TIDMN4P

RNS Number : 8278G

N4 Pharma PLC

18 November 2022

18 November 2022

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 which has been

incorporated into UK law by the European Union (Withdrawal) Act

2018. Upon the publication of this announcement via Regulatory

Information Service, this inside information is now considered to

be in the public domain.

N4 Pharma plc

("N4 Pharma" or the "Company")

Placing to raise GBP1million

Broker Offer

N4 Pharma Plc (AIM: N4P), the specialist pharmaceutical company

developing Nuvec(R), a novel delivery system for cancer treatments

and vaccines, is pleased to announce that it has raised GBP1

million (before expenses) through a placing of 50,000,000 new

ordinary shares of 0.4p each in the Company (the "Placing Shares")

at an issue price of 2p ("Issue Price") per Placing Share (the

"Placing"). The Placing was undertaken by Turner Pope Investments

(TPI) Limited ("TPI").

The net proceeds of the Placing will be used to progress the

Company's development work relating to the loading of SiRNA onto

Nuvec (R), including to commit to doing in-vivo studies and also to

explore acquisition opportunities.

Nigel Theobald, Chief Executive of N4 Pharma, commented: "The

additional funding raised provides sufficient working capital for

our Nuvec(R) program into 2024 and will enable us to do more in

vivo development work on double loaded SiRNA on Nuvec(R) and begin

business development on this opportunity. Alongside this, we will

undertake further research to support our patent application on the

use of Nuvec(R) to improve the efficiency of viral vectors and

start business development activities in this area.

"This funding will also give us more scope to continue to look

for additional asset opportunities alongside Nuvec."

Broker Offer

To provide shareholders and other investors who did not

initially participate in the Placing the opportunity to invest in

the Company, under the Placing Agreement, TPI will launch a broker

offer ("Broker Offer") under which TPI will, as agent for the

Company, invite subscriptions for additional new ordinary shares

("Broker Offer Shares") with an initial expected value of GBP0.25

million at the Issue Price. The Broker Offer may be extended, with

the express agreement of the Company, to GBP1.0 million in the

event the Broker Offer is oversubscribed. The Broker Offer opens

immediately following this announcement and will close at 4.30 p.m.

on 21 November 2022.

As far as is practical, participation in the Broker Offer will

be prioritised for qualifying shareholders (direct or indirect) on

the Company's share register at the close of business on 17

November 2022 ("Existing Shareholders"). If the maximum

subscription under the Broker Offer is taken up, it will raise an

additional GBP1 million, before expenses, for the Company.

To subscribe for Broker Offer Shares, Existing Shareholders or

other interested parties who wish to register their interest in

participating in the Broker Offer should click on the following

link : N4 Pharma Broker Offer

A further announcement will be made following the end of the

period during which the Broker Offer is open. If the Broker Offer

is not fully subscribed by 4.30 p.m. on 21 November 2022, orders

from eligible investors will be satisfied in full, and the balance

of the Broker Offer shall lapse.

Broker Warrants

As part of its fee, TPI will be issued with warrants ("Broker

Warrants") to subscribe for new ordinary shares exercisable at the

Issue Price, such number of warrants that would be equivalent to 6

(six) per cent. of the gross aggregate value of funds raised in the

Placing and Broker Offer. The Broker Warrants have a term of 36

months from the date of admission of the Broker Offer Shares to

trading on AIM and are being issued under the Company's existing

share authorities.

Application for Admission

The Placing has been conducted utilising the Company's existing

share authorities. Application has been made for the Placing Shares

to be admitted to trading on AIM ("Admission") and it is expected

that Admission will take place at 8.00 a.m. on or around 24

November 2022. Once issued, the Placing Shares will rank pari passu

with the Company's existing ordinary shares.

A further announcement will be made regarding the admission to

trading of the Broker Offer Shares to be issued pursuant to the

Broker Offer which is also being conducted utilising the Company's

existing share authorities.

Total Voting Rights

Following Admission of the Placing shares, the enlarged issued

share capital of the Company will comprise 231,080,349 ordinary

shares of 0.4 pence each. The Company does not hold any ordinary

shares in treasury. Consequently, 231,080,349 is the figure which

may be used by shareholders as the denominator for the calculation

by which they will determine if they are required to notify their

interest in, or a change to their interest in, the Company under

the FCA's Disclosure and Transparency Rules. A separate

notification will be made following closure of the Broker

Offer.

Enquiries:

N4 Pharma plc

Nigel Theobald, CEO Via IFC Advisory

Luke Cairns, Executive Director

SP Angel Corporate Finance LLP Tel: +44(0)20 3470

0470

Nominated Adviser and Joint Broker

Matthew Johnson/Caroline Rowe (Corporate

Finance)

Vadim Alexandre/Abigail Wayne/Rob Rees

(Corporate Broking)

Turner Pope Investments (TPI) Limited Tel: +44(0)20 3657

0050

Joint Broker

Andy Thacker

James Pope

IFC Advisory Ltd Tel: +44(0)20 3934

6630

Financial PR

Graham Herring

Zach Cohen

About N4 Pharma

N4 Pharma is a specialist pharmaceutical company developing a

novel delivery system for cancer and vaccine treatments using its

unique silica nanoparticle delivery system called Nuvec(R).

N4 Pharma's business model is to partner with companies

developing novel antigens for cancer and vaccine treatments to use

Nuvec(R) as the delivery vehicle to get their antigen into cells to

express the protein needed for the required immunity. As these

products progress through preclinical and clinical programs, N4

Pharma will seek to receive upfront payments, milestone payments

and ultimately royalty payments once products reach the market.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEBRBDBUXBDGDR

(END) Dow Jones Newswires

November 18, 2022 02:00 ET (07:00 GMT)

N4 Pharma (LSE:N4P)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

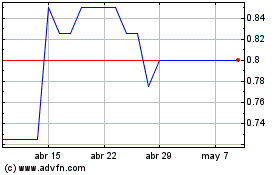

N4 Pharma (LSE:N4P)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024