Kanabo Group PLC Oversubscribed Placing to Raise GBP2.25m (3345C)

21 Febrero 2022 - 11:15AM

UK Regulatory

TIDMKNB

RNS Number : 3345C

Kanabo Group PLC

21 February 2022

Kanabo Group plc

("Kanabo" or the "Company")

Oversubscribed Placing to Raise GBP2.25m

Issue of Warrants

Kanabo Group Plc (LSE:KNB) the pan-European medical cannabis

company that focuses on developing and commercialising

cannabis-derived products for medical patients and wellness CBD

consumers, is pleased to announce that is has successfully

completed a GBP2.25 million fundraising (the "Fundraise") via the

company's broker, Peterhouse Capital Limited.

Avihu Tamir, CEO of Kanabo Group plc, commented; "We are pleased

to report strong investor support for the Company from both

existing and new investors. The Company has a well-developed plan

to deploy the proceeds from the placing to accelerate its stated

strategy to become one of Europe's leading 'product to patient'

medical providers for millions of people who suffer from a range of

conditions including chronic pain, anxiety and central nervous

system diseases as well as looking after their general health and

wellbeing."

Details of the Placing

The fundraise was oversubscribed and completed by way of a

placing of 28,125,000 new ordinary shares of 2.5 pence each in the

Company ("Placing Shares") at a price of 8p per share. The Placing

Shares being issued will represent approximately c.7% of the

Company's enlarged Ordinary Share capital following the Placing by

Peterhouse Capital.

Each Placing Share issued pursuant to the Fundraise has half a

warrant attached granting the holder the right to subscribe for an

additional half a new ordinary share at an exercise price of 16

pence for a period of 18 months following Admission ("New Ordinary

Share"). Further to this, each Placing Share issued pursuant to the

Fundraise also has half a warrant attached granting the holder the

right to subscribe for an additional half a New Ordinary Share at

an exercise price of 24 pence for a period of 24 months following

Admission, subject to the publication of a prospectus by the

Company.

When issued, the Placing Shares and New Ordinary Shares will be

credited as fully paid and will rank pari passu in all respects

with the existing Ordinary Shares in the share capital of the

Company, including the right to receive all dividends and other

distributions declared, made, or paid on or in respect of such

shares after the date of issue of the Placing Shares.

Application will be made to the Financial Conduct Authority for

admission of the Placing Shares to the standard listing segment of

the Official List and to the London Stock Exchange (the "LSE") for

admission to trading of the Placing Shares on the LSE's Main Market

for listed securities (together "Admission"). It is expected that

Admission will take place at 8.00 a.m. on or around 25 February

2022 and that dealings in the Placing Shares on the LSE's Main

Market for listed securities will commence at the same time.

Total Voting Rights

For the purposes of the Financial Conduct Authority's Disclosure

Guidance and Transparency Rules, Kanabo Group Plc announces that

the Company has 401,322,778 ordinary shares of 2.5p each in issue

("Ordinary Shares"), each share carrying the right to one vote. The

figure of 401,322,778 should be used by shareholders in the Company

as the denominator for the calculations by which they will

determine if they are required to notify their interest in, or a

change to their interest in, the Company under the Financial

Conduct Authority's Disclosure Guidance and Transparency Rules.

The Directors of the Company accept responsibility for the

contents of this announcement.

For further information, please visit

http://www.kanabogroup.com/ or contact the following:

Kanabo Group Plc

Avihu Tamir, CEO Via Vox Markets

Peterhouse Capital Ltd (Financial Adviser) Tel: +44 (0)20 7469 0930

Eran Zucker / Lauren Riley

Peterhouse Capital Limited (Corporate Broker) Tel: +44 (0)20 7469 0930

Lucy Williams / Charles Goodfellow / Duncan Vasey / Martin Lampshire

Vox Markets (Investor Relations) KanaboGroup@voxmarkets.co.uk

Kat Perez kperez@voxmarkets.co.uk

About Kanabo Group Plc

Kanabo Group Plc is creating a new standard in the medical

cannabis industry to improve the well-being of millions of people

around the world by providing a better alternative to the smoking

of medicinal cannabis flowers. Kanabo, which was the first

medicinal cannabis company to IPO on London Stock Exchange, has a

focus on the distribution of cannabis-derived products for medical

patients and non-THC products for CBD consumers. It has conducted

extensive Research & Development to produce high-quality

cannabis extract formulas, innovative medical-grade vaporizers, and

various non-smoking consumption solutions. Kanabo sells a range of

medical cannabis products and wellness CBD products in the Primary

Markets, including its VapePod, which delivers a metered dose with

every inhalation.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEQFLFLLLLZBBK

(END) Dow Jones Newswires

February 21, 2022 12:15 ET (17:15 GMT)

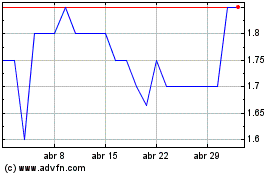

Kanabo (LSE:KNB)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Kanabo (LSE:KNB)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024