TIDMNWG

RNS Number : 5468D

NatWest Group plc

20 October 2022

20 October 2022

NatWest and Vodeno Create Strategic Partnership

NatWest Group plc and the Vodeno Group enter into a Strategic

Partnership to Create Banking-as-a-Service Business

NatWest Group plc ("NatWest Group") has entered into a strategic

partnership with the Vodeno Group (comprising of Vodeno Limited and

its subsidiaries) which will see the creation of a

Banking-as-a-Service ("BaaS") business in the UK. This strategic

partnership will enable businesses to embed financial services

products such as payments, deposits, point-of-sale credit and

merchant cash advances directly in their ecosystem by leveraging

the Vodeno Group's BaaS technology, and NatWest Group's banking

technology and UK banking licenses.

Vodeno Group is a European BaaS provider which combines the

Poland-based Vodeno Sp Z.o.o ("Vodeno TechCo"), a software company

providing its API-based technology platform and the Belgium-based

Aion Bank, which has a banking license covering a range of banking

products, including loans, deposits and access to EEA payment

systems . Vodeno Group is majority owned by Warburg Pincus.

Under the terms of the agreements, a new UK based entity will

combine the Vodeno Group's technological and operational

capabilities and its cloud platform with NatWest Group's banking

technology and expertise, building on NatWest Group's position as a

leading supporter of UK business. Through its business banking app

Mettle, NatWest Group has built a standalone core banking and

payments capability, Vodeno's Group's platform will provide a

channel for delivering these capabilities to BaaS clients in the

UK.

The new UK entity will be 82% majority owned and consolidated by

National Westminster Bank Plc, with Vodeno TechCo holding the

remaining minority interest. NatWest Group will additionally take a

minority interest (initially a 9.9% holding, increasing to 18%

subject to certain conditions and approvals being met) in Vodeno

Limited, which owns 100% of Vodeno TechCo and Aion Bank.

NatWest Group Chief Executive Alison Rose said:

"As a leading supporter of UK business , we are committed to

investing in digital transformation to provide a simpler and better

banking experience for our customers. By entering into this

strategic partnership with Vodeno Group we will be able to m eet

the evolving needs of our business customers as they look to embed

financial products in their own propositions and journeys."

"This strategic partnership presents a strong potential source

of fee income in a growing market, and an opportunity to deliver

sustainable growth by building deeper relationships with our

corporate customers. It also complements our existing investment in

the development of business banking technology within our Mettle

business."

Wojciech Sobieraj, CEO of Vodeno Sp Z.o.o added:

"Consumers require high quality and accessible banking products

that are end-to-end digital, and Banking-as-a-Service is making

this possible. Our fully API-based platform offers a comprehensive

suite of BaaS products that enable brands to 'embed' financial

services directly into their ecosystems to create seamless customer

journeys. We are excited to combine our technology with NatWest

Group to offer the next generation of financial services."

Completion of the arrangements is subject to satisfying various

conditions, including licensing, servicing and other documentation,

and obtaining regulatory approvals (including the UK Financial

Conduct Authority and National Bank of Belgium / European Central

Bank).

NatWest is committed to make in total i) a capped commitment of

c.GBP115m, to enable the establishment of the new UK entity; and

ii) a EUR58m investment in Vodeno Group to acquire an 18% minority

stake, investment in each case subject to certain conditions and

approvals being met.

ENDS

Banking-as-a-Service

Banking-as-a-Service provides corporates and financial

institutions with complete end-to-end banking solutions, allowing

them to embed and sell white labelled financial products

underpinned by a bank's secure and regulated infrastructure

combined with a modern API-driven platform.

About Vodeno and Aion Bank

Vodeno Sp Z.o.o and Aion Bank have combined a modern

cloud-native '360' platform ecosystem, an EU banking license and a

team of banking experts to offer comprehensive embedded financial

services for banks, lenders and merchants across multiple sectors.

