TIDMPEBB

RNS Number : 4686G

Pebble Group PLC (The)

30 March 2022

30 March 2022

THE PEBBLE GROUP PLC

(the "Company")

Grant of performance share awards under Long Term Incentive

Plan

and

Notification of transactions by PDMRs

The Pebble Group plc (AIM: PEBB), a leading provider of

technology, services and products to the global promotional

products industry , announces that on 29 March 2022 the Company

made awards of 1,719,986 in the form of nil cost options or

conditional share awards ("Performance Shares") under The Pebble

Group plc Long Term Incentive Plan ("LTIP") to a number of senior

employees across the Group, including to the Persons Discharging

Managerial Responsibilities, as detailed below ("PDMR"):

PDMR Number of Performance Shares

Christopher Lee 280,788

-----------------------------

Claire Thomson 206,897

-----------------------------

Louisa Hesketh 22,660

-----------------------------

Ashley McCune 195,705

-----------------------------

Karl Whiteside 129,842

-----------------------------

The vesting of all the Performance Shares is conditional on

meeting performance conditions measured over a three-year period as

described below.

Performance conditions

1. Adjusted Earnings Per Share ("EPS") Target

Up to 70% of the total Performance Shares will vest dependent

upon the achievement of cumulative adjusted EPS targets for the

three years ending 31 December 2024, determined as follows:

Cumulative Adjusted EPS for Portion of Ordinary Shares vesting

the three year period to 31 subject to Adjusted EPS target

December 2024

Below 17.6p No vesting

-----------------------------------

17.6p 25%

-----------------------------------

18.8p 60%

-----------------------------------

19.9p 100%

-----------------------------------

2. Total Shareholder Return ("TSR") Target

Up to 30% of the total Performance Shares will vest dependent

upon the performance of the Company's Absolute TSR measured over

the three year period ending 31 December 2024. The share price at

the start of this period was 132.50 pence, being the average

closing price of the Company's shares over the three trading days

ending on the day before the start of the performance period.

Annualised TSR for the three Portion of Ordinary Shares vesting

year period to 31 December subject to TSR Target

2024

Below 8.0% per annum No vesting

-----------------------------------

8.0% per annum 25%

-----------------------------------

11.3% per annum 60%

-----------------------------------

15% per annum 100%

-----------------------------------

A holding period of two years from date of vesting is applicable

to the LTIP awards granted to the Executive Directors of the

Company.

The making of these awards at these levels and with these

performance conditions is considered by the Remuneration Committee

to be in accordance with the Company's Remuneration Policy with

regard to the Executive Directors.

The Remuneration Committee has discretion to adjust the level of

vesting if in its opinion such level of vesting resulting from the

application of the performance conditions is considered not to be a

fair and accurate reflection of the performance of the Company or a

fair and accurate reflection of the award holder's performance or

where there is any other factor or any other circumstances which

would make the level of vesting inappropriate without

adjustment.

The information set out below is provided in accordance with the

requirements of Regulation 19(3) of the EU Market Abuse Regulation

No 596/2014:

1 Details of the person discharging managerial responsibilities/person

closely associated

(a) Name 1. Christopher Lee

2. Claire Thomson

3. Louisa Hesketh

4. Ashley McCune

5. Karl Whiteside

----------------------------------------- --------------------------------------

2 Reason for the notification

---------------------------------------------------------------------------------

(a) Position/status 1. Chief Executive Officer

2. Chief Financial Officer

3. Group Financial Controller

4. President, Facilisgroup

5. Group MD, Brand Addition

----------------------------------------- --------------------------------------

(b) Initial notification/Amendment Initial notification

----------------------------------------- --------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

---------------------------------------------------------------------------------

(a) Name The Pebble Group plc

----------------------------------------- --------------------------------------

(b) LEI 213800LZUQAYBHDEQY04

----------------------------------------- --------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

---------------------------------------------------------------------------------

(a) Description of the financial instrument, Ordinary shares of 1 pence

type of instrument each

Identification code ISIN GB00BK71XP16

PEBB.L

----------------------------------------- --------------------------------------

(b) Nature of the transaction Award of nil-cost options

or conditional share awards

pursuant to The Pebble Group

plc Long Term Incentive Plan

----------------------------------------- --------------------------------------

(c) Price(s) and volume(s) Price(s) Volume(s)

1 NIL 280,788

2 NIL 206,897

3 NIL 22,660

4 NIL 195,705

5 NIL 129,842

----------------------------------------- --------------------------------------

(d) Aggregated information N/A

- Aggregated volume

- Price

----------------------------------------- --------------------------------------

(e) Date of the transaction 29 March 2022

----------------------------------------- --------------------------------------

(f) Place of the transaction Outside a trading venue

----------------------------------------- --------------------------------------

Enquiries:

The Pebble Group plc

Chris Lee, Chief Executive Officer

Claire Thomson, Chief Financial

Officer +44 (0) 7385 024855

Grant Thornton UK LLP (Nominated

Adviser)

Samantha Harrison / Harrison Clarke

/ Ciara Donnelly +44 (0) 20 7383 5100

Berenberg (Corporate Broker)

Chris Bowman / Jen Clarke / Arnav

Kapoor +44 (0) 20 3207 7800

Belvedere Communications (Financial

PR) +44 (0) 7715 769 078

Cat Valentine +44 (0) 7967 816 525

Keeley Clarke thepebblegrouppr@belvederepr.com

About The Pebble Group plc - www.thepebblegroup.com

The Pebble Group is a provider of digital commerce, products and

related services to the global promotional products industry,

comprising two differentiated businesses, focused on specific areas

of the promotional products market:

Facilisgroup - www.facilisgroup.com

Facilisgroup focuses on supporting the growth of mid-sized

promotional product businesses in North America by providing a

digital commerce platform, which enables those businesses to

benefit from significant business efficiency and gain meaningful

supply chain advantage from the ability to purchase from quality

suppliers under preferred terms. The value to our clients is

reflected in the very high retention rates of the business.

Brand Addition - www.brandaddition.com

Brand Addition focuses upon providing promotional products and

related services under contract to some of the world's most

recognisable brands. Its largest contracts are valued in the

millions of pounds with the products and services supplied being

used for brand building, customer engagement and employee rewards.

Working in close collaboration with its clients, Brand Addition

designs products and product ranges, hosts client-branded global

web stores and provides international sourcing and distribution

solutions.

We categorise our revenues into two divisions, Corporate

Programmes, that supports our clients' general marketing

activities, and Consumer Promotions, that supports our clients in

driving their own sales volumes.

The Pebble Group aims to act responsibility through effective

management of its Environmental, Social and Governance ("ESG"). To

find out more, read our ESG report - The Pebble Group ESG report

2021 .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHEAPDNASLAEFA

(END) Dow Jones Newswires

March 30, 2022 02:00 ET (06:00 GMT)

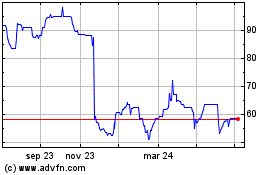

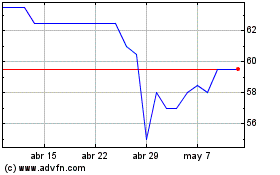

The Pebble (LSE:PEBB)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

The Pebble (LSE:PEBB)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024