Orchard Funding Group PLC Updated Confirmation of Bond Issue Size (2412D)

01 Marzo 2022 - 8:30AM

UK Regulatory

TIDMORCH

RNS Number : 2412D

Orchard Funding Group PLC

01 March 2022

1 March 2022

This is an advertisement and not a prospectus.

The information contained herein may only be released, published

or distributed in the United Kingdom, the Isle of Man, Jersey and

the Bailiwick of Guernsey in accordance with applicable regulatory

requirements. The information contained herein is not for release,

publication or distribution in or into the United States,

Australia, Canada, Japan, South Africa, the Republic of Ireland or

in any other jurisdiction where it is unlawful to distribute this

document.

MiFID II and UK MiFIR retail investors, professional investors

and ECPs target market - Manufacturer target market (MIFID II and

UK MiFIR product governance) is eligible counterparties and

professional clients (all distribution channels) and also retail

clients (all distribution channels). This announcement contains

inside information for the purposes of Article 7 of EU Regulation

596/2014. Upon the publication of this announcement, this inside

information is now considered to be in the public domain.

ORCHARD FUNDING GROUP PLC

ORCHARD BOND FINANCE 6.25% BONDS DUE 2027

UPDATE TO BOND ISSUE SIZE

The Company confirms an update to the total Bond issue size, as

originally set Issue Size Announcement, released on 23 February

2022. The Issue Size Announcement is referred to in the Prospectus,

published by Orchard Bond Finance PLC, a wholly-owned subsidiary of

Orchard Funding Group PLC, on dated 9 February 2022 (the

"Prospectus") and any announcements relating to the Bonds must be

read in conjunction with the Prospectus. Defined terms used herein

shall have the meanings attributed to them in the Prospectus.

The Issuer confirms the following updated Bond issue size in

connection with the offer of the Bonds made pursuant to the

Prospectus:

Issue Date: 1 March 2022

Total principal amount of the GBP7,795,000

Bonds issued (including Retained

Bonds):

Total principal amount of Retained GBP4,997,700

Bonds

Estimated expenses relating to GBP178,000

the offer:

Estimated net proceeds of the GBP2,619,000

offer:

-ENDS-

For further information, please contact:

Convexity Capital

Michael Smith, CFA

ms@convexity-capital.com

0207 058 0090 / 07557 265266

IMPORTANT INFORMATION

The Bonds may not be suitable for all investors. Investors

should ensure they fully understand the risks and seek independent

financial advice.

Investors should note that the market price of the Bonds can

rise and fall during the life of the investment and the price of

the Bonds could fall below the issue price of GBP100.

In the event that Orchard Bond Finance PLC or Orchard Funding

Group PLC becomes insolvent or goes out of business, investors may

lose some or all of their investment.

This announcement is an advertisement and is not a prospectus

for the purposes of Regulation (EU) 2017/1129 as it forms part of

domestic law by virtue of the European Union (Withdrawal) Act 2018

(as amended, the "UK Prospectus Regulation") . A prospectus dated 9

February 2022 (the "Prospectus") relating to the Bonds has been

prepared and made available to the public in accordance with the UK

Prospectus Regulation.

The Prospectus is available on the website of Orchard Group

Funding PLC (please see www.orchardgroupfundingplc.com/bonds).

The Prospectus has been approved by the Financial Conduct

Authority (the "FCA"). The FCA only approves the Prospectus as

meeting the standards of completeness, comprehensibility and

consistency imposed by the Prospectus Regulation. Such approval

should not be considered as an endorsement of Orchard Bond Finance

PLC, the Orchard Group or the quality of the Bonds that are the

subject of the Prospectus.

Potential investors should read the Prospectus before making an

investment decision in order to fully understand the potential

risks and rewards associated with the decision to invest in the

Bonds that are the subject of the Prospectus. Investors should not

subscribe for any bonds referred to in this announcement except on

the basis of information in the Prospectus.

This announcement is issued and approved by Orchard Bond Finance

PLC (formerly CRM Associated Limited) which is authorised and

regulated by the FCA with firm reference number 733619.

The offering and the distribution of this announcement and other

information in connection with the offer in certain jurisdictions

may be restricted by law and persons into whose possession any

document or other information referred to herein comes should

inform themselves about and observe any such restriction. Any

failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdiction.

This announcement does not constitute or form part of any offer

or invitation to sell, or any solicitation of any offer to purchase

any Bonds. Any purchase of Bonds pursuant to the offer should only

be made on the basis of the information contained in the

Prospectus.

The Bonds have not been and will not be registered under the

United States Securities Act of 1933 (as amended, the "Securities

Act") and, subject to certain exceptions, may not be offered or

sold within the United States or to United States persons. The

Bonds are being offered and sold outside of the United States in

reliance on Regulation S of the Securities Act.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUPUMPWUPPGCG

(END) Dow Jones Newswires

March 01, 2022 09:30 ET (14:30 GMT)

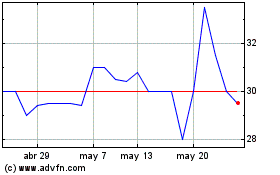

Orchard Funding (LSE:ORCH)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Orchard Funding (LSE:ORCH)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024