London Stock Exchange Group PLC Update on Share Buyback Programme (0892C)

07 Octubre 2022 - 1:00AM

UK Regulatory

TIDMLSEG

RNS Number : 0892C

London Stock Exchange Group PLC

07 October 2022

7 October 2022

London Stock Exchange Group plc - Update on Share Buyback

Programme

London Stock Exchange Group plc (the "Company") announces today

that it has entered into an irrevocable commitment with Morgan

Stanley & Co. International Plc ("Morgan Stanley") with respect

to the second tranche ("Tranche 2") of the share buyback programme

announced by the Company on 5 August 2022 (the "Buyback"). The

first tranche of the Buyback managed by Goldman Sachs International

("Goldman Sachs") completed on 5 October 2022.

In connection with Tranche 2, the Company has instructed Morgan

Stanley (acting as riskless principal and in accordance with

certain pre-set parameters) to purchase voting ordinary shares of

6(79) /(86) pence each in the Company ("Shares") with a value up to

GBP250 million. Purchases will commence on 1 December 2022 and are

expected to end no later than 31 March 2023.

Morgan Stanley will make trading decisions in relation to

Tranche 2 independently of, and uninfluenced by, the Company with

regard to the timing of the purchases of Shares. Any purchase of

Shares by Morgan Stanley contemplated by this announcement will be

carried out on the London Stock Exchange and/or on Turquoise

Equities Trading. Shares purchased by Morgan Stanley will be

on-sold by Morgan Stanley to the Company, and any purchases of

Shares by the Company from Morgan Stanley will be carried out on

the London Stock Exchange, with the Shares purchased by the Company

being held in Treasury. The arrangements between the Company and

Morgan Stanley are subject to customary termination rights in

favour of the Company and Morgan Stanley.

The Company intends to enter into similar arrangements with

respect to the final tranche of the Buyback. Further details will

be communicated in due course.

As noted in the Company's announcement of 5 August, BCP York

Holdings (Delaware) L.P. (an entity owned by a consortium of

certain investment funds affiliated with Blackstone Inc. and

including an affiliate of Canada Pension Plan Investment Board, an

affiliate of GIC Special Investments Pte. Ltd and certain other

co-investors) ("BCP York"), York Holdings II Limited ("Holdings

II") and York Holdings III Limited ("Holdings III") (entities owned

indirectly by BCP York, Thomson Reuters and certain other minority

holders) (BCP York, Holdings II and Holdings III, the "Consortium

Shareholders" and together, the "Consortium"), have notified the

Company of their intention to participate in the Buyback in line

with one of the exceptions to the lock-up provisions contained in

the Relationship Agreement entered into with, among others, the

Consortium on 29 January 2021 in connection with completion of the

Refinitiv acquisition (the "Relationship Agreement").

To enable the Consortium's continued participation in the

Buyback in accordance with the Relationship Agreement on a pro rata

basis according to the Consortium's aggregate economic interest in

the Company, arrangements have been entered into between Holdings

II and Morgan Stanley pursuant to which Holdings II has irrevocably

elected to participate in Tranche 2 of the Buyback, subject to

certain pricing parameters to be communicated by Holdings II to

Morgan Stanley from time to time. On days on which any such

parameters are met, Morgan Stanley will purchase, in aggregate,

33.7% (or such other proportion that corresponds to the

Consortium's aggregate economic interest in the Company at such

time that Tranche 2 commences) of the Shares it intends to purchase

in connection with Tranche 2 of the Buyback from Holdings II at the

same average price at which Morgan Stanley has bought Shares from

other market participants that day.

The Consortium is a related party of the Company for the

purposes of the Listing Rules of the Financial Conduct Authority

(the "Listing Rules"). As a result of similar arrangements entered

into between Holdings II and Goldman Sachs with respect to the

first tranche of the Buyback, Tranche 2 is expected (to the extent

Shares are purchased from Holdings II) to be classified as a

smaller related party transaction under LR 11.1.10R of the Listing

Rules. As a result, in accordance with the Listing Rules, a

sponsor's written confirmation has been obtained from Morgan

Stanley relating to Tranche 2 stating that the arrangements with

Holdings II are fair and reasonable as far as the Company's

shareholders are concerned.

In accordance with Listing Rule 9.6.16R, the Company notes that

any disposals of Shares by the Consortium pursuant to Tranche 2 of

the Buyback will continue to be made in accordance with one of the

exemptions allowed in the lock-up provisions contained in the

Relationship Agreement. Further details of the Relationship

Agreement can be found at pages 65-70 of the prospectus published

by the Company dated 9 December 2020, which is available on the

Company's website at

https://www.lseg.com/investor-relations/reports-results-and-ma/acquisition-refinitiv.

Due to the size of the Buyback and certain parameters agreed

with respect to its implementation (including in connection with

Tranche 2), the Buyback will not result in any member of the

Consortium or any persons acting in concert with them carrying 30

per cent. or more of the total voting rights in the Company.

Any purchases under the Buyback shall take place in accordance

with (and subject to the limits prescribed by) the Company's

general authority to repurchase Shares granted by its shareholders

at the annual general meeting on 27 April 2022 (the "2022

Authority") and any further authority to repurchase Shares as may

be granted by its shareholders from time to time and Chapter 12 of

the Listing Rules. The maximum number of Shares that the Company is

authorised to purchase under the 2022 Authority is 55,814,730.

Purchases of Shares by Morgan Stanley shall take place in

accordance with the Market Abuse Regulation (EU) No 596/2014 (as in

force in the UK pursuant to the European Union (Withdrawal) Act

2018 and as amended by the Market Abuse (Amendment) (EU Exit)

Regulations 2019) and (to the extent so applicable under the terms

of the Buyback) the Commission Delegated Regulation (EU) No

2016/1052 (as in force in the UK pursuant to the European Union

(Withdrawal) Act 2018 and as amended by the Financial Conduct

Authority's Technical Standards (Market Abuse Regulation) (EU Exit)

Instrument 2019).

The Company will make further regulatory announcements to

shareholders in respect of purchases of Shares under Tranche 2 as

they occur.

- Ends -

For further information, please contact:

London Stock Exchange Group

plc

Lucie Holloway, Rhiannon +44 (0)20 7797 1222

Davies (Media) ir@lseg.com

Paul Froud, Chris Turner

(Investors)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com .

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy Policy

.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

POSUNVNRUOURRAA

(END) Dow Jones Newswires

October 07, 2022 02:00 ET (06:00 GMT)

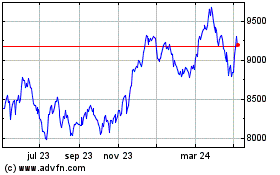

London Stock Exchange (LSE:LSEG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

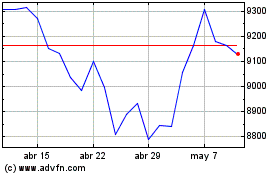

London Stock Exchange (LSE:LSEG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024