TIDMNWG

RNS Number : 2608X

NatWest Group plc

25 August 2022

NatWest Group plc

General Meeting and Class Meeting Statement

25 August 2022

NatWest Group plc will hold a General Meeting at 2.00 p.m. today

to be followed immediately by a Class Meeting of Ordinary

Shareholders. The meetings will deal with the proposed resolutions

as set out in the Circular and Notice of General Meeting and Class

Meeting issued to shareholders on 9 August 2022 and a proposed

amendment to resolution 2, the details of which are referenced

below.

The following is an extract from the remarks to be made by

Howard Davies, Chairman, at the meetings.

The strength of NatWest Group's balance sheet and financial

performance mean that we are well positioned to grow our lending to

customers responsibly and to support those customers, colleagues

and communities who are likely to need it most. We are also

continuing to invest in the transformation of the bank while

delivering sustainable returns to shareholders.

At our first half results we announced our intention to pay an

ordinary interim dividend of 3.5 pence per share alongside the

special dividend and share consolidation that are being voted on

today.

The special dividend of 16.8 pence per share would return

approximately GBP1.75 billion to ordinary s hareholders.

The accompanying share consolidation would result in ordinary

shareholders receiving 13 new ordinary shares for every 14 ordinary

shares currently held, maintaining the comparability, so far as

practicable, of the Group's share price before and after the

special dividend is paid.

Combining a share consolidation with a special dividend is a

common approach when a large amount of capital is being distributed

and we believe it is in the best interests of the bank and its

shareholders.

There are three main reasons why the Board has chosen to

implement the distribution of excess capital in this way:

First, it allows us to return a significant amount of capital to

shareholders quickly compared to an on-market buyback

programme.

Secondly, by undertaking the share consolidation alongside the

special dividend, it is accretive to the Group's earnings per share

and tangible book value per share, similar to the financial effects

of an on-market buyback programme.

And finally, it does not increase the relative proportion of the

government's shareholding in NatWest Group which could be the case

if a further on-market buyback programme was launched without

sell-downs from HM Treasury.

If these resolutions are approved, NatWest Group will have

announced capital returns of approximately GBP3.3 billion so far

this year through a directed buyback from HM Treasury and both the

interim and special dividend.

We completed our GBP750 million on-market buy-back programme

announced at Full Year.

We have maintained capacity to participate in an off-market

directed buyback of HM Treasury's shareholding in the Group. As

ever, any such off-market directed buyback would require the

government to seek to sell down their holding and could only take

place after 29 March 2023 onwards, 12 months after our most recent

transaction.

I would like to draw your attention to a proposed amendment to

resolution 2, which is an ordinary resolution relating to the

proposed share transaction. Resolution 2, as set out in the Notice

of Meeting, includes a reference in the second line to c.10.406

billion existing ordinary shares of GBP1 each in the capital of the

Company being consolidated into one intermediate ordinary share of

GBP14.00 each in the capital of the Company. Rather than referring

to the issued share capital being consolidated into one

intermediate ordinary share, the resolution should instead have

made clear that it is every 14 existing ordinary shares (including

treasury shares) that are being consolidated into one intermediate

ordinary share in the capital of the Company and each intermediate

ordinary share will then be divided into 13 new ordinary

shares.

The proposed amendment involves no departure from the substance

of the resolution set out in the Notice of Meeting and is necessary

to correct this patent error.

To deal with this, it is necessary for the meeting to consider

first whether this amendment should be approved and then, assuming

that the meeting approves the amendment, for the substantive

resolution to be put to the meeting.

To close, I would reiterate that the Board considers the

resolutions to be voted on today to be in the best interests of the

Company and our shareholders and is recommending our shareholders

vote in favour of them.

For more information contact:

Investor Relations

+ 44 (0)207 672 1758

Media Relations

+44 (0)131 523 4205

Legal Entity Identifier: 2138005O9XJIJN4JPN90

Forward-looking statements

This document may include forward-looking statements within the

meaning of the United States Private Securities Litigation Reform

Act of 1995, such as statements that include, without limitation,

the words 'expect', 'estimate', 'project', 'anticipate', 'commit',

'believe', 'should', 'intend', 'will', 'plan', 'could',

'probability', 'risk', 'Value-at-Risk (VaR)', 'target', 'goal',

'objective', 'may', 'endeavour', 'outlook', 'optimistic',

'prospects' and similar expressions or variations on these

expressions. These statements concern or may affect future matters,

such as NatWest Group's future economic results, business plans and

strategies. In particular, this document may include

forward-looking statements relating to NatWest Group in respect of,

but not limited to: its economic and political risks, its

regulatory capital position and related requirements, its financial

position, profitability and financial performance (including

financial, capital, cost savings and operational targets), the

impact of the Share Consolidation and the Special Dividend, the

implementation of its purpose-led strategy, its environmental,

social, governance and climate related targets, its access to

adequate sources of liquidity and funding, increasing competition

from new incumbents and disruptive technologies, the impact of the

COVID-19 pandemic, its exposure to third party risks, its ongoing

compliance with the UK ring-fencing regime and ensuring operational

continuity in resolution, its impairment losses and credit

exposures under certain specified scenarios, substantial regulation

and oversight, ongoing legal, regulatory and governmental actions

and investigations, the transition of LIBOR and IBOR rates to

alternative risk free rates and NatWest Group's exposure to

operational risk, conduct risk, cyber, data and IT risk, financial

crime risk, key person risk and credit rating risk. Forward-looking

statements are subject to a number of risks and uncertainties that

might cause actual results and performance to differ materially

from any expected future results or performance expressed or

implied by the forward-looking statements. Factors that could cause

or contribute to differences in current expectations include, but

are not limited to, future growth initiatives (including

acquisitions, joint ventures and strategic partnerships), the

outcome of legal, regulatory and governmental actions and

investigations, the level and extent of future impairments and

write-downs (including with respect to goodwill), legislative,

political, fiscal and regulatory developments, accounting

standards, competitive conditions, technological developments,

interest and exchange rate fluctuations, general economic and

political conditions, the impact of climate-related risks and the

transitioning to a net zero economy and the impact of the COVID-19

pandemic. These and other factors, risks and uncertainties that may

impact any forward-looking statement or NatWest Group's actual

results are discussed in NatWest Group's UK 2021 Annual Report and

Accounts (ARA), NatWest Group's Interim Results for Q1 2022 and H1

2022 and NatWest Group's filings with the US Securities and

Exchange Commission, including, but not limited to, NatWest Group's

most recent Annual Report on Form 20-F and Reports on Form 6-K. The

forward-looking statements contained in this document speak only as

of the date of this document and NatWest Group does not assume or

undertake any obligation or responsibility to update any of the

forward-looking statements contained in this document, whether as a

result of new information, future events or otherwise, except to

the extent legally required.

No statement in this document is or is intended to be a profit

forecast or to imply that the earnings of NatWest Group for the

current or future financial years will necessarily match or exceed

the historical or published earnings of NatWest Group.

Any information contained in this document on the price at which

shares or other securities in NatWest Group have been bought or

sold in the past, or on the yield on such shares or other

securities, should not be relied upon as a guide to future

performance.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCPAMTTMTMTBAT

(END) Dow Jones Newswires

August 25, 2022 09:00 ET (13:00 GMT)

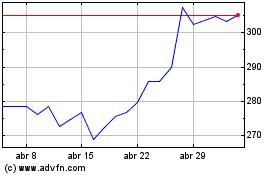

Natwest (LSE:NWG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Natwest (LSE:NWG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024