kanabo Research Limited was successfully completed on

16 February 2021 and the Company raised gross proceeds of GBP6M.

Additionally, on 24 May 2021 the company raised GBP1M to fund a

Pre-IPO acquisition investment in Hellenic Dynamics S.A.

The Board remains committed to executing our strategy of leading

the global evolution of the cannabis industry by building an

integrated platform that will generate value from new product

development through to production and distribution. Thanks to the

steadfast commitment and dedication of our people, we are making

significant progress in the execution of this strategy.

We have also strengthened our board with the appointment of Dr

Daniel Poulter MP as a Non-Executive Director. Daniel's knowledge

and insight into, both, UK health service provision, and cannabis

regulation has been (and will continue to be) invaluable to the

Board.

The Company's pre-revenue status is reflected in the operating

loss of GBP1.2m for the six-month period under review as it

continued to lay the foundations for a successful full year and

beyond. The total loss for this period was GBP2.4m, largely due to

the one-off costs associated with the reverse acquisition.

Our balance sheet is strong and the Company finished the period

with cash reserves of GBP5.9m as of 30 June 2021.

Strategy Summary

Leading the global evolution of the medical cannabis industry

by building an integrated platform that will generate value

from product development through to production and distribution.

PRODUCT DEVELOPMENT Kanabo's research centre in Israel is a fully licensed

lab for the development of medical devices and medical

cannabis formulations. The Company focuses on the

development of new innovative delivery methods and

cannabis formulations for specific indications.

-------------------------------------------------------------

PRODUCTION Kanabo will continue to build relationships with

production partners to ensure the supply of our products

to the Company's key markets. Kanabo provides its

production partners with the necessary know-how,

IP and production protocol in addition to the production

equipment. Integral to this is the retention of full

control over all aspects of product quality via 3rd

party testing of raw materials and end products.

-------------------------------------------------------------

SUPPLY CHAIN The Company continues to develop its strategic relationships

& with cultivators of high quality which provide sustainable

DISTRIBUTION and consistent raw materials. This will ensure the

Company is able to secure the supplies needed, without

becoming a cultivator.

Kanabo will establish multiple channels in its primary

markets both in the wellness and the medical markets.

The Company believes that having significant control

over the 'last-mile' is key for brand building and

sustainable growth.

-------------------------------------------------------------

Highlights

PRODUCT DEVELOPMENT On 22 September 2021 the company launched a new wellness

product line in the UK's CBD market. The product

was developed in Kanabo's research centre and is

patent pending. Kanabo's unique IP is based on a

formulation that can improve sleep quality, promote

calmness, and may ease discomfort.

In addition, the Company developed and launched the

first medical cannabis vape formula in the UK, that

will initially target pain management. It is based

on a formula developed and tested in Israel.

Our Partnership Agreement with Jupiter Research to

license Jupiter's technology for the VapePod device

has also moved forward even though physical audits

for medical device certifications during the COVID-19

pandemic have been severely limited. Progress has

been made having completed the first successful audit;

the producer obtained the ISO 13485:2016 certification

of its Quality Management System for medical devices,

a crucial step in meeting the requirements. The company

is expected to have the second audit stage commence

in the near future.

-------------------------------------------------------------

PRODUCTION PharmaCann

On 9 March 2021, the Company signed a Joint Venture

with PharmaCann Polska. PharmaCann, based in Warsaw,

is a part of the PHCANN International Group and has

a fully licensed medical cannabis compound in Skopje,

North Macedonia. The compound comprises both an indoor

cultivation facility and an EU-GMP standard extraction

facility for the production of products based on

cannabinoids.

The Joint Venture establishes Kanabo's first medical

cannabis production line in the EU with initial production

capacity of up to 36,000 cartridges per month, and

the ability to further increase production when necessary.

Pure Origin

On 20 May 2021, the Company signed a supply agreement

with Pure Origin Ltd and its affiliates to manufacture,

package and deliver the Kanabo wellness product line

from their EU GMP licensed facility in Wales.

