TIDMLSEG

RNS Number : 4463J

London Stock Exchange Group PLC

27 April 2022

London Stock Exchange Group plc: Q1 2022 Trading Update

This release contains revenues, cost of sales and key

performance indicators (KPIs) for the three months ended 31 March

2022 (Q1). All figures quoted in this release are on an underlying

basis. Q1 2022 is compared against Q1 2021 on both a statutory and

pro-forma basis. Pro-forma figures assume that the acquisition of

Refinitiv took place on 1 January 2021. Revenues and cost of sales

associated with the BETA+ divestment have been classed as

discontinued and are excluded from all periods. Revenues and cost

of sales associated with the Borsa Italiana Group divestment, which

completed in H1 2021, are also excluded. Constant currency variance

is calculated on the basis of consistent FX rates applied across

the current and prior year period. For more information on

accounting treatments and approach to FX please refer to the

"Accounting and modelling notes" section below.

Q1 2022 highlights - continued strong financial and operational progress

Note: Unless otherwise stated, variances refer to growth rates on

a constant currency basis, with the comparator, Q1 2021, on a pro-forma

basis which also excludes the impact of a deferred revenue accounting

adjustment(1) .

* LSEG continues to make strong financial and

operational progress

* Q1 total income (excluding recoveries) up 6.3% with

good growth across all divisions; up 6.8% adjusting

for the actions LSEG has taken in response to the

Ukraine and Russia (U/R) conflict(2)

* Good Q1 performance driven by new business growth and

high customer retention, building on the strong

foundations in 2021

* Data & Analytics up 4.5% on an underlying basis; up

5.1% excluding U/R impacts, with Trading & Banking

growing; Annual Subscription Value (ASV) growth of

4.9% adjusted for U/R, or 3.6% unadjusted

* Capital Markets up 11.9%, with good contributions

across Fixed Income (Tradeweb), FX and Equities

* Post Trade up 6.6% with broad-based growth

* 73% of Group income (excluding recoveries) is highly

recurring in nature; diversified across customer,

activity, product and geography

* Continued achievement of cost and revenue synergies

during the quarter; GBP25 million run-rate revenue

synergies achieved by end of Q1

* On track to meet all financial targets

-- Continued focus on portfolio enhancement: acquisitions of Quantile,

TORA and GDC, which will enhance our offerings in Post Trade, Trading

& Banking and Customer & Third-Party Risk respectively, are all on

track for completion during 2022; divestment of BETA+, with a significant

proportion of the net proceeds of the divestment to be returned to

shareholders via a share buyback likely to commence in Q3 2022

(1) The deferred revenue impact is a one-time, non-cash,

negative revenue impact resulting from the accounting treatment of

deferred revenue within Refinitiv's accounts which have been

re-evaluated upon acquisition by LSEG under purchase price

accounting rules. This reduced Q1 2021 revenue by GBP22m, mainly in

Data & Analytics with a smaller impact in the FX business

within Capital Markets. There is no material impact in 2022. More

details can be found in the "Accounting and modelling notes"

section

(2) Growth rates excluding the Ukraine / Russia conflict impact

have been calculated by excluding income in the region and from

sanctioned customers and related business from both periods

David Schwimmer, CEO said:

"LSEG has delivered a good first quarter, with strong underlying

performance across all divisions. During the quarter we announced

two acquisitions to enhance our product offerings in Trading &

Banking and Customer & Third-Party Risk. We also announced the

divestment of BETA+, which will simplify and refocus our Wealth

Solutions business.

"Our ability to invest for growth, make strategic acquisitions

and return capital to shareholders demonstrates the strength of the

Group and its high-quality recurring revenues. The Group is well

positioned and we look forward to further progress during the rest

of 2022."

Q1 2022 Summary

Variances are provided on a pro-forma and constant currency

basis. Unless stated otherwise, commentary is provided on the

constant currency variance (excluding the deferred revenue

adjustment) to provide insight into performance on a comparable

basis. Revenues and cost of sales associated with the BETA+

divestment have been classed as discontinued and are excluded from

all periods. Revenues and cost of sales associated with the Borsa

Italiana Group divestment, which completed in H1 2021, are also

excluded.