From 'smart contract enabled' core banking to accounts, onboarding,

payments, cards, investment and lending solutions, Vodeno Sp Z.o.o

and Aion Bank aim to offer the ability to meet the demands of

regulation while enabling innovation at speed.

For further information, please contact:

Investor Relations

Alexander Holcroft

Head of Investor Relations

+44 (0) 20 7672 1758

NWG Media Relations

+44 (0) 131 523 4205

Forward-looking statements

This document may include forward-looking statements within the

meaning of the United States Private Securities Litigation Reform

Act of 1995, such as statements that include, without limitation,

the words 'expect', 'estimate', 'project', 'anticipate', 'commit',

'believe', 'should', 'intend', 'will', 'plan', 'could',

'probability', 'risk', 'Value-at-Risk (VaR)', 'target', 'goal',

'objective', 'may', 'endeavour', 'outlook', 'optimistic',

'prospects' and similar expressions or variations on these

expressions. These statements concern or may affect future matters,

such as NatWest Group's future economic results, business plans and

strategies. In particular, this document includes expectations

regarding the fee income potential of the BaaS business and the

amount of NatWest Group investment in Vodeno Group and may include

forward-looking statements relating to NatWest Group plc in respect

of, but not limited to: its economic and political risks, its

regulatory capital position and related requirements, its financial

position, profitability and financial performance (including

financial, capital, cost savings and operational targets), the

implementation of its purpose-led strategy, its environmental,

social, governance and climate related targets, its access to

adequate sources of liquidity and funding, increasing competition

from new incumbents and disruptive technologies, the impact of the

Covid-19 pandemic, its exposure to third party risks, its ongoing

compliance with the UK ring-fencing regime and ensuring operational

continuity in resolution, its impairment losses and credit

exposures under certain specified scenarios, substantial regulation

and oversight, ongoing legal, regulatory and governmental actions

and investigations, the transition of LIBOR and IBOR rates to

alternative risk free rates and NatWest Group's exposure to

operational risk, conduct risk, cyber, data and IT risk, financial

crime risk, key person risk and credit rating risk. Forward-looking

statements are subject to a number of risks and uncertainties that

might cause actual results and performance to differ materially

from any expected future results or performance expressed or

implied by the forward-looking statements. Factors that could cause

or contribute to differences in current expectations include, but

are not limited to, future growth initiatives (including

acquisitions, joint ventures and strategic partnerships), the

outcome of legal, regulatory and governmental actions and

investigations, the level and extent of future impairments and

write-downs (including with respect to goodwill), legislative,

political, fiscal and regulatory developments, accounting

standards, competitive conditions, technological developments,

interest and exchange rate fluctuations, general economic and

political conditions, the impact of climate-related risks and the

transitioning to a net zero economy and the impact of the Covid-19

pandemic. These and other factors, risks and uncertainties that may

impact any forward-looking statement or NatWest Group plc's actual

results are discussed in NatWest Group plc's UK 2021 Annual Report

and Accounts (ARA), NatWest Group plc's Interim Results for Q1 2022

and H1 2022 and NatWest Group plc's filings with the US Securities

and Exchange Commission, including, but not limited to, NatWest

Group plc's most recent Annual Report on Form 20-F and Reports on

Form 6-K. The forward-looking statements contained in this document

speak only as of the date of this document and NatWest Group plc

does not assume or undertake any obligation or responsibility to

update any of the forward-looking statements contained in this

document, whether as a result of new information, future events or

otherwise, except to the extent legally required.

Legal Entity Identifier:

NatWest Group plc 2138005O9XJIJN4JPN90

National Westminster Bank Plc 213800IBT39XQ9C4CP71

---------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDBLBLLBLLFBV

(END) Dow Jones Newswires

October 20, 2022 04:00 ET (08:00 GMT)

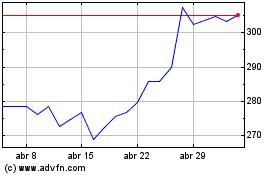

Natwest (LSE:NWG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Natwest (LSE:NWG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024