Under the agreement, Pure Origin will establish a

dedicated production line with an initial capacity

of 44,000 units a month and the ability to further

increase production when necessary.

The PharmaCann and Pure Origin relationships add

significant production capacity to the CBD wellness

business while retaining full control over product

quality and distribution of Kanabo's tamper proof

cartridges.

-------------------------------------------------------------

SUPPLY CHAIN Hellenic

& DISTRIBUTION

On May 24, 2021, the Company completed a strategic

investment in Hellenic Dynamics S.A ("Hellenic").

Hellenic is a medical cannabis cultivator with a

substantial facility in Northern Greece. This investment

(GBP750,000) is a precursor to, subject to regulatory

approvals, a preferred supply agreement for up to

1,000kg per year of EU GMP certificated cannabis

flowers with pre-defined THC or CBD contents.

Medocan

On October 7,2021, the Company concluded a strategic

development agreement with Medocann Pharma Ltd..

Under this agreement the parties will combine Kanabo's

preclinical data on the effect of cannabis on different

illnesses with Medocann's genetics bank, breeding

and strain development expertise.

Medocann is an established producer of medical-grade

cannabis products with an indoor hydroponic facility

located in central Israel and a library of proprietary

cannabis genetics all grown in a fully controlled

environment, without the use of pesticides or insecticides.

Medocann has an IMC GAP license for commercial propagation

and commercial cultivation and is currently selling

their premium products in Israel.

Astral Health

On 23 February 2021, Kanabo signed its first UK medicinal

cannabis distribution agreement. Astral Health Limited

(part of LYPHE Group) will distribute Kanabo's VapePod

medicinal cannabis formula under the brand NOIDECS.

-------------------------------------------------------------

Looking ahead

On 26 July 2021, Kanabo announced the proposed acquisition of

Materia to be satisfied wholly through the issue of Kanabo shares.

This will be a transformational acquisition for Kanabo, bringing

senior level management expertise in the cannabis agri-chem

industry and an EU GMP licensed production facility in Malta from

which the Company intends to supply its key markets including

Germany and the UK.

The facility in Malta has the ability to process around 6,000kg

of cannabis flowers from dozens of cultivators which, at capacity

and based on current market rates, could deliver revenues of around

GBP30M per annum.

The growing relationship between Kanabo and Materia has already

borne fruit with the launch of Kanabo's products on one of the

leading online marketplaces for CBD, HandpickedcCBD.com, which is

wholly owned by Materia.

Whilst the nature and structure of this acquisition makes it

particularly complex, I am pleased to report that good progress is

being made.

In addition to the acquisition of Materia, the Company is also

pursuing other opportunities with the potential to add supply and

production capacity or to expand Kanabo's routes to markets.

Thank you for your support of our company. I look forward to

updating you again in the near future.

Non-Executive Chairman

David Tsur

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The Directors confirm that these condensed consolidated interim

financial statements have been prepared in accordance with

International Accounting Standard 34, 'Interim Financial Reporting'

as adopted by the United Kingdom and that the interim management

report includes a fair review of the information required by DTR

4.2.7 and DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months and their impact on the condensed set of

financial statements, and a description of the principal risks and

uncertainties for the remaining six months of the financial year;

and

-- material related-party transactions in the first six months

and any material changes in the related-party transactions

described in the last annual report.

STATEMENTS OF FINANCIAL POSITION

June 30 December

31

-----------

2021 2020 2020

----- ---- --------

Unaudited Audited

---------------------

Note GBP '000

---- ---------------------

ASSETS

NON-CURRENT ASSETS:

Property, plant and equipment 34 17 13

Long term deposits 13 16 14

Investment 8 750 - -

-

----- ---- --------

797 33 27

----- ---- --------

CURRENT ASSETS:

Cash and cash equivalents 5,945 429 380

Short-term deposit 7 5 5

Trade receivables 4 3 -

Other accounts receivable 85 19 33

Inventories 59 40 27

6,100 496 445

----- ---- --------

6,897 529 472

===== ==== ========

The accompanying notes are an integral part of the interim

consolidated financial statements.