Continuing operations Q1 2022 Pro-forma Variance(2) Constant Constant

Currency Currency

Variance(3) Variance

GBPm Q1 2021(1) % % (excl.

deferred

revenue

adjustment)

(3,4)

GBPm %

-------- ------------ ------------ -------------

Trading & Banking Solutions 378 372 1.6% 1.0% (0.9%)

Enterprise Data Solutions 304 279 9.0% 8.8% 6.5%

Investment Solutions 308 274 12.4% 10.8% 9.4%

Wealth Solutions 63 61 3.3% 2.2% 0.9%

Customer & Third-Party

Risk Solutions 94 85 10.6% 9.9% 7.8%

--------------------------------- -------- ------------ ------------ ------------- --------------

Data & Analytics 1,147 1,071 7.1% 6.3% 4.5%

Equities 67 61 9.8% 10.0% 10.0%

FX 60 57 5.3% 2.7% 2.4%

Fixed Income, Derivatives

& Other 232 200 16.0% 15.2% 15.2%

--------------------------------- -------- ------------ ------------ ------------- --------------

Capital Markets 359 318 12.9% 11.9% 11.9%

OTC Derivatives 93 87 6.9% 7.5% 7.5%

Securities & Reporting 64 63 1.6% 5.1% 5.1%

Non-Cash Collateral 24 22 9.1% 10.5% 10.5%

Net Treasury Income 57 55 3.6% 5.2% 5.2%

--------------------------------- -------- ------------ ------------ ------------- --------------

Post Trade 238 227 4.8% 6.6% 6.6%

Other 7 5 40.0% 44.1% 44.1%

--------------------------------- -------- ------------ ------------ ------------- --------------

Total income (excl. recoveries) 1,751 1,621 8.0% 7.6% 6.3%

Recoveries 80 88 (9.1%) 1.6% (0.5%)

--------------------------------- -------- ------------ ------------ ------------- --------------

Total income (incl. recoveries) 1,831 1,709 7.1% 7.3% 6.0%

Cost of sales (240) (230) 4.3% 2.9% 2.9%

--------------------------------- -------- ------------ ------------ ------------- --------------

Gross profit 1,591 1,479 7.6% 8.0% 6.4%

--------------------------------- -------- ------------ ------------ ------------- --------------

(1) The Q1 2021 comparator is pro-forma and assumes that the

acquisition of Refinitiv took place on 1 January 2021

(2) Variance is the difference between current and prior year

periods using FX rates prevalent at each time, therefore any

changes in the FX rates are reflected in the variance percentage

alongside business performance

(3) Constant currency variance shows underlying financial

performance, excluding currency impacts, by comparing the current

and prior period at consistent exchange rates

(4) Excludes the deferred revenue adjustment further explained

in the "Accounting and modelling notes" section

Q1 2022 Highlights

Group Income (excluding recoveries) grew 6.3% at constant

currency and up 6.8% adjusting for the actions LSEG has taken in

response to the Ukraine and Russia (U/R) conflict. The revenue

impact of U/R is anticipated to be c.GBP60 million in 2022. Most of

the impact reflects the suspension of Data & Analytics services

to customers in Russia, with the largest impact in Trading &

Banking.

-- Data & Analytics : revenues up 4.5%; up 5.1% excluding U/R impacts

o Trading & Banking Solutions down 0.9%; but grew 0.1%

excluding U/R impacts - Driven by better understanding and

servicing of customer needs, with growth in Banking products and an

improved performance in Trading revenues. Acquisition of TORA,

expected to complete in H2, will enhance customers' ability to

trade multiple asset classes across global markets through our

platform

o Enterprise Data Solutions up 6.5% - Continued acceleration in

revenue growth reflects our investment in broadening and deepening

our data & analytics offering, and innovation in our delivery

of this content. This has reinforced our #1 position in real-time

data and continues to support market share gains in pricing and

reference data

o Investment Solutions up 9.4% - Good growth in FTSE Russell

with subscription revenues up 10.3%. Asset-based revenues rose

17.0%, despite volatile market conditions over the quarter. Further

revenue synergy realisation in the quarter from cross-selling of

FTSE Russell and Refinitiv data products

o Wealth Solutions up 0.9% - Steady growth in our

subscription-based services providing data and analytics to Wealth

advisory companies. Contribution from the transaction-orientated

BETA+ business moved to discontinued operations ahead of expected

divestment in H2 2022

o Customer & Third-Party Risk Solutions up 7.8% -

Double-digit organic growth maintained in Q1, reduced on a reported

basis by disposal of ERMT business in November 2021. Strong growth

in the core screening business, WorldCheck, reflecting market share

gains and customer demand for comprehensive, reliable and timely

sanctions and KYC data

-- Capital Markets : revenues up 11.9%

o Equities up 10.0% - Robust secondary market activity in Q1,

reflecting the value customers place on the breadth and depth of

LSEG's liquidity, especially during periods of heightened

volatility. This more than offsets the impact of weaker primary

market issuance and suspension of securities impacted by the U/R

conflict

o FX up 2.4% - Strong growth in our leading global

dealer-to-client FX platform, FXall, reflects investment in

customer service and platform functionality. Performance partially

offset by weaker volumes on Matching platform, our dealer-to-dealer

FX trading venue. We continue to make good progress towards

transitioning Matching to our modern, proprietary trading

architecture in 2023

o Fixed Income, Derivatives & Other up 15.2% - Strong

performance at Tradeweb(1) which saw $1.17 trillion of total

Average Daily Volume traded in the quarter, an increase of 11%.

Growth was driven by continued market share gains and a more

volatile macroeconomic backdrop

-- Post Trade : total income up 6.6%

o OTC Derivatives up 7.5% - Strong volumes seen across

SwapClear, ForexClear, CDSClear and SwapAgent, as we support OTC

market participants' need for robust risk management and capital

optimisation

o Securities & Reporting up 5.1% - Good volume growth at

RepoClear and EquityClear as they continue to provide an essential

service through volatile markets and the introduction of Central

Securities Depository Regulation (CSDR)

o Non-Cash Collateral up 10.5% - Mainly driven by an increase in

average non-cash collateral balances

o Net Treasury Income up 5.2% - Reflecting the benefit of larger

cash collateral balances due to increased clearing activity in

Q1

(1) Tradeweb Q1 2022 results will be released on 28 April 2022

and will provide more detailed commentary on performance

Statutory financials(1)

Continuing operations Q1 2022 Q1 2021

GBPm GBPm

--------

Trading & Banking Solutions 378 247

Enterprise Data Solutions 304 194

Investment Solutions 308 238

Wealth Solutions 63 40

Customer & Third-Party

Risk Solutions 94 57

--------------------------------- -------- --------

Data & Analytics 1,147 776

Equities 67 61

FX 60 39

Fixed Income, Derivatives

& Other 232 141

--------------------------------- -------- --------

Capital Markets 359 241

OTC Derivatives 93 87

Securities & Reporting 64 63

Non-Cash Collateral 24 22

Net Treasury Income 57 55

--------------------------------- -------- --------

Post Trade 238 227

Other 7 4

--------------------------------- -------- --------

Total income (excl. recoveries) 1,751 1,248

Recoveries 80 58

--------------------------------- -------- --------

Total income (incl. recoveries) 1,831 1,306

Cost of sales (240) (171)

--------------------------------- -------- --------

Gross profit 1,591 1,135

--------------------------------- -------- --------

(1) The comparator Q1 2021 figures are statutory results,

incorporating Refinitiv from acquisition at the end of January

2021. Revenues and cost of sales associated with the BETA+

divestment have been classed as discontinued and are excluded from

all periods. Revenues and cost of sales associated with the Borsa

Italiana Group divestment, which completed in H1 2021, are also

excluded

Contacts: London Stock Exchange Group plc

Investors

Paul Froud / Chris Turner - Investor Relations ir@lseg.com

Media

Lucie Holloway / Rhiannon Davies - Financial Communications +44 (0) 20 7797 1222

newsroom@lseg.com

Additional information can be found at www.lseg.com

Q1 investor and analyst conference call:

The Group will host a conference call on its Q1 Trading

Statement for analysts and institutional shareholders today at

08:30am (UK time). On the call will be David Schwimmer (Chief

Executive Officer), Anna Manz (Chief Financial Officer) and Paul

Froud (Group Head of Investor Relations).

To access the telephone conference call or webcast please

register in advance using the following link and instructions

below:

https://www.lsegissuerservices.com/spark/LondonStockExchangeGroup/events/7c30d30d-da35-461a-8d5e-4314cd811e0e

-- If you wish to participate in Q&A, questions can be

submitted by clicking the 'Ask a question button' on the page or by

emailing the LSEG Investor Relations team at ir@lseg.com .

Questions can be submitted in advance and during the event

itself

-- If you wish to ask a question live, you will need to register

for the telephone conference call here:

https://cossprereg.btci.com/prereg/key.process?key=PQ6N49EQ8

-- NOTE: Once you have registered for the conference call, you

will be provided with the information you need to join the

conference, including dial-in numbers and passcodes. Please save

this information to your calendar or print this information

Presentation slides can be viewed at

https://www.lseg.com/investor-relations

Accounting and modelling notes

Minor business revenue reclassification - As indicated at

Preliminary results 2021

To better align with our operating model, some small revenue

items have been reallocated between business lines from Q1 2022.

All results in this release reflect this reclassification. At a

divisional level, the impact on the 2021 results previously

reported is:

-- GBP7 million of revenue moves from Post Trade to Data & Analytics

-- GBP6 million of revenue moves from Capital Markets to Data & Analytics

Deferred revenue accounting adjustment

This adjustment is as previously described in 2021. There is no

material impact in 2022. An adjusted variance, excluding the

deferred revenue adjustment, has been presented to show true

underlying business growth on the prior year.

As a reminder, the adjustment results from the acquisition of

Refinitiv and the associated purchase price accounting rules.

Refinitiv's deferred revenue balances were subject to a one-time

haircut at the time of acquisition. This was a non-cash adjustment.

2021 saw a negative revenue impact of GBP25 million, with GBP22

million in Q1; GBP1 million in Q2; GBP1 million in Q3; GBP1 million

in Q4. The impact is mostly in the Group's Data & Analytics

division, with a much smaller impact on the Group's FX venues

business sitting within Capital Markets.

FX conversion

As a result of the acquisition of Refinitiv, the majority of

LSEG revenues and expenses are in USD followed by GBP, EUR and

other currencies. All guidance given by LSEG, including the

longer-term targets associated with the acquisition of Refinitiv as

well as specific guidance for the 2022 financial year, has been

given on a constant currency basis.

The results for Q1 2022 have been translated into Sterling using

the average exchange rates for the period. The rates for the

largest two currency pairs are shown in the table below.

Average rate Closing rate Average rate Closing rate

3 months at 3 months at

ended 31-Mar-22 ended 31-Mar-21

31-Mar-22 31-Mar-21

GBP : USD 1.342 1.317 1.379 1.374

------------- ------------- ------------- -------------

GBP : EUR 1.196 1.180 1.143 1.173

------------- ------------- ------------- -------------

Divisional revenue, gross profit and non-financial KPIs

1. Data & Analytics

Results to gross profit (1)

Continuing operations Q1 2022 Pro-forma Variance(2) Constant Constant

Currency Currency

Variance(3) Variance

(excl. deferred

revenue

adjustment)

(3,4)

GBPm Q1 2021(1) % % %

GBPm

-------- ------------ ------------- -----------------

Trading & Banking Solutions 378 372 1.6% 1.0% (0.9%)

Trading 298 297 0.3% - (2.0%)

Banking 80 75 6.7% 5.2% 3.3%

Enterprise Data Solutions 304 279 9.0% 8.8% 6.5%

Real Time Data 195 178 9.6% 9.2% 6.6%

PRS 109 101 7.9% 8.2% 6.4%

Investment Solutions 308 274 12.4% 10.8% 9.4%

Benchmark Rates, Indices

& Analytics 137 122 12.3% 10.6% 10.3%

Index - Asset-Based 70 58 20.7% 17.0% 17.0%

Data & Workflow 101 94 7.4% 7.0% 3.7%

Wealth Solutions 63 61 3.3% 2.2% 0.9%

Customer & Third-Party

Risk Solutions 94 85 10.6% 9.9% 7.8%

----------------------------- -------- ------------ ------------ ------------- -----------------

Total revenue (excl.

recoveries) 1,147 1,071 7.1% 6.3% 4.5%

Recoveries 80 88 (9.1%) 1.6% (0.5%)

----------------------------- -------- ------------ ------------ ------------- -----------------

Total revenue (incl.

recoveries) 1,227 1,159 5.9% 6.0% 4.1%

Cost of sales (198) (192) 3.1% 1.5% 1.5%

----------------------------- -------- ------------ ------------ ------------- -----------------

Gross profit 1,029 967 6.4% 6.9% 4.6%

----------------------------- -------- ------------ ------------ ------------- -----------------

Non-financial KPIs (1)

Q1 2022 Q1 2021 Variance

%

-------- --------

Annual Subscription Value growth

(%) (5) 3.6% 3.0%

Annual Subscription Value growth

excl. U/R impact (%) (5, 6) 4.9% 3.0%

Subscription revenue growth (%)

(5, 7) 3.7%

Subscription revenue growth excl.

U/R impact (%) (5, 6, 7) 3.9%

Index - ETF AUM ($bn) 1,100 956 15.1%

Index - ESG Passive AUM ($bn) (8) 167 63 165.1%

----------------------------------- -------- -------- ---------

(1) The Q1 2021 comparator is pro-forma and assumes that the

acquisition of Refinitiv took place on 1 January 2021. Revenues and

cost of sales associated with the BETA+ divestment have been

classed as discontinued and are excluded from all periods. Revenues

and cost of sales associated with the Borsa Italiana Group

divestment, which completed in H1 2021, are also excluded

(2) Variance is the difference between current and prior year

periods using FX rates prevalent at each time, therefore any

changes in the FX rates are reflected in the variance percentage

alongside business performance

(3) Constant currency variance shows underlying financial

performance, excluding currency impacts, by comparing the current

and prior period at consistent exchange rates

(4) Excludes the deferred revenue adjustment further explained

in the "Accounting and modelling notes" section

(5) The variance is a constant currency variance adjusted for

acquisitions and disposals

(6) Growth rates excluding the Ukraine / Russia conflict impact

have been calculated by excluding income in the region and from

sanctioned customers and related business from both periods

(7) The variance is a 12-month rolling constant currency

variance excluding the impact of the deferred revenue accounting

adjustment. The comparator is not available due to different

methodologies applied to the data for the periods before the

completion of the Refinitiv acquisition

(8) ESG Passive AUM is at 30 June 2021 and prior period

comparator is at 30 June 2020. The metric is updated

bi-annually

2. Capital Markets

Results to gross profit (1)

Continuing operations Q1 2022 Pro-forma Variance(2) Constant Constant

Currency Currency

Variance(3) Variance

(excl. deferred

revenue

adjustment)

(3,4)

GBPm Q1 2021(1) % % %

GBPm

-------- ------------ ------------- -----------------

Equities 67 61 9.8% 10.0% 10.0%

FX 60 57 5.3% 2.7% 2.4%

Fixed Income, Derivatives

& Other 232 200 16.0% 15.2% 15.2%

Total revenue 359 318 12.9% 11.9% 11.9%

Cost of sales (8) (6) 33.3% 12.7% 12.7%

--------------------------- -------- ------------ ------------ ------------- -----------------

Gross profit 351 312 12.5% 11.9% 11.8%

--------------------------- -------- ------------ ------------ ------------- -----------------

Non-financial KPIs (1)

Q1 2022 Q1 2021 Variance

%

--------- ---------

Equities

Primary Markets

New issues 27 35 (22.9%)

Total money raised (GBPbn) 2.6 6.9 (62.3%)

Secondary Markets - Equities

UK Value Traded (GBPbn)

- Average Daily Value 5.7 4.9 16.3%

SETS Yield (bps) 0.66 0.71 (7.0%)

FX

Average daily total volume

($bn) 484 471 2.8%

Fixed income, Derivatives

and Other

Tradeweb Average Daily ($m)

Rates - Cash 387,494 378,323 2.4%

Rates - Derivatives 361,041 287,477 25.6%

Credit - Cash 10,793 10,382 4.0%

Credit - Derivatives 22,420 16,690 34.3%

------------------------------ --------- --------- ---------

(1) The Q1 2021 comparator is pro-forma and assumes that the

acquisition of Refinitiv took place on 1 January 2021. Revenues and

cost of sales associated with the Borsa Italiana Group divestment,

which completed in H1 2021, are excluded from all periods

(2) Variance is the difference between current and prior year

periods using FX rates prevalent at each time, therefore any

changes in the FX rates are reflected in the variance percentage

alongside business performance

(3) Constant currency variance shows underlying financial

performance, excluding currency impacts, by comparing the current

and prior period at consistent exchange rates

(4) Excludes the deferred revenue adjustment further explained

in the "Accounting and modelling notes" section

3. Post Trade

Results to gross profit (1)

Continuing operations Q1 2022 Pro-forma Variance(2) Constant

Currency

Variance(3)

GBPm Q1 2021(1) % %

GBPm

-------- ------------ -------------

OTC Derivatives 93 87 6.9% 7.5%

Securities & Reporting 64 63 1.6% 5.1%

Non-Cash Collateral 24 22 9.1% 10.5%

Total revenue 181 172 5.2% 7.0%

Net Treasury Income 57 55 3.6% 5.2%

------------------------ -------- ------------ ------------ -------------

Total income 238 227 4.8% 6.6%

Cost of sales (34) (32) 6.3% 9.9%

------------------------ -------- ------------ ------------ -------------

Gross profit 204 195 4.6% 6.0%

------------------------ -------- ------------ ------------ -------------

Non-financial KPIs (1)

Q1 2022 Q1 2021 Variance

%

-------- --------

OTC

SwapClear

IRS notional cleared ($trn) 324 271 19.6%

SwapClear members 123 121 1.7%

Client trades ('000) 658 574 14.6%

Client average 10-year notional

equivalent ($trn) 4.2 4.8 (12.5%)

ForexClear

Notional cleared ($bn) 6,512 5,474 19.0%

ForexClear members 36 35 2.9%

CDSClear

Notional cleared (EURbn) 927 627 47.8%

CDSClear members 25 26 (3.8%)

Securities & Reporting

EquityClear trades (m) 647 506 27.9%

Listed derivatives contracts

(m) 77.8 74.9 3.9%

RepoClear - nominal value

(EURtrn) 67.5 55.6 21.4%

Non-Cash Collateral

Average non-cash collateral

(EURbn) 172.0 160.6 7.1%

Net Treasury Income

Average cash collateral

(EURbn) 121.5 106.4 14.2%

--------------------------------- -------- -------- ---------

(1) The Q1 2021 comparator is pro-forma and assumes that the

acquisition of Refinitiv took place on 1 January 2021

(2) Variance is the difference between current and prior year

periods using FX rates prevalent at each time, therefore any

changes in the FX rates are reflected in the variance percentage

alongside business performance

(3) Constant currency variance shows underlying financial

performance, excluding currency impacts, by comparing the current

and prior period at consistent exchange rates

Appendix - Total income by type (1)

Continuing operations Q1 2022 Pro-forma Variance(2) Constant Constant

Currency Currency

Variance(3) Variance

(excl. deferred

revenue

adjustment)

(3,4)

GBPm Q1 2021(1) % % %

GBPm

-------- ------------ ------------- -----------------

Recurring 1,273 1,189 7.1% 6.6% 4.9%

Transactional 414 372 11.3% 10.7% 10.7%

Net Treasury Income 57 55 3.6% 5.2% 5.2%

Other income 7 5 40.0% 44.1% 44.1%

Total income (excl. recoveries) 1,751 1,621 8.0% 7.6% 6.3%

Recoveries 80 88 (9.1%) 1.6% (0.5%)

--------------------------------- -------- ------------ ------------ ------------- -----------------

Total income (incl. recoveries) 1,831 1,709 7.1% 7.3% 6.0%

--------------------------------- -------- ------------ ------------ ------------- -----------------

(1) The Q1 2021 comparator is pro-forma and assumes that the

acquisition of Refinitiv took place on 1 January 2021

(2) Variance is the difference between current and prior year

periods using FX rates prevalent at each time, therefore any

changes in the FX rates are reflected in the variance percentage

alongside business performance

(3) Constant currency variance shows underlying financial

performance, excluding currency impacts, by comparing the current

and prior period at consistent exchange rates

(4) Excludes the deferred revenue adjustment further explained

in the "Accounting and modelling notes" section

Appendix - Total income and gross profit by quarter (1)

The table below has used FX rates on a YTD average basis which

is the basis upon which the Group presents its financials. The 2021

results have been rebased to reflect the minor revenue

reclassifications described in the "Accounting and modelling notes"

section. Revenues and cost of sales associated with the BETA+

divestment have been classed as discontinued and are excluded in

all periods. Revenues and cost of sales associated with the Borsa

Italiana Group divestment, completed in H1 2021, are also

excluded.

GBPm Q1 Q2 Q3 Q4 2021 Q1

------ ------ ------ ------ ------

Trading & Banking Solutions 372 373 373 375 1,493 378

------

Trading 297 297 296 296 1,186 298

------ ------ ------ ------ ------

Banking 75 76 77 79 307 80

------ ------ ------ ------ ------

Enterprise Data Solutions 279 282 284 296 1,141 304

------ ------ ------ ------ ------

Real Time Data 178 182 182 188 730 195

------ ------ ------ ------ ------

PRS 101 100 102 108 411 109

------ ------ ------ ------ ------

Investment Solutions 274 286 294 302 1,156 308

------ ------ ------ ------ ------

Benchmark Rates, Indices

& Analytics 122 126 136 134 518 137

------ ------ ------ ------ ------

Index - Asset-Based 58 64 62 69 253 70

------ ------ ------ ------ ------

Data & Workflow 94 96 96 99 385 101

------ ------ ------ ------ ------

Wealth Solutions 61 62 61 65 249 63

------ ------ ------ ------ ------

Customer & Third-Party

Risk Solutions 85 90 92 92 359 94

--------------------------------- ------ ------ ------ ------ ------ ------

Data & Analytics 1,071 1,093 1,104 1,130 4,398 1,147

------ ------ ------ ------ ------

Equities 61 59 60 61 241 67

------ ------ ------ ------ ------

FX 57 53 56 57 223 60

------ ------ ------ ------ ------

Fixed Income, Derivatives

& Other 200 187 193 205 785 232

--------------------------------- ------ ------ ------ ------ ------ ------

Capital Markets 318 299 309 323 1,249 359

------ ------ ------ ------ ------

OTC Derivatives 87 82 86 103 358 93

------ ------ ------ ------ ------

Securities & Reporting 63 60 60 63 246 64

------ ------ ------ ------ ------

Non-Cash Collateral 22 24 24 25 95 24

------ ------ ------ ------ ------

Net Treasury Income 55 53 47 52 207 57

--------------------------------- ------ ------ ------ ------ ------ ------

Post Trade 227 219 217 243 906 238

------ ------ ------ ------ ------

Other 5 10 9 10 34 7

--------------------------------- ------ ------ ------ ------ ------ ------

Total income (excl. recoveries) 1,621 1,621 1,639 1,706 6,587 1,751

------ ------ ------ ------ ------

Recoveries 88 90 90 86 354 80

--------------------------------- ------ ------ ------ ------ ------ ------

Total income (incl. recoveries) 1,709 1,711 1,729 1,792 6,941 1,831

------ ------ ------ ------ ------

Cost of sales (230) (222) (227) (241) (920) (240)

--------------------------------- ------ ------ ------ ------ ------ ------

Gross profit 1,479 1,489 1,502 1,551 6,021 1,591

--------------------------------- ------ ------ ------ ------ ------ ------

(1) Q1 2021 is pro-forma and assumes that the acquisition of

Refinitiv took place on 1 January 2021

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTPPUCGCUPPGBQ

(END) Dow Jones Newswires

April 27, 2022 02:01 ET (06:01 GMT)

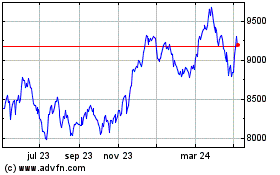

London Stock Exchange (LSE:LSEG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

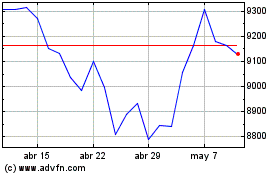

London Stock Exchange (LSE:LSEG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024