TIDMLAND

RNS Number : 1781A

Land Securities Group PLC

21 September 2022

21 September 2022

Land Securities Group PLC ("Landsec")

Landsec and Lendlease exchange contracts on 21 Moorfields for

GBP809m

Landsec announces that it has exchanged contracts for the sale

of 21 Moorfields, EC2 to an investment vehicle managed by global

real estate and investments group, Lendlease (ASX:LLC) . The total

consideration for the sale amounts to GBP809m, which, after

outstanding development-related items results in a net cash receipt

to Landsec of GBP733m. Rothesay is providing financing for the

acquisition with a 10 year senior term loan.

21 Moorfields is a premium 568,500 sq ft London office

development fully pre-let to Deutsche Bank AG (DB) on a 25 year

lease, with an annualised net rent of GBP38m. Built directly above

Moorgate station, the asset is targeting sustainability ratings of

BREEAM Excellent and LEED v3 Gold.

Landsec will retain the responsibility for completing the

development, with practical completion expected in Q1 2023.

Lendlease will manage the investment vehicle , on behalf of its

investment partners including Australia's TCorp and its own

minority interest.

The total consideration of the disposal represents an effective

9% discount to the March 2022 value, yet crystallises an

anticipated development profit of GBP 145m, representing 25% profit

on cost. The sale is in line with Landsec's strategy to recycle

capital out of mature London offices and reduces the company's loan

to value from 34% to 30% based on a pro-forma March 2022 balance

sheet, further strengthening its strong financial base. Following

its strategic review in late 2020, Landsec has now sold GBP1.8bn of

London offices at an average yield of 4.35%.

Completion of the transaction is expected to take place in the

coming week and the net proceeds of the disposal will initially be

used to pay down debt. Landsec's low financial leverage post the

sale of this profitable development provides the company with

significant flexibility to invest in future opportunities with a

higher forward return. The company maintains its guidance on

earnings growth provided in the full year results statement in

May.

Marcus Geddes, Managing Director, Central London at Landsec said

: "21 Moorfields is a fantastic example of Landsec's development

expertise in delivering a high-quality project at one of the most

complex construction sites in London. We are particularly proud to

have achieved a number of engineering firsts associated with the

development of such a significant building which sits directly

above both Moorgate Underground Station and the new Crossrail line

to Liverpool Street.

"These achievements, combined with the securing of a 25-year

pre-let agreement with Deutsche Bank, has culminated in substantial

grade A office space with long-term income, the value from which we

can now unlock in order to recycle capital into new opportunities,

in line with our growth strategy."

Neil Martin, Chief Executive Office, Europe, Lendlease said :

"The scale of this joint investment in the City of London reflects

the global appetite for premium and sustainable office assets in

the world's key gateway cities. In addition to our close

partnerships with international capital, Lendlease also brings our

global expertise in funds and asset management to this deal at 21

Moorfields.

"This significant acquisition adds size and weight to our

European investments platform and contributes to our global funds

under management target of AU$70 billion by FY26. In addition to

converting our AU$117 billion development pipeline, our team will

continue to scope on-market opportunities across Europe as we seek

to add further scale to our investments platform in the

region."

Stewart Brentnall, Chief Investment Officer at TCorp (NSW

Treasury Corporation) said : "TCorp has been actively pursuing

direct property investment opportunities across Europe and is

pleased to expand its relationship with Lendlease by partnering in

the landmark 21 Moorfields opportunity. This strategic initiative

contributes return, diversity and sustainability to our global real

estate exposures. This is TCorp's first direct investment into the

London Office market and our second UK transaction after acquiring

a large scale, high quality logistics asset earlier this year."

Harish Haridas, Head of Commercial Real Estate Debt at Rothesay,

said: "We are delighted to support the acquisition of this unique

new addition to the City of London's premium office stock. These

types of high quality, secured commercial real estate loans are

attractive to us and play an important part in our investment

portfolio, providing long-term security for the pensions we

protect."

Ends

About Landsec

At Landsec, we build and invest in buildings, spaces and

partnerships to create sustainable places, connect communities and

realise potential. We are one of the largest real estate companies

in Europe, with a GBP12 billion portfolio of retail, leisure,

workspace and residential hubs. Landsec is shaping a better future

by leading our industry on environmental and social sustainability

while delivering value for our shareholders, great experiences for

our guests and positive change for our communities.

Find out more at www.landsec.com

About Lendlease

Lendlease is a globally integrated real estate and investments

group with core expertise in shaping cities and creating strong and

connected communities. Founded in 1958, we're listed on the ASX and

operate across Australia, Europe, Asia and the Americas.

We manage funds and assets for some of the world's largest real

estate investors. We also have a strong track record in creating

award winning urban precincts where communities thrive, and

delivering essential civic and social infrastructure.

Learn more at www.lendlease.com/europe

About TCorp

TCorp is the financial services partner to the NSW public

sector, providing best-in-class investment management, financial

management solutions and advice. With $100.7bn of assets under

management, TCorp is a top 10 Australian investment manager and is

the central borrowing authority of the state of NSW, with a balance

sheet of $124.3bn.

About Rothesay

Rothesay is the UK's largest pensions insurance specialist,

purpose-built to protect pension schemes and their members'

pensions. With over GBP50 billion of assets under management, we

secure the pensions of more than 810,000 people and pay out, on

average, approximately GBP200 million in pension payments each

month.

Rothesay is dedicated to providing excellence in customer

service alongside prudent underwriting, a conservative investment

strategy and the careful management of risk. We are trusted by the

pension schemes of some of the UK's best known companies to provide

pension solutions, including Asda, British Airways, Cadbury's, the

Civil Aviation Authority, National Grid, the Post Office and

telent.

Rothesay has two substantial institutional shareholders, GIC and

Massachusetts Mutual Life Insurance Company ("MassMutual"), who

provide the company with long-term support for its growth and

development. In September 2020, our shareholders increased their

investment in Rothesay through a transaction which valued the

business at GBP5.75bn at that time.

Rothesay refers to Rothesay Limited and its subsidiaries and is

the trading name for Rothesay Life Plc, an insurance company

authorised by the Prudential Regulation Authority and regulated by

the Financial Conduct Authority and the Prudential Regulation

Authority. Firm Reference Number: 466067. Rothesay Life Plc is

registered in England and Wales with company registration number:

06127279 and registered address: Rothesay Life Plc, The Post

Building, 100 Museum Street, London WC1A 1PB. Further information

is available at www.rothesay.com

Please contact:

Press Investors

Sara Doggett Edward Thacker

+44 (0)7834 431258 +44 (0) 7887 825869

sara.doggett@landsec.com edward.thacker@landsec.com

Rothesay: Anthony Marlowe, Head of Communications & Public

Affairs

+44 (0)7912 550184 or anthony.marlowe@rothesay.com

Lendlease: Thomas Dearnley-Davison, Senior Communications

Manager

+ 44 (0) 7889 594 165 or

Thomas.DearnleyDavison@lendlease.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

CNTFFLFLLKLEBBB

(END) Dow Jones Newswires

September 21, 2022 07:53 ET (11:53 GMT)

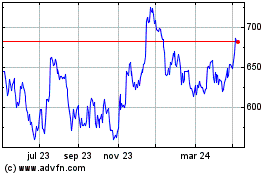

Land Securities (LSE:LAND)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

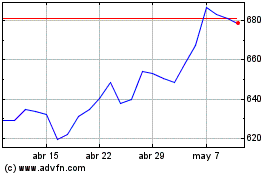

Land Securities (LSE:LAND)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024