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

June 30, December

31,

-------------------

2021 2020 2020

--------- -------- ----------

Unaudited Audited

------------------- --------

Note GBP '000

----- --------------------------------

LIABILITIES AND EQUITY

NON-CURRENT LIABILITIES:

Severance pay, net - 3 -

--------- -------- ----------

- 3 -

CURRENT LIABILITIES:

Trade payables 33 5 20

Employee and related payables 95 42 34

Accrued expenses and other accounts

payables 9 120 6 33

Loan - 313 424

248 366 511

--------- -------- ----------

248 369 511

--------- -------- ----------

EQUITY (DEFICIT) ATTRIBUTABLE

TO EQUITY HOLDERS OF THE COMPANY:

Share capital 11 9,213 - -

Share premium 14,189 2,05 9 2,098

Reserve from share-based payment

transactions 267 807 805

Reverse acquisition reserve 7 (12,468) - -

Foreign Currency reserve 30 82 75

Retained earnings (accumulated

deficit) (4,582) (2,788) (3,017)

Total equity (deficit) 6,649 160 (39)

--------- -------- ----------

6,897 529 472

========= ======== ==========

- represent amount less than one GBP

The accompanying notes are an integral part of the interim

consolidated financial statements.

20 October, 2021

-------------------- ---------------

Date of approval David Tzur

of the

financial statements Chairman of the

board

STATEMENTS OF PROFIT OR LOSS

For the

year ended

December

For the 6 months ended 31,

------------------------ ------------

Unaudited Audited

------------------------ ------------

2021 2020 2020

------------- --------- -----------

Note GBP '000

--------------------------------------

Revenue 15 14 60

Cost of Sales (19) 6 26

Gross (loss)/profit (4) 8 34

Research expenses 116 75 149

Selling and marketing expenses 187 75 59

General and administrative expenses 888 200 389

1,191 350 597

------------- --------- -----------

Operating loss (1,195) (342) (563)

Other expense 7 1,172 - -

Finance expenses net. 10 2 28

Loss before Tax (2,377) (344) (591)

Income tax - - -

Loss for the period from continuing

operations (2,377) (344) (591)

------------- --------- -----------

Other comprehensive income

Foreign exchange translation

gains/ (loss) 45 (147) 11

Total items that may be reclassified

to profit or loss 45 (147) 11

------- ----- -----

Total comprehensive income for

the period (2,332) (491) (580)

------- ----- -----

Earnings per share from continuing

operation- pence (1) (159) (274)

------- ----- -----

The accompanying notes are an integral part of the interim

consolidated financial statements

STATEMENTS OF CHANGES IN EQUITY

Share Share Reserve from Retained Reverse Foreign Total

capital premium share-based earnings acquisition exchange equity

payment (accumulated reserve reserve

transactions deficit)

-------- ---------- ------------ ------------ -------

GBP '000

Balance as of

January

1, 2021 - 2,098 805 (3,017) - 75 (39)

Net income

(loss) - - - (2,377) - - (2,377)

Other

comprehensive

income (45) (45)

Exercise of

options - - (812) 812 - - -

Transfer to

reverse

acquisition

reserve - (2,098) - - 2,098 - -

Recognition of

plc equity

at acquisition

date 735 592 - 434 1,761

Issue of shares

for

acquisition

of subsidiary 5,769 9,231 - - (15,000) -

Issue of shares 2,600 4,774 - - - - 7,374

Exercise of

warrants 94 314 - - - - 408

Issue of shares

in settlement

of fees 15 25 - - - - 40

Cost of share

issue - (747) - - - - (747)

Issue of

warrants - - 114 - - - 114

Cost of

share-based

payment - - 160 - - 160

Balance as of

June 30,

2021 9,213 14,189 267 (4,582) (12,468) 30 6,649

======== ========== ============ ============ =========== ========== =======

The accompanying notes are an integral part of the interim

consolidated financial statements.

STATEMENTS OF CHANGES IN EQUITY

Share Share premium Reserve from Retained Foreign exchange Total

Capital share-based earnings reserve Equity

payment (accumulated

transactions deficit)

-------- ------------- --------------- ---------------- -------

Balance as of

January 1, 2020 - 1,831 800 (2,506) 65 190

Net income

(loss) - (344) (344)

Exercise of

options - - (62) 62 -

Exercise of

warrant - 228 228

Cost of

share-based

payment 69 69

Other

comprehensive

loss 17 17

Balance as of

June 30, 2020 - 2,05 9 807 (2,788)) 82 160

-------- ------------- --------------- ---------------- ---------------- -------

Share Share premium Reserve from Retained Foreign exchange Total

Capital share-based earnings reserve Equity

payment (accumulated

transactions deficit)

-------- ------------- ---------------- ---------------- -------

Balance as of

January 1, 2020 - 1,831 800 (2,506) 65 190

Net income (loss) - - - (591) - (591)

Exercise of

options - - (80) 80 - (*

Exercise of

warrant - 267 - - 267

Cost of

share-based

payment 85 85

Other

comprehensive

loss 10 10

Balance as of

December 31,

2020 - 2,098 805 (3,017) 75 (39)

======== ============= ================ ================ ================ =======

The accompanying notes are an integral part of the interim

consolidated financial statements.

STATEMENTS OF CASH FLOWS

For the year

For the six months ended December

ended June 30, 31,

-------------------- ---------------

2021 2020 2020

----------- ------- ---------------

GBP '000

-------------------------------------

Cash flows from operating activities:

Net loss (2,377) (344) (591)

----------- ------- ---------------

Adjustments to reconcile net

income (loss) to net cash provided

by (used in) operating activities:

Adjustments to the profit or

loss items:

Depreciation and amortization 1 3 5

Finance expense (income), net 11 7 18

Professional fees redeemed by

shares 40

Cost of share-based payment 160 68 85

Reverse acquisition share-based

payment expense 1,172 - -

Loss from sale of property,

plant and equipment - - 1

1,384 78 109

----------- ------- ---------------

Changes in asset and liability

items:

Increase in trade receivable

and other accounts receivable (50) (5) (16)

(Increase)/Decrease in inventories (32) (2) 9

(Decrease)/Increase in trade

payable and other accounts payable 48 (55) (17)

Increase /(decrease) in employee

and related payables 62 (21) (28)

28 (83) (52)

Net cash used in operating activities (965) (349) (534)

----------- ------- ---------------

Cash flows from investing activities:

Purchase of property, plant

and equipment (24) - -

Investment in Available for

sale (750) - -

Cash acquired on acquisition 358 - -

Investment in short term deposits (2) (5) (5)

Investment in long term deposits - (2)

Net cash used in investing activities (418) (7) (5)

----------- ------- ---------------

Cash flows from financing activities:

Receipts on short term loan - 191 300

Share Issue net of issuing cost 6,480 - -

Issue of warrants 374 268 268

Issue of options 98 - (*

Net cash generated from financing

activities 6,952 459 568

----------- ------- ---------------

Net increase in cash and cash

equivalents 5,569 103 29

Cash and cash equivalents at

beginning of the period 380 334 333

Effect of exchange rates on

cash (4) (8) 18

----------- ------- ---------------

Cash and cash equivalents at

end of the period 5,945 429 380

=========== ======= ===============

The accompanying notes are an integral part of the interim

consolidated financial statements.

NOTES TO THE INTERIM CONDENSED FINANCIAL STATEMENT

1. Information on the Company

Kanabo Group plc's (the "Company") and its subsidiaries

(together, "the Group") principal activities are the distribution

and developing of medical cannabis products.

The Group has its research center in Israel.

The Company is incorporated and domiciled in England and Wales

as a public limited company and listed on the London Stock Exchange

(standard segment)

2. Basis of preparation and principal accounting policies

These condensed consolidated interim financial statements do not

comprise statutory accounts within the meaning of section 434 of

the Companies Act 2006. Statutory accounts for the year ended 31

December 2020 were approved by the Board of Directors on 1 June

2021 and delivered to the Registrar of Companies. The report of the

auditors on those accounts was unqualified, did not contain an

emphasis of matter paragraph and did not contain any statement

under section 498 of the Companies Act 2006.

These condensed consolidated interim financial statements have

been reviewed, not audited.

These condensed consolidated interim financial statements for

the six months ended 30 June 2021 have been prepared in accordance

with the Disclosure Guidance and Transparency Rules of the

Financial Conduct Authority and with IAS 34, 'Interim financial

reporting' as adopted by the United Kingdom. The condensed

consolidated interim financial statements should be read in

conjunction with the annual financial statements for the year ended

31 December 2020, which have been prepared in accordance with IFRSs

as adopted by the European Union.

Segment reporting

The company considers it has one operating segment and therefore

the results are as presented in the primary statements.

Forward-looking statements

Certain statements in this condensed set of consolidated interim

financial statements are forward looking. Although the Group

believes that the expectations reflected in these forward-looking

statements are reasonable, we can give no assurance that these

expectations will prove to be correct. As these statements involve

risks and uncertainties, actual results may differ materially from

those expressed or implied by these forward-looking statements. We

undertake no obligation to update any forward-looking statements,

whether as a result of new information, future events or

otherwise.

3. Going concern

The Directors have assessed the current financial position of

the Company, along with future cash flow requirements, to determine

if the Company has the financial resources to continue as a going

concern for the foreseeable future.

The conclusion of this assessment is that it is appropriate that

the Company be considered a going concern. For this reason, the

Directors continue to adopt the going concern basis in preparing

the unaudited interim financial statements

4. Seasonality

The Group is not subject to seasonal variations in trading.

5. Estimates and Judgements

The preparation of interim financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income, and expense.

Actual results may differ from these estimates. In preparing

these condensed consolidated interim financial statements, the

significant judgements made by management in applying the Group's

accounting policies and the key sources of estimation uncertainty

were the same as those that applied to the financial statements for

the

year ended 31 December 2020 and, in the prospectus, issued in February 2021.

6. Financial risk management

The Group's activities expose it to a variety of financial

risks, including - market risk (including currency risk and

interest rate risk), credit risk and liquidity risk. The condensed

consolidated interim financial statements do not include all

financial risk management information and disclosures required in

the annual financial statements; they should be read in conjunction

with the Group's annual financial statements as at 31 December

2020. There have been no changes in any risk management policies

since the year end or as disclosed in the prospectus.

7. Reverse Acquisition

On 16 February 2021, Kanabo Group PLC ("Company") formerly known

as Spinaker Opportunities PLC, acquired through a share for share

exchange the entire share capital of Kanabo Research ltd., whose

principal activity is the provision of THC-Free retail CBD products

and Vaporization devices.

Although the transaction resulted in Kanabo Research Ltd

becoming a wholly owned subsidiary of the Company, the transaction

constituted a reverse acquisition, as the previous shareholders of

Kanabo Research Ltd own a substantial majority of the Ordinary

Shares of the Company and the executive management of Kanabo

Research Ltd became the executive management of Kanabo Group

plc.

In substance, the shareholders of Kanabo Research Ltd acquired a

controlling interest in the Company and the transaction has

therefore been accounted for as a reverse acquisition. As the

Company's activities prior to the acquisition were purely the

maintenance of the LSE Listing, acquiring Kanabo Research Ltd and

raising equity finance to provide the required funding for the

operation of the acquisition, it did not meet the definition of a

business in accordance with IFRS 3.

Accordingly, this reverse acquisition does not constitute a

business combination and was accounted for in accordance with IFRS

2 "Share-based Payments" and associated IFRIC guidance. Although,

the reverse acquisition is not a business combination, the Company

has become a legal parent and is required to apply IFRS 10 and

prepare consolidated financial statements. The Directors have

prepared these financial statements using the reverse acquisition

methodology, but rather than recognising goodwill, the difference

between the equity value given up by Kanabo Research Ltd's

shareholders and the share of the fair value of net assets gained

by these shareholders, is charged to the statement of comprehensive

income as a share-based payment on reverse acquisition, and

represents in substance the cost of acquiring an LSE listing.

On 16 February 2021, the Company issued 230,769,231 ordinary

shares to acquire the 237,261 ordinary shares of Kanabo Research

Ltd. Based on a share price of GBP0.065 (which was used for the

fund-raising on the same date), the Company's investment in Kanabo

Research Ltd is valued at GBP15,000,000.

Because the legal subsidiary, Kanabo Research Ltd, was treated

on consolidation as the accounting acquirer and the legal Parent

Company, Kanabo Group plc, was treated as the accounting

subsidiary, the fair value of the shares deemed to have been issued

by Kanabo Research Ltd was calculated at GBP1,911,000 based on an

assessment of the purchase consideration for a 100% holding of

Kanabo Group plc.

According to the IFRS 2 the value of the share-based payment is

calculated as the difference between the deemed cost and the fair

value of the net assets as at the acquisition day. During the

period between 1 January 2021 to 16 February several shareholders

exercised their warrants. The exercised warrants indicated that in

the event the RTO acquisition would not be completed the funds

would be returned to the shareholders. For that reason, we decided

that it would be more appropriate to use the value of the net

assets as of 1 January 2021.

Deemed cost 1,911,007

Trade and other receivables 433,781

Cash and cash equivalents 358,726

Trade and other payables (53,631)

RTO expenses 1,172,131

----------

The difference between the deemed cost (GBP1,911,000) and the

fair value of the net assets assumed per above of GBP739,396

resulted in GBP11,172,131 being expensed within "reverse

acquisition expenses" in accordance with IFRS 2, Share Based

Payments, reflecting the economic cost to Kanabo Research Ltd's

shareholders of acquiring a quoted entity.

The reverse acquisition reserve which arose from the reverse

takeover is made up as follows:

GBP'000

Pre-acquisition equity1 (738,876)

Kanabo research ltd share capital

at acquisition 2 2,098,889

Investment in Kanabo research ltd

3 (15,000,000)

Reverse acquisition expense 4 1,172,131

(12,467,855)

----------------------------------- -------------

1. Recognition of pre-acquisition equity of Kanabo Group plc as at 1 January 2021.

2. Kanabo Research Ltd had issued share capital of 2,098,889. As

these financial statements present the capital structure of the

legal parent entity, the equity of Kanabo Research Ltd is

eliminated.

3. The value of the shares issued by the Company in exchange for

the entire share capital of Kanabo Research Ltd. The above entry is

required to eliminate the balance sheet impact of this

transaction.

4. The reverse acquisition expense represents the difference

between the value of the equity issued by the Company, and the

deemed consideration given by Kanabo research ltd to acquire the

Company.

8. Investments

On 24 May 2021 the Company invested GBP750,000 into Hellenic

Dynamics ("HD") and the company will receive equity as part of the

proposed listing of Hellenic Dynamics. HD is in the process of

securing admission to the London Stock Exchange through a Reverse

Take Over (" RTO"). The number of HD shares that will be issued to

the Company shall be calculated based upon a discount of 30% to the

RTO Valuation.

9. Accrued expenses and other accounts payables

December

June 30, 31,

---------- --------

2021 2020 2020

---- ---- --------

GBP '000

--------------------

Accrued expenses 114 3 33

Deferred Revenues 6 3 -

120 6 33

==== ==== ========

10. Earnings per share

The basic earnings per share is calculated by dividing the

(loss)/profit attributable to the ordinary shareholders of the

Company by the weighted average number of Ordinary shares in issue

during the period, excluding Ordinary shares purchased by the

Company and held as treasury shares.

Half year Half year

ended ended Year ended

30.06.21 30.06.20 31.12.20

Loss attributable to equity holders ( 2,377

of the Company (GBP'000) ) (342) (591)

Weighted average number of shares in

issue 278,192,783 216,077 215,733

Earnings per share pence (1) (159) (274)

------------------------------------- ----------- --------- ----------

Due to the loss incurred in the period under review, the

dilutive securities have no effect at 30 June 2021.

11. Share Capital

Opening number of shares of the parent

company 29,400,120

Shares issued in the year for RTO(1) 230,769,210

Shares issued in placing and subscriptions

16 February 2021(2) 92,307,693

Shares issued on account of fees 615,384

Share issued in placing and subscriptions

24 May 2021(3) 4,545,454

Shares issued during the period due

to option and warrant exercises 10,878,429

Total number of shares at 30 June

2021 368,516,290

1. On February 16, 2021, the company completed its reverse

takeover (" RTO") process with Spinnaker Opportunities Plc ("SOP").

The RTO was done in the form of a share for shares exchange and the

ratio was approximately 1:972.64.

2. On February 16, 2021 the company issued 92,307,693 shares raising GBP 6,000,000 before costs

3. On 24 May the company issued 4,545,454 shares raising GBP 1,000,000 before costs

12. Share based payment

a. Warrants

Number of Weighted average

awards exercise price

----------------

At 31 December 2020 - -

Granted 19,051,774 0.09

Exercised 4,241,508 0.09

At 30 June 2021 14,810,266 0.09

b. Stock Option

a. On February, 2018 Kanabo Research Limited approved an

employee share option plan ("The Original Plan"). The vesting

period attaching to grants made under this plan ranged from

immediately to after four years. All grants were approved by the

Board of Directors. On February 16, 2021 and following the

transaction, this plan was cancelled and superseded by the

Replacement Plan (see below).

b. On March 28, 2021, the Group approved a share-based payment

plan for its Israeli employees ("The Replacement Plan"). Options

will be granted under the Replacement Plan to replace cancelled

options granted under the Original Plan. The recipients of

replacement options will include employees and directors.

c. No changes were made in Kanabo Group Plc. option scheme.

Further details regarding the Company's share option plans

For the six months ended

June 2021

Weighted

average of

the exercise

Number of price in GBP

options

------------ ---------------

Are in circulation at the beginning

of the year 20,612 0.62

------------ ---------------

Granted during the year -

------------

Forfeited during the year -

------------

Realized during the year 18,407 -

------------

Expired during the year 2,205 -

------------ ---------------

Are in circulation at the end -

of the period

------------ ---------------

Further details regarding the Group's share option plans

For the six months ended

June 2021

Weighted average

of the exercise

price in GBP

Number of

options

------------ ------------------

Are in circulation at the beginning

of the year 1,960,000

------------ ------------------

Granted during the year 11,458,102

------------

Forfeited during the year

------------

Realized during the year 1,960,000

------------

Expired during the year -

------------ ------------------

Are in circulation at the end

of the period 11,458,102 0.14

------------ ------------------

13. Events after the reporting period

The company doesn't have any post reporting period events to

report.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DKDBQPBDDKKB

(END) Dow Jones Newswires

October 22, 2021 02:00 ET (06:00 GMT)

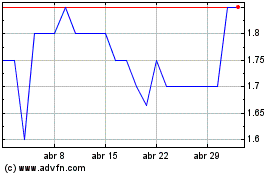

Kanabo (LSE:KNB)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Kanabo (LSE:KNB)